- Home

- »

- Advanced Interior Materials

- »

-

3D Printing Powder Market Size, Share, Growth Report, 2033GVR Report cover

![3D Printing Powder Market Size, Share & Trends Report]()

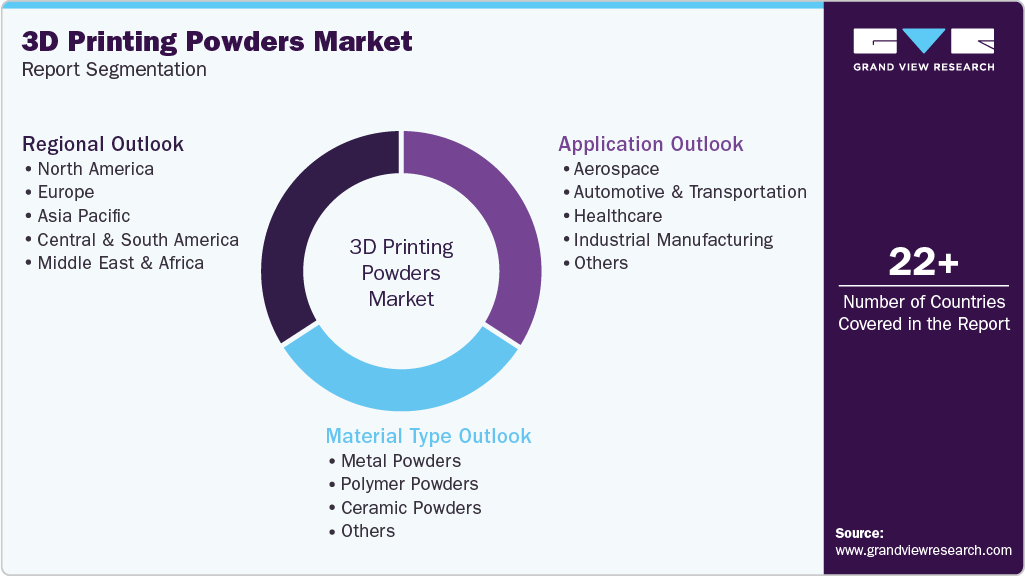

3D Printing Powder Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Metal Powders, Polymer Powders, Ceramic Powders), By Application (Aerospace, Automotive And Transportation, Healthcare, Industrial Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-831-6

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printing Powder Market Summary

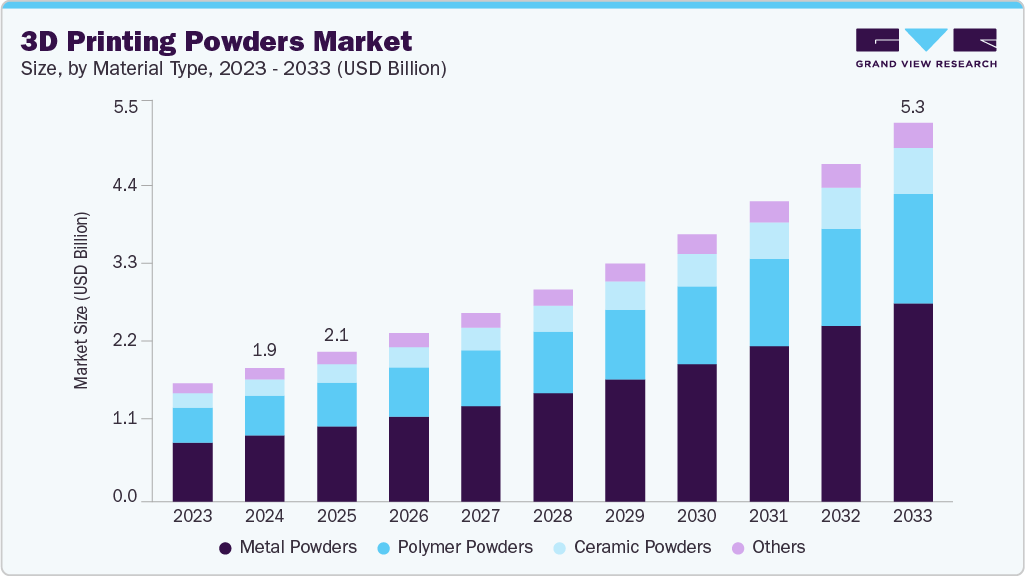

The global 3D printing powder market size was estimated at USD 1.87 billion in 2024 and is projected to reach USD 5.33 billion by 2033, growing at a CAGR 12.3% from 2025 to 2033. The demand for 3D printing powders is rising due to the rapid adoption of additive manufacturing across aerospace, automotive, medical, and industrial sectors for lightweight, high-strength components.

Key Market Trends & Insights

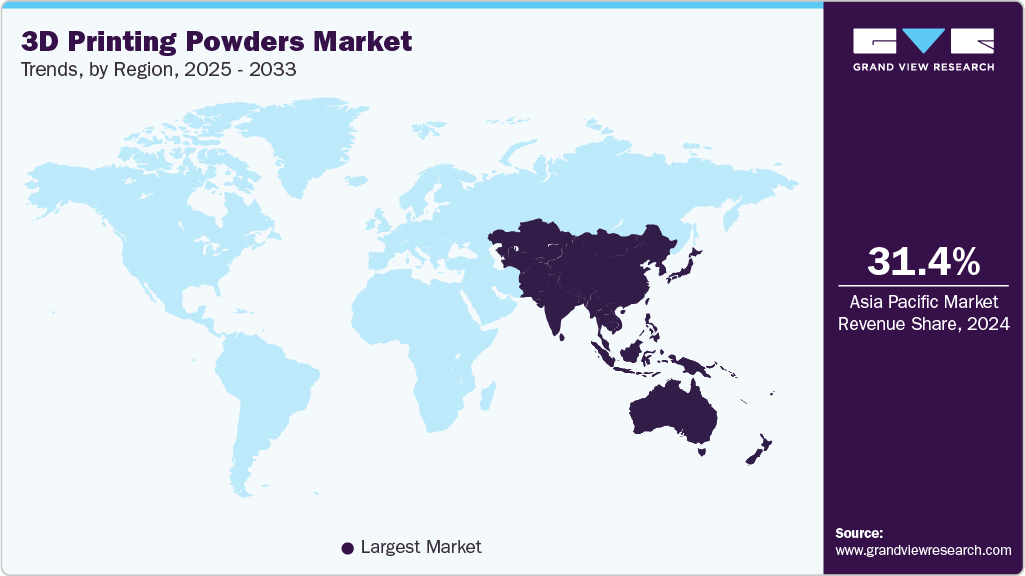

- Asia Pacific dominated the 3D printing powder market with the largest revenue share of 31.4% in 2024.

- The 3D printing powder market in China is rapidly scaling its AM powder production capacity, especially for titanium, steel, and aluminum powders.

- By material type, the metal powders segment is expected to grow at the fastest CAGR of 12.9% over the forecast period.

- By application, the healthcare segment is expected to grow at the fastest CAGR of 13.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.87 Billion

- 2033 Projected Market Size: USD 5.33 Billion

- CAGR (2025-2033): 12.3%

- Asia Pacific: Largest market in 2024

Industries are shifting from prototyping to full-scale manufacturing, increasing the consumption of metal, polymer, and ceramic powders. Customization needs in medical implants and dental prosthetics are accelerating powder usage. The cost-efficiency and reduced material wastage associated with powder-based printing are also driving adoption. Growing interest in on-demand manufacturing is further strengthening demand. Advancements in printer capabilities are expanding the compatibility of new powder materials. Sustainability benefits, such as lower scrap rates, are supporting long-term market growth.Key demand drivers include the increasing applications of metal AM powders, such as titanium, aluminum, and Inconel, in high-performance industries. The rise of electric vehicles is pushing OEMs to adopt AM for lightweight parts, boosting powder consumption. Healthcare innovation is driving the usage of biocompatible powders for patient-specific implants. Defense and aerospace authorities are expanding AM qualification programs, creating a strong pipeline for powder suppliers. Growing investments in distributed manufacturing are increasing powder volumes globally. Improvements in powder recyclability are lowering costs and encouraging repeat usage. Expanding R&D for next-generation materials such as copper and refractory metal powders is supporting market momentum.

Advanced powder atomization technologies, such as plasma atomization and EIGA, are improving powder quality and consistency. Sustainable powder production using recycled feedstocks is gaining traction among manufacturers. The rise of multi-material and functionally graded materials is influencing the development of powder blends. Nanostructured powders and high-entropy alloy powders are emerging as high-performance AM materials. Automated powder handling and closed-loop systems are improving safety and reducing contamination. Customized powder formulations for high-speed binder jetting are accelerating the adoption of this technology. Increasing focus on powder reusability and lifecycle tracking is shaping future material standards.

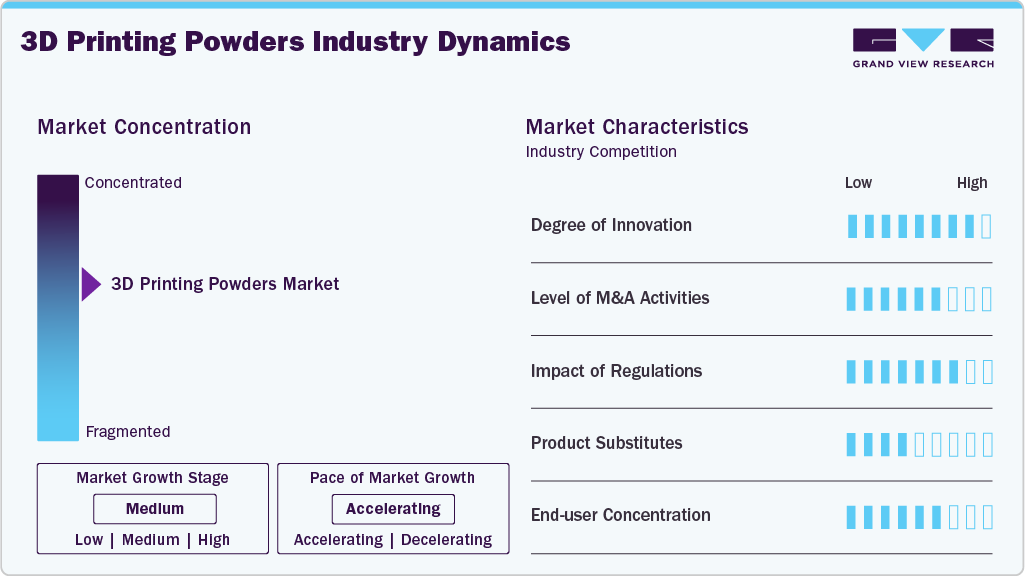

Market Concentration & Characteristics

The 3D printing powder market is moderately concentrated, with a mix of global metal powder giants and specialized AM powder suppliers. Major companies like Höganäs, GKN Additive, and EOS GmbH dominate the metal segment with strong proprietary processes. The polymer powder space is less consolidated, with multiple regional players. Aerospace-grade titanium and Inconel powders are concentrated among a few certified producers. Barriers to entry include capital-intensive atomization facilities and stringent quality requirements. Emerging suppliers from China are increasing competitive pressure.

Substitutes include conventional manufacturing materials such as cast metals and injection-molded plastics, which remain cost-effective for mass production. However, the unique geometrical freedom of AM reduces the substitutability of complex or lightweight components. Alternative AM processes such as filament-based FDM or resin-based SLA serve as substitutes for powders in some applications. Powder metallurgy can also compete in certain metal component categories. Cost differences between powders and bulk materials still limit adoption in low-value parts. Technological advancements are reducing dependency on traditional methods.

Material Type Insights

The metal powders segment held the largest revenue share of 50.0% in 2024, as aerospace, automotive, and industrial sectors increasingly require high-strength, corrosion-resistant, and lightweight materials for mission-critical components. Their compatibility with advanced AM technologies such as SLM, DMLS, and EBM, along with continuous improvements in powder purity, flowability, and size distribution, has strengthened their position. Growing certification of metal additively manufactured parts and the expansion of large-scale industrial 3D printing facilities are further reinforcing the dominance of metal powders across global production lines.

The ceramic powders segment is expected to grow at a significant CAGR of 12.4% over the forecast period, due to their expanding role in dental restorations, biomedical implants, semiconductors, aerospace heat shields, and high-temperature industrial applications where polymers and metals cannot perform. Advancements in ceramic sintering, improved powder consistency, and greater process reliability are enabling wider adoption in both prototyping and end use manufacturing. As industries demand materials with superior hardness, thermal shock resistance, and electrical insulation, ceramic powders are becoming a key growth segment in the additive manufacturing materials ecosystem.

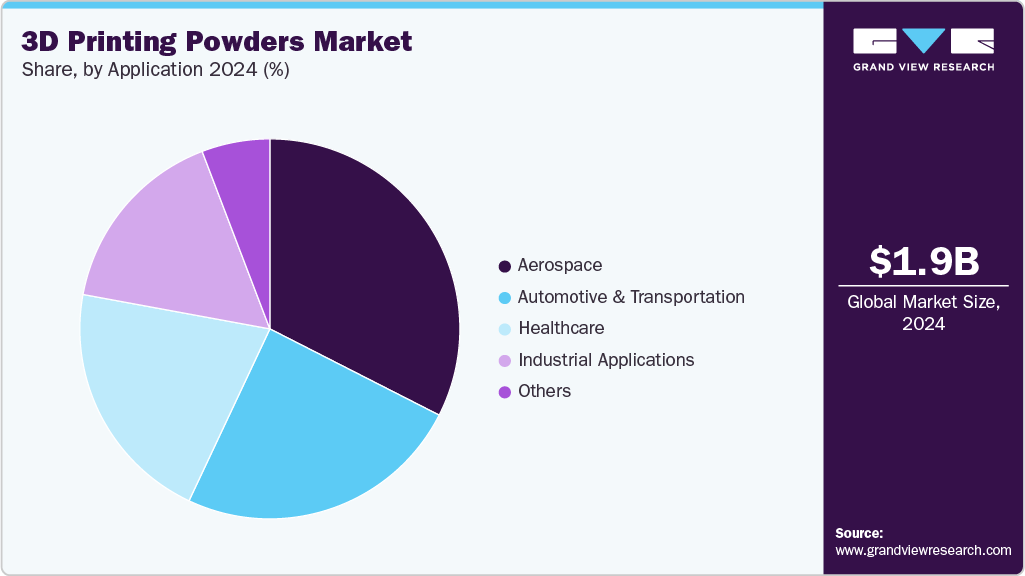

Application Insights

The aerospace segment held the highest revenue market share of 32.5% in 2024, due to its deep integration of additive manufacturing in producing engine parts, structural components, fuel nozzles, turbine blades, and lightweight assemblies that require exceptional durability and heat resistance. Metal powders especially titanium, nickel-based superalloys, and aluminum alloys are extensively used to achieve weight savings, performance improvements, and part consolidation benefits. With ongoing FAA and EASA certifications, rising production of AM-enabled aircraft components, and continued investments by OEMs and defense contractors, aerospace remains the most advanced and highest-value consumer of 3D printing powders.

The automotive & transportation segment is expected to grow at a significant CAGR of 12.2% over the forecast period, as companies utilize 3D printing powders for lightweighting, rapid prototyping, tooling, functional brackets, EV components, and spare parts production. The shift toward electric mobility, along with stricter efficiency and emission standards, is pushing manufacturers to adopt additive manufacturing for optimized designs and reduced material waste. Powder-based AM technologies support faster iteration cycles, complex geometries, and cost-effective short-run manufacturing, driving sustained growth in this application segment.

Regional Insights

Asia Pacific 3D printing powders market dominated the respective global market and accounted for the largest revenue share of 31.4% in 2024, driven by expanding manufacturing ecosystems in China, Japan, South Korea, and India. China leads in titanium and steel powder production, supported by government-backed industrial programs. Japan’s automotive and electronics sectors are driving demand for polymer and metal powders. South Korea’s strong electronics and defense industries are adopting AM for precision components. India is expanding aerospace and medical AM usage under national manufacturing initiatives. Growing private investments in AM facilities are enhancing regional supply. Increasing domestic sourcing of metal powders is strengthening Asia Pacific’s competitive position.

China 3D Printing Powder Market Trends

3D Printing Powder Market in China is rapidly scaling its AM powder production capacity, especially for titanium, steel, and aluminum powders. Local companies are investing in atomization facilities to reduce dependence on imports. The EV sector is a major consumer, using powders for lightweight components. Aerospace qualification programs are expanding the use of high-performance alloys. Cities such as Shanghai and Shenzhen are becoming AM innovation hubs. Government support through subsidies and digital manufacturing policies is accelerating adoption. Low-cost powder manufacturers are increasing China’s export competitiveness.

North America 3D Printing Powder Market Trends

North America is driven by strong aerospace, defense, and medical demand for certified AM powders. The region has stringent quality standards, favoring established suppliers like Carpenter Technology and 6K Additive. Large automotive manufacturers are scaling binder jetting production lines, boosting steel and aluminum powder usage. The medical sector is increasingly adopting titanium powders for orthopedic implants. U.S. federal funding for AM innovation is supporting next-generation powder development. Powder reuse tracking systems are gaining traction for safety and compliance. Canada is emerging as a significant player in metal powder R&D.

The U.S. remains a global center for high-performance AM powder development. Aerospace and defense OEMs are expanding procurement of Inconel, titanium, and aluminum powders. Medical device companies are increasing the adoption of patient-specific implant production, driving powder demand. Automakers are shifting toward AM for prototyping and lightweight EV components. Major universities and national labs are advancing research on advanced alloys and ceramics. New atomization facilities are being established to reduce reliance on imports. Strong regulatory frameworks ensure consistent quality standards across powder suppliers.

Europe 3D Printing Powder Market Trends

Europe is a mature market with strong demand from aerospace, automotive, industrial machinery, and medical sectors. Germany, France, and the UK lead in high-precision powder manufacturing. EU-funded research programs are promoting the development of next-generation alloys. Automotive and Transportation OEMs are investing in AM for lightweighting and sustainability, increasing powder consumption. Binder jetting and laser powder bed fusion are expanding across manufacturing clusters. Powder recyclability and sustainability are major focus areas. Strong certification standards continue to shape the competitiveness of suppliers.

3D Printing Powder Market in Germany is one of the most advanced markets for AM powders, supported by a strong industrial base. Automotive and Transportation giants are scaling AM adoption for prototyping and lightweight structures. Aerospace and machine tool manufacturers rely heavily on high-quality metal powders. Research institutes are partnering with companies to develop advanced alloy powders. The growth of binder jetting is driving demand for steel and aluminum powders. Strict material certification standards ensure high entry barriers. Sustainability initiatives are driving efforts to increase powder recyclability.

Central & South America 3D Printing Powder Market Trends

Central & South America is emerging slowly but steadily, driven by growing adoption in automotive, general manufacturing, and healthcare. Brazil and Mexico are leading 3D printing initiatives in industrial clusters. Import dependence on metal powders remains high, raising costs. Universities and research centers are introducing AM-focused programs, increasing awareness. Healthcare institutions are deploying AM for dental and orthopedic applications. Government incentives for digital manufacturing are beginning to appear. Regional powder production capacity remains limited but is expected to grow.

Middle East & Africa 3D Printing Powder Market Trends

The Middle East & Africa demand is growing due to adoption in oil & gas, aerospace, and industrial manufacturing. The UAE is emerging as a major AM hub, benefiting from strong government support. Saudi Arabia is using AM to enhance local manufacturing capabilities under Vision 2030. South Africa has strong metal powder research capabilities, especially in titanium. Local production remains limited, leading to significant imports. Increased investment in digital manufacturing technologies is boosting powder usage. AM centers of excellence in UAE and Saudi Arabia are driving innovation.

Key 3D Printing Powder Company Insights

Some of the key players operating in the market include Forward AM, Sandvik AB

-

Forward AM, the 3D printing division of BASF, specializes in advanced materials for additive manufacturing, including polymer powders, photopolymers, and metal filaments. The company focuses on high-performance materials engineered for industrial-scale applications in automotive, aerospace, medical, and consumer goods. With strong R&D capabilities and partnerships across the AM ecosystem, Forward AM delivers end-to-end material solutions that support mass customization and high-strength part production.

-

Sandvik AB is a global engineering leader with a strong portfolio in metal powders through its Sandvik Additive Manufacturing division. The company produces premium gas-atomized metal powders, including titanium, nickel-based superalloys, stainless steels, and tool steels, designed for high-precision additive manufacturing.

EOS GmbH and Arkema are some of the emerging market participants in the 3D printing powders market.

-

EOS GmbH is a pioneer in industrial 3D printing and a global leader in metal and polymer powder bed fusion technologies. The company offers a broad portfolio of AM systems supported by high-performance materials and process parameters optimized for production-grade applications. EOS’s proprietary powders, quality standards, and software solutions enable reliable and scalable additive manufacturing in aerospace, medical, automotive, and tooling sectors. Its continuous innovation has shaped the global AM ecosystem.

-

Arkema is a leading specialty materials company with a strong presence in additive manufacturing through its advanced polymer powder and resin portfolio. Its flagship brands, such as Kepstan PEKK, Rilsan PA12, and Rilsamid polyamides, are widely used in high-performance 3D printing applications. Arkema focuses on lightweighting, chemical resistance, and high-temperature materials that serve aerospace, medical, industrial, and consumer markets.

Key 3D Printing Powder Companies:

The following are the leading companies in the 3D printing powder market. These companies collectively hold the largest market share and dictate industry trends.

- Höganäs

- GKN Additive

- EOS GmbH

- Sandvik AB

- SSAB

- Evonik

- Arkema

- INDO-MIM

- Forward AM

- Carpenter Technology

Recent Developments

-

In June 2025, Sandvik and Additive Industries announced a powder supply partnership for the direct filling of the Powder Load Tool (PLT), an industrial powder hopper for metal AM printing.

-

In July 2024, Höganäs became the first metal powder producer to introduce product-specific carbon footprints. The product carbon footprint (PCF) calculations follow the ISO 14067:2018 standard and communicate how many kg CO2 eq. is emitted for every kg of metal powder produced.

3D Printing Powder Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.10 billion

Revenue forecast in 2033

USD 5.33 billion

Growth rate

CAGR of 12.3% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Höganäs; GKN Additive; EOS GmbH; Sandvik AB; SSAB; Evonik; Arkema; INDO-MIM; Forward AM; Carpenter Technology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Printing Powder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the 3D printing powder market based on material type, application, and region:

-

Material Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Metal Powders

-

Polymer Powders

-

Ceramic Powders

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace

-

Automotive & Transportation

-

Healthcare

-

Industrial Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 3D printing powders market size was estimated at USD 1.87 billion in 2024 and is expected to reach USD 2.10 billion in 2025.

b. The global 3D printing powders market is expected to grow at a compound annual growth rate of 12.3% from 2025 to 2033 to reach USD 5.33 billion by 2033.

b. The metal powders segment held the highest revenue market share of 50.0% in 2024, as aerospace, automotive, and industrial sectors increasingly require high-strength, corrosion-resistant, and lightweight materials for mission-critical components.

b. Some of the key players operating in the 3D printing powders market include Höganäs, GKN Additive, EOS GmbH, Sandvik AB, SSAB, Evonik, Arkema, INDO-MIM, Carpenter Technology, and Forward AM.

b. The rising adoption of additive manufacturing across the aerospace, automotive, and healthcare industries is driving demand for high-performance 3D printing powders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.