- Home

- »

- Automotive & Transportation

- »

-

Wholesale & Distribution Automotive Aftermarket Industry Report 2030GVR Report cover

![Wholesale & Distribution Automotive Aftermarket Industry Size, Share & Trends Report]()

Wholesale & Distribution Automotive Aftermarket Industry Size, Share & Trends Analysis Report By Replacement Part (Tire, Battery, Brake Parts, Filters, Body Parts, Lighting & Electronic Components) And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-508-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wholesale & Distribution Automotive Aftermarket Industry Summary

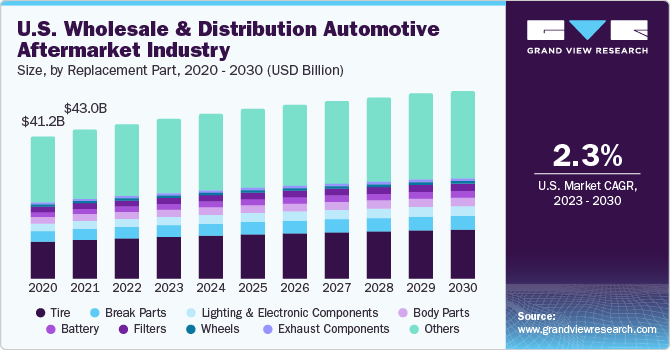

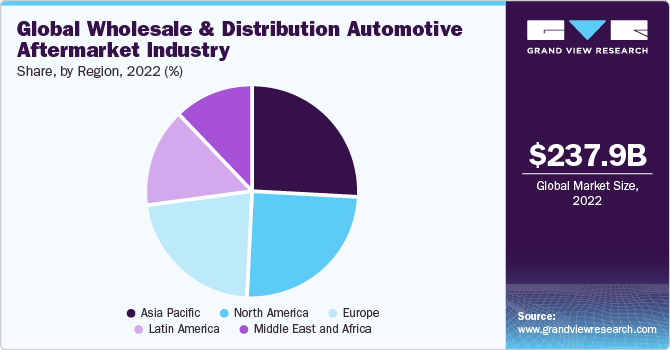

The global wholesale & distribution automotive aftermarket industry size was estimated at USD 237.98 billion in 2022 and is projected to reach USD 342.72 billion by 2030, growing at a CAGR of 4.5% from 2023 to 2030. The automotive aftermarket is the secondary commercial channel of the automotive sector.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 24.8% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 8.6% during the forecast period.

- Based on replacement part, the tire segment accounted for the largest revenue share of 22.8% in 2022.

- In terms of replacement part, the filters segment is expected to grow at the fastest CAGR of 6.4% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 237.98 billion

- 2030 Projected Market Size: USD 342.72 billion

- CAGR (2023-2030): 4.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Once vehicles are sold by original equipment manufacturers (OEMs), they require replacement parts, servicing items, and accessories for failed or damaged components throughout their life. Aftermarket parts are manufactured by OEMs and other manufacturers who supply them to OEMs. Due to higher dependability, the aftermarket parts industry is dependent on the changing trends in the primary automotive industry.Stringent production norms have led automotive vendors to improvise and optimize their techniques and introduce advanced technologies and innovations to their products in a bid to reduce automobile production costs. With the increasing sales of automobiles worldwide, the demand for automotive collision repair is expected to grow.

Servicing and repairing aggregation has emerged as a popular choice among customers, leading to technological advancements in the automotive sector. Technical information along with coding parts is not freely available to the wholesale & distribution automotive aftermarket for carrying out maintenance and repair, due to which the growth of independent workshops is hampered.

The manufacturers of aftermarket replacement components face a great risk from counterfeit automotive component manufacturers. These manufacturers design a fraudulent imitation of original auto-components, thereby hampering the life of automobiles alongside threatening passenger safety.

Replacement Part Insights

The tire segment accounted for the largest revenue share of 22.8% in 2022. Tires are one of the first automotive parts that need replacement due to friction and wear & tear. The average age of vehicles is increasing due to technological advancements. As a result, an increasing need for replacement parts, especially tires, has been observed. The most significant function of a battery is to start the vehicle. The battery has the capacity to hold a charge. However, it loses some of its capacity over time, which leads to the need for replacement.

Brake pads wear each time a brake is applied. The vehicle often experiences stoppages in traffic, which results in the faster wear and tear of brakes. Additionally, the weight and size of a vehicle are also responsible for affecting the brake pads.

The filters segment is expected to grow at the fastest CAGR of 6.4% during the forecast period. The auto filter prevents harmful debris from entering into the air and fluid flows of the vehicle, such as radiator, engine, and fuel lines. Over the period, filters undergo aging and get contaminated with debris and pollutants. This leads to decreased performance and damages various parts of the vehicle. Customers are also keen on replacing various accessories of vehicles, such as body parts, lighting & electronic components, wheels, and more. These replacements enhance the performance and appearance of the vehicle.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 24.8% in 2022. Growth in the region is due to a number of factors, including the large and mature automotive industry, the high vehicle ownership rate, the growing demand for used cars, and technological advancements. The region is home to some of the world's leading car manufacturers, and the vehicle ownership rate is very high. Additionally, the demand for used cars is growing, and new cars are increasingly equipped with complex electronics and other features that can require specialized parts and services.

The growth in the global automotive aftermarket is directly related to the growth of the global automobiles market. With the increasing sales of automobiles worldwide, the demand for automotive collision repair is expected to grow. In developing regions, such as Asia Pacific, South America, and the Middle East, a surge in the usage of passenger vehicles is anticipated over the next decade, thereby bolstering the growth of the automotive aftermarket.

Asia Pacific is expected to grow at the fastest CAGR of 8.6% during the forecast period. The increasing vehicle penetration is driven by the overall improvement in lifestyles in developing countries, such as India and Brazil. This is expected to drive the growth of the automobile industry in the region. A surge in automotive manufacturing across various regions, along with increasingly stringent norms regarding emissions, is expected to drive the growth of the automotive aftermarket sales over the forecast period.

In the emerging markets of Brazil, Russia, India, China, and South Africa (BRICS), a greater e-commerce participation has been observed in the automotive aftermarket. This trend is likely to increase over the forecast period.

Key Companies & Market Share Insights

Key players in the market have adopted the strategy of mergers & acquisitions to expand their product and service portfolios.

Key Wholesale & Distribution Automotive Aftermarket Industry Companies:

- 3M

- Continental AG

- BorgWarner Inc.

- DENSO CORPORATION.

- Federal-Mogul Corporation

- Stellantis NV

- Marelli Holdings Co., Ltd.

- JSC Baltic Filter

Recent Developments

-

In July 2023, General Motors Co. acquired ALGOLiON Ltd., an Israel-based battery software startup. The acquisition is managed by GM's newly formed technologies Acceleration and Commercialization (TAC) team, which attempts to find emerging technologies that enhance GM's expertise in battery development through investments, acquisitions, or collaborations.

-

In June 2023, Continental AG introduced the UltraContact NXT, its most environmentally friendly tire to date. The tire is produced from up to 65% recycled, renewable, and mass balance certified components, making it one of the most environmentally friendly tires available. The tire nevertheless fulfills the highest safety and performance criteria, making it an excellent choice for environmentally conscious drivers.

-

In May 2023, Stellantis NV, a Dutch car manufacturing business, collaborated with Petromin in Saudi Arabia to launch Eurorepar. Eurorepar is a collection of automobile parts and maintenance supplies. This collaboration is part of their ongoing efforts to improve road safety.

-

In February 2023, Continental AG launched the new CrossContact H/T summer tire, which is designed for drivers who need a tire that can handle a variety of road conditions. The tire is rugged enough to handle unpaved roads and gravel tracks, yet it also provides a comfortable ride on paved roads. The CrossContact H/T has an M+S rating, which means it is suitable for use in mild off-road conditions. The tire can be fitted to vehicles with conventional and electric drive systems.

-

In March 2023, BorgWarner Inc. launched new bi-metallic brake discs that are lighter, quieter, and more fuel-efficient than traditional cast-iron discs. The new discs are made from a two-part alloy that is 15% lighter than a single cast-iron disc. This weight reduction helps to improve fuel economy and reduce emissions. The two-part construction also reduces vibration and noise, providing a more comfortable and satisfying driving experience.

-

In October 2020, BorgWarner Inc., an American automotive supplier, completed the acquisition of Delphi Technologies. The combined company will have a stronger portfolio of electronics and power electronics products, as well as greater scale and capabilities. This will position the company well to take advantage of the future migration to electrified vehicles.

-

In September 2020, Marelli and Highly (Hong Kong) launched an association with Highly Marelli Holdings Co., Ltd. to create an innovative cabin comfort business. The joint venture aims to concentrate on creating world-class solutions for customers and suppliers in the areas of compressor electrification, HVAC systems, and electric-driven compressors.

Wholesale & Distribution Automotive Aftermarket Report Scope

Report Attribute

Details

Market size value in 2023

USD 251.30 billion

Revenue forecast in 2030

USD 342.72 billion

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Replacement part, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

3M; Continental AG; BorgWarner Inc.; DENSO CORPORATION.; Federal-Mogul Corporation; Stellantis NV; Marelli Holdings Co., Ltd.; JSC Baltic Filter

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wholesale & Distribution Automotive Aftermarket Industry Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global wholesale & distribution automotive aftermarket based on replacement part and region:

-

Replacement Part Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tire

-

Battery

-

Break parts

-

Filters

-

Body parts

-

Lighting & electronic components

-

Wheels

-

Exhaust components

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wholesale and distribution automotive aftermarket industry size was estimated at USD 237.98 billion in 2022 and is expected to reach USD 251.30 billion in 2023.

b. The global wholesale and distribution automotive aftermarket industry is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 342.72 billion by 2030.

b. North America dominated the wholesale and distribution automotive aftermarket industry with a share of 24.8% in 2022. This is attributable to the increasing sales of automobiles in the region.

b. Some key players operating in the wholesale and distribution automotive aftermarket industry include 3M; Continental AG; Delphi Automotive PLC; Denso Corporation; and Federal-Mogul Corporation.

b. Key factors that are driving the market growth include the surge in consumer and passenger automobile production and advanced technology usage in the fabrication of auto parts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.