- Home

- »

- Power Generation & Storage

- »

-

Battery Separator Market Size, Share & Trends Report, 2030GVR Report cover

![Battery Separator Market Size, Share & Trends Report]()

Battery Separator Market (2023 - 2030) Size, Share & Trends Analysis By Battery Type (Li-Ion, Lead Acid, Nickel-cadmium, Nickel Metal), By Type (Coated, Non-coated), By Material, By Thickness, By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-137-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Separator Market Summary

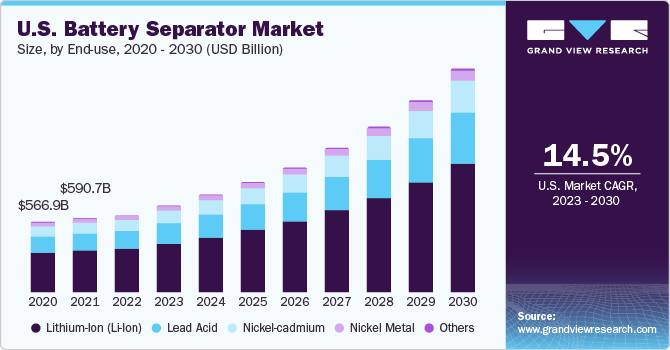

The global battery separator market size was estimated at USD 4.21 billion in 2022 and is projected to reach USD 13.33 billion by 2030, growing at a CAGR of 15.8% from 2023 to 2030. The product demand is propelled by its wide-scale usage in the end-use industries, such as automotive, consumer electronics, and industrial.

Key Market Trends & Insights

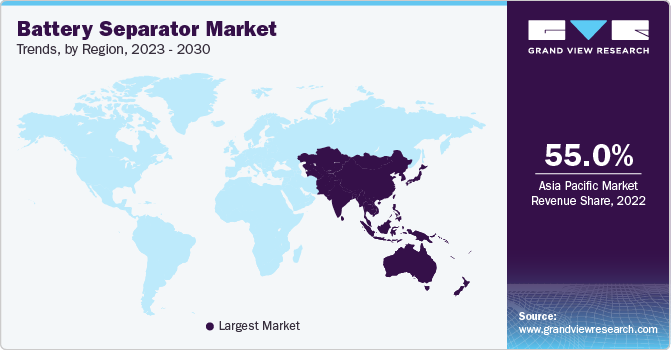

- The Asia Pacific region dominated the global market in 2022 and accounted for the largest share of over 55.0% of the overall revenue.

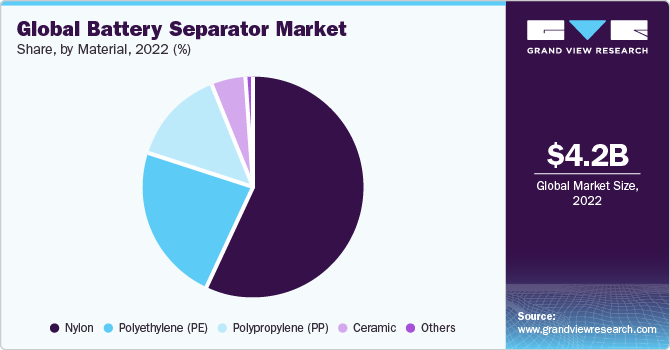

- By material, the nylon material segment dominated the global market in 2022 and accounted for the largest share of above 45.0% of the overall revenue.

- By thickness, the 5μM-10μM thickness range segment dominated the global market in 2022 and accounted for the largest share of above 61.0% of the overall revenue.

- By technology, The dry battery separator technology segment dominated the global market in 2022 and accounted for the largest share of above 61.0% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 4.21 Billion

- 2030 Projected Market Size: USD 13.33 Billion

- CAGR (2023-2030): 15.8%

- Asia Pacific: Largest market in 2022

The automotive industry is shifting toward electric vehicles (EVs) to reduce emissions and dependence on fossil fuels. EVs require large and high-performance batteries, and the demand for these batteries has a direct impact on the demand for high-quality separators. Thus, the increasing sales of EVs in the U.S., owing to supportive federal policies coupled with the presence of market players in the country, are expected to drive the product demand.

This, in turn, is expected to propel the demand for battery separators during the forecast period. The robust manufacturing base and rapid growth of the automotive industry in the U.S. are expected to augment the demand for vehicle production, which, in turn, is expected to fuel the demand for lead-acid batteries over the coming years. The growing demand for passenger cars in the U.S. is expected to augment the lead-acid batteries demand further, thereby boosting the demand for battery separators.

Battery Type Insights

The lithium-ion battery type segment dominated the global market in 2022 and accounted for a revenue share above 56.0%. One of the most significant drivers of Li-ion battery demand is the automotive industry's shift toward electric vehicles. Various automakers are investing heavily in EV production, and the batteries used in these vehicles are typically lithium-ion due to their high energy density and power output.

The lead-acid battery type segment accounted for a revenue share of over 23.0% in 2022. Lead-acid batteries are still widely used in the automotive industry for traditional internal combustion engine vehicles. Vehicles, such as cars, trucks, motorcycles, and boats, often rely on lead-acid batteries for their starting, lighting, and ignition (SLI) systems.

Type Insights

The coated separator type segment dominated the global market in 2022 and accounted for the largest share of above 62.0% of the overall revenue. Coated separators can provide an additional layer of protection within lithium-ion batteries. They can offer thermal stability and help prevent thermal runaway, a critical safety concern, by inhibiting direct contact between the anode and cathode materials.

The non-coated battery separator type segment accounted for a revenue share of above 37.0% in 2022. Non-coated separators are generally more cost-effective to manufacture compared to coated separators. This cost advantage makes them attractive for applications where cost is a primary consideration, such as in traditional lead-acid batteries and some consumer electronics.

Material Insights

The nylon material segment dominated the global market in 2022 and accounted for the largest share of above 45.0% of the overall revenue. Nylon-based separators exhibit excellent thermal stability, making them suitable for high-temperature applications. This characteristic is particularly valuable in batteries used in electric vehicles, where heat generation can be significant.

The polyethylene-based material segment accounted for a revenue share of above 23.0% in 2022. These separators maintain their shape and structural integrity under stress and high-temperature conditions, ensuring the long-term durability and performance of batteries, which drive their demand.

Thickness Insights

The 5μM-10μM thickness range segment dominated the global market in 2022 and accounted for the largest share of above 61.0% of the overall revenue. Various lithium-ion batteries used in consumer electronics and electric vehicles employ separators in the 5μm to 10μm thickness range. These separators provide a balance between ion conductivity and mechanical stability.

The 10μM-20μM thickness range segment accounted for a revenue share of above 38.0% in 2022. Batteries designed for high energy density, such as those used in electric vehicles and grid energy storage, often use separators in the 10μM-20μM thickness range. These separators enable greater electrode material loading, resulting in higher energy density.

Technology Insights

The dry battery separator technology segment dominated the global market in 2022 and accounted for the largest share of above 61.0% of the overall revenue. The widespread usage of smartphones, laptops, wearables, and other portable devices relies on lithium-ion batteries with dry separators to provide efficient and safe energy storage.

The wet battery separator technology segment accounted for a share of above 38.0% in 2022. Lead-acid batteries, which are commonly used in automotive applications for SLI systems, rely on wet separators to facilitate the flow of ions between the positive and negative plates. As the automotive industry continues to grow and evolve, the demand for wet separators is also expected to increase.

End-use Insights

The automotive segment dominated the global market in 2022 and accounted for the largest share of above 43.0% of the overall revenue. Concerns over climate change and air pollution have prompted individuals, governments, and organizations to seek cleaner transportation alternatives. EVs produce zero tailpipe emissions, making them an attractive choice for environmentally conscious consumers.

The consumer electronics segment accounted for a significant share of above 23.0% of the overall revenue in 2022. The ongoing technological innovations have led to the development of more advanced consumer electronics products. Consumers are drawn to new and improved devices with enhanced capabilities.

Regional Insights

The Asia Pacific region dominated the global market in 2022 and accounted for the largest share of over 55.0% of the overall revenue. The robust manufacturing base of batteries in China, Japan, and India along with the commitment of governments toward infrastructure development is expected to drive the growth of the regional market. Furthermore, the growing number of FMCG companies in India, China, and Singapore is expected to augment the demand for batteries, thereby driving the market growth over the forecast period. In addition, rapid industrialization, increasing government infrastructure spending, and growing FDIs are expected to promote market expansion.

In addition, the growing automotive industry, which is one of the largest end-users of lead-acid batteries, across various countries including India, Indonesia, Sri Lanka, and Vietnam is expected to augment the market growth. However, the rising awareness levels about the technical limitations of batteries, such as low energy density and weight of the battery, are expected to restrict the market growth.

Key Companies & Market Share Insights

Research activities by key players focused on new materials, which combine several properties, are projected to gain wide acceptance in the industry. Some of the prominent companies in the global battery separator market include:

-

Toray Battery Separator Film Korea Limited

-

Sumitomo Chemical Co., Ltd.

-

Asahi Kasei Corporation

-

SK Innovation Co., Ltd.

-

Freudenberg Performance Materials

-

ENTEK International, LLC

-

W-Scope Corporation

-

UBE Corporation

-

Bernard Dumas

-

Dow, Inc.

-

Mitsubishi Paper Mills, Ltd.

-

Teijin Limited

-

Eaton Corporation plc

-

Ahlstrom

-

Sinoma Lithium Film Co., Ltd.

Battery Separator Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.78 billion

Revenue forecast in 2030

USD 13.33 billion

Growth rate

CAGR of 15.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion, and CAGR (%) from 2023 to 2030

Report coverage

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Battery type, type, material, thickness, technology, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; The Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

Toray Battery Separator Film Korea Ltd.; Sumitomo Chemical Co., Ltd.; Asahi Kasei Corp.; SK Innovation Co., Ltd.; Freudenberg Performance Materials; ENTEK International, LLC; W-Scope Corp.; UBE Corp.; Bernard Dumas; Dow, Inc.; Mitsubishi Paper Mills, Ltd.; Teijin Ltd.; Eaton Corp. Plc; Ahlstrom; Sinoma Lithium Film Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Separator Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the battery separator market report on the basis of battery type, type, material, thickness, technology, end-use, and region:

-

Battery Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Lithium-Ion (Li-Ion)

-

Lead Acid

-

Nickel-cadmium

-

Nickel metal

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coated separator

-

Non-coated separator

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nylon

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Ceramic

-

Others

-

-

Thickness Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

5μM-10μM

-

10μM-20μM

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dry Battery Separator

-

Wet Battery Separator

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer electronics

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global battery separator market size was estimated at USD 4.21 billion in 2022 and is expected to reach USD 4.78 billion in 2023.

b. The global battery separator market is expected to grow at a compound annual growth rate of 15.8% from 2023 to 2030 to reach USD 13.33 billion by 2030.

b. Lithium-ion (Li-ion) battery type accounted to the largest share in battery separator market with a revenue share of 56.65% in 2022.

b. Major players present across the market include Toray Battery Separator Film Korea Limited; Sumitomo Chemical Co., Ltd.; Asahi Kasei Corporation; SK innovation co., Ltd.; Freudenberg Performance Materials; ENTEK International, LLC; W-SCOPE CORPORATION; UBE Corporation; Bernard Dumas; Dow, Inc.; Mitsubishi Paper Mills,Ltd.; TEIJIN LIMITED; Eaton Corporation plc; Ahlstrom; and Sinoma Lithium Film Co., Ltd.

b. The demand for battery separator is propelled by their rising demand from the end-use industries such as automotive, consumer electronics, and industrial.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.