- Home

- »

- Animal Health

- »

-

Veterinary Equipment And Disposables Market Report, 2030GVR Report cover

![Veterinary Equipment And Disposables Market Size, Share & Trends Report]()

Veterinary Equipment And Disposables Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Equipment & Accessories), By Animal Type (Small Animals, Large Animals), By Usage (Surgical, Monitoring), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-064-2

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Equipment And Disposables Market Summary

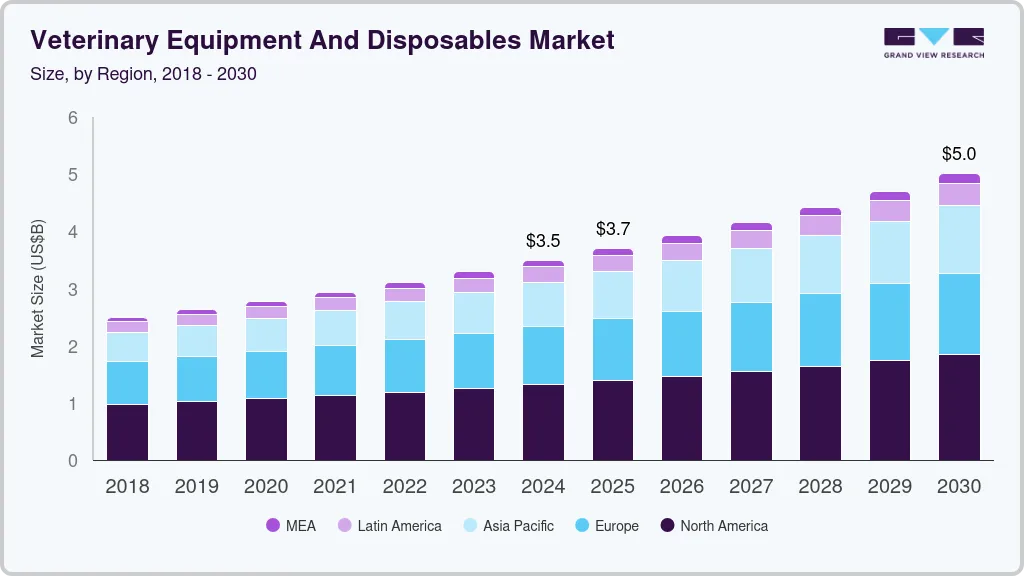

The global veterinary equipment and disposables market size was estimated at USD 3,496.3 million in 2024 and is projected to reach USD 5,013.8 million by 2030, growing at a CAGR of 6.3% from 2025 to 2030. Factors driving the market growth include increasing expenditure on pets, uptake of pet insurance, medicalization rate, prevalence of diseases in animals, technological advancements, and interventional or surgical procedures in animals.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, equipment & accessories accounted for a revenue of USD 2,392.1 million in 2024.

- Disposables/ Consumables is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,496.3 Million

- 2030 Projected Market Size: USD 5,013.8 Million

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2024

The market has been experiencing comprehensive developments in the last couple of years, with industry participants involved in activities from business expansion to commercial product launch. For instance, in September 2024, Patterson's UK business, National Veterinary Services (NVS), acquired Infusion Concepts, a manufacturer & provider of veterinary equipment & disposable infusion pumps and other critical care products.

The company also plans to enhance its infusion pump portfolio in the US by utilizing Infusion Concept's expertise in the field. Furthermore, in January 2023, Zomedica expanded its relationship with Structured Medical Products, Inc. to commercialize its patented Doppler technology-based vital signs remote monitoring system for veterinary use called VetGuardian. The system is intended to benefit vet practices for ICU, overnight monitoring, and pre- and post-surgical monitoring.

Several factors are driving the demand and uptake of vet equipment & disposables across the globe. Technological advancements in veterinary medicine, including minimally invasive surgeries and advanced monitoring techniques, create demand for specialized equipment like anesthesia machines, telemetry systems, and oxygen concentrators. For instance, in July 2024, PetPace launched its innovative product in Canada, an AI-powered collar for monitoring various pet health parameters. This unique collar has features like vital signs, behavioral gathering with real-time health alerts, and a recent introduction of pregnancy monitoring.

Moreover, increased awareness about the importance of animal health and preventive care among pet owners and veterinarians drives the adoption of sophisticated equipment for diagnosis, treatment, and monitoring. Expanding veterinary services, including specialty clinics and emergency care facilities, increases the need for advanced equipment to cater to a broader range of medical procedures.

For instance, in April 2025, Indian pet care brand Zigly (Cosmo First Limited) unveiled its roadmap to business expansion. The company launched four new pet stores in Northern & Southern India and two veterinary hospitals. These hospitals are in urban centers like Delhi (Kailash Colony Experiential Center) and Hyderabad (Jubilee Hills). Furthermore, the company also provides 24/7 services like consultations, surgeries, vaccinations, diagnostics, and emergency care across leading cities like Bangalore and Delhi.

Ongoing Clinical Trials for Veterinary Medical Devices

Sr. No.

Study Name

Description

Species

1

Nasal Cancer Treatment with Electrochemotherapy

This clinical trial aims to evaluate the effectiveness of electrochemotherapy (ECT) using a single needle electrode (SiNE) for treating nasal tumors in dogs. This method uses electrical impulses to enhance local chemotherapy delivery, potentially offering a targeted and less invasive alternative to traditional treatments.

Canine, Feline, Exotics/ Wildlife

2

Cryotherapy for Canine Mast Cell Tumors

This clinical trial evaluates a novel cryotherapy probe made from carbon dioxide-based for treating canine mast cell tumors.

Canine

The expanding applications of veterinary equipment in terms of therapeutic category or animal species is another key factor fueling the market growth. For example, the Large Animal Equine Anesthesia Machine from SHINOVA is applicable for use in large animals such as horses and cows weighing up to 1,200 kg. Furthermore, in January 2025, researchers from the Tokyo University of Science studied a novel multi-camera tracking system to monitor dairy cows across large barns. This technology utilizes overlapping camera views to seamlessly track individual cows, overcoming challenges like complex barn layouts and cow fur patterns. The system has attained high accuracy (90% tracking and 80% identification). It is capable of round-the-clock health monitoring, early disease detection, and gestation management, ensuring efficient dairy farm operations and high-quality milk production.

Market Concentration & Characteristics

The industry exhibits low market concentration, a medium growth stage, and an accelerating pace of growth. Low concentration is the result of a fragmented market, owing to the presence of several participants. No single company or a few dominant players controls a significant portion of the market share, intensifying the competition among manufacturers and suppliers of veterinary equipment and disposables.

The medium growth stage implies that the products in the market have already passed through their initial phase of introduction and adoption and are currently experiencing steady growth. During this stage, demand for veterinary equipment and disposables is expected to increase at a moderate pace as more veterinary clinics, hospitals, and research institutions adopt advanced equipment and practices.

Despite being in a medium growth stage, the market is experiencing an accelerating pace of growth. This is due to increasing pet ownership, rising awareness about animal health and welfare, advancements in veterinary medicine and technology, and expanding veterinary services globally.

The market is characterized by moderate innovation in product development and technological advancements. Companies continuously invest in R&D to improve existing products and introduce new ones. Bionet America, Inc., for instance, has developed the first wearable and wireless ECG sensor for vet clinics that simplifies ECG, heart rate, and respiratory rate monitoring. Furthermore, with the rapidly increasing use of artificial intelligence (AI), this sector also integrates technology to enhance existing products and launch innovative, novel products.

The market experiences a moderate to high level of M&A activity. Companies engage in mergers, acquisitions, or strategic partnerships to expand their product portfolios, enhance their market presence, or gain access to new technologies or distribution channels. For example, in March 2025, Creative Sciences acquired two prominent manufacturers of veterinary solutions for radiology, interventional cardiology, soft-tissue surgery, and orthopedics, Infiniti Medical Llc and Orthomed UK Ltd.

Regulatory factors play a moderate role in shaping the market dynamics. While regulations govern the manufacturing, distribution, and use of veterinary products, they are not as stringent as those in highly regulated industries such as pharmaceuticals. Regulatory authorities, like the US FDA, regulate veterinary devices based on how they function. A product is considered a device if it does not rely on chemical action within the animal's body to achieve its intended effects.

The threat of product substitutes in the market is moderate to high and majorly dependent on the product category. In terms of telemetry systems, for instance, veterinarians can manually monitor vital signs, such as heart rate, respiratory rate, temperature, and blood pressure, using basic tools such as stethoscopes, thermometers, and sphygmomanometers. Smartphone apps and wearable devices equipped with sensors for vital signs are emerging as potential substitutes for traditional vital signs monitors. Whereas, when it comes to disposables and consumables, the market is highly fragmented due to the large number of players in each country across the globe. Additionally, the off-label use of equipment for human use is a crucial factor that increases product substitutes.

The market experiences high levels of regional expansion, with companies seeking to penetrate new geographic markets to capitalize on growth opportunities. Expansion strategies may involve establishing distribution networks, forming strategic partnerships with local distributors or veterinary clinics, or setting up subsidiaries or production facilities in key regions. For instance, in January 2025, a UK-based veterinary supplies manufacturer, Millpledge Veterinary, forged a distribution partnership with Eickemeyer Canada to expand internationally.

Product Insights

Based on product, the equipment & accessories segment dominated with a revenue share of 65% in 2024. Amongst the equipment & accessories category, anesthesia equipment dominated the market in 2024 owing to increasing interventional and surgical procedures in veterinary medicine. Furthermore, initiatives such as product launches and distribution agreements by key companies are expected to fuel the segment growth in the near future. For instance, in September 2023, Shenzhen Melevet Medical Co., Ltd. launched a new veterinary anesthesia machine- AM70. In December 2024 , the company expanded its product reach into the European industry by introducing it in the Czech Republic.

The disposables/ consumables segment, comprising airway management consumables and others, is expected to grow the fastest at 7.0% in the coming years. Expanding veterinary services, including specialty clinics, emergency care centers, and mobile veterinary units, increases the utilization of disposable products for airway management and other procedures.

Animal Type Insights

Based on animal type, the small animal’s segment accounted for the largest revenue share in 2024 and is also projected to grow the fastest at a CAGR of 6.4% over the forecast period. Small animals, such as dogs, cats, birds, and small mammals, are among the most popular choices for household pets worldwide. The increasing trend of pet ownership, particularly in urban areas, drives the demand for veterinary services and related equipment.

The advancement of veterinary medical technology has led to the development of sophisticated equipment and disposables for small animals. This includes advanced anesthesia delivery systems and vital signs monitors. These advancements enhance the quality of care provided to small animals and contribute to the market segment's growth. There's a growing trend of humanizing companion animals, where pet owners increasingly view their pets as family members. This cultural shift leads to higher spending on veterinary care, thus propelling the segment's growth.

Usage Insights

Based on usage, the surgical segment held the highest revenue share of 39.8% of the market in 2024. Surgeries are performed for various reasons, including spaying/neutering, tumor removal, orthopedic procedures, dental surgeries, and trauma management. The increasing frequency of surgical procedures across different veterinary specialties contributes to the segment's high share.

The monitoring segment is anticipated to grow fastest in the forecast period. This is owing to increasing strategic initiatives such as partnerships, product launches, and regional expansion by market players. In November 2024, VETiNSTANT, a startup from IIT Madras, developed Exam D, a novel handheld IoT-driven diagnostic device for pets. The device provides non-invasive monitoring of vital signs like temperature, heart rate, and SpO2. It assists pet owners in tracking health data at home and sharing it with veterinarians via a connected app.

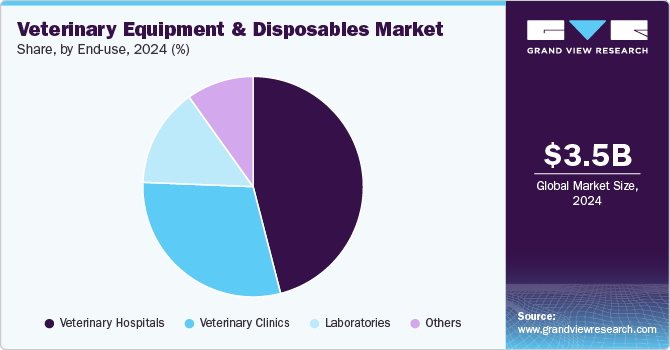

End Use Insights

Based on end use, veterinary hospitals accounted for the largest revenue share of about 46% of the market in 2024. Veterinary hospitals serve a larger volume of patients compared to smaller clinics or mobile practices. This higher patient volume translates to increased utilization of equipment and disposables daily. Moreover, hospitals typically offer comprehensive medical services, including preventive care, diagnostics, surgery, dentistry, imaging, emergency care, and specialty services. They require diverse equipment and disposables to support these services effectively.

Mindray Animal Medical, for example, supplies its imaging, patient monitoring, and life support solutions to a range of notable veterinary hospitals. These include the Animal Medical Center (AMC) in North America, RVC's Queen Mother Hospital for Animals in the UK, Ghent University Animal Hospital in Belgium, and AniCura and IVC Evidensia Group.

The others segment comprising home or farm use and research institutes, is projected to grow at the highest CAGR from 2025 to 2030. This can be attributed to advancements in veterinary technology that have led to the development of sophisticated diagnostic tools and treatment options. A growing trend of preventive care in veterinary medicine is encouraging regular health monitoring of pets & livestock animals alike, which requires various tools and disposables. Research institutions are also expanding their studies on animal health, leading to a higher demand for specialized equipment and consumables for experiments and clinical trials. Furthermore, animal care and welfare regulatory requirements are becoming stricter, prompting farms and research facilities to adopt better practices and invest in appropriate veterinary supplies.

Regional Insights

North America veterinary equipment and disposables market held the highest revenue share of about 38% of the market in 2024. Apart from the leader, the U.S., other countries like Canada are now beginning to assert their presence in this manufacturing sector. These activities range from attracting international players into the country market to expanding veterinary services by launching clinical and research settings.

For instance, in March 2024, as per data, The Centre Hospitalier universitaire Vétérinaire (CHUV) (University of Montreal) launched its Centre of Excellence in Interventional Medicine (CEMI) as an expansion of its Small Animal Hospital. This innovative facility is one of the first in Canada, equipped with advanced equipment to enhance animal interventional procedures. The center aims to improve treatment outcomes and provide specialized care for various conditions. A donation of around USD 1 million from Royal Canin Canada and USD 0.2 million from Boehringer Ingelheim Animal Health Canada Inc. was made to fast-track the completion.

U.S. Veterinary Equipment and Disposables Market Trends

The veterinary equipment & disposables market in the U.S. is attributed to the largest revenue share by country in North America in 2024. Technological innovations, advanced veterinary healthcare infrastructure, and a growing trend toward specialized veterinary care drive this market. In October 2024, Vetlen Advanced Veterinary Devices, a U.S.-based company, launched a novel drug-delivery device, Vetlen Pouch, capable of delivering antibiotics directly to wounds in dogs and horses. The device has a controlled release mechanism to ensure consistent antibiotic delivery. It is suitable for various wound types, making it a versatile tool in veterinary medicine.

Europe Veterinary Equipment and Disposables Market Trends

The Europe veterinary equipment and disposables market is the second largest with revenue share due to its well-established veterinary healthcare facilities, increasing number of companion animals, animal healthcare expenditure, and attentiveness to animal illnesses. Furthermore, industry players from the region are expanding their business into other areas to increase their market presence. For instance, in November 2024, Sigmed, a leading veterinary equipment manufacturer from Poland, announced its expansion into Taiwan's veterinary market. The company is actively seeking collaborations with veterinary product manufacturers and distributors from Taiwan to introduce their products and jointly develop novel products for the country market.

The veterinary equipment and disposables market in the UK attributed to Europe's largest share by country in 2024. Some key factors propelling the market growth include a high uptake of pet insurance, increasing pet ownership rates, a high medicalization rate, and a rise in product options for various animal species. For instance, in May 2024, MSD Animal Health UK launched a novel EID-based real-time health monitoring system for pigs named LeeO. The cloud-based system can integrate with existing farm systems and capture crucial health-related data from EID ear tags, readers, scales, and mobile devices to monitor key performance metrics.

The Spain veterinary equipment and disposables market is expected to grow at the fastest CAGR in Europe from 2025 to 2030. The primary source of this growth domination can be attributed to the country’s emergence as an investment hub for the veterinary market players. As per a December 2024 article by IFEMA Madrid, the veterinary sector in the country is undergoing a transformation fueled by international investment funds acquiring clinics and related businesses, mirroring a trend seen in the UK. Such activities help enhance the availability of advanced medical technologies for veterinary care.

This corporate expansion is driven by the increasing "pet parent" phenomenon, with household spending on veterinary services rising significantly. For instance, in March 2025, Unavets, a leading veterinary healthcare group from the U.S., on the advice of Cuatrecasas, raised around USD 128 million in assistance from Ares Management to support its business expansion strategy to open veterinary hospitals & clinics across European countries of Spain & Portugal.

Asia Pacific Veterinary Equipment and Disposables Market Trends

The veterinary equipment and disposables market in the Asia Pacific region is estimated to grow at the highest rate of 7.5% in the coming years. This can be attributed mainly to countries like China, India, Japan, and Australia. Apart from having large populations of pets & livestock animals, these countries are at the forefront of adopting advanced veterinary technologies into their veterinary health care settings.

Furthermore, countries like China & India have a notable presence of local manufacturers & distributors and emerging new market participants to rival the global brands. The company exports its products globally via a network of distributors. The region is also a booming place for startup culture, with numerous startup companies emerging to address various issues in the sector. For instance, Rakesh Shukla, an Indian entrepreneur, in May 2024, launched Vet2Trade, a B2B marketplace dedicated to veterinary products. The parent company, VOSD Corporation, has onboarded over 100,000 veterinary products from over 1000 veterinary

India veterinary equipment and disposables market is set to dominate the Asia Pacific region in terms of growth rate over the forecast period. This growth can be primarily attributed to growing efforts to enhance the reach of veterinary care in the country. Large corporations are engaging in various investments throughout the country's veterinary sector. For instance, in February 2025, The Mangalore Refinery and Petrochemicals Limited (MRPL) donated multiple types of veterinary equipment worth around INR 26 lakhs (USD 30,000) to 9 government veterinary hospitals in Karnataka state of India.

Latin America Veterinary Equipment and Disposables Market Trends

The veterinary equipment and disposablesmarket in Latin America is set to experience lucrative growth owing to rising pet ownership and improved veterinary care standards. The animal health industry's rapid expansion, driven by investments in medical devices, is also a key factor. Government policies and international trade agreements enhance accessibility to these products. Additionally, growing awareness of animal welfare supports increased investment in better veterinary facilities. Economic growth and societal values also contribute to this trend.

Brazil veterinary equipment & disposables market is attributed to the largest share by country in Latin America in 2024. Factors such as a growing pet population, increasing awareness of pet healthcare, and improvements in veterinary infrastructure are driving market growth. Additionally, economic factors, regulatory standards, and technological advancements play significant roles in shaping market dynamics, with rising demand for advanced veterinary equipment to meet pet owners' and veterinary professionals' evolving needs. For instance, in November 2024, L Catterton, an investment firm, invested strategically in WeVets, Brazil's leading veterinary hospital group. WeVets operates 15 hospitals and two labs and aims to expand across Brazil through acquisitions and organic growth.

MEA Veterinary Equipment and Disposables Market Trends

The veterinary equipment and disposablesmarket in MEA is mainly driven by the rising emergence of industry players launching innovative veterinary products and expanding globally. For instance, ThaMa-Vet, an Israeli company that manufactures various veterinary equipment, in its attempt for global expansion, showcased its latest product innovation at the VIV Asia 2025 in Thailand. In this March 2025 expo, the company showcased its full product portfolio of advanced veterinary syringes for poultry, swine, and aquaculture applications.

The South Africa veterinary equipment & disposables market is attributed to the largest share by country in the Middle East & Africa region in 2024. This is due to the expanding pet ownership base, awareness of veterinary healthcare, and increasing strategic initiatives by market players. For instance, in April 2025, BioChek Group expanded into the South African market by opening a new office in Johannesburg. The company does this expansion to expand into the larger Sub-Saharan region.

Key Veterinary Equipment And Disposables Company Insights

The market is highly competitive and diverse due to its fragmented nature, with numerous small to large companies operating within it. The various product segments, including anesthesia equipment, telemetry systems, oxygen concentrators, rescue & resuscitation equipment, and fluid management equipment, contribute to this fragmentation and competition. For instance, competition in the fluid management equipment segment focuses on product reliability, accuracy in fluid delivery, compatibility with different fluids and medications, ease of maintenance, and cost.

Manufacturers set themselves apart by offering innovative features like advanced programming capabilities, wireless connectivity, and integration with electronic medical records. An example is the EN-V7P veterinary infusion pump from Vue Imaging, which features a touchscreen, dual CPU, and optional wireless connectivity to the company's C7 Central Station. Overall, success in the veterinary equipment and disposables market requires ongoing innovation, product differentiation, and a deep understanding of veterinarians' changing needs and preferences. Companies that effectively navigate these elements are well-positioned to succeed in this competitive environment.

Key Veterinary Equipment And Disposables Companies:

The following are the leading companies in the veterinary equipment and disposables market. These companies collectively hold the largest market share and dictate industry trends.

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Midmark Corporation

- Masimo

- Covetrus, Inc.

- Avante Animal Health

- Shenzhen Comen Medical Instruments Co., Ltd.

- Qingdao Meditech Equipment Co ., Ltd

- Dispomed Ltd

- JD Medica

- Nonin

- B. Braun SE (Vet Care)

Recent Developments

-

In December 2024, the UC Davis Veterinary Hospital's Ophthalmology Department upgraded its surgical microscope, enhancing surgical precision and enabling new procedures. Key improvements include intraoperative OCT for detailed imaging and a back-of-the-eye viewing system, allowing retinal reattachment surgery for the first time at UC Davis.

-

In May 2024, Bionet America, Inc. launched the Brio XVet series, an advanced multiparameter monitor for veterinary surgery. The series features variations such as Brio X3Vet, X5Vet, X7Vet, and BT Link Next software. It is designed for ease of use and anesthetic safety and is available throughout North America.

-

In January 2024, SunTech Medical, Inc. launched Vet40- a surgical Vital Signs Monitor for pets, thus expanding its portfolio.

-

In May 2023, Shenzhen melevet Medical Co., Ltd. launched its AM30 veterinary anesthesia machine in Greece via JMCO- its Greek distributor.

Veterinary Equipment and Disposables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.70 billion

Revenue forecast in 2030

USD 5.01 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, usage, animal type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Shenzhen Mindray Animal Medical Technology Co.,Ltd.; Midmark Corporation; Masimo; Covetrus Inc.; Avante Animal Health; Shenzhen Comen Medical Instruments Co., Ltd.; Qingdao Meditech Equipment Co .,Ltd; Dispomed Ltd; JD Medica; Nonin; B. Braun SE (Vet Care)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Equipment and Disposables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary equipment and disposables market report based on product, animal type, usage, end use, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Dogs

-

Cats

-

Other Small Animals

-

-

Large Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Accessories

-

Anesthesia Equipment

-

Anesthesia Machines

-

Vaporizers

-

Ventilators

-

Waste Gas Management Systems

-

Anesthesia Accessories

-

-

Veterinary Telemetry Systems

-

Patient Monitors

-

Patient Monitoring Accessories

-

-

Oxygen Concentrator & Accessories

-

Fluid Management Equipment

-

Large-Volume Infusion Pumps

-

Syringe Pumps

-

-

Rescue & Resuscitation Equipment

-

Temperature Management Equipment

-

Patient Warming Systems

-

Fluid Warmers

-

-

-

Disposables/ Consumables

-

Airway Management Consumables

-

Other Consumables

-

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Diagnostic

-

Monitoring

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary equipment and disposables market size was estimated at USD 3.50 billion in 2024 and is expected to reach USD 3.7 billion in 2025.

b. The global veterinary equipment and disposables market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 5.01 billion by 2030.

b. North America held the highest share of about 38% of the market by region in 2024. Apart from the leader, the U.S., other countries like Canada are now beginning to assert their presence in this manufacturing sector. These activities range from attracting international players into the country market to expanding veterinary services by launching clinical and research settings.

b. Some key players operating in the veterinary equipment and disposables market include Shenzhen Mindray Animal Medical Technology Co., Ltd. , Midmark Corporation Masimo, Covetrus Inc., Avante Animal Health, Shenzhen Comen Medical Instruments Co., Ltd., Qingdao Meditech Equipment Co .,Ltd, Dispomed Ltd, JD Medica, Nonin, and B. Braun SE (Vet Care).

b. Key factors that are driving the veterinary equipment and disposables market growth include increasing expenditure on pets, uptake of pet insurance, medicalization rate, prevalence of diseases in animals, technological advancements, and interventional or surgical procedures in animals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.