- Home

- »

- Automotive & Transportation

- »

-

Automotive Fasteners Market Size, Industry Report, 2033GVR Report cover

![Automotive Fasteners Market Size, Share & Trends Report]()

Automotive Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Threaded Fasteners, Non-threaded Fasteners), By Material (Metal, Plastic/Composite), By Application (Powertrain & Chassis), By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-664-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Fasteners Market Summary

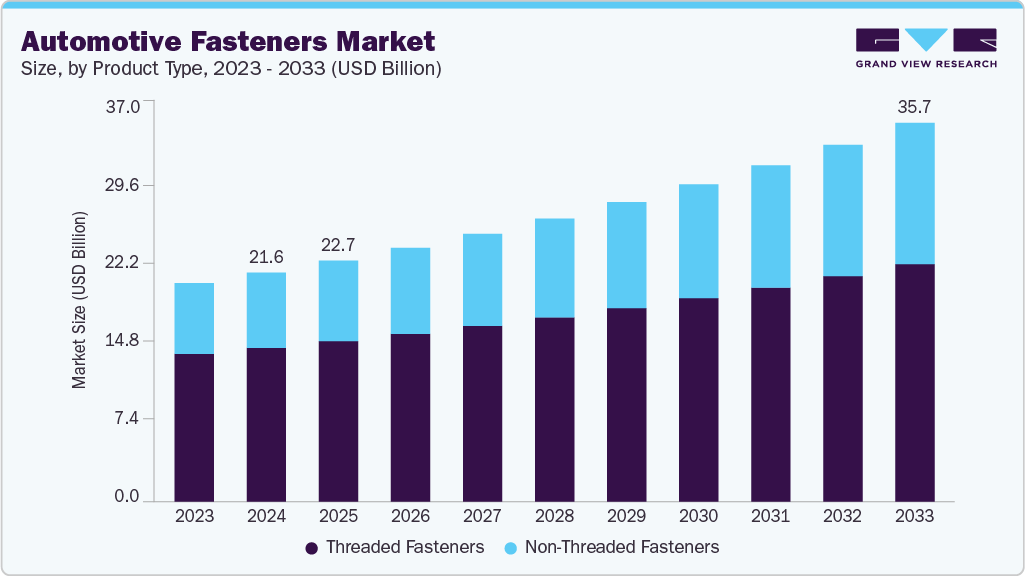

The global automotive fasteners market size was estimated at USD 21.61 billion in 2024 and is projected to reach USD 35.73 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The automotive fasteners industry is gaining momentum, driven by increasing electric vehicle (EV) production and the growing use of plastics and composites in vehicle interiors and electrical systems.

Key Market Trends & Insights

- The Asia Pacific automotive fasteners market accounted for a 38.6% share of the overall market in 2024.

- The China automotive fasteners market held a substantial revenue share in 2024.

- By product type, the threaded fasteners segment accounted for the largest share of 67.1% in 2024.

- By material, the metal segment held the largest market share in 2024.

- By application, the powertrain & chassis segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.61 Billion

- 2030 Projected Market Size: USD 35.73 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Expanding vehicle production in Asia Pacific and re-shoring trends in North America are further supporting demand. The rising adoption of modular vehicle architectures is also contributing to the increased need for advanced fastening solutions. The development of smart and self-locking fasteners tailored for autonomous and connected vehicles presents significant opportunities for manufacturers to innovate and differentiate. However, maintaining fastening integrity in multi-material vehicle designs remains a key challenge due to varying thermal and mechanical properties.According to the India Brand Equity Foundation, the Indian EV battery market is projected to grow from USD 16.77 billion in 2023 to USD 27.70 billion by 2028, underscoring the scale of electrification in the country. India has outlined aggressive EV adoption targets by 2030, including 30% penetration in private cars and up to 80% in two-wheelers and three-wheelers. This shift is being accelerated by the 'Make in India' initiative, which promotes full-scale domestic EV production.

As OEMs worldwide prepare to launch a diverse range of EV models in 2025, the automotive fasteners segment is expected to witness rising demand for application-specific solutions. EVs require more fasteners per vehicle due to modular battery packs, thermal management systems, and high-voltage wiring assemblies. Moreover, the push for lightweighting to offset battery weight is increasing the adoption of advanced materials such as aluminum and composites, driving demand for compatible fasteners with enhanced corrosion resistance, mechanical integrity, and electrical insulation properties.

As automakers shift toward lightweight, durable, and aesthetically versatile materials to improve fuel efficiency and design flexibility, traditional metal fasteners are often unsuitable. This has led to the growing adoption of engineered fasteners designed specifically for plastic and composite assemblies, offering controlled installation torque, thermal expansion compatibility, and vibration resistance. For instance, interior components such as instrument panels, center consoles, and seat structures are now predominantly built using glass fiber-reinforced plastics (GFRP) and polymer blends, requiring fasteners that prevent cracking or loosening under thermal cycling. Similarly, electronic housings and connectors demand non-conductive, high-precision fastening to ensure reliability and safety.

In APAC, countries including China, India, and Southeast Asian nations are experiencing robust growth in automotive manufacturing due to rising domestic demand, supportive government policies, and expanding EV infrastructure. For example, India’s vehicle production exceeded 26 million units in FY2023-24, supported by investments from global OEMs and component suppliers. Meanwhile, North America is witnessing a strong re-shoring movement, with automakers and Tier-1 suppliers expanding local production to mitigate supply chain risks and comply with USMCA regional content rules. These shifts are creating higher demand for locally sourced, high-performance fasteners tailored for diverse vehicle platforms, including EVs and hybrid models.

The development of smart and self-locking fasteners presents a significant opportunity in the market, particularly with the rise of autonomous and connected vehicles. These advanced fasteners are equipped with features such as embedded sensors, torque monitoring, and remote locking capabilities, enabling real-time diagnostics, predictive maintenance, and enhanced safety. As vehicle electronics and Advanced Driver Assistance Systems (ADAS) become more complex, the reliability of mechanical joints becomes critical. Smart fasteners can alert systems to loosening or failure risks, reducing maintenance costs and enhancing overall system integrity. For instance, companies are investing in sensor-enabled bolting solutions that support vehicle-to-infrastructure (V2I) communication, aligning with the broader shift toward intelligent transportation systems.

Maintaining fastening integrity in multi-material vehicle designs poses a major challenge in the automotive fasteners market. As OEMs increasingly adopt lightweight materials such as aluminum, carbon fiber, magnesium alloys, and advanced plastics to improve fuel efficiency and reduce emissions, ensuring reliable fastening becomes more complex. Different thermal expansion rates, surface hardness, and galvanic corrosion risks between dissimilar materials can lead to joint failure, loosening, or stress concentration. Traditional fasteners may not provide sufficient clamping force or may degrade the integrity of softer substrates. This challenge necessitates the development of application-specific fastening solutions with features including differential thread profiles, thermal compensation, and insulating coatings to preserve joint reliability across dynamic operating conditions.

Product Type Insights

The threaded fasteners segment accounted for the largest share of 67.1% in 2024. Threaded fasteners such as bolts, screws, and studs are extensively used in chassis, powertrain, interior components, and battery enclosures due to their ability to withstand high mechanical stresses and allow for serviceability. Factors such as their widespread use in automotive assembly, high load-bearing capacity, compatibility with metal and plastic substrates, and ease of disassembly and maintenance support the segment's growth.

The non-threaded fasteners segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by the increasing use of lightweight materials, rising demand for reduced assembly time, improved vibration resistance, and enhanced aesthetic integration in EV interiors and compact electronic assemblies. Non-threaded fasteners such as rivets, push-fit retainers, compression limiters, and plastic clips are increasingly favored in plastic and composite structures where conventional torque-based fasteners may induce stress fractures, material fatigue, or loosening over time. These fasteners also offer significant advantages in terms of automation compatibility, cost efficiency, and overall system weight reduction. For instance, multiple Tier 1 suppliers in Asia have incorporated non-threaded snap-fit fasteners into high-voltage EV connector housings, enabling faster assembly, improved electromagnetic interference (EMI) shielding, and better component packaging in space-constrained environments.

Material Insights

The metal segment accounted for the largest share of the automotive fasteners industry in 2024, driven by their superior strength-to-weight ratio, high load-bearing capacity, thermal resistance, and widespread compatibility with structural vehicle components. Metal fasteners, particularly those made from steel and stainless steel, remain essential in areas requiring high structural integrity, such as suspension systems, engine mounts, and brake assemblies. Factors such as the increasing production of internal combustion engine (ICE) vehicles, demand for high-torque applications in chassis and powertrain assemblies, and established supply chains across global OEMs are fueling the segment’s growth.

The plastic/composite segment is expected to grow at a significant CAGR during the forecast period, supported by rising adoption of lightweight materials in electric vehicles, growing integration of electronic modules, and the need for corrosion-resistant, non-conductive fastening solutions in interior and under-the-hood applications. These fasteners offer key advantages, including weight savings, design flexibility, cost-effectiveness, and insulation properties, making them ideal for securing infotainment systems, wiring harnesses, sensors, and battery components. As EV manufacturers push for higher energy efficiency and reduced vehicle mass, the demand for advanced plastic and composite fasteners is expected to rise steadily, especially in high-volume production scenarios.

Application Insights

The powertrain & chassis segment accounted for the largest share in 2024,driven by increasing production of internal combustion engine (ICE) vehicles, higher torque and vibration requirements in transmission and suspension systems, and widespread use of threaded metal fasteners for engine mounts, drivetrain components, and underbody structures. Additionally, the growing demand for performance and durability across passenger and commercial vehicles continues to reinforce the importance of mechanically robust fastener systems in these critical vehicle areas.

The electrical & fluid connectors segment is expected to register a notable CAGR from 2025 to 2033, supported by the rapid electrification of vehicles, increasing use of electronic control units (ECUs), and expansion of high-voltage electrical architectures in EVs. Fasteners used in this segment are designed to provide vibration resistance, EMI shielding, and fluid-tight sealing, especially in sensor housings, battery packs, power electronics, and thermal management systems. As OEMs integrate more sensors, ADAS components, and wire harnesses into compact modules, the need for application-specific non-threaded fasteners and sealing solutions is rising significantly.

Vehicle Type Insights

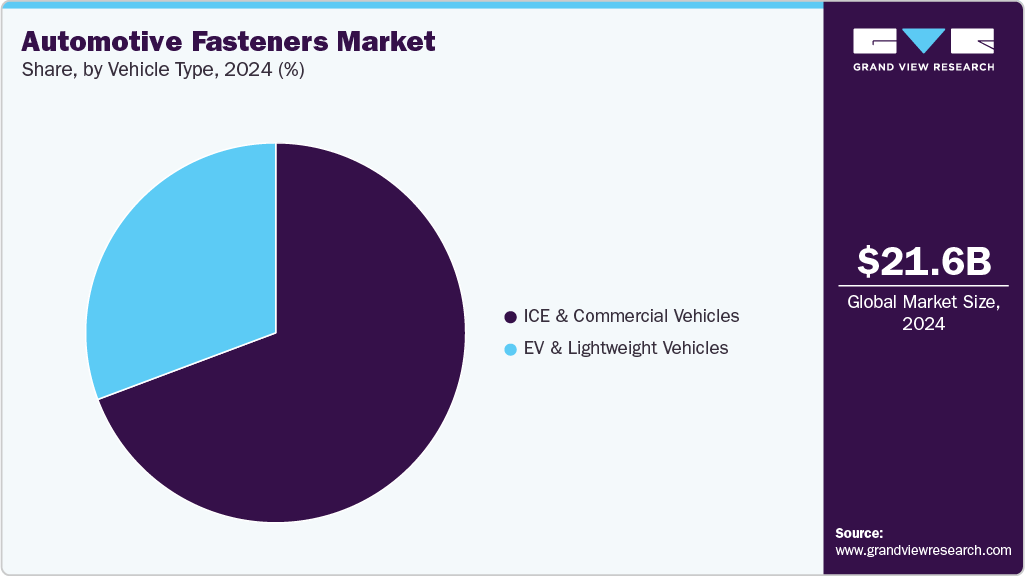

The ICE & commercial vehicles segment accounted for the largest share of the automotive fasteners market in 2024, driven by increasing production of internal combustion engine vehicles, robust demand across freight and utility applications, and the continued dominance of diesel-powered fleets in long-haul logistics and industrial sectors. These vehicles typically require durable, high-torque fasteners to support engines, transmissions, exhaust assemblies, and heavy chassis components. According to CEIC Data, the U.S. had approximately 283 million registered vehicles in 2022, and passenger car sales rose to 3.1 million units in December 2023, up from 2.86 million units in December 2022. This growth in vehicle registrations and monthly sales underscores sustained momentum in ICE-powered platforms

The EV & lightweight vehicles segment is expected to register a notable CAGR from 2025 to 2033, owing to the rising adoption of electric powertrains, increasing emphasis on vehicle light weighting to extend range, and growing demand for advanced fasteners compatible with aluminum and composite structures. As EV designs evolve, the need for application-specific fasteners that support modular battery packs, high-voltage assemblies, and lightweight body panels is accelerating. Supporting this trend, several OEMs and Tier 1 suppliers are actively sourcing sustainable and precision fasteners tailored for EV platforms to reduce weight and carbon footprint. For instance, in March 2022, Bulten signed a Full Service Provider (FSP) contract to supply fasteners for a new European electric vehicle program. Deliveries will begin in Q4 2023, scaling to USD 7 million annually, with a strong focus on low-carbon, sustainable solutions.

Regional Insights

The Asia Pacific automotive fasteners market accounted for 38.6% of the global share in 2024, driven by rising vehicle production in countries including China and India, expansion of EV manufacturing ecosystems, supportive government policies such as PLI schemes and FDI inflows, and the rapid localization of auto component supply chains. The region continues to benefit from low manufacturing costs, availability of skilled labor, and growing exports of both ICE and electric vehicles.

Demand for specialized fasteners has surged, particularly in EV platforms, where lightweight, high-strength, and corrosion-resistant solutions are essential for battery packs, e-axles, and power electronics. For instance, in April 2024, Sterling Tools Ltd. signed an MoU with South Korea’s Yongin Electronics to co-develop EV and electronic components in India. The partnership, expected to generate approximately USD 30 million (INR 250 crore) over five years, reflects Sterling’s strategic push into EV supply chain localization. Such developments show how regional players are strengthening cross-border collaborations to capitalize on Asia Pacific’s growing EV and component manufacturing momentum, further reinforcing its leadership in the global market.

The China automotive fasteners market held a substantial revenue share in 2024. The market is experiencing rapid growth, driven by the country’s dominance in electric vehicle (EV) production, large-scale investments in domestic automotive R&D, robust aftermarket demand, and government subsidies for new energy vehicles (NEVs). China continues to lead global EV output, requiring high-performance fasteners for battery modules, thermal management, and high-voltage assemblies.

Also, the presence of leading EV makers such as BYD, NIO, and XPeng has accelerated local sourcing of advanced fastening solutions to meet scale, speed, and cost efficiency. As OEMs increasingly shift toward lightweight structures and modular platforms, the demand for both metal and composite-compatible fasteners is expected to rise.

The automotive fasteners market in Japan held a significant share in 2024.In Japan, the market is influenced by the steady pace of automotive innovation, strong export volumes of hybrid vehicles, and a deep-rooted focus on manufacturing precision components. Major OEMs, including Toyota and Honda, are continuously advancing hybrid and fuel-efficient vehicle platforms, which depend on lightweight, vibration-resistant, and corrosion-proof fasteners for both structural and electrical applications. Also, Japan’s well-established Tier 1 supply network emphasizes product quality, miniaturization, and advanced material compatibility, particularly for fasteners used in compact engine bays and advanced driver assistance system (ADAS) modules. The integration of more electronics per vehicle is further supporting demand for precision fasteners across powertrain and infotainment subsystems.

Europe Automotive Fasteners Market Trends

The Europe automotive fasteners industry was identified as a lucrative region in 2024. The market is witnessing significant transformation, driven by rising EV production, stringent sustainability regulations, increasing adoption of lightweight materials, and growing investment in advanced manufacturing infrastructure. With the EU targeting net-zero transport emissions and banning internal combustion engine (ICE) vehicle sales beyond 2035, OEMs and Tier 1 suppliers are accelerating the localization of low-emission fastener solutions. Additionally, the shift toward electric and autonomous vehicle platforms is increasing the demand for lightweight, corrosion-resistant, and multi-material-compatible fasteners.

To meet growing demand and reduce reliance on imports, manufacturers are scaling up regional production capabilities with modernized and automated plants across the continent. For instance, in December 2024, Shanghai Electric broke ground on Nedschroef’s second automotive fastener factory in Tarragona, Spain. The new facility is part of a three-year action plan to expand capacity and enhance operational efficiency across Europe.

Also, the region’s environmental regulations and OEM decarbonization targets are driving partnerships for low-impact material sourcing and process innovation in fastener manufacturing. For instance, in September 2022, Bulten partnered with Polestar on the Polestar 0 project to develop climate-neutral electric vehicles by 2030. Bulten will supply sustainable fasteners made using low-impact materials and renewable energy, contributing to an emissions-free automotive supply chain.

The automotive fasteners market in Germany is expected to grow over the forecast period. Germany’s position as Europe’s automotive manufacturing hub, with legacy automakers such as Volkswagen, BMW, and Mercedes-Benz leading the transition to electrification, is amplifying the demand for specialized, application-specific fasteners. The Germany market is being shaped by increasing electric vehicle (EV) penetration, rising integration of advanced driver-assistance systems (ADAS), strong OEM presence, and growing use of lightweight multi-material assemblies.

The UK automotive fasteners market is being shaped by growing EV production investments, heightened supplier compliance requirements, and increased focus on domestic sourcing post-Brexit. OEMs are placing greater emphasis on nearshoring and vertically integrated supply models to mitigate logistical disruptions and improve traceability across the supply chain. For instance, in May 2024, Auto Fasteners Ltd expanded its UK footprint by leasing a 15,000 sq ft facility at Sucham Park, Warwickshire. This site will support warehousing, assembly, and inspection operations for fasteners delivered to key OEMs, including Volvo, Daimler, Stellantis, and Ford.

North America Automotive Fasteners Market Trends

The North America automotive fasteners industry was identified as a lucrative region in 2024. The market in North America is being driven by the resurgence of vehicle manufacturing, re-shoring of component supply chains, and growing demand for domestically produced high-strength fasteners in electric and commercial vehicle platforms. Additionally, OEMs are prioritizing supplier proximity to ensure agility and reduce lead times amid ongoing global supply chain uncertainties. For instance, in April 2025, Auto Bolt partnered with Southeast Sales & Engineering to enhance regional sales coverage in the southeastern U.S. The move supports Auto Bolt’s strategy to expand its domestic footprint for cold-headed fasteners in automotive and heavy-duty markets while reinforcing customer-focused service delivery.

U.S. Automotive Fasteners Market Trends

The U.S. automotive fasteners industry held a dominant position in 2024, driven by rising investments in localized manufacturing, growth in the automotive aftermarket, and increasing demand for safety-critical components in electric and commercial vehicles. The shift toward reshoring production to reduce dependency on imports has further fueled domestic innovation and brand development in the fasteners segment. For instance, in February 2022, MacLean-Fogg Component Solutions launched Threadstrong, a new U.S.-made aftermarket wheel fastener line. With a strong focus on safety, precision engineering, and quality assurance, the brand aims to counter low-grade imports and expand the company’s reach beyond OEMs into the replacement market. Such development highlights the strategic focus of U.S. manufacturers on strengthening domestic supply chains and capitalizing on aftermarket opportunities driven by aging vehicle fleets and the growing EV ecosystem.

The Canada automotive fasteners market is being supported by the country’s strong automotive manufacturing base, rising investments in EV supply chains, and the presence of Tier 1 suppliers across Ontario and Quebec. In Mexico, the market is expanding steadily, fueled by its role as a key vehicle production and export hub for North American OEMs.

Key Automotive Fasteners Company Insights

Some of the key players operating in the market include Illinois Tool Works Inc.; Stanley Black & Decker, Inc.; Würth Group; ARaymond Network (ARaymond); and Norma Group SE.

-

Founded in 1912 and headquartered in Glenview, Illinois, Illinois Tool Works Inc. (ITW) is a global industrial manufacturer with a strong presence in the automotive fasteners segment. The company offers a wide range of Threaded Fasteners, Non-threaded Fasteners, and specialty fastening solutions for OEM and Tier 1 automotive suppliers. ITW focuses on lightweight, high-strength, and corrosion-resistant products for powertrain, chassis, and interior applications.

-

Founded in 1843 and headquartered in New Britain, Connecticut, Stanley Black & Decker, Inc. is a global provider of tools, industrial solutions, and engineered fastening systems. Through its Stanley Engineered Fastening division, the company specializes in Blind Fasteners, Stud Welding, Inserts, and Assembly Tools used across automotive, aerospace, and heavy industrial sectors. The company is a key supplier to electric and autonomous vehicle manufacturers, offering fastening solutions that support lightweighting, structural integrity, and modular design.

Key Automotive Fastener Companies:

The following are the leading companies in the automotive fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- Illinois Tool Works Inc.

- Stanley Black & Decker, Inc.

- Würth Group

- ARaymond Network (ARaymond)

- Norma Group SE

- Bulten AB

- KAMAX Holding GmbH & Co. KG

- LISI Automotive (LISI Group)

- Bossard Holding AG (Bossard Group)

- Sundram Fasteners Limited

Recent Developments

-

In March 2025, Fontana Gruppo acquired a 60% stake in Right Tight Fasteners (RTF) for around USD 120.5 million (INR 1,000 crore), merging it with BG Fastening to form a unified Indian entity. The deal enhances Fontana’s presence in Asia and supports RTF’s global expansion and capacity growth plans.

-

In April 2024, TR Fastenings launched the Plas-Tech 30-20 screw, designed for superior performance in plastic assemblies. Developed in-house, the product expands TR’s engineered fastener portfolio, aligning with rising demand for lightweight, high-performance components across automotive and industrial applications.

-

In September 2023, MW Components acquired Elgin Fastener Group to expand its U.S. manufacturing footprint and specialty fastener portfolio. The combined entity becomes one of the largest fastener suppliers in the U.S., supporting automotive and industrial markets with custom and ready-to-ship metal components globally.

-

In March 2022, TR Fastenings launched a range of compression limiters designed for high-load plastic assemblies, especially in EV battery housings. With variants made from steel, brass, and aluminum, these non-threaded inserts reduce fastening stress and are gaining traction across global automotive and gigafactory applications.

Automotive Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.72 billion

Revenue forecast in 2033

USD 35.73 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product type, material, application, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Illinois Tool Works Inc.; Stanley Black & Decker, Inc.; Würth Group; ARaymond Network (ARaymond); Norma Group SE; Bulten AB; KAMAX Holding GmbH & Co. KG; LISI Automotive (LISI Group); Bossard Holding AG (Bossard Group); Sundram Fasteners Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Fasteners Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive fasteners market report based on product type, material, application, vehicle type, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Threaded Fasteners

-

Non-threaded Fasteners

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal

-

Plastic/Composite

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Powertrain & Chassis

-

Body & Trim

-

Electrical & Fluid Connectors

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

ICE & Commercial Vehicles

-

EV & Lightweight Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive fasteners market size was estimated at USD 21.61 billion in 2024 and is expected to reach USD 35.73 billion in 2033.

b. The global automotive fasteners market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 35.73 billion by 2033.

b. The Asia Pacific automotive fasteners market accounted for 38.6% of the global share in 2024, driven by rising vehicle production in countries including China and India, expansion of EV manufacturing ecosystems, supportive government policies such as PLI schemes and FDI inflows, and the rapid localization of auto component supply chains. The region continues to benefit from low manufacturing costs, availability of skilled labor, and growing exports of both ICE and electric vehicles.

b. Some key players operating in the automotive fasteners market include Illinois Tool Works Inc., Stanley Black & Decker, Inc., Würth Group, ARaymond Network (ARaymond), Norma Group SE, Bulten AB, KAMAX Holding GmbH & Co. KG, LISI Automotive (LISI Group), Bossard Holding AG (Bossard Group), Sundram Fasteners Limited.

b. Key factors that are driving the market growth include increasing electric vehicle (EV) production and the growing use of plastics and composites in vehicle interiors and electrical systems. Expanding vehicle production in Asia Pacific and re-shoring trends in North America are further supporting demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.