- Home

- »

- Biotechnology

- »

-

Antibody Production Market Size, Industry Report, 2033GVR Report cover

![Antibody Production Market Size, Share & Trends Report]()

Antibody Production Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Consumables, Software), By Type (Polyclonal Antibody, Monoclonal Antibody), By Process, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-698-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibody Production Market Summary

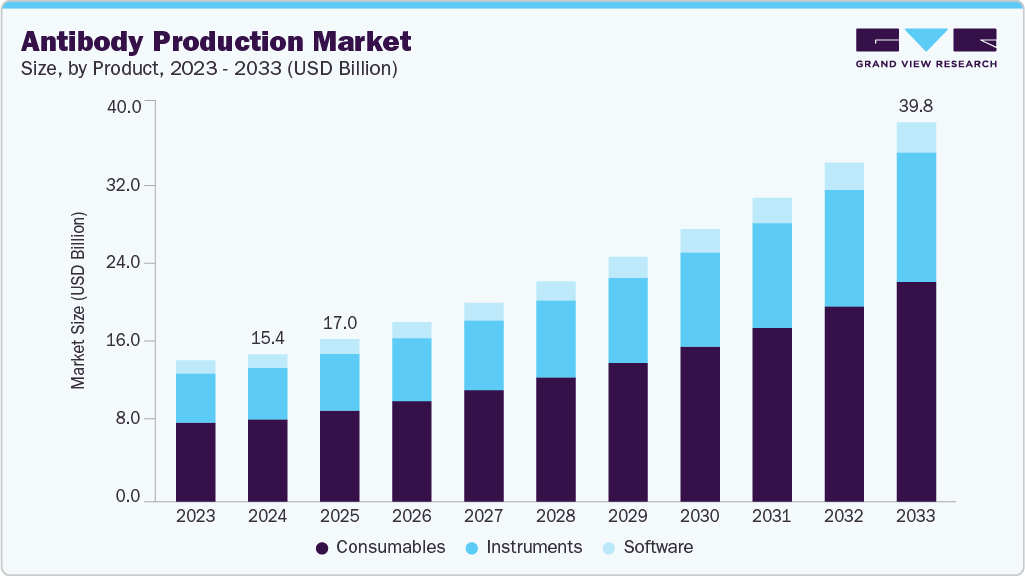

The global antibody production market size was estimated at USD 15.44 billion in 2024 and is projected to reach USD 39.80 billion by 2033, growing at a CAGR of 11.2% from 2025 to 2033. Increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, coupled with the growing demand for therapeutic antibodies, has led to the rapid growth of the antibody production market.

Key Market Trends & Insights

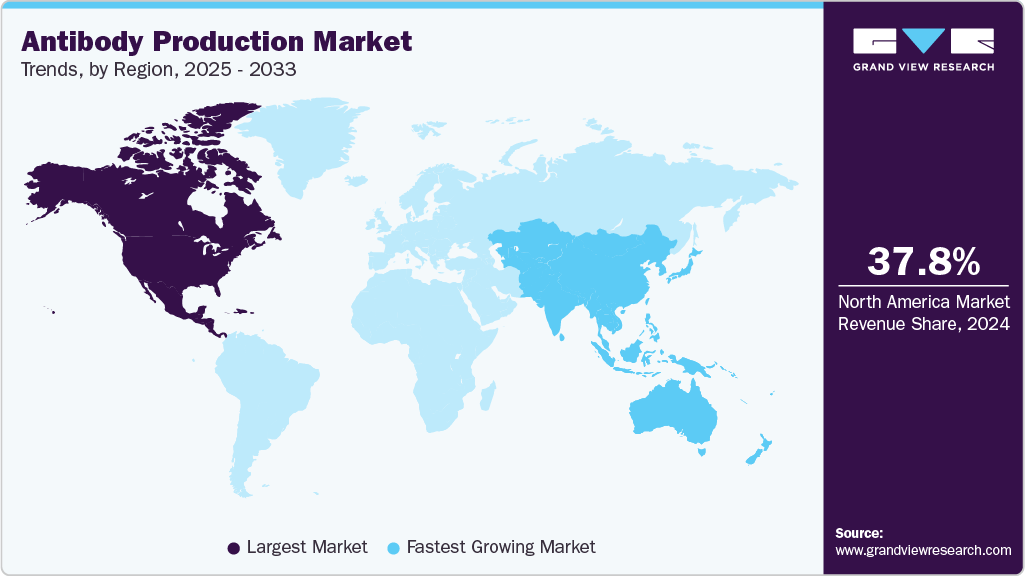

- North America antibody production market held the largest share of 37.78% of the global market in 2024.

- The antibody production industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held the largest market of 55.91% in 2024.

- By process, the downstream processing segment held the largest market share in 2024.

- By type, monoclonal antibody segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.44 Billion

- 2033 Projected Market Size: USD 39.80 Billion

- CAGR (2025-2033): 11.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Personalized and Next-Generation Antibodies

The global antibody production market is experiencing a significant shift as the industry moves beyond conventional monoclonal antibodies toward more complex, next-generation formats. Personalized therapies are increasingly becoming the standard of care, with bispecific antibodies, antibody-drug conjugates (ADCs), and engineered monoclonal antibodies emerging as critical tools in targeting diseases with greater precision and efficacy. These novel modalities not only enhance therapeutic outcomes but also open new opportunities for biopharmaceutical companies to differentiate their portfolios in an increasingly competitive landscape.

The rise of next-generation antibodies is fueling demand for advanced and highly specialized production technologies. Unlike traditional mAbs, which rely on relatively standardized production processes, bispecifics and ADCs require more sophisticated cell line development, purification techniques, and conjugation platforms. Manufacturers are rapidly adopting innovative solutions such as high-density perfusion bioreactors, modular single-use systems, and integrated continuous bioprocessing to meet these evolving requirements. This technological advancement is essential to achieve cost-effective scalability while maintaining the high quality and safety standards expected for complex biologics.

Market growth is further reinforced by strong investment flows from both established pharmaceutical players and emerging biotech firms aiming to capitalize on next-generation antibody pipelines. Partnerships, acquisitions, and capacity expansion initiatives are accelerating globally, with a particular focus on regions that are investing heavily in biopharma infrastructure. As regulatory frameworks evolve to accommodate these innovative therapies, companies that can align their production capabilities with the unique demands of personalized and next-generation antibodies are well positioned to capture a larger share of this expanding market. Ultimately, the convergence of scientific innovation, manufacturing excellence, and strategic investment is reshaping the antibody production landscape and sustaining robust long-term growth.

Rising Disease Burden Fueling Monoclonal Antibody Demand

The growing prevalence of chronic and infectious diseases is a critical driver of the antibody production market, as monoclonal antibodies (mAbs) increasingly serve as frontline therapies across multiple therapeutic areas. With the global incidence of cancers, autoimmune disorders, and infectious diseases continuing to rise, demand for highly targeted and effective treatment options has intensified. Monoclonal antibodies provide unique advantages through their ability to specifically bind to disease-related antigens, offering improved safety profiles, reduced side effects, and greater treatment efficacy compared to traditional small-molecule drugs. This clinical superiority has firmly established mAbs as a cornerstone of modern therapeutics, driving consistent growth in development pipelines and regulatory approvals worldwide.

This expanding demand directly impacts antibody production, as healthcare systems and pharmaceutical companies face the dual challenge of scaling manufacturing capacity while maintaining cost efficiency and product quality. Advances in bioprocessing, such as high-yield cell culture platforms, single-use bioreactor technologies, and continuous processing methods, are being rapidly adopted to meet the growing need for large-scale, reliable supply. Moreover, the rise of biosimilars, spurred by the expiry of patents on blockbuster mAbs, is further stimulating production activity by broadening patient access and intensifying competition among manufacturers. Collectively, the convergence of rising disease prevalence, expanding therapeutic pipelines, and advancing production technologies is positioning monoclonal antibodies as a key growth engine within the global biopharmaceutical sector.

Market Concentration & Characteristics

The antibody production industry demonstrates a high degree of innovation, driven by advances in bioprocessing technologies, adoption of single-use systems, and development of next-generation formats such as bispecifics and antibody-drug conjugates. Continuous investments in R&D, capacity expansion, and digitalized manufacturing solutions are enhancing scalability, efficiency, and product quality. These innovations are not only meeting rising therapeutic demand but also shaping a competitive market landscape with accelerated time-to-market for novel biologics.

The antibody production industry demonstrates a high degree of innovation, driven by advances in bioprocessing technologies, adoption of single-use systems, and development of next-generation formats such as bispecifics and antibody-drug conjugates. Continuous investments in R&D, capacity expansion, and digitalized manufacturing solutions are enhancing scalability, efficiency, and product quality. These innovations are not only meeting rising therapeutic demand but also shaping a competitive market landscape with accelerated time-to-market for novel biologics.

Regulations significantly impact the antibody production industry, shaping manufacturing standards, product quality, and market access. Strict guidelines from agencies such as the FDA and EMA mandate compliance with Good Manufacturing Practices (GMP), driving investments in advanced production technologies and robust quality control systems. While regulatory oversight ensures the safety and efficacy of therapeutic antibodies, it also increases operational complexity and costs, compelling companies to adopt innovative, compliant, and scalable processes to remain competitive.

Product expansion is emerging as a key growth strategy in the antibody production industry, with leading players actively broadening their portfolios to meet diverse therapeutic needs and capture wider market share. Companies are introducing next-generation antibodies, biosimilars, and innovative production platforms to strengthen competitiveness. This strategy not only addresses rising demand across oncology, autoimmune, and infectious diseases but also supports differentiation in an increasingly crowded market, positioning firms for sustainable long-term growth.

Regional expansion has become a central strategy for companies operating in the antibody production market, as demand for biologics accelerates across emerging and developed economies. Firms are investing in new manufacturing facilities, partnerships, and localized supply chains to strengthen presence in high-growth regions such as Asia-Pacific and the Middle East. This approach enhances market access, reduces distribution challenges, and enables closer collaboration with regional biopharma players, ultimately driving competitiveness and long-term growth opportunities.

Product Insights

In 2024, the consumables segment dominated the market with a market share of 55.91% and is estimated to have the fastest CAGR during the forecast period. Consumables include a wide range of products such as reagents, kits, media, buffers, and other materials that are used in the production of antibodies. Rising demand for antibodies across research, diagnostic, and therapeutic applications is driving significant growth in consumables. Moreover, the growing adoption of automated production systems is further boosting consumables usage, as advanced platforms require consistent supplies to ensure efficiency, scalability, and high-quality outcomes in antibody manufacturing.

The instruments segment is poised for significant growth in the global antibody production market. These instruments are essential to the production process, encompass bioreactors, centrifuges, chromatography systems, and other critical equipment. Advancements in automation, high-throughput technologies, and process optimization are driving demand for more efficient and scalable production solutions. As the global need for therapeutic and research antibodies rises, manufacturers are increasingly investing in state-of-the-art instruments to enhance yield, reduce production timelines, and ensure consistent product quality. This positions the instruments segment as a key growth driver within the antibody production market in the coming years.

Process Insights

The downstream segment led the antibody production market in 2024 and is projected to grow at the fastest CAGR of 11.9% from 2025 to 2033. Downstream processes are critical for ensuring antibody quality, safety, efficacy, purity, and identity. Technological innovations are enhancing efficiency and driving bio-manufacturing advancements. Key developments include single-use sensors, membrane chromatography, remote monitoring, and advanced data analytics, all of which streamline processing and improve consistency. As manufacturers focus on scaling production and meeting rising global demand, the downstream segment remains a central growth driver, underpinned by continuous innovation and process optimization in antibody manufacturing.

The upstream process segment is expected to witness strong growth in the antibody production market over the forecast period. This growth is driven by significant investments in advanced production infrastructure by key manufacturers. Companies are increasingly adopting state-of-the-art bioreactors and process optimization technologies in the upstream stage to enhance yield, efficiency, and product quality. These innovations not only improve the consistency and scalability of antibody production but also support the rising global demand for therapeutic and research antibodies. As a result, the upstream process segment is positioned as a critical driver of growth and technological advancement within the antibody production market.

Type Insights

Monoclonal antibody segment is anticipated to dominate the antibody production market with a significant revenue share in 2024 and is anticipated to grow at the fastest CAGR of 12.1% during 2025-2033. The segment’s growth is driven by rising investments in monoclonal antibody research and the launch of various innovative antibody-based products. For instance, in March 2023, Eli Lilly, a US-based pharmaceutical company, invested nearly USD 1 billion in a monoclonal antibody (mAbs) manufacturing plant in Ireland that would start the production of novel clinical products by the 2026.

The polyclonal antibody segment is expected to experience a significant growth over the forecast period, driven by advantages such as a straightforward production process, low cost, and rising demand for diagnostic tests for prevalent diseases. Advances in technologies such as recombinant DNA methods and transgenic animal models are further supporting this growth. In addition, polyclonal antibodies can be produced faster and more cost-effectively than monoclonal antibodies, as they do not require the complex cell culture and screening processes involved in monoclonal antibody production.

End Use Insights

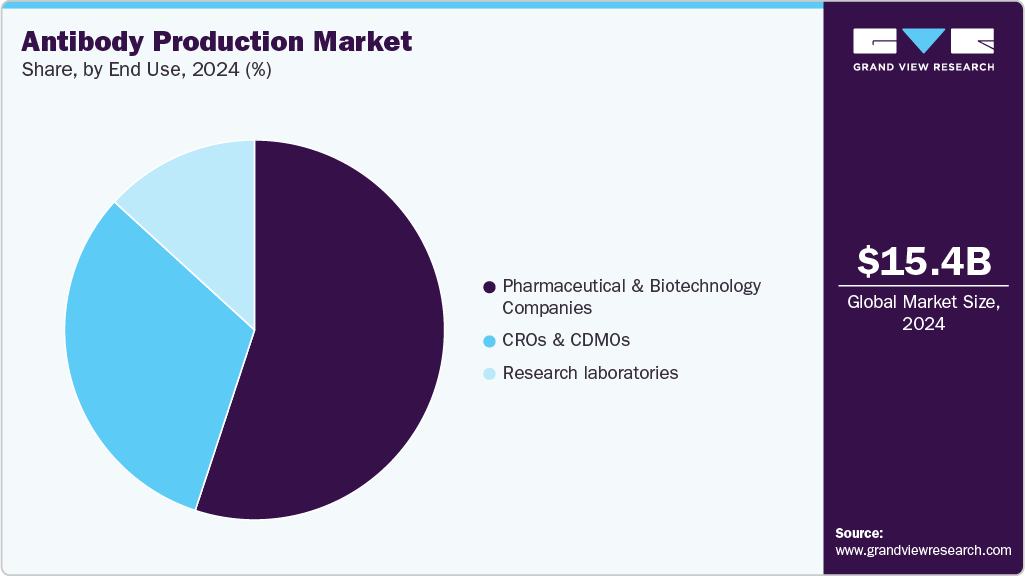

pharmaceutical & biotechnology companies segment dominated the antibody production market with a revenue share of 55.06% in 2024. A major driver of segment growth is the expanding role of biopharmaceutical companies in antibody production. Leading pharmaceutical and biotechnology firms are investing heavily in R&D, leveraging substantial financial resources and advanced technologies. This enables the development of innovative antibody products that address the evolving needs of healthcare providers and patients, reinforcing their pivotal position in the antibody production market.

CROs and CDMOs held the highest CAGR of 12.5% during 2025-2033. The growth is largely driven by rising demand for outsourcing services, as pharmaceutical and biotechnology companies aim to lower operational costs and concentrate on core competencies. Additionally, the COVID-19 pandemic has amplified demand for CMOs and CROs, with companies seeking to accelerate the development and production of antibody-based therapies and vaccines.

Regional Insights

North America antibody production market held the largest revenue share of 37.78% in 2024. This leadership is driven by the presence of major biopharmaceutical companies, advanced research infrastructure, and significant investments in antibody development and manufacturing. Strong regulatory support, high adoption of innovative technologies, and growing demand for therapeutic and diagnostic antibodies further reinforce the region’s dominant position, making North America a key contributor to global market growth.

U.S Antibody Production Market Trends

The U.S. antibody production market is growing rapidly, supported by advanced biopharmaceutical infrastructure, substantial R&D investments, high adoption of cutting-edge production technologies, and strong demand for therapeutic and diagnostic antibodies. Additionally, favorable regulatory frameworks and the presence of leading global players further drive market expansion, positioning the U.S. as a key hub in the global antibody production landscape.

Europe Antibody Production Market Trends

The European antibody production industry is driven by strong R&D capabilities, government support for biopharmaceutical innovation, and the presence of leading pharmaceutical and biotechnology companies. High adoption of advanced production technologies, growing investments in antibody-based therapeutics, and increasing demand for diagnostics further fuel market growth. In addition, collaborations between industry players and research institutions are accelerating innovation, enabling Europe to maintain a competitive position in the global antibody production market.

The UK antibody production market is supported by a strong biopharmaceutical ecosystem, robust R&D infrastructure, and significant investments in antibody therapeutics and diagnostics. High adoption of advanced manufacturing technologies, favorable government policies, and active collaborations between academia and industry further drive market growth, positioning the UK as a key contributor to Europe’s antibody production landscape.

Antibody production market in Germany is expanding steadily, fueled by the country’s strong pharmaceutical and biotechnology infrastructure, advanced R&D capabilities, and significant investments in antibody-based therapeutics. High adoption of innovative production technologies, government support for biopharma innovation, and strategic collaborations with research institutions further drive market growth, reinforcing Germany’s leadership in the European antibody production landscape.

Asia Pacific Antibody Production Market Trends

The Asia Pacific antibody production market is projected to grow at a robust CAGR of 13.5% over the forecast period, driven by expanding biopharmaceutical manufacturing capabilities, rising investments in R&D, and increasing demand for therapeutic and diagnostic antibodies. Rapidly growing healthcare infrastructure, adoption of advanced production technologies, and supportive government initiatives further contribute to market growth. Additionally, collaborations between local and global players are accelerating innovation and production efficiency, positioning the region as a key emerging hub in the global antibody production landscape.

The China antibody production market is experiencing rapid growth, supported by expanding biopharmaceutical infrastructure, substantial R&D investments, and increasing demand for therapeutic and diagnostic antibodies. Government incentives, adoption of advanced manufacturing technologies, and collaborations between domestic and international companies further drive market expansion, positioning China as a major player in the Asia Pacific antibody production landscape.

Antibody production market in Japan is driven by advanced biopharmaceutical infrastructure, strong R&D capabilities, and significant investments in antibody-based therapeutics and diagnostics. High adoption of innovative production technologies, government support for healthcare innovation, and collaborations between industry and research institutions further propel market growth, positioning Japan as a key player in the Asia Pacific antibody production landscape.

MEA Antibody Production Market Trends

The Middle East & Africa antibody production industry is developing steadily, driven by increasing healthcare investments, rising demand for therapeutic and diagnostic antibodies, and growing biopharmaceutical infrastructure. Governments in the region are supporting innovation through favorable policies and funding initiatives. Additionally, collaborations with global pharmaceutical and biotechnology companies are enhancing local production capabilities, enabling the region to expand its presence in the global antibody production market. Rising awareness of advanced healthcare solutions and adoption of modern manufacturing technologies further contribute to the sector’s growth in the coming years.

The Kuwait antibody production market is at an early stage, supported by growing healthcare infrastructure, increasing investments in biopharmaceutical R&D, and rising demand for therapeutic and diagnostic antibodies. Government initiatives to promote advanced healthcare solutions, coupled with collaborations with international biopharma companies, are further fostering the development of local antibody production capabilities.

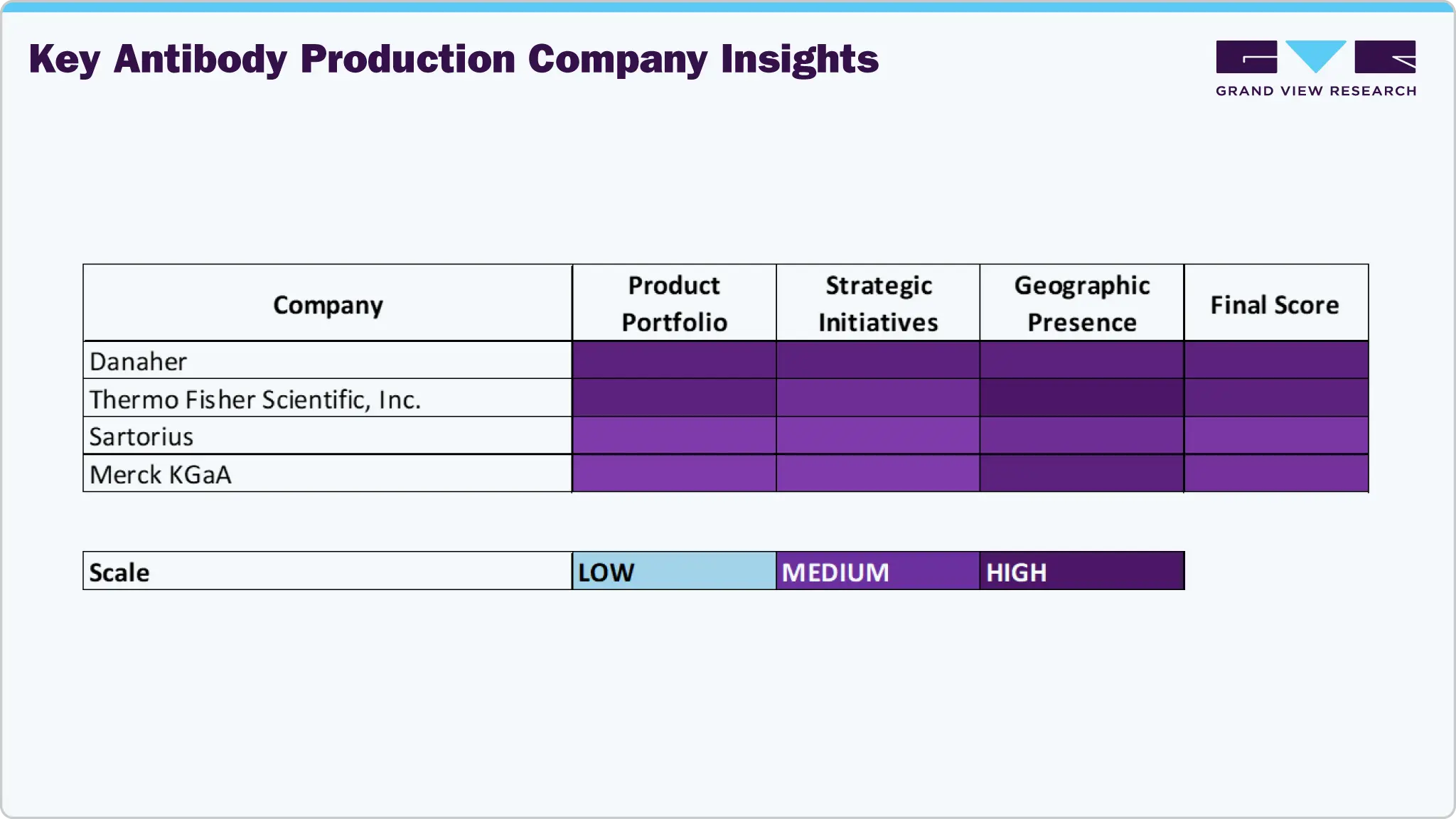

Key Antibody Production Company Insights

The global antibody production market is highly competitive, with several leading biopharmaceutical companies driving innovation and capturing significant market share. Key players include Danaher, Merck KGaA, Thermo Fisher Scientific, Eppendorf, and Sartorius, among others. These companies leverage advanced technologies, strong R&D capabilities, and extensive global manufacturing networks to maintain leadership. Danaher and Thermo Fisher Scientific, for example, are recognized for their high-throughput antibody production platforms and consumables, while Merck KGaA and Sartorius focus on providing integrated solutions for both upstream and downstream processes. Eppendorf contributes specialized instruments that optimize production efficiency and scalability.

In addition to the established players, several other companies are expanding their footprint through strategic partnerships, acquisitions, and innovative product launches. Lonza Group, AGC Biologics, Wuxi Biologics, Charles River Laboratories, and Abcam are notable players providing contract development and manufacturing services, high-quality antibodies, and cutting-edge discovery platforms. These companies are increasingly leveraging automation, AI-driven technologies, and single-use systems to streamline antibody development and production, enabling faster timelines and reduced costs. Emerging players like Biointron and Creative Biolabs are also contributing to market dynamism by introducing high-throughput and fully human antibody discovery platforms.

Regional market presence further influences market share distribution. North America dominates globally, supported by robust R&D infrastructure, strong regulatory frameworks, and the presence of major biopharmaceutical companies. Europe, led by Germany, the UK, and France, benefits from advanced research capabilities, collaborations between industry and academia, and adoption of innovative production technologies. Asia Pacific, particularly China and Japan, is witnessing rapid growth due to expanding biopharma infrastructure, government support, and increasing demand for therapeutic and diagnostic antibodies. The Middle East & Africa markets are at nascent stages but developing steadily, driven by healthcare investments and international collaborations. Overall, market leadership is shaped by technological innovation, strategic expansion, and regional penetration, defining the competitive landscape of the antibody production industry.

Key Antibody Production Companies:

The following are the leading companies in the antibody production market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation

- Sartorius

- Thermo Fisher Scientific

- Eppendorf

- Merck KGaA

- Lonza Group

- AGC Biologics

- Wuxi Biologics

- Charles River Laboratories

- Biointron

Recent Developments

-

In August 2025, Zifo launched an AI-powered Antibody Engineering app on the Snowflake Marketplace, enabling faster design, optimization, and analysis of therapeutic antibodies, directly supporting efficiency and innovation in the global antibody production market.

-

In March 2025, Biointron launched AbDrop, a high-throughput platform for rapid discovery of fully human antibodies, enhancing efficiency and innovation in the global antibody production market.

Antibody Production Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.03 billion

Revenue forecast in 2033

USD 39.80 billion

Growth rate

CAGR of 11.2% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Danaher Corporation; Sartorius; Thermo Fisher Scientific; Eppendorf; Merck KGaA; Lonza Group; AGC Biologics; Wuxi Biologics; Charles River Laboratories; Biointron

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Antibody Production Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global antibody production market based on product, process, type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Bioreactors

-

Multi-use Bioreactors

-

Single-use bioreactors

-

-

Chromatography systems

-

Filtration systems

-

-

Consumables

-

Media

-

Buffers and reagents

-

Chromatography resins and columns

-

Filtration consumables and accessories

-

Others

-

Software

-

-

-

Process Outlook (Revenue, USD Million, 2021 - 2033)

-

Upstream Processing

-

Downstream Processing

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibody

-

Polyclonal Antibody

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and biotechnology companies

-

Research laboratories

-

CROs and CDMOs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global antibody production market size was valued at USD 15.44 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 11.19% from 2025 to 2033

b. The global antibody production market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2033 to reach USD 39.80 billion by 2033.

b. Downstream processing dominated the antibody production market, with a share of 67.33% in 2024. This is attributable to various technological advancements supporting the downstream process to maintain efficiency. This fuels innovations in bio-manufacturing and hence increases the demand for the process in the antibody production market.

b. Some of the key players operating in the antibody production market include Danaher Corporation; Sartorius; Thermo Fisher Scientific; Eppendorf; Merck KGaA; Lonza Group; AGC Biologics; Wuxi Biologics; Charles River Laboratories; Biointron.

b. Major factors driving market growth include the rising incidence of chronic illnesses such as cancer, diabetes, and cardiovascular diseases, as well as the increased need for therapeutic antibodies the antibody production market is anticipated a significant growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.