- Home

- »

- Medical Devices

- »

-

Antimicrobial Urinary Catheters Market, Industry Report 2033GVR Report cover

![Antimicrobial Urinary Catheters Market Size, Share & Trends Report]()

Antimicrobial Urinary Catheters Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Intermittent, External, Foley/ Indwelling), By Material, By Coating, By Catheterization, By Gender, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-852-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antimicrobial Urinary Catheters Market Summary

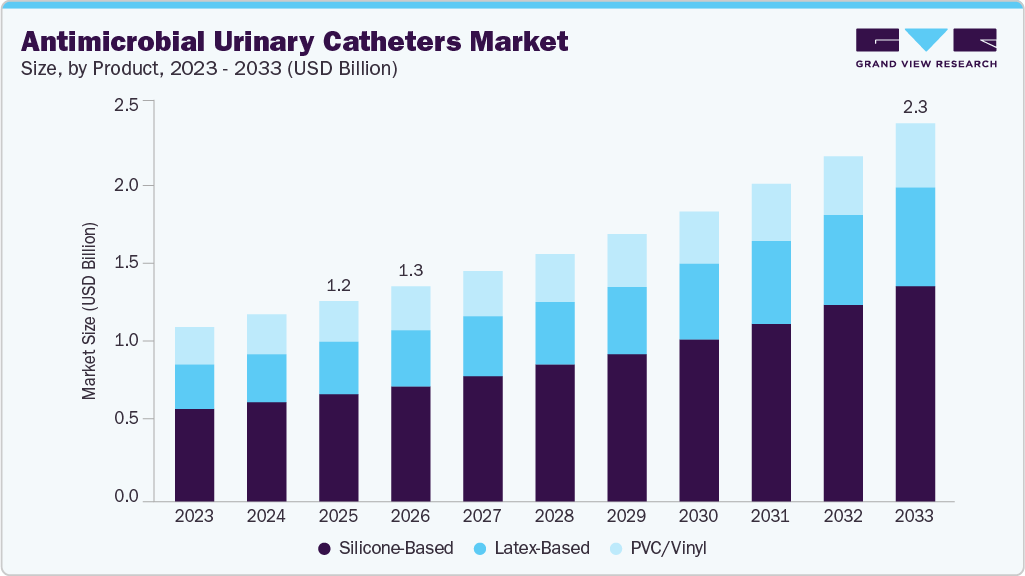

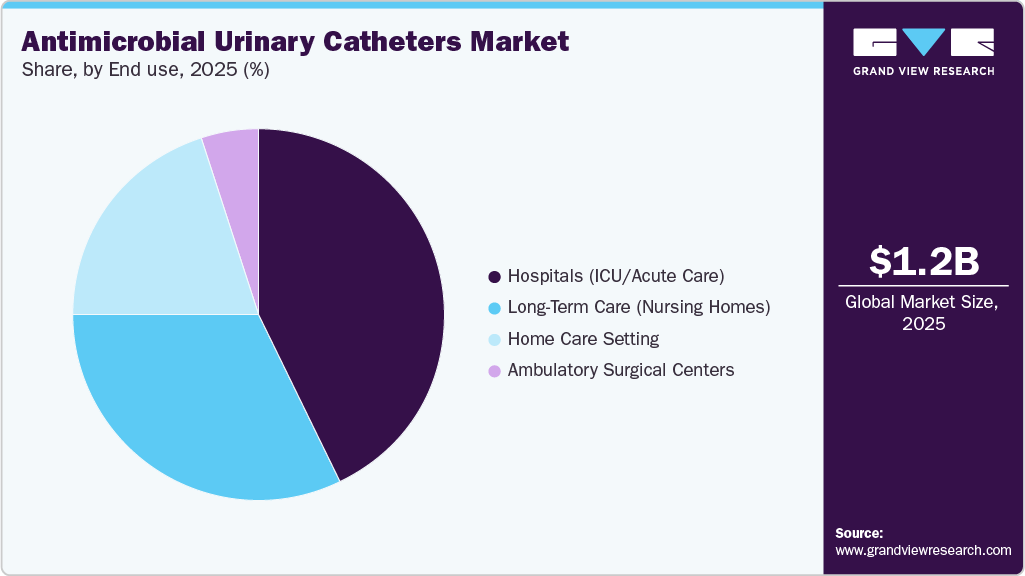

The global antimicrobial urinary catheters market size was estimated at USD 1.20 billion in 2025 and is projected to reach USD 2.27 billion by 2033, growing at a CAGR of 8.46% from 2026 to 2033. The market is primarily driven by the rising incidence of catheter-associated urinary tract infections (CAUTIs), which has increased demand for infection-prevention solutions in hospitals and home-care settings.

Key Market Trends & Insights

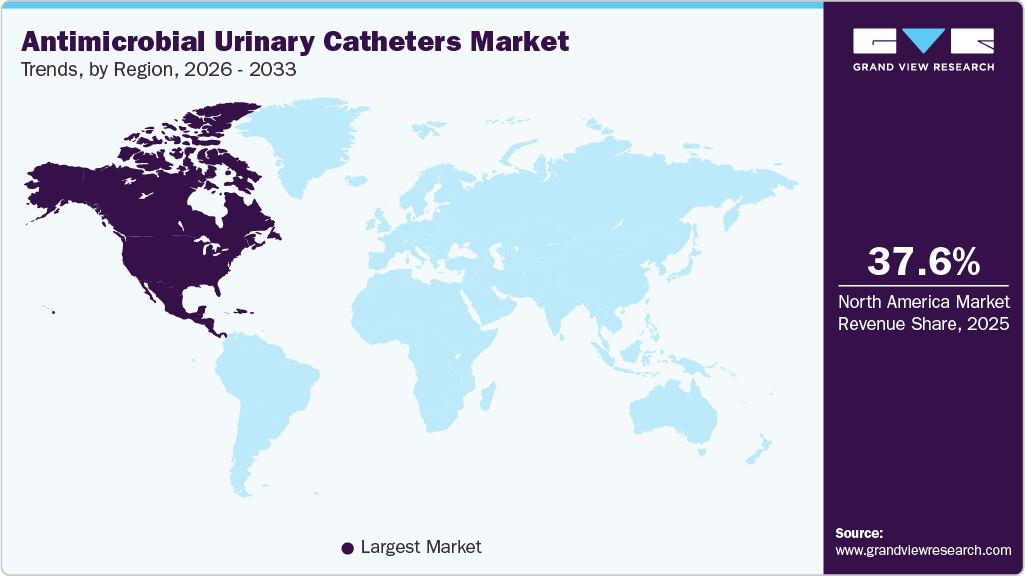

- North America dominated the antimicrobial urinary catheters market with the largest revenue share of 37.65% in 2025.

- The antimicrobial urinary catheters market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the intermittent catheters segment led the market with the largest revenue share in 2025.

- By material, silicone-based led the market with the largest revenue share in 2025.

- By coating, hydrophilic coatings led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.20 Billion

- 2033 Projected Market Size: USD 2.27 Billion

- CAGR (2026-2033): 8.46%

- North America: Largest market in 2025

The growing prevalence of chronic conditions such as spinal cord injuries, urinary retention, and neurogenic bladder further supports catheter usage. Furthermore, heightened awareness of hospital-acquired infections, strict regulatory guidelines, and technological advancements such as silver-coated and antibiotic-impregnated catheters are accelerating market growth.The rising incidence of CAUTIs is a key factor driving the market, as healthcare providers prioritize infection prevention and patient safety. Frequent complications related to CAUTIs, extended hospital stays, and higher treatment costs have accelerated the adoption of antimicrobial-coated and antibiotic-impregnated catheters. Furthermore, growing regulatory focus on reducing hospital-acquired infections and improving clinical outcomes is encouraging hospitals and home-care settings to shift toward advanced antimicrobial catheter solutions.

For instance, in 2023, a total of 21,525 CAUTIs were reported through the NHSN across 6,452 healthcare facilities. Acute care hospitals accounted for the largest share, highlighting the significant infection burden in hospital settings. The table highlights the substantial burden of CAUTIs across multiple healthcare settings, particularly acute care hospitals, underscoring the need for effective infection-control measures.

CAUTIs Reported through NHSN in 2023

Setting

Number of Facilities Reporting

Number of CAUTIs Reported

Acute care hospitals

3,774

17,370

Critical access hospitals

1,070

1,259

Inpatient rehabilitation facilities

1,218

1,415

Long-term acute care hospitals

390

1,481

Total

6,452

21,525

Source: Association for Professionals in Infection Control and Epidemiology

This directly supports the growing demand for antimicrobial urinary catheters, as hospitals and long-term care facilities adopt advanced catheter technologies to reduce CAUTI rates, improve patient outcomes, and minimize the overall economic burden of infection-related healthcare costs.

A CAUTI prevention program tailored to facility-specific risks emphasizes the adoption of antimicrobial urinary catheters as a targeted intervention. As multidisciplinary teams identify infection risks and prevention gaps, the use of antimicrobial catheter technologies gains importance, thereby driving demand and supporting market growth. Rising bacterial infection rates are fueling increased adoption of antimicrobial urinary catheters. According to the WHO, antimicrobial resistance caused 1.27 million deaths in 2019, with projections reaching 10 million annually by 2050 due to antibiotic overuse and misuse. Antimicrobial catheters play a crucial role in reducing infection risk and improving patient outcomes.

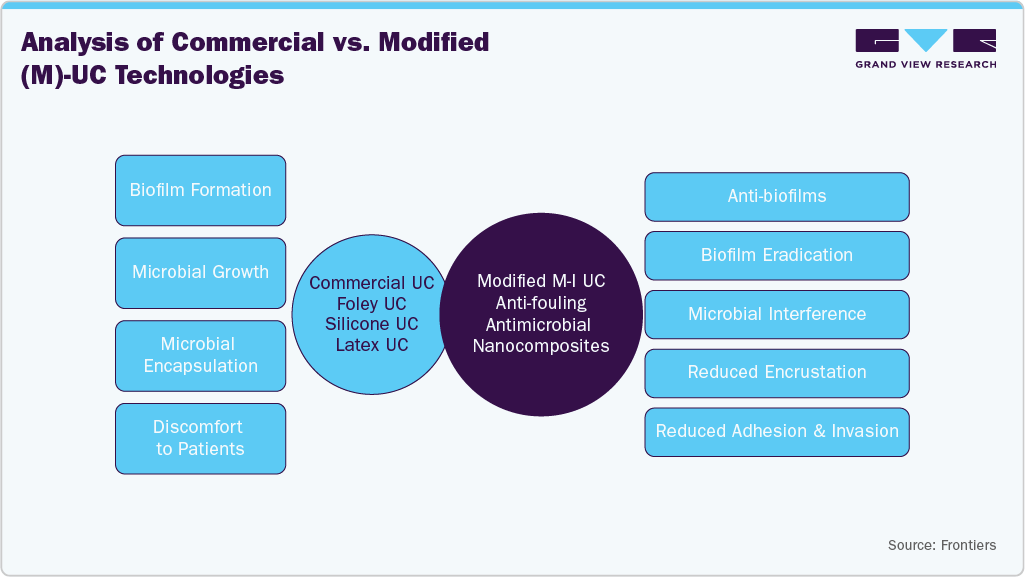

Furthermore, advancements in antimicrobial coating technologies have significantly improved the ability of urinary catheters to prevent bacterial adhesion and biofilm formation. Innovations such as silver alloy coatings, antibiotic-impregnated materials, and antimicrobial polymer surfaces enhance long-term infection control while maintaining catheter biocompatibility, driving increased adoption across healthcare settings.

For example, BD highlights the economic and clinical value of advanced antimicrobial catheter technologies. According to an Agency for Healthcare Research and Quality-supported report, the average cost of a CAUTI is estimated at USD 13,793. In contrast, the Bactiguard coating has demonstrated a 32%-71.2% reduction in CAUTI risk compared with standard catheters. Multiple studies indicate that using Bactiguard-coated Foley catheters delivers net economic benefits, with decision models also showing cost savings for silver alloy-coated catheters through reductions in symptomatic UTIs and bacteremia.

The urinary pathogens contribute to approximately 12.7% of non-CLABSI hospital-onset bacteremia and fungemia, resulting in incremental costs of over USD 25,000 per patient. Consequently, healthcare providers are adopting antimicrobial urinary catheters to reduce infection rates and associated financial burdens. This economic and clinical pressure directly accelerates market growth by driving demand for advanced, infection-preventive catheter technologies.

The trend shown in this image highlights a key market driver: a shift from standard materials to advanced, bioactive coatings. As healthcare providers aim to reduce CAUTIs and minimize hospital readmission costs, demand is rising for nanocomposite-enhanced catheters. This transition is fueling market growth by creating opportunities for manufacturers to innovate beyond traditional silicone and latex, developing specialized anti-fouling technologies that deliver long-term effectiveness, improved patient safety, and drive increased adoption of antimicrobial urinary catheters.

Market Concentration & Characteristics

The antimicrobial urinary catheters industry demonstrates a high degree of innovation, driven by ongoing advancements in coating technologies and material science. Manufacturers are developing silver alloy, antibiotic-impregnated, and antimicrobial polymer coatings to prevent biofilm formation and CAUTIs more effectively. In addition, innovations in surface modification, sustained antimicrobial release, and biocompatible materials are enhancing safety, comfort, and clinical outcomes, supporting continuous market evolution. For instance, in November 2023, Silq Technologies introduced ClearTract, a new catheter innovation designed to reduce infections and catheter-related complications. Rather than using antibiotics, ClearTract features a specialized zwitterionic surface coating that resists microbial deposition and growth.

The antimicrobial urinary catheters industry shows a moderate level of merger and acquisition activity, as leading medical device companies pursue strategic acquisitions to strengthen their infection-prevention portfolios. M&A efforts are largely focused on acquiring proprietary antimicrobial coating technologies, niche catheter manufacturers, and innovation-driven startups. These activities enable companies to expand their product offerings, enhance technological capabilities, and strengthen their global market presence.

Regulatory frameworks have a strong impact on the antimicrobial urinary catheters industry, as stringent guidelines aimed at reducing hospital-acquired infections drive the adoption of infection-preventive devices. Compliance requirements from health authorities increase product development costs and approval timelines, while also raising quality and safety standards. Furthermore, reimbursement policies and infection-control mandates encourage healthcare facilities to adopt antimicrobial catheters, positively influencing market growth. For instance, in January 2023, Bactiguard announced its first MDR (Medical Device Regulation 2017/745) product approval following a comprehensive authorization process. The approval covers the latex BIP Foley Catheter, an indwelling urinary catheter featuring Bactiguard’s proprietary infection prevention technology.

Patient safety always comes first for Bactiguard, and stricter regulations are an advantage to us. Products scrutinized in the MDR process are audited through higher standards of quality and safety. The BIP Foley catheter made it through this thorough process and will not only improve patient safety by reducing the risk of HAI but also by reducing the use of antibiotics. A powerful combination with positive impact on both patients and a healthier world, says Fatima Stensvad Flodin, Bactiguard’s Chief Quality & Regulatory Officer.

Gaining the MDR approval for the BIP Foley Catheter is a first step, but an important achievement for us; it is a formal acknowledgement of our work on quality and safety, and this will pave the way also for future product approvals. The BIP Foley urinary catheter is one of Bactiguard’s products that combats HAI, and our ambition is to remain at the forefront of both complying with the highest regulatory requirements and continuing to bring safe infection solution technology and products to the market. And ultimately, make them accessible to more patients, says Anders Göransson, Bactiguard’s CEO.

Furthermore, antimicrobial urinary catheters are classified as Class II medical devices in most major markets, including the U.S., under regulatory frameworks such as the FDA’s 21 CFR 876.5130.

End-use concentration in the antimicrobial urinary catheters industry is highly skewed toward hospitals and acute care facilities, where the risk of CAUTIs is greatest and infection-control protocols are stringent. Long-term care facilities and rehabilitation centers represent a growing share due to prolonged catheter use among elderly and chronically ill patients. Home healthcare settings are emerging as a significant segment, supported by the rise of outpatient care and improved access to antimicrobial catheter technologies.

Product Insights

Intermittent catheters dominated the product segment with the largest revenue market share in 2025. Their preference is driven by lower infection risk compared to indwelling catheters, improved patient comfort, and ease of use. Growing adoption in both hospital and home care settings further strengthened their market leadership.

The external catheters segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for less invasive catheterization options. Their lower risk of infection and enhanced comfort make them particularly appealing in both hospital and long-term care settings. Rising awareness of infection prevention and expanding use in male continence care are further boosting their adoption. As healthcare providers seek cost-effective and patient-friendly solutions, external catheters with antimicrobial properties are poised to capture a larger market share.

Material Insights

The silicone-based segment dominated the market in 2025 and is projected to experience the fastest growth over the forecast period. This dominance is driven by silicone’s superior biocompatibility, durability, and lower risk of patient discomfort or irritation. Ongoing advancements in antimicrobial silicone technologies, combined with an increasing demand for safer, long-term catheter solutions, continue to accelerate adoption across healthcare settings. For instance, in February 2025, the MDPI journal published a study on hydrogel-coated silicone urinary catheters featuring antibacterial and lubricating properties. These modified catheters demonstrated strong antibacterial activity, excellent biocompatibility, and reduced friction, highlighting their potential for widespread clinical use.

The PVC/vinyl segment is experiencing significant market growth due to its cost-effectiveness and wide availability. These materials are commonly used in short-term catheterization, particularly in high-volume hospitals and emergency care settings. Improvements in antimicrobial coating and manufacturing processes are further enhancing their performance and driving broader adoption.

Coating Insights

The hydrophilic coatings segment led the market in 2025 and is expected to achieve the fastest growth during the forecast period. This is due to its ability to reduce friction, minimize the risk of urinary tract infections, and enhance patient comfort. The growing preference for advanced infection-preventive catheters and ongoing technological improvements are driving the increasing adoption of these devices across hospitals and long-term care facilities.

The silver-based coatings segment is experiencing significant market growth due to its strong antibacterial properties and effectiveness in preventing catheter-associated infections. Rising awareness of antimicrobial resistance and demand for infection-control solutions in hospitals and long-term care settings are driving adoption. Advances in coating technologies are further enhancing the performance and safety of silver-coated catheters, boosting their market presence.

Catheterization Insights

The short-term segment dominated the market in 2025 and is expected to register the fastest growth during the forecast period. This is driven by the high demand for temporary catheterization in hospitals, especially in ICUs and surgical settings, where infection prevention is critical. The increasing use of advanced antimicrobial catheters for short-term applications and rising awareness of the risks associated with catheter-associated infections are further boosting the adoption of this segment.

The long-term segment of the market is experiencing significant growth due to the rising number of patients requiring extended catheterization in hospitals and long-term care facilities. Increasing focus on infection prevention and the use of advanced antimicrobial technologies are driving adoption. This growth is further supported by the aging population and the prevalence of chronic conditions that necessitate prolonged catheter use.

Gender Insights

The male segment dominated the market in 2025, driven by the higher prevalence of catheter use among men for conditions such as urinary retention and prostate-related complications. The demand is further supported by the availability of male-specific catheter designs that enhance comfort and reduce the risk of infection. Growing awareness of infection prevention and adoption of advanced antimicrobial technologies are supporting this market dominance.

The female segment is expected to experience significant market growth during the forecast period. This is driven by increasing awareness of urinary tract infection risks among women and the growing demand for specialized catheters tailored to the female anatomy. Advances in antimicrobial technologies and infection-prevention strategies are further supporting the adoption of female-specific catheter solutions across hospitals and long-term care settings.

End Use Insights

Hospitals (ICU/Acute Care) dominated the end-use segment in the market in 2025. High patient volumes, frequent catheterization, and a greater risk of hospital-acquired infections drive the market. Strict infection-control protocols and strong purchasing power further support widespread adoption in these settings.

The long-term care (nursing homes) segment is expected to grow at the fastest CAGR in the market. This is driven by the increasing elderly population, higher catheter use among residents, and a growing focus on reducing infection rates. Enhanced infection-control protocols and rising awareness of antimicrobial resistance are further encouraging the adoption of antimicrobial catheter technologies in these facilities.

Regional Insights

The antimicrobial urinary catheters market in North America held the largest share and accounted for 37.65% of global revenue in 2025. This can be attributed to the strong emphasis on infection prevention and patient safety across hospitals and long-term care settings. Growing awareness of catheter-associated urinary tract infections is driving the adoption of antimicrobial-coated catheters, particularly in the U.S. Technological advancements and supportive healthcare policies continue to encourage usage, while cost considerations and resistance concerns influence purchasing decisions.

U.S. Antimicrobial Urinary Catheters Market Trends

The antimicrobial urinary catheters market in the U.S. held the largest share in North America's market in 2025. The market is expanding as healthcare providers focus on reducing catheter-associated urinary tract infections by adopting advanced antimicrobial coatings and technologies. Increased hospital investments in infection control measures and stringent regulatory standards are encouraging the use of these specialized catheters. Innovation in materials and design is enhancing clinical outcomes, while budget pressures and cost-effectiveness considerations continue to shape purchasing decisions. The demand is rising significantly as patient safety remains a top priority. According to the CDC, approximately 75% of urinary tract infections acquired in hospitals are associated with the use of urinary catheters. Between 15% and 25% of hospitalized patients receive a urinary catheter during their hospital stay, which increases their risk of infection. CAUTIs contribute to higher morbidity and mortality, greater healthcare costs, and extended hospital stays.

Europe Antimicrobial Urinary Catheters Market Trends

The antimicrobial urinary catheters market in Europe is growing as healthcare systems prioritize infection control and the reduction of catheter-associated urinary tract infections. Countries like Germany, the UK, and France are adopting advanced antimicrobial solutions due to rising clinical awareness and supportive healthcare policies. Innovation in catheter materials and antimicrobial technologies is enhancing performance and safety, while cost pressures and reimbursement variability influence market adoption rates. The trend indicates significant growth, as patient outcomes and quality standards continue to drive demand.

The UK antimicrobial urinary catheters market is expanding as healthcare providers place a greater emphasis on reducing catheter-associated urinary tract infections and improving patient safety. Clinical guidelines and a growing emphasis on infection control in both hospitals and community care settings support the adoption of advanced antimicrobial-coated catheters. Innovation in catheter technology and materials is improving clinical outcomes, while cost-effectiveness and NHS procurement priorities continue to influence market uptake. The trend reflects significant demand driven by quality-of-care objectives.

The antimicrobial urinary catheters market in France is witnessing significant growth as healthcare facilities intensify efforts to prevent catheter-associated urinary tract infections and enhance patient care quality. There is increasing uptake of advanced antimicrobial-coated catheters, driven by clinical awareness and infection control initiatives within hospitals and long-term care settings. Technological improvements in catheter design and materials are further supporting market development, while cost considerations and reimbursement policies influence purchasing decisions. Demand is rising as healthcare providers prioritize safer, more effective urinary catheter solutions.

Asia Pacific Antimicrobial Urinary Catheters Market Trends

The antimicrobial urinary catheters market in the Asia Pacific is expanding as healthcare facilities prioritize infection prevention and deliver high-quality patient care. Rising awareness of catheter-associated urinary tract infections, growing healthcare expenditure, and expanding hospital infrastructure are driving demand for advanced antimicrobial catheter technologies. Adoption varies across countries, with stronger uptake in developed markets, such as Japan and Australia, and growing interest in emerging markets, including China and India. Cost sensitivity and varying reimbursement frameworks continue to influence market growth and purchasing decisions.

China antimicrobial urinary catheters marketis gaining momentum as hospitals and healthcare providers emphasize infection control and reducing catheter-associated urinary tract infections. Increasing healthcare spending and modernization of medical facilities are driving interest in advanced antimicrobial-coated catheters, particularly in tier-1 and tier-2 cities. While adoption is growing, cost sensitivity and uneven access to technologies across regions influence market penetration. Overall, demand is expected to rise steadily as awareness and clinical standards continue to improve.

Latin America Antimicrobial Urinary Catheters Market Trends

The antimicrobial urinary catheters market in Latin America is significantly expanding as awareness of catheter-associated urinary tract infections and infection control practices improves across the region. Healthcare facilities in key countries, such as Brazil and Mexico, are adopting antimicrobial-coated catheters to enhance patient safety, supported by rising healthcare spending and modernization efforts. However, cost constraints and variability in access to advanced medical technologies continue to influence adoption rates. The market is poised for growth as clinical standards and demand for quality care rise.

MEA Antimicrobial Urinary Catheters Market Trends

The antimicrobial urinary catheters market in the MEA is experiencing significant growth as hospitals and clinics focus on preventing catheter-associated urinary tract infections. Adoption rates are highest in developed healthcare centers in countries like Saudi Arabia and the UAE, where advanced antimicrobial-coated catheters are utilized. In other parts of the region, limited infrastructure and budget constraints slow uptake. The increasing awareness of infection control and patient safety drives market growth.

Key Antimicrobial Urinary Catheters Company Insights

The key market players dominate through the use of advanced catheter technologies and a strong global distribution network. Market share is concentrated among a few leading companies, while regional players target niche or price-sensitive segments. Strategic product launches and partnerships help expand presence in both developed and emerging markets.

Key Antimicrobial Urinary Catheters Companies:

The following key companies have been profiled for this study on the antimicrobial urinary catheters market.

- BD (Bactigaurd)

- MEDLINE

- ConvaTec Group PLC

- WellLead Medical Co., Ltd.

- Silq Technologies

- AvantGuard (Halomine Inc.)

Recent Developments

-

In November 2025, AvantGuard, Inc., a biotechnology company developing next-generation antimicrobial technologies inspired by the human immune system, announced that it had received three National Institutes of Health (NIH) research grants totaling USD2.65 million.

-

In November 2023, Silq Technologies introduced ClearTract, an indwelling Foley catheter featuring a zwitterionic surface designed to reduce infections and enhance patient comfort. For individuals with spinal cord injuries, using a urinary catheter to empty the bladder often becomes a routine part of daily life.

-

In June 2023, AvantGuard was awarded a USD 325K NIH Phase I Grant to develop non-coating antimicrobial, anti-host deposition, and anti-inflammatory urinary catheters.

-

In September 2022, UCLA researchers developed a coating for implanted medical devices aimed at reducing the risk of infection. The surface treatment was cleared by the FDA for use on urinary catheters and was created by Silq, a company co-founded by Richard Kaner, the Dr. Myung Ki Hong Endowed Chair in Materials Innovation.

Antimicrobial Urinary Catheters Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.29 billion

Revenue forecast in 2033

USD 2.27 billion

Growth rate

CAGR of 8.46% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, coating, catheterization, gender, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Norway; Denmark; Sweden; Spain; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

BD (Bactigaurd); MEDLINE; ConvaTec Group PLC; WellLead; Medical Co., Ltd.; Silq Technologies; AvantGuard (Halomine Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimicrobial Urinary Catheters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global antimicrobial urinary catheters market report based on product, material, coating, catheterization, gender, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Intermittent Catheters

-

Foley/Indwelling Catheters

-

External Catheters

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Latex-Based

-

Silicone-Based

-

PVC/Vinyl

-

-

Coating Outlook (Revenue, USD Million, 2021 - 2033)

-

Silver-Based Coatings

-

Antibiotic-Impregnated

-

Hydrophilic Coatings

-

Others

-

-

Catheterization Outlook (Revenue, USD Million, 2021 - 2033)

-

Long-Term

-

Short-Term

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals (ICU/Acute Care)

-

Long-Term Care (Nursing Homes)

-

Home Care Setting

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global antimicrobial urinary catheters market size was estimated at USD 1.20 billion in 2025.

b. The global antimicrobial urinary catheters market is expected to grow at a compound annual growth rate of 8.46% from 2026 to 2033 to reach USD 2.27 billion by 2033.

b. North America dominated the antimicrobial urinary catheters market, accounting for the largest revenue share of 37.65% in 2025.

b. Some key players operating in the antimicrobial urinary catheters market include BD (Bactiguard), Medline, Convatec Group plc, WellLead Medical Co., Ltd., Silq Technologies, and AvantGuard (Halomine Inc.).

b. The antimicrobial urinary catheters market is driven by the rising incidence of catheter-associated urinary tract infections (CAUTIs), increasing hospitalization and long-term catheter use, and a growing geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.