- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Aramid Fiber Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Aramid Fiber Market Size, Share & Trends Report]()

Asia Pacific Aramid Fiber Market Size, Share & Trends Analysis Report By Product (Para-aramid, Meta-aramid), By Application (Security & Protection, Frictional Materials, Rubber Reinforcement, Optical Fibers), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-234-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Asia Pacific Aramid Fiber Market Trends

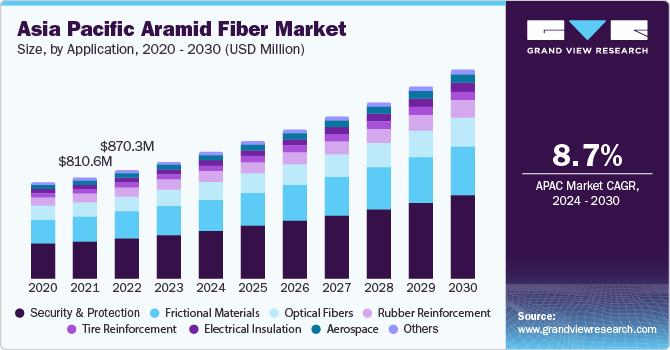

The Asia Pacific aramid fiber market size was estimated at USD 940.6 million in 2023 and is anticipated to grow at a CAGR of 8.7% from 2024 to 2030. The growth in the market is driven by the increasing demand for security and protection measures across various industries, as well as the rising usage of aramid fibers as alternatives to asbestos and steel. Factors such as the increasing demand for internet from emerging economies, rapid industrialization, and strong growth in the telecom sector are expected to boost aramid fiber demand in the coming years.

Aramid fibers are known for their toughness, synthetic nature, and heat resistance, making them appropriate for military and aerospace applications, such as ballistic-grade body armor. They are resistant to flames and heat and do not ignite or melt under normal oxygen levels. Aramid fibers are also used in place of metal wire and organic fibers in structural composite applications, such as ropes for offshore oil rigs, marine and aerospace sectors, automobiles, and bulletproof vests, due to their superior mechanical properties compared to other synthetic fibers.

This need for security and protection measures in sectors such as healthcare/medical, mining, oil & gas, manufacturing, building & construction, and military is driving the adoption of aramid fibers in major economies such as China and India, presenting significant growth opportunities.

Furthermore, growing investments in construction, manufacturing, and healthcare sectors are anticipated to fuel demand for global aramid fiber market in the coming years. In addition, increasing demand for the Internet from emerging economies, rapid industrialization, and robust growth in the telecom industry are expected to drive the demand for para-aramid fibers in the coming years. The expansion of the industrial sector in developing countries such as China and India is also expected to contribute to market growth over the forecast period.

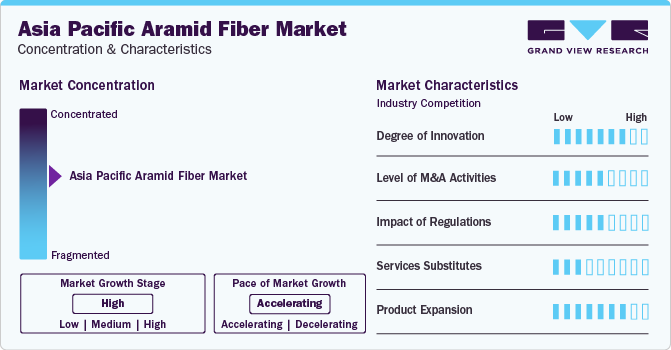

Market Concentration & Characteristics

The aramid market in the Asia Pacific region is characterized by a high level of innovation, driven by continuous R&D efforts aimed at improving fiber characteristics and discovering new applications. The market players differentiate themselves and maintain competitiveness through innovative manufacturing processes and product designs.

The market experiences a moderate level of mergers and acquisitions. Although there have been cases of consolidations and strategic alliances to broaden market reach and capabilities, the rate of these activities is not as high as in other industries. This is due to the specialized nature of aramid fiber production and the limited number of major players.

Regulations related to safety, environmental sustainability, and product standards moderately influence market operations. While adherence to strict regulations affects manufacturing processes, product specifications, and barriers to market entry, the overall regulatory environment is manageable for established players.

The market witnessed a high degree of product expansion as companies continually innovate to develop new variants of aramid fibers designed for specific applications. These expansion efforts focus on developing aramid fibers with enhanced features such as increased tensile strength, flame resistance, and durability to meet the different industry demands.

Application Insights

The security & protection segment dominated the market and accounted for the largest revenue share of 37.6% in 2023. The growth in this market is mainly driven by escalating demand for safety and protection applications across various sectors. This surge can be attributed to the heightened concern for personnel safety in military and industrial settings. Aramid fibers are increasingly being utilized in the manufacture of bullet-resistant and protective clothing, as well as stab-resistant products such as helmets and protective gloves. Moreover, the aerospace industry's adoption of aramid fibers in components such as primary wings, fuselage structures, landing gear doors, and leading and trailing edge panels of new-generation aircraft is expected to further fuel market growth. This is due to aramid fibers' superior strength, impact resistance, and low weight, which contribute to high product consumption.

The frictional material segment held a significant market share in 2023, mainly due to the widespread use of aramid fibers as a substitute for asbestos in friction and sealing products. These fibers are also employed as reinforcement material in the production of friction products such as brake pads and clutch plates. In addition, aramid fibers find application in high-pressure/temperature hoses, gaskets and seals, which are expected to contribute to market growth during the forecast period.

The optical fiber segment also captured a substantial revenue share in 2023, primarily because aramid fibers are used as the strength member in the design and manufacture of fiber optic cables. This is possible due to aramid fibers' beneficial properties, such as low weight, flexibility, dielectricity, and handling requirements in an optical fiber cable. Optical fibers have numerous applications, including aerial dielectric self-supporting cables, premise cables, water-blocking yarns, fiber to the home (FTTH), ballistic tapes, and ripcords.

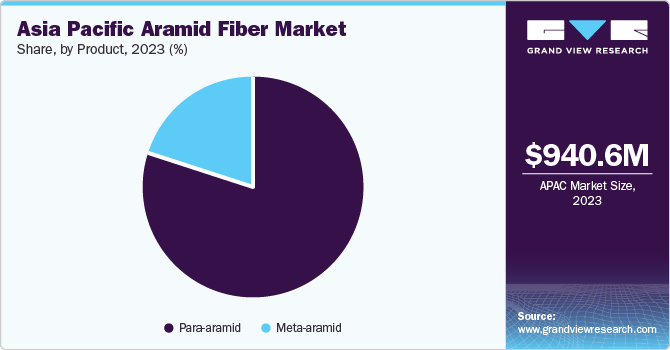

Product Insights

The para-aramid led the market and accounted for the largest revenue share of 78.93% in 2023. The salient properties of para-aramid fiber, such as high heat and flame resistance, exceptional chemical resistance, high resistance to cuts, outstanding ballistic properties, and good chemical resistance, have driven its growth in various applications, including aerospace, security and protection, and frictional materials. Para-aramid fiber is a synthetic fiber that demonstrates high tensile strength and modulus behavior, offering an excellent strength-to-weight ratio. In recent years, its popularity has soared, and it is now utilized in various products such asnallyy ballistic protection, wire and cables, hose reinforcement, race cars, and protective gloves.

Meta-aramid registered a significant market share in 2023, due to its high resistance to chemical degradation, temperature, and abrasion. This type of aramid fiber is unique in its ability to withstand tensile stress when exposed to flames and temperatures of up to 400°C. Meta-aramid fibers are employed in various applications, including protective clothing for military personnel, electrical insulation, auto racing, and protective equipment for various industrial sectors.

Country Insights

China Aramid Fiber Market Trends

The Aramid fiber market in China accounted for the largest revenue share of 43.9% in 2023. This growth is primarily driven by the increasing demand from the military and industrial sectors for personnel security and protection. In addition, aramid fiber market growth is expected to continue over the forecast period due to rising demand from military and industrial sectors. The personal protective equipment and automotive industries are also anticipated to increase aramid fiber demand in the country. Furthermore, increased research and development activities by market players are expected to boost product demand.

India Aramid Fiber Market Trends

The India aramid fiber market held a significant share in 2023, primarily due to the growing demand from various sectors such as security & protection, electrical insulation, rubber and tire reinforcement, optical fibers, aerospace, and frictional materials. Favorable government initiatives such as "Make in India" are expected to drive investments in sectors such as aircraft, electronics, and automotive manufacturing industries. The demand for protective equipment is expected to grow due to stringent product testing and compliance with regulatory standards in electronics and pharmaceuticals.

Japan Aramid Fiber Market Trends

The aramid fiber market in Japan experienced substantial growth in 2023, driven by the increased use of aramid fiber as an alternative to asbestos and steel, higher fuel efficiency in automotive, and technological advancements in transportation. Aramid fibers are used in tire reinforcement applications to decrease fuel consumption and enhance automobile performance, comfort, and protection. The presence of key automotive manufacturers such as TOYOTA, Lexus, Suzuki, Mazda, Honda, Acura, Mitsubishi, Nissan, Infiniti, and ISUZU in the country further fuels aramid fiber demand.

Key Asia Pacific Aramid Fiber Company Insights

The Asia Pacific aramid fiber market is moderately concentrated as it is dominated by a few major players. Companies such as Tejin Ltd. and Kolon Industries hold substantial market shares due to their broad product range, technological prowess, and global presence.

Key players in the market include Teijin Ltd.; Toray Chemicals South Korea, Inc.; and Kolon Industries, Inc.:

-

Teijin Ltd. is a diversified company that offers a variety of products and services in sectors such as healthcare, environment & energy, safety & protection, and information & electronics. Its aramid fiber operations are managed through its subsidiary, Teijin Aramid B.V., and it provides high-performance fibers, composites, and carbon fibers under its advanced fibers and composites segment.

-

Toray Chemicals South Korea, Inc. is a producer of aramid fibers and operates in various industries including plastics & chemicals, fibers & textiles, IT-related products, life science, environment and engineering, and other services. The company's product portfolio includes items such as PET resins, filters, films, staple fibers, filaments, aramid fiber, and melt-blown non-woven fiber.

SRO Aramid (Jiangzu) Co., Ltd.; Apex Tech Tex; and Huvis Corp. are some other participants in the Asia Pacific aramid fiber market

-

Huvis Corp. specializes in the production of various types of fibers including super fiber, differentiated fiber, and environment-friendly fiber. The company's operations are divided into four segments: super fibers, polyester fibers, water treatment, and industrial materials.

Key Asia Pacific Aramid Fiber Companies:

- Teijin Ltd.

- Yantai Tayho Advanced Materials Co. Ltd.

- Hyosung Corp.

- Toray Chemicals South Korea, Inc.

- Kolon Industries, Inc.

- Huvis Corp.

- China National Bluestar (Group) Co., Ltd.

- SRO Aramid (Jiangzu) Co., Ltd.

- Apex Tech Tex

- Supertech Fabrics Private Limited

Recent Developments

-

In February 2024, Teijin Limited announced, that it has signed a collaboration agreement with the Japanese Red Cross College of Nursing (JRCCN) to conduct tests showing the potency of hydrogen fuel cell generators as a backup power source in the event of a disaster. The objective is to confirm that hydrogen fuel cell generators are a reliable emergency power supply in enclosed locations where running diesel or gasoline generators could be hazardous. In enclosed places such as homes and shelters, the trials will take into account the best placement sites for installations and ventilation techniques.

-

In December 2023, Kolon Industries declared that it had invested KRW 298.9 billion in its Gumi factory to increase the capacity of its Aramid product "Heracron" production facilities, bringing the total yearly production to 7,810 tons. With the integration of cutting-edge ICT technology, the expanded Aramid plant has been designed as a next-generation smart factory. To provide consistent quality control throughout the polymerization and production process, a real-time monitoring system has been implemented. Specifically, the completely automated unmanned packaging process is anticipated to boost output while lowering the possibility of safety mishaps.

-

In August 2023, Huvis (CEO Shin You Dong, 079980) announced that it had successfully created the first-ever "Chemical Recycle Low Melting Fiber (CR-LMF)" in history, using waste plastic that has been chemically recycled as its main component. Because of its lower melting temperature, the eco-friendly and highly innovative LMF is a versatile adhesive that can be used to attach a wide range of materials. One notable feature of LMF is that it melts at a temperature of 110-120°C, which is much lower than the 265°C threshold of conventional polyester. This efficiency results in significant energy savings and reduced CO2 emissions when bonding. The CR-LMF version reduces the use of crude oil and further reduces CO2 emissions by an astounding 20% to 57%. It is made from recycled waste plastics.

Asia Pacific Aramid Fiber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.01 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons, Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application,country

Country scope

China; India; Japan; South Korea

Key companies profiled

Teijin Ltd.; Yantai Tayho Advanced Materials Co. Ltd.; Hyosung Corp.; Toray Chemicals South Korea, Inc.; Kolon Industries, Inc.; Huvis Corp.; China National Bluestar (Group) Co., Ltd.; SRO Aramid (Jiangzu) Co., Ltd.; Apex Tech Tex; Supertech Fabrics Private Limited.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Aramid Fiber Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific aramid fiber market report based on product, application, and country.

-

Product Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Para-aramid

-

Meta-aramid

-

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Security & Protection

-

Frictional Materials

-

Rubber Reinforcement

-

Optical Fibers

-

Tire Reinforcement

-

Electrical Insulation

-

Aerospace

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific filters market size was estimated at USD 35.1 billion in 2023 and is expected to be USD 37.38 billion in 2024.

b. The Asia Pacific filters market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 54.4 billion by 2030.

b. The motor vehicles segment dominated the Asia Pacific filters market with a revenue share of 45.0% in 2023, on account of several factors including the substantial automotive industry in the region, which is fueled by the increasing vehicle production and sales in populous countries like China and India.

b. Some of the key players operating in the Asia Pacific filters market include Qualcomm Technologies; Mann+Hummel; Molex; TE Connectivity; Microsemi Corporation; Qorvo Inc.; Anantech Electronics; Crystek Corporation; CTS Corporation; Cummins.

b. Key factors that are driving the Asia Pacific filters market growth include the region’s industrialization advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."