- Home

- »

- Automotive & Transportation

- »

-

Automotive LiDAR Market Size, Share, Growth Report, 2030GVR Report cover

![Automotive LiDAR Market Size, Share & Trends Report]()

Automotive LiDAR Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Mechanical LiDAR, Solid-state LiDAR), By Application, By Propulsion Type, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-218-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive LiDAR Market Summary

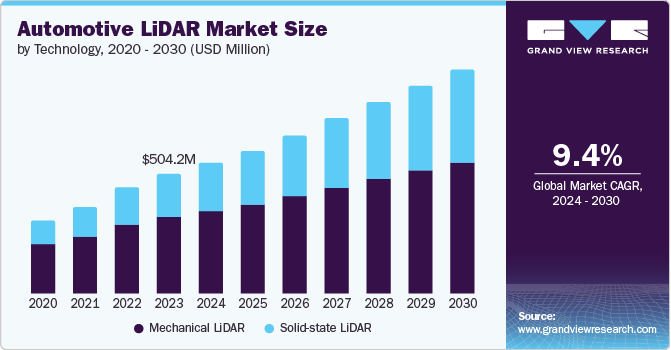

The global automotive LiDAR market size was estimated at USD 504.2 million in 2023 and is projected to reach USD 942.1 million by 2030, growing at a CAGR of 9.4% from 2024 to 2030. The automotive light detection and ranging (LiDAR) industry is driven by the increasing adoption of autonomous and ADAS technologies, stricter safety regulations, technological advancements, and growing consumer demand for enhanced driving experiences.

Key Market Trends & Insights

- North America accounted to hold significant share in the market and accounted for a 34.9% share in 2023.

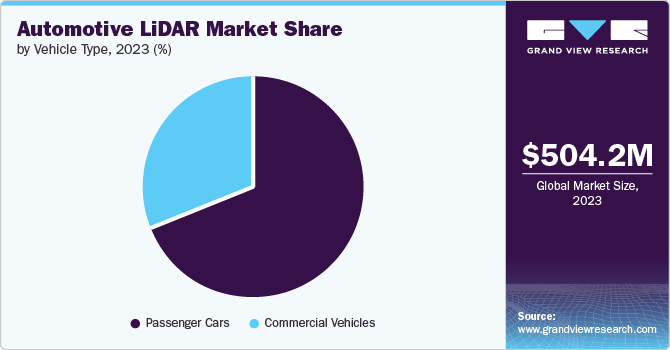

- In terms of vehicle type, the passenger cars segment holds the highest market share of the global revenue in 2023.

- In terms of technology, the mechanical LiDAR segment led the market and accounted for 64.2% of the global revenue in 2023.

- In terms of application, the ADAS segment hold the highest market share of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 504.2 Million

- 2030 Projected Market Size: USD 942.1 Million

- CAGR (2024-2030): 9.4%

- North America: Largest market in 2023

The rising adoption of autonomous and semi-autonomous vehicle technologies is a primary driver for the automotive LiDAR market. LiDAR sensors are crucial for the accurate perception and mapping of a vehicle's surroundings, which is essential for autonomous driving capabilities. Further, increased emphasis on vehicle safety and government regulations mandating advanced driver assistance systems (ADAS) is fostering the demand for automotive LiDAR systems.

Ongoing improvements in LiDAR technology, such as reduced cost, increased resolution, and enhanced performance, are making LiDAR systems more accessible and attractive for automotive applications. Growing consumer awareness and demand for safety features and autonomous driving capabilities are driving the adoption of LiDAR-equipped vehicles. Continuous research and development efforts are focused on improving the performance, reliability, and cost-effectiveness of LiDAR sensors to make them more viable for mainstream automotive applications.

There is a significant increase in prominence of solid-state LiDAR solutions, which are more compact, cost-effective, and reliable compared to traditional mechanical LiDAR systems. This trend is driven by the need for scalable and integrated LiDAR solutions for mass-market adoption. The integration of LiDAR with other sensing technologies, such as cameras and radars, is becoming more prevalent. Sensor fusion enhances the overall perception capabilities and reliability of ADAS and autonomous driving systems.

The automotive industry is rapidly advancing towards higher levels of vehicle autonomy, with LiDAR playing a critical role in this evolution. LiDAR's integration with Adaptive Cruise Control (ACC) and Automatic Emergency Braking (AEB) systems is essential for vehicles progressing to Level 3 and Level 4 autonomy. Its ability to create detailed 3D maps of the surroundings enables accurate environmental perception, supporting informed decision-making in complex driving scenarios. As automakers develop more advanced autonomous vehicles, the demand for LiDAR technology in these safety systems is growing significantly. This trend is driving the need for increasingly sophisticated ACC and AEB systems that can meet both current and future autonomous driving requirements, ultimately accelerating growth in the Automotive LiDAR market.

Technology Insights

The mechanical LiDAR segment led the market and accounted for 64.2% of the global revenue in 2023. The automotive LiDAR market is witnessing significant technological advancements, particularly in sensor capabilities. Mechanical LiDAR systems, known for their rotating components, provide high-resolution 3D mapping essential for autonomous vehicle navigation. However, these systems face challenges such as bulkiness and susceptibility to wear and tear, which can affect long-term reliability. Innovations in laser technology and signal processing are enhancing the performance of mechanical LiDAR, making them more competitive against solid-state alternatives. As manufacturers strive for improved accuracy and efficiency, mechanical LiDAR continues to play a vital role in the evolution of automotive sensing technologies.

Solid-state LiDAR is being rapidly integrated into both autonomous and semi-autonomous vehicles, playing a crucial role in enhancing operational safety. The technology’s ability to deliver high-resolution, real-time 3D mapping is essential for the effective functioning of advanced driver assistance systems (ADAS), such as adaptive cruise control and automatic emergency braking. As the automotive industry progresses toward greater levels of automation, the demand for solid-state LiDAR systems is expected to surge. This trend highlights the importance of solid-state technology in meeting regulatory standards and improving the overall safety and efficiency of modern vehicles. The growing application of solid-state LiDAR across various vehicle types underscores its pivotal role in the future of transportation.

Application Insights

The ADAS segment hold the highest market share of the global revenue in 2023. The growing consumer focus on vehicle safety is significantly influencing the ADAS segment of the automotive LiDAR market. As awareness of road safety issues increases, consumers are actively seeking vehicles equipped with advanced safety features. This shift in consumer behavior is prompting automakers to prioritize the integration of LiDAR technology into their ADAS offerings. Features such as lane-keeping assistance, pedestrian detection, and blind-spot monitoring are becoming essential selling points for new vehicles. As a result, the automotive industry is responding to this demand by enhancing the capabilities of ADAS through the incorporation of cutting-edge LiDAR solutions.

Growing consumer awareness of road safety is driving the demand for autonomous cars equipped with advanced LiDAR systems. As consumers seek safer and more convenient transportation options, the integration of LiDAR technology into autonomous cars becomes increasingly appealing. Features such as automatic emergency braking, lane-keeping assistance, and pedestrian detection are becoming essential selling points for new vehicles. The emphasis on safety and convenience is prompting automakers to prioritize the incorporation of LiDAR sensors into their autonomous vehicle designs. This trend reflects a broader shift in consumer preferences towards vehicles that offer enhanced safety features and autonomous capabilities.

Propulsion Type Insights

The internal combustion engine (ICE) vehicle segment holds the highest market share of the global revenue in 2023. The increasing demand for advanced safety features is driving automakers to integrate LiDAR technology into internal combustion engine (ICE) vehicles, which have traditionally relied on conventional sensors. LiDAR provides superior detection capabilities, enabling functions such as collision avoidance and lane-keeping assistance, which are increasingly becoming standard in many ICE models. This shift is influenced by rising consumer expectations for enhanced safety and the need for ICE vehicles to stay competitive with electric vehicles, which are often seen as more technologically advanced. By incorporating LiDAR, ICE vehicles can deliver comparable safety and performance, making them more appealing to a safety-conscious market. This trend underscores the expanding role of LiDAR technology across all vehicle types, including ICE, electric, and autonomous vehicles.

The rising demand for autonomous driving technologies in electric & hybrid vehicles is placing LiDAR technology at the forefront of this transformation. LiDAR's high-precision 3D mapping and real-time obstacle detection are crucial for the safe operation of autonomous and semi-autonomous systems. As electric vehicles (EVs) & hybrid vehicles (HVs) increasingly adopt autonomous features, the need for advanced LiDAR systems is growing. This trend is especially prominent in premium EV models, which often showcase the latest in autonomous driving technologies. The focus on advancing autonomous capabilities is leading automakers to invest significantly in integrating LiDAR into their electric and hybrid vehicle lineups.

Vehicle Type Insights

The passenger cars segment holds the highest market share of the global revenue in 2023. The growing popularity of advanced driver assistance systems (ADAS) and autonomous features in passenger cars is a major driver for the automotive LiDAR market. LiDAR sensors are essential for enabling features such as automatic emergency braking (AEB), adaptive cruise control (ACC), lane departure warning, and blind spot detection. As consumers increasingly prioritize safety and convenience, automakers are integrating LiDAR technology to enhance vehicle capabilities. This trend is further fueled by advancements in machine learning (ML) and artificial intelligence (AI), which improve the functionality of LiDAR systems in real-time decision-making. Consequently, the demand for LiDAR-equipped vehicles is expected to rise significantly, positioning LiDAR as a critical component in the future of automotive safety.

Commercial vehicles are increasingly using LiDAR in conjunction with radar and camera systems to create a more comprehensive sensing environment. This sensor fusion approach enhances the overall accuracy and reliability of vehicle perception systems. Combining data from multiple sensors helps in overcoming the limitations of individual technologies and provides a more robust solution. Sensor fusion supports better decision-making and improves the effectiveness of advanced driver assistance systems (ADAS). The integration of LiDAR with other sensors is becoming a standard practice in the commercial vehicle industry.

Regional Insights

North America accounted to hold significant share in the market and accounted for a 34.9% share in 2023. The North America automotive LiDAR market is characterized by significant investments in autonomous vehicle technology and a strong presence of major LiDAR manufacturers. There's a growing focus on developing solid-state LiDAR solutions and integrating LiDAR with other sensing technologies. Partnerships between automotive OEMs, tech giants, and LiDAR startups are driving innovation and market growth. The region is also seeing increased testing and deployment of autonomous vehicles, particularly in the United States, which is fueling demand for advanced LiDAR systems.

U.S. Automotive LiDAR Market Trends

the U.S. is at the forefront of LiDAR technology development and adoption. The market is driven by substantial investments from both established automakers and tech companies in autonomous driving research. There's a strong emphasis on reducing the cost of LiDAR systems while improving their performance and reliability. The U.S. is also witnessing a rise in LiDAR applications beyond autonomous cars, including in smart city infrastructure and advanced driver assistance systems (ADAS) for conventional vehicles.

Europe Automotive LiDAR Market Trends

The Europe automotive LiDAR market is characterized by stringent safety regulations and a strong focus on reducing carbon emissions, which is driving the adoption of electric and autonomous vehicles. There's significant research and development activity in countries like Germany, France, and the UK, with a focus on developing high-resolution, long-range LiDAR systems. European automakers are increasingly integrating LiDAR into their premium vehicle models, and there's growing interest in LiDAR applications for urban mobility solutions and public transportation.

Asia Pacific Automotive LiDAR Market Trends

The Asia Pacific region, led by countries like China, Japan, and South Korea, is experiencing rapid growth in the automotive LiDAR market. There's a strong push for autonomous vehicle technology, particularly in China, where government support and investments are driving market expansion. The region is seeing a rise in domestic LiDAR manufacturers, especially in China, challenging established Western players. The region is also witnessing increased collaboration between automakers and tech companies, fostering innovation in areas such as autonomous driving and AI-powered user interfaces. Additionally, the diverse market conditions across the region are driving the development of scalable solutions that can cater to both premium and budget vehicle segments.

Key Automotive LiDAR Company Insights

The competitive landscape of the automotive LiDAR market is dynamic and characterized by a mix of established players, innovative startups, and new entrants. Major automotive OEMs and technology companies are increasingly investing in the vertical integration of LiDAR technology, aiming to have more control over the supply chain and differentiate their offerings. Partnerships and collaborations between LiDAR suppliers, automotive OEMs, and technology companies are becoming more prevalent to drive the adoption and integration of LiDAR in the automotive industry. As the technology matures, differentiation through software capabilities, manufacturing scalability, and integration expertise is becoming increasingly important in automotive LiDAR market.

Key Automotive LiDAR Companies:

The following are the leading companies in the automotive LiDAR market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Denso Corporation

- Innoviz Technologies

- LeddarTech Inc.

- KUBOTA Corporation

- Quanergy Solutions, Inc.

- Robert Bosch GmbH

- Teledyne Geospatial

- Valeo

- Velodyne LiDAR, Inc.

Recent Developments

-

In July 2024, Japanese automotive lighting manufacturer Koito Manufacturing Co., Ltd. entered into a definitive agreement to acquire Cepton, Inc., a U.S.-based LiDAR solutions provider. This strategic acquisition is expected to significantly bolster Koito's position in the automotive sensing market. By integrating Cepton's technology and expertise, Koito aims to enhance its capabilities in several key areas.

-

In June 2023, Innoviz Technologies Ltd partnered with LOXO to deploy InnovizOne LiDAR units on LOXO delivery vehicles until 2024. LOXO will utilize Innoviz's automotive-grade LiDAR in zero-emission autonomous delivery vehicles. By integrating InnovizOne into LOXO vehicles, retailers can benefit from enhanced capabilities for streamlined and eco-friendly goods transportation. This collaboration aims to address the increasing demand in the autonomous last-mile delivery market, which is expected to grow to USD 5.9 billion by 2030.

-

In April 2023, Cepton, Inc. introduced Komodo, its proprietary ASIC (Application-Specific Integrated Circuit) chip for lidar point cloud processing. This highly integrated custom SoC (System on Chip) is designed to optimize Cepton's patented lidar architecture, improving point cloud data quality and lowering costs by replacing multiple off-the-shelf silicon components. By utilizing dedicated ASICs, Cepton is positioning its lidar products for widespread deployment in future vehicles, meeting the cost targets required by automotive OEMs for mass-market adoption.

Automotive LiDAR Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 548.1 Million

Revenue forecast in 2030

USD 942.1 Million

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, propulsion type, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, Japan, India, South Korea, Australia, Brazil, Mexico, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Continental AG; Denso Corporation; Innoviz Technologies; LeddarTech Inc.; KUBOTA Corporation; Quanergy Solutions, Inc.; Robert Bosch GmbH; Teledyne Geospatial; Valeo

Velodyne LiDAR, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive LiDAR Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Automotive LiDAR Market report based on technology, application, propulsion type, vehicle type, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical LiDAR

-

Solid-state LiDAR

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ADAS

-

Automatic Emergency Braking (AEB)

-

Adaptive Cruise Control (ACC)

-

-

Autonomous Cars

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Combustion Engine (ICE) Vehicle

-

Electric & Hybrid Vehicles

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive LiDAR market size was estimated at USD 504.2 million in 2023 and is expected to reach USD 548.1 million in 2023.

b. The global automotive LiDAR market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 942.1 million by 2030.

b. North America dominated the automotive LiDAR market with a share of 35.6% in 2022. The growing adoption on account of administrative regulations, mandating the installation of certain automotive safety technologies in both lightweight and heavyweight vehicles in the region

b. Some key players operating in the automotive LiDAR market include Continental AG; Denso Corporation; LeddarTech; Novariant, Inc.; Phantom Intelligence, Inc.; Quanergy Systems, Inc; Robert Bosch GmbH; Teledyne Optech; Valeo; Velodyne LiDAR, Inc

b. Key factors that are driving the market growth include the increasing adoption of ADAS systems in the automotive industry and the rising development of autonomous vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.