- Home

- »

- Next Generation Technologies

- »

-

Accelerated Processing Unit Market Size, Share Report 2030GVR Report cover

![Accelerated Processing Unit Market Size, Share & Trend Report]()

Accelerated Processing Unit Market (2024 - 2030) Size, Share & Trend Analysis Report By Product Type (System Integration, Architectural Integration), By CPU Cores (Quad Core, Hexa Core), By Devices, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-473-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Accelerated Processing Unit Market Summary

The global accelerated processing unit market size was estimated at USD 13.85 billion in 2023 and is projected to reach USD 42.97 billion by 2030, growing at a CAGR of 17.5% from 2024 to 2030. This growth is driven by rising demand for high-performance computing in AI, machine learning, gaming, and HPC, where Accelerated Processing Unit (APU) optimize performance by integrating CPU and GPU functions on a single chip.

Key Market Trends & Insights

- The North America represented a significant market share of over 43% in 2023.

- Based on product type, the system integration segment led the market and accounted for over 50% of the global revenue in 2023.

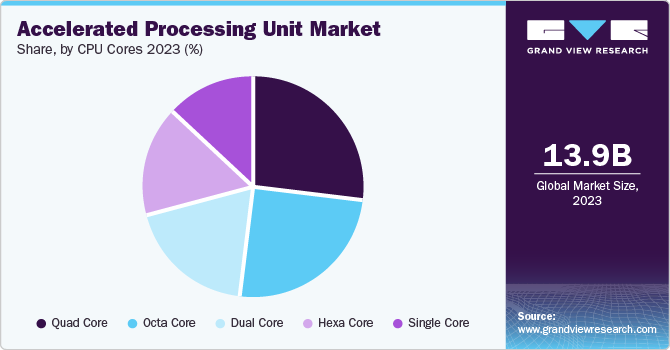

- Based on CPU cores, the quad-core segment led the market in 2023.

- Based on devices, the laptop segment accounted for the largest market revenue share in 2023.

- Based on application, the gaming segment led the APU market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.85 Billion

- 2030 Projected Market Size: USD 42.97 Billion

- CAGR (2024 to 2030): 17.5%

- North America: Largest market in 2023

The gaming industry and multimedia applications also contribute significantly, as APUs offer cost-effective, high-definition graphics rendering. APUs are increasingly adopted in portable devices such as laptops and smartphones due to their power efficiency and improved thermal management.

The expansion of 5G networks is increasing the adoption of APUs in mobile devices and edge computing as they handle the heavy computational and graphical demands of real-time gaming, Virtual Reality (VR), and Augmented Reality (AR). In the automotive industry, APUs are required for advanced driver-assistance systems (ADAS), autonomous vehicles, and in-car entertainment, enabling real-time data processing and high-definition graphics. Due to integrated CPU and GPU which allow energy efficiency and cost-saving benefits, make APUs valuable for battery-powered devices and industries such as data centers. Additionally, APUs' ability to balance performance and power consumption makes them useful for high-performance tasks in portable electronics.

APUs are also gaining momentum with the rise of cloud computing, virtualization, and remote work, offering the compute and graphics capabilities needed for virtual desktops and cloud-based gaming. In healthcare, APUs power medical imaging systems, providing the processing power required for complex 3D data. Their use in AI and deep learning is expanding, with APUs offering parallel processing capabilities that accelerate model training. Government investments in digital transformation and smart cities are fueling demand for APUs in sectors such as industrial automation and robotics, where real-time decision-making and efficiency are essential.

Product Type Insights

The system integration segment led the market and accounted for over 50% of the global revenue in 2023, driven by the increasing demand for efficient and cost-effective solutions. APUs, which integrate both CPU and GPU functions on a single chip, reduce the need for separate components, which is beneficial for system integrators in industries such as consumer electronics, automotive, and IoT. This integration simplifies system design, enhances energy efficiency, and lowers costs, benefiting applications ranging from laptops to autonomous vehicles. System integrators also recognize the scalability and flexibility of APUs, allowing for optimized solutions across diverse sectors.

The optimized platform segment within the APU market is experiencing significant growth due to its ability to provide tailored solutions for specific industries such as gaming, AI, automotive, and data centers. These platforms offer a balance of high-performance computing and power efficiency, which is useful for portable electronics, edge computing, and autonomous vehicles. APUs integrated into optimized platforms deliver the real-time processing and parallel computing required for tasks such as AI workloads, sensor fusion, and immersive gaming experiences. The streamlined development and deployment process further drives their adoption, reducing time-to-market and design complexity.

CPU Cores Insights

The quad-core segment led the APU market in 2023 due to its balance of performance and energy efficiency. These APUs are widely used in devices such as laptops, desktops, and gaming consoles, offering enough processing power for multitasking and everyday applications without excessive power consumption. Their cost-effectiveness is useful for mid-range computing devices, providing solid performance at a lower price than higher-core alternatives. Quad-core APUs are also gaining traction in portable devices, IoT, and automotive systems, where moderate processing power and energy efficiency are essential.

The octa-core segment is experiencing significant growth due to the increasing demand for high-performance computing in industries such as gaming, AI, and HPC. With eight processing cores, octa-core APUs are well-suited for intensive workloads and multithreaded applications, allowing for efficient multitasking in areas such as video editing, 3D rendering, and scientific computing. Their ability to handle the processing demands of 4K and 8K media consumption drives their adoption in smart TVs, streaming devices, and professional media production. Advancements in semiconductor technology, such as 7nm and 5nm processes, have enabled more powerful and energy-efficient octa-core APUs.

Devices Insights

The laptop segment accounted for the largest market revenue share in 2023 due to growing demand for portable, energy-efficient computing solutions. APUs, which combine CPU and GPU capabilities on a single chip, are ideal for laptops as they offer compact performance and enhanced thermal management, which are crucial for long battery life and efficient operation. The rise in gaming laptops, remote work, and online education has further fueled demand for APUs, which support both productivity and high-performance gaming. APUs also provide a cost-effective solution for manufacturers, reducing production costs in mid-range and budget laptops.

The smartphone segment is experiencing significant growth due to rising demands for high-performance and feature-rich mobile devices. APUs, efficiency supports enhanced multimedia experiences, 5G capabilities, and advanced photography features, contributing to improved user experiences. The surge in mobile gaming, augmented reality (AR), and multimedia consumption further drives the need for APUs, enabling smoother gaming experiences, enhanced video playback, and advanced photography. Additionally, the compact and integrated design of APUs supports innovative smartphone features such as foldable and dual-screen phones, contributing to their widespread adoption and growth in the market.

Application Insights

The gaming segment led the APU market in 2023 due to the growing demand for high-performance graphics and cost-effective solutions. APUs offer reduced latency and improved performance, making them useful for gaming, especially in mid-range and entry-level systems. The rise of mobile and casual gaming has increased the need for efficient, integrated processing units in devices such as laptops, tablets, and consoles. Advances in APU technology, enhancing processing power and graphics performance, have made them capable of handling more demanding games. Additionally, the growth of e-sports and streaming has driven the adoption of APUs, providing affordable and powerful solutions for both gaming and content creation.

The gesture & facial recognition segment is experiencing significant growth due to the increasing demand for enhanced user interfaces and security. With their integrated CPU and GPU capabilities, APUs handle the complex algorithms required for real-time facial and gesture recognition. The rise of AI and machine learning has further driven the need for APUs that incorporate advanced processing features to improve recognition accuracy and efficiency. As smart devices and IoT expand, APUs are increasingly used for their ability to manage multiple tasks, including advanced interaction methods.

End Use Insights

The media and entertainment segment led the market in 2023 due to its high demands for robust processing power in tasks such as video editing, rendering, and streaming. APUs are well-suited for efficiently handling these media-intensive tasks, driving their widespread adoption in this sector. The growth of streaming services, content creation, and multimedia technologies such as VR and AR has further fueled the need for powerful processing solutions, with APUs offering the necessary performance. Their suitability for high-definition content, gaming, and interactive media has established them as a preferred solution for these applications. Additionally, the cost-effectiveness of integrating CPU and GPU functions into a single chip enhances performance while reducing overall system costs, making APUs beneficial for media and entertainment purposes.

The automotive segment is expected to grow significantly. The increasing adoption of Advanced Driver Assistance Systems (ADAS) requires advanced processing for features such as adaptive cruise control and lane-keeping, which APUs are well-equipped to handle. Additionally, the rise of advanced in-car infotainment systems and the development of autonomous vehicles demand high-performance processing for real-time data and sensor fusion. APUs also support enhanced vehicle connectivity and integration, including features such as vehicle-to-everything communication and over-the-air updates. As electric vehicles become more prevalent, APUs are integral to managing control systems and energy efficiency, driving the sector's expansion.

Regional Insights

North America represented a significant market share of over 43% in 2023, driven by the region's leadership in technological innovation and research fuels the adoption of APUs across various applications, including consumer electronics, gaming, and automotive technologies. North America's substantial consumer electronics market, combined with a strong gaming and entertainment industry, further boosts APU demand. Additionally, the region's focus on AI and machine learning, along with the presence of major tech companies, supports significant market growth.

U.S. Accelerated Processing Unit (APU) Market Trends

The APU market in the U.S. is expected to grow significantly over the forecast period. The country’s strong technology ecosystem, led by major companies such as Advanced Micro Devices, Inc., Intel Corporation, and NVIDIA Corporation, fosters innovation and boosts APU adoption. The expansion of the gaming and entertainment sectors further fuels demand for APUs by requiring enhanced graphics and processing power. Additionally, the U.S. automotive industry’s rapid integration of advanced driver assistance systems and autonomous technologies also contributes to market growth.

Europe Accelerated Processing Unit (APU) Market Trends

The APU market in Europe is gaining significant traction. Digital transformation initiatives across sectors such as government, healthcare, and finance are spurring investments in advanced processing solutions such as APUs. European Union funding programs, such as Horizon Europe and Digital Europe, further support the development and adoption of these technologies. The presence of major automotive manufacturers and a focus on green technology align with APUs' energy efficiency and processing capabilities. Additionally, the growth of smart home technologies and the European gaming industry, associated with a strong R&D ecosystem, continues to drive the demand for APUs across the region.

Asia Pacific Accelerated Processing Unit (APU) Market Trends

The Asia Pacific APU market is poised for significant growth. The region's technological advancement, led by countries such as China, South Korea, Japan, and India, fuels the demand for cutting-edge processing solutions. Government initiatives and investments, such as China's "Made in China 2025" plan and India's smart city projects, create substantial opportunities for APUs in various applications. APAC's strong manufacturing base supports the production and distribution of APUs, enhancing their accessibility and affordability. Additionally, the rise of 5G technology in the region boosts the demand for APUs in edge devices and network infrastructure, further driving market expansion.

Key Accelerated Processing Unit Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in February 2024, Topton Technology Co., Ltd., a provider of minicomputers, launched the D11 Mini PC, powered by the AMD Ryzen 7 8845HS processor, for demanding tasks. The D11 serves as a gaming system with an external GPU with a powerful APU from Advanced Micro Devices, Inc. and is available in various configurations, including a barebone option. The maximum configuration features 4 TB NVMe SSD and 64 GB of DDR5 RAM with support for up to 96 GB of DDR5 memory and an additional M.2 2280 slot.

Key Accelerated Processing Unit Companies:

The following are the leading companies in the accelerated processing unit market. These companies collectively hold the largest market share and dictate industry trends.

- Arm Limited

- Advanced Micro Devices, Inc.

- Broadcom

- Intel Corporation

- IBM Corporation

- Imagination Technologies

- Marvell

- NVIDIA Corporation

- NXP Semiconductors.

- Qualcomm Technologies, Inc.

Recent Developments

-

In July 2024, ASUSTeK Computer Inc. launched its AMD Ryzen AI 300 series "Strix Point" APU-powered laptops, including the ProArt PX13, ProArt P16, and ZenBook S16. These laptops feature new RDNA 3.5 GPU cores, Zen 5 CPU cores, and an upgraded XDNA 2 NPU for AI tasks with up to 50 TOPS. The ProArt P16, the flagship model, comes with a 16-inch 4K+ OLED touchscreen display with a true 10-bit color and 500 nits of HDR peak brightness.

-

In May 2024, MediaTek Inc. unveiled the Dimensity 8250 5G SoC, featuring the APU 580 for improved AI performance, aimed at premium mid-range smartphones. The 4nm chip includes a Mali-G610 MC6 GPU for smooth visuals, an integrated 5G modem with download speeds up to 4.7Gbps, and an octa-core CPU with a high-performance Arm Cortex-A78 core clocked at 3.1GHz. It supports WiFi 6E, Bluetooth 5.3, and India's NavIC navigation system alongside global options.

-

In January 2024, Advanced Micro Devices, Inc. launched the Ryzen 8000G series of APUs, led by the Ryzen 7 8700G. This chip features an eight-core CPU based on Advanced Micro Devices, Inc.'s Zen 4 architecture, which offers a larger cache and improved efficiency. Advanced Micro Devices, Inc. also claims it is the world's most powerful integrated graphics accelerator, based on the RDNA3 GPU architecture, optimized for rendering lighting and shadow effects in games.

Accelerated Processing Unit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.29 billion

Revenue forecast in 2030

USD 42.97 billion

Growth rate

CAGR of 17.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered Application

Product type, CPU cores, devices, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Arm Limited; Advanced Micro Devices, Inc.; Broadcom; Intel Corporation; IBM Corporation; Imagination Technologies; Marvell; NVIDIA Corporation; NXP Semiconductors.; Qualcomm Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Accelerated Processing Unit (APU) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global APU market report based on product type, CPU cores, devices, application, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

System Integration

-

Architectural Integration

-

Optimized Platform

-

-

CPU Cores Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Core

-

Dual Core

-

Quad Core

-

Hexa Core

-

Octa Core

-

-

Devices Outlook (Revenue, USD Million, 2017 - 2030)

-

Tablets

-

Smartphones

-

Personal Computers

-

Laptops

-

Gaming Consoles

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Gaming

-

Gesture & Facial Recognition

-

Visual & Audio Data Processing

-

3D Rendering

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

IT & Telecommunications

-

Electronics & Semiconductor

-

Healthcare

-

Media & Entertainment

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global accelerated processing unit market size was estimated at USD 13.85 billion in 2023 and is expected to reach USD 16.29 billion in 2024.

b. The global accelerated processing unit market is expected to grow at a compound annual growth rate of 17.5% from 2024 to 2030 to reach USD 42.97 billion by 2030.

b. North America dominated the market in 2023, accounting for over 43.0% share of the global revenue, driven by the region's leadership in technological innovation and research fuels the adoption of APUs across various applications, including consumer electronics, gaming, and automotive technologies.

b. Some key players operating in the APU market include Arm Limited; Advanced Micro Devices, Inc.; Broadcom; Intel Corporation; IBM Corporation; Imagination Technologies; Marvell; NVIDIA Corporation; NXP Semiconductors.; Qualcomm Technologies, Inc.

b. Key factors driving the APU market growth include the rising adoption of APUs in gaming and graphics and the growing demand for high-performance computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.