- Home

- »

- Next Generation Technologies

- »

-

Automotive Intelligent Lighting System Market Report, 2030GVR Report cover

![Automotive Intelligent Lighting System Market Size, Share & Trends Report]()

Automotive Intelligent Lighting System Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type, By Lighting Technology, By Application, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-606-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Intelligent Lighting System Market Summary

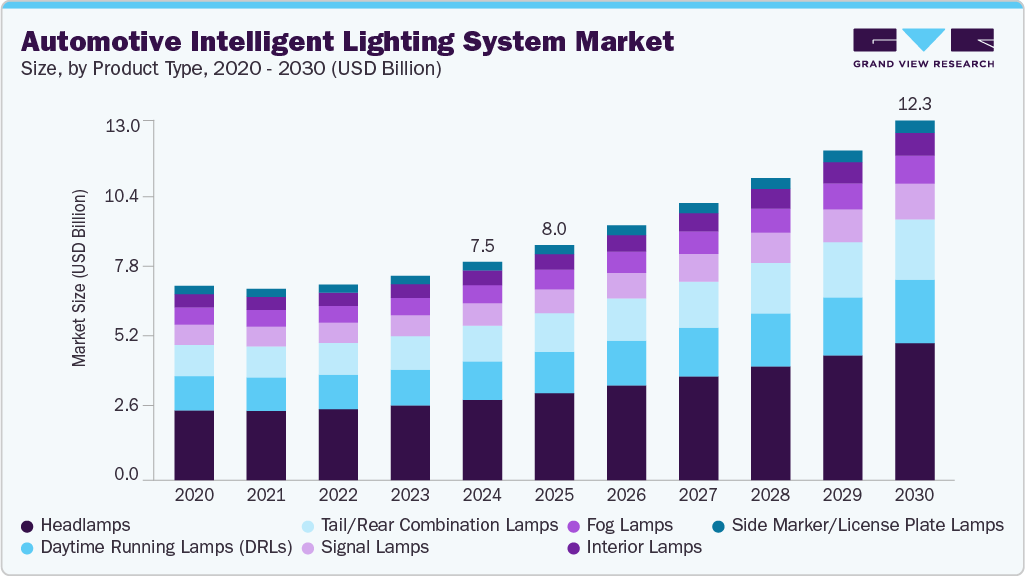

The global automotive intelligent lighting system market size was valued at USD 7.45 billion in 2024 and is projected to reach USD 12.27 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. The automotive intelligent lighting system industry is gaining momentum, driven by rising adoption of LED and matrix lighting systems in premium and mid-range vehicles, strict global safety and visibility regulations that are accelerating the integration of advanced front and signal lighting, and a growing consumer preference for ambient and customizable interior lighting to enhance the in-cabin experience.

Key Market Trends & Insights

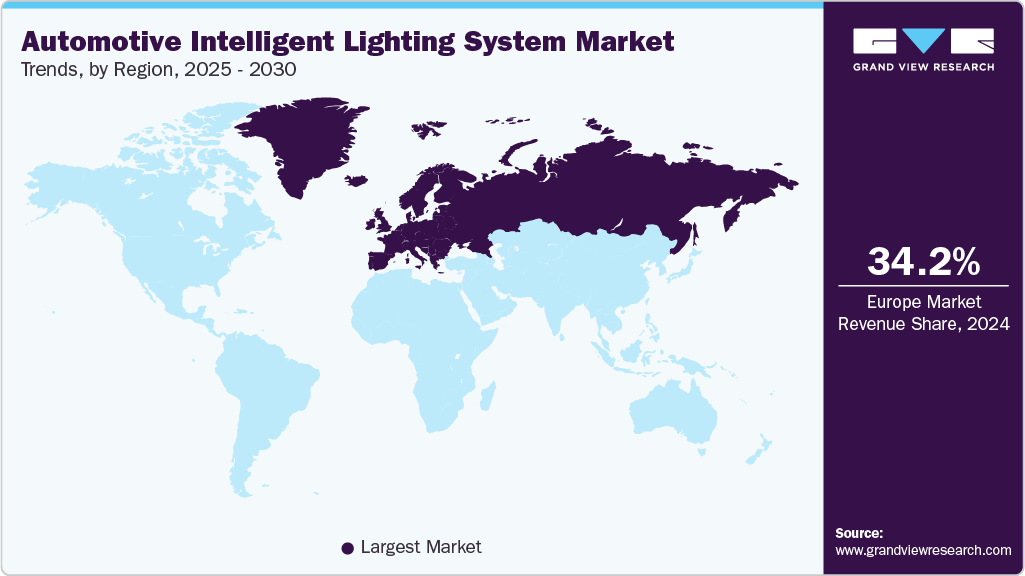

- The Europe automotive intelligent lighting system market accounted for 34.2% of the global share 2024.

- The U.S. automotive intelligent lighting system market held a dominant position in 2024.

- In terms of product, the headlamps segment accounted for the largest share of 36.8% in 2024.

- In terms of lighting technolog, the LED (light emitting diode) segment accounted for the largest share in 2024.

- In terms of application, the front lighting segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.45 Billion

- 2030 Projected Market Size: USD 12.27 Billion

- CAGR (2025-2030): 8.9%

- Europe: Largest market in 2024

The increased demand for adaptive and laser lighting technologies, particularly in electric and autonomous vehicles, where innovative lighting solutions play a critical role in safety and vehicle design, presents a major growth opportunity for the market. However, the market faces a significant challenge due to the high development and integration costs of advanced lighting technologies, which can limit adoption, especially in cost-sensitive vehicle segments. LED lighting is rapidly penetrating global new vehicle production, with the International Energy Agency (IEA) reporting that its share in automotive applications increased from 20% in 2015 to over 65% in 2022. This growth has been primarily driven by the superior energy efficiency, compact form factor, and extended lifespan of LED technology compared to traditional halogen and xenon systems.

Premium automakers such as Audi, BMW, and Mercedes-Benz have led this transition, using LED and matrix LED systems not only to enhance road visibility but also to differentiate vehicle design. Matrix LED lighting, which allows for adaptive beam distribution that avoids dazzling oncoming traffic, has increasingly been adopted in mid-range vehicles as production costs decline. For instance, Audi’s Digital Matrix LED technology, initially introduced in the A8, is now available in the A6 and Q5, reflecting a democratization of advanced lighting features.

Regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) in the U.S. and the United Nations Economic Commission for Europe (UNECE) have mandated standards for headlamp illumination, automatic lighting systems, and turn signal visibility. These requirements have led to the widespread implementation of adaptive driving beam (ADB) systems, daytime running lights (DRLs), and intelligent signaling solutions. For instance, in 2022, the NHTSA approved the use of Adaptive Driving Beam (ADB) headlights in the U.S., aligning its standards with UNECE Regulation No. 123. This has prompted OEMs including Toyota and Ford to integrate matrix LED and laser headlight systems into their next-generation vehicle platforms. Additionally, automated signaling and cornering light functions are being adopted to meet safety test protocols defined by the New Car Assessment Program (NCAP) in multiple regions.

Consumer preferences are increasingly shifting toward vehicles that offer personalized and immersive in-cabin experiences, with ambient and customizable interior lighting becoming a key differentiator. OEMs are responding to this trend by incorporating multi-zone RGB LED lighting systems that allow drivers and passengers to select colors, brightness levels, and dynamic patterns based on mood or driving mode. Once exclusive to high-end models such as the Mercedes-Benz S-Class or BMW 7 Series, this feature is now being implemented across mainstream vehicles, including the Hyundai Sonata, Volkswagen Golf, and Kia EV6. Many companies, including OSRAM (part of ams OSRAM) and Stanley Electric, are developing advanced LED modules and control software that support dynamic ambient effects synchronized with music, climate settings, and drive profiles.

According to the International Council on Clean Transportation (ICCT), the U.S. electric vehicle (EV) market reached 1.56 million units in sales in 2024, capturing a 10% share of total light-duty vehicle sales. This surge in EV adoption has created a favorable environment for the integration of next-generation lighting solutions, as advanced lighting plays a pivotal role in enhancing visibility, aesthetics, and safety. Adaptive lighting systems, such as Adaptive Front Lighting Systems (AFS), are being increasingly specified by OEMs to dynamically adjust beam patterns based on vehicle speed, steering angle, and road conditions. Similarly, laser lighting, known for its extended range and superior luminance, is being positioned as a premium offering in performance and high-end electric models. These technologies are especially critical in autonomous vehicle platforms, where traditional driver inputs are replaced by sensor-led navigation, necessitating highly responsive and intelligent lighting.

High development and integration costs continue to present a significant challenge in adopting advanced automotive lighting technologies. The research, prototyping, and validation phases for adaptive LED, matrix, and laser lighting systems can cost OEMs and Tier 1 suppliers upwards of USD 10-15 million per vehicle platform. Integration into vehicle architecture also requires specialized electronic control units (ECUs), thermal management systems, and compliance with international safety standards, further elevating expenses. For instance, laser headlight systems alone can add USD 2,000-3,000 to the cost of a premium vehicle. These high costs often restrict implementation to luxury models, limiting mass-market scalability.

Product Type Insights

The headlamps segment accounted for the largest share of 36.8% in 2024. Factors include the growing demand for advanced front lighting systems that enhance visibility and safety, increasing OEM focus on integrating Adaptive Driving Beam (ADB) and matrix LED systems, and growing deployment of lighting technologies that support ADAS and intelligent driving features. In October 2024, ams OSRAM introduced the EVIYOS HD 25 Gen2 multipixel LED, featuring 25,600 individually controllable pixels, designed specifically for ADB headlamps. The technology improves night visibility, reduces glare for oncoming traffic, and enables symbol projection onto roads. It has been integrated into Volkswagen’s Touareg and Tiguan through Marelli's headlamp systems. This integration reflects how next-generation lighting solutions are adopted to enhance headlamp functionality and ADAS compatibility, directly contributing to the segment's dominant share in the coming years.

The tail/rear combination lamps segment is expected to grow at the highest CAGR from 2025 to 2030. Factors such as the rising demand for distinctive rear lighting designs that enhance brand identity, increasing integration of OLED and dynamic lighting elements in premium models, and regulatory emphasis on improved rear visibility and signaling functions support the segment growth. Automakers are leveraging rear combination lamps for functional signaling and as a key styling element. For instance, Audi and Mercedes-Benz have incorporated full-width OLED tail lamps with animated light sequences in models including the Q6 e-tron and EQS to differentiate vehicle aesthetics while meeting evolving safety standards.

Lighting Technology Insights

The LED (light emitting diode) segment accounted for the largest share in 2024, driven by the increasing demand for energy-efficient lighting solutions in vehicles, the integration of adaptive lighting features to support advanced driver-assistance systems (ADAS), and the growing preference for customizable and dynamic lighting designs are fueling the segment’s growth. In April 2025, Stellantis and Valeo launched Europe’s first remanufactured LED headlamp and infotainment display screen. This move deepens their circular economy partnership by extending product lifespans without compromising OEM quality. Aligned with Stellantis’ 2038 Net Zero target and Valeo’s 2050 neutrality goal, remanufacturing is key in reducing waste and emissions. This innovation supports the LED segment's growth by enhancing sustainability efforts and extending the functional lifecycle of LED components, further reinforcing their widespread adoption in the automotive industry.

The matrix LED segment is expected to grow at a significant CAGR during the forecast period, driven by the increasing adoption of adaptive front lighting systems (AFS) that enhance driving safety, and the rising demand for premium and luxury vehicles equipped with advanced lighting features for improved visibility and aesthetics. Additionally, regulatory requirements for safer and more energy-efficient lighting solutions are accelerating the integration of matrix LEDs into mainstream vehicles.

Application Insights

The front lighting segment accounted for the largest share in 2024, driven by the rising integration of Adaptive Driving Beam (ADB) technology, which optimizes headlamp beam patterns based on driving conditions to enhance safety, and the growing adoption of matrix LED systems that reduce glare for oncoming drivers. Additionally, the increasing demand for laser headlights in high-end models, such as BMW's iX3 and Audi's Q7, to extend illumination range up to 600 meters is contributing to the segment's growth.

The ambient and cornering lights segment is expected to register a notable CAGR from 2025 to 2030. Major factors such as the increasing consumer demand for personalized in-cabin lighting solutions that enhance the driving experience, and the integration of cornering lights in mid-range vehicles for improved safety during turns is supporting the segment growth. Additionally, advancements in OLED and dynamic lighting technologies enable automakers to offer customizable ambient lighting systems, further fueling the segment’s growth.

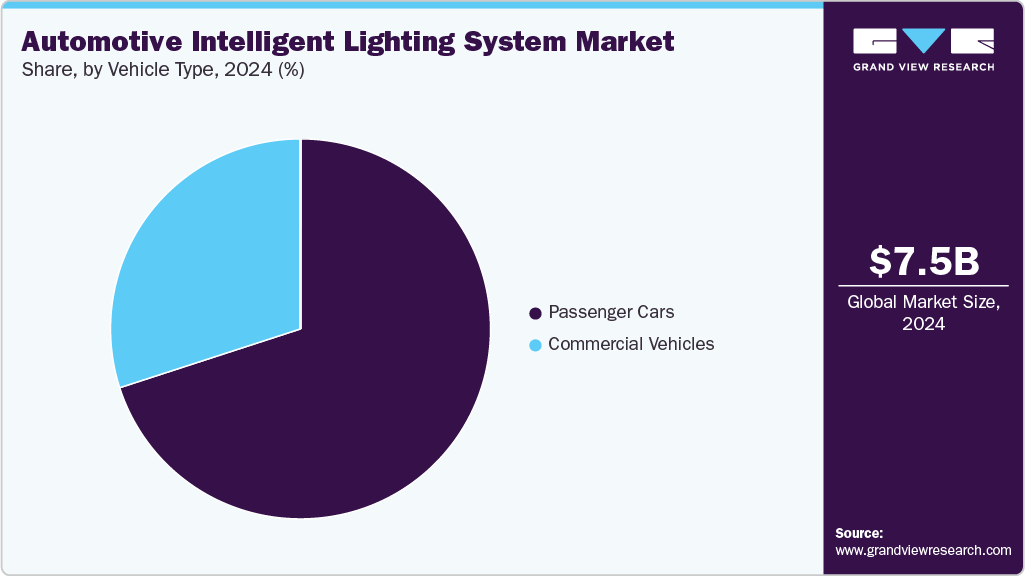

Vehicle Type Insights

The passenger cars segment accounted for the largest share in 2024. Factors such as the increasing adoption of advanced lighting systems for enhanced safety in compact and mid-range models, growing demand for aesthetically customizable ambient lighting options, and the rising integration of headlamp technologies that support advanced driver-assistance systems (ADAS) are driving growth in this segment. In July 2023, Hyundai launched its HD Lighting System, an intelligent headlamp technology leveraging micro-LEDs and mirrors to project visual information onto roads. The system interacts with GPS and detects signs and road objects to deliver real-time alerts, enhancing driver safety and advancing vehicle-to-environment communication capabilities. This innovation reflects the increasing importance of intelligent lighting systems in passenger vehicles, directly supporting the segment’s growth by improving safety features and integrating interactive technologies that enhance the driving experience.

The commercial vehicles segment is expected to register a notable CAGR from 2025 to 2030, owing to the increasing adoption of LED-based lighting systems in heavy-duty trucks and buses to reduce maintenance costs and improve energy efficiency, the rising implementation of cornering and adaptive headlights in long-haul freight vehicles for enhanced nighttime visibility, and stricter safety regulations in regions like the EU mandating advanced lighting for commercial fleets.

Regional Insights

The Europe automotive intelligent lighting system market accounted for 34.2% of the global share 2024. The market is witnessing significant transformation, driven by the widespread integration of adaptive and matrix LED lighting technologies in premium vehicles, rising investment in vehicle safety compliance amid Euro NCAP and UNECE lighting regulations, and the push toward energy-efficient and sustainable vehicle components. According to the ACEA (Association des Constructeurs Européens d’Automobiles), the European Union’s fleet includes 252.2 million cars and 37.4 million commercial vehicles and buses. Notably, Poland leads in truck volume with 1.2 million units, and the overall medium and heavy commercial vehicle fleet in the EU grew by 1.9% compared to 2021. In 2022, the EU car fleet expanded by 1.1%, with Romania and Slovakia showing the highest growth rates. This expanding vehicle base, combined with regulatory and technological advancements, continues to drive the demand for intelligent lighting systems across both passenger and commercial vehicle segments in Europe.

Germany Automotive Intelligent Lighting System Industry Trends

The German automotive intelligent lighting system market is being shaped by increasing R&D investments in high-resolution adaptive lighting and laser technologies by domestic OEMs such as BMW, Audi, and Mercedes-Benz. These manufacturers are integrating features,including digital light and matrix LED systems to enhance driver assistance and road safety. Additionally, Germany’s strong regulatory push for Euro NCAP-compliant lighting systems accelerates innovation and adoption of intelligent lighting across new vehicle platforms.

The UK automotive lighting market is being driven by the rising focus on vehicle electrification and the integration of intelligent lighting in electric and autonomous vehicles. Companies like Jaguar Land Rover are partnering with lighting suppliers to develop predictive lighting systems that adapt to weather, road type, and navigation data. Moreover, the UK government's ongoing investments in connected vehicle infrastructure are creating new opportunities for V2X-capable lighting technologies.

Asia Pacific Automotive Intelligent Lighting System Market Industry Trends

The Asia Pacific automotive intelligent lighting system industry was identified as a lucrative region in 2024, driven by the accelerating localization of advanced lighting technologies in major automotive markets such as China, India, and Japan, and the increasing adoption of intelligent lighting in electric two-wheelers and compact cars to enhance road safety and aesthetic appeal. Additionally, regional OEMs rapidly embrace adaptive lighting to comply with evolving vehicle safety norms and differentiate offerings in highly competitive segments. In June 2023, Motherson and Marelli inaugurated the Motherson Automotive Lighting Tool Room (MALT) in Noida, India, the first-ever facility dedicated to automotive lighting in the country. This 8700 sq m facility aims to meet the needs of Indian OEMs for localizing advanced automotive lighting solutions, fostering collaboration and innovation between Motherson and Marelli to develop cutting-edge tooling solutions. This initiative reflects the region's broader trend toward self-reliance and technological sophistication in automotive lighting, directly contributing to Asia Pacific’s growing significance in the global intelligent lighting landscape.

The China automotive intelligent lighting system market held a substantial market share in 2024. Leading Chinese OEMs such as BYD, NIO, and Xpeng are incorporating high-performance matrix LED and laser lighting technologies in premium EV models to enhance safety and brand differentiation. The market is experiencing rapid growth, driven by aggressive adoption of advanced driver-assistance systems in new energy vehicles (NEVs), which has boosted demand for adaptive lighting integrated with forward-facing sensors. Additionally, China’s mandatory GB standards on automotive lighting performance and headlamp illumination levels are reinforcing the integration of intelligent lighting across mid- and high-end vehicle segments.

The Japanese automotive intelligent lighting system market held a significant share in 2024. In Japan, the market is influenced by the steady growth in autonomous and connected vehicle initiatives supported by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). Automakers, including Toyota and Honda, are developing intelligent lighting technologies such as road sign projection and adaptive high-beam systems aligned with Japan’s strategic roadmap for automated driving. Also, Japan’s stringent safety inspection (Shaken) system, which evaluates lighting system performance and alignment, is further contributing to the demand for advanced and compliant lighting modules in both new and aftermarket vehicles.

North America Automotive Intelligent Lighting System Market Industry Trends

The North America automotive intelligent lighting system industry was identified as a lucrative region in 2024. The automotive intelligent lighting system market in North America is being driven by the increasing integration of adaptive lighting solutions in premium vehicles by U.S. automakers, as well as the push toward advanced safety features mandated under the National Highway Traffic Safety Administration (NHTSA) regulations. OEMs such as General Motors and Ford are expanding the deployment of matrix LED and adaptive front lighting systems across multiple vehicle platforms to enhance night-time driving safety and ADAS synergy. Additionally, growing consumer expectations for vehicle personalization are fueling demand for customizable ambient lighting packages across luxury and mid-segment vehicles.

In Canada automotive intelligent lighting system market, the expansion of intelligent lighting solutions is supported by the rising share of medium-duty vehicle registrations, which grew by 2.5% in 2023, according to the Government of Canada. This trend indicates increasing commercial vehicle activity, where robust front and rear intelligent lighting is crucial for safety compliance and visibility in logistics and fleet operations, particularly during adverse weather conditions.

The Mexico intelligent lighting system market benefits from a booming automotive manufacturing ecosystem. According to the U.S. International Trade Administration, Mexico is the world’s seventh-largest passenger vehicle producer and fifth-largest manufacturer of heavy-duty cargo vehicles. OEMs such as BMW, Nissan, and Tesla (with a new plant in Nuevo Leon) are adopting advanced lighting technologies to meet export market requirements, especially for vehicles bound for the U.S., where intelligent lighting integration is becoming standard in premium and EV segments.

The U.S. automotive intelligent lighting system market held a dominant position in 2024. The automotive intelligent lighting system market in the U.S. is witnessing significant transformation, driven by the accelerated adoption of intelligent lighting solutions in the growing luxury electric vehicle (EV) segment. According to the U.S. Energy Information Administration, battery electric vehicles (BEVs) accounted for 35.8% of U.S. luxury light-duty vehicle (LDV) sales in Q3 2024, while luxury BEVs made up over 70% of total BEV sales. This high concentration of luxury EVs, which often come equipped with advanced adaptive and matrix LED lighting systems, continues to stimulate demand for high-performance lighting technologies.

Additionally, the implementation of advanced safety mandates by NHTSA, including regulations encouraging adaptive driving beam (ADB) systems and automated headlamp dimming, is propelling OEMs to integrate intelligent lighting as a standard safety feature. Automakers such as Tesla, Ford, and General Motors are investing in cutting-edge lighting platforms that support ADAS functionalities including lane guidance and pedestrian detection.

Key Automotive Intelligent Lighting System Company Insights

Some of the key players operating in the market include Koito Manufacturing Co., Ltd., Valeo SA, HELLA GmbH & Co. KGaA, Marelli (Part of KKR), and Stanley Electric Co., Ltd.

-

Founded in 1915 and headquartered in Tokyo, Japan, Koito Manufacturing Co., Ltd. is a prominent supplier of automotive lighting systems and a core member of the Toyota Group. The company specializes in the development and production of advanced vehicle lighting products, including LED headlamps, adaptive front lighting systems (AFS), and intelligent signaling solutions. Koito’s technology portfolio supports the integration of ADAS and autonomous driving features through high-precision lighting modules.

-

Founded in 1923 and headquartered in Paris, France, Valeo SA is a global automotive supplier known for its advanced technologies in powertrain systems, thermal management, and visibility systems. The company’s intelligent lighting systems division offers a wide range of adaptive front lighting, matrix LED modules, and ambient interior lighting tailored for electric and autonomous vehicles. Valeo collaborates closely with OEMs to deliver systems that support driving assistance and road safety.

Key Automotive Intelligent Lighting System Companies:

The following are the leading companies in the automotive intelligent lighting system market. These companies collectively hold the largest market share and dictate industry trends.

- Koito Manufacturing Co., Ltd.

- Valeo SA

- HELLA GmbH & Co. KGaA

- Marelli Holdings Co., Ltd.

- Stanley Electric Co., Ltd.

- ZKW Group (Part of LG Electronics)

- OSRAM GmbH

- Hyundai Mobis

- Aptiv PLC

- Tung Thih Electronic Co., Ltd.

Recent Developments

-

In April 2025, Valeo and Appotronics announced a strategic partnership to create a next-generation front lighting system using laser video projection technology. The collaboration aims to enhance adaptive lighting (ADB) functionalities, improve road safety, and provide drivers with more comfortable lighting options and entertainment features.

-

In November 2024, ams OSRAM introduced the OSIRE E3731i intelligent RGB LED, designed for dynamic interior automotive lighting. With a built-in Open System Protocol (OSP), which allows control of up to 1,000 LEDs via a single microcontroller. The technology simplifies design, reduces wiring and cost, and enables customizable lighting effects with high optical consistency.

-

In April 2024, ams OSRAM partnered with DOMINANT Opto Technologies to incorporate its Open System Protocol (OSP) into DOMINANT’s next-generation intelligent RGB LEDs for automotive ambient lighting. The collaboration is designed to improve lighting capabilities by introducing a universal communication protocol that enables cross-manufacturer compatibility, fostering greater flexibility and innovation in automotive lighting systems.

-

In July 2023, HELLA, under the FORVIA umbrella, and Porsche launched the world’s first high-resolution SSL | HD matrix headlamp. This advanced headlamp, featuring over 32,000 LED pixels, delivers enhanced visibility and safety and is now available as an optional extra on the new Porsche Cayenne. It marks a significant leap in automotive lighting technology.

-

In July 2023, Marelli, in collaboration with ams OSRAM, launched the h-Digi microLED, a high-resolution digital front-lighting module now in series production. This compact, efficient, and affordable system features around 20,000 pixels per lamp and provides adaptive, dynamic headlight operation, including glare-free high beams, dynamic curve lights, and road projections. The system is designed for a wider range of vehicles and offers enhanced safety, energy efficiency, and adaptability, marking a major advancement in automotive lighting.

-

In February 2022, Motherson and Valeo signed a Memorandum of Understanding (MOU) to create the automotive interior of the future by integrating innovative lighting systems with advanced surface finishes. This collaboration aims to transform vehicle interiors, redesigning panels and trims to offer enhanced functionality and immersive experiences for drivers.

Automotive Intelligent Lighting System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.02 billion

Revenue Forecast in 2030

USD 12.27 billion

Growth Rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Product type, lighting technology, application, vehicle type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Koito Manufacturing Co., Ltd.; Valeo SA; HELLA GmbH & Co. KGaA; Marelli Holdings Co., Ltd.; Stanley Electric Co., Ltd.; ZKW Group (a part of LG Electronics); OSRAM GmbH; Hyundai Mobis (a part of Hyundai Motor Group); Aptiv PLC; Tung Thih Electronic Co., Ltd. (a part of Tung Thih Group)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Intelligent Lighting System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive intelligent lighting system market report based on product type, lighting technology, application, vehicle type, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Headlamps

-

Daytime Running Lamps (DRLs)

-

Tail/Rear Combination Lamps

-

Signal Lamps

-

Fog Lamps

-

Interior Lamps

-

Side Marker/License Plate Lamps

-

-

Lighting Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Halogen

-

LED (Light Emitting Diode)

-

Xenon / HID (High-Intensity Discharge)

-

Laser

-

OLED (Organic Light Emitting Diode)

-

Matrix LED

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Front Lighting

-

Ambient and Cornering Lights

-

Rear Lighting

-

Interior Lighting

-

Signaling Lighting

-

Other Applications

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive intelligent lighting system market size was estimated at USD 7.45 billion in 2024 and is expected to reach USD 8.02 billion in 2030.

b. The global automotive intelligent lighting system market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2030 to reach USD 12.27 billion by 2030.

b. Europe automotive intelligent lighting system market accounted for 34.2% of the global share in 2024. The European automotive intelligent lighting system market is witnessing significant transformation, driven by the widespread integration of adaptive and matrix LED lighting technologies in premium vehicles, rising investment in vehicle safety compliance amid Euro NCAP and UNECE lighting regulations, and the push toward energy-efficient and sustainable vehicle components.

b. Some key players operating in the automotive intelligent lighting system market include Koito Manufacturing Co., Ltd., Valeo SA, HELLA GmbH & Co. KGaA, Marelli Holdings Co., Ltd., Stanley Electric Co., Ltd., ZKW Group (a part of LG Electronics), OSRAM GmbH, Hyundai Mobis (a part of Hyundai Motor Group), Aptiv PLC, Tung Thih Electronic Co., Ltd. (a part of Tung Thih Group).

b. Key factors that are driving the market growth include rising adoption of LED and matrix lighting systems in premium and mid-range vehicles, strict global safety and visibility regulations that are accelerating the integration of advanced front and signal lighting, and a growing consumer preference for ambient and customizable interior lighting to enhance the in-cabin experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.