- Home

- »

- Biotechnology

- »

-

3D Scaffolds Market Size & Share, Industry Report, 2033GVR Report cover

![3D Scaffolds Market Size, Share & Trends Report]()

3D Scaffolds Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Application (Tissue Engineering & Regenerative Medicine, Stem Cell Research), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-776-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Scaffolds Market Summary

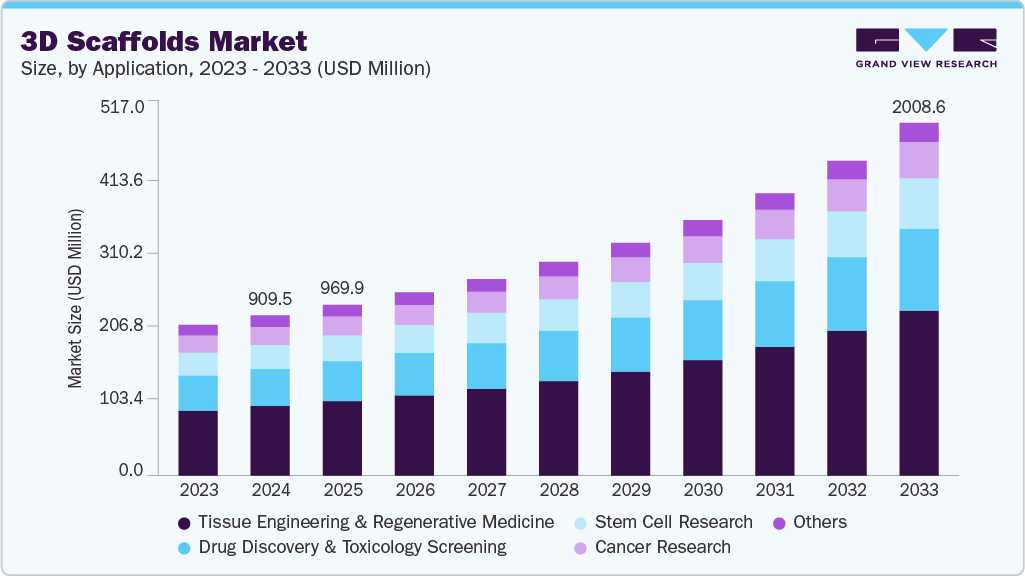

The global 3D scaffolds market size was valued at USD 909.5 million in 2024 and is projected to reach USD 2,008.6 million by 2033, growing at a CAGR of 9.53% from 2025 to 2033. This growth is driven by the rising demand for advanced cell culture and tissue engineering solutions.

Key Market Trends & Insights

- The North America 3D scaffolds market held the largest share of 37.50% of the global market in 2024.

- The 3D scaffolds industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the synthetic segment held the highest market share of 64.48% in 2024.

- Based on application, the tissue engineering & regenerative medicine segment held the highest market share in 2024.

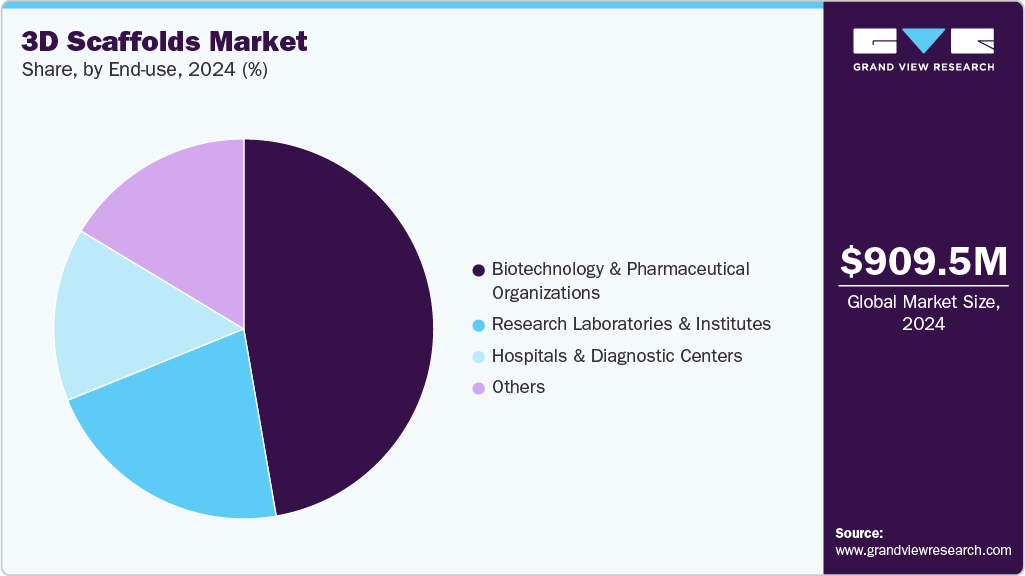

- By end use, the biotechnology and pharmaceutical organizations segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 909.5 Million

- 2033 Projected Market Size: USD 2,008.6 Million

- CAGR (2025-2033): 9.53%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing focus on personalized and regenerative therapies

The increasing focus on customization and regenerative treatments is one of the key drivers driving the growth of the 3D scaffold market. As healthcare moves toward individualized treatment approaches, 3D scaffolds are crucial for developing customized biological structures that closely mimic each patient's tissue architecture. In order for cells to adhere, multiply, and differentiate into functional tissues or organs that can eventually replace damaged or diseased ones, these scaffolds act as a temporary framework. Biocompatible and bioresorbable polymers, like collagen, gelatin, and polylactic acid, can now easily enter the human body without causing immunological reactions due to developments in materials science. This has made 3D scaffolds particularly valuable in bone regeneration, cartilage repair, and wound healing, where the demand for patient-tailored implants and grafts continues to rise.

Moreover, the convergence of 3D bioprinting and regenerative medicine has accelerated innovation in personalized therapies. Researchers can now fabricate scaffolds with specific pore sizes, mechanical strengths, and spatial geometries tailored to individual patient requirements, thereby improving cellular behavior and tissue functionality. Personalized scaffolds enhance integration with native tissues and decrease the likelihood of implant rejection and postoperative complications. Pharmaceutical and biotech companies are utilizing 3D scaffold technologies to develop patient-specific disease models for drug testing and efficacy evaluation, thereby decreasing dependence on animal models and enhancing translational success rates. Collectively, this shift toward personalized and regenerative healthcare is positioning 3D scaffolds as a cornerstone technology for next-generation therapeutic and clinical innovations.

Growing collaborations between research institutions and biotechnology companies

Collaborations between Evonik and BellaSeno’s work on RESOMER-based bone scaffolds, have underscored how 3D scaffolds move from the lab to real-world use in orthopedic and reconstructive medicine. Growing government support for tissue engineering research, along with the expanding role of 3D scaffolds in drug discovery, toxicology studies, and cancer research, is further driving momentum in this space. These developments are shaping the 3D scaffold market into a cornerstone of modern biomedical research and regenerative healthcare.

At the same time, companies are increasingly focusing on developing personalized, 3D bioprinted scaffolds designed for tissue regeneration. For instance, in June 2022, when 3D Systems partnered with United Therapeutics Corporation to unveil a human lung scaffold and two other major breakthroughs in 3D-printed organ technology. Building on the launch of its Regenerative Medicine division the previous year, 3D Systems has been steadily strengthening its expertise in bioprinting and regenerative medicine, aiming to turn these innovations into practical, life-changing medical solutions.

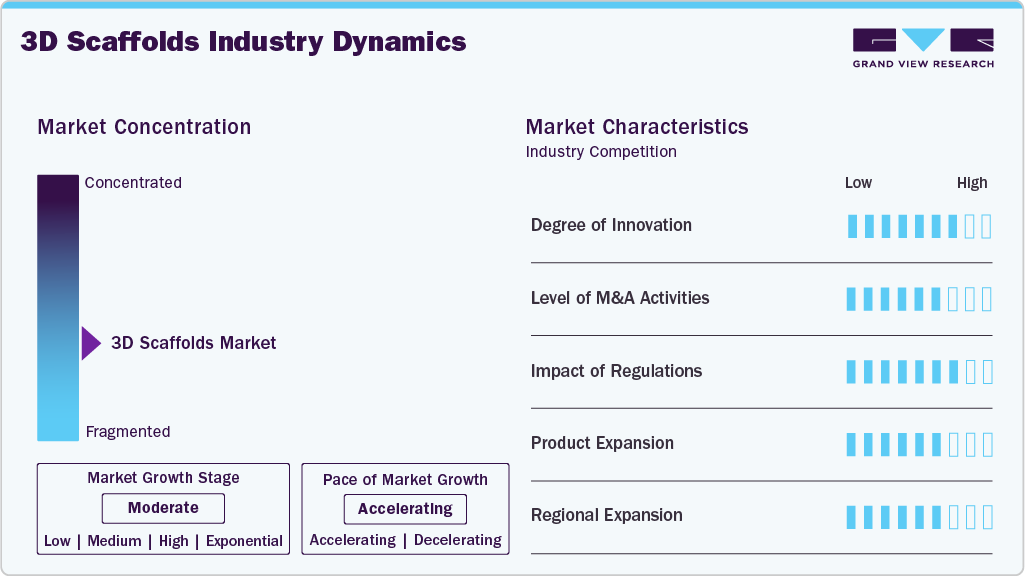

Market Concentration & Characteristics

The 3D scaffold market is witnessing rapid innovation driven by advancements in biomaterials, 3D bioprinting, and nanotechnology. Researchers and companies are continuously developing scaffolds with improved biocompatibility, controlled degradation rates, and enhanced structural precision to better mimic the natural extracellular matrix. Emerging technologies, such as hybrid scaffolds combining synthetic and natural polymers, are enabling new applications in tissue regeneration, organ reconstruction, and disease modeling. These innovations are not only improving clinical outcomes but also broadening the market’s scope across regenerative medicine, pharmaceutical research, and personalized therapy development.

Mergers, acquisitions, and strategic partnerships have played a key role in shaping the competitive landscape of the 3D scaffold market. Leading companies are acquiring smaller firms and startups specializing in biomaterials, 3D bioprinting platforms, and cell culture technologies to expand their technological capabilities and market reach. Collaborations between biopharma firms, material suppliers, and academic institutions are accelerating product development and commercialization. Such activities reflect a growing industry consolidation trend aimed at integrating innovation, manufacturing expertise, and global distribution networks to strengthen positioning in the regenerative medicine and biomedical research sectors.

Regulatory frameworks have a significant influence on the 3D scaffold market, particularly for scaffolds intended for clinical and therapeutic use. Compliance with guidelines from agencies such as the FDA and EMA ensures product safety, quality, and biocompatibility, which is essential for market acceptance. While stringent regulations can slow down commercialization timelines, they also encourage the development of standardized, high-quality scaffolds suitable for medical applications. Increasing clarity around regulatory pathways for 3D bioprinted and bioresorbable scaffolds is expected to support innovation while maintaining patient safety and ethical standards.

Many players in the 3D scaffold industry are expanding their offerings beyond product manufacturing to include design customization, material testing, and bioprinting-as-a-service. This shift toward comprehensive service models allows companies to cater to academic institutions, pharmaceutical firms, and hospitals seeking tailored solutions for tissue engineering and drug testing. Additionally, service expansion is enabling better integration between scaffold production, cell culture optimization, and analytical support-helping customers streamline R&D workflows. This approach not only enhances customer engagement but also drives recurring revenue through long-term partnerships.

Regional expansion has become a key growth strategy as demand for regenerative medicine and cell culture technologies rises globally. North America and Europe remain early adopters due to strong R&D infrastructure and funding support, while Asia-Pacific is emerging as a high-potential region driven by growing biotechnology investments in China, Japan, and South Korea. Companies are establishing regional production hubs and distribution partnerships to better serve local research institutes and healthcare facilities. This geographic diversification not only reduces dependency on mature markets but also positions companies to tap into new revenue streams in developing economies with increasing biomedical research activity.

Type Insights

Synthetic segment dominated the market, with the largest revenue share of 64.48% in 2024. Synthetic materials such as polylactic acid (PLA), polyglycolic acid (PGA), polycaprolactone (PCL), and polyethylene glycol (PEG) allow researchers to precisely tailor scaffold porosity, stiffness, and degradation time to match specific tissue requirements. These materials also offer better scalability and reproducibility, making them ideal for large-scale tissue engineering, orthopedic, and dental applications. Furthermore, ongoing advancements in 3D printing and polymer chemistry are enabling the development of hybrid and bioactive synthetic scaffolds that enhance cell adhesion and tissue integration. As a result, synthetic scaffolds are becoming a preferred choice for both research and clinical applications, fueling steady growth in this segment of the 3D scaffold market.

Natural segment is expected to grow at the fastest CAGR from 2025 to 2033. Materials such as collagen, gelatin, alginate, chitosan, and silk fibroin provide an inherently favorable environment for cell attachment, proliferation, and differentiation, making them ideal for tissue engineering, wound healing, and regenerative medicine. Advances in material purification and crosslinking technologies have also improved the mechanical stability and reproducibility of natural scaffolds, expanding their use in soft tissue and organ regeneration. As researchers and clinicians increasingly focus on biocompatible and cell-friendly materials, natural 3D scaffolds continue to play a vital role in driving innovation within the regenerative medicine landscape.

Application Insights

The tissue engineering & regenerative medicine segment led the 3D scaffolds market in 2024, accounting for the largest revenue share of 43.45%. The increasing incidence of chronic diseases, trauma injuries, and age-related tissue degeneration has intensified demand for bioengineered tissues in orthopedics, cardiovascular repair, and wound healing. Moreover, ongoing progress in 3D bioprinting and biomaterial science has enabled the creation of patient-specific scaffolds with tailored mechanical and biological properties, improving integration and recovery outcomes. As clinical translation of regenerative therapies accelerates, the adoption of 3D scaffolds in tissue engineering continues to expand, solidifying this segment’s position as a key growth driver in the global market.

The drug discovery & toxicology screening segment is expected to grow at the significant CAGR over the forecast period. This segment is driving the 3D scaffold market by providing more physiologically relevant models for evaluating drug efficacy and safety. This has become increasingly important for pharmaceutical companies and biotech firms aiming to reduce late-stage drug failures, cut development costs, and comply with stricter regulatory requirements. As a result, the integration of 3D scaffolds in preclinical research is expanding rapidly, making them a critical tool in accelerating drug development and enhancing predictive toxicology.

End Use Insights

Based on end use, the biotechnology and pharmaceutical organizations segment led the market with the largest revenue share of 47.26% in 2024, These organizations rely on 3D scaffolds to create physiologically relevant tissue models that improve the accuracy of preclinical studies, including drug efficacy and toxicity testing. The ability to produce reproducible, high-quality scaffolds accelerates R&D timelines, reduces dependence on animal models, and supports the development of personalized therapies. Additionally, collaborations with material suppliers and research institutes enable these companies to access cutting-edge scaffold technologies, expand their product pipelines, and strengthen their position in competitive pharmaceutical and biotech markets, further fueling demand for 3D scaffolds.

The research laboratories and institutes segment is projected to grow at the fastest CAGR during the forecast period. These institutions utilize 3D scaffolds to replicate the complex architecture of human tissues, enabling more accurate studies of cellular behavior, stem cell differentiation, and tissue regeneration. The adoption of 3D scaffolds allows researchers to conduct high-throughput experiments, drug testing, and mechanistic studies with greater precision and relevance to in vivo conditions. Additionally, ongoing investments in academic research, government grants, and collaborative projects with industry players are expanding the development and application of scaffold technologies, making research laboratories and institutes a significant growth engine for the market.

Regional Insights

North America dominated the 3D scaffolds market with the largest revenue share of 37.50% in 2024, market is driven by a strong research infrastructure, advanced healthcare facilities, and high adoption of regenerative medicine technologies. The market benefits from substantial government funding for tissue engineering, stem cell research, and biomedical innovation. The presence of leading biotechnology and pharmaceutical companies, along with academic collaborations, has accelerated the development and commercialization of 3D scaffold products, making the region a key contributor to market growth.

U.S 3D Scaffolds Market Trends

In the U.S., the growth of the 3D scaffold market is fueled by increasing investments in personalized medicine, organ regeneration, and preclinical drug testing. Regulatory support, a high prevalence of chronic diseases, and a robust biotechnology ecosystem encourage adoption of advanced scaffold technologies. Additionally, collaborations between research institutions and commercial players are facilitating innovation in 3D bioprinting and scaffold design.

Europe 3D Scaffolds Market Trends

The European market is expanding due to the rising focus on regenerative medicine, academic research, and supportive healthcare policies. Countries like Germany, the UK, and France have well-established research facilities and strong public-private partnerships, driving both clinical and preclinical applications of 3D scaffolds. The increasing prevalence of orthopedic and chronic conditions also contributes to the demand for advanced scaffold technologies.

The UK 3D scaffold market is propelled by a combination of government-funded research initiatives, biotech innovation hubs, and a growing focus on regenerative therapies. Academic and clinical collaborations are fostering the development of customized scaffolds for tissue engineering, stem cell research, and drug discovery, supporting regional market expansion.

The 3D scaffold market in Germany is driven by its advanced healthcare infrastructure, strong research ecosystem, and high adoption of tissue engineering and regenerative medicine technologies. The presence of leading biomaterials manufacturers and robust funding for academic and clinical research facilitates the development of innovative scaffold solutions for bone, cartilage, and organ regeneration.

Asia Pacific 3D Scaffolds Market Trends

The Asia Pacific 3D scaffold market is witnessing fastest growth due to increasing investments in biotechnology, rising healthcare awareness, and expanding research activities in countries such as China, Japan, and South Korea. The region benefits from government support, growing collaborations with international biotech companies, and a rising number of clinical research centers adopting scaffold-based tissue engineering solutions.

The China 3D scaffold market is driven by rapid advancements in biotechnology, regenerative medicine research, and government-backed innovation programs. Increasing R&D expenditure, a growing number of biotech startups, and the adoption of advanced 3D bioprinting technologies are contributing to the rising demand for synthetic and natural scaffolds in research and clinical applications.

The 3D scaffold market in Japan growth is fueled by its technologically advanced research facilities, aging population, and high demand for regenerative therapies. 3D scaffolds are increasingly utilized in tissue engineering, organ regeneration, and pharmaceutical testing, supported by strong collaborations between academic institutions, biotech companies, and hospitals.

Middle East & Africa 3D Scaffolds Market Trends

The 3D scaffold market in the Middle East is expanding due to government initiatives to develop advanced healthcare infrastructure and invest in biotechnology and regenerative medicine research. Countries in the region are increasingly focusing on modern treatment solutions, including tissue engineering, organ repair, and preclinical research, which are driving scaffold adoption.

The Kuwait 3D scaffold market growth is supported by rising healthcare investments, the establishment of research and medical centers, and interest in regenerative medicine technologies. The country is gradually adopting 3D scaffold solutions for tissue engineering, drug testing, and clinical research, reflecting broader regional trends in the Middle East toward advanced biomedical innovation.

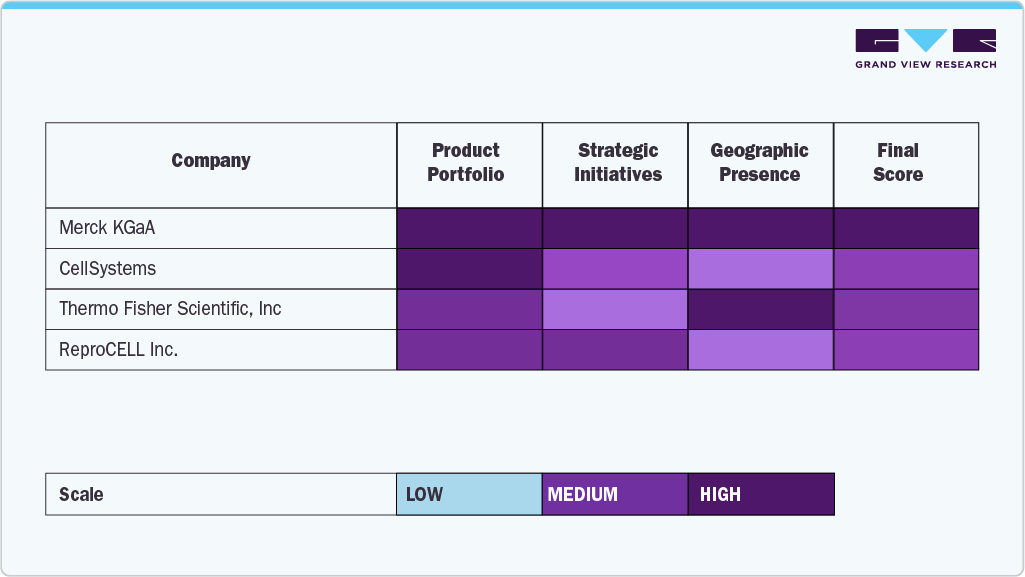

Key 3D Scaffolds Company Insights

Merck KGaA, CellSystems, Thermo Fisher Scientific, and ReproCELL Inc. are key players driving the 3D scaffold market through innovative solutions that enhance tissue engineering, regenerative medicine, and drug discovery research. Merck leverages its global reach to provide high-quality scaffolds for diverse laboratory and pharmaceutical applications, while CellSystems focuses on specialized scaffolds that create more physiologically relevant in vitro models. Thermo Fisher’s AlgiMatrix system offers versatile, animal-free scaffolds for organogenesis, tumor spheroids, and high-throughput drug screening, and ReproCELL’s Alvetex scaffolds enable in vivo-like cell behavior for predictive studies. Collectively, these companies are expanding the market by improving scaffold technology, broadening applications, and supporting more accurate preclinical research models.

Key 3D Scaffolds Companies:

The following are the leading companies in the 3D scaffolds market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- CellSystems

- Thermo Fisher Scientific, Inc

- Femtika

- Gelatex Technologies

- ReproCELL Inc.

- Ilex Life Sciences

- BellaSeno GmbH

- Ossiform

Recent Developments

-

In August 2025, as per study published in Advanced Healthcare Materials, a peer-reviewed scientific journal, a research team at the University of Minnesota Twin Cities demonstrated a groundbreaking process that combined 3D printing, stem cell biology, and lab-grown tissues to support spinal cord injury recovery.

-

In December 2024, Researchers at the Institute for Bioengineering of Catalonia developed novel 3D-printed scaffolds made from polylactic acid and calcium phosphate. These innovative scaffolds promoted blood vessel formation, ensuring improved healing and regeneration of bone tissue.

-

In March 2023, Evonik and BellaSeno collaborated to commercialize innovative 3D-printed scaffolds for bone regeneration. These bone scaffolds were made using Evonik’s RESOMER polymers and were designed to treat large and complex bone defects.

3D Scaffolds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 970.0 million

Revenue forecast in 2033

USD 2,008.6 million

Growth rate

CAGR of 9.53% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Merck KGaA; CellSystems; Thermo Fisher Scientific, Inc.; Femtika; Gelatex Technologies; ReproCELL Inc.; Ilex Life Sciences; BellaSeno GmbH; Ossiform

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global 3D Scaffolds Market Report Segmentation

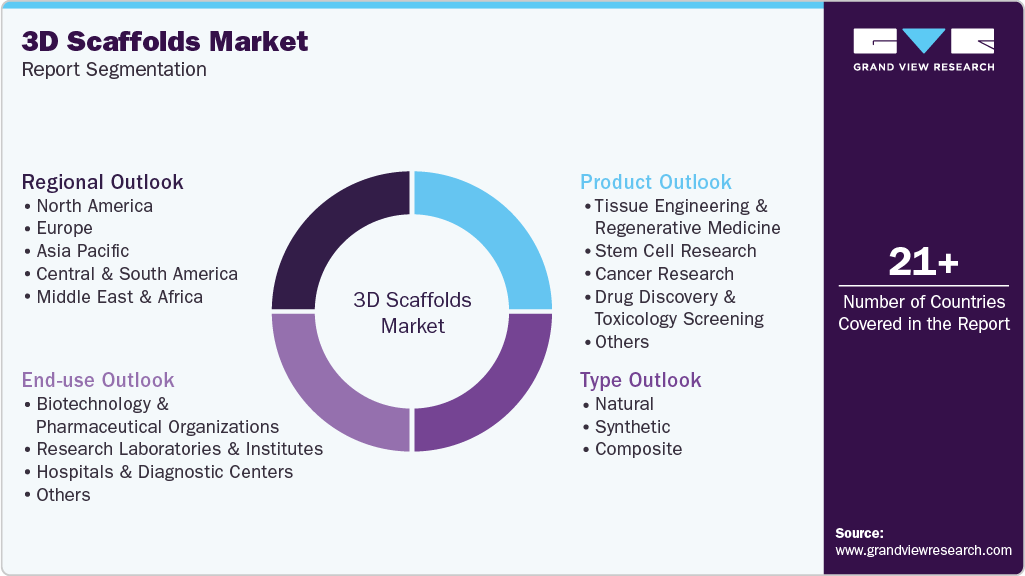

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global 3D scaffolds market on the basis of type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

Composite

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Tissue Engineering & Regenerative Medicine

-

Stem Cell Research

-

Cancer Research

-

Drug Discovery & Toxicology Screening

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biotechnology and Pharmaceutical Organizations

-

Research Laboratories and Institutes

-

Hospitals and Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.