- Home

- »

- Medical Devices

- »

-

Virtual Clinical Trials Market Size And Share Report, 2030GVR Report cover

![Virtual Clinical Trials Market Size, Share & Trends Report]()

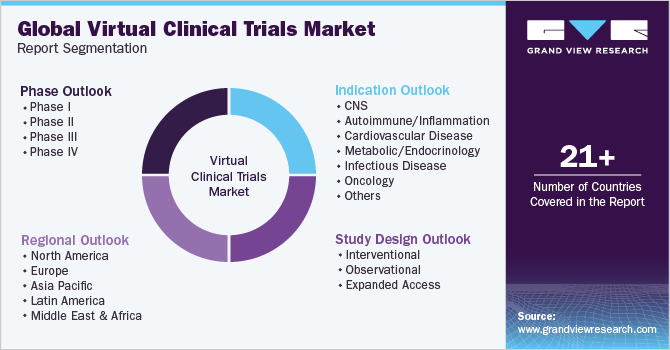

Virtual Clinical Trials Market (2024 - 2030) Size, Share & Trends Analysis Report By Study Design (Interventional, Observational, Expanded Access), By Indication (Oncology, Cardiovascular Disease), By Phase, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-239-7

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Clinical Trials Market Summary

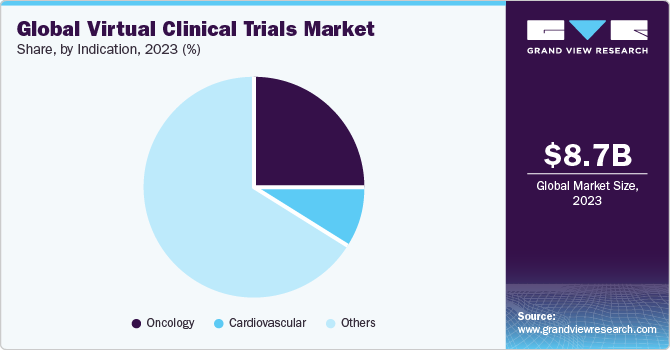

The global virtual clinical trials market size was valued at USD 8.75 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030. The market is majorly driven by a rise in R&D activities, increasing healthcare digitization, as well as the adoption of telehealth.

Key Market Trends & Insights

- North America accounted for the largest regional revenue share of 48.73% in 2023.

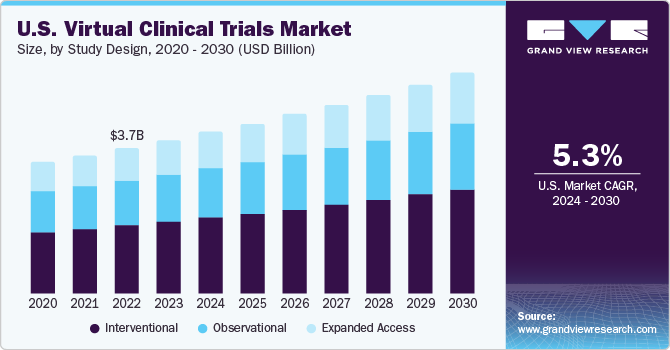

- By study design, the interventional design segment led the virtual clinical trials market with the largest revenue share of 46.8% in 2023.

- By indication, the oncology segment dominated and accounted for the largest revenue share of over 25.0% in 2023.

- By phase, the phase II segment dominated and accounted for the largest revenue share of over 30% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.75 Billion

- 2030 Projected Market Size: USD 12.9 Billion

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

Besides, technological advancements, alliances between clinical research organizations, pharmaceutical, and biotechnology companies as well as supportive government initiatives are anticipated to drive the market. The COVID-19 pandemic changed the way of conducting ongoing or upcoming trials which positively impacted the virtual clinical trials industry.

Rising penetration of technology in healthcare is expected to drive the market growth. Digital technology is transforming the entire process of drug development. The advent of mobile & wearables, artificial intelligence, cloud technology, and associated platforms now enable collection of frequent, precise, and multidimensional data during the length of trials. These advanced technologies have the potential to enable innovative trial designs that lead to easy recruitment & retention, improve patient experience, and establish novel endpoints in clinical studies.

Moreover, to ensure efficiency of clinical trials based on new perspectives, an advanced strategy called patient-centricity has emerged. Clinical trial sponsors such as Pfizer and Sanofi have aligned their strategies of business development and designed new apps & wearables that enhance data collection and improve direct communication with patients.With apps & wearable devices directly connected to patients’ phones, clinical trials can now have access to data based on patients’ daily behavior.

Virtual methods let people take part in the trial from their homes ensuring research can continue even when site visits cannot, hence, representing a novel approach of collecting safety and efficacy data from participants of clinical studies. Virtual visits and remote patient monitoring of in-person site visits give participants a choice and peace of mind for not being exposed to unnecessary risks. virtual studies enable sponsors to include a larger population in the study, thus improving recruitment, engagement, and retention. Also, it enables continuous real-time data collection through digital health technologies. Eventually, virtual connectivity, monitoring as well as management can significantly decrease an effort, time commitment, and burden on the participants, CRCs, and investigators.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The virtual clinical trials market is characterized by a high degree of innovation. Rapid advancement of technology, particularly in the fields of telemedicine, remote monitoring, wearable devices, and electronic data capture, has paved the way for more sophisticated virtual clinical trial methodologies.

Virtual clinical trials market is also characterized by a medium level of merger and acquisition (M&A) activity by a leading player. Leading players are engaging M&A activities to expand their market presence and diversify their service offerings. Acquiring complementary technologies, expertise, or capabilities allows companies to strengthen their position in the virtual clinical trials ecosystem.

Virtual clinical trials market is characterized by a high impact of regulations. Regulatory agencies emphasize the importance of protecting the safety and rights of study participants. In virtual clinical trials, where participants may be remotely located, ensuring informed consent and monitoring participant safety become critical.

Virtual clinical trials market is characterized by a medium impact of service expansion.The virtual clinical trials market heavily relies on rapidly evolving technologies, and there is a need for some level of standardization to ensure interoperability and seamless integration of various tools and platforms. Service expansion may be moderate due to ongoing efforts to standardize technologies across the industry.

Study Design Insights

Interventional design segment led the virtual clinical trials market with largest revenue share of 46.8% in 2023. The rapid increase in number of experiments to develop novel medications for various diseases and the digitalization of laboratories are factors driving the segment. The outbreak of coronavirus has raised the demand for testing and trials of new drugs and vaccines to combat the situation around the world as the traditional method of clinical trials comes with a huge risk of infection in people. Thus, propelling the demand for interventional study designs.

Virtual trials are better suited for chronic diseases as well as less interventional observational studies including cardiovascular diseases, immunology, gastrointestinal, dermatology, respiratory, and endocrinology. The firm that first started this concept conducted an entire interventional Phase2b “site-less” clinical trial with 372 patients across 10 states using their proprietary mobile telemedicine-based platform namely “NORA”.

Expanded access segment is projected to witness a rapid growth of 5.9% during a forecast period. Expanded access is a potential pathway that is appropriate where the potential benefit for the patient subdues the potential risks, hence continuous emergence of new variants of COVID-19 is expected to drive demand for expanded access to new drugs over a short term.

Indication Insights

Oncology segment dominated a market for virtual/decentralized clinical trials and accounted for a largest revenue share of over 25.0% in 2023. The segment is also anticipated to contribute to the maximum share of a market during the forecast period. This is attributed to a rising cases of cancer globally and the increasing number of oncology clinical trials. Cancer patients are the most vulnerable during the COVID-19 pandemic. Investigators and sponsors managing oncology clinical trials have quickly incorporated virtual and remote trials to keep patients safe and trials moving forward.

Cardiovascular segment is anticipated to witness a significant growth rate over a forecast period. Rising incidence of cardiovascular disorder across the globe is expected to drive the segment growth. According to WHO, an estimated 17.9 million people die every year owing to cardiovascular diseases, making it the biggest cause of death globally. According to CDC, one person dies every 36 seconds in the U.S. due to cardiovascular diseases.

Phase Insights

Phase II segment dominated virtual clinical trials market and accounted for largest revenue share of over 30% in 2023. This is largely due to the adoption of DCT tools and platforms in phase II and phase I clinical trial procedures for patient participation. Virtual clinical trials are most beneficial in phase II of the clinical trials as It delivers value to the biopharmaceutical and pharmaceutical industry by saving time-sensitive patient data, delayed approvals, and site payments.

Traditional phase II clinical trials are the most expensive trials because s largest expense is the central clinical located in a large hospital to which the participants are required to report on a regular basis. Also, there is a large number of participants in the phase II clinical trials. While phase II virtual clinical trials are performed remotely with a help of the Internet, from recruiting to screening the data, which reduces a travel burden of the participants in the phase II trials and also reduces the cost of trials that no longer need to support frequent visit to the hospitals.

Phase III segment is anticipated to register a fastest CAGR of over 5.0% over the forecast period. Digital forces such as Big Data, Artificial Intelligence, Computing, Cloud, robotics, and social media offer opportunities to reimagine clinical trial processes. Some pharmaceutical companies are conducting virtual trials in addition to onsite traditional trials in Phase III & phase IV for additional data from diverse patient populations across the globe. Virtual clinical trials in phase III could automate data collection, increase patient engagement and retention, and data can be easily accessed through a monitoring device by trial investigators in real-time. The aforementioned associated benefits are further anticipated to provide this segment with lucrative growth opportunities in the near future.

Regional Insights

North America accounted for a largest regional revenue share of 48.73% in 2023 and is expected to continue its dominance over the forecast period. This can be attributed to increasing R&D in this region, increasing an adoption of new technologies in clinical research as well as government support. Furthermore, market players are also using digital technologies to meet client needs. For instance, Parexel performed more than 100 decentralized trials including hybrid and virtual approaches. Covance also has around 1,900 LabCorp Patient Service Centers across the U.S. that bring the trial to patients.

The U.S. contributed to a maximum share of the North American market. It accounted for over 90% of the North American virtual clinical trials market. This can be attributed to the presence of several players (such as ICON plc; IQVIA Holdings, Inc.; Covance, Inc.; PAREXEL; PRA Health Sciences; Medable, Inc.) that provide decentralized clinical trial services. Moreover, players are also introducing new products to increase their market share. Furthermore, due to the COVID 19 pandemic, the interest of researchers in virtual clinical trials has increased. The number of studies has risen exponentially since the pandemic, accelerating a long-simmering trend of virtual clinical trials that might persistently change the face of clinical research.

Asia Pacific is expected to witness exponential growth of 6.8% over a forecast period. Increasing rate of cardiovascular diseases and growing geriatric population are among factors projected to boost a growth of virtual clinical trials market over the forecast period. An increasing number of clinical trials to find effective and reliable solutions to decrease or cure and avoid the spread of cardiovascular and other diseases is expected to boost the demand for virtual clinical trials during the forecast period. Indian virtual clinical trials market is expected to be a fastest growing in Asia Pacific region in the next seven years, followed by China. Japan was the largest market in Asia Pacific region in 2023, majorly due to high healthcare and R&D expenditure and increasing demand for virtual clinical trials in the market.

Japan is a fifth largest market for virtual clinical trials in Asia Pacific region. Some of the major factors contributing to a growth of this market are rapid technological advancements and considerable healthcare expenditure. Japan is also expected to dominate the market owing to increasing demand for new and cost-effective clinical trials. Thus, increase in the need to maintain standards and curb healthcare expenditure are anticipated to drive the market in Japan. As Japan is technologically developed, there are various CROs that provide virtual solutions for clinical research

Key virtual clinical trials Company Insights

The market for global virtual clinical trials is highly competitive. Significant factors affecting the competitive nature are the quick adoption of advanced technology for improved healthcare. Besides, players are also acquiring, collaborating, and partnering with other firms to gain market share. For instance, in February 2023, Nova Scotia Health forged a strategic partnership with Medable Inc. for a two-year pilot study aimed at enhancing access to clinical trials. This collaboration exemplified a progressive approach in utilizing virtual clinical trial technologies to overcome geographical constraints, optimize patient experience, and elevate overall outcomes within the realm of clinical research.

Key Virtual Clinical Trials Companies:

The following are the leading companies in the virtual clinical trials market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these virtual clinical trials companies are analyzed to map the supply network.

- ICON, plc

- Parexel International Corporation

- IQVIA

- Covance

- PRA Health Sciences

- LEO Innovation Lab

- Medidata

- Oracle

- CRF Health

- Clinical Ink

- Medable, Inc.

- Signant Health

- Halo Health Systems

- Croprime

Recent Developments

-

In July 2023, Signant Health completed the acquisition of DSG, strategically augmenting its eClinical solution suite for both traditional and decentralized clinical trials. By integrating DSG's unified platform, the acquisition facilitated the development of a comprehensive trial ecosystem equipped with advanced software, analytics, and logistics solutions, enabling seamless study conduct and data generation across all modalities, thereby accomplishing the goal of fully digitalizing clinical trials.

-

In June 2023, Medable Inc. unveiled a comprehensive toolkit tailored for Institutional Review Boards (IRBs)/Ethics Committees (ECs), designed to establish standardized ethics review procedures for decentralized clinical trials (DCTs). The implementation of this toolkit successfully simplified, streamlined, and accelerated the IRB/EC process, playing a pivotal role in fostering enhanced efficiency and patient-centeredness in the execution of DCTs.

-

In October 2022, Oracle and ObvioHealth entered into a strategic collaboration to integrate diverse data sets into virtual/decentralized clinical trials in the Asia Pacific region. This initiative is expected to allow the quick collection, integration and analysis of multi-source data collected from labs, devices, patients, and sites.

Virtual Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.3 billion

Revenue forecast in 2030

USD 12.9 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Study design, indication, phase, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ICON, plc; Parexel International Corporation; IQVIA; Covance; PRA Health Sciences; LEO Innovation Lab; Medidata; Oracle; CRF Health; Clinical Ink; Medable, Inc; Clinical Ink; Halo Health Systems; Croprime

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Virtual Clinical Trials Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual clinical trials market report based on study design, indication, phase, and region:

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional

-

Observational

-

Expanded Access

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

CNS

-

Autoimmune/Inflammation

-

Cardiovascular Disease

-

Metabolic/Endocrinology

-

Infectious Disease

-

Oncology

-

Genitourinary

-

Ophthalmology

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global virtual clinical trials market size was estimated at USD 8.3 billion in 2022 and is expected to reach USD 8.8 billion in 2023.

b. The global virtual clinical trials market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 12.9 billion by 2030.

b. North America dominated the virtual clinical trials market with a share of 49.0% in 2022. This is attributable to rising healthcare awareness coupled with rising healthcare expenditure, high disposable income, and constant research and development initiatives.

b. Some key players operating in the virtual clinical trials market include Iconplc, LEO Innovation Lab, Science 37, IQVIA, PRA Health Sciences, Clinical Ink, Parexel, Medable, and Covance.

b. Key factors driving the virtual clinical trials market growth include increasing prevalence of diseases and high demand for clinical trials, rising demand rising research and development to deliver advanced healthcare infrastructure, increasing per capita income, and favorable government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.