- Home

- »

- Advanced Interior Materials

- »

-

Air Deflector Market Size And Share, Industry Report, 2030GVR Report cover

![Air Deflector Market Size, Share & Trends Report]()

Air Deflector Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Window Deflector, Sunroof Deflector), By Mounting Method (Tape-on, Bolt-on), By Material (Acrylic, ABS), By Vehicle Type (Passenger Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-473-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Deflector Market Size & Trends

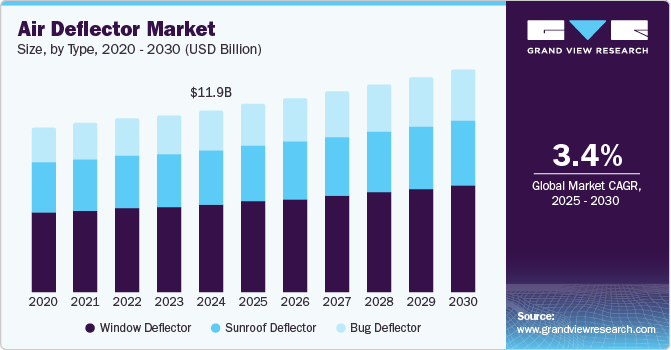

The global air deflector market was estimated at USD 11.9 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2025 to 2030. Air deflectors have witnessed a consistent demand in both the automotive and HVAC industries. In the automotive sector, air deflectors are crucial for improving a vehicle's aerodynamics, which in turn can enhance fuel efficiency and reduce noise while driving at high speeds. For instance, a car manufacturer might integrate air deflectors into the design of new models to appeal to consumers seeking a quieter, more fuel-efficient ride. These components direct airflow in a way that minimizes drag and turbulence, showcasing how practical design elements can contribute to a vehicle's overall performance and appeal.

In recent years, the demand for air deflectors has seen a notable increase, driven by the growing emphasis on energy efficiency and indoor air quality in both the residential and commercial sectors. Air deflectors may also contribute to minimizing vehicle drag, which reduces fuel consumption and CO2 emissions, making it easier to comply with the strict environmental regulations imposed by the Government. Furthermore, air deflectors have been increasingly effective and cost-effective as material technology has advanced. This enables improved performance, which drives acceptance in original equipment manufacturing (OEM) and aftermarket sales. In addition, with an increased emphasis on sustainability, producers and consumers are seeking methods to decrease carbon footprints. Air deflectors contribute to this objective by increasing fuel economy, which reduces overall vehicle emissions.

Consumers and businesses recognize the benefits of air deflectors in improving HVAC system efficiency, enhancing comfort levels, and reducing energy costs. This trend is further supported by advancements in material technology and design innovation, making air deflectors more effective and aesthetically pleasing. As environmental awareness and the push for sustainable living continue to gain momentum, the market for air deflectors is expected to grow, with a particular interest in products that offer smart features, such as automated adjustments to optimize airflow and temperature distribution.

The market faces certain restraints that could hinder its growth. One of the significant restraints is the high cost associated with the development and installation of air deflectors, which may deter budget-conscious consumers and manufacturers. Moreover, the fluctuating raw material prices, such as plastics and metals used in manufacturing air deflectors, add to the cost pressures. Another challenge is the stringent regulations and standards imposed by governments and automotive bodies worldwide, which mandate rigorous testing and quality assurance for vehicle accessories, including air deflectors.

Despite these challenges, the market presents several opportunities for growth and innovation. The increasing focus on electric vehicles (EVs) opens new avenues for air deflector manufacturers. EVs require efficient aerodynamics for better range and performance, and air deflectors can play a significant role in achieving these goals. As the EV market continues to grow, the demand for specialized air deflectors is expected to rise. In addition, advancements in materials and manufacturing technologies offer the potential to reduce costs and improve the performance of air deflectors. The use of lightweight, durable materials can enhance fuel efficiency further and appeal to both manufacturers and consumers. Finally, the expanding aftermarket for vehicle accessories provides a lucrative opportunity for air deflector manufacturers. As consumers seek to personalize and upgrade their vehicles, the demand for high-quality, innovative air deflectors in the aftermarket is likely to increase, driving the overall market growth.

Type Insights

Based on type, the window deflectors segment led the market with the largest revenue share of 48.4% in 2024. Window deflectors are vehicle accessories designed to allow fresh air into the car while keeping rain out. They are typically installed above the car windows and work by redirecting airflow away from the vehicle's interior. This unique functionality not only enhances the comfort of the occupants during various weather conditions but also reduces fogging on the windows, thereby improving visibility for the driver. Window deflectors are made from durable materials like acrylic or polycarbonate, ensuring longevity and resistance to the elements. Moreover, they contribute to the vehicle's aesthetic appeal, adding a sleek, streamlined look. Their easy installation process, usually involving adhesive tape or a snug, in-channel fit, makes them popular among vehicle owners looking to upgrade their ride's functionality and style.

The bug deflector segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. Mounted on the hood, these accessories work by creating an aerodynamic flow that lifts bugs and debris over the vehicle, thus preventing them from splattering on the windshield or damaging the paint. This not only helps in keeping the windshield clean for improved visibility but also reduces the time and effort spent on cleaning the vehicle's exterior. Bug deflectors are crafted from high-impact materials like acrylic, making them durable against the rigors of daily driving. Their installation is straightforward, with many models requiring no drilling, thereby preserving the integrity of the vehicle. Besides their practical benefits, bug deflectors also offer an aesthetic upgrade, giving the vehicle a rugged, ready-for-adventure look.

Mounting Method Insights

The tape-on air deflectors mounting method segment dominated the market and accounted for a share of 59.1% in 2024. Tape-on air deflectors use adhesive tape to secure the deflector to the vehicle's window frame, eliminating the need for drilling or permanent modifications and ensuring a secure bond without any drilling. This method is highly favored for its simplicity and the fact that it doesn't require any alterations to the vehicle. Tape-on deflectors are particularly appealing for drivers looking for a quick and easy way to enhance their vehicle's functionality and style. It can be installed in minutes, providing immediate benefits such as reduced wind noise and improved aerodynamics without compromising the vehicle's original structure.

The in channel mounting method segment is expected to grow at the fastest CAGR of 3.2% over the forecast period. By fitting snugly into the window channel, these deflectors achieve a more streamlined look that many car owners prefer. The in-channel method might require more precision during installation, but the end result is a cleaner appearance that looks almost factory-installed. In addition to their aesthetic benefits, in-channel air deflectors also minimize the risk of theft and reduce wind noise more effectively than their tape-on counterparts. This mounting style has gained popularity among those who value both functionality and a sleek appearance, making it a sought-after option in the market.

Material Insights

The acrylic material segment dominated the market and accounted for a share of 54.0% in 2024. Acrylic is renowned for its crystal-clear transparency, durability, and resistance to UV rays, making it an ideal choice for sunroof and moon roof deflectors. It is mostly designed to improve a vehicle's aerodynamics. It helps reduce wind noise and enhance passenger comfort by directing airflow in an efficient manner. Moreover, acrylic material helps in reducing glare from the sun, which provides a comfortable driving experience. It is mostly favored because it integrates effortlessly into any vehicle design, retaining aesthetic appeal while providing effectiveness.

The ABS plastic segment is expected to grow at a significant CARG over the forecast period. It is celebrated for its robustness, impact resistance, and overall versatility. This material is frequently chosen for side window and hood deflectors due to its ability to withstand road debris and harsh weather conditions. Its plastic is stronger and can withstand higher impact without cracking. It also helps streamline airflow around the vehicle, reducing drag and improving fuel efficiency. ABS plastic minimizes wind resistance and provides ventilation for a smoother and more enjoyable ride. Products like AVS's hood deflectors are a testament to the strength and durability of ABS, offering protection against bugs, dirt, and rocks while complementing the vehicle's rugged look. Moreover, ABS's paintable surface allows for customization, aligning with the current market trend toward personalized vehicle accessories. As consumers continue to prioritize functionality and aesthetic appeal, the choice between acrylic and ABS materials in air deflectors underscores the diverse needs and preferences within the market.

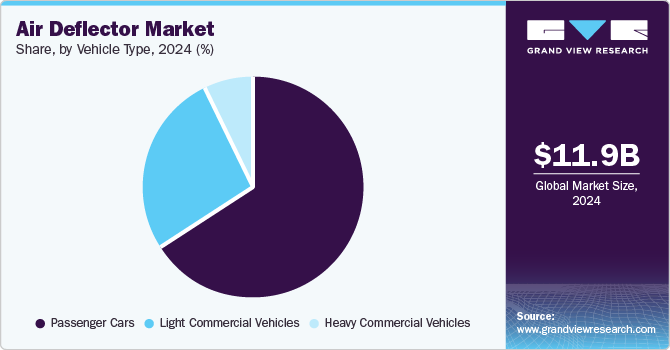

Vehicle Type Insights

The passenger vehicles segment dominated the market and accounted for a share of 66.0% in 2024. The trend towards more aerodynamic designs in passenger vehicles underscores the growing importance of fuel efficiency and noise reduction during high-speed travel. Air deflectors have become a renowned aftermarket component, as they elevate vehicle aesthetics and comfort, reduce wind noise, and improve aerodynamics for better fuel efficiency. They are widely used for streamlining airflow around the car, which helps in reducing drag. Manufacturers like WeatherTech and Lund are leading the way with innovative designs that cater to a wide range of passenger vehicles, from sedans to SUVs, highlighting the versatility and adaptability of air deflectors to modern automotive design trends.

The light commercial vehicles segment is expected to grow at the fastest CAGR of 3.6% over the forecast period. In this segment, the focus is on improving fuel efficiency, reducing drag, and protecting cargo from harsh weather conditions. LCV operators are increasingly recognizing the benefits of installing air deflectors to reduce drag and, consequently, fuel consumption, which is critical for businesses aiming to optimize operational costs. Furthermore, the trend toward customization and branding in the LCV market has seen a rise in demand for customizable air deflectors that can serve as both functional accessories and promotional tools.

Regional Insights

The air deflector market in North America is expected to grow at a steady CAGR over the forecast period, driven by rising demand for fuel-efficient vehicles and advancements in automotive aerodynamics. Air deflectors, which help improve vehicle aerodynamics by reducing air drag and enhancing fuel efficiency, are becoming increasingly popular among automakers and consumers. Strict emission norms and fuel efficiency standards have further pushed manufacturers to incorporate air deflectors to meet the regulatory standards required by the Government. This market is expected to develop as material technology advances, customer awareness of the vehicle economy rises, and the automotive aftermarket business expands.

U.S. Air Deflector Market Trends

The air deflector market in the U.S. dominated the North American air deflector market with a revenue share of 81.4% in 2024. The U.S. air deflector market is poised for significant growth, driven by factors such as increasing fuel efficiency regulations, growing demand for fuel-efficient vehicles, and rising consumer awareness of the benefits of air deflectors. Air deflectors offer several advantages, including improved fuel economy, reduced wind noise, and enhanced aerodynamics. The U.S. market is expected to witness a steady increase in the demand for air deflectors, particularly for passenger vehicles, light commercial vehicles, and heavy commercial vehicles.

Asia Pacific Air Deflector Market Trends

Asia Pacific dominated the air deflector market with the largest revenue share of 54.0% in 2024. Rapid expansion in countries such as India, China, and Japan resulted in greater automobile production and sales. The increasing adoption of electric vehicles (EVs) in these countries also plays a critical role, as manufacturers seek to improve the aerodynamics of EVs to maximize battery range, making air deflectors an essential accessory. Brands like Heko and ClimAir have found a strong foothold in the Asia Pacific market by offering products that cater to a wide array of vehicles, highlighting the region's importance in the global market landscape.

The India air deflector market is anticipated to grow at the fastest CAGR of 4.8% during the forecast period. The demand for air deflectors has been on a steady rise, largely fueled by the growing automotive industry and an increasing awareness among consumers about vehicle maintenance and enhancement. The hot and humid climate across much of the country further drives the need for air deflectors, as they help maintain a comfortable cabin temperature and improve air circulation within vehicles. Major cities with high pollution levels also see a demand for air deflectors as a means to reduce the ingress of pollutants. Companies like Autoform and Carhatke have tapped into this market by offering a wide range of air deflectors suited to the diverse models of cars available in India, emphasizing the importance of both functionality and style in meeting consumer demands.

Europe Air Deflector Market Trends

The air deflector market in Europe's demand for air deflectors is shaped by its stringent environmental regulations and the compact nature of its cities. European consumers tend to prioritize eco-friendly and aerodynamically efficient accessories that comply with their environmental values. The market here leans towards in-channel air deflectors for their sleek design and minimal wind noise, aligning with the European preference for subtlety and efficiency. Companies such as ClimAir and G3 have successfully catered to the European market by offering air deflectors that not only improve vehicle aerodynamics but also adhere to the region's aesthetic sensibilities and environmental standards, illustrating the regional differences in consumer preferences within the global market.

Key Air Deflector Company Insights

Some key companies operating in the market include Lund International; Climair UK Ltd.; Piedmont Plastics; Magna International Inc.; WeatherTech; Stampede Automotive Accessories; AVS (Auto Ventshade); EGR and Heko among others.

-

Lund International is a highly regarded player in the automotive accessories sector, specializing in the design, manufacturing, and marketing of branded automotive accessories for a broad range of vehicle categories. This includes cars, trucks, SUVs, vans, and heavy trucks. Founded in 1965, the company has carved out a significant presence in the market by offering products that enhance the functionality and aesthetic appeal of vehicles. Lund International's portfolio includes a wide array of accessories, such as hood protectors, running boards, tonneau covers, and floor mats, under well-known brand names. The company is committed to delivering high-quality, innovative products that meet the diverse needs of consumers and automotive enthusiasts alike

-

Röchling SE & Co. KG is a global leader in high-performance plastics engineering, with a rich history dating back to 1822. The company operates in a wide range of industries, including automotive, medical, and industrial engineering, providing solutions that are vital in addressing modern challenges such as reducing emissions, lightweight construction, and enhancing energy efficiency. Röchling’s extensive product line includes high-quality plastic components and systems that are designed to improve performance and sustainability. With a strong focus on innovation and technology, Röchling SE & Co. KG continues to expand its global footprint, delivering solutions that contribute to its customers' success and drive advancements in various sectors

Key Air Deflector Companies:

The following are the leading companies in the air deflector market. These companies collectively hold the largest market share and dictate industry trends.

- Lund International

- Climair UK Ltd

- Piedmont Plastics

- Magna International Inc.

- WeatherTech

- AVS (Auto Ventshade)

- Stampede Automotive Accessories

- EGR

- Heko

Recent Developments

-

In October 2024, Acacia Research Corporation acquired Deflecto Acquisition, Inc. for USD 103.7 million. Headquartered in Indianapolis, Indiana, it is a leading specialty manufacturer of essential products for commercial transportation, HVAC, and office markets.

-

The Röchling Group has made a significant investment exceeding USD 17.3 million to establish a new facility in Chuzhou, China. Spanning nearly 20,000 square meters, this plant has generated over 60 new employment opportunities. With this expansion, the plastics processing company is reinforcing its dominant position in the burgeoning Asian market.

Air Deflectors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.2 billion

Revenue forecast in 2030

USD 14.5 billion

Growth rate

CAGR of 3.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, mounting method, material, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Lund International; Climair UK Ltd; Piedmont Plastics; Magna International Inc.; WeatherTech; AVS (Auto Ventshade); Stampede Automotive Accessories; EGR; Heko

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Deflector Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air deflector market report based on the type, mounting method, material, vehicle type and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Window Deflector

-

Sunroof Deflector

-

Bug Deflector

-

-

Mounting Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tape-on

-

Bolt-on

-

In-channel

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Acrylic

-

ABS

-

Fiberglass

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCVs)

-

Heavy Commercial Vehicles (HCVs)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.