- Home

- »

- Next Generation Technologies

- »

-

Artificial Intelligence In Robotics Market Size Report, 2033GVR Report cover

![Artificial Intelligence In Robotics Market Size, Share & Trends Report]()

Artificial Intelligence In Robotics Market (2026 - 2033) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Deployment (On-Premise, Cloud), By Robots, By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-277-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artificial Intelligence In Robotics Market Summary

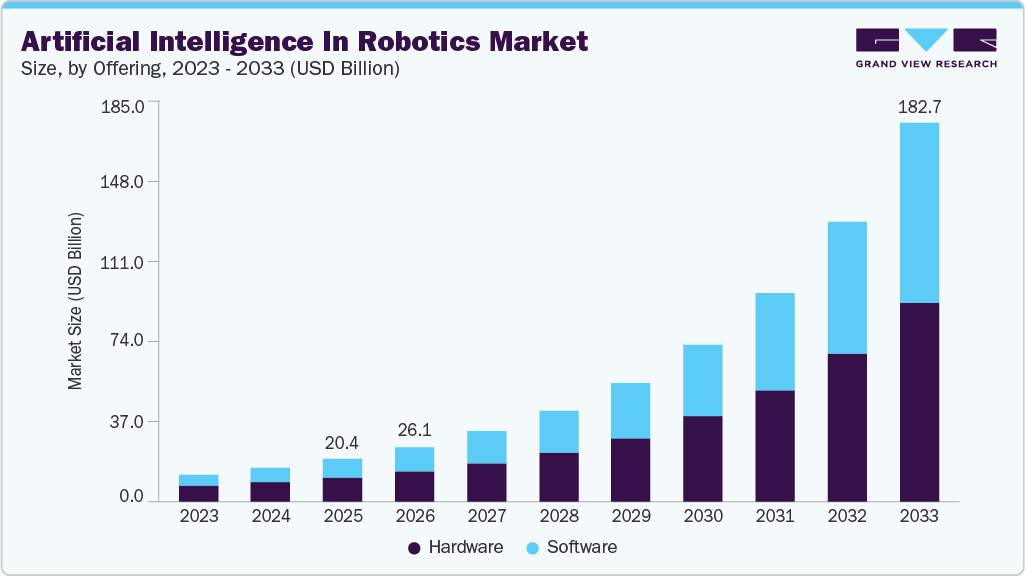

The global artificial intelligence in robotics market size was estimated at USD 20,433.0 million in 2025 and is projected to reach USD 182,705.1 million by 2033, growing at a CAGR of 32.0% from 2026 to 2033. The market growth is driven by surging demand for automation across manufacturing, healthcare, logistics, and e-commerce sectors.

Key Market Trends & Insights

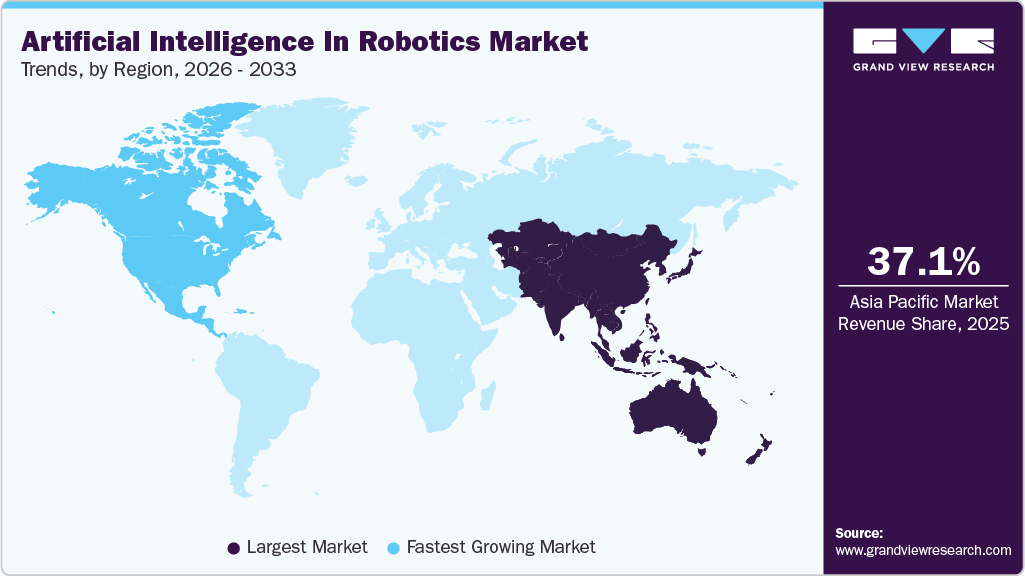

- The Asia Pacific artificial intelligence in robotics industry accounted for the largest revenue share of over 45% in 2025.

- By offering, the hardware segment is expected to grow at the fastest CAGR of over 56% in 2025.

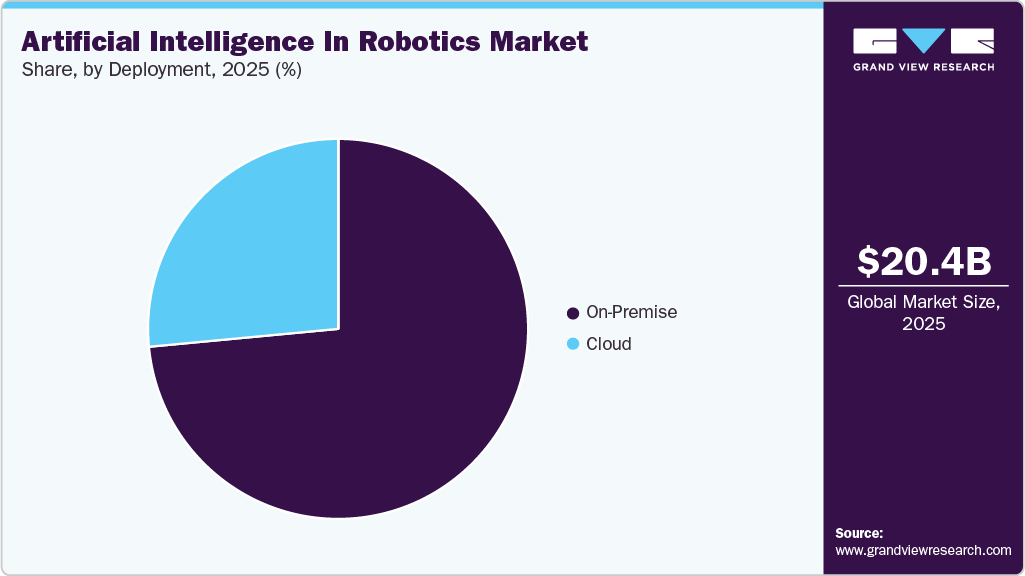

- By deployment, the on-premise segment held the largest revenue share of over 73% in 2025.

- By robots, the service robots segment is expected to grow at the fastest CAGR of over 70% in 2025.

- By technology, the machine learning segment accounted for the largest revenue share of over 24% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 20,433.0 Million

- 2033 Projected Market Size: USD 182,705.1 Miillion

- CAGR (2026-2033): 32.0%

- Asia Pacific: Largest market in 2025

Government-backed Industry 4.0 initiatives, rising investments in humanoid and collaborative robots, and IT/OT convergence are further driving the market expansion. The increasing adoption of AI-powered robotics technologies, such as vision-guided industrial robots, AI-enabled collaborative robots (cobots), autonomous mobile robots (AMRs), and humanoid service robots, to enhance operational efficiency, improve precision, and reduce dependency on manual labor, is accelerating enterprise investments in artificial intelligence in robotics. These factors are collectively accelerating adoption across manufacturing, logistics, defense, agriculture, and service sectors, thereby contributing to the sustained expansion of the artificial intelligence in robotics industry.

The increasing adoption of AI-powered robotics technologies, such as vision-guided industrial robots, AI-enabled collaborative robots (cobots), autonomous mobile robots (AMRs), and humanoid service robots, to enhance operational efficiency, improve precision, and reduce dependency on manual labor, is accelerating enterprise investments in artificial intelligence in robotics. These factors are collectively accelerating adoption across manufacturing, logistics, defense, agriculture, and service sectors, thereby contributing to the sustained expansion of the artificial intelligence in robotics industry.

The rapid integration of advanced AI software into robotic control systems, including vision-based perception, reinforcement learning for motion planning, and real-time decision intelligence is creating substantial growth opportunities for the artificial intelligence in robotics industry. These innovations enable robots to perform complex tasks such as adaptive assembly and human-safe collaboration while maintaining precision. This trend is accelerating demand for edge AI processors, AI-ready robot controllers, sensor fusion modules, and real-time inference frameworks that support low-latency performance, reliability, and seamless deployment across industrial and service robotics applications.

In addition, Industry 4.0 adoption and smart factory infrastructure investments worldwide are significant drivers fueling the expansion of the artificial intelligence in robotics industry. Large-scale deployments of industrial IoT platforms, digital twins, and AI-enabled predictive maintenance systems are encouraging manufacturers to integrate robotics with intelligent analytics for improved throughput, quality inspection, and energy efficiency. Government-backed manufacturing modernization programs and incentives supporting automation, semiconductor production, and advanced electronics assembly are further lowering adoption barriers for AI-driven robotic systems, thereby strengthening the market’s growth trajectory across developed and emerging economies.

Moreover, leading robotics manufacturers and AI technology providers are actively strengthening their market position by expanding their AI robotics portfolios, production capacity, and commercial deployment partnerships. Companies are forming strategic collaborations with system integrators, cloud AI providers, and healthcare robotics operators to scale intelligent robotic deployments across logistics, hospitals, retail operations, and defense environments. The emphasis on improved autonomy, safer human robot interaction, higher payload-to-weight ratios, and scalable fleet management platforms is further increasing the attractiveness of AI-enabled robotics.

Offering Insights

The hardware segment accounted for the largest market share of over 56% in 2025, driven by demand for high-performance processors, AI accelerators, advanced sensors, and edge computing hardware that enable real-time decision-making in robots. The expansion of industrial automation in manufacturing, logistics, and warehousing is accelerating the adoption of intelligent robotic hardware. Advancements in collaborative and service robots are increasing the need for compact, energy-efficient, and high-speed AI hardware platforms. These factors in the AI-driven robotic hardware are emerging as a critical enabler of next-generation automation strategies.

The software segment is expected to register the fastest CAGR of over 33% from 2026 to 2033. This growth is attributed to the accelerating shift toward software-first robotics, where enterprises prioritize scalable AI capabilities such as perception, planning, and real-time decision intelligence over purely hardware-driven automation. The growing preference for outcome-based automation models, where robotics vendors are evaluated on uptime, cycle-time improvement, and error reduction, is further strengthening adoption of advanced AI software in the artificial intelligence in robotics industry.

Robots Insights

The service robots segment accounted for the largest market share in 2025, driven by the accelerating deployment of AI-powered robots across healthcare, retail, hospitality, logistics, and last-mile delivery applications. The rapid expansion of e-commerce fulfillment, increasing demand for contactless services, and the growing adoption of autonomous mobile robots (AMRs) for sorting, picking assistance, and in-facility transport are strengthening demand for service robots. This broad multi-industry scalability, combined with fast commercialization of AI-enabled autonomy, continues to sustain the leadership of the service robots segment in the artificial intelligence in robotics industry.

The industrial robots segment is expected to witness the fastest CAGR from 2026 to 2033. This growth is driven by rising investment in Industry 4.0, smart factory modernization, and the increasing need for high-precision automation. The growing shift toward collaborative robotics (cobots) and AI-enabled machine vision is accelerating adoption among mid-sized factories that previously lacked the technical workforce to deploy complex automation. This shift toward software-defined, self-optimizing robotic production systems is positioning industrial robots as the fastest-growing segment within the market.

Technology Insights

The machine learning segment accounted for the largest market share in 2025, driven by the widespread integration of ML models across robot perception, motion planning, predictive maintenance, and adaptive decision-making. The strong expansion of computer vision-based quality inspection, AI-powered warehouse robotics is further strengthening demand for machine learning-enabled robotics platforms. The availability of large-scale training datasets from cameras and industrial IoT systems is accelerating the development of ML-driven robotic intelligence, thereby sustaining the dominance of the segment in the market.

The edge computing segment is expected to register the fastest CAGR from 2026 to 2033. This growth is primarily driven by the rising need for real-time robotic decision-making with ultra-low latency, especially in environments where cloud connectivity is unreliable. Industries such as logistics, defense, healthcare, and manufacturing are accelerating edge deployments to reduce bandwidth costs and enable robots to operate continuously in high-volume facilities while maintaining secure local data processing. This shift toward decentralized intelligence is significantly accelerating the growth of edge computing within the market.

End Use Insights

The automotive segment accounted for the largest market share in 2025, driven by the rapid expansion of smart manufacturing, advanced driver-assistance production requirements, and high-volume automation needs. The growing complexity of vehicle architectures, especially in EV production, has further accelerated demand for machine vision, predictive maintenance, and adaptive robotic control. The strong push toward lights-out manufacturing, combined with rising labor shortages in key automotive hubs, is reinforcing investments in AI-powered robotics, thereby sustaining the dominance of the automotive segment in the market.

The healthcare segment is expected to register the fastest CAGR from 2026 to 2033. This growth is primarily driven by the increasing adoption of AI-enabled service robots, surgical robotics, hospital logistics automation, and assistive care systems. Hospitals and healthcare providers are deploying intelligent robots for tasks such as patient monitoring, medication delivery, imaging assistance, and autonomous navigation in complex indoor environments, reducing manual workload. This accelerating shift toward automation in clinical workflows is strengthening demand for AI-driven robotics, thereby supporting the strong growth of the healthcare segment in the market.

Deployment Insights

The on-premise segment accounted for the largest market share in 2025, driven by the strong preference among large manufacturers, defense agencies, and critical infrastructure operators. The rising deployment of robotics in automotive production, semiconductor fabs, aerospace assembly, and defense logistics is increasing demand for on-premise AI stacks that support low-latency motion control, real-time machine vision processing, and deterministic safety functions. These factors, which focus on security, reliability, and full-stack customization, continue to sustain the leadership of the on-premise segment in the market.

The cloud segment is expected to witness the fastest CAGR from 2026 to 2033. This growth is primarily driven by the increasing adoption of robot-as-a-service (RaaS) business models, and rising demand for centralized AI model updates. The growing integration of cloud platforms with robot fleet management, digital twins, predictive maintenance analytics, and AI training pipelines is enabling enterprises to reduce deployment timelines while improving robot performance continuously through software upgrades. This software-centric shift is positioning cloud-based AI robotics platforms as the preferred foundation for scalable automation, thereby driving the rapid growth of the cloud segment.

Regional Insights

North America artificial intelligence in robotics industry is expected to register the fastest CAGR of over 34% from 2026 to 2033, fueled by the region’s strong adoption of warehouse automation, rising labor shortages across manufacturing and logistics, and the presence of leading AI and robotics innovators. The rapid expansion of e-commerce fulfillment centers, growing deployment of AMRs in retail supply chains, and increasing use of AI-based vision inspection in high-value manufacturing are strengthening demand for intelligent robotics. These factors continue to position the region as a global hub for AI-enabled robotics adoption and innovation.

U.S. Artificial Intelligence In Robotics Market Trends

The U.S. artificial intelligence in robotics industry accounted for the largest market share of over 70% in 2025, driven by the rising deployment of AI-powered robots in automotive and electronics manufacturing, and increasing adoption of service robots in healthcare and retail operations. The growing demand for autonomous mobile robots in warehouses, combined with the widespread adoption of AI-driven quality inspection systems, is driving this trend. The U.S. leads in AI compute infrastructure, enabling rapid commercialization of foundation-model-driven robotics, reinforcement learning-based motion control. This innovation momentum is expected to sustain long-term growth in the U.S. market.

Europe Artificial Intelligence In Robotics Market Trends

Europe artificial intelligence in robotics industry is expected to grow at a CAGR of over 31% from 2026 to 2033. In Europe, the market is driven by rising investments in smart factories, increasing adoption of collaborative robots to address labor shortages, and growing demand for automation in high-precision manufacturing sectors. The region’s emphasis on productivity, sustainability, and energy-efficient industrial operations is encouraging the deployment of AI-driven robotics for optimized motion control, predictive maintenance, and defect reduction. These factors are positioning Europe as a major market for next-generation AI-enabled robotics deployments.

The UK artificial intelligence in robotics industry is expected to grow at a significant rate in the coming years. This expansion is supported by the rising adoption of AI-enabled robotics in healthcare and strong innovation in robotics research. The UK’s strong startup ecosystem and university-driven robotics innovation are supporting the commercialization of AI-powered perception and navigation systems. These factors are expected to drive the sustained growth of AI-enabled robotics adoption across the country.

The Germany artificial intelligence in robotics industry is rapidly expanding, driven by the country’s leadership in automotive manufacturing, strong adoption of industrial automation, and growing investments in smart factory modernization. Germany’s strong robotics manufacturing base and system integration ecosystem further strengthen the deployment of advanced AI-driven automation solutions. These trends continue to reinforce Germany’s position as a key European market for AI in robotics.

Asia-Pacific Artificial Intelligence In Robotics Market Trends

The Asia-Pacific artificial intelligence in robotics industry accounted for the largest market share of over 45% in 2025, fueled by the rapid expansion of electronics and semiconductor manufacturing, rising adoption of smart factories, and strong government support for robotics-driven industrial transformation. Increasing demand for warehouse automation, last-mile delivery robotics, and AI-enabled quality inspection is further supporting market growth. Asia-Pacific’s strong innovation in edge AI chips and robotics hardware is enabling cost-effective deployment across industrial and service robotics. These factors are positioning Asia-Pacific as a growing market for AI in robotics.

The Japan artificial intelligence in robotics industry is gaining momentum, driven by the country’s leadership in industrial robotics, rising demand for automation in an aging society, labor shortages, and increasing adoption of AI-enabled service robots. The strong focus on human-robot collaboration is accelerating adoption in SMEs. Japan’s innovation in perception AI and robotics mobility systems is supporting the deployment of intelligent robots in public environments. These factors are strengthening Japan’s role as a high-value market for AI-enabled robotics solutions.

The China artificial intelligence in robotics industry is witnessing robust expansion, supported by large-scale industrial automation adoption, rapid deployment of AI-enabled robots, and strong domestic production of robotics hardware. Chinese manufacturers are increasingly using AI-powered industrial robots for electronics assembly, automotive production, and high-speed quality inspection, improving throughput and reducing dependency on labor. These factors are driving widespread adoption of AI-enabled robotics across China’s industrial and service sectors.

Key Artificial Intelligence in Robotics Company Insights

Some of the key players operating in the market are NVIDIA Corporation and YASKAWA ELECTRIC CORPORATION, among others.

-

NVIDIA Corporation is a global company in AI computing and accelerated hardware platforms, enabling advanced artificial intelligence in robotics through GPU-powered training, simulation, and real-time inference for autonomous and collaborative robotic systems. The company’s Isaac robotics platform, edge AI modules, and AI software ecosystem support critical capabilities, motion planning, reinforcement learning, and multi-sensor fusion across industrial robots, AMRs, and humanoid robotics. Strong partnerships across robotics manufacturers and system integrators, NVIDIA continues to strengthen its role as a foundational technology provider in the artificial intelligence in robotics industry.

-

YASKAWA ELECTRIC CORPORATION is a major industrial robotics and automation company, specializing in AI-integrated robotic arms, motion control systems, and intelligent automation solutions used across automotive, electronics, logistics, and manufacturing applications. The company is increasingly advancing AI-driven robotics capabilities through machine vision, predictive maintenance, adaptive control, and smart factory integration, enabling robots to operate with higher precision, flexibility, and reduced downtime. YASKAWA remains a core player who drives large-scale adoption in the artificial intelligence in robotics industry.

Diligent Robotics Inc. and Starship Technologies are some of the emerging participants in the artificial intelligence in robotics industry.

-

Diligent Robotics Inc. is an emerging service robotics company focused on AI-powered autonomous mobile robots designed to support healthcare operations, particularly in hospitals and clinical environments. The company’s robots leverage AI-based navigation, obstacle avoidance, task prioritization, and human-aware interaction to assist with internal logistics such as supply delivery, material transport, and workflow automation. With increasing adoption of service robotics in healthcare and rising demand for workforce optimization, Diligent Robotics is strengthening its presence as a high-growth emerging player in the market.

-

Starship Technologies is an autonomous robotics company specializing in AI-enabled last-mile delivery robots designed for sidewalks, campuses, and urban environments. The company’s autonomous systems rely on AI-driven perception, real-time mapping, route optimization, and edge-based decision-making to enable safe navigation in complex public spaces. With rising demand for contactless delivery, micro-fulfillment expansion, and autonomous logistics solutions, Starship Technologies is increasingly positioned as a high-potential emerging player in the artificial intelligence in robotics industry.

Key Artificial Intelligence In Robotics Companies:

The following key companies have been profiled for this study on the artificial intelligence in robotics market

- NVIDIA Corporation

- SoftBank Robotics Group

- Intel Corporation

- Boston Dynamics

- Advanced Micro Devices, Inc.

- HANSON ROBOTICS LTD.

- Starship Technologies

- Keenon Robotics Co., Ltd

- Diligent Robotics Inc.

- Brain Corporation

- YASKAWA ELECTRIC CORPORATION

- Universal Robots A/S

- Hanwha Robotics CO.LTD

- Franka Robotics GmbH

Recent Developments

-

In January 2026, NVIDIA Corporation unveiled GR00T N1.6 and related Isaac models independently at CES 2026, partnering with ecosystem players like Boston Dynamics, Franka Robotics, Hugging Face (via LeRobot), and others for Jetson Thor integration and humanoid robot demos, further solidifying its leadership in the artificial intelligence in robotics industry.

-

In January 2026, Google DeepMind partnered with Boston Dynamics to integrate Gemini Robotics foundation models into Atlas robots, focusing on cognitive reasoning. This partnership supports Google’s evolution in artificial intelligence in robotics technology adoption.

-

In October 2025, Intel Corporation launched the Robotics AI Suite, featuring reference applications, AI-optimized hardware configurations, OpenVINO libraries, and benchmarking tools integrated with Core Ultra processors to accelerate edge robotics from pilot to production. The suite enhances perception, motion planning, and imitation learning for industrial automation, boosting deployment speed.

Artificial Intelligence In Robotics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 26,128.9 million

Revenue forecast in 2033

USD 182,705.1 million

Growth rate

CAGR of 32.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, robots, technology, end use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

NVIDIA Corporation; SoftBank Robotics Group; Intel Corporation; Boston Dynamics; Advanced Micro Devices, Inc.; HANSON ROBOTICS LTD.; Starship Technologies; Keenon Robotics Co., Ltd; Diligent Robotics Inc.; Brain Corporation; YASKAWA ELECTRIC CORPORATION; Universal Robots A/S; Hanwha Robotics CO.LTD; Franka Robotics GmbH.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Artificial Intelligence In Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the artificial intelligence in robotics market report based on offering, deployment, robots, technology, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premise

-

Cloud

-

-

Robots Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial Robots

-

Service Robots

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning

-

Computer Vision

-

Natural Language Processing

-

Context Aware Computing

-

Edge Computing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Manufacturing

-

Transportation and Logistics

-

Healthcare

-

Retail

-

Aerospace

-

Military and Defense

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in robotics market size was estimated at USD 20,433.0 million in 2025 and is expected to reach USD 26,128.9 million in 2026

b. The hardware segment accounted for the largest market share of over 56% in 2025, driven by demand for high-performance processors, AI accelerators, advanced sensors, and edge computing hardware that enable real-time decision-making in robots. The expansion of industrial automation in manufacturing, logistics, and warehousing is accelerating the adoption of intelligent robotic hardware. Advancements in collaborative and service robots are increasing the need for compact, energy-efficient, and high-speed AI hardware platforms. These factors in the AI-driven robotic hardware are emerging as a critical enabler of next-generation automation strategies.

b. Some key players operating in the artificial intelligence in robotics market include NVIDIA Corporation, SoftBank Robotics Group, Intel Corporation, Boston Dynamics, Advanced Micro Devices, Inc., HANSON ROBOTICS LTD., Starship Technologies, Keenon Robotics Co., Ltd, Diligent Robotics Inc., Brain Corporation, YASKAWA ELECTRIC CORPORATION, Universal Robots A/S, Hanwha Robotics CO.LTD, Franka Robotics GmbH.

b. The market growth is driven by surging demand for automation across manufacturing, healthcare, logistics, and e-commerce sectors. Government-backed Industry 4.0 initiatives, rising investments in humanoid and collaborative robots, and IT/OT convergence are further driving the market expansion.

b. The global artificial intelligence in robotics market is expected to grow at a compound annual growth rate of 32.0% from 2026 to 2033 to reach USD 182,705.1 million by 2033

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.