- Home

- »

- Power Generation & Storage

- »

-

Wind Turbine Tower Market Size, Industry Report, 2030GVR Report cover

![Wind Turbine Tower Market Size, Share & Trends Report]()

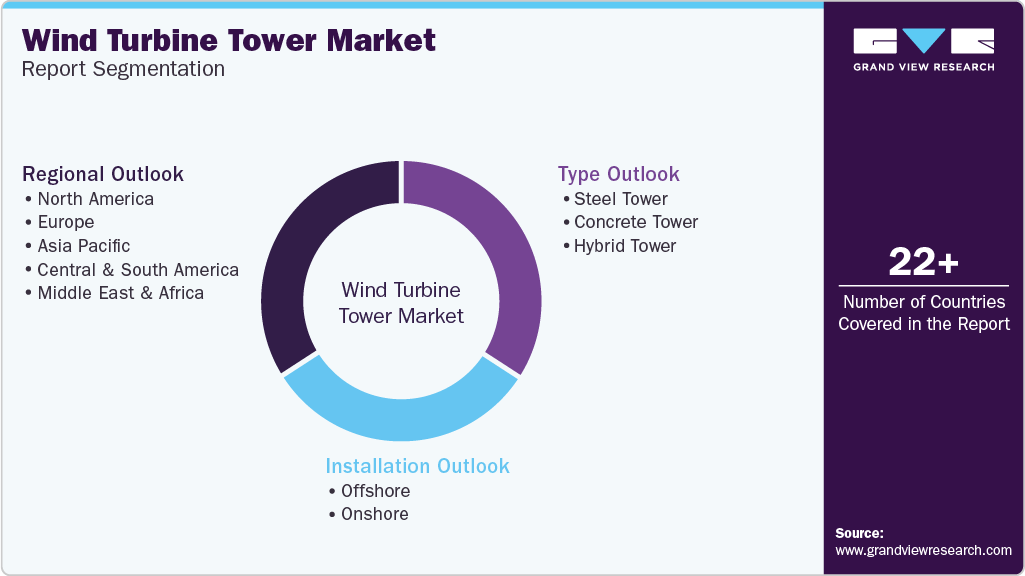

Wind Turbine Tower Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Steel Tower, Concrete Tower, Hybrid Tower), By Installation (Offshore, Onshore), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-388-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wind Turbine Tower Market Summary

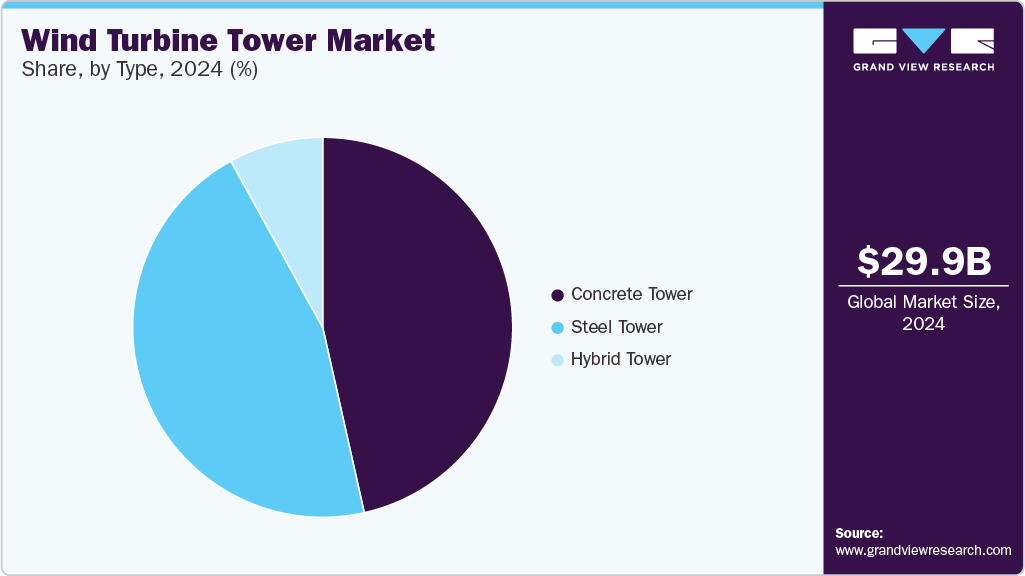

The global wind turbine tower market size was estimated at USD 29.94 billion in 2024 and is projected to reach USD 47.76 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The market is primarily driven by the increasing demand for clean, renewable energy sources as countries worldwide aim to reduce their carbon footprint and combat climate change.

Key Market Trends & Insights

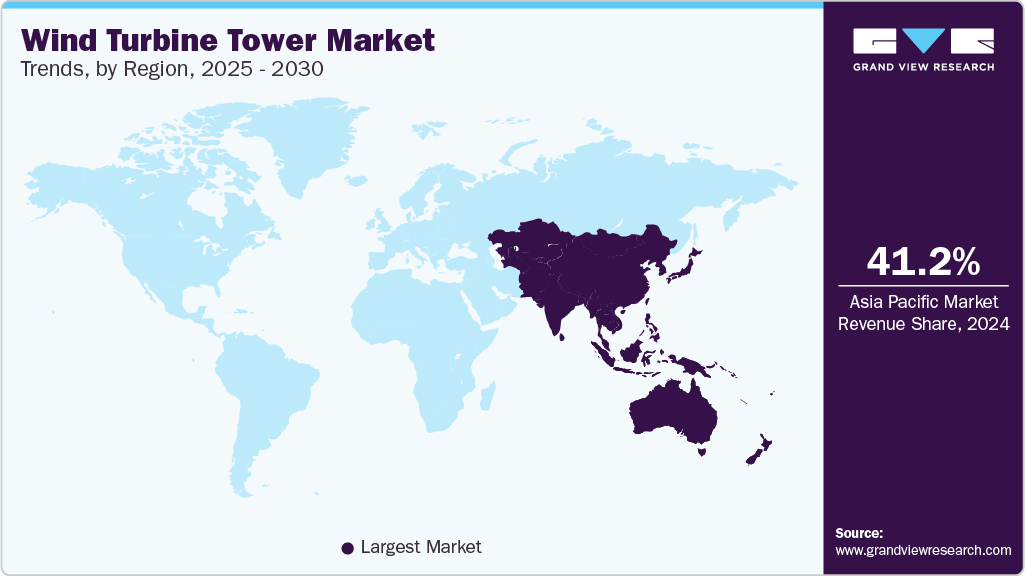

- Asia Pacific dominated the market and accounted for the largest share of over 41.21% in 2024.

- The wind turbine tower market in China dominated the Asia Pacific region in 2024.

- By installation, the onshore installation segment registered the largest share of over 83.32% in 2024.

- Based on the type, the concrete tower segment accounted for the highest share of over 47.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 29.94 Billion

- 2030 Projected Market Size: USD 47.76 Billion

- CAGR (2025-2030): 8.1%

- Asia Pacific: Largest market in 2024

Governments are implementing supportive policies, such as tax incentives and renewable energy targets, to encourage the adoption of wind power. For example, the European Union has set a target to derive 32% of its energy from renewable sources by 2030, while China aims to be carbon neutral by 2060, driving significant investments in wind energy infrastructure.Technological advancements in wind turbine design and manufacturing have also significantly propelled the market. Innovations such as taller towers and larger rotor diameters enhance wind turbines' efficiency and energy output. Taller towers can access stronger and more consistent wind currents at higher altitudes, which translates to increased energy generation. For example, the latest generation of wind turbines can have towers exceeding 100 meters in height, enabling them to harness more wind power. These advancements not only improve the overall performance of wind turbines but also make wind energy more competitive with traditional energy sources, further driving market growth.

Government policies and incentives are another critical factor driving the global market. Many governments worldwide are implementing supportive policies, including subsidies, tax incentives, and feed-in tariffs, to encourage the adoption of wind energy. The U.S., for instance, offers the Production Tax Credit (PTC) and the Investment Tax Credit (ITC), which have been instrumental in promoting wind power projects. Similarly, China's government provides substantial subsidies and favorable policies to support the wind energy sector, making it one of the largest markets for wind turbine towers globally. These policy measures create a favorable investment environment, attracting both domestic and international players to the wind energy market.

Moreover, the declining cost of wind energy is a significant factor triggering market growth. Over the past decade, the cost of wind power has decreased considerably due to economies of scale, improved supply chain efficiencies, and technological innovations. This cost reduction makes wind energy an increasingly attractive option for power generation, especially in regions with high wind potential. For example, the Levelized Cost of Energy (LCOE) for wind has reached competitive levels compared to fossil fuels in many markets. This economic viability encourages more investments in wind power projects, driving the demand for wind turbine towers. As these driving factors continue to evolve and strengthen, the global market is poised for sustained growth and development.

Installation Insights

Based on the installation, the market is segmented into offshore and onshore. Onshore installation registered the largest revenue market share of over 83.32% in 2024. These towers are generally easier and less expensive to construct and maintain compared to their offshore counterparts. Onshore installations can range from single turbines to large wind farms, and they are often found in rural or remote locations. The height of onshore towers varies but is usually between 80 to 120 meters tall, allowing the turbines to capture stronger and more consistent winds at higher altitudes.

Offshore wind turbine towers are installed in bodies of water, usually in shallow coastal areas or on continental shelves. These installations can harness stronger and more consistent wind resources compared to onshore sites. Offshore towers are typically taller than onshore ones, often exceeding 100 meters in height, and they require specialized construction and maintenance techniques to withstand marine conditions. While more expensive to install and maintain, offshore wind farms can generate more electricity due to better wind conditions and can be built at larger scales without the land-use constraints faced by onshore installations.

Type Insights

Based on the type, the market is segmented into steel, concrete, and hybrid towers. The concrete tower type accounted for the highest revenue market share of over 47.0% in 2024. Concrete towers are gaining popularity, especially for taller turbines and offshore installations. These towers can be constructed using precast concrete segments or cast-in-place concrete. Concrete towers offer superior stability and can reach heights exceeding 200 meters. They have longer lifespans and require less maintenance compared to steel towers. Concrete towers also have better damping properties, reducing vibrations and potentially extending the life of turbine components. However, they are generally more expensive to produce and transport than steel towers.

Steel towers are the most common type in the wind turbine market due to their cost-effectiveness and ease of manufacturing. They are typically made from cylindrical steel sections that are bolted together on-site. Steel towers offer good strength-to-weight ratios, allowing them to reach heights of up to 160 meters. They are relatively easy to transport and install, making them suitable for a wide range of locations. However, as turbine sizes increase, steel towers face challenges in terms of stability and transportation logistics for taller structures.

Hybrid towers combine the advantages of both steel and concrete designs. Typically, they feature a concrete base section topped with a steel upper section. This design allows for greater heights while maintaining stability and reducing transportation challenges associated with very tall steel towers. Hybrid towers can reach heights of 140-180 meters or more, making them suitable for low-wind areas where taller turbines are needed to capture stronger winds at higher altitudes. While they offer a good balance of benefits, hybrid towers can be more complex to design and construct compared to single-material towers.

Regional Insights

The North America wind turbine tower market benefits from vast open spaces and favorable wind conditions, especially in the Great Plains region. This geographical advantage allows for installing larger, more efficient wind turbines. The trend towards taller towers, some exceeding 100 meters in height, has been particularly pronounced in North America. These taller towers can access stronger, more consistent winds at higher altitudes, increasing energy production efficiency. For instance, the Vestas V150-4.2 MW turbine, with a hub height of up to 166 meters, has been deployed in several North American projects.

U.S. Wind Turbine Tower Market Trends

The U.S. wind turbine tower market is experiencing steady growth driven by increasing demand for renewable energy, federal incentives like the Inflation Reduction Act (IRA), and state-level renewable portfolio standards (RPS). Technological advancements, such as taller towers for higher energy yields and hybrid steel-concrete designs, are enhancing efficiency, while supply chain improvements and domestic manufacturing investments aim to reduce costs and logistical challenges. However, challenges like permitting delays, transmission constraints, and competition from solar energy persist. Offshore wind expansion and repowering projects further contribute to market opportunities, positioning wind towers as a key component of the U.S. energy transition.

Europe Wind Turbine Tower Market Trends

The wind turbine tower market in Europe benefits from favorable geographical conditions for wind power generation, particularly in offshore locations. The North Sea, Baltic Sea, and Atlantic coastlines offer ideal conditions for large-scale offshore wind farms. This has led to the development of specialized offshore wind turbine towers, which are typically larger and more complex than their onshore counterparts. The Dogger Bank Wind Farm in the UK, set to be the world's largest offshore wind farm when completed, exemplifies this trend and will require hundreds of advanced turbine towers, thus driving the market.

Asia Pacific Wind Turbine Tower Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 41.21% in 2024. This dominance can be attributed to several key factors, including government policies, large-scale investments, and favorable geographical conditions. Countries such as China, India, and Japan have implemented supportive policies to promote renewable energy, including wind power. For instance, China's government has set ambitious targets for renewable energy capacity, aiming to achieve 1,200 GW of wind and solar power by 2030. This strong policy support has led to significant investments and the rapid expansion of wind energy infrastructure in the region, boosting the demand for wind turbine towers.

The wind turbine tower market in China dominated the Asia Pacific market in 2024. China stands out as the largest market for wind energy in the world. The country has leveraged its robust manufacturing capabilities to become a global leader in wind turbine production. Besides, the presence of a well-established supply chain and the ability to produce wind turbine components at lower costs have given China a competitive edge, contributing to the region's market dominance.

Key Wind Turbine Tower Company Insights

The market is marked by intense competition and rapid technological advancements. Major players strive to gain market share through product innovation, cost reduction, and geographical expansion. These players are concentrating on developing taller towers to harness stronger winds at higher altitudes and addressing environmental impact and noise pollution concerns. Regional markets exhibit significant variation, with Europe and Asia-Pacific emerging as major growth areas.

Key Wind Turbine Tower Companies:

The following are the leading companies in the wind turbine tower market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Gamesa Renewable Energy, S.A.U.

- Arcosa Wind Towers, Inc.

- US Forged Rings Inc.

- CS Wind

- Marmen

- Modvion

- CNBM

- GRI Renewable Industries

- Vestas

- PVUNITE Ltd.

- SENLISWELD

- Rohn Products, LLC

- Ventower Industries

- Global Energy (Group) Limited

Recent Developments

In February 2024, US Forged Rings Inc., a Delaware-based company, planned to invest USD 700.0 billion in two new facilities on the US East Coast to produce 100% American-made offshore wind turbine towers, with operations expected to begin in 2026. The project includes a tower fabrication facility capable of producing 100 towers annually, expandable to 200, and a steel forging plant that will be the largest of its kind in North America and Europe, producing large flanges for turbine towers. This initiative aims to reduce carbon footprints using 77% recycled materials and address supply chain bottlenecks as the U.S. targets 30 GW of offshore wind capacity by 2030 and 110 GW by 2050. The company emphasizes the importance of a local supply chain to support the growing offshore wind market.

Wind Turbine Tower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.30 billion

Revenue forecast in 2030

USD 47.76 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Installation, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; UAE

Key companies profiled

Siemens Gamesa Renewable Energy, S.A.U.; Arcosa Wind Towers, Inc.; US Forged Rings Inc.; CS Wind; Marmen; Modvion; CNBM; GRI Renewable Industries; Vestas; Pemamek; PVUNITE Ltd.; SENLISWELD; Rohn Products, LLC; Ventower Industries; Global Energy (Group) Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wind Turbine Tower Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wind turbine tower market report based on installation, type, and region:

-

Installation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offshore

-

Onshore

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Steel Tower

-

Concrete Tower

-

Hybrid Tower

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global market for wind turbine towers was estimated at around USD 29.94 billion in 2024 and is expected to reach around USD 32.30 billion in 2025.

b. The global market for wind turbine towers is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030, reaching around USD 47.76 billion by 2030.

b. The concrete tower type segment accounted for the highest revenue market share, over 54.0%, in 2024. Concrete towers are gaining popularity, especially for taller turbines and offshore installations. They can be constructed using precast concrete segments or cast-in-place concrete.

b. Key players in the market include Siemens Gamesa Renewable Energy, S.A.U.; Arcosa Wind Towers, Inc.; US Forged Rings Inc.; CS Wind; Marmen; Modvion; CNBM; GRI Renewable Industries; Vestas; Pemamek; PVUNITE Ltd.; SENLISWELD; Rohn Products, LLC; Ventower Industries; and Global Energy (Group) Limited.

b. The global wind turbine tower market is primarily driven by the increasing demand for clean, renewable energy sources as countries worldwide aim to reduce their carbon footprint and combat climate change.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.