- Home

- »

- Petrochemicals

- »

-

Benzenoid Market Size And Share, Industry Report, 2030GVR Report cover

![Benzenoid Market Size, Share & Trends Report]()

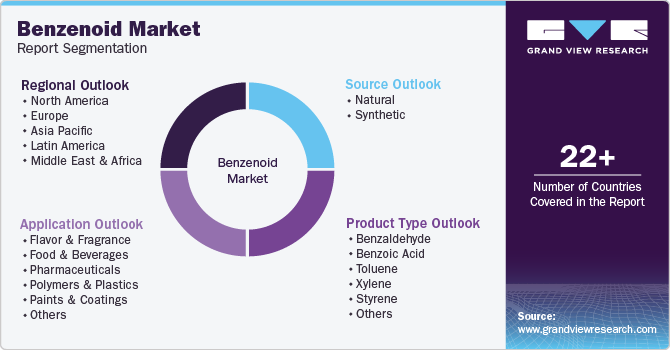

Benzenoid Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Benzaldehyde, Benzoic Acid, Toluene, Xylene, Styrene), By Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-510-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Benzenoid Market Size & Trends

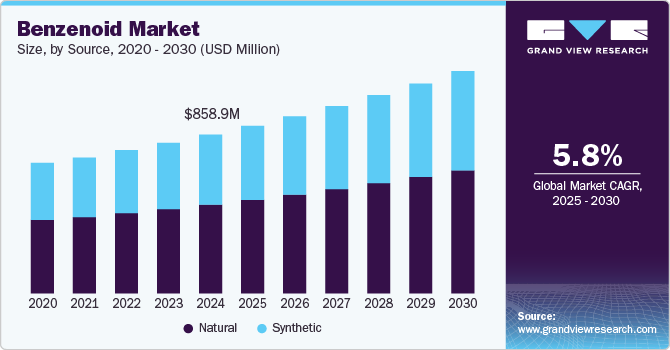

The global benzenoid market size was estimated at USD 858.88 million in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The increasing demand for fragrances and flavors across various industries is a primary driver of the global market. Benzenoids are widely used as key aromatic compounds in perfumes, cosmetics, personal care products, and food and beverage formulations. With rising consumer preference for high-quality scented products and natural ingredients, manufacturers are investing in benzenoid-based formulations to enhance sensory appeal.

The expansion of the luxury perfume industry and the growing popularity of premium skincare and haircare products have further fueled the demand for benzenoids. As urbanization and disposable incomes rise, particularly in emerging economies, the consumption of fragranced and flavored products is expected to witness significant growth.

The shift towards bio-based and sustainable benzenoid compounds is also contributing to market growth. With increasing environmental concerns and regulatory restrictions on synthetic chemicals, manufacturers are focusing on developing bio-derived benzenoids from renewable sources such as essential oils and plant extracts. This transition aligns with consumer preferences for eco-friendly products while ensuring compliance with stringent environmental regulations. Advancements in biotechnology and green chemistry have further enabled the production of high-purity bio-based benzenoids, expanding their application in natural fragrances, organic food additives, and pharmaceutical formulations.

Drivers, Opportunities & Restraints

The global benzenoid industry is driven by its widespread application across multiple industries, including fragrances, personal care, pharmaceuticals, and food and beverages. The increasing demand for aromatic compounds in the fragrance and flavor industry is a key factor fueling market growth, as benzenoids serve as essential ingredients in perfumes, soaps, detergents, and household cleaning products. In addition, the pharmaceutical sector relies on benzenoid compounds for the synthesis of active pharmaceutical ingredients (APIs), further supporting market expansion. The rising consumer preference for natural and organic products has also contributed to the development of bio-based benzenoids, driving innovation and investment in sustainable production methods.

Significant opportunities exist in the growing trend of clean-label and sustainable products, which has led to increased demand for naturally sourced benzenoids. Advancements in biotechnology and green chemistry have enabled manufacturers to develop eco-friendly and bio-based benzenoid compounds, presenting lucrative opportunities for companies aiming to align with global sustainability goals. In addition, the expansion of the food and beverage industry, particularly in emerging economies, is expected to provide a strong market outlook. The increasing use of benzenoids in functional foods, beverages, and dietary supplements creates further growth avenues, as consumers become more health-conscious and seek high-quality ingredients.

Despite its growth trajectory, the benzenoid industry faces certain restraints, primarily related to stringent regulatory frameworks governing synthetic chemicals and their environmental impact. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) have imposed strict guidelines on the use of certain benzenoid compounds, which could limit their applications. In addition, price volatility in raw materials, particularly petroleum-based feedstocks, poses a challenge for manufacturers in maintaining cost efficiency. Competition from alternative aromatic compounds and substitutes in fragrance and pharmaceutical formulations also adds pressure on market players to continuously innovate and differentiate their product offerings.

Product Type Insights

The benzaldehyde segment led the market with the largest revenue share of 41.46% in 2024. Benzaldehyde is used in the synthesis of various active pharmaceutical ingredients (APIs) and as a precursor for other benzenoid derivatives. With the expanding pharmaceutical industry globally, driven by an increase in chronic diseases and the demand for innovative drug formulations, the demand for benzaldehyde as a building block for API production continues to rise.

The xylene segment is anticipated to grow at the fastest CAGR of 6.2% over the forecast period. Xylene is widely used as a solvent in the production of paints, coatings, adhesives, and industrial chemicals. As the global construction and automotive industries continue to grow, the demand for xylene as a solvent in paints and coatings for protective finishes and aesthetic purposes is on the rise. The expansion of the automotive sector, in particular, is a significant factor driving the demand for xylene-based products, as it is essential in the production of automotive coatings and finishes.

Source Insights

Based on source, the natural segment led the market with the largest revenue share of 55.95% in 2024.The growing consumer preference for natural and organic products is a key driver for the natural segment of the benzenoid industry. Consumers are becoming increasingly aware of the potential health and environmental risks associated with synthetic chemicals, which has led to a surge in demand for natural and bio-based benzenoid compounds. This shift in consumer behavior is particularly prominent in industries such as personal care, cosmetics, and food and beverages, where products with clean, natural ingredients are gaining popularity.

The synthetic segment is expected to grow at the fastest CAGR of 6.0% over the forecast period. Synthetic benzenoid compounds can be produced in large quantities at relatively lower costs compared to their natural counterparts. This affordability makes synthetic benzenoids highly attractive to manufacturers across various industries, including personal care, food and beverages, and pharmaceuticals. The widespread use of synthetic benzenoids in fragrances, flavors, and medicinal products is further supported by advancements in chemical synthesis and production techniques, which have improved efficiency and product consistency, making them more accessible to a broader range of consumers.

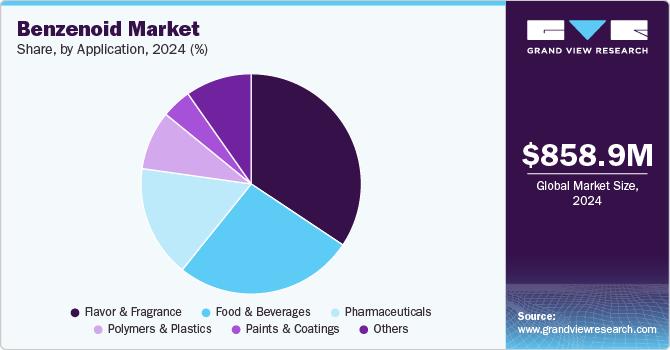

Application Insights

Based on application, the flavor and fragrance segment led the market with the largest revenue share of 34.35% in 2024, driven by the increasing consumer demand for personal care, cosmetics, and household products with appealing scents. As consumers become more conscious of their sensory experiences, there is a growing preference for high-quality, long-lasting fragrances in products such as perfumes, shampoos, deodorants, and air fresheners.

The food and beverages segment is expected to grow at the fastest CAGR of 6.2% over the forecast period, driven by the growing demand for natural and enhanced flavors in processed foods and beverages. With increasing consumer preference for clean-label and organic products, food manufacturers are turning to bio-based benzenoid compounds to replace synthetic alternatives. These naturally derived ingredients are not only preferred for their purity but also cater to the rising trend of health-conscious consumption.

Regional Insight

The benzenoid market in North America is primarily driven by the increasing demand for fragrances and flavors across various industries, including personal care, cosmetics, and food and beverages. Benzenoid compounds serve as key ingredients in perfumes, deodorants, soaps, and household cleaning products, where their aromatic properties enhance consumer appeal. The growing preference for premium and long-lasting fragrances, coupled with the rising disposable income of consumers, has fueled the expansion of the fragrance industry in the region.

U.S. Benzenoid Market Trends

The benzenoid market in the U.S. accounted for the largest market revenue share in North America in 2024. The food and beverage industry is a key contributor to the market growth of the U.S. These compounds are extensively used as flavoring agents in processed foods, beverages, and confectionery products to enhance taste and aroma. The rising consumer preference for natural and organic flavors has led to a shift toward bio-based benzenoids, driving investments in sustainable production methods. In addition, the growing demand for functional foods and dietary supplements that incorporate benzenoid-derived ingredients has created new growth opportunities within the market.

Asia Pacific Benzenoid Market Trends

Asia Pacific dominated the benzenoid market with the largest revenue share of 44.82% in 2024. Rapid industrialization and technological advancements in chemical synthesis are contributing to the expansion of the benzenoid industry in Asia Pacific. Improved production techniques, cost-effective raw material sourcing, and large-scale manufacturing capabilities in China and India provide a competitive edge to regional market players. In addition, the integration of artificial intelligence (AI) and automation in chemical processing has enhanced efficiency and quality control, ensuring high purity benzenoid compounds for diverse applications. As the region continues to experience economic growth and technological advancements, the demand for benzenoid compounds is expected to remain strong across multiple industries.

The benzenoid market in China is driven by the rapid expansion of the personal care and cosmetics industry. With a growing middle-class population and increasing disposable income, there is a strong demand for high-quality beauty, skincare, and personal hygiene products. Benzenoid compounds, known for their aromatic properties, are essential ingredients in perfumes, shampoos, lotions, and deodorants. In addition, the rise of domestic cosmetic brands and the influence of international luxury brands in China have further propelled the demand for premium fragrance formulations, boosting the benzenoid industry.

Europe Benzenoid Market Trends

The benzenoid market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The rising adoption of green chemistry and sustainable manufacturing practices is another key factor driving the market. With stringent environmental regulations imposed by the European Chemicals Agency (ECHA) and other regulatory bodies, companies are increasingly focusing on the development of eco-friendly and bio-based benzenoid compounds. The push for sustainability has led to greater investments in renewable feedstocks, biodegradable chemicals, and innovative extraction methods that reduce environmental impact while maintaining product efficacy.

Latin America Benzenoid Market Trends

The benzenoid market in Latin America is anticipated to grow at a significant CAGR during the forecast period. Latin America's well-established agricultural sector provides a strong foundation to produce natural and bio-based benzenoid compounds. The abundance of raw materials such as essential oils, spices, and botanical extracts used in benzenoid synthesis supports local manufacturing and reduces dependence on imports. Governments and industry stakeholders are increasingly promoting sustainable agricultural practices and value-added chemical processing to strengthen domestic supply chains. This has led to a rise in investments in eco-friendly extraction and production methods, aligning with global sustainability trends and enhancing the competitiveness of the regional benzenoid industry.

Key Benzenoid Company Insights

Some of the key players operating in the market include BASF, Sigma-Aldrich Co. LLC

-

In the benzenoid industry, BASF offers a wide range of aromatic ingredients used in fragrances, flavors, and pharmaceuticals. Its product offerings include high-purity benzenoid derivatives such as benzyl alcohol, benzaldehyde, and cinnamic aldehyde, which are essential in the production of perfumes, food flavoring agents, and pharmaceutical formulations.

-

Sigma-Aldrich offers an extensive portfolio of benzenoid compounds, including aromatic aldehydes, ketones, esters, and other related derivatives, which are widely used in applications such as flavor and fragrance formulations, pharmaceutical synthesis, and chemical research

Key Benzenoid Companies:

The following are the leading companies in the benzenoid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Sigma-Aldrich Co. LLC.

- The Good Scents Company

- International Flavors & Fragrances

- Givaudan

- Firmenich

- Quest International

- Takasago

- Haarmann & Reimer

- Sensient Technologies

Benzenoid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 906.88 million

Revenue forecast in 2030

USD 1202.87 million

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, Volume in Kilotons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF; Sigma-Aldrich Co. LLC.; The Good Scents Company; International Flavors & Fragrances; Givaudan; Firmenich; Quest International; Takasago; Haarmann & Reime; Sensient Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Benzenoid Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global benzenoid market report based on the product type, source, application and region.

-

Product Type Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Benzaldehyde

-

Benzoic Acid

-

Toluene

-

Xylene

-

Styrene

-

Others

-

-

Source Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Flavor and Fragrance

-

Food and Beverages

-

Pharmaceuticals

-

Polymers and Plastics

-

Paints and Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global benzenoid market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 1,202.9 billion by 2030.

b. Asia Pacific dominated the benzenoid market with a share of 44.8% in 2024. Rapid industrialization and technological advancements in chemical synthesis are contributing to the expansion of the benzenoid market in Asia Pacific.

b. Some key players operating in the benzenoid market include BASF, Sigma-Aldrich Co. LLC., The Good Scents Company, International Flavors & Fragrances, Givaudan, Firmenich, Quest International, Takasago, Haarmann & Reime, and Sensient Technologies

b. Key factors that are driving the market growth include increasing demand for fragrances and flavors across various industries is a primary driver of the global benzenoid market.

b. The global benzenoid market size was estimated at USD 858.88 million in 2024 and is expected to reach USD 906.88 million in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.