- Home

- »

- Automotive & Transportation

- »

-

Automotive Battery Market Size, Share, Growth Report, 2030GVR Report cover

![Automotive Battery Market Size, Share & Trends Report]()

Automotive Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Drive (ICE, Electric Vehicle), By Vehicle (Passenger Cars, Commercial Vehicles, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-331-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Battery Market Summary

The global automotive battery market size was estimated at USD 69,108.5 million in 2023 and is projected to reach USD 105,612.9 million by 2030, growing at a CAGR of 6.4% from 2024 to 2030. Rising inclination towards adoption of zero-emission electric vehicles and hybrid vehicles over traditional vehicles, advancements in technology, and ease of availability are some of the key primary factors contributing to the growing demand for automotive batteries.

Key Market Trends & Insights

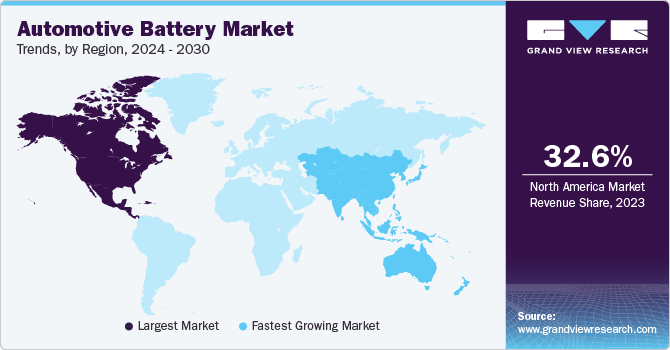

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, lithium-ion based accounted for a revenue of USD 69,108.5 million in 2023.

- Lithium-Ion Based is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 69,108.5 Million

- 2030 Projected Market Size: USD 105,612.9 Million

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

In recent years, major market participants have adopted strategies such as improved research & development efforts, innovation, and capacity enhancements in production plants. It is expected to develop further growth for this industry in the coming years.

The increasing global demand for cleaner energy and sustainable transportation has increased demand for electric vehicles run by batteries. For instance, the European Union has introduced a set of regulations to accomplish its aim to reduce net greenhouse gas emissions by at least 55% by 2030 and become the first climate-neutral continent by 2050. Growing awareness regarding the carbon footprint left by regular petrol/diesel vehicles has developed a large number of opportunities for this industry.

Promotional activities and government support through regulations and initiatives, such as offering subsidies in the total vehicle price, address consumer limitations such as higher initial costs, vehicle range, lack of awareness, and restricted model alternatives. These factors are expected to influence the demand for electric vehicles and, in turn, the automotive battery market. Long-term partnerships established between major manufacturing companies and other vendors have also contributed to the rapid growth of this industry.

Furthermore, the rising investment of companies in expanding production capacity through technological advancements, innovation, process improvements, and facility enhancements is expected to drive the growth of this industry. For instance, in April 2024, Panasonic Energy Co., Ltd., one of the prominent primary battery manufacturers and part of Panasonic Group, completed construction of its new production facility within its Suminoe premise in Osaka, Japan.

Type Insights

The lead-acid type battery segment dominated the global industry and accounted for a share of 53.5% in 2023. This growth is attributed to the increasing inclination toward the use of rechargeable batteries and the cost-effectiveness offered by the lead-acid type. This battery type is suitable for various climatic conditions and extreme temperatures. It has become more reliable for vehicles in regions experiencing extreme heat or cold. Lead-acid batteries have higher energy density than other types. These batteries can store more energy in relatively more minor space while providing a more extended drive range to the vehicles.

The sodium-ion type battery segment is expected to experience a significant CAGR during the forecast period. Factors such as ease of availability and environment-friendly nature drive the rise in the utilization and manufacturing of sodium-ion batteries. Moreover, sodium-ion batteries contain aluminum, available at a lesser price than copper used in lithium-ion batteries, making them a budget-friendly option for consumers and manufacturers. Also, this sodium-ion battery charges faster than lithium-ion batteries and has a higher operating temperature range, making it suitable for use in extreme temperatures.

Drive Insights

Electric Vehicles (EV) segment accounted for the largest revenue share in 2023. The growth of this segment is attributed to the growing popularity of electric two-wheelers and cars and rising awareness regarding sustainability. The cost-effectiveness offered by electric vehicles compared to conventional cars running on petrol or diesel has attracted a large customer base to the EV market. No to less noise levels, energy efficiency, government support, and growing market penetration attained by key brands in the market have driven growth for this segment.

The Internal Combustion Engine (ICE) vehicles segment is expected to experience a significant revenue share during the forecast period. This segment is primarily driven by aspects such as the emergence of the hybrid vehicles industry, increasing inclination towards using EVs while maintaining the option to drive conventional fuel-based cars, and ease of availability. Generally, lead-acid batteries are used in these vehicles to provide power for multiple purposes, including starting the car.

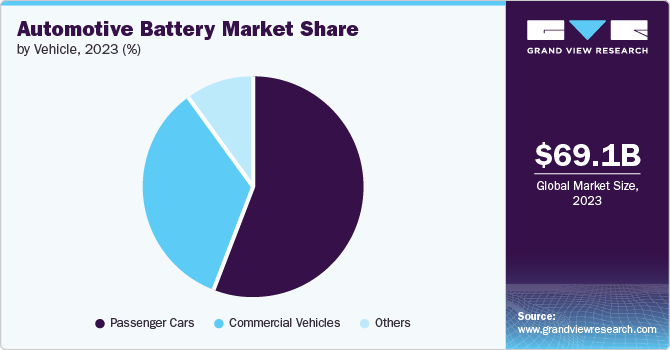

Vehicle Insights

Passenger cars segment accounted for the largest revenue share in 2023. The market is driven by the increased sale of mid-price range and premium-range passenger vehicles with additional features such as autonomy. Increasing consumer interest in electric cars is driving the uptake of automotive batteries, especially for this type of transportation. Environmental consciousness, improvements in battery technology, and government initiatives are driving growth for this segment.

The commercial vehicle segment is anticipated to experience the fastest CAGR over the forecast period. The lead-acid battery is widely used in commercial vehicles, providing high energy to heavy-duty vehicles, semi-trucks, and dump trucks. Major companies are investing in innovating emission-free batteries and integrating cutting-edge technology into the batteries to fulfill consumer demands. These batteries are designed to tolerate extreme temperatures, have high safety assurance, and be durable. These aspects are expected to generate more significant growth for this segment in the approaching years.

Regional Insights

North America automotive battery market dominated the global industry with revenue share of 32.6% in 2023. The anticipated market growth in this region is attributed to the presence of significant battery producers in the region. Growing number of EV buyers in the region, early technology adoption trends and presence of multiple large enterprises manufacturing EVs in the region is expected to fuel growth for this regional industry.

U.S. Automotive Battery Market Trends

The automotive battery market in U.S. held largest revenue share in regional industry and accounted for 81.3% in 2023. Factors such as awareness about greenhouse gas emission, reducing noise pollution and environmental concerns. The increase in electric vehicle users highlights the important role of automotive batteries in fueling these advanced technologies.

Europe Automotive Battery Market Trends

The automotive battery market in Europe was identified as a lucrative region in 2023. The presence of leading vehicle manufacturers such as Jaguar, Lamborghini, BMW, Volkswagen, Mercedes Benz, and others is expected to increase the need for car batteries in the region during the forecast period. Stricter regulations regarding emissions, investment by key companies in infrastructure enhancements, and rising demand for EVs in the region are expected to fuel the automotive battery market during the forecast period.

Germany automotive battery Market is expected to experience rapid growth in approaching years. This market is primarily driven by the presence of multiple automotive manufacturers, the existence of numerous technology-driven companies, and the increasing demand for electric and hybrid vehicles, which has driven this industry in the country. Innovations in several technical areas, such as lithium extraction technology, battery production, and green battery solutions, are likely to generate greater demand for this market.

Asia Pacific Automotive Battery Market Trends

The automotive battery market in Asia Pacific is anticipated to witness the fastest growth during the forecast period. Economies such as China, Japan, and India have been experiencing a significant rise in disposable income and an alarming need to address carbon emissions. The increasing need for automotive products in countries such as South Korea, India, and China is anticipated to positively affect the development of the region during the forecast period. Moreover, ongoing product development by multiple companies to create affordable and efficient vehicles is expected to support the expansion of the local market. Entry of numerous global companies from the industry, rising awareness regarding sustainability and reduction of greenhouse gases, and growing demand for EVs are key factors influencing the growth of this regional industry.

China automotive battery market held a substantial revenue share of regional industry in 2023. China has successfully obtained nearly 80 % of global lithium chemical production, and an impressive 70 % of cell manufacturing for the electric vehicles industry. In addition, government initiatives to offer subsidies determined by the cost gap between electric vehicles and vehicles powered by internal combustion engines are is driving the market growth.

Key Automotive Battery Company Insights

Some of the key companies in the market for automotive battery, include Exide Technologies, GS Yuasa International Ltd., Panasonic Holdings Corporation, LG Energy Solution., East Penn Manufacturing Company, and others.The industry has been experiencing unprecedented competition in recent years. To develop a competitive advantage over other market participants, prominent companies in the industry have adopted strategies such as enhanced research & development, innovation backed new product development, facility expansions and more.

-

Exide Technologies, a multinational company operating in battery manufacturing market, offers its products to multiple industries. It produces batteries for automotive, marine, power sport, heavy duty vehicles, and lawn & garden machines. In addition, it offers extensive battery and charging solutions for locomotives used in mining, material handling, and railroads.

-

Panasonic, one of the prominent organizations in battery packs, offers variety of battery solutions to automotive industry equipped with its technology excellence, and feature such as burst prevention vent plug, fluid loss prevention filter, and silver alloy technology.

Key Automotive Battery Companies:

The following are the leading companies in the automotive battery market. These companies collectively hold the largest market share and dictate industry trends.

- Exide Technologies

- GS Yuasa International Ltd.

- Panasonic Corporation

- LG Energy Solution

- A123 Systems Corp (Wanxiang A123 Systems Corp.)

- East Penn Manufacturing Company

- Robert Bosch GmbH

- ENERSYS.

- Samsung SDI

- Hitachi, Ltd.

Recent Developments

-

In March 2024, Exide Technologies acquired BE-Power GmbH. This strategic partnership represents a significant achievement as both companies can unite their respective strengths to drive innovation efforts with increased investments in the advanced lithium-ion business.

-

In May 2024, EnerSys signed an agreement to acquire Bren-Tronic, Inc., a prominent manufacturer of lithium batteries and charging solutions. The deal strengthened EnerSys's positioning and enhanced its portfolio related to the Specialty Aerospace and defense business. The company is expected to strengthen its relationship with the U.S. Department of Defense through its military and defense applications offerings backed by improved engineering and product development competencies.

Automotive Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 72.79 billion

Revenue forecast in 2030

USD 105.61 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drive, vehicle, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, South Africa

Key companies profiled

Exide Technologies; GS Yuasa International Ltd.; Panasonic Corporation; LG Energy Solution.; A123 Systems (Wanxiang A123 Systems Corp.); East Penn Manufacturing Company; Robert Bosch GmbH; ENERSYS.; Samsung SDI; Hitachi, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Battery Market Report Segmentation

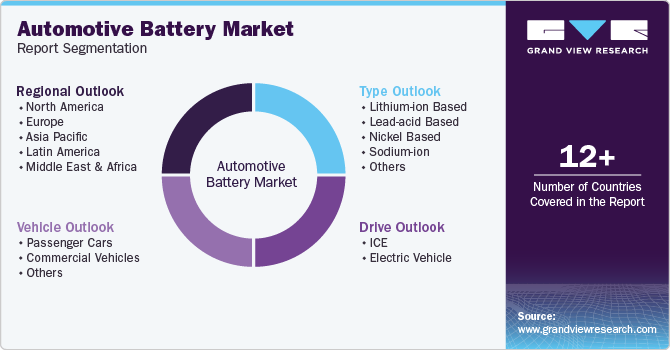

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive battery market report based on type, drive, vehicle, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lithium-ion Based

-

Lead-acid Based

-

Nickel Based

-

Sodium-ion

-

Others

-

-

Drive Outlook (Revenue, USD Billion, 2018 - 2030)

-

ICE

-

Electric Vehicle

-

BEV

-

PHEV

-

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.