- Home

- »

- Advanced Interior Materials

- »

-

Basalt Rock Market Size And Share, Industry Report, 2033GVR Report cover

![Basalt Rock Market Size, Share & Trends Report]()

Basalt Rock Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Basalt Fiber, Basalt Aggregates), By End-use (Building & Construction, Infrastructure, Automotive & Transportation, Energy & Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-602-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Basalt Rock Market Summary

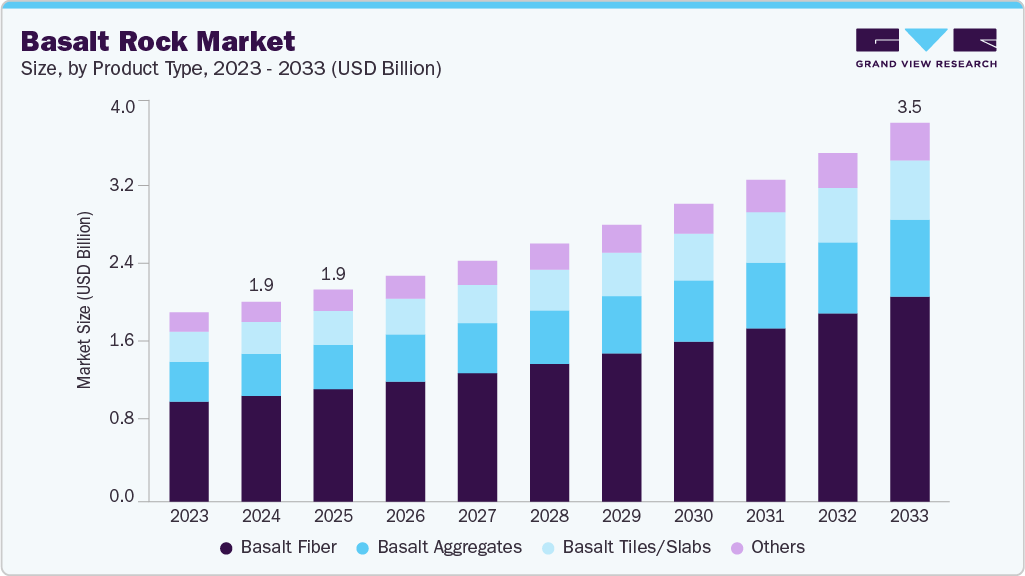

The global basalt rock market size was estimated at USD 1,868.2 million in 2024 and is projected to reach USD 3,541.3 million in 2033, growing at a CAGR of 7.5% from 2025 to 2033. Due to its excellent physical properties, such as high compressive strength, corrosion resistance, and thermal stability, basalt rock finds extensive applications across various industries.

Key Market Trends & Insights

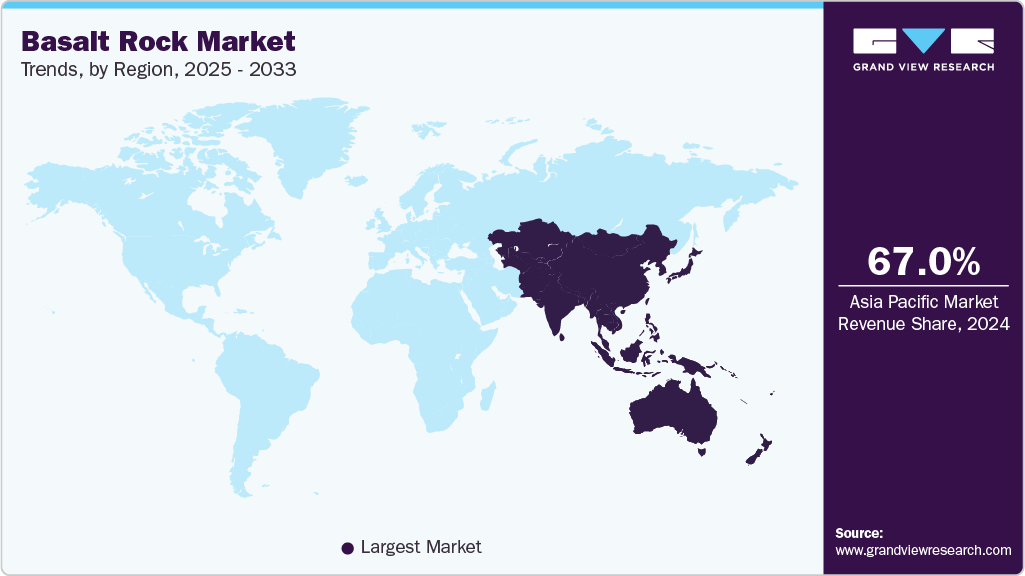

- Asia Pacific dominated the basalt rock market with the largest revenue share of 67% in 2024.

- The basalt rock market in China is anticipated to grow at a lucrative CAGR during the forecast period.

- By product type, the basalt fiber segment led the market with the largest revenue share of 53.0% in 2024.

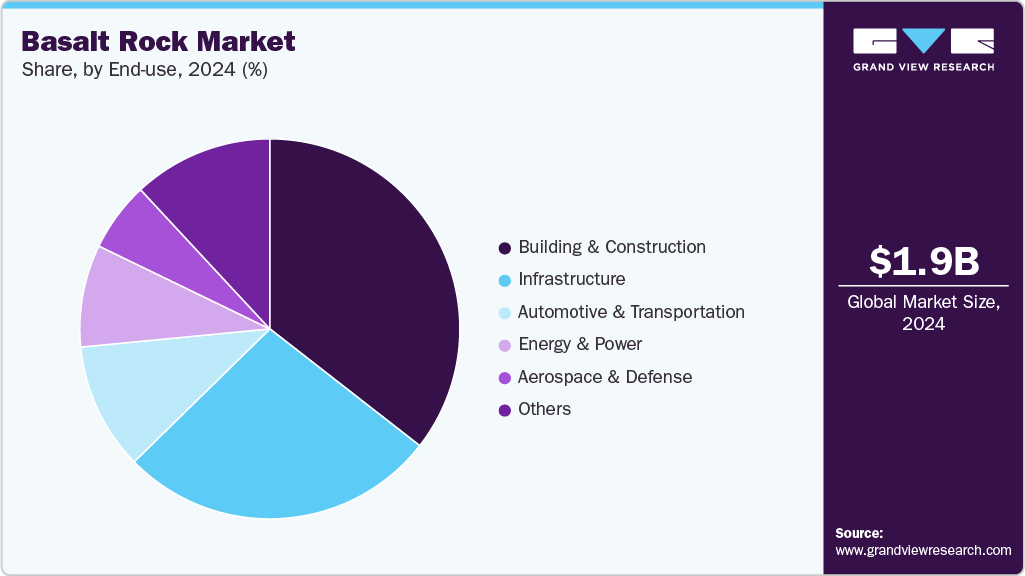

- By end use, the building & construction segment led the market with the largest revenue share of 35.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,868.2 Million

- 2033 Projected Market Size: USD 3,541.3 million

- CAGR (2025-2033): 7.5%

- Asia Pacific: Largest market in 2024

In April 2025, China hosted the "Basalt Fiber Composite Materials New Standards, New Technologies, and New Products Application Promotion Conference" in Dazhou City, Sichuan Province. During this event, Southeast University and the Dazhou High-tech Zone Management Committee released the "2024 Basalt Fiber and Composite Materials Industry Development Report." This report analyzes the development status of the basalt fiber and composite materials industry, highlighting technical obstacles and future trends. The initiative underscores China's commitment to advancing basalt fiber applications and establishing industry standards.The application of basalt rock in the building and construction sector is gaining significant traction globally, driven by its superior mechanical properties, environmental benefits, and cost-effectiveness. Several major players and regions actively invest in basalt-based materials to enhance infrastructure resilience and sustainability.

Sustainability initiatives and recycling are increasingly influencing the future of the basalt rock industry. The recovery and reuse of basalt fibers and aggregates from construction and industrial waste are gaining traction as part of wider circular economic practices. Furthermore, industry stakeholders are investing in R&D to enhance eco-friendly extraction and processing technologies, aiming to reduce carbon emissions and improve energy efficiency. As global industries advance toward sustainable infrastructure and carbon neutrality, basalt will continue to play a vital role in material innovation, offering durability, recyclability, and a low environmental footprint.

Drivers, Opportunities & Restraints

The basalt rock industry is gaining momentum primarily due to its increasing adoption in the construction and infrastructure sectors, which are undergoing robust global expansion. One of the key drivers is the rising demand for corrosion-resistant and eco-friendly alternatives to traditional materials like steel and concrete. Basalt rebar, for instance, is increasingly used in coastal infrastructure projects because it does not corrode steel in high-moisture and salt-laden environments. A prime example is the growing use of basalt rebar in Middle Eastern countries such as Saudi Arabia and the UAE, where major infrastructure projects under Vision 2030 (such as NEOM and The Line) emphasize using sustainable materials. Moreover, basalt aggregates are used in large-scale road and rail projects due to their durability and resistance to thermal stress.

The market will benefit significantly from the growing use of basalt fiber composites in the automotive and aerospace sectors. These industries are seeking lightweight materials to improve fuel efficiency and reduce emissions. Basalt fiber offers an excellent alternative to carbon and glass fiber composites due to its comparable strength and significantly lower cost. For example, companies like Sinoma and Kamenny Vek are expanding basalt fiber production to meet rising global demand, particularly in electric vehicles (EVs) and lightweight aircraft components. The shift toward electric mobility and carbon-neutral manufacturing further enhances the market outlook for basalt fiber applications.

High initial cost and technical complexity involved in the production of basalt fibers and advanced composites restrict the market growth. Unlike traditional building materials, basalt-based products often require specialized processing equipment, which can deter small and mid-sized manufacturers. In addition, a lack of industry standards and limited awareness among end-users about basalt's benefits hampers its broader adoption. In developing regions, traditional materials still dominate due to their cost advantage and widespread availability. Overcoming these challenges will require increased investment in R&D, public-private collaborations, and educational efforts to promote the long-term benefits of basalt-based solutions.

Product Type Insights

The basalt fiber segment led the market with the largest revenue share of 53.0% in 2024, driven by its superior mechanical and thermal properties and environmental advantages. Derived from natural basalt rock, this fiber offers high tensile strength, thermal stability up to 800°C, excellent corrosion resistance, and a lightweight profile. It is a beautiful alternative to traditional materials like steel, glass, and carbon fibers. These characteristics have led to widespread adoption across construction, automotive, aerospace, and marine sectors.

The demand for basalt tiles and slabs is steadily increasing across the construction and interior design industries due to their durability, aesthetic appeal, and eco-friendliness. Basalt, a volcanic rock, is naturally dense, non-porous, and resistant to wear, making it an ideal material for indoor and outdoor applications. These tiles are widely used in flooring, wall cladding, countertops, paving, and facades, particularly in high-traffic and high-moisture environments like commercial buildings, public infrastructure, and luxury residences.

End-use Insights

The building & construction segment led the market with the largest revenue share of 35.5% in 2024, primarily driven by the growing demand for durable, sustainable, and cost-effective materials in infrastructure development. Basalt rock, known for its high compressive strength, resistance to weathering, and fire-retardant properties, is increasingly used in applications such as aggregates, tiles, slabs, rebar, and insulation materials.

The automotive and transportation segment is experiencing growing demand for basalt rock, driven by the industry’s push for lightweight, high-performance, and environmentally friendly materials. Basalt fiber composites are increasingly used to substitute heavier and more expensive materials like steel, carbon fiber, and fiberglass. Their excellent strength-to-weight ratio, thermal stability, sound insulation, and corrosion resistance make them ideal for automotive applications such as body panels, heat shields, brake pads, and interior components.

Regional Insights

Asia Pacific dominated the basalt rock market with the largest revenue share of 67% in 2024, primarily driven by rapid urbanization and industrialization. Countries such as China, India, and Southeast Asian nations are witnessing a surge in construction activities to accommodate expanding urban populations and to support industrial development. Basalt rock, known for its durability and resistance to environmental factors, is increasingly utilized in infrastructure projects, including roads, bridges, and buildings.

The basalt rock market in China is anticipated to grow at a lucrative CAGR during the forecast period. In China, basalt fiber-reinforced concrete has been extensively utilized in large-scale infrastructure projects, notably the Hong Kong-Zhuhai-Macao Bridge. This application has significantly enhanced the bridge's durability and crack resistance. The market for basalt fiber-reinforced concrete in China is expected to grow at a lucrative pace over the coming year, reflecting the country's commitment to integrating sustainable materials into its construction practices.

North America Basalt Rock Market Trends

The basalt rock market in North America is experiencing significant growth, primarily driven by the increasing demand for sustainable and durable construction materials. Basalt rock's inherent properties, such as high compressive strength, resistance to weathering, and thermal stability, make it an ideal choice for infrastructure projects. The region's focus on green building initiatives and the adoption of eco-friendly materials has further propelled the use of basalt in construction applications, including aggregates, tiles, and rebar.

U.S. Basalt Rock Market Trends

The basalt rock market in the U.S. is experiencing robust growth, driven by multiple converging factors across infrastructure, sustainability, and advanced materials sectors. The U.S. government's continued emphasis on infrastructure development, including roads, bridges, and public buildings, has significantly increased the demand for durable construction materials. The USD 1.2 trillion infrastructure spending bill from 2021 continues to fuel growth in the building materials sector, with companies like Vulcan Materials Co. and Martin Marietta Materials, Inc. benefiting from this surge in demand.

Europe Basalt Rock Market Trends

The basalt rock market in Europe is experiencing significant growth, driven by sustainability initiatives, infrastructure development, and technological advancements. Europe's commitment to environmental sustainability has led to innovative applications of basalt rock, particularly in carbon sequestration. Enhanced rock weathering, a process that accelerates the natural reaction between CO₂ and crushed basalt, is gaining traction as a carbon dioxide removal technique.

Key Basalt Rock Company Insights

Some of the key players operating in the market include Kamenny Vek, Mafic SA, and Technobasalt-Invest LLC.

-

Kamenny Vek is a leading manufacturer of high-quality basalt fiber products. The company is renowned for its advanced production techniques and innovative solutions catering to various automotive, aerospace, construction, and marine industries.

-

Mafic SA is a renowned manufacturer of advanced basalt fiber solutions, specializing in high-modulus basalt fiber for aerospace and automotive applications. The company has a strong R&D team and collaborates with leading industry players.

-

Technobasalt-Invest is one of Europe’s largest producers, controlling over 20% of global basalt fiber output. The company focuses on vertical integration and owns basalt quarries and manufacturing facilities, which reduces dependency on raw material suppliers and ensures consistent quality.

Key Basalt Rock Companies:

The following are the leading companies in the basalt rock market. These companies collectively hold the largest market share and dictate industry trends.

- Aravali India Marbles & Granites

- Basaltex NV

- Basalt Fiber Tech

- Deutsche Basalt Faser GmbH

- Galen Ltd

- Jumeisheng

- Kamenny Vek

- Mafic SA

- Mudanjiang Basalt Fiber Co. Ltd

- Shanxi Basalt Fiber Technology Co., Ltd.

- Technobasalt Invest LLC

Recent Developments

-

In June 2024, Deutsche Basalt Faser GmbH, in collaboration with FibreCoat GmbH, developed a novel basalt-aluminum composite fiber designed to shield electromagnetic radiation. This innovation, known as AluCoat, offers an affordable, sustainable solution for applications in digital devices, medical technology, and electric vehicle batteries. The project was awarded the overall prize at the 17th “IQ Innovationspreis Mitteldeutschland” on June 24, 2024.

-

In July 2024, JOGANI Reinforcement introduced high-tensile basalt fiber reinforcement in India for the concrete and infrastructure sectors. These advanced fibers are explicitly designed for high-grade concrete applications and promise to revolutionize how modern construction addresses challenges like durability, tensile strength, and crack resistance.

-

In January 2024, the Arab Basalt Fiber Company participated in the Future Minerals Forum 2024 held in Riyadh, Saudi Arabia. The company showcased its latest innovations in basalt fiber technology, emphasizing applications in the construction and automotive industries, and engaged in discussions on sustainable practices in the minerals industry.

Basalt Rock Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,981.1 million

Revenue forecast in 2033

USD 3,541.3 million

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, Germany; France; UK; Italy; China; India; Japan; Brazil

Key companies profiled

Aravali India Marbles & Granites, Basaltex NV; Basalt Fiber Tech; Deutsche Basalt Faser GmbH; Galen Ltd; Jumeisheng; Kamenny Vek; Mafic SA; Mudanjiang Basalt Fiber Co., Ltd.; Shanxi Basalt Fiber Technology Co., Ltd.; Technobasalt Invest LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Basalt Rock Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global basalt rock market report based on the product type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Basalt Fiber

-

Basalt Aggregates

-

Basalt Tiles/Slabs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Infrastructure

-

Automotive & Transportation

-

Aerospace & Defense

-

Energy & Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.