- Home

- »

- Plastics, Polymers & Resins

- »

-

Americas Biodegradable Plastic Market, Industry Report 2030GVR Report cover

![Americas Biodegradable Plastic Market Size, Share & Trends Report]()

Americas Biodegradable Plastic Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Starch-based, PLA, PBS, PBAT, PHA, Polycaprolactone), By End-use (Packaging, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-513-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Americas biodegradable plastic market size was estimated at USD 2.04 billion in 2024 and is expected to grow at a CAGR of 9.4% from 2025 to 2030. The growth of the Americas biodegradable plastics industry is primarily driven by the increasing restrictions on the utilization of single-use non-biodegradable plastics in developed regions such as North America and Central & South America.

Americas biodegradable plastics market is witnessing a transformative phase driven by environmental consciousness, regulatory mandates, and technological advancements. As industries and consumers increasingly prioritize sustainability, biodegradable plastics have emerged as a viable alternative to conventional plastics. This shift is supported by a growing emphasis on reducing environmental impact and achieving circular economy objectives.

One of the significant trends in the market is the shift towards bio-based feedstocks. Manufacturers are leveraging renewable resources such as corn, sugarcane, cassava, and potato starch to produce biodegradable plastics. This approach not only reduces dependency on fossil fuels but also aligns with the increasing demand for sustainable production processes. The versatility of biodegradable plastics has further fueled their adoption across diverse industries, including packaging, agriculture, and healthcare. From food containers and grocery bags to mulch films and drug delivery systems, these materials are finding applications in areas previously dominated by traditional plastics.

Regulatory interventions have been a major catalyst for the growth of biodegradable plastics. Governments in North America and Central & South America are implementing bans and restrictions on single-use plastics, creating a favorable environment for biodegradable alternatives. The European Union’s Single-Use Plastics Directive is a notable example, encouraging the adoption of biodegradable materials in packaging and utensils.

At the same time, heightened consumer awareness and corporate sustainability initiatives are driving companies to integrate biodegradable plastics into their operations. Leading brands are using these materials in packaging to meet environmental goals and cater to the demand for sustainable products. These factors are expected to boost the product demand over the forecast period.

Material Insights

The starch based material segment recorded the largest market revenue share of over 41.7% in 2024, due to their biodegradability and cost-effectiveness. These blends are commonly used in disposable items like cutlery, bags, and packaging materials. The agricultural sector utilizes starch blends for mulch films, which help reduce plastic pollution in the soil. The driving forces behind this segment include stringent regulations on single-use plastics, especially in Europe, and increasing awareness among consumers regarding environmental conservation.

Moreover, the ability of starch blends to be combined with other bioplastics, such as PLA or polybutylene adipate terephthalate (PBAT), to enhance properties like strength and flexibility, further drives their demand in various applications. Thus, the segment is expected to grow at the fastest CAGR of 10.4% from 2025 to 2030.

Polylactic acid (PLA) material segment is projected to grow at a substantial CAGR of 10.2% during the forecast period. PLA is a leading segment in the biodegradable bioplastics market, driven by its versatility and alignment with sustainability goals. PLA is primarily used in packaging, textiles, and agricultural applications, due to its compostable nature. The growing acceptance of PLA in the food packaging industry, where it is favored for producing items such as bottles, trays, and films, is further fueling their demand.

PBAT is a flexible and compostable bioplastic that finds significant use in the production of bags, agricultural films, and packaging. Its growth is primarily driven by the rising demand for flexible packaging solutions that can decompose in industrial composting environments. In regions like North America and Europe, government regulations pushing for sustainable packaging solutions are key drivers of the PBAT market.

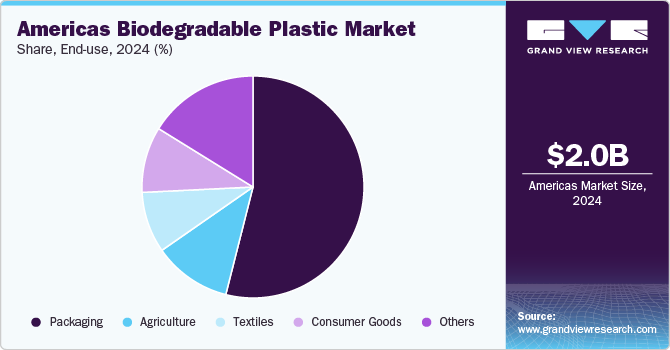

End Use Insights

The packaging segment accounted for the fastest and largest market share of over 53.0% in 2024 and is expected to continue its dominance over the forecast period. Biodegradable plastics are widely utilized in packaging applications, including films, sheets, and household care items. The most popular biodegradable plastics used for packaging are starch blends, PLA, PBAT, and PBS. Owing to escalating waste issues in the Americas and consumer trends toward sustainable packaging, local regulatory bodies are mandating manufacturers to employ biodegradable plastics in packaging, thereby boosting the product demand.

The agriculture segment is anticipated to grow at a substantial CAGR of 8.6% during the forecast period owing to increased emphasis on lowering environmental pollution and creating an atmosphere appropriate for composting. Biodegradable products are gradually being used in nurseries and gardening due to their ability to foster plant seedling growth and minimize fruit rot. Mulch films, yard waste bags, tomato clips & pegs, landscape drains & fabrics, and fabric ports are some of the major applications of biodegradable plastics in agriculture.

Bioplastics are used in the textile industry to manufacture bags, apparel, footwear, home textiles, and technical textiles. In the automobile sector, technical textiles are utilized in interiors, including seats, side panels, and various other parts, owing to their high material strength and wear resistance. To lower their carbon footprint, major producers of technical textiles are transitioning to biodegradable plastics from traditional polymers. Thus, the Americas biodegradable plastics industry is projected to benefit from the industry's shifting preference.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 76.2% in 2024 and is anticipated to grow at the fastest CAGR of 9.6% over the forecast period. Certain key factors such as stringent government regulations and clean-up initiatives taken by the EPA, like short-term cleanups of National Priorities List (NPL) sites, waste sites, or sites with the possibility of release of hazardous materials, are likely to drive the demand for biodegradable plastics in the region in the coming years.

U.S. Biodegradable Plastic Market Trends

The biodegradable plastic market in the U.S. is experiencing significant growth, driven primarily by increasing consumer awareness and stringent environmental regulations. The rising demand for sustainable packaging solutions in the food and beverage industry has been a major contributor to this growth. Furthermore, government initiatives such as the U.S. 2030 Food Loss and Waste Reduction Goal and policies promoting the use of compostable and biodegradable materials further boost product demand. As a result, various industries are transitioning to biodegradable plastics for packaging, especially in response to increasing consumer demand for greener products.

The biodegradable plastic market in Canada is expected to witness growth due to the growth of the country’s consumer goods sector. Canada significantly contributes to the demand for biodegradable plastics in North America owing to its supportive government laws. In addition, the textile industry offers opportunities in sectors such as automotive, agriculture, medical, and protective for smart textiles and fabrics that assimilate digital monitoring components.

The biodegradable plastic market in Mexico is expected to witness substantial growth over the forecast period, owing to the rising demand from key application sectors such as packaging and consumer goods. The growing adoption of biodegradable plastics in food packaging and agriculture is further propelling the demand for these materials in the country.

Central & South America Biodegradable Plastic Market Trends

Central & South America’s growth in the biodegradable plastics industry can be attributed to increasing disposable incomes and increasing consumer preference for sustainable & compostable alternatives. The recovering agriculture sector in Central & South America is driving the demand for associated materials and components. Noteworthy initiatives related to the circular economy for plastics and plastic waste have been introduced across the region.

For instance, in February 2023, the Colombia Plastics Pact was designed and launched by WRAP, an action NGO, in coordination with CEMPRE, a non-profit association. The Colombia Plastics Pact aims to address the disparity and accelerate the transition to a more circular economy for plastics by collaborating across the packaging value chain and uniting key market players, including Nestlé, Carvajal, Coca-Cola, Plastisol, Jerónimo Martins, Grupo Plastilene, Xiclo, and Resiter.

The biodegradable plastic market in Brazil is supported by its abundant supply of inexpensive raw materials. Moreover, in recent years, Brazil has witnessed a strong push toward sustainability, exemplified by actions such as São Paulo's ban on traditional plastic bags, with many other cities expected to implement similar measures. The campaign, Saco é um saco, by the Brazilian Ministry of Environment aims to reduce the use of conventional plastic bags by raising awareness about their environmental impact and promoting eco-friendly alternatives, such as biodegradable plastic packaging.

Argentina's biodegradable plastic market is experiencing steady growth, supported by the country’s robust agricultural sector, which serves as a major foundation for its food processing industry. As one of the world’s leading agricultural producers, Argentina benefits from vast arable land, favorable climate conditions, and a strong tradition in farming, particularly in grains like wheat and corn, soybeans, and livestock such as beef. These agricultural outputs create a steady supply of raw materials, such as starch and plant-based oils, for the production of biodegradable plastics.

Key Americas Biodegradable Plastic Company Insights

Americas biodegradable plastics industry exhibits intense competition among both established manufacturers and emerging players. Consumer goods companies are leveraging biodegradable plastics to stand out by addressing the growing environmental concerns of eco-conscious consumers. This approach strengthens brand loyalty and positions companies as sustainability leaders.

To tap into this market, key players can focus on building partnerships and leveraging incentives. Collaborating with governments, retailers, and agricultural players can establish a strong distribution network and facilitate adoption across industries. Additionally, sustainability initiatives such as carbon credit programs and tax benefits in North America, combined with targeted R&D efforts, can help develop region-specific solutions that align with local waste management systems and consumer preferences.

-

In June 2024, BASF SE launched a new biopolymer product called ecoflex F Blend C1200 BMB, which is a biomass-balanced variant of polybutylene adipate terephthalate (PBAT). This innovative product aims to replace fossil raw materials with renewable feedstock sourced from waste and residual biomass, utilizing a certified mass balance approach.

-

In November 2023, Teijin Frontier Co., Ltd. launched its biodegradable resin, BIOFRONT, made from polylactic acid (PLA), available globally. This new resin decomposes more quickly than traditional PLA products in natural environments, including oceans and soil, due to a unique biodegradation accelerator that enhances the breakdown process without sacrificing strength or moldability.

Key Americas Biodegradable Plastic Companies:

- Novamont S.p.A

- PTT MCC Biochem Co., Ltd.

- Biome Technologies plc

- Plantic Technologies Limited

- BASF SE

- TotalEnergies Corbion

- NatureWorks LLC

- FKuR Plastics Corp.

- Trineso

- Danimer Scientific

Americas Biodegradable Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.23 billion

Revenue forecast in 2030

USD 3.50 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

States scope

North America; Central & South America

Key companies profiled

Novamont S.p.A; PTT MCC Biochem Co., Ltd.; Biome Technologies plc; Plantic Technologies Limited; BASF SE; TotalEnergies Corbion; NatureWorks LLC; FKuR Plastics Corp.; Trineso; Danimer Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Biodegradable Plastic Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Americas biodegradable plastic market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Starch Based

-

PLA

-

PBAT

-

PBS

-

PHA

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Food Packaging

-

Non-Food Packaging

-

-

Agriculture

-

Textiles

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Frequently Asked Questions About This Report

b. The Americas biodegradable plastic market size was estimated at USD 2.04 billion in 2024 and is expected to reach USD 2.23 billion in 2025.

b. Americas biodegradable plastic market is expected to grow at a compound annual growth rate of 9.4% from 2025 to 2030, reaching USD 3.50 billion by 2030.

b. The starch based material segment recorded the largest market revenue share of over 41.7% in 2024. , due to their biodegradability and cost-effectiveness. These blends are commonly used in disposable items like cutlery, bags, and packaging materials.

b. Key players operating in the Americas biodegradable plastic market are Novamont S.p.A, PTT MCC Biochem Co., Ltd., Biome Technologies plc, Plantic Technologies Limited, BASF SE, TotalEnergies Corbion, NatureWorks LLC, FKuR Plastics Corp., and Trineso, Danimer Scientific

b. The key factors driving Americas biodegradable plastics market include growing emphasis on reducing environmental impact by restricting the utilization of single-use non-biodegradable plastics in regions such as North America and Central & South America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.