- Home

- »

- Pharmaceuticals

- »

-

Australia Legal Cannabis Market Size, Industry Report, 2033GVR Report cover

![Australia Legal Cannabis Market Size, Share & Trends Report]()

Australia Legal Cannabis Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Marijuana, Hemp), By Derivative (CBD, THC), By End Use (Medical Use, Recreational Use, Industrial Use), And Segment Forecasts

- Report ID: GVR-4-68038-472-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Australia Legal Cannabis Market Summary

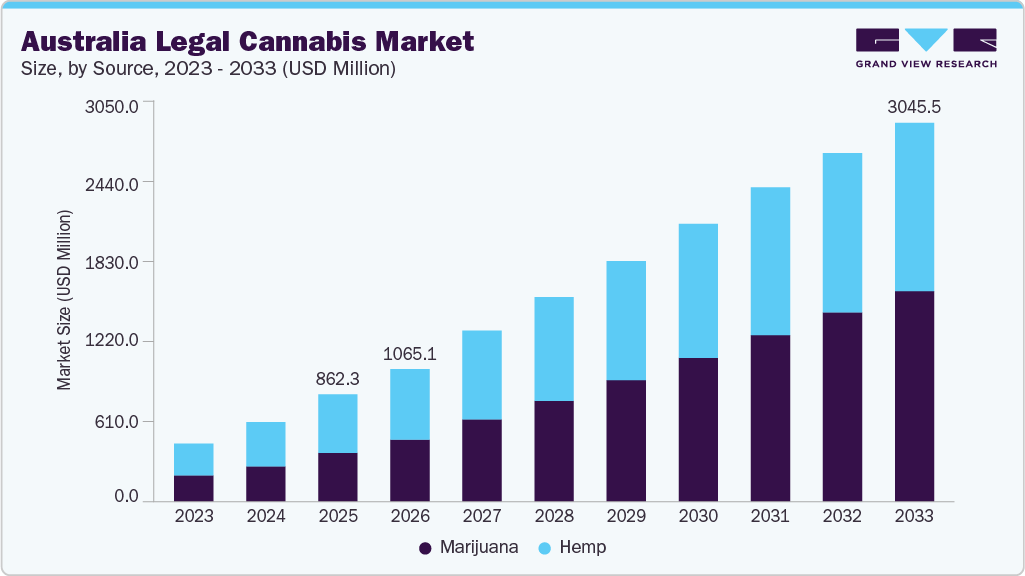

The Australia legal cannabis market size was estimated at USD 123.9 million in 2024 and is projected to reach USD 815.1 million by 2033, growing at a CAGR of 20.3% from 2025 to 2033. The industry is driven by growing awareness of the health benefits of cannabis and the growing legalization of marijuana, mostly for medical purposes.

Key Market Trends & Insights

- By source type, the hemp segment held the highest revenue share of 67.1% in 2024.

- Based on derivatives, the CBD segment held the highest market share in 2024.

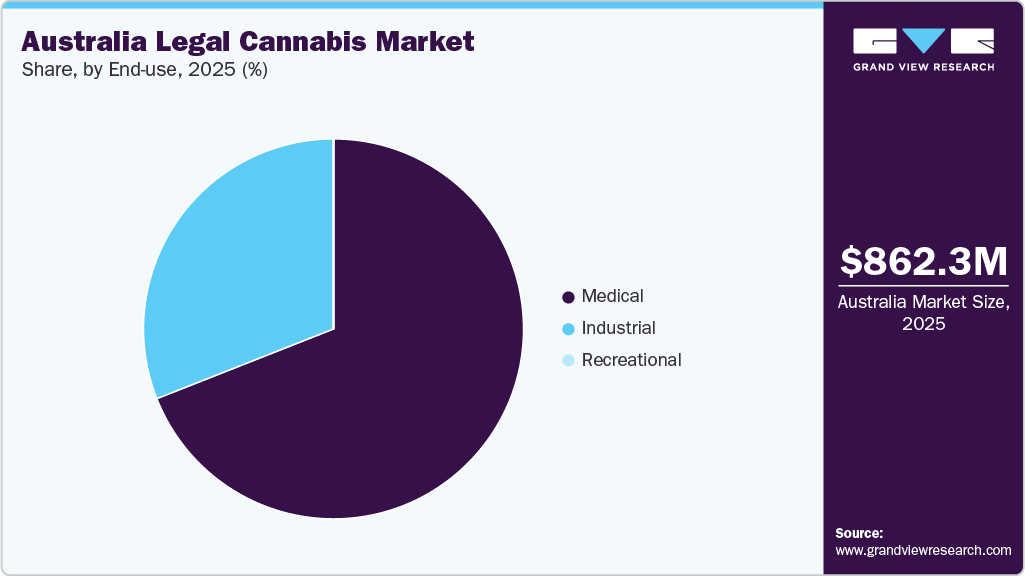

- Based on end use, the industrial segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 123.9 Million

- 2033 Projected Market Size: USD 815.1 Million

- CAGR (2025-2033): 20.3%

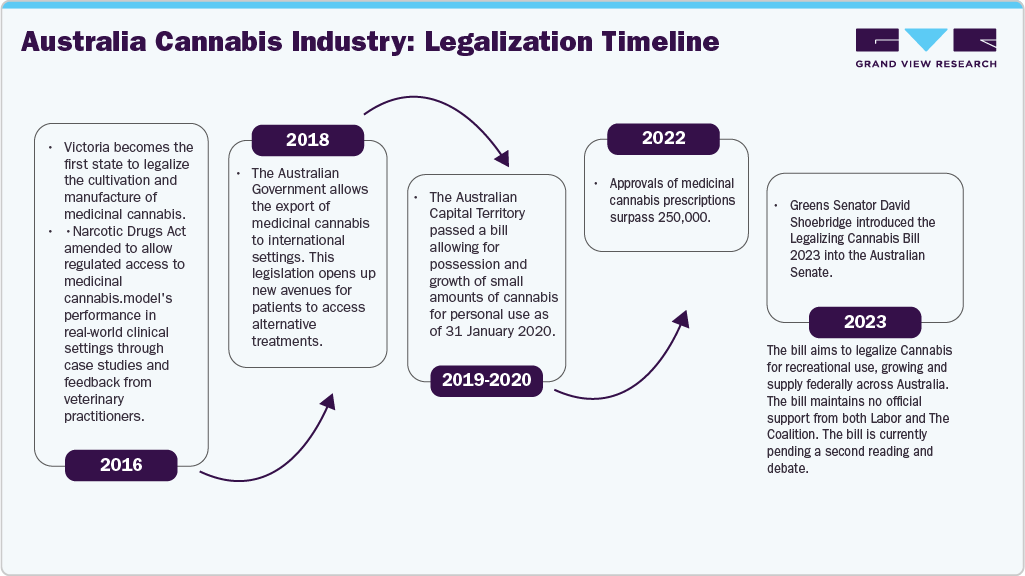

Furthermore, the increase in medical marijuana output as a result of increasing demand in the pharmaceutical sector is boosting overall growth. For instance, in 2016, the Australian Government legalized cannabis for medicinal purposes in all six states and two territories. Furthermore, the Therapeutic Goods Administration (TGA) regulates the supply of medicinal products in Australia.

In Australia, the legal framework regulating medicinal cannabis is constantly evolving and remains closely monitored. New legislation was enacted by the Australian government, allowing the Australian Capital Territory (ACT) to acquire and cultivate four plants per household for personal use. In October 2023, the Australian Capital Territory (ACT) introduced certain regulations on the use of products such as marijuana and hemp. It stated that individuals over 18 years old can own cannabis (fresh up to 150 grams or dried up to 50 grams). This factor is expected to contribute to their usage in Australia.

Moreover, as per the March 2025 updates, the tax benefit of recreational products in Australia is expected to reach USD 700 million annually, which is aimed at having significant implications for the industry. This figure, highlighted by the Australian Greens as they renew their pledge to advocate for legalizing recreational cannabis, underscores both the economic potential and the shifting political landscape surrounding cannabis legislation in Australia. The estimated USD 700 million revenue can be allocated to various public services, including healthcare, education, and infrastructure. By legalization, governments can create a new stream of income that can help alleviate budgetary pressures.

The rising use of marijuana, mostly for medical purposes, and the availability of several medicinal products are boosting market growth as customers adopt cannabis-based treatment. For instance, as per a Commonwealth of Australia report published in November 2024, there are two approved medicinal products registered on the Australian Register of Therapeutic Goods (ARTG): Epidyolex (cannabidiol) and Sativex Oromucosal Spray (nabiximols). Many other medicinal products are available but are unregistered or unapproved. In addition, more than 450 medicinal products are available in Australia. There are five different categories of cannabis products available, such as,

-

Category 1: CBD Medicinal Product (CBD >98%)

-

Category 2: CBD Dominant Medicinal Product (CBD >60% and <98%)

-

Category 3: Balanced Medicinal Product (CBD <60% and >40%)

-

Category 4: THC Dominant Medicinal Product (THC 60-98%)

-

Category 5: THC Medicinal Product (THC >98%).

The growing number of approvals of different forms & formulations of cannabis for medicinal usage is another factor expected to propel market growth. According to TGA data estimates between 2018 and 2023, dried herb and oral liquid were the two most commonly manufactured formulations of cannabis and approved by the SAS-B patient pathway.

Australian medical cannabis approvals by the SAS-B pathway, by form, 2018-2023

Form

2018

2019

2020

2021

2022

2023

Oral Liquid

-

-

-

51,870

63,020

10,190

Dried Herb

Purchase report license for the complete analysis

Oil

Solution

Inhalation

Capsule

Vaporization

Other

Total

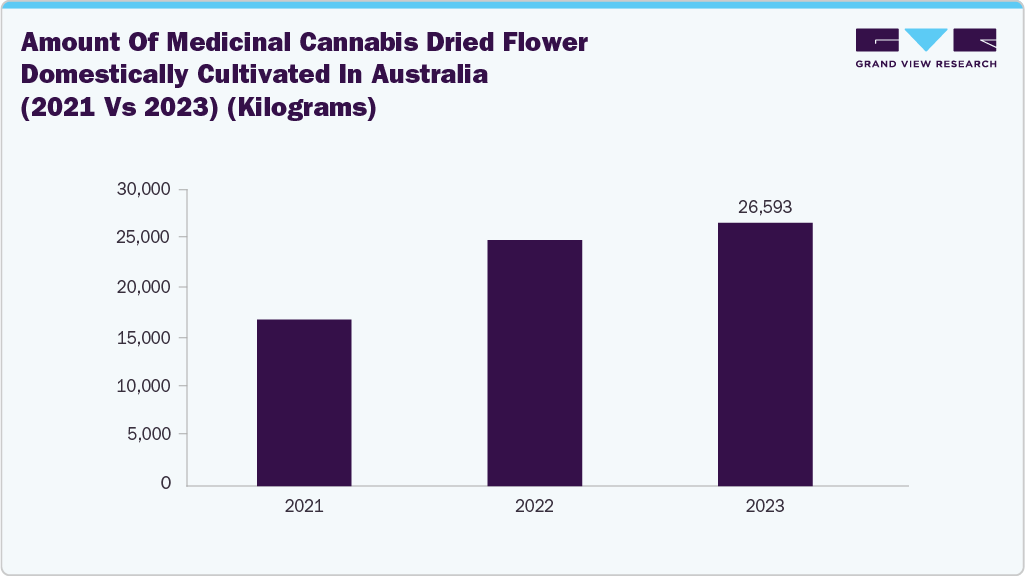

As Australia continues to expand its medicinal cannabis industry, the cultivation of domestically grown cannabis has become a key focus. The infographic below illustrates the significant increase in the amount of medicinal cannabis dried flower produced locally, comparing data from 2021 to 2023. This growth not only underscores the rising demand for medicinal cannabis but also highlights Australia's efforts to strengthen its domestic supply chain, ensuring both the availability and quality of products for medical use.

Moreover, Australia is increasingly adopting advanced cannabis cultivation technologies to improve production efficiency and product quality. The integration of high-tech solutions such as automated growing systems, climate control technologies, and hydroponics has become essential for meeting the growing demand for medicinal products. For instance, companies such as Cann Group Ltd utilize modular glasshouse systems that allow for precise environmental control, optimizing conditions for plant growth while minimizing resource use. In February 2023, Aurora Inc. partnered with MedReleaf Australia to launch a new medical brand, CraftPlant. This initiative aims to enhance the availability of premium products for patients in Australia, reflecting Aurora's commitment to expanding its international presence in the market.

Australia's cannabis testing laboratories play a vital role in ensuring the safety and quality of cannabis products since the legalization of medicinal cannabis in 2016. With increasing demand for compliance with regulations from the Therapeutic Goods Administration (TGA), these labs conduct essential tests for potency and contaminants like pesticides and heavy metals. The rise in testing facilities is driven by a growing number of prescriptions, with projections suggesting that around 670,000 patients will access them by 2030.

Furthermore, the cannabis e-commerce market in Australia is growing rapidly due to the legalization of medical cannabis and potential future recreational use. The TGA regulates medicinal products, resulting in over 450 available products, including oils, tinctures, and edibles. E-commerce platforms have made accessing these products more convenient, significantly boosting the country's industry. For instance, Xfive collaborated with Cannatrek to develop a comprehensive digital platform aimed at streamlining the medical cannabis prescription process. The platform serves multiple stakeholders, including doctors, pharmacists, and patients, facilitating the application and management of medical treatments. The team collaborated closely with Cannatrek to transform their vision into a functional and secure platform, addressing the unique challenges of the industry.

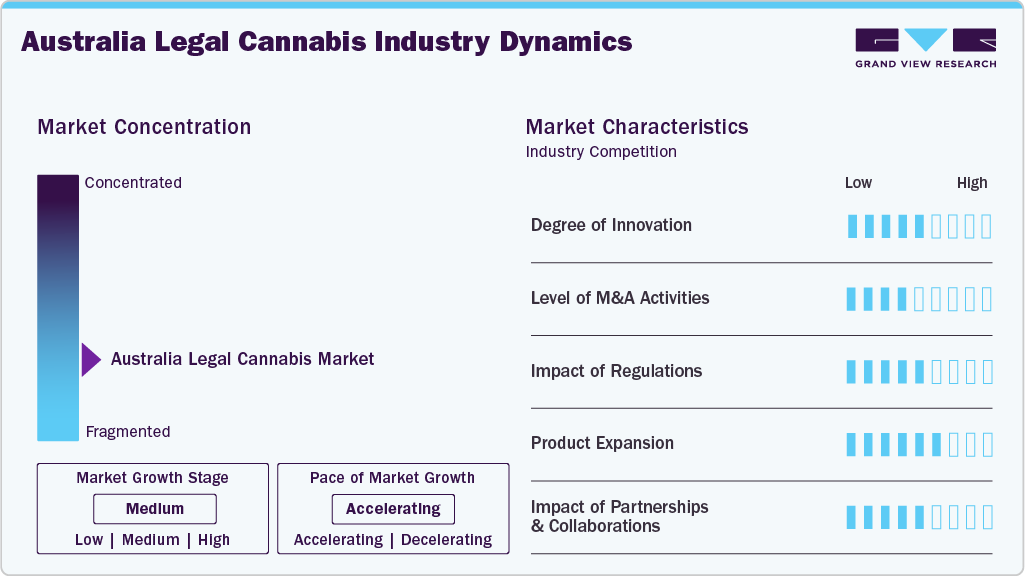

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, and impact of regulations, level of mergers & acquisition activities, and market expansion. For instance, the Australia legal cannabis industry is moderately consolidated, with few large players existing in the market and launching new products and innovative cultivation techniques. The degree of innovation is medium, the level of mergers & acquisition activities is medium, the impact of regulations on the market is high, and the market expansion is medium.

The degree of innovation in the industry is moderate. The innovation is attributed to products being used in cases where patients suffer from severe, persistent symptoms that do not respond adequately to conventional therapies recommended for their condition. In April 2025, Tilray Medical announced the launch of its first medical cannabis edibles in Australia under the brand name Good Supply Pastilles. This initiative aims to meet the increasing demand for alternative treatment options among patients who may prefer non-inhalation methods due to health concerns or personal preferences.

Market players implement diverse business strategies to increase revenue growth, fostering market growth. For instance, in February 2024, Aurora Inc., a Canada-based medical cannabis company, acquired approximately 90% equity interest in MedReleaf Australia, a distributor of medical cannabis products in Australia, at an enterprise value of USD 32.6 million to strengthen its presence in Australia.

Legal cannabis regulation in Australia involves a comprehensive framework that governs the cultivation, manufacturing, distribution, sale, and medical use of cannabis. In Queensland, the Drugs Misuse Act 1986 (Part 5B) and the Drugs Misuse Regulation 1987 (Part 4) supervise industrial cannabis production. Moreover, the Commonwealth Narcotic Drugs Act 1967 exclusively authorizes cannabis cultivation for medicinal use in Australia.

Key industry participants are directing their efforts toward geographical expansion to seize opportunities within previously unexplored markets. This expansion typically involves the establishment of manufacturing facilities and research and development centers in new regions or through mergers and acquisitions with companies in different locations. For instance, in January 2024, Cronos Group Inc. expanded its distribution network to the Australian market by providing its first delivery of cannabis flowers to Vitura Health Limited, a medicinal cannabis products manufacturer. The company owns approximately 10% of the common shares of Vitura (Cronos Australia).

Source Insights

Based on the source type, the hemp segment dominated the market for legal cannabis in Australia and accounted for the highest revenue share of 67.1% in 2024. The growth is attributed to increasing rates of ailments such as epilepsy and other sleep disorders, and increased usage of hemp-based goods, such as hemp CBD and supplements, for their many health advantages. For instance, according to Epilepsy Action Australia, epilepsy was diagnosed in 250,000 people in Australia. Moreover, the growing use of hemp-based products for various industrial purposes and increased demand for green buildings due to environmental degradation are expected to propel the market for hemp-based construction materials over the forecast period.

The marijuana segment is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to the therapeutic benefits of marijuana to ease the suffering from illnesses such as cancer, AIDS, multiple sclerosis, glaucoma, seizure disorders, spinal cord injuries, chronic pain, and other disorders. According to the Australian Institute of Health and Welfare, approximately 165,000 cancer cases were diagnosed, resulting in around an 88% increase from 2000. Furthermore, according to the WAAC, in 2023, there were around 29,000 individuals living with HIV, and over 90% getting treated for the same. Moreover, according to the Australian Institute of Health and Welfare, in 2019, 2.7% (600,000 people) of the total Australian population used cannabis for medical purposes. Thus, the increasing number of such disorders is expected to result in increased use of marijuana for medical purposes, further driving the segment's growth.

Derivatives Insights

Based on the derivatives, the CBD segment had the largest market share of 63.5% in 2024. The growth is attributed to the legalization of low-dose CBD products by TGA; even though these products have been legalized, they have yet to be approved by the Australian Register of Therapeutic Goods (ARTG). CBD medical products can be imported into Australia through the Authorised Prescriber and Special Access schemes. CBD has been approved for various conditions, such as treating epileptic seizures, nausea caused by chemotherapy, and arthritic pain. According to the Alcohol and Drug Foundation, there are two CBD products approved in Australia, such as nabiximols from the Sativex brand and cannabidiol from the Epidyolex brand.

The THC segment is expected to grow at a lucrative CAGR during the forecast period. This growth is driven by increasing medical applications, evolving consumer preferences, and legislative changes. The therapeutic benefits of THC (tetrahydrocannabinol), particularly for conditions such as chronic pain, cancer-related symptoms, and neurological disorders, have led to a growing acceptance and demand for THC-based products. For instance, the Australian Institute of Health and Welfare reported that approximately 165,000 cancer cases were diagnosed in Australia in 2023, which has contributed to a significant increase in the use of medical marijuana among patients seeking relief from symptoms associated with their condition. Moreover, as awareness grows about the potential health benefits of THC and as more patients seek alternative treatments outside conventional pharmaceuticals, the segment is expected to continue its rapid expansion.

End Use Insights

The industrial application segment dominated the market and accounted for the largest revenue share of 63.6% in 2024. The construction, personal care, food and beverage, automotive, and textile industries are all witnessing an increase in demand for hemp fibers and oil, which is helping the category grow. Varnishes, fuel, oil paints, putty, solvents, chain-saw lubricants, printing inks, and coatings are all expected to increase demand. Furthermore, hemp can be used as an alternative protein source in food products and as animal feed. Cannabis is rapidly used in non-textile applications to reduce deforestation, pollution, and landfill waste. Cannabis for industrial use in Queensland, Australia, is regulated under the Drugs Misuse Act 1986 (Part 5B) and the Drugs Misuse Regulation 1987 (Part 4).

The recreational segment is expected to grow at the fastest CAGR during the forecast period. The growth is driven by changing public perceptions, legislative developments, and increasing consumer demand. Public support for cannabis legalization has been steadily rising, with a significant portion of the population advocating for its recreational use. For instance, a YouGov poll conducted in December 2023 indicated that approximately 54% of Australians favored decriminalization and personal cultivation of cannabis. This shift in public sentiment is crucial as it influences policymakers to consider more progressive legislation. In addition, the growing variety of cannabis products is drawing mainstream consumers, prompting retailers to offer not just traditional smoking items, but also edibles, beverages, and topicals. As awareness of cannabis benefits like relaxation and social enjoyment increases, demand for these products continues to rise.

Key Australia Legal Cannabis Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. For instance, in October 2023, AgriFutures Australia, a Research and Development Corporation, invested USD 2.5 million over five years to conduct research into four key areas such as hemp primary production, hemp seeds and varieties, hemp sustainability, and hemp products. Market players such as Zelira AusCann Group Holdings Ltd. and others dominated the market. These key players have been supplying cannabis for medical purposes. Furthermore, emerging players, including ECOFIBRE and Bod Australia, are undertaking several partnerships and research studies to promote cannabis-based medicines.

Key Australia Legal Cannabis Companies:

- Cann Group Limited

- Zelira Therapeutics

- AusCann Group Holdings Ltd.

- Bod Australia

- Althea Group

- ECOFIBRE

- Botanix Pharmaceuticals

- EPSILON

- Little Green Pharma

- Incannex

Recent Developments

-

In April 2025, Software Effective Solutions Corp., operating under the name Medcana, announced a significant strategic expansion into the Australian market through the acquisition of licenses for the import and distribution of pharmaceutical cannabis. This move is part of Medcana's broader global growth strategy aimed at enhancing its international presence in the medical cannabis sector.

-

In February 2024, Peak Processing Solutions, an Althea Group Holdings subsidiary, signed an agreement with Collective Project to produce 6 cannabis-based beverage products based on contract manufacturing.

-

In January 2024, Althea Group Holdings Limited, a manufacturer and distributor of cannabis-based products, launched two new products, Althea THC10 and Althea CBD3:THC2, and expanded its softgel capsule product range.

Australia Legal Cannabis Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 815.1 million

Growth rate

CAGR of 20.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sources, derivatives, end use

Country scope

Australia

Key companies profiled

Cann Group Limited; Zelira Therapeutics; AusCann Group Holdings Ltd.; Bod Australia; Althea Group; ECOFIBRE; Botanix Pharmaceuticals; EPSILON; Little Green Pharma; Incannex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Australia Legal Cannabis Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the Australia legal cannabis market report based on sources, derivatives, and end use:

-

Sources Outlook (Revenue, USD Million, 2021 - 2033)

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

Hemp

-

Hemp CBD

-

Supplements

-

Industrial Hemp

-

-

-

Derivatives Outlook (Revenue, USD Million, 2021 - 2033)

-

CBD

-

THC

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer

-

Post Traumatic Stress Disorder (PTSD)

-

Parkinson's Disease

-

Tourette

-

Others

-

-

Recreational

-

Industrial

-

Frequently Asked Questions About This Report

b. The Australia legal cannabis market size was estimated at USD123.90 million in 2024 and is expected to reach USD 186.38 million in 2025.

b. The Australia legal cannabis market is expected to grow at a compound annual growth rate of 20.25% from 2025 to 2033 to reach USD 815.10 million by 2033.

b. Hemp dominated the Australia legal cannabis market with a share of 67.11% in 2024. This is attributable to the increased number of patients consuming hemp-based products such as hemp CBD and supplements for various health benefits.

b. Some key players operating in the Australia legal cannabis market include AusCann Group Holdings Pty Ltd; Cann Group Ltd; Bod Australia; Zelira Therapeutics; Althea Group Holdings Limited; THC Global Group Limited; MGC Pharmaceuticals Ltd; and Ecofibre Limited.

b. Key factors that are driving the Australia legal cannabis market growth include the increasing legalization of marijuana for adult and medical use and the high consumption rate in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.