- Home

- »

- Next Generation Technologies

- »

-

Visual Intelligence Market Size & Share, Industry Report 2030GVR Report cover

![Visual Intelligence Market Size, Share & Trends Report]()

Visual Intelligence Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Deep Learning, Computer Vision, Machine Learning, Image Processing), By Application (Facial Recognition, Retail Analytics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-584-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Visual Intelligence Market Size & Trends

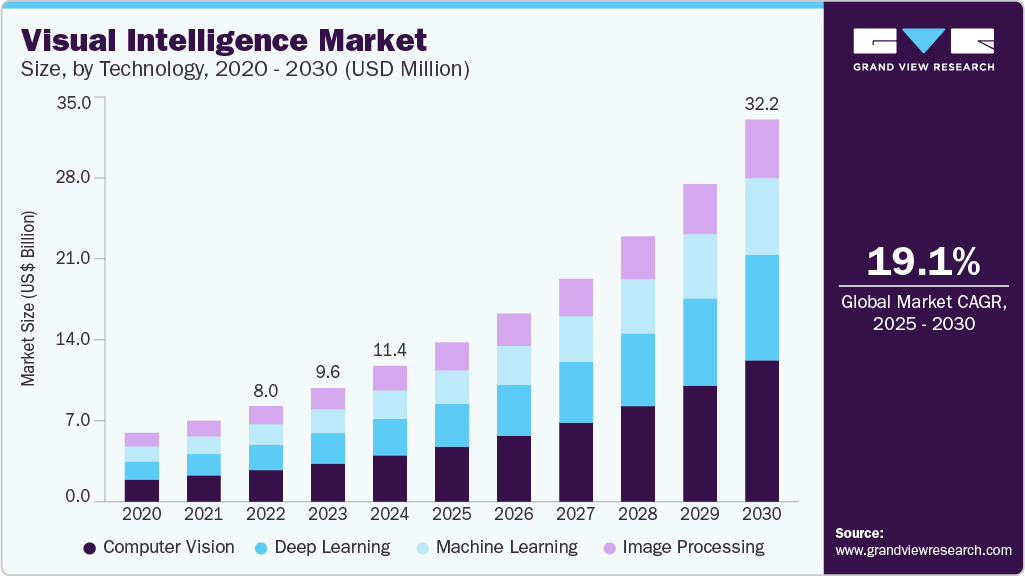

The global visual intelligence market size was estimated at USD 11,432.0 million in 2024 and is projected to grow at a CAGR of 19.1% from 2025 to 2030. The growing adoption of augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) is changing the way industries handle real-time decision-making.

Key Highlights:

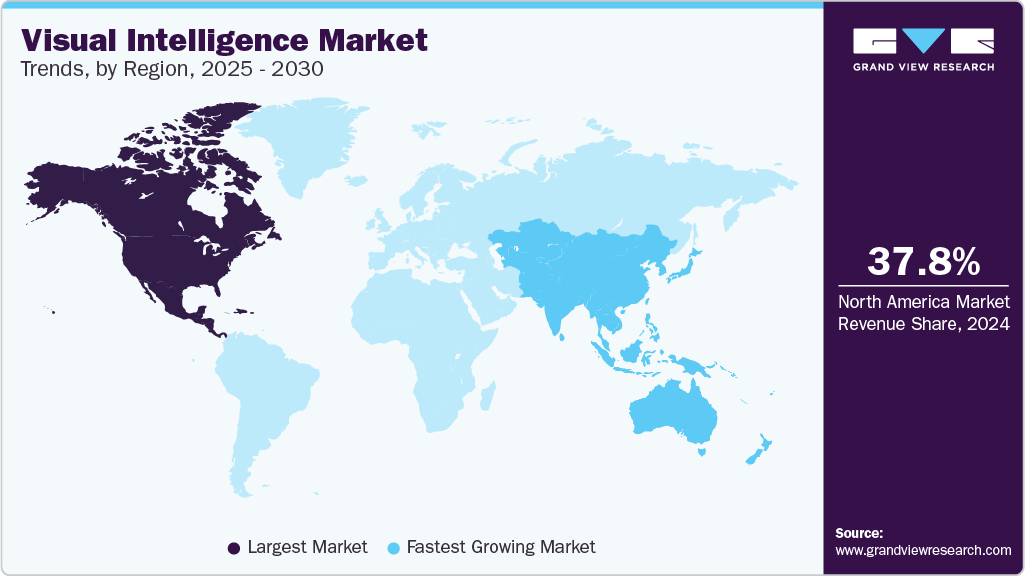

- North America dominated the market and accounted for 37.8% share in 2024.

- The visual intelligence market in the U.S. remains the largest contributor, driven by early technology adoption and strong R&D investment.

- In terms of technology, the computer vision segment dominates the visual intelligence market and is anticipated to hold 34.1% in 2024.

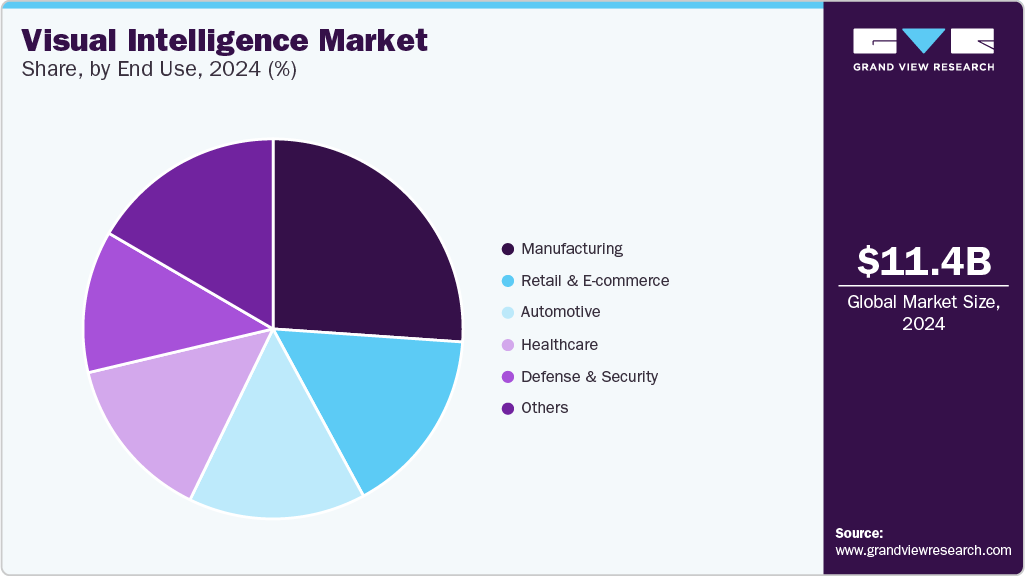

- By application segment, the surveillance and security accounted for the largest market revenue share in 2024.

- In terms of end use, the manufacturing segment generated the highest market revenue in 2024.

These technologies are becoming integral to enhancing situational awareness, which is a key aspect of visual intelligence, enabling more informed actions in fast-paced environments. As businesses seek to improve operational efficiency, they use immersive technologies to provide clearer, more immediate insights.

Industries and companies are increasingly embracing AR, VR, and AI to enhance real-time decision-making processes, particularly through the lens of visual intelligence. For instance, in February 2025, Microsoft and Anduril Industries, a U.S.-based defense industry company, are expanding their partnership to advance the U.S. Army's Integrated Visual Augmentation System (IVAS) program. This partnership integrates Anduril's AI and defense technology with Microsoft's Azure cloud and AI capabilities to enhance battlefield awareness, decision-making, and mission success using AR and VR.

The growing integration of visual intelligence into mainstream technology signals a rising trend in consumer adoption of real-time visual recognition tools. As these technologies become more accessible in everyday devices, consumer demand for instant, AI-powered visual capabilities is set to increase. This trend highlights the growing reliance on visual intelligence to enhance user experience and decision-making. With greater accessibility, visual intelligence is expected to become a standard feature in consumer tech. The broader adoption of these tools is solely to drive innovation and expand their application across various industries. For instance, in February 2025, Apple, a U.S.-based technology company that designs and sells electronics, software, and services, introduced its Visual Intelligence feature to the iPhone 15 Pro, allowing users to point their camera at objects to learn more about them. This feature is accessible via the Action Button or Control Center on the iPhone 15 Pro, enhancing real-time information retrieval.

Integrating visual intelligence with IoT enhances the creation of smarter, interconnected systems. Combining computer vision with IoT devices leads to advanced solutions for smart cities, smart homes, and industrial IoT. This fusion enables the real-time collection and analysis of data from multiple sources, offering a more comprehensive understanding of situations. With visual intelligence, IoT devices can interpret contextual data, improving decision-making. Seamless system connectivity allows faster, more accurate responses in various environments. Security, manufacturing, and healthcare industries benefit from enhanced operational efficiency and automation. Continuous data flow strengthens predictive capabilities and supports more informed decisions. Ultimately, it helps create autonomous systems with improved situational awareness.

There is a growing focus on visual intelligence systems that can perceive and understand the 3D structure of the environment. This advancement greatly enhances the capabilities of robots and autonomous systems, enabling them to navigate and interact more effectively with the physical world. By incorporating 3D understanding, these systems can better adapt to their surroundings, increasing efficiency and responsiveness. This development also improves the accuracy and realism of applications such as augmented reality (AR) and virtual reality (VR), offering more immersive and interactive experiences. As visual intelligence systems gain better spatial awareness, their ability to interact with real-world objects becomes more precise. This is especially important for industries such as manufacturing, logistics, and healthcare, where precision is critical. The enhanced 3D perception also opens new opportunities for smarter environments, such as intelligent cities and smart homes.

Technology Insights

In terms of technology, the computer vision segment dominates the visual intelligence market and is anticipated to hold 34.1% in 2024. It primarily focuses on enabling machines to interpret and understand visual information from the world. This segment involves advanced algorithms and models for tasks such as object detection, facial recognition, and image classification. Computer vision technology has applications across industries, including automotive, healthcare, and security. Its ability to analyze visual data in real time contributes significantly to its dominance in the market. As businesses and organizations continue to utilize computer vision, the segment is expected to maintain its market leadership.

Deep learning is rapidly growing within the visual intelligence space. It involves training artificial neural networks to learn from large datasets and make predictions or decisions. Deep learning techniques, particularly convolutional neural networks (CNNs), are used extensively in computer vision tasks. The continuous advancement of deep learning algorithms is leading to more accurate and efficient visual intelligence systems. As the technology becomes more refined, it is expected to drive further growth in the visual intelligence market. Deep learning is increasingly being integrated into new applications, accelerating innovation across various sectors.

Application Insights

Surveillance and security accounted for the largest market revenue share in 2024. These systems utilize advanced visual recognition technologies to monitor environments effectively. The growing safety concerns, coupled with technological improvements, have made this application central to market growth. With the rise in public and private security needs, video analytics has become indispensable in surveillance. This sector is highly integrated with smart city projects and industrial surveillance systems, driving its dominance. As the need for real-time analysis and threat detection escalates, the surveillance and security domain remains a market leader.

Quality inspection & automation is growing significantly, driven by its increasing use in manufacturing and industrial sectors. Visual intelligence aids in detecting product defects and improving production efficiency. The precision and speed offered by these systems make them crucial for automating quality control processes. As industries adopt automation to enhance product quality and reduce human error, the demand for visual inspection technologies has surged. Moreover, the ongoing push for Industry 4.0 and smart factories is further boosting this growth. Integrating these systems with existing automation setups has enhanced their value and improved operational efficiency.

End Use Insights

The manufacturing segment generated the highest market revenue in 2024. Manufacturing has dominated the visual intelligence market due to its early adoption of machine vision for quality control and automation. Visual inspection systems are widely used to detect defects, ensure precision, and reduce human error. High demand for real-time monitoring and predictive maintenance has further driven adoption. Integration with robotics and AI enables manufacturers to optimize productivity and reduce downtime. As factories move toward smart manufacturing, visual intelligence continues to be a core component of operational efficiency. This strong foundation gives manufacturing a lasting edge in visual intelligence investment and innovation.

Retail and e-commerce are rapidly expanding their use of visual intelligence to enhance customer engagement. AI-powered visual search and recommendation engines are improving product discovery and personalization. In-store analytics using cameras and computer vision provides insights into customer behavior. Virtual try-ons and AR features are gaining popularity, especially in fashion and beauty. As digital shopping evolves, visual intelligence is becoming essential for competitive differentiation and user experience. This trend is pushing more retailers to invest in advanced imaging technologies to stay relevant.

Regional Insights

North America dominated the market and accounted for 37.8% share in 2024. The North American visual intelligence market is growing due to strong technology infrastructure and industry demand. Both manufacturing and retail sectors are expanding their use of computer vision for efficiency and customer engagement. Investments in AI startups and collaborations between enterprises and research institutions support innovation. The region also benefits from a skilled workforce and advanced data capabilities.

U.S. Visual Intelligence Market Trends

The visual intelligence market in the U.S. remains the largest contributor, driven by early technology adoption and strong R&D investment. Key industries such as defense, retail, and manufacturing are integrating computer vision to enhance performance and efficiency. Tech companies based in the U.S. are leading in developing visual AI platforms and tools. Government initiatives in AI ethics and regulation are shaping the market’s future.

Europe Visual Intelligence Market Trends

The visual intelligence market in Europe is advancing through strong industrial automation and AI policy support. Countries such as Germany and France are applying computer vision in manufacturing and smart cities. Retailers across the continent are using visual analytics for personalized customer experiences. The European Union’s AI Act is expected to influence future development and deployment strategies.

Asia Pacific Visual Intelligence Market Trends

The visual intelligence market in Asia Pacific is experiencing rapid expansion driven by widespread adoption in consumer electronics, surveillance, and e-commerce. China, Japan, and South Korea are leading in deploying visual AI across both public and private sectors. The region benefits from a large user base, strong manufacturing ecosystems, and active government support. As digital transformation accelerates, visual intelligence is becoming a key part of regional innovation strategies.

Key Visual Intelligence Company Insights

Some key companies in the visual intelligence industry include Apple Inc., Cognex Corporation, International Business Machines Corporation, and Intel Corporation. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Apple Inc. has integrated visual intelligence across its product lines, notably enhancing the camera capabilities of its devices through advanced AI algorithms. The company focuses on improving image recognition, object tracking, and augmented reality experiences on platforms such as iOS and iPadOS. Apple's visual intelligence advancements enable features such as Face ID, real-time photo enhancements, and intelligent video editing. The company is also expanding its AI-powered features in wearables, such as Apple Watch, for health-related visual data analysis.

-

Cognex Corporation specializes in industrial machine vision, using visual intelligence to automate manufacturing processes across various industries. The company's In-Sight vision sensors and vision systems incorporate AI to perform tasks such as object detection, quality control, and assembly verification. Cognex’s products are designed to solve challenges in visual inspections, such as recognizing reflective, distorted, or varying contrast objects. Their AI-powered tools, such as the In-Sight SnAPP vision sensor, enable manufacturers to automate tasks that traditionally required complex programming, boosting efficiency and accuracy.

Key Visual Intelligence Companies:

The following are the leading companies in the visual intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Alphabet Inc.

- Amazon.com, Inc.

- Apple Inc.

- Cognex Corporation

- International Business Machines Corporation

- Intel Corporation

- Meta Platforms, Inc.

- Microsoft

- NVIDIA Corporation

- Qualcomm Incorporated

Recent Developments

-

In September 2024, Apple introduced a visual intelligence feature for iPhone 16, enabling users to perform visual searches through its Camera Control button, with support from partners such as Google and OpenAI. This allows users to access services such as Google Search and ChatGPT directly from the camera view, marking a shift toward integrated AI-powered interactions without needing standalone apps.

-

In August 2024, Cognex Corporation launched an AI-powered counting tool for its In-Sight SnAPP vision sensor, designed to simplify and automate counting tasks across various industries. This tool enhances accuracy and efficiency by using AI to reliably count objects, even in challenging scenarios such as reflective or distorted parts, with minimal setup and training required.

Visual Intelligence Market Report Scope

Report Attribute

Details

Market Size value in 2025

USD 13,420.4 million

Revenue forecast in 2030

USD 32,166.4 million

Growth rate

CAGR of 19.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Technology, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Alphabet Inc.; Amazon.com, Inc.; Apple Inc.; Cognex Corporation; International Business Machines Corporation; Intel Corporation; Meta Platforms, Inc.; Microsoft; NVIDIA Corporation; Qualcomm Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Visual Intelligence Market Report Segmentation

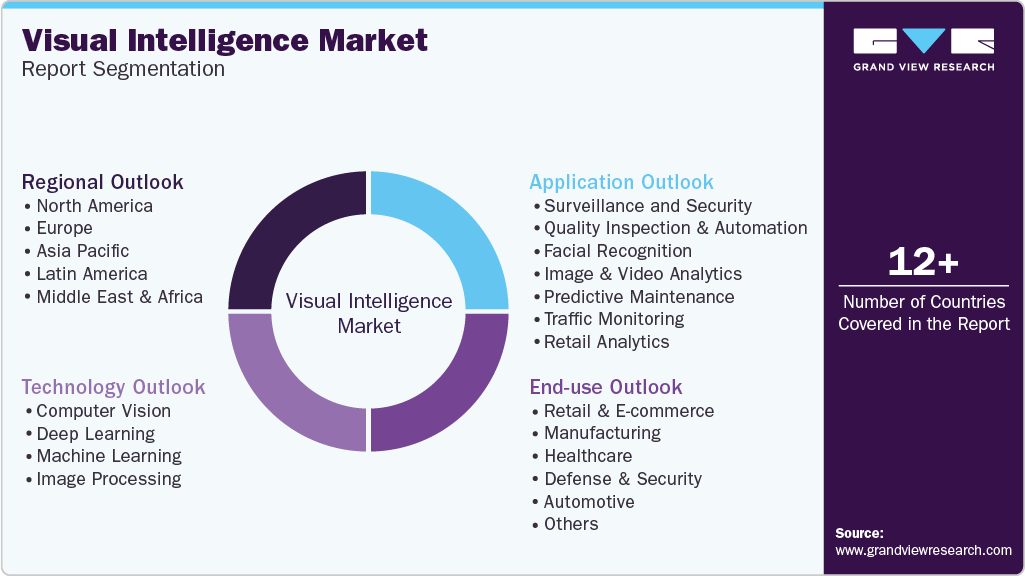

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global visual intelligence market in terms of technology, application, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Computer Vision

-

Deep Learning

-

Machine Learning

-

Image Processing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surveillance and Security

-

Quality Inspection & Automation

-

Facial Recognition

-

Image & Video Analytics

-

Predictive Maintenance

-

Traffic Monitoring

-

Retail Analytics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Manufacturing

-

Healthcare

-

Defense & Security

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global visual intelligence market size was estimated at USD 11,432.0 million in 2024 and is expected to reach USD 13,420.4 million in 2025.

b. The global visual intelligence market is expected to grow at a compound annual growth rate of 19.1% from 2025 to 2030 to reach USD 32,166.4 million by 2030.

b. North America dominated the visual intelligence market with a share of 37.8% in 2024. This is attributable to strong technological infrastructure and widespread enterprise adoption.

b. Some key players operating in the visual intelligence market include Alphabet Inc., Amazon.com, Inc., Apple Inc., Cognex Corporation, International Business Machines Corporation, Intel Corporation, Meta Platforms, Inc., Microsoft, NVIDIA Corporation, Qualcomm Incorporated

b. Key factors driving the market growth include rising demand for automation, advancements in AI technologies, and increased investment in intelligent systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.