- Home

- »

- Power Generation & Storage

- »

-

Battery Recycling Market Size & Share Analysis Report, 2030GVR Report cover

![Battery Recycling Market Size, Share & Trends Report]()

Battery Recycling Market Size, Share & Trends Analysis Report By Chemistry (Lithium-Ion, Lead Acid, Nickel), By Application (Transportation, Consumer Electronics, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-624-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Battery Recycling Market Size & Trends

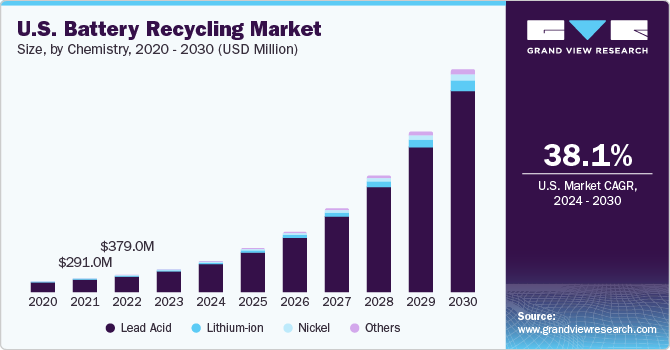

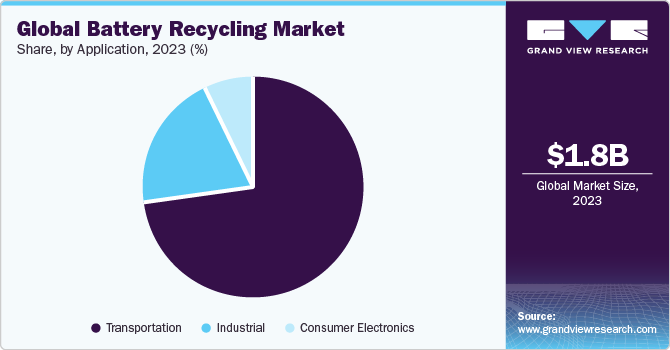

The global battery recycling market size was estimated at USD 1.83 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 37.6% from 2024 to 2030. The industry is expected to grow rapidly during the forecast period owing to increasing popularity of electric vehicles (EVs) and renewable energy storage systems leading to a higher demand for batteries, and, in turn, driving the need for recycling. Governments globally are implementing regulations to promote the recycling of batteries and reduce environmental impact, which is expected to boost industry growth.

The U.S. emerged as the largest market in North America in 2023. Increasing sales of EVs in the U.S. owing to the formulation of supportive federal policies, such as the Responsible Battery Recycling Act of 2022 California, and presence of leading industry players are expected to drive demand for batteries in the country over the forecast period. Responsible Battery Recycling Act of 2022 California instructs each battery retailer in the state to have a system for collection of used rechargeable batteries for recycling and reusing purposes.

The U.S. has emerged as a growing market for the recycling of li-ion batteries owing to the presence of large-scale li-ion recycling facilities in the country. For instance, Li-cycle Corp. inaugurated its new li-ion recycling facility with 120,000 square feet of warehousing space. This facility can process 10,000 tons of battery material for electric vehicles annually. The company possesses the capacity to recycle 60,000 electric vehicle batteries.

Market Dynamics

Increasing demand for electric vehicles and growing demand for UPS systems are preponderance for the market. Lithium is one of the most important components of electric vehicle batteries. It is the basic material required for production of lithium-ion batteries. The recycling cost of lithium is less than the cost of mining. Moreover, recycling is less hazardous to environment and human health than producing new lithium from mines. Therefore, demand for battery recycling is expected to increase with the growth of the electric vehicle industry.

Lead Acid batteries find application in uninterruptible power supply (UPS) systems as they provide high power density and enhanced life expectancy. A UPS system is an electrical equipment that provides a power supply when the main power or input power source fails. UPS systems are extensively used in buildings such as hospitals, banks, offices, data centers, and educational institutions.

Chemistry Insights

Based on chemistry, the lead-acid segment dominated the market for a revenue share of more than 84.0% in 2023.Lead-acid batteries are suitable for recycling compared to other batteries owing to an extensive usage of reusable lead and plastics for manufacturing. Battery recycling companies collect used batteries from consumers for recycling and reusing purposes. Used batteries are first broken into pieces. Plastics are sent for recycling into a plastic recycler and then given shape by process of extrusion.

Lithium-ion batteries are mainly used in electric vehicles (EVs) that are emerging as their fastest-growing application. According to the International Energy Association (IEA), more than 13% of new cars sold in 2023 were electronic which posed a high demand for lithium-ion batteries globally. Demand for recovering cobalt from used batteries by recycling them is increasing worldwide for their employment in electric vehicles. Cobalt and lithium are key materials for developing batteries for electric vehicles. As demand for battery manufacturing materials is increasing globally, companies are adopting various strategies to increase their share in the market.

Application Insights

Based on application, the transportation segment dominated the market for the largest revenue share of more than 73.0% in 2023.Lithium-ion, lead-acid, and nickel metal hydride batteries are extensively used in the transportation industry. Various types of lead-acid batteries such as flooded and valve-regulated types are used as automotive batteries. These batteries are robust, low maintenance, cheap, corrosion-resistant, and durable. Hence, lead-acid batteries hold the largest applications among the rest of the battery chemistries available in the market.

Recycling of li-ion batteries recovers lithium, cobalt, manganese, and nickel, which are used in manufacturing of new lithium-ion or other types of batteries. Lithium-ion batteries are widely used in electric vehicles owing to growing awareness about their advantages and increasing fuel prices, mainly in North America, Asia Pacific, and Europe. This is projected to drive automotive battery recycling owing to the presence of a large number of battery manufacturing and recycling companies in the region.

Regional Insights

Asia Pacific is expected to account for the largest revenue share of over 40.0% in 2023. Asia Pacific is also expected to register the fastest CAGR over the forecast period. Countries, such as China, India, Australia, and Japan, are expected to witness high growth rates owing to rising demand from growing end-use industries, such as automotive, consumer electronics, and industrial. North America occupied a significant revenue share in 2023, with the U.S. being a major contributor to industry growth. A surge in usage of li-ion batteries in smartphones to extend their shelf life and enhance their efficiency is expected to drive growth of the market in North America in the coming years.

Europe is also expected to witness a significant growth rate over the forecast period owing to presence of key automotive companies, such as Audi, BMW, Mercedes Benz, Jaguar, Aston Martin, Volkswagen, Volvo, Fiat, Ferrari, Lamborghini, and Porsche, in the region is expected to augment growth of automotive industry in Europe. This, in turn, is anticipated to drive demand for recycled batteries in the region over the forecast period.

Key Companies & Market Share Insights

Market is highly competitive and consolidated due to the presence of a large number of well-established players. Dominant trend in operations of these battery recycling companies includes collaborations, mergers & acquisitions, and expansions, which facilitate competition in the industry.

In November 2023, Redwood Materials announced their expansion for battery recycling in line with the increasing demand for recycling of electric vehicle batteries.

Key Battery Recycling Companies:

- Call2Recycle

- Exide Technologies

- Gravita India Ltd.

- Glencore

- Cirba Solutions

- American Battery Technology Company

- Gopher Resource

- East Penn Manufacturing Co.

- Aqua Metals

Battery Recycling Market Report Scope

Report Attribute

Details

Market size revenue in 2024

USD 2.47 billion

Revenue forecast in 2030

USD 17.08 billion

Growth rate

CAGR of 37.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Chemistry, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; France; Italy; Spain; Poland; Netherlands; China; Japan; South Korea; Taiwan; India; Indonesia; Malaysia; Thailand; Vietnam; Australia;Brazil; Argentina; Chile; UAE; Saudi Arabia; South Africa

Key companies profiled

Call2Recycle; Aqua Metals; Exide Technologies; Glencore; Gravita India Ltd.; Cirba Solutions; Gopher Resource; East Penn Manufacturing Co.; American Battery Technology Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

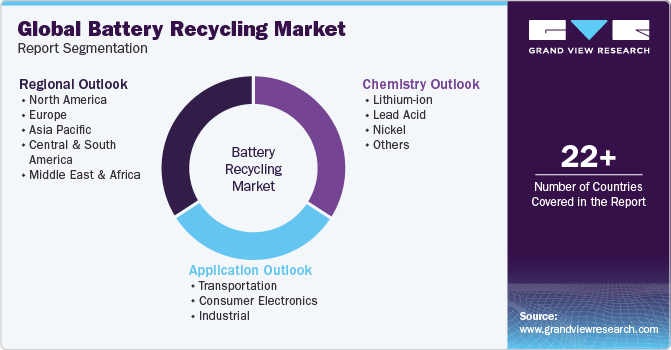

Global Battery Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global battery recycling market report based on chemistry, application, and region:

-

Chemistry Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Lead Acid

-

Nickel

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Consumer Electronics

-

Industrial

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Taiwan

-

India

-

Indonesia

-

Malaysia

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global battery recycling market size was estimated at USD 1.83 billion in 2023 and is expected to reach USD 2.47 billion in 2024.

b. The battery recycling market is expected to grow at a compound annual growth rate of 37.6% from 2024 to 2030 to reach USD 17.08 billion by 2030.

b. The transportation segment led the global battery recycling market and accounted for a revenue share of 73.05% in 2023.

b. The key players in the battery recycling market include Call2Recycle, ECOBAT, Aqua Metals, Exide Technologies, G&P Batteries, and EnerSys .

b. Stringent government regulations around safe battery disposal coupled with bottlenecks in virgin material sourcing is expected to aid the demand for battery recycling across major economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."