- Home

- »

- Petrochemicals

- »

-

Wax Emulsion Market Size, Share & Growth Report, 2030GVR Report cover

![Wax Emulsion Market Size, Share & Trends Report]()

Wax Emulsion Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Synthetic, Natural), By Product (Paraffin, Carnauba, Polyethylene), By End-use (Cosmetics, Textiles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-8

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wax Emulsion Market Size & Trends

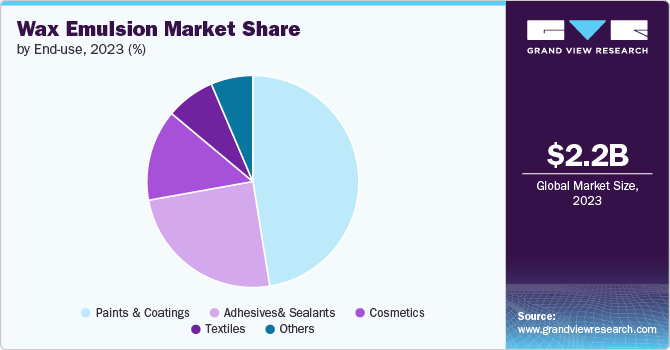

The global wax emulsion market size was estimated at USD 2.23 billion in 2023 and is projected grow at a CAGR of 4.7% from 2024 to 2030, owing to its rising consumption in the paints and coatings industry. The product is used as an additive in paints & coatings to improve scratch resistance, impart gloss and sheen, enhance water repellency, and provide a smooth finish.

As per Coatings World, the global paints & coatings market reached USD 177.4 billion in 2023 and is further expected to reach USD 269 billion by 2032, exhibiting a growth rate (CAGR) of 4.7% during 2023-2032. The end use market growth of the product is further expected to increase product consumption globally in the coming years. The product contributes significantly to formulating coatings that offer enhanced durability against abrasion and weathering, making them ideal for applications in architectural paints, industrial coatings, and automotive finishes.

Moreover, the product also finds extensive application in adhesives and sealants, contributing to superior bonding strength, flexibility to accommodate joint movements and resistance to moisture and environmental elements. Furthermore, industries such as textiles utilize wax emulsions to impart softness, water repellency, and crease resistance to fabrics. The product market faces several restraints impacting its growth and adoption across industries. One significant challenge is the competition from alternative technologies and materials, such as solvent-based formulations or other additives, which can sometimes offer comparable or enhanced performance characteristics at competitive prices.

The complexity of formulating wax emulsions to meet specific application requirements, such as achieving desired viscosity, stability, or compatibility with other ingredients, can pose technical challenges for manufacturers and formulators.

Material Insights

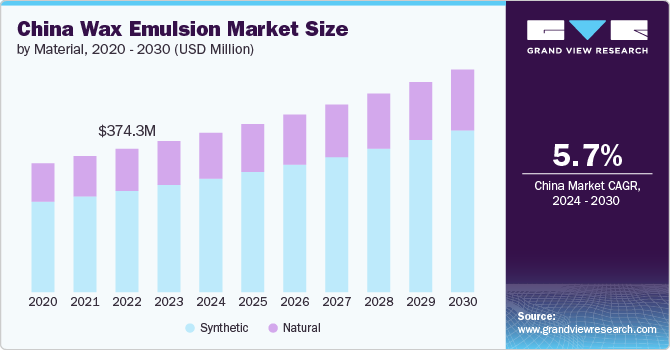

Synthetic form of the product dominated the market with a revenue share of 66.96% in 2023 due to their consistent quality and purity.Moreover, synthetic waxes can offer enhanced stability and performance in formulations compared to natural waxes, particularly in challenging environments or applications that require resistance to extreme temperatures, chemicals, or UV exposure.

Natural waxes are derived from plants (like carnauba) or animals (like beeswax) and offer specific characteristics such as natural adhesion, gloss, and water resistance. In contrast, synthetic waxes are manufactured through chemical processes, allowing for precise control over properties like melting point, hardness, and consistency.

Product Insights

Paraffin wax emulsion dominated the market with a revenue share of 51.10% in 2023. It is preferred over other types of wax owing to its affordability. Moreover, the paraffin product type is highly versatile and can be used in a wide range of applications, including paints and coatings, paper packaging, adhesives, and textiles.

The product type primarily comprises paraffin wax dispersed in water with emulsifiers; it forms a stable emulsion that is easy to handle and apply. In the cosmetic industry, paraffin emulsion wax is known for its moisturizing and protective qualities. It is a key ingredient in lotions, creams, and ointments designed to soothe and hydrate the skin.

End-use Insights

Paints and coatings end use dominated the market with a revenue share of 47.4% in 2023. Wax emulsions are widely used in paints and coatings to enhance water repellency, durability, and surface protection. The expanding construction industry globally boosts the demand for high-quality paints and coatings, growing the product market. Moreover, the product is also used in the paper and packaging industry to improve paper products' water-resistance and surface properties. It is also used in the textile industry for fabric finishing and coating applications.

The product is essential in adhesive and sealant formulations, imparting critical properties that enhance performance and durability. In adhesives, they adjust viscosity for optimal application, provide water resistance, and prevent blocking in pressure-sensitive applications. For sealants, wax emulsions contribute to barrier formation against moisture and contaminants, increase flexibility to accommodate joint movements, enhance weather resistance, and ensure smooth application for a seamless finish.

Regional Insight

Asia Pacific dominated the market segment with a revenue share of 43.45% in 2023. Asia Pacific is a key region in paints and coating production; thus, it holds the highest share in global product consumption. As per Coatings World, the Asia Pacific paint and coatings market was the largest and fastest-growing geographic segment in the world in 2023. In addition, the paints and coatings market in the region is estimated to be 27 billion liters and $88 billion in 2023. The rapidly growing end-use industries are further expected to increase product demand in the region. Greater China represents the largest Asia Pacific coatings market segment, accounting for 55% of the region's geographic share. It is followed by Japan and Korea, with Japan contributing approximately 10% and South Korea contributing 5%, totaling 15% for the subregion. In recent years, this has been the strongest-growing region in the world due mainly to strong growth in the Indian market. India has surpassed Japan as Asia's second-largest paint and coatings market and continues to be the fastest-growing major country market in the world.

North America Wax Emulsion Market Trends

The wax emulsion market in North America is expected to grow significantly over the forecast period. The product is highly consumed by the textile industry in North America owing to its application in fabric finishing and coatings. The textile and apparel industry in North America is growing rapidly, as exports to the Western Hemisphere rose 14.9 percent to reach USD 18 billion in 2022, compared with five years ago in 2017. Thus, the growing textile industry is further expected to increase the demand for the product in the region in the upcoming years.

Europe Wax Emulsion Market Trends

The wax emulsion market in Europe is growing, owing to its rising demand from the cosmetic and personal care industry. As per Cosmetic Europa, the region is a global flagship market for cosmetics and personal care products, Valued at USD 104.58 billion at retail sales price in 2023. It is estimated that the cosmetics and personal care industry brings at least USD 31.59 billion in added value to the European economy annually. Thus, the rapidly growing cosmetic industry in the region is further expected to rocket fuel the consumption of products in the region.

Key Wax Emulsion Company Insights

Some key players operating in the market include BASF SE, Nippon Seiro Co, Sasol Limited, Exxon Mobil Corporation & The Lubrizol Corporation, among others.

-

BASF SE, a Germany-based chemicals manufacturing company, holds a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments: Chemicals, Surface Technologies, Materials, Nutrition & care, Industrial Solutions, and Agricultural Solutions. The company has 11 operating divisions, which are categorized under the company’s 6 business segments. The company sells its wax emulsion product under the brand “JONCRYL.”

-

ExxonMobil Corporation is a U.S.-based, integrated energy company that produces and supplies oil and gas worldwide. It operates through three business segments: Upstream, Chemicals, and Downstream. ExxonMobil Corporation's product portfolio includes olefins, aromatics, fluids, synthetic rubber, polyethylene, polypropylene, and wax emulsions. It also offers various petrochemicals such as polyethylene, polymer modifiers, polypropylene, and olefins.

Key Wax Emulsion Companies:

The following are the leading companies in the wax emulsion market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Nippon Seiro Co.

- Altana AG

- Sasol Limited

- Exxon Mobil Corporation

- Hexion

- The Lubrizol Corporation

- Danquinsa GmbH

- RAZON CONSTRUCTION CHEMICALS

- Khavaran Paraffin

Recent Developments

-

In May 2024, DEUREX AG introduced micronized carnauba waxes, a new product to its portfolio in addition to sugar cane waxes. These waxes are generally very easy to polish and provide a high gloss. Pure, micronized carnauba waxes type 1 and type 3 can be used in the food industry.

-

In June 2021, Michelman, Inc. established an exclusive partnership with OMYA, a leading global producer of calcium carbonate and specialty chemicals. Under this collaboration, OMYA will exclusively distribute Michelman's range of wax emulsion products tailored explicitly for the paints and coatings industry. This strategic alliance aims to leverage OMYA's extensive distribution network and market reach to enhance the availability and accessibility of Michelman's specialized wax emulsions, thereby meeting the diverse needs of customers within the paints and coatings sector more effectively.

Wax Emulsion Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.33 billion

Revenue forecast in 2030

USD 3.07 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

BASF SE; Nippon Seiro Co.; Altana AG; Sasol Limited;

Exxon Mobil Corporation; Hexion; The Lubrizol Corporation; Danquinsa GmbH; RAZON CONSTRUCTION CHEMICALS; Khavaran Paraffin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wax Emulsion Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wax emulsion market report based on material, product, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paraffin

-

Carnauba

-

Polyethylene

-

Polypropylene

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesives & Sealants

-

Cosmetics

-

Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wax emulsion market size was estimated at USD 2.23 billion in 2023 and is expected to reach USD 2.33 billion in 2024.

b. The global wax emulsion market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 3.07 billion by 2030.

b. Asia Pacific dominated the wax emulsion market with a share of 43.9% in 2023. This is attributable to Asia Pacific being a key region in terms of paints and coating production.

b. Some key players operating in the wax emulsion market include BASF SE, Nippon Seiro Co., Altana AG, Sasol Limited Exxon Mobil Corporation, Hexion, The Lubrizol Corporation, Danquinsa GmbH, RAZON CONSTRUCTION CHEMICALS, Khavaran Paraffin

b. Key factors that are driving the market growth include its rising consumption in paints and coatings industry. The product is used as an additive in the paints & coatings in order to improve scratch resistance, impart gloss and sheen, enhance water repellency, and provide a smooth finish.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.