- Home

- »

- Automotive & Transportation

- »

-

Automotive Active Safety System Market Size Report, 2030GVR Report cover

![Automotive Active Safety System Market Size, Share & Trends Report]()

Automotive Active Safety System Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Adaptive Cruise Control, Night Vision System), By Sensor Type, By Vehicle Type, By Propulsion Type (ICE, Electric), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-401-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Active Safety System Market Summary

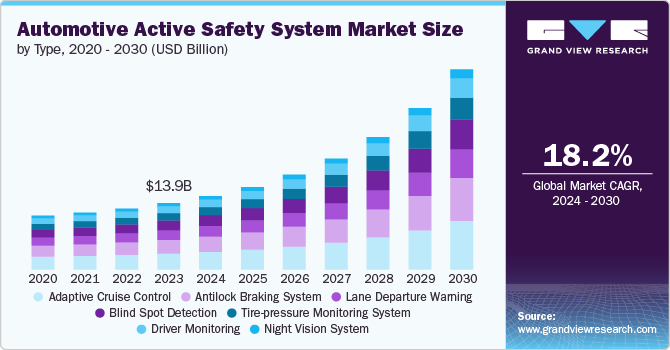

The global automotive active safety system market size was estimated at USD 13,859.0 million in 2023 and is projected to reach USD 41,826.1 million by 2030, growing at a CAGR of 18.2% from 2024 to 2030. In the automotive industry, active safety involves Advanced Driving Assistance Systems (ADAS) that aid drivers in minimizing the severity of accidents or preventing them by managing braking, steering, and propulsion.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, tire-pressure monitoring system accounted for a revenue of USD 13,859.0 million in 2023.

- Tire-pressure Monitoring System is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 13,859.0 Million

- 2030 Projected Market Size: USD 41,826.1 Million

- CAGR (2024-2030): 18.2%

- North America: Largest market in 2023

Increased integration of ADAS systems in modern vehicles is a major driving factor behind the growth of the market. In addition, rising government regulations to integrate active safety systems in vehicles and government initiatives such as tax credits or incentives to promote the adoption of electric vehicles are further propelling the market growth.

The shift towards autonomous driving technologies represents one of the most transformative trends in the market. Autonomous vehicles, equipped with sophisticated sensor arrays, artificial intelligence, and machine learning algorithms, are being developed to operate without human intervention. Companies are investing heavily in technologies such as full self-driving (FSD) systems, which include advanced radar, LiDAR, cameras, and GPS to enable vehicles to navigate complex driving environments safely. Thus, rising development of autonomous driving technologies to reduce human error, increase road safety, and revolutionize personal and commercial transportation is also boosting the market’s growth.

Regulatory bodies worldwide are implementing rigorous safety standards and requirements for active safety systems to mitigate accident risks and enhance driver protection. Regulations often mandate the integration of features such as automatic emergency braking, lane-keeping assist, and adaptive cruise control into new vehicles, ensuring that automakers meet specific performance criteria. For instance, in April 2024, The U.S. Department of Transportation’s National Highway Traffic Safety Administration finalized a new Federal Motor Vehicle Safety Standard requiring that automatic emergency braking (AEB), including pedestrian AEB, be standard on all light trucks and passenger cars by September 2029. This regulation is anticipated to significantly decrease the incidence of rear-end collisions and pedestrian accidents, thereby improving the market’s growth.

Vehicle-to-Everything (V2X) communication is also an emerging trend in the market, aimed at enhancing vehicle safety and traffic efficiency through advanced connectivity. V2X technology facilitates communication between vehicles, infrastructure, and other road users, enabling vehicles to share information about their speed, location, and direction with surrounding entities. This interconnected network supports various applications, including Vehicle-to-Vehicle (V2V) collision warnings, Vehicle-to-Infrastructure (V2I) traffic signal coordination, and Vehicle-to-Pedestrian (V2P) alerts. Thus, the integration of V2X systems is expected to play a crucial role in the development of smart cities and intelligent transportation systems, further driving market growth.

High costs associated with advanced safety technologies, including sensors, cameras, and radar systems, could hamper the growth of the market. In addition, concerns about cybersecurity threats and the potential for system malfunctions or false alerts could hinder the widespread adoption of active safety systems. Moreover, a factor that reduces the effectiveness of active safety systems is the variability of real-world road conditions. For instance, a modern lane-keeping system may only operate effectively on roads with well-defined lane markings. Thus, factors such as the high cost of advanced active safety systems, privacy and data security concerns, and other drawbacks of these systems could restrain the market growth.

Type Insights

The adaptive cruise control segment dominated the market in 2023 and accounted for a 24.2% share of global revenue. The widespread adoption of Adaptive Cruise Control (ACC), a sophisticated vehicle system, has been driven by advancements in technology, safety concerns, and consumer demand. ACC enhances both convenience and safety by allowing a vehicle to automatically adjust its speed to maintain a safe distance from the vehicle ahead. ACC contributes to improved vehicle efficiency by optimizing speed and reducing unnecessary acceleration and braking. This results in better fuel economy and reduced emissions, aligning with the growing emphasis on environmental sustainability and efficiency in the automotive sector. As consumers increasingly prioritize eco-friendly solutions, the efficiency benefits of ACC further drive its adoption and growth in the market.

The antilock braking system segment is projected to witness significant growth from 2024 to 2030. Technological advancements have significantly enhanced antilock braking systems capabilities, improving vehicle stability and control during hard braking or slippery conditions by preventing wheel lockup. Additionally, the growing awareness of road safety and the need to reduce accident rates further fuels the demand for these systems, as they play a critical role in preventing skidding and maintaining steering control. Thus, the growing demand for antilock braking systems is driven by increasingly stringent global safety standards and the heightened need for advanced safety features in vehicles.

Sensor Type Insights

The radar sensor segment dominated the market in 2023. These sensors provide accurate and real-time data on the distance, speed, and movement of objects around a vehicle, which is crucial for systems such as adaptive cruise control, collision avoidance, and lane-keeping assistance. By utilizing radar technology, vehicles can detect potential hazards and respond more quickly to dynamic road conditions, improving overall driver and passenger safety. The ability of radar sensors to operate effectively in various weather conditions, including rain and fog, further drives their demand in the market.

The camera sensor segment is projected to register significant growth from 2024 to 2030. Camera sensors provide critical visual data that enhances the functionality and accuracy of various safety features. The detailed visual information from camera sensors allows for precise detection of lane markings, road signs, pedestrians, and other vehicles, improving the system's ability to make real-time safety decisions. The continued advancement of camera technology, including enhancements in image processing and low-light performance, is expected to drive the demand for camera sensors from 2024 to 2030.

Vehicle Type Insights

The passenger cars segment dominated the market in 2023. Increasing production and sales of passenger cars such as SUVs, sedans, and luxury cars with various advanced safety features is driving the segment’s growth. In addition, active safety systems in passenger vehicles provide various benefits by preventing accidents, improving vehicle control, enhancing driver awareness, reducing fatigue, and ensuring compliance with safety regulations. Their various applications address a wide range of driving scenarios, making them essential for modern vehicle safety and driver assistance.

The light commercial vehicles segment is projected to witness considerable growth from 2024 to 2030. As businesses and logistics companies prioritize safety and efficiency, there is an increasing demand for advanced active safety systems in light commercial vehicles. Stricter safety regulations and standards are being enforced globally, requiring light commercial vehicles to be equipped with advanced safety features. The growing focus on fleet safety and operational efficiency drives the adoption of these technologies, thereby boosting the segment’s growth.

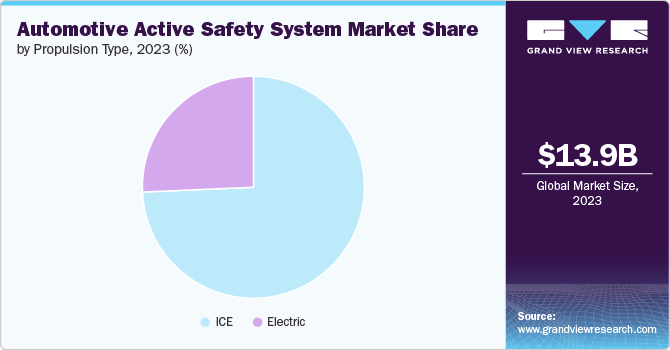

Propulsion Type Insights

The ICE segment dominated the market in 2023. In ICE vehicles, active safety systems are primarily focused on enhancing driver control and preventing accidents. These systems are essential for managing the dynamics of traditional vehicles, especially in emergencies where rapid braking or acceleration is required. Additionally, systems such as adaptive cruise control and lane departure warning are increasingly integrated into ICE vehicles, providing drivers with assistance that enhances safety and reduces fatigue during long drives. Thus, the rising integration of various active safety systems in ICE vehicles owing to their several benefits can be attributed to the segment growth.

The electric segment is projected to witness significant growth from 2024 to 2030. An increasing adoption of electric vehicles across the world is a major factor driving the segment’s growth. In addition, with advancements in sensor technologies such as lidar, radar, and cameras providing a comprehensive view of the vehicle’s environment, ADAS in electric vehicles has witnessed significant progress. Moreover, the integration of artificial intelligence and machine learning systems enables EVs to process real-time data, adapt to changing road conditions, and make informed decisions, thereby enhancing driving safety. Thus, the adoption of ADAS in electric vehicles is driving the segment’s growth.

Regional Insights

North America dominated the automotive active safety system market accounted for 34.06% of global revenue in 2023. The region’s strong automotive manufacturing sector, coupled with significant investments in autonomous driving technologies, supports the continuous development and integration of active safety systems in modern vehicle models, thereby boosting the market’s growth.

U.S. Automotive Active Safety System Market Trends

The automotive active safety system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. Stringent federal safety regulations and high consumer demand for safety and convenience features in automotive vehicles is the major driver behind the market growth. For instance, in U.S., the National Highway Traffic Safety Administration (NHTSA) and other regulatory bodies are driving the adoption of sophisticated safety systems, including AEB, lane-keeping assist, and adaptive cruise control in automobiles.

Europe Automotive Active Safety System Market Trends

Europe automotive active safety system marketis expected to grow at a notable CAGR from 2024 to 2030. In Europe, the automotive active safety system market is driven by strong regulatory frameworks and a high emphasis on safety standards. Europe has some of the most stringent safety regulations in the world, which drive the integration of ADAS in vehicles. For instance, in July 2024, new regulations regarding active safety features, including speed limiters, have been implemented across the European Union. The updated Regulation (EU) 2019/2144 or Vehicle General Safety Regulation (GSR2), revises the minimum performance standards (type approval) for motor vehicles within the EU, mandating the addition of various advanced driver assistance systems.

Asia Pacific Automotive Active Safety System Market Trends

The automotive active safety system market in the Asia Pacific is expected to grow at the highest CAGR from 2024 to 2030. Increasing vehicle production, rising disposable incomes, and growing awareness of road safety are some of the major factors behind the market’s growth in the region. Countries such as China, Japan, India, and South Korea are major contributors to this growth. Moreover, the increasing popularity of electric vehicles and autonomous vehicles in this region is further driving the demand for advanced active safety systems.

Key Automotive Active Safety System Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Automotive Active Safety System Companies:

The following are the leading companies in the automotive active safety system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen

- Autoliv Inc.

- Hyundai Mobis

- Valeo SA

- Magna International

- DENSO Corporation

- FLIR Systems

- Infineon Technologies.

Recent Developments

-

In April 2024, Volvo Buses, a bus manufacturing company, introduced new and enhanced active safety systems designed to help drivers navigate safely and avoid potential accident scenarios. These systems feature several components with a particular emphasis on safeguarding vulnerable road users, including cyclists and pedestrians.

-

In June 2023, Magna International expanded its active safety business by acquiring Veoneer Active Safety, a prominent company in automotive electronic safety systems. The acquisition positions Magna International as one of the few suppliers capable of addressing the rising complexity associated with advanced software, systems, and integration challenges by providing a comprehensive suite of solutions to its customers.

Automotive Active Safety System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.33 billion

Revenue forecast in 2030

USD 41.83 billion

Growth rate

CAGR of 18.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, sensor type, vehicle type, propulsion type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Robert Bosch GmbH; Continental AG; ZF Friedrichshafen; Autoliv Inc.; Hyundai Mobis; Valeo SA; Magna International; DENSO Corporation; FLIR Systems; Infineon Technologies

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Active Safety System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive active safety system market based on type, sensor type, vehicle type, propulsion type, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tire-pressure Monitoring System

-

Lane Departure Warning

-

Adaptive Cruise Control

-

Night Vision System

-

Driver Monitoring

-

Antilock Braking System

-

Blind Spot Detection

-

-

Sensor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Camera Sensor

-

Radar Sensor

-

Lidar Sensor

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Buses & Coaches

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive active safety system market size was estimated at USD 13.86 billion in 2023 and is expected to reach USD 15.33 billion in 2024.

b. The global automotive active safety system market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030, reaching USD 41.83 billion by 2030.

b. The adaptive cruise control segment dominated the market in 2023 and accounted for a 24.2% share of global revenue. The widespread adoption of Adaptive Cruise Control (ACC), a sophisticated vehicle system, has been driven by advancements in technology, safety concerns, and consumer demand. ACC enhances both convenience and safety by allowing a vehicle to automatically adjust its speed to maintain a safe distance from the vehicle ahead.

b. Some of the players operating in the automotive active safety system market include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen, Autoliv Inc., Hyundai Mobis, Valeo SA, Magna International, DENSO Corporation, FLIR Systems, and Infineon Technologies.

b. In the automotive industry, active safety involves Advanced Driving Assistance Systems (ADAS) that aid drivers in minimizing the severity of accidents or preventing them by managing braking, steering, and propulsion. Increased integration of ADAS systems in modern vehicles is a major driving factor behind the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.