Artificial Intelligence Market Size, Share & Trends Analysis Report By Solution, By Technology (Deep Learning, Machine Learning, NLP, Machine Vision, Generative AI), By Function, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-955-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

We value your investment and offer free customization with every report to fulfil your research needs.

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence Market Size, Share, Growth Report 2030GVR Report cover

![Artificial Intelligence Market Size, Share & Trends Report]()

Artificial Intelligence Market Size, Share & Trends Analysis Report By Solution, By Technology (Deep Learning, Machine Learning, NLP, Machine Vision, Generative AI), By Function, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-955-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Artificial Intelligence Market Size & Trends

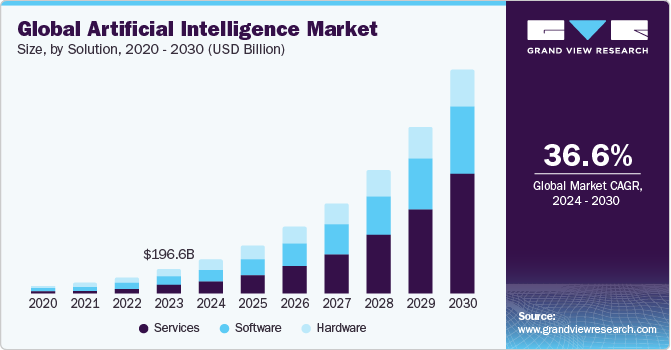

The global artificial intelligence market size was estimated at USD 196.63 billion in 2023 and is projected to grow at a CAGR of 36.6% from 2024 to 2030. The continuous research and innovation directed by tech giants are driving adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing. For instance, in December 2023, Google LLC launched ‘Gemini’, a large language AI model, made available in three sizes, namely, Gemini Nano, Gemini Pro, and Gemini Ultra. Gemini stands out from its competitors due to its native multimodal characteristic.

AI has proven to be a significant revolutionary element of the upcoming digital era. Tech giants like Amazon.com, Inc.; Google LLC; Apple Inc.; Facebook; International Business Machines Corporation; and Microsoft are investing significantly in research and development (R&D) of AI, thus increasing the artificial intelligence market cap. These companies are working to make AI more accessible for enterprise use cases. Moreover, various companies adopt AI technology to provide a better customer experience and improve their presence in the artificial intelligence industry 4.0.

The essential fact accelerating the rate of innovation in AI is accessibility to historical datasets. Since data storage and recovery have become more economical, healthcare institutions and government agencies build unstructured data accessible to the research domain. Researchers are getting access to rich datasets, from historic rain trends to clinical imaging. The next-generation computing architectures, with access to rich datasets, are encouraging information scientists and researchers to innovate faster.

Furthermore, progress in profound learning and Artificial Neural Networks (ANN) has also fueled the adoption of AI in several industries, such as aerospace, healthcare, manufacturing, and automotive. ANN works in recognizing similar patterns and helps in providing modified solutions. Tech companies like Google Maps have been adopting ANN to improve their route and work on feedback received using ANN. ANN is substituting conventional machine learning systems to evolve precise and accurate versions.

For instance, recent advancements in computer vision technology, such as Generative Adversarial Networks (GAN) and Single Shot MultiBox Detector (SSD), have led to digital image processing techniques. For instance, images and videos taken in low light, or low resolution, can be transformed into HD quality by employing these techniques. Continuous research in computer vision has built the foundation for digital image processing in security & surveillance, healthcare, and transportation, among other sectors. Such emerging methods in machine learning are anticipated to alter the manner AI versions are trained and deployed.

COVID-19 outbreak stimulated market growth of next-generation tech domains, including artificial intelligence, owing to mandated work-from-home (WFH) policy due to the pandemic. For instance, LogMeIn, Inc., a U.S.-based company that provides Software-as-a-Service (SaaS) and cloud-based customer engagement and remote connectivity & collaboration services, has experienced a significant increase in new sign-ups across its product portfolios amid the pandemic.

Also, tech companies are expanding their product offerings and services to widen availability across the globe. For instance, in July 2022, Clarifai announced the launch of its ‘Clarifai Community’ free service for enabling everyone to share, create, and use The World’s AI. Moreover, it also announced the development of the ‘AI Lake’ product category, which collects and centralizes every AI resource of an enterprise, and offers tools for sharing across the enterprise.

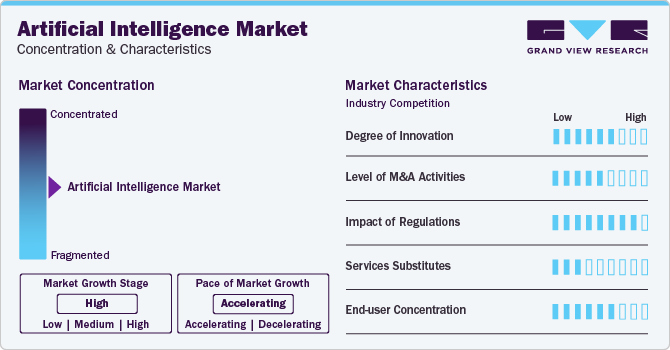

Market Concentration & Characteristics

The growth stage of the artificial intelligence industry is high, and the pace of the growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in machine learning algorithms, availability of big data, and increasing computing power. Subsequently, innovative AI applications are constantly emerging, disrupting existing industries and creating new ones.

The AI market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new AI technologies and talent, the need to consolidate in a rapidly growing market, and increasing strategic importance of AI.

The AI industry is also subject to increasing regulatory scrutiny due to concerns about the potential negative impacts of AI, such as algorithmic bias, privacy violations, and job displacement. As a result, governments around the world are developing regulations to govern the development and use of AI. These regulations could have a significant impact on the AI market, affecting the development and adoption of AI technologies.

There are a limited number of direct product substitutes for AI. However, several technologies can be used to achieve similar outcomes to AI, such as automation, rule-based systems, and expert systems. These technologies can be used as substitutes for AI in certain applications, but they typically do not offer the same level of performance or flexibility as AI.

End-user concentration is a significant factor in the AI industry. Since there are a number of end-use verticals that are driving demand for AI solutions. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing AI solutions for these industries. However, it also creates challenges for companies that are trying to compete in a crowded market.

Market Dynamics

The introduction of big data is projected to accelerate the expansion of the artificial intelligence market as a large volume of data needs to be stored, captured, and analyzed. End-users are increasingly concerned about the need to manage and improve the computational model of such data. This is encouraging companies to AI solutions at a faster pace and increase the implementation of artificial intelligence in business. Several private and public organizations have gathered tasks or application-specific information comprising issues, such as medical informatics, fraud detection, national intelligence, marketing, and cybersecurity. Artificial intelligence algorithms enable automated analysis of unsupervised and unorganized data by continuously improving each set of data.

AI is becoming increasingly important in big data because it enables the extraction of high-level and complex abstractions through a centralized learning process. The need for extracting and mining meaningful patterns from large amounts of data propels the growth of artificial intelligence in big data analytics. The technology also aids in overcoming big data analytics challenges such as data analysis trustworthiness, raw data format variation, imbalanced input data, and highly distributed input sources. Another issue is a lack of efficient storage and information retrieval, as data is collected in large quantities and made available across multiple domains. These difficulties are overcome by using semantic indexing, which improves comprehension and knowledge discovery.

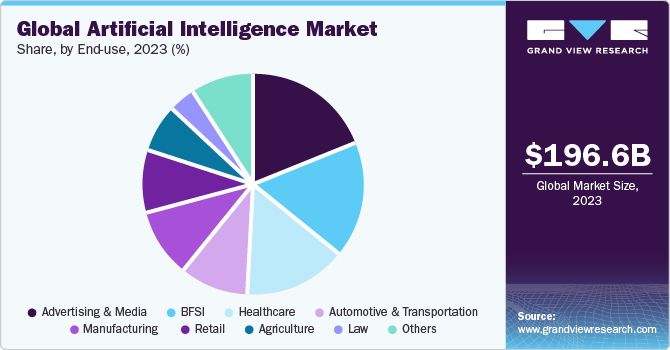

End-use Insights

The advertising & media segment led the market and accounted for the largest revenue share in 2023. This is attributable to the growing application of AI marketing with significant traction. For instance, in January 2022, Cadbury started an initiative to let small business owners create their AD for free using the face and voice of a celebrity, with the help of an AI tool.

However, the healthcare sector is anticipated to gain a leading share by 2030. Healthcare segment has been segregated based on use cases such as robot-assisted surgery, dosage error reduction, virtual nursing assistants, clinical trial participant identifier, hospital workflow management, preliminary diagnosis, and automated image diagnosis. The BFSI segment includes financial analysis, risk assessment, and investment/portfolio management solicitations.

Artificial intelligence has gained a significant share in the BFSI sector due to the high demand for risk & compliance applications along with regulatory and supervisory technologies (SupTech). By using AI-based insights in SupTech tools in financial markets, the authorities are increasingly examining FinTech-based apps used for regulatory, supervisory, and oversight purposes for any potential benefits.

In a similar vein, regulated institutions are creating and implementing FinTech applications for reporting and regulatory and compliance obligations. Financial institutions are using AI applications for risk management and internal controls as well. The combination of AI technology with behavioral sciences enables large financial organizations to prevent wrongdoing, moving the emphasis from ex-post resolution to proactive prevention.

Other verticals for artificial intelligence systems include retail, law, automotive & transportation, agriculture, and others. Increasing government regulations play a crucial role in driving the growth of the automotive artificial intelligence market. Governments worldwide are becoming increasingly concerned about road safety and enacting strict safety measures. Additionally, conversational AI platform is also one of the most used AI applications in every vertical.

The retail segment is anticipated to witness a substantial rise during the forecast period, owing to the increasing focus on providing an enhanced shopping experience. An increasing amount of digital data in text, sound, and images from different social media sources is driving the need for data mining and analytics. In the entertainment and advertising industry, AI has been creating a positive impact, and companies are using AI techniques to promote their products and connect to the customer base.

Solution Insights

Software solutions led the market and accounted for 35.8% of the global revenue in 2023. This leading share can be attributed to prudent advances in information storage capacity, high computing power, and parallel processing capabilities to deliver high-end services. The ability to extract data, provide real-time insight, and aid decision-making has positioned this segment to capture a significant portion of the market. Artificial intelligence software solutions include libraries for designing and deploying AI applications, such as primitives, linear algebra, inference, sparse matrices, video analytics, and multiple hardware communication capabilities. The need for enterprises to understand and analyze visual content to gain meaningful insights is expected to spur the adoption of artificial intelligence software over the forecast period.

Companies adopt AI services to reduce their overall operational costs, yielding more profit. Artificial Intelligence as a Service, or AIaaS, is being used by companies to obtain a competitive advantage over the cloud, thus assisting the growth of the mobile AI market. Artificial intelligence services include installation, integration, maintenance, and support undertakings. The segment is projected to grow significantly over the forecast period. AI hardware includes chipsets such as Graphics Processing Unit (GPU), CPU, application-specific integrated circuits (ASIC), and field-programmable gate arrays (FPGAs). GPUs and CPUs currently dominate the artificial intelligence hardware market due to their high computing capabilities required for AI frameworks.

Technology Insights

The deep learning segment led the market with the largest revenue share in 2023, owing to the growing prominence of the complicated data-driven applications of deep learning, including text/content or speech recognition. Deep learning offers lucrative investment opportunities as it helps overcome the challenges of high data volumes. Rising R&D investments by leading players will also play a crucial role in increasing the uptake of artificial intelligence technologies.

Machine learning and deep learning cover significant investments in AI. They include both AI platforms and cognitive applications, including tagging, clustering, categorization, hypothesis generation, alerting, filtering, navigation, and visualization, which facilitate the development of advisory, intelligent, and cognitively enabled solutions. Growing deployment of cloud-based computing platforms and on-premises hardware equipment for the safe and secure restoration of large volumes of data has paved the way for the expansion of the analytics platform.

During the forecast period, the Natural Language Processing (NLP) segment is expected to gain momentum. NLP is widely being used in various businesses to understand client preferences, evolving trends, purchasing behavior, decision-making processes, and more, in a better manner. This factor is anticipated to bode well for this segment’s growth.

Function Insights

The operations segment accounted for the largest market revenue share in 2023. The operations segment is the engine room of a business, encompassing all day-to-day activities that deliver products or services to customers. Implementation of AI can automate repetitive tasks, such as data entry and order processing, improving efficiency and reducing errors. Furthermore, by using AI for predictive maintenance, process automation, and supply chain optimization, businesses can streamline workflows, reduce costs, and ensure the smooth delivery of their offerings.

The sales and marketing segment is projected to grow at the fastest CAGR from 2024 to 2030. It leverages AI to transform how businesses attract and convert customers. AI can analyze vast amounts of customer data to identify high-potential leads, prioritize sales efforts, and personalize marketing campaigns. Chatbots powered by AI can answer customer inquiries, qualify leads, and even schedule appointments, freeing up sales reps for more complex interactions. AI can personalize marketing messages and recommendations based on a customer's demographics, purchase history, and online behavior, leading to more targeted and effective marketing campaigns that drive sales.

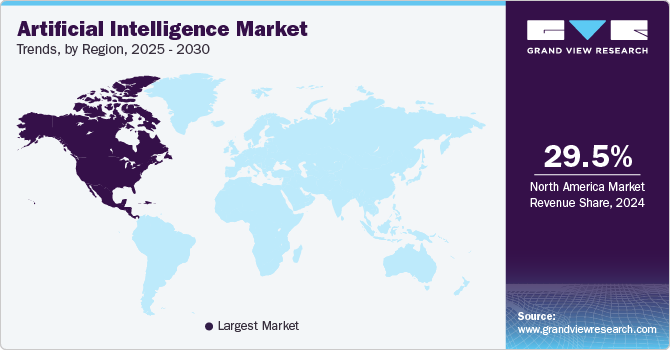

Regional Insights

The North America AI market accounted for a revenue share of 30.9% in 2023. This can be attributed to favorable government initiatives to encourage the adoption of AI across various industries. Governments in North America are investing in AI research and development, establishing specialized research institutes and centers, and funding AI-related projects. They also utilize AI in many fields, such as enhancing public safety and transportation and promoting healthcare innovation.

U.S. AI Market Trends

The U.S. artificial intelligence market was valued at USD 42.00 billion in 2023 and has made remarkable progress in the field of AI and robotics. Regional companies and research institutions have been at the forefront of creating innovative robots that leverage AI to perform various tasks. In addition, the U.S. is actively developing social and companion robots capable of interacting with humans and offering assistance in diverse environments.

Europe AI Market Trends

The Europe artificial intelligence market is anticipated to witness a substantial CAGR of 33.2% from 2024 to 2030. The financial sector Europe is undergoing a significant transformation due to the growing adoption of AI technologies. Artificial intelligence is being integrated into different areas of finance, leading to revolutionary changes in traditional practices and improving customer experiences.

The AI market in UK accounted for a 24.8% revenue share of Europe in 2023. The UK's rapid digitalization across various sectors, including banking, insurance, healthcare, and business services, has emerged as a primary catalyst for the accelerated growth of artificial intelligence in the UK.

The Germany AI market is expected to grow at a CAGR of 30.9% from 2024 to 2030. This growth is prominently driven by government initiatives such as the German AI Strategy and the National AI Competence Center (KI-Campus) that promote the adoption of artificial intelligence in the country.

The AI market in France is projected to grow over the forecast period, due to a rise in government initiatives such as the National Strategy for AI and France 2030. Furthermore, the increasing R&D investments and a notable rise in AI startups are anticipated to drive the growth of the artificial intelligence market in France.

Asia Pacific AI Market Trends

The Asia Pacific artificial intelligence market accounted for a 25.6% share of the global revenue in 2023. The educational institutions in Asia Pacific embrace AI to enhance educational outcomes through personalized learning experiences, intelligent tutoring systems, and data analytics.

The AI market in China is projected to grow at a CAGR of 43.5% from 2024 to 2030. This is due to the implementation of AI applications, such as natural language processing, computer vision, robotics, autonomous vehicles, and virtual assistants in various end-use industries in China.

The India AI market is portraying prominent growth opportunities as the Indian government is actively supporting the progress of AI through multiple initiatives, notably the National AI Strategy. This strategy outlines the country's approach to AI research, development, and adoption, aiming to unlock AI's potential for fostering innovation, economic prosperity, and societal progress.

Middle East & Africa AI Market Trends

The AI market in the Middle East and Africa (MEA) region is anticipated to reach USD 166.33 billion by 2030. With its diverse linguistic landscape, the MEA region significantly emphasizes advancing Arabic language processing in AI technologies. This includes natural language processing (NLP) and speech recognition capabilities that can accurately interpret and generate Arabic text and speech.

The Saudi Arabia AI market growth is driven through a range of initiatives, policies, and financial support programs. For instance, the Saudi Data and AI Authority (SDAIA) is a government agency that creates an AI ecosystem of government and private sector entities. SDAIA deploys innovative AI solutions, which comprise strategies for combining data and AI into key domains.

Key Artificial Intelligence Company Insights

Vendors are focusing on increasing their customer base to gain a competitive edge in the market. Therefore, the key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies. For instance, in October 2023, NVIDIA Corporation and Oracle entered into a partnership agreement to assist customers in overcoming business difficulties using accelerated computing and AI. The partnership is aimed to help speed up customer adoption of artificial intelligence services.

Key Artificial Intelligence Companies:

The following are the leading companies in the artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices

- AiCure

- Arm Limited

- Atomwise, Inc.

- Ayasdi AI LLC

- Baidu, Inc.

- Clarifai, Inc.

- Cyrcadia Health

- Enlitic, Inc.

- Google LLC

- H2O.ai.

- HyperVerge, Inc.

- International Business Machines Corporation

- IBM Watson Health

- Intel Corporation

- Iris.ai AS.

- Lifegraph

- Microsoft

- NVIDIA Corporation

- Sensely, Inc.

- Zebra Medical Vision, Inc.

Recent Developments

-

Open AI is developing an innovative artificial general intelligence (AGI) model code-named Project Q-Star. The model could have an immense impact on the overall AI market and provide breakthroughs in interactions with technology, process automation, and solving a few of the world’s most pressing issues.

-

In March 2024, Microsoft and NVIDIA announced a collaboration focused on advancing AI for the healthcare and life sciences industry. This partnership leverages the strengths of both companies: Microsoft Azure's cloud infrastructure and advanced computing capabilities, alongside NVIDIA's DGX Cloud and Clara suite. The goal is to accelerate innovation and improve patient care through developments in areas like clinical research and drug discovery.

-

In March 2024, NVIDIA launched new Generative AI Microservices designed to advance medical technology (MedTech), drug discovery, and digital health. These microservices leverage artificial intelligence (AI) to potentially improve healthcare technology.

-

In January 2024, Google unveiled a new AI model, Lumiere. It is a text-to-video diffusion model capable of generating short video clips based on text descriptions. It can also be used to animate still images or apply a specific style to video generation.

-

In December 2023, Google LLC released a new large language model (LLM) called Gemini. Gemini comes in three versions: Nano, Pro, and Ultra. A key feature of Gemini is its ability to handle multiple modalities, which differentiates it from competing LLMs.

-

In November 2023, The University of Cambridge, along with Intel Corporation and Dell Technologies announced the implementation of the co-designed fastest AI supercomputer ‘Dawn Phase 1’. Leading technical teams built the supercomputer that mobilizes the power of both high-performance computing (HPC) and artificial intelligence for solving some of the world’s most critical challenges. This is projected to accelerate the future technology leadership and inward investment into the UK technology sector.

-

In March 2023, Enlitic introduced the latest release of Enlitic Curie, a platform that makes it easy for radiology departments to manage their workflow. The platform hosts Curie|ENDEX, which utilizes NLP and computer vision for the analysis & processing of medical images; and Curie|ENCOG, which leverages AI to identify and protect Protected Health Information.

-

In June 2023, AMD unveiled its AI Platform strategy with the introduction of the AMD Instinct MI300 Series accelerator family, which included a first look at the AMD Instinct MI300X accelerator. The accelerator has been developed for large language model training and inference for generative AI workloads.

-

In June 2023, IBM announced that it would be partnering with The All England Lawn Tennis Club at the 2023 Wimbledon Championship. The company would be leveraging IBM Watsonx’s generative AI technology to product commentary for video highlights during the tournament. Additionally, the IBM AI Draw Analysis will offer insights regarding how favorable the draws would be for every singles player.

-

In April 2023, H20.ai announced a strategic partnership with GeoTechnologies, a Japan-based provider of map data & location information solutions for vehicle navigation systems. The company has leveraged H20.ai’s H2O AI Cloud to develop an AI-powered platform that uses onboard camera footage for gauging sidewalk safety.

-

In January 2023, Iris.ai announced that it had received the EIC Accelerator Blended finance, which is EIC’s flagship startup funding program. The funding includes a €2.4 million grant as well as up to €12 million in investments from the EIC and the European Investment Grant.

-

In September 2022, AiCure launched its clinical site services program that partners with sponsors and sites through the course of research and offers data-driven, actionable insights to minimize study risks and optimize the workflow.

-

In August 2022, Atomwise announced an exclusive, strategic research collaboration with Sanofi for AI-powered drug discovery. As part of the deal, Sanofi is leveraging Atomwise’s AtomNet platform for computational discovery & research of up to 5 drug targets.

-

In June 2022, Francisco Partners announced that it had acquired the healthcare analytics and data assets that formed a part of the Watson Health business of IBM. As part of this development, the new standalone company was named Merative, with its products organized into 6 product categories.

-

In April 2022, Sensely and Keralty S.A.S, along with its American affiliate Sanitas USA, Inc., announced a multi-year partnership. Through this collaboration, Sanitas aims to power its next-gen mySanitas application by leveraging Sensely’s advanced visual UI and multilingual symptom assessment tool.

Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 279.22 billion

Revenue forecast in 2030

USD 1,811.75 billion

Growth rate

CAGR of 36.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, technology, end-use, function, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; and South Africa

Key companies profiled

Advanced Micro Devices; AiCure; Arm Limited; Atomwise, Inc.; Ayasdi AI LLC; Baidu, Inc.; Clarifai, Inc; Cyrcadia Health; Enlitic, Inc.; Google LLC; H2O.ai.; HyperVerge, Inc.; International Business Machines Corporation; IBM Watson Health; Intel Corporation; Iris.ai AS.; Lifegraph; Microsoft; NVIDIA Corporation; Sensely, Inc.; Zebra Medical Vision, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence market report based on solution, technology, function, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Accelerators

-

Processors

-

Memory

-

Network

-

-

Software

-

Services

-

Professional

-

Managed

-

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

Generative AI

-

-

Function Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cybersecurity

-

Finance and Accounting

-

Human Resource Management

-

Legal and Compliance

-

Operations

-

Sales and Marketing

-

Supply Chain Management

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Healthcare

-

Robot Assisted Surgery

-

Virtual Nursing Assistants

-

Hospital Workflow Management

-

Dosage Error Reduction

-

Clinical Trial Participant Identifier

-

Preliminary Diagnosis

-

Automated Image Diagnosis

-

-

BFSI

-

Risk Assessment

-

Financial Analysis/Research

-

Investment/Portfolio Management

-

Others

-

-

Law

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Agriculture

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence market size was estimated at USD 196.63 billion in 2023 and is expected to reach USD 279.22 billion in 2024.

b. The global artificial intelligence market is expected to grow at a compound annual growth rate of 36.6% from 2023 to 2030 to reach USD 1,811.75 billion by 2030.

b. North America dominated the AI market and accounted for over 30.9% share of global revenue in 2021 owing to favorable government initiatives to encourage the adoption of artificial intelligence (AI) across various industries.

b. Some key players operating in the AI market include Atomwise, Inc.; Lifegraph; Sense.ly, Inc.; Zebra Medical Vision, Inc.; Baidu, Inc.; H2O ai; IBM Watson Health; NVIDIA; Enlitic, Inc.; Google LLC; Intel Corporation; and Microsoft Corporation.

b. Key factors that are driving the artificial intelligence market growth include a rise in the adoption of big data, analytics, and the increasing potential of R&D in developing AI systems and technological innovations across the globe.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Artificial Intelligence Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.5. Artificial Intelligence Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. Artificial Intelligence Market: Solution Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Artificial Intelligence Market: Solution Movement Analysis, 2023 & 2030 (USD Million)

4.3. Hardware

4.3.1. Hardware Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Software

4.4.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Services

4.5.1. Services Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. Artificial Intelligence Market: Technology Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Artificial Intelligence Market: Technology Movement Analysis, 2023 & 2030 (USD Million)

5.3. Deep Learning

5.3.1. Deep Learning Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Machine Learning

5.4.1. Machine Learning Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5. Natural Language Processing (NLP)

5.5.1. Natural Language Processing (NLP) Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.6. Machine Vision

5.6.1. Machine Vision Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.7. Generative AI

5.7.1. Generative AI Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. Artificial Intelligence Market: Function Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Artificial Intelligence Market: Function Movement Analysis, 2023 & 2030 (USD Million)

6.3. Cybersecurity

6.3.1. Cybersecurity Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Finance and Accounting

6.4.1. Finance and Accounting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Human Resource Management

6.5.1. Human Resource Management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. Legal and Compliance

6.6.1. Legal and Compliance Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.7. Operations

6.7.1. Operations Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.8. Sales and Marketing

6.8.1. Sales and Marketing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.9. Supply Chain Management

6.9.1. Supply Chain Management Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. Artificial Intelligence Market: End-user Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Artificial Intelligence Market: End-user Movement Analysis, 2023 & 2030 (USD Million)

7.3. Healthcare

7.3.1. Healthcare Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. BFSI

7.4.1. BFSI Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. Law

7.5.1. Law Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. Retail

7.6.1. Retail Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7. Advertising & Media

7.7.1. Advertising & Media Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.8. Automotive & Transportation

7.8.1. Automotive & Transportation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.9. Agriculture

7.9.1. Agriculture Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.10. Manufacturing

7.10.1. Manufacturing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.11. Others

7.11.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. Artificial Intelligence Market: Regional Estimates & Trend Analysis

8.1. Artificial Intelligence Market Share, By Region, 2023 & 2030 (USD Million)

8.2. North America

8.2.1. North America Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.2. UK

8.3.2.1. UK Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Germany Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.3.4. France

8.3.4.1. France Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.2. China

8.4.2.1. China Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.3. Japan

8.4.3.1. Japan Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.4. India

8.4.4.1. India Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4.5. South Korea

8.4.5.1. South Korea Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. Latin America

8.5.1. Latin America Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Brazil Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5.3. Mexico

8.5.3.1. Mexico Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.2. KSA

8.6.2.1. KSA Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.3. UAE

8.6.3.1. UAE Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6.4. South Africa

8.6.4.1. South Africa Artificial Intelligence Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Heat Map Analysis

9.5. Strategy Mapping

9.5.1. Expansion

9.5.2. Mergers & Acquisition

9.5.3. Partnerships & Collaborations

9.5.4. New Product Launches

9.5.5. Research And Development

9.6. Company Profiles

9.6.1. Advanced Micro Devices

9.6.1.1. Participant’s Overview

9.6.1.2. Financial Performance

9.6.1.3. Product Benchmarking

9.6.1.4. Recent Developments

9.6.2. AiCure

9.6.2.1. Participant’s Overview

9.6.2.2. Financial Performance

9.6.2.3. Product Benchmarking

9.6.2.4. Recent Developments

9.6.3. Arm Limited

9.6.3.1. Participant’s Overview

9.6.3.2. Financial Performance

9.6.3.3. Product Benchmarking

9.6.3.4. Recent Developments

9.6.4. Atomwise, Inc.

9.6.4.1. Participant’s Overview

9.6.4.2. Financial Performance

9.6.4.3. Product Benchmarking

9.6.4.4. Recent Developments

9.6.5. Ayasdi AI LLC

9.6.5.1. Participant’s Overview

9.6.5.2. Financial Performance

9.6.5.3. Product Benchmarking

9.6.5.4. Recent Developments

9.6.6. Baidu, Inc.

9.6.6.1. Participant’s Overview

9.6.6.2. Financial Performance

9.6.6.3. Product Benchmarking

9.6.6.4. Recent Developments

9.6.7. Clarifai, Inc

9.6.7.1. Participant’s Overview

9.6.7.2. Financial Performance

9.6.7.3. Product Benchmarking

9.6.7.4. Recent Developments

9.6.8. Cyrcadia Health

9.6.8.1. Participant’s Overview

9.6.8.2. Financial Performance

9.6.8.3. Product Benchmarking

9.6.8.4. Recent Developments

9.6.9. Enlitic, Inc.

9.6.9.1. Participant’s Overview

9.6.9.2. Financial Performance

9.6.9.3. Product Benchmarking

9.6.9.4. Recent Developments

9.6.10. Google LLC

9.6.10.1. Participant’s Overview

9.6.10.2. Financial Performance

9.6.10.3. Product Benchmarking

9.6.10.4. Recent Developments

9.6.11. H2O.ai.

9.6.11.1. Participant’s Overview

9.6.11.2. Financial Performance

9.6.11.3. Product Benchmarking

9.6.11.4. Recent Developments

9.6.12. HyperVerge, Inc.

9.6.12.1. Participant’s Overview

9.6.12.2. Financial Performance

9.6.12.3. Product Benchmarking

9.6.12.4. Recent Developments

9.6.13. International Business Machines Corporation

9.6.13.1. Participant’s Overview

9.6.13.2. Financial Performance

9.6.13.3. Product Benchmarking

9.6.13.4. Recent Developments

9.6.14. IBM Watson Health

9.6.14.1. Participant’s Overview

9.6.14.2. Financial Performance

9.6.14.3. Product Benchmarking

9.6.14.4. Recent Developments

9.6.15. Intel Corporation

9.6.15.1. Participant’s Overview

9.6.15.2. Financial Performance

9.6.15.3. Product Benchmarking

9.6.15.4. Recent Developments

9.6.16. Iris.ai AS.

9.6.16.1. Participant’s Overview

9.6.16.2. Financial Performance

9.6.16.3. Product Benchmarking

9.6.16.4. Recent Developments

9.6.17. Lifegraph

9.6.17.1. Participant’s Overview

9.6.17.2. Financial Performance

9.6.17.3. Product Benchmarking

9.6.17.4. Recent Developments

9.6.18. Microsoft

9.6.18.1. Participant’s Overview

9.6.18.2. Financial Performance

9.6.18.3. Product Benchmarking

9.6.18.4. Recent Developments

9.6.19. NVIDIA Corporation

9.6.19.1. Participant’s Overview

9.6.19.2. Financial Performance

9.6.19.3. Product Benchmarking

9.6.19.4. Recent Developments

9.6.20. Sensely, Inc.

9.6.20.1. Participant’s Overview

9.6.20.2. Financial Performance

9.6.20.3. Product Benchmarking

9.6.20.4. Recent Developments

9.6.21. Zebra Medical Vision, Inc.

9.6.21.1. Participant’s Overview

9.6.21.2. Financial Performance

9.6.21.3. Product Benchmarking

9.6.21.4. Recent Developments

List of Tables

Table 1 Global AI Market by Solution, 2017 - 2030 (USD Million)

Table 2 Global AI Market by Technology, 2017 - 2030 (USD Million)

Table 3 Global AI Market by Function, 2017 - 2030 (USD Million)

Table 4 Global AI Market by End Use, 2017 - 2030 (USD Million)

Table 5 Global AI Market by Region, 2017 - 2030 (USD Million)

Table 6 North America AI Market by Country, 2017 - 2030 (USD Million)

Table 7 Europe AI Market by Country, 2017 - 2030 (USD Million)

Table 8 Asia Pacific AI Market by Country, 2017 - 2030 (USD Million)

Table 9 Latin America AI Market by Country, 2017 - 2030 (USD Million)

Table 10 MEA AI Market by Country, 2017 - 2030 (USD Million)

Table 11 Company heat map analysis

Table 12 Key companies launching new products/services

Table 13 Key companies engaged in mergers & acquisition

Table 14 Key companies engaged in Research & development

Table 15 Key Companies engaged in expansion

List of Figures

Fig. 1 AI Market Segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Market formulation & validation

Fig. 7 AI Market Snapshot

Fig. 8 AI Market Segment Snapshot

Fig. 9 AI Market Competitive Landscape Snapshot

Fig. 10 Market driver impact analysis

Fig. 11 Market restraint impact analysis

Fig. 12 AI Market, solution outlook key takeaways (USD Million)

Fig. 13 AI Market: solution movement analysis 2023 & 2030 (USD Million)

Fig. 14 Hardware market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 15 Software market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 16 Services market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 17 AI Market: Technology Outlook Key Takeaways (USD Million)

Fig. 18 AI Market: Technology Movement Analysis 2023 & 2030 (USD Million)

Fig. 19 Deep Learning market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 20 Machine Learning market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 21 Natural Language Processing market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 22 Machine Vision market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 23 Generative AI market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 24 AI Market: Function outlook key takeaways (USD Million)

Fig. 25 AI Market: Function movement analysis 2023 & 2030 (USD Million)

Fig. 26 Cybersecurity market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 27 Finance and Accounting market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 28 Human Resource Management market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 29 Legal and Compliance market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 30 Operations market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 31 Sales and Marketing market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 32 Supply Chain Management market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 33 AI Market: End-Use Outlook Key Takeaways (USD Million)

Fig. 34 AI Market: End-Use Movement Analysis 2023 & 2030 (USD Million)

Fig. 35 Healthcare market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 36 BFSI market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 37 Law market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 38 Legal market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 39 Retail market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 40 Advertising & Media market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 41 Automotive & Transportation market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 42 Agriculture market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 43 Manufacturing market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 44 Others market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 45 Regional marketplace: Key takeaways

Fig. 46 AI Market: Regional Outlook, 2023 & 2030 (USD Million)

Fig. 47 North America AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 48 U.S. AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 49 Canada AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 50 Europe AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 51 UK AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 52 Germany AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 53 France AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 54 Asia Pacific AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 55 China AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 56 Japan AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 57 India AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 58 South Korea AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 59 Australia AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 60 Latin America AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 61 Brazil AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 62 Mexico AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 63 MEA AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 64 KSA AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 65 UAE AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 66 South Africa AI Market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 67 Company Categorization

Fig. 68 Company Market Positioning

Fig. 69 Strategy frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Artificial Intelligence Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Artificial Intelligence Technology Outlook (Revenue, USD Billion, 2017 - 2030)

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Artificial Intelligence Function Outlook (Revenue, USD Billion, 2017 - 2030)

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Artificial Intelligence End-Use Outlook (Revenue, USD Billion, 2017 - 2030)

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Artificial Intelligence Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- North America Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- North America Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- North America Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- North America Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- U.S.

- U.S. Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- U.S. Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- U.S. Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- U.S. Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- U.S. Artificial Intelligence Market, By Solution

- Canada

- Canada Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Canada Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Canada Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Canada Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Canada Artificial Intelligence Market, By Solution

- North America Artificial Intelligence Market, By Solution

- Europe

- Europe Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Europe Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Europe Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Europe Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- UK

- UK Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- UK Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- UK Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- UK Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- UK Artificial Intelligence Market, By Solution

- Germany

- Germany Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Germany Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Germany Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Germany Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Germany Artificial Intelligence Market, By Solution

- France

- France Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- France Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- France Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- France Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- France Artificial Intelligence Market, By Solution

- Europe Artificial Intelligence Market, By Solution

- Asia Pacific

- Asia Pacific Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Asia Pacific Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Asia Pacific Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Asia Pacific Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- China

- China Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- China Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- China Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- China Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- China Artificial Intelligence Market, By Solution

- Japan

- Japan Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Japan Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Japan Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Japan Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Japan Artificial Intelligence Market, By Solution

- India

- India Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- India Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- India Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- India Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- India Artificial Intelligence Market, By Solution

- South Korea

- South Korea Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- South Korea Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- South Korea Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- South Korea Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- South Korea Artificial Intelligence Market, By Solution

- Australia

- Australia Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Australia Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Australia Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Australia Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Australia Artificial Intelligence Market, By Solution

- Asia Pacific Artificial Intelligence Market, By Solution

- Latin America

- Latin America Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Latin America Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Latin America Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Latin America Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Brazil

- Brazil Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Brazil Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Brazil Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Brazil Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Brazil Artificial Intelligence Market, By Solution

- Mexico

- Mexico Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- Mexico Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- Mexico Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- Mexico Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- Mexico Artificial Intelligence Market, By Solution

- Latin America Artificial Intelligence Market, By Solution

- MEA

- MEA Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- MEA Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- MEA Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- MEA Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- KSA

- KSA Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- KSA Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- KSA Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- KSA Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- KSA Artificial Intelligence Market, By Solution

- UAE

- UAE Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- UAE Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- UAE Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- UAE Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare

- UAE Artificial Intelligence Market, By Solution

- South Africa

- South Africa Artificial Intelligence Market, By Solution

- Hardware

- Accelerators

- Processors

- Memory

- Network

- Software

- Services

- Professional

- Managed

- Hardware

- South Africa Artificial Intelligence Market, By Technology

- Deep Learning

- Machine Learning

- Natural Language Processing

- Machine Vision

- Generative AI

- South Africa Artificial Intelligence Market, By Function

- Cybersecurity

- Finance and Accounting

- Human Resource Management

- Legal and Compliance

- Operations

- Sales and Marketing

- Supply Chain Management

- South Africa Artificial Intelligence Market, By End-Use

- Healthcare

- Robot Assisted Surgery

- Virtual Nursing Assistants

- Hospital Workflow Management

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Automated Image Diagnosis

- BFSI

- Risk Assessment

- Financial Analysis/Research

- Investment/Portfolio Management

- Others

- Law

- Retail

- Advertising & Media

- Automotive & Transportation

- Agriculture

- Manufacturing

- Others

- Healthcare