- Home

- »

- Advanced Interior Materials

- »

-

Arc Welding Equipment Market Size, Industry Report, 2033GVR Report cover

![Arc Welding Equipment Market Size, Share & Trends Report]()

Arc Welding Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Shielded Metal/Stick Arc Welding, Metal Inert Gas Welding), By Product (Automatic, Semi-automatic), By End-use (Aerospace, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-670-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Arc Welding Equipment Market Summary

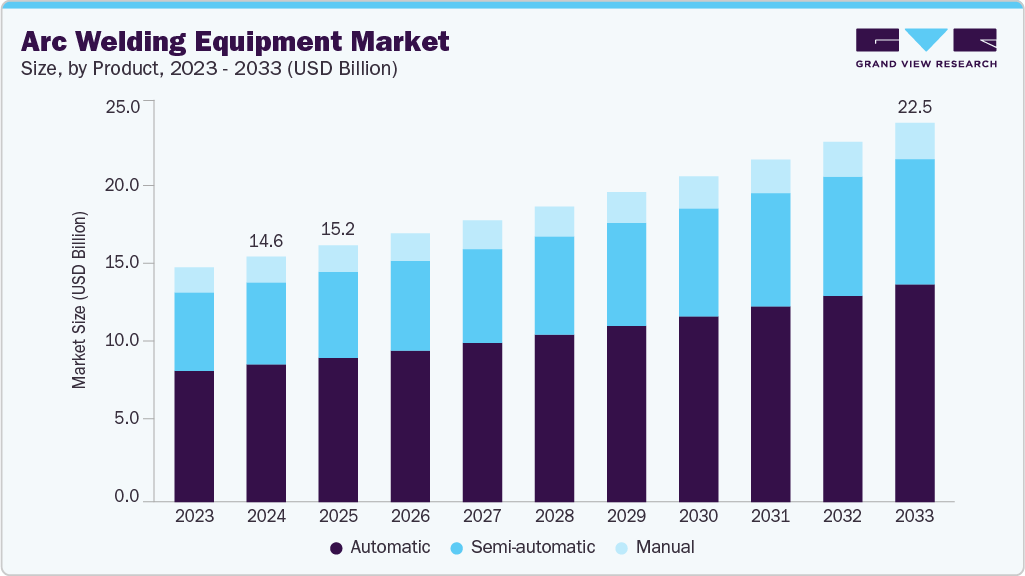

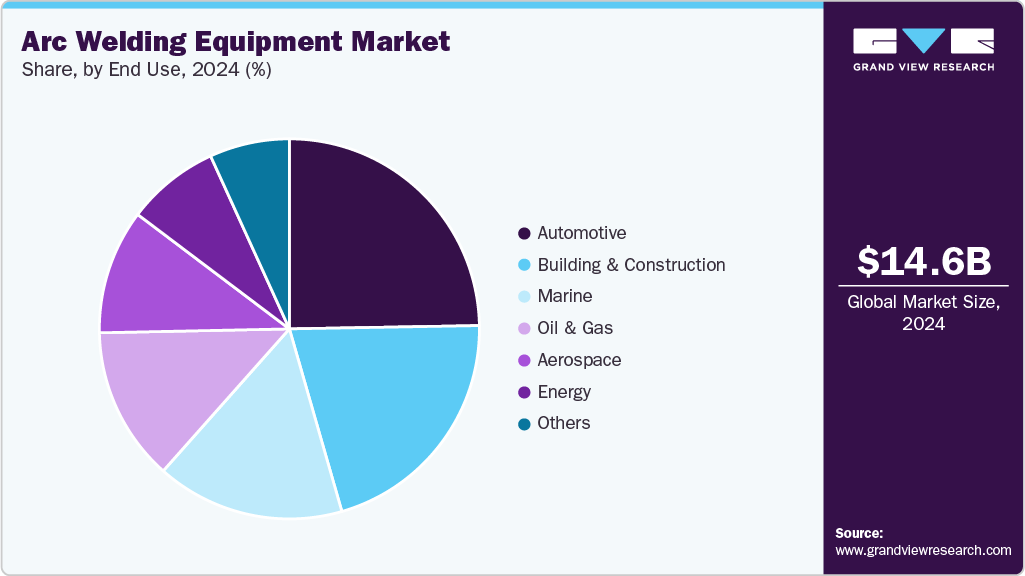

The global arc welding equipment market size was estimated at USD 14.55 billion in 2024 and is projected to reach USD 22.49 billion by 2033, growing at a CAGR of 5.0% from 2025 to 2033. This growth is primarily driven by increasing demand from the construction and infrastructure sectors, where arc welding plays a critical role in fabricating steel structures, pipelines, and frameworks.

Key Market Trends & Insights

- Asia Pacific dominated the arc welding equipment market with the largest revenue share of 35.8% in 2024.

- The arc welding equipment market in the U.S. is expected to grow at a substantial CAGR of 4.0% from 2025 to 2033.

- By product, the automatic arc welding equipment segment holds a 56.1% share due to its high efficiency, precision, and reduced reliance on manual labor.

- By type, the tungsten inert gas welding (TIG) segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

- By end use, the aerospace segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 14.55 Billion

- 2033 Projected Market Size: USD 22.49 Billion

- CAGR (2025-2033): 5.0%

- Asia Pacific: Largest market in 2024

Rapid urbanization and industrialization, particularly in developing economies across Asia Pacific and Latin America, are intensifying the need for durable and cost-effective welded components. In addition, government investments in public infrastructure, including roads, bridges, railways, and energy facilities, are further fueling market expansion.

In addition, the expansion of the automotive and shipbuilding industries is contributing significantly to market growth. Automakers increasingly rely on automated and robotic arc welding for precision, speed, and production efficiency. Rising global vehicle production and increased focus on lightweight materials have further accelerated adoption. This industrial shift enhances the demand for advanced welding technologies and integrated welding solutions.

Market Concentration & Characteristics

The global arc welding equipment industry is moderately concentrated, with a few major players dominating a significant share. Leading companies focus on technological advancements, automation, and strategic partnerships to maintain their market positions. However, the presence of numerous regional and niche players adds a fragmented element to the competitive landscape. This mix creates a market where both global brands and local suppliers coexist.

The market shows a high degree of innovation, driven by automation, robotics, and smart welding technologies. Manufacturers are investing in AI-integrated systems and IoT-enabled machines for real-time monitoring and efficiency. These innovations improve precision, reduce human error, and enhance safety. The focus on energy-efficient and eco-friendly solutions further supports technological advancement.

Mergers and acquisitions are common in this market as major players aim to expand their product portfolios and global reach. Companies often acquire regional firms to gain access to new customer bases and technologies. This consolidation helps strengthen competitive positioning and economies of scale. M&A activities also promote innovation by integrating complementary expertise.

Regulations related to worker safety, emissions, and energy consumption significantly influence the market. Compliance with standards such as OSHA and ISO requires continual product upgrades and testing. Environmental regulations push companies to develop sustainable and low-emission equipment. These regulatory pressures encourage ongoing improvement and investment in advanced systems.

Drivers, Opportunities & Restraints

Rapid industrialization and infrastructure development worldwide are major drivers of the arc welding equipment industry. Growing demand from sectors like construction, automotive, and shipbuilding boosts equipment adoption. The shift toward automation and advanced manufacturing processes further supports growth. In addition, rising investments in renewable energy projects create more welding applications.

The increasing adoption of robotic and automated welding systems presents significant growth opportunities. Emerging economies offer untapped markets due to expanding industrial bases and infrastructure needs. Technological advancements in welding processes enhance efficiency and open new application areas. Customized and energy-efficient equipment also attracts demand from environmentally conscious industries.

High initial costs of advanced welding equipment can limit adoption among small and medium enterprises. A shortage of skilled welders and technical workforce poses a challenge in many regions. Strict safety and environmental regulations may increase compliance costs for manufacturers. In addition, fluctuating raw material prices can affect production and profitability.

Type Insights

The shielded metal/stick arc welding segment currently dominates the market and accounted for a 29.5% share in 2024, due to its simplicity, low equipment cost, and versatility. It is widely used in construction, repair, and maintenance across various industries. The process is suitable for outdoor and remote locations, requiring minimal setup. Its adaptability to different metals and environments ensures continued high demand.

TIG welding is witnessing the fastest growth owing to its precision, clean welds, and suitability for high-quality applications. It is increasingly used in aerospace, automotive, and fabrication of stainless steel and thin metals. The growing focus on quality standards and aesthetic finish is driving its adoption. Technological enhancements and automation are further accelerating TIG welding’s market expansion.

Product Insights

The automatic arc welding equipment segment holds a 56.1% share due to its high efficiency, precision, and reduced reliance on manual labor. It is widely used in large-scale industries such as automotive and shipbuilding, where consistency and speed are crucial. Automation minimizes errors and enhances production rates, making it ideal for repetitive tasks. Rising labor costs and demand for quality are pushing industries toward full automation.

Semi-automatic welding systems are experiencing notable growth as they offer a balance between manual flexibility and automation benefits. These systems are preferred by small to mid-sized manufacturers due to lower investment costs compared to fully automated setups. They improve productivity while allowing human control over critical welds. The rising need for scalable solutions in developing regions is driving demand.

End Use Insights

The automotive sector dominated the market and accounted for a 24.7% share in 2024, due to its high-volume production and need for consistent, strong welds. Welding is essential in assembling vehicle frames, exhaust systems, and other structural components. Automation and robotic welding are extensively used for efficiency and precision. Growing global vehicle demand continues to drive equipment adoption in this sector.

The aerospace industry is the fastest-growing end use segment, driven by its demand for high-precision and lightweight welds. TIG and advanced arc welding methods are vital for joining sensitive materials like aluminum and titanium. Increased aircraft production and stringent safety standards fuel this growth. Technological innovation and rising global air travel further support market expansion.

Regional Insights

North America arc welding equipment industry is, anticipated to grow at a significant CAGR of 4.1% over the forecast period due to its mature industrial base and widespread adoption of automation technologies. The region benefits from strong demand in the automotive, aerospace, and energy sectors. Major manufacturers and technology providers are headquartered here driving continuous innovation. High safety and quality standards further push the adoption of advanced welding solutions. Government initiatives supporting infrastructure modernization also contribute to sustained market leadership.

U.S. Arc Welding Equipment Market Trends

The U.S. arc welding equipment industry dominates the North American region, due to its large-scale industrial base and advanced manufacturing capabilities. High demand from automotive, aerospace, and energy sectors drives equipment adoption. Strong presence of key manufacturers and early adoption of automation support market leadership. Government infrastructure spending further fuels consistent demand for welding technologies.

The arc welding equipment industry in Canada is experiencing steady growth supported by investments in construction, transportation, and energy projects. The country’s focus on sustainable development and infrastructure renewal increases demand for efficient welding solutions. Adoption of semi-automatic and automated systems is rising among industrial players. Workforce training programs and technological upgrades are further enhancing market potential.

Europe Arc Welding Equipment Market Trends

The Europe arc welding equipment industry is growing steadily, owing to its focus on advanced manufacturing and environmentally sustainable practices. Countries such as Germany, Italy, and France lead in precision welding technologies, especially in the automotive and machinery sectors. Strict regulatory standards encourage the adoption of energy-efficient and high-performance equipment. The presence of globally recognized welding companies strengthens the regional market. Ongoing investments in smart factories and Industry 4.0 solutions drive demand for automated welding systems.

Germany arc welding equipment industry dominates the European region due to its strong industrial and engineering sectors. The country leads in automotive manufacturing, machinery, and metal fabrication, all of which heavily rely on welding technologies. High levels of automation and precision welding drive demand for advanced equipment. Government support for Industry 4.0 and innovation further strengthens its market position.

The arc welding equipment industry in the UK is growing steadily, driven by increased investment in infrastructure, aerospace, and renewable energy projects. Demand for high-quality and efficient welding solutions is rising, especially in offshore wind and defense sectors. Adoption of automated and energy-efficient welding systems is expanding across industries. Supportive policies and efforts to boost domestic manufacturing are contributing to growth.

Asia Pacific Arc Welding Equipment Market Trends

Asia Pacific arc welding equipment industry is a dominant force in the global market and accounted for a share of 35.8% in 2024, fueled by rapid industrialization and urbanization in China, India, and Southeast Asia. The region is home to a robust manufacturing base, especially in automotive, shipbuilding, and construction. Government policies promoting domestic manufacturing and foreign direct investment bolster market growth. Rising demand for cost-effective and scalable welding solutions supports high equipment consumption. Technological adoption is increasing, particularly in large-scale production facilities.

China arc welding equipment industry is witnessing strong growth due to its vast manufacturing base and infrastructure development. High demand from the construction, automotive, and shipbuilding sectors drives equipment sales. Government initiatives like "Made in China 2025" promote industrial automation and smart manufacturing. The presence of local manufacturers offering cost-effective solutions further boosts market expansion.

India arc welding equipment industry is growing rapidly, supported by industrialization, urban infrastructure projects, and the expanding automotive sector. Government programs like “Make in India” are encouraging domestic production and foreign investment. Small and medium enterprises are increasingly adopting semi-automatic and automatic welding systems. Rising demand for skilled labor and technological upgrades also contribute to market growth.

Middle East & Africa Arc Welding Equipment Market Trends

The Middle East and Africa arc welding equipment industry is showing promising growth due to investments in oil & gas, construction, and renewable energy. Welding demand is increasing for pipeline construction, structural fabrication, and industrial facilities. While overall industrial development is uneven, some countries like the UAE and Saudi Arabia are leading regional growth. Governments are focusing on diversification beyond oil, promoting industrialization and infrastructure development. As technology awareness spreads, the market is expected to grow steadily.

Saudi Arabia arc welding equipment industry is experiencing growing demand, driven by large-scale infrastructure and industrial projects under Vision 2030. The construction of smart cities, energy facilities, and transportation networks boosts welding applications. The oil & gas sector continues to be a major contributor, requiring advanced welding for pipelines and refineries. Government efforts to diversify the economy and localize manufacturing are further accelerating market growth.

Latin America Arc Welding Equipment Market Trends

Latin America arc welding equipment industry is a growing market, driven by infrastructure development and industrial expansion. Countries like Brazil and Mexico are seeing increased demand in automotive assembly and construction. However, economic instability in some areas can hinder growth momentum. Local manufacturers are gradually adopting semi-automatic and automated welding systems to boost productivity. With rising foreign investment and regional trade agreements, long-term growth prospects remain positive.

Brazil arc welding equipment industry is growing steadily due to rising investments in infrastructure, energy, and industrial sectors. Projects in construction, oil & gas, and transportation are driving the demand for welding technologies. The automotive and shipbuilding industries further contribute to equipment usage across fabrication and assembly. Supportive government policies and increased focus on modernizing manufacturing practices are fueling market expansion.

Key Arc Welding Equipment Company Insights

Some of the key players operating in the market include The Lincoln Electric Company, ACRO Automation Systems, Inc., and Illinois Tool Works Inc.

-

The Lincoln Electric Company specializes in advanced welding and cutting technologies with a strong focus on automation and system integration. It offers industry-specific solutions, including robotic welding cells, CNC plasma systems, and welding consumables tailored for high-performance applications. The company is known for integrating IoT and real-time monitoring features into its equipment for enhanced productivity. Lincoln also provides custom-engineered systems for complex manufacturing environments. Its solutions are widely used in automotive, shipbuilding, and structural steel sectors.

-

ACRO Automation Systems, Inc. is a provider of custom robotic welding and assembly systems, focusing on turnkey automation for industrial manufacturers. The company designs and builds automated production lines that include precision welding, vision inspection, and material handling systems. ACRO specializes in handling complex, high-precision components in the automotive and heavy equipment industries. Their expertise lies in seamlessly integrating robotics with advanced motion control and part tracking. They also offer post-installation support, including system upgrades and process optimization.

Key Arc Welding Equipment Companies

The following are the leading companies in the arc welding equipment market. These companies collectively hold the largest market share and dictate industry trends.

- The Lincoln Electric Company

- ACRO Automation Systems, Inc

- Illinois Tool Works Inc.

- Ador Welding Limited

- Mitco Weld Products Pvt. Ltd.

- voestalpine Böhler Welding Group GmbH

- Carl Cloos Schweisstechnik GmbH

- OTC DAIHEN Inc.

- Panasonic Industry Co., Ltd.

- Coherent, Inc.

- ESAB

- Polysoude S.A.S.

- Kemppi Oy.

- Cruxweld Industrial Equipment Pvt. Ltd.

- Fronius International GmbH

Recent Developments

-

In June 2025, ESAB Corporation is set to acquire German welding equipment manufacturer EWM GmbH. The deal is aimed at expanding ESAB’s capabilities in heavy industrial welding and automation. EWM is expected to contribute around €120 million in revenue in 2025, with the acquisition closing later that year. This move will strengthen ESAB’s position in Europe and enhance its product offerings in advanced welding solutions.

-

In July 2024, Lincoln Electric acquired Vanair Manufacturing, a U.S.-based company known for its vehicle-mounted power solutions, including compressors, generators, and welders. This acquisition enhances Lincoln’s capabilities in the mobile power sector, especially for service trucks. Vanair’s offerings align well with Lincoln’s maintenance and repair product lines, expanding its reach in key markets. The move is expected to support long-term growth and innovation in portable industrial solutions.

Arc Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.22 billion

Revenue forecast in 2033

USD 22.49 billion

Growth rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Germany; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

The Lincoln Electric Company; ACRO Automation Systems, Inc; Illinois Tool Works Inc.; Ador Welding Limited; Mitco Weld Products Pvt. Ltd.; voestalpine Böhler Welding Group GmbH; Carl Cloos Schweisstechnik GmbH; OTC DAIHEN Inc.; Panasonic Industry Co., Ltd.; Coherent, Inc.; ESAB; Polysoude S.A.S.; Kemppi Oy.; Cruxweld Industrial Equipments Pvt. Ltd.; Fronius International GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Arc Welding Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global arc welding equipment market report based on product, type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Shielded Metal/Stick Arc Welding

-

Metal Inert Gas welding (MIG)

-

Tungsten Inert Gas welding (TIG)

-

Plasma Arc Welding

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global arc welding equipment market size was estimated at USD 14,545.9 million in 2024 and is expected to reach USD 15,220.4 million in 2025.

b. The arc welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 22,491.8 million by 2033.

b. Automatic arc welding equipment segment holds a 56.1% share due to its high efficiency, precision, and reduced reliance on manual labor. It is widely used in large-scale industries such as automotive and shipbuilding, where consistency and speed are crucial. Automation minimizes errors and enhances production rates, making it ideal for repetitive tasks.

b. Some of the key players operating in the arc welding equipment market include The Lincoln Electric Company, ACRO Automation Systems, Inc, Illinois Tool Works Inc., Ador Welding Limited, Mitco Weld Products Pvt. Ltd., voestalpine Böhler Welding Group GmbH, Carl Cloos Schweisstechnik GmbH, and among others

b. Key factors driving the arc welding equipment market include rapid industrialization and infrastructure development across emerging economies. Growing demand from automotive, construction, and energy sectors boosts the need for advanced welding technologies. Additionally, increased adoption of automation and robotics enhances efficiency, further fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.