- Home

- »

- Next Generation Technologies

- »

-

Wi-Fi 6E Chipset Market Size, Share & Trends Report, 2030GVR Report cover

![Wi-Fi 6E Chipset Market Size, Share & Trends Report]()

Wi-Fi 6E Chipset Market Size, Share & Trends Analysis Report By Device Type (WLAN Infrastructure, Industrial IoT Devices), By Application (Commercial, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-073-4

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Wi-Fi 6E Chipset Market Size & Trends

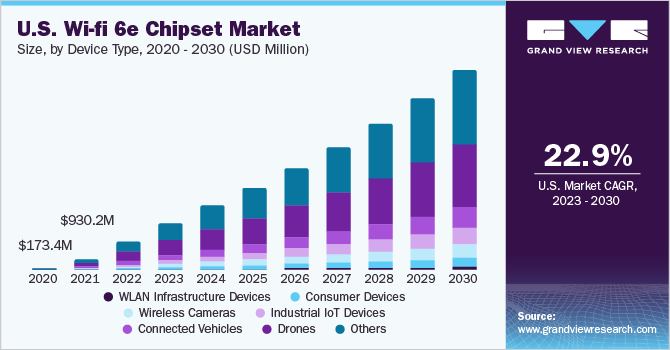

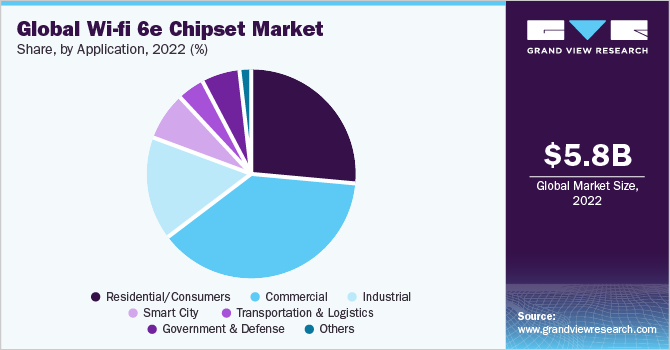

The global Wi-Fi 6E chipset market size was valued at USD 5.78 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 22.4% from 2023 to 2030. The rising need for improved network low latency and bandwidth communications across companies is expected to drive the market over the projected period. The greatly increased data traffic has driven the need for enhanced network connectivity across numerous industries, including corporate and industrial. Thus, over the coming years, it is projected that the installation of Wi-Fi 6E devices will expand, as will the demand for their chipsets. Several companies across the globe are focusing on developing Wi-Fi 6E modules to power the upcoming laptops and PCs.

For instance, in November 2021, MediaTek Inc., a semiconductor company, and Advanced Micro Devices (AMD) Inc. announced a collaboration to produce Wi-Fi 6E modules to power the next AMD Ryzen-series laptop and desktop PCs beginning in 2022 and beyond. The businesses have released the AMD RZ600 Series Wi-Fi 6E modules, including the AMD RZ608 and AMD RZ616 modules, incorporating MediaTek's Filogic 330P processor. The Filogic 330P chipset supports 2x2 Wi-Fi 6 (2.4/5GHz) and 6E (6GHz band up to 7.125GHz) communication standards, as well as Bluetooth 5.2 (BT/BLE). In 2020, Broadcom Inc. unveiled the BCM4389, the world debut of the Wi-Fi 6E customer.

Increasing demand for high-speed and low-latency wireless connectivity among consumers has led to higher adoption of Wi-Fi 6E chipset devices. With the growing adoption of advanced technologies, such as 4K/8K video streaming, Virtual Reality (VR), Augmented Reality (AR), and cloud-based gaming, there is a significant need for high-speed and low-latency wireless connectivity. The Wi-Fi 6E technology offers faster data transfer rates and lower latency, making it an ideal solution for these applications. The adoption of smart home and smart city technologies is increasing rapidly, with consumers and governments recognizing these solutions' benefits.

Wi-Fi 6E offers higher bandwidth and faster data transfer speeds, enabling seamless connectivity between smart devices and the cloud. Improvements in connected technology are also expected to contribute to the growth of the market. The advent of new wireless connectivity technologies, such as Wi-Fi 6E and 5G, has made it possible to connect more IoT devices and transfer larger amounts of data at faster speeds. This has helped overcome some of the limitations of earlier IoT connectivity technologies and enabled new use cases for IoT devices. Moreover, many IoT devices are used to gather and transmit real-time data, such as environmental sensors used in smart cities and industrial IoT applications.

This data is used to optimize processes, improve efficiency, and enable new services, which requires fast and reliable wireless connectivity. The growing demand for smart home devices, such as thermostats, security cameras, smart lighting, and voice assistants, which require reliable and fast Wi-Fi connections to function properly, is also contributing to the growth of the market. The demand for smart homes is growing as consumers seek to automate and simplify daily tasks, such as home security, energy management, and entertainment. Wi-Fi 6E technology is well-suited to support the growing demand for smart home devices, offering faster data transfer rates, lower latency, and better performance in congested wireless environments.

Impact of the COVID-19 Pandemic

The continued proliferation of the COVID-19 pandemic had an adverse impact on Wi-Fi chipset manufacturing and demand throughout the world. With the fast spread of viruses in 2020, federal governments in key countries, such as China, the U.S., Germany, Japan, and the UK, imposed nationwide lockdowns. Several production facilities and international crossings were temporarily closed due to the shutdown. As a result, overall chipset output fell, and supply in the worldwide market slowed the overall industry development for a brief time. However, the pandemic has led to an increase in remote work, online learning, and video conferencing, which has supported the demand for high-speed and low-latency wireless connectivity solutions. This has resulted in a greater need for Wi-Fi 6E technology, which can provide faster data transfer rates and better performance in congested wireless environments.

Device Type Insights

The WLAN infrastructure devices segment dominated the market in 2022 and accounted for more than 34.0% share of the global revenue due to the rising demand for cloud-managed WLAN architecture, which enables IT managers to manage and monitor WLAN networks from a single place. This trend is being driven by the growing popularity of remote work and the requirement for IT teams to maintain networks in numerous locations. At the same time, the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) technologies into WLAN infrastructure equipment, which can aid in network performance and security by monitoring network traffic and identifying possible concerns, is also contributing to the segment's growth.

New use cases, such as high-density public Wi-Fi, industrial IoT, and wireless backhaul, are also increasing the demand for WLAN infrastructure devices with more bandwidth and reduced latency. The Industrial IoT Devices segment is projected to witness remarkable growth over the forecast period. The Industrial Internet of Things (IIoT) is rapidly expanding, and the use of Wi-Fi 6E chipset devices is playing an increasingly important role in this growth. There are several emerging trends in IIoT devices that are driving demand for Wi-Fi 6E technology. For instance, the adoption of edge computing in IIoT applications, which involves processing data closer to the source rather than sending it to a centralized cloud.

This approach requires high-speed and low-latency wireless connectivity, which can be provided by Wi-Fi 6E. Another trend is the use of wireless sensors and actuators in IIoT applications, which require reliable and robust wireless connectivity to function properly. Wi-Fi 6E can provide higher bandwidth and lower latency than previous Wi-Fi standards, making it well-suited for industrial applications that require real-time data transmission. Furthermore, the adoption of 5G networks in industrial settings is creating new opportunities for Wi-Fi 6E technology, particularly in the areas of mobile offloading and hybrid wireless connectivity.

Application Insights

In terms of value, the commercial segment accounted for a share of over 33.0% in 2022. The increasing use of smart devices and IoT technology in commercial spaces is a major factor contributing to the segment's growth. With Wi-Fi 6E’s improved connectivity, businesses can better support these devices and applications, leading to increased productivity and efficiency. In addition, the COVID-19 pandemic has accelerated the adoption of remote work and online communication tools, making reliable and fast Wi-Fi connectivity even more critical for businesses. As a result, the demand for Wi-Fi 6E chipsets in the commercial segment is expected to continue to grow in the coming years. The industrial segment is projected to witness significant growth over the forecast period.

The growing adoption of Industry 4.0 technologies, which require reliable and high-speed wireless connectivity to support the implementation of advanced automation and control systems is a significant factor contributing to the segment growth. Wi-Fi 6E's improved capacity and reduced interference enable industrial plants to support an increasing number of connected devices and applications, such as autonomous robots and smart sensors, leading to increased efficiency and productivity. At the same time, Wi-Fi 6E chipsets in the industrial segment are the need for real-time data processing and communication. With the increasing use of cloud-based analytics and edge computing, fast and reliable Wi-Fi connectivity is crucial to enable real-time data collection and analysis, leading to improved decision-making and operational efficiency.

Regional Insights

In terms of value, North America dominated the market in 2022 and accounted for more than 42.0% share of the global revenue. Increasing demand for higher bandwidth and faster internet speeds, driven by the growing number of connected devices in homes and businesses is a significant factor contributing to the regional market growth. Wi-Fi 6E's improved speed, capacity, and reduced latency can meet the needs of these devices, resulting in better user experiences and improved productivity. The growing adoption of Wi-Fi 6E chipsets in North America is the need for improved network security.

With the rise of cyber threats and data breaches, businesses and individuals are increasingly seeking solutions that provide enhanced security features. Wi-Fi 6E's improved security protocols, such as WPA3, can help protect against unauthorized access and data theft. In addition, the COVID-19 pandemic has accelerated the adoption of remote work and online education, increasing the demand for reliable and fast Wi-Fi connectivity at home. The Asia Pacific region is anticipated to register the fastest CAGR over the forecast period.

The growth of e-commerce and online shopping, which requires reliable and fast wireless connectivity to enable seamless transactions and better user experiences is a major factor contributing to the regional growth. Asia Pacific is home to several emerging economies, which are increasingly investing in infrastructure development, including 5G and Wi-Fi 6E technologies, to support their digital transformation efforts. The trend towards Industry 4.0 and advanced automation are driving product demand in the manufacturing and logistics sectors of the Asia Pacific region.

Key Companies & Market Share Insights

The market can be characterized as being fragmented due to the presence of numerous notable players. These players are fostering market competition by implementing various strategies aimed at the long-term sustainability of the market position, which makes it difficult for new players to enter the space. These strategies include product developments, regional expansions, and so on. Several businesses in the market are forming alliances and partnerships with other industry participants. This allows them to use one another's expertise and resources, allowing them to offer clients more comprehensive and integrated solutions.

Businesses are also expanding their presence in new geographic areas and introducing new products to build better connectivity solutions. For instance, in February 2023, Nokia, a telecommunication company, launched Beacon 10. It is the company's first gateway to enable Wi-Fi 6E to deliver seamless, high-capacity mesh networking. The Beacon 10 is a full tri-band device with a 10Gbps Wi-Fi speed. It has a 10G WAN interface that can be paired with 10 Gb/second fiber modems to provide multi-gigabit services to the house. The new gateway will be unveiled for the first time at the Mobile World Congress in Barcelona. Some of the prominent players in the global Wi-Fi 6E chipset market include:

-

Broadcom Inc.

-

Qualcomm Technologies, Inc.

-

ON Semiconductor Connectivity Solutions, Inc.

-

Intel Corp.

-

Renesas Electronics Corp.

-

MediaTek Inc.

-

Texas Instruments Inc.

-

Infineon Technologies AG

-

STMicroelectronics N.V.

-

NXP Semiconductors N.V.

Wi-Fi 6E Chipset Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.50 billion

Revenue forecast in 2030

USD 39.17 billion

Growth rate

CAGR of 22.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2020 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Device type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Singapore; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Broadcom Inc.; Qualcomm Technologies, Inc.; ON Semiconductor Connectivity Solutions, Inc.; Intel Corp.; Renesas Electronics Corp.; MediaTek Inc.; Texas Instruments Inc.; Infineon Technologies AG; STMicroelectronics N.V.; NXP Semiconductors N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wi-Fi 6E Chipset Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2020 to 2030. For this report, Grand View Research has segmented the global Wi-Fi 6E chipset market report based on device type, application, and region:

-

Device Type Outlook (Volume, Million Units; Revenue, USD Million, 2020 - 2030)

-

WLAN Infrastructure Devices

-

Consumer Devices

-

Smartphones/Tablets

-

Desktops/Laptops

-

AR/VR and Wearables

-

Smart Home Devices

-

Others

-

-

Wireless Cameras

-

Industrial IoT Devices

-

Connected Vehicles

-

Drones

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2020 - 2030)

-

Residential/Consumers

-

Commercial

-

Enterprises/Corporates

-

Airports

-

Stadiums

-

Malls/Shops

-

Hospitals

-

Hotels & Restaurants

-

Educational Campuses

-

Others

-

-

Industrial

-

Smart Manufacturing

-

Energy & Utility

-

Oil & Gas and Mining

-

-

Smart City

-

Transportation & Logistics

-

Government & Defense

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Wi-Fi 6E Chipset market size was estimated at USD 5.78 billion in 2022 and is expected to reach USD 9.50 billion in 2023.

b. The global Wi-Fi 6E Chipset market is expected to grow at a compound annual growth rate of 22.4% from 2023 to 2030 to reach USD 39.17 billion by 2030.

b. North America dominated the Wi-Fi 6E Chipset market with a share of 42.1% in 2022. Increasing demand for higher bandwidth and faster internet speeds, driven by the growing number of connected devices in homes and businesses is a significant factor contributing to the regional growth.

b. Some of the key players in the Wi-Fi 6E chipset market include Broadcom Inc., Qualcomm Technologies, Inc., ON Semiconductor Connectivity Solutions, Inc., Intel Corporation, Renesas Electronics Corporation., MediaTek Inc., Texas Instruments Incorporated, Infineon Technologies AG, STMICROELECTRONICS N.V., and NXP SEMICONDUCTORS N.V.

b. Key factors that are driving the Wi-Fi 6E chipset market growth include increasing demand for high-speed and low-latency wireless connectivity among consumers has led to higher adoption of the Wi-Fi 6E Chipset devices. With the growing adoption of advanced technologies such as 4K/8K video streaming, virtual reality, augmented reality, and cloud-based gaming, there is a significant need for high-speed and low-latency wireless connectivity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."