- Home

- »

- Advanced Interior Materials

- »

-

Advanced Carbon Materials Market, Industry Report, 2033GVR Report cover

![Advanced Carbon Materials Market Size, Share & Trends Report]()

Advanced Carbon Materials Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Carbon Fibers, Structural Graphite, CNT, Graphene), By Application (Aerospace & Defense, Energy, Electronics, Sports, Automotive, Construction), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-160-3

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Advanced Carbon Materials Market Summary

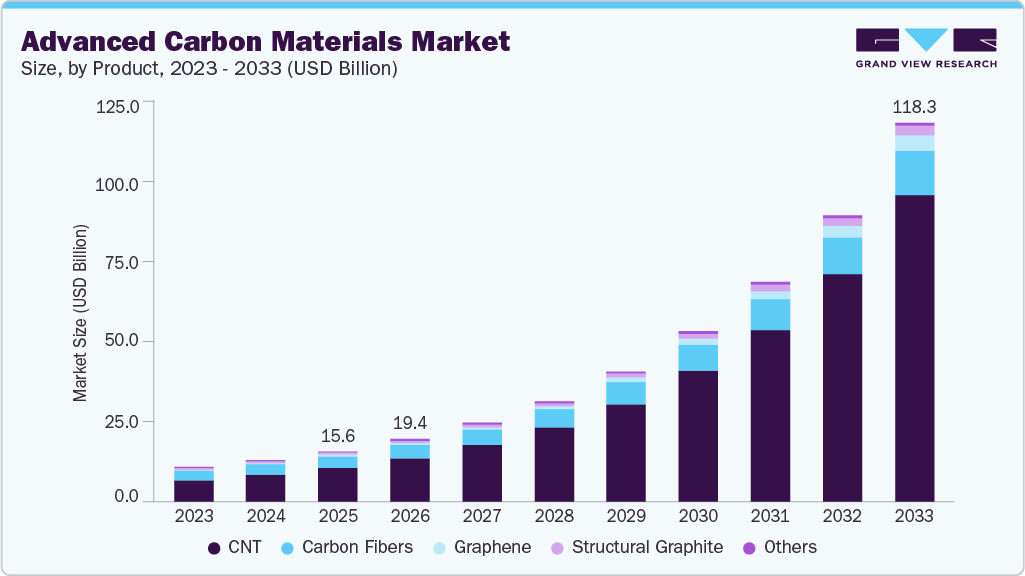

The global advanced carbon materials market size was estimated at USD 15.57 billion in 2025 and is projected to reach USD 118.27 billion by 2033, growing at a CAGR of 29.5% from 2026 to 2033. The demand for advanced carbon materials is increasing due to their exceptional mechanical strength, thermal stability, electrical conductivity, and lightweight properties.

Key Market Trends & Insights

- Europe dominated the advanced carbon materials market with the largest revenue share of 36.9% in 2025.

- By product, the graphene segment is expected to grow at the fastest CAGR of 36.7% over the forecast period.

- By application, the electronics segment is expected to grow at the fastest CAGR of 30.8% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 15.57 Billion

- 2033 Projected Market Size: USD 118.27 Billion

- CAGR (2026-2033): 29.5%

- Europe: Largest market in 2025

- North America: Fastest market

These materials are increasingly replacing conventional metals and polymers in high-performance applications. Rapid adoption in electric vehicles, renewable energy systems, and aerospace structures is accelerating the growth of the market. Advanced carbon materials enhance energy efficiency and product durability across industries. Rising focus on material performance optimization is further boosting consumption. Their ability to withstand extreme operating conditions makes them essential in advanced engineering applications. Growing industrial modernization globally continues to support sustained demand.Key drivers include expanding applications in lithium-ion batteries, fuel cells, and supercapacitors, where high conductivity and durability are critical. Growth in electric mobility and energy storage infrastructure is significantly increasing the use of carbon fibers, graphene, and carbon nanotubes. Aerospace and defense sectors are adopting these materials for weight reduction and structural performance. Semiconductors and electronics industries rely on advanced carbon materials for thermal management. Increasing R&D investments in nanomaterials are strengthening commercialization. Industrial automation and advanced manufacturing technologies also support demand growth. Rising need for sustainable and recyclable materials is an additional driver.

Key innovations include large-scale production of graphene and carbon nanotubes at reduced cost. Development of bio-based and recycled carbon materials is gaining traction. Hybrid composites combining carbon materials with metals or polymers are emerging. Advances in additive manufacturing are enabling complex carbon-based structures. Improved surface functionalization techniques are expanding application scope. AI-driven material design is enhancing performance predictability. The market is witnessing growth due to trend of shifted focus on circular economy-aligned carbon materials.

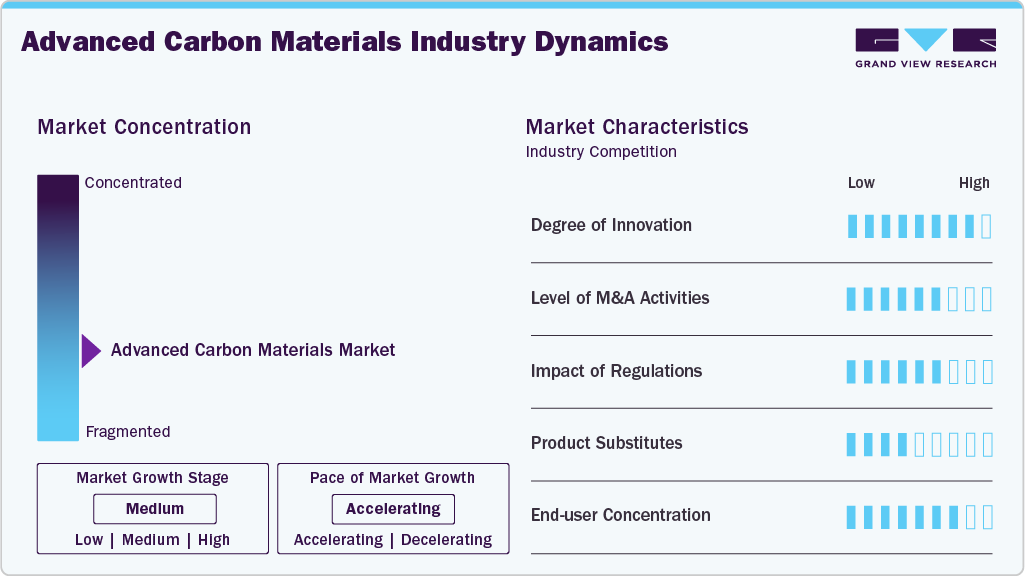

Market Concentration & Characteristics

The advanced carbon materials market is moderately fragmented, with a mix of global chemical companies, specialty material manufacturers, and emerging technology players. Leading firms dominate high-volume carbon fiber and graphite production. Smaller players focus on niche applications such as graphene and CNTs. Strategic collaborations and licensing agreements are common to accelerate innovation. Entry barriers remain high due to capital-intensive manufacturing and technical expertise requirements. Intellectual property plays a critical competitive role. Overall, competition is driven by technological capability and application-specific customization.

Substitute materials include advanced polymers, aluminum alloys, and ceramic composites. However, these alternatives often lack the combined strength-to-weight ratio and conductivity of advanced carbon materials. Cost sensitivity may encourage substitution in low-performance applications. Technological improvements in metal alloys pose moderate competition. Hybrid materials partially replace pure carbon materials in some uses. Despite this, performance advantages limit large-scale substitution. Overall threat of substitutes remains moderate.

Product Insights

The CNT segment held the largest revenue market share of 67.5% in 2025, due to their superior electrical conductivity, mechanical strength, and thermal stability. CNTs are widely used in energy storage, composites, electronics, and aerospace applications where high performance is critical. Their established commercial production and broad application base support consistent revenue generation. Increasing use in batteries and conductive additives further strengthens market dominance. Strong demand from industrial and advanced manufacturing sectors continues to sustain the segment’s leading position.

The graphene segment is expected to grow at the fastest CAGR of 36.7% over the forecast period, due to rapid technological advancements and expanding application scope. Graphene’s exceptional conductivity, flexibility, and strength enable its use in electronics, sensors, coatings, and energy storage systems. Ongoing improvements in scalable production methods are reducing costs and improving adoption. Increasing R&D investments and pilot commercialization projects support growth. Rising demand for next-generation electronic and energy solutions is accelerating graphene uptake.

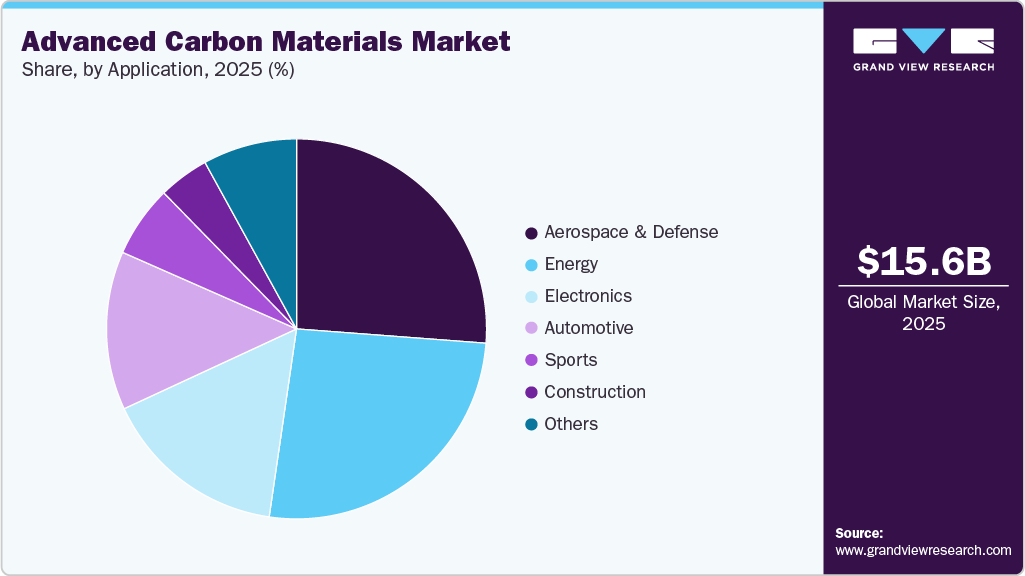

Application Insights

The aerospace & defense segment held the largest revenue market share of 26.2% in 2025, due to heavy reliance on lightweight and high-strength materials. Advanced carbon materials are widely used in aircraft structures, defense equipment, and space applications to improve fuel efficiency and durability. Long product lifecycles and high material value contribute to strong revenue generation. Continuous investment in fleet modernization supports sustained demand. Stringent performance requirements further reinforce the segment’s dominance.

The electronics segment is expected to grow at the fastest CAGR of 30.8% over the forecast period, driven by increasing miniaturization and performance demands. Advanced carbon materials are increasingly used for thermal management, conductive components, and flexible electronics. Growth in semiconductors, wearable devices, and next-generation displays supports adoption. Technological advancements in graphene and CNT-based electronics are expanding applications. Rising demand for high-speed and energy-efficient electronic devices accelerates segment growth.

Regional Insights

Europe advanced carbon materials market dominated the respective global market and accounted for the largest revenue share of 36.9% in 2025, driven by strict environmental regulations and sustainability goals. Lightweight materials are widely adopted to improve automotive fuel efficiency. Strong aerospace manufacturing supports demand for high-performance carbon composites. European research initiatives promote graphene and nanocarbon applications. Renewable energy projects increase the use of advanced carbon materials. Circular economy policies influence material development strategies. Cross-border collaborations strengthen technological advancement.

Advanced carbon materials market in Germany plays a leading role in the European market. The country’s strong automotive and industrial engineering base drives adoption of lightweight materials. Carbon fiber composites are widely used to enhance vehicle efficiency and performance. Research institutions actively develop next-generation carbon technologies. Advanced manufacturing and automation support scalability. Environmental regulations encourage energy-efficient material usage. Export-oriented manufacturing further supports market growth.

Asia Pacific Advanced Carbon Materials Market Trends

Asia Pacific advanced carbon materials market is growing due to large-scale industrialization and strong downstream manufacturing capacity. The region benefits from high demand from electric vehicles, batteries, electronics, and aerospace manufacturing. Countries such as China, Japan, and South Korea are major producers and consumers of carbon fibers, graphene, and specialty graphite. Government-backed investments in advanced materials and nanotechnology support innovation and capacity expansion. Cost-efficient production and skilled labor strengthen regional competitiveness. Rapid infrastructure development further increases material adoption. Strong export orientation supports sustained market leadership.

Advanced carbon materials market in China holds a leading position in the global market due to its integrated supply chain and high production capacity. The country is a major producer of graphite, carbon fibers, and graphene-based materials. Rapid growth in electric vehicle manufacturing and lithium-ion battery production significantly drives demand. Government policies emphasize self-reliance in advanced materials and high-performance composites. Continuous investment in R&D accelerates commercialization of nanocarbon technologies. Aerospace and defense sectors also contribute steadily to demand. Export-driven manufacturing enhances China’s global market presence.

North America Advanced Carbon Materials Market Trends

North America represents a technologically advanced market supported by strong innovation ecosystems. Demand is driven by aerospace, defense, energy storage, and semiconductor industries. High adoption of carbon fiber composites in aircraft and defense equipment supports market growth. The region benefits from advanced research institutions and material science expertise. Government funding for clean energy and battery innovation indirectly boosts demand. Strategic partnerships between manufacturers and research labs are common. Emphasis on high-performance and sustainable materials sustains long-term growth.

U.S. Advanced Carbon Materials Market Trends

The U.S. is a major contributor to the North American advanced carbon materials market. Strong demand comes from aerospace, defense, electric vehicles, and electronics manufacturing. Federal programs support nanotechnology and advanced material research. Domestic production of carbon fibers and specialty carbons is expanding. Energy storage and semiconductor applications are growing rapidly. Focus on supply chain localization supports market development. Innovation-driven startups enhance technological competitiveness.

Latin America Advanced Carbon Materials Market Trends

Latin America is an emerging market for advanced carbon materials with gradual adoption. Renewable energy projects and industrial development support the market growth. Automotive and infrastructure sectors contribute modestly to demand. Limited domestic production results in high dependence on imports. Research and development activity is still in the early stages. Economic diversification efforts support material adoption. Long-term industrial expansion offers growth potential.

Key Advanced Carbon Materials Company Insights

Some of the key players operating in the market include Mitsubishi Rayon and Graphenano.

-

Mitsubishi Rayon is a leading Japanese materials company known for its advanced carbon fiber and composite solutions. The company serves aerospace, automotive, and industrial applications with high-performance materials. Its strong R&D capabilities support innovation in lightweight and durable carbon-based products.

-

Graphenano is a Spain-based company specializing in graphene-enhanced materials and energy storage solutions. It focuses on large-scale graphene production and applications in batteries, composites, and coatings. The company is known for integrating graphene into commercial industrial products.

Grupo Antolin Ingenieria S.A. and Haydale Graphene Industries PLC are some of the emerging market participants in the advanced carbon materials market.

-

Grupo Antolin Ingeniería is a major global automotive interior supplier based in Spain. The company integrates advanced materials, including carbon-based composites and graphene, into lightweight vehicle interior solutions. Its focus on sustainability and innovation supports automotive efficiency and design performance.

-

Haydale Graphene Industries is a UK-based company focused on the functionalization and commercialization of graphene and nanomaterials. The company targets applications in composites, electronics, coatings, and energy storage. Its proprietary plasma technology enables enhanced dispersion and performance of graphene materials.

Key Advanced Carbon Materials Companies:

The following are the leading companies in the advanced carbon materials market. These companies collectively hold the largest market share and dictate industry trends.

- Jiangsu CNano Technology Co. Ltd

- Anaori Carbon Co. Ltd

- Grupo Antolin Ingenieria S.A

- Graphenano

- Graphenea

- CVD Equipment Corporation

- Haydale Graphene Industries PLC

- Showa Denko K.K

- Mitsubishi Rayon

- Hexcel Corporation

Recent Developments

-

In May 2024, Haydale announced showcasing their demonstration for graphene ‘Hot Seat’ at Advanced Materials Show 2024 in Birmingham. This optimizes automotive seating technology and is an eco-friendly alternative to current solutions.

-

In October 2023, Hexcel corporation announced the launch of new intermediate and high modulus fiber Hexply M79 Prepregs at METS, which is expected to be used in making high performance windship components and superyachts.

Advanced Carbon Materials Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 19.37 billion

Revenue forecast in 2033

USD 118.27 billion

Growth rate

CAGR of 29.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; RoW

Country scope

U.S.; Germany; UK; Italy; China; Japan; India; Brazil; Argentina

Key companies profiled

Jiangsu CNano Technology Co. Ltd; Anaori Carbon Co. Ltd; Grupo Antolin Ingenieria S.A.; Graphenano; Graphenea; CVD Equipment Corporation; Haydale Graphene Industries PLC; Showa Denko K.K.; Mitsubishi Rayon; Hexcel Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

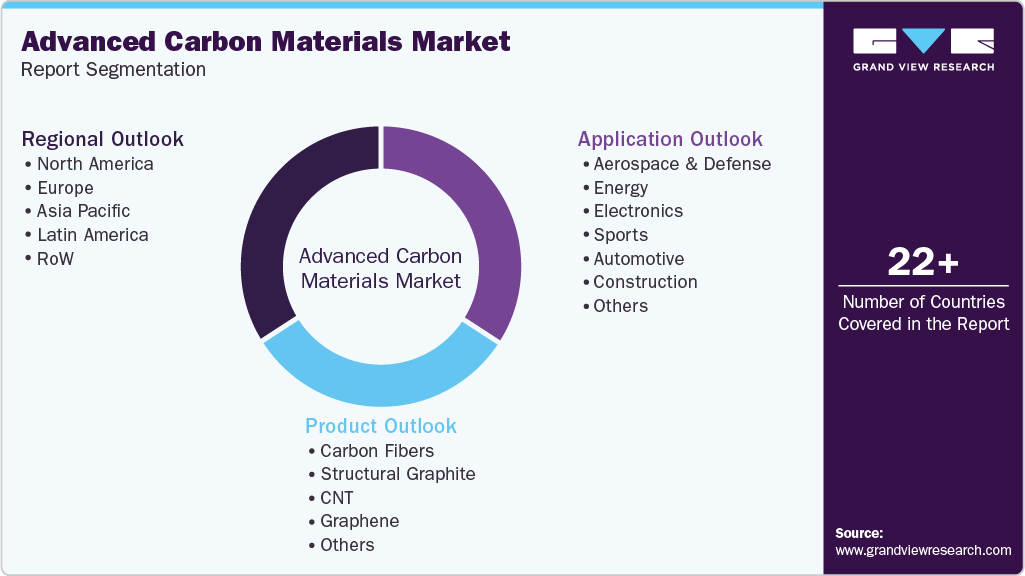

Global Advanced Carbon Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the advanced carbon materials market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Carbon Fibers

-

Structural Graphite

-

CNT

-

Graphene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Energy

-

Electronics

-

Sports

-

Automotive

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

RoW

-

Frequently Asked Questions About This Report

b. The global advanced carbon materials market size was estimated at USD 15.57 billion in 2025 and is expected to reach USD 19.37 billion in 2026.

b. The global advanced carbon materials market is expected to grow at a compound annual growth rate of 29.5% from 2026 to 2033 to reach USD 118.27 billion by 2033.

b. The CNT segment held the highest revenue market share of 67.5% in 2025, due to their superior electrical conductivity, mechanical strength, and thermal stability.

b. Some of the key players operating in the advanced carbon materials market include Jiangsu CNano Technology Co. Ltd, Anaori Carbon Co. Ltd, Grupo Antolin Ingenieria S.A, Graphenano, Graphenea, CVD Equipment Corporation, Haydale Graphene Industries PLC, Showa Denko K.K, Hexcel Corporation, and Mitsubishi Rayon.

b. Rising demand for lightweight, high-strength, and conductive materials across energy storage, electric vehicles, aerospace, and electronics along with rapid advances in nanotechnology and sustainability-focused material innovation is driving the advanced carbon materials market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.