- Home

- »

- Plastics, Polymers & Resins

- »

-

Biopolymers In Electrical And Electronics Market Report, 2030GVR Report cover

![Biopolymers In Electrical And Electronics Market Size, Share & Trends Report]()

Biopolymers In Electrical And Electronics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Biodegradable (PLA, PBAT), Non-biodegradable (PE, PET, PA)), By Application (Wires & Cables, Electronic Device Casings), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-123-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2019 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

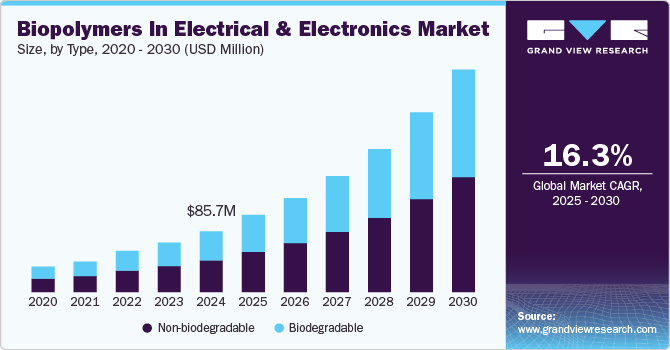

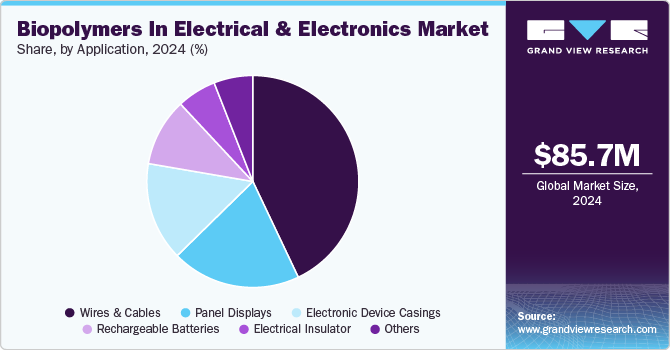

The global biopolymers in electrical and electronics market size was estimated at USD 85.67 million in 2024 and expected to grow at a CAGR of 16.31% from 2025 to 2030. The demand for biopolymers across the electrical & electronics industry is propelled by the adoption of green procurement policies by electrical & electronics manufactures and changing consumer preferences towards eco-friendly commodities. Furthermore, the electrical & electronics industry is one of the major utilizers of biopolymers for the manufacturing of their applications such as wires & cables, electrical insulators, rechargeable batteries, panel displays, and others. Rising concerns for environment protection has propelled the manufacturers to introduce the utilization of biopolymers for the manufacturing of their applications.

The adoption of biopolymers in the electrical and electronics market is rising, driven by increasing sustainability goals. Manufacturers are integrating bio-based materials into components like circuit boards, casings, and connectors to meet stringent environmental regulations. For instance, the European Union's Green Deal has emphasized eco-friendly production, prompting companies to explore biodegradable and bio-based polymers. This trend is further supported by advancements in material performance, with biopolymers like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) offering comparable durability and thermal resistance to traditional polymers, making them viable substitutes in various applications.

Drivers, Opportunities & Restraints

Stringent environmental regulations worldwide are a major driver of biopolymer adoption in the electrical and electronics industry. Countries are implementing policies to minimize the environmental impact of e-waste, such as extended producer responsibility (EPR) laws, which encourage manufacturers to use recyclable and biodegradable materials. In addition, consumer demand for sustainable electronics is compelling companies to shift from petroleum-based plastics to bio-based alternatives. This transition aligns with corporate sustainability goals and builds brand reputation, fostering long-term competitive advantages in the market.

The growing demand for wearable electronics presents a significant opportunity for biopolymers in the industry. Wearable devices like smartwatches, fitness trackers, and medical monitors require lightweight, flexible, and sustainable materials. Biopolymers, with their customizable properties and biodegradability, are well-positioned to cater to this demand. For example, bio-based polyurethane can provide elasticity and resilience, essential for wearable applications. Partnerships between material innovators and electronics manufacturers can further accelerate the adoption of biopolymers in this expanding segment, particularly in regions with high consumer adoption of technology.

Despite their potential, the high production cost of biopolymers compared to conventional plastics poses a restraint for widespread adoption in the electrical and electronics market. The reliance on agricultural feedstocks such as corn or sugarcane increases costs, especially during periods of raw material scarcity or price volatility. Additionally, the biopolymers' performance limitations, such as reduced heat resistance in certain applications, make them less suitable for high-performance electronics. Overcoming these challenges requires significant investments in R&D and scaling production technologies to achieve cost parity with traditional materials.

Type Insights

Non-biodegradable plastics dominated the market with a revenue share of 52.31% in 2024. Non-biodegradable plastics such as polyethylene (PE), polyethylene terephthalate (PET), and polyamide (PA), are non-complex resins to be manufactured and have a longer life span, which has propelled their demand across the electrical & electronics industry.

Furthermore, biopolymers such as PLA and PET are being utilized for the manufacturing of printed circuit boards (PCB). In addition, green electronics has witnessed rise in traction with the introduction of biopolymers for the manufacturing of inject and screen printing, dip coating, and others.

Application Insights

Wires & cables dominated the market with revenue share of 42.95% in 2024. This is followed by the rising growth of global building & construction industry, which is a major utilizer of wires & cables. Hence the demand for biopolymers for the manufacturing of wires & cables is anticipated to propel during the forecast period.

Followed by the advancement in technology such as artificial intelligence, machine learning, cloud computing, and internet of things, electronic manufacturers are prominently introducing advance electronic device such as cell phones, television, and others. Panel displays have introduced the utilization of biopolymers such as PE, PET, and PA.

Regional Insights

In biopolymers in electrical & electronics market in the North America, the adoption of biopolymers in the electrical and electronics market is largely driven by government initiatives promoting sustainable manufacturing and waste reduction. Programs such as the U.S. Department of Energy’s support for bioplastic innovations and Canada’s Zero Plastic Waste initiative are pushing manufacturers to incorporate biodegradable materials. In addition, the strong presence of eco-conscious technology consumers has led to rising demand for sustainable electronics, especially in markets like smartphones and home appliances, which incentivizes companies to integrate biopolymers into their products.

U.S. Biopolymers In Electrical & Electronics Market Trends

In the U.S. biopolymers in electrical & electronics market, the driver for biopolymer usage in electronics lies in the rapid shift toward sustainable supply chains driven by corporate sustainability commitments. Major tech companies such as Apple, Microsoft, and Google have pledged to achieve carbon neutrality and reduce the environmental footprint of their products, leading to increased R&D in bio-based materials.

Asia Pacific Biopolymers In Electrical & Electronics Market Trends

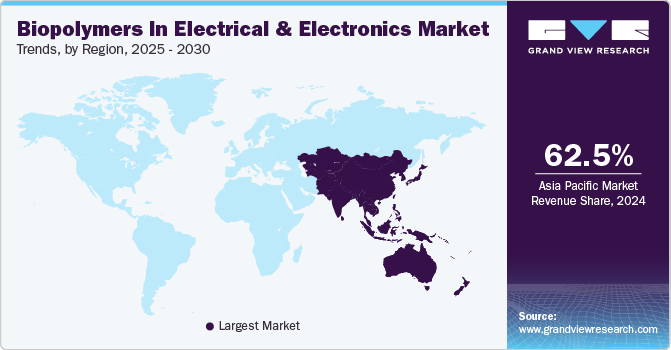

Asia Pacific biopolymers in electrical & electronics market dominated the global market and accounted for largest revenue share of 62.45% in 2024, which is attributable to the growing electronics industry, fueled by rapid urbanization and rising middle-class populations, is driving demand for sustainable materials like biopolymers. Countries like India, South Korea, and Japan are emphasizing green manufacturing as part of their environmental policies. The region’s abundant agricultural resources, such as sugarcane and corn, provide an ample supply of feedstocks for biopolymer production, making bio-based materials an attractive option for cost-conscious manufacturers looking to export eco-friendly electronics to global markets.

China biopolymers in electrical & electronics market push toward greener manufacturing under its dual carbon goals (carbon peaking by 2030 and neutrality by 2060) has created a strong incentive for biopolymer adoption in the electrical and electronics sector. The government is actively promoting the use of bio-based materials to reduce the country’s reliance on petroleum-derived plastics. This is further supported by the rapid growth of the electronics manufacturing industry in China, where domestic and global companies are looking for cost-effective, sustainable materials to align with international eco-friendly standards.

Europe Biopolymers In Electrical & Electronics Market Trends

The biopolymers in electrical & electronics market in Europe is driven by the stringent regulations such as the European Green Deal and the Waste Electrical and Electronic Equipment (WEEE) Directive. These policies encourage manufacturers to use materials that are recyclable or biodegradable, reducing e-waste and environmental harm.

Key Biopolymers In Electrical And Electronics Company Insights

The industry is highly competitive due to several key players dominating the landscape. Major companies includes SABIC; BASF SE; Trinseo; Braskem; TEIJIN LIMITED; Toyota Tsusho Corporation; NatureWorks LLC; Total Carbion PLA; Solvay; and Futtero. The industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Biopolymers In Electrical And Electronics Companies:

The following are the leading companies in the biopolymers in electrical and electronics market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- BASF SE

- Trinseo

- Braskem

- TEIJIN LIMITED

- Toyota Tsusho Corporation

- NatureWorks LLC

- Total Carbion PLA

- Solvay

- Futerro

Recent Developments

-

In October 2024, India inaugurated its first Demonstration Facility for Biopolymers, located in Pune, developed by Praj Industries. This facility focuses on the production of PLA bioplastic, representing a significant step towards sustainable alternatives to traditional fossil-based plastics.

-

In May 2024, NatureWorks, a company specializing in biopolymers, secured significant funding of USD 350 million to expand its PLA production capabilities in Thailand. This investment is aimed at enhancing the production of sustainable materials that can replace traditional plastics.

Biopolymers In Electrical And Electronics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 108.85 million

Revenue forecast in 2030

USD 313.41 million

Growth rate

CAGR of 16.31% from 2025 to 2030

Actual data

2019 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Thousand/ million, volume in Tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; UK; France; Italy; The Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); South Africa

Key companies profiled

SABIC; BASF SE; Trinseo; Braskem; TEIJIN LIMITED; Toyota Tsusho Corporation; NatureWorks LLC; Total Carbion PLA; Solvay; Futtero

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopolymers In Electrical And Electronics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented biopolymers in electrical and electronics market report on the basis of product type, application, and region:

-

Product Type Outlook (Volume, Tons; Revenue, USD Thousand; 2018 - 2030)

-

Biodegradable

-

Polylactic Acid (PLA)

-

Polybutylene Adipate Terephthalate (PBAT)

-

-

Non-biodegradable

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)Polyamide (PA)

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand; 2018 - 2030)

-

Rechargeable batteries

-

Wires & cables

-

Electrical insulator

-

Panel displays

-

Electronic Device Casings

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biopolymers in electrical & electronics market size was estimated at USD 85.67 million in 2024 and is expected to reach USD 108.85 million in 2025.

b. The global biopolymers in electrical & electronics market is expected to grow at a compound annual growth rate of 16.31% from 2025 to 2030 to reach USD 313.41 million by 2030.

b. Wires & cables dominated the Biopolymers in electrical & electronics market across the application segmentation in terms of revenue, accounting to a market share of 42.95% in 2024. This is attributed to the rise in demand for bio-based electrical & electronics products in line with increasing global building & construction industry.

b. Some key players operating in the biopolymers in electrical & electronics market include SABIC; BASF SE; Trinseo; Braskem; TEIJIN LIMITED; Toyota Tsusho Corporation; NatureWorks LLC; Total Carbion PLA; Solvay; and Futerro

b. Key factors that are driving the market growth include shifting of electrical & electronics manufacturers towards sustainable plastics for the manufacturing of their products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.