- Home

- »

- Renewable Chemicals

- »

-

Biotech Ingredients Market Size, Share, Industry Report 2030GVR Report cover

![Biotech Ingredients Market Size, Share & Trends Report]()

Biotech Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Flavors (By Source, By Product, By Application)), Fragrances, Active Cosmetic Ingredients), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-666-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biotech Ingredients Market Summary

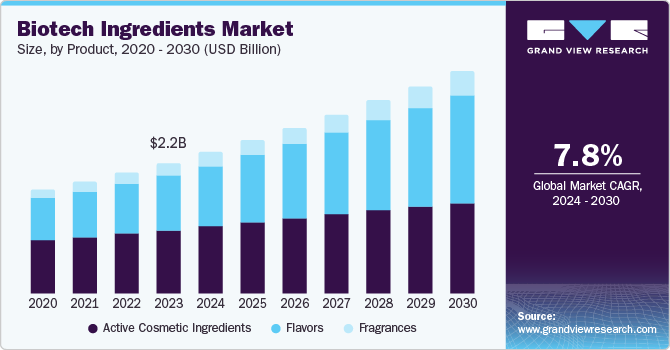

The global biotech ingredients market size was estimated at USD 2.17 billion in 2023 and is projected to reach USD 3.68 billion by 2030, growing at a CAGR of 7.8% from 2024 to 2030. Innovations in genetic engineering, fermentation processes, and biocatalysis have enabled the production of high-quality biotech ingredients with greater efficiency and precision.

Key Market Trends & Insights

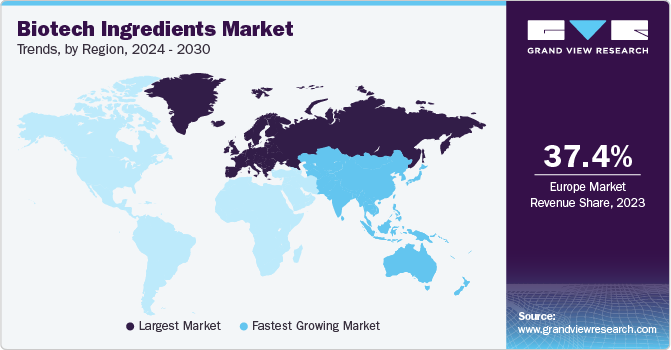

- The Europe biotech ingredients market registered the dominant market share of 37.4% in 2023.

- The Asia Pacific biotech ingredients market accounted for a significant market share in 2023

- By product, Active cosmetic ingredients dominated the market with a 49.0% share in 2023.

- By flavor ingredients, The flavor segment accounted for 42.0% in 2023.

- By fragrance ingredients, fine fragrances accounted for the dominant market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.17 Billion

- 2030 Projected Market Size: USD 3.68 Billion/li>

- CAGR (2024-2030): 7.8%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

These advancements are crucial for developing complex molecules such as recombinant proteins, monoclonal antibodies, and growth factors, essential for various applications in pharmaceuticals, cosmetics, and food industries.

In addition, the increasing demand for sustainable and natural products propelled the market forward. Consumers have become progressively environmentally conscious and have sought effective and sustainable products. Biotech ingredients derived from natural sources such as bacteria, yeast, and fungi align well with this trend. They offer a more sustainable alternative to synthetic chemicals, reducing the environmental footprint of production processes.

This shift in consumer preference is particularly evident in the cosmetics and personal care industry, as the market witnessed a growing demand for natural and organic products free from harmful chemicals. The Biotechnology Innovation Organization (BIO) reported substantial growth in producing bio-based chemicals in the U.S., such as lactic acid and succinic acid. These chemicals, produced through biotechnological processes, including fermentation, are used as ingredients in bioplastics, detergents, and personal care products.

Furthermore, government support and favorable regulations played a pivotal role in expanding the biotech ingredients market. Many governments worldwide have invested in biotechnology research and providing financial incentives to biotech companies. These initiatives aim to promote innovation and the development of new biotech products. For instance, regulatory frameworks that streamline the approval process for biotech ingredients and provide clear guidelines for their use in various industries have increasingly encouraged more companies to adopt these ingredients.

Product Insights

Active cosmetic ingredients dominated the market with a 49.0% share in 2023, owing to the increasing consumer demand for effective and high-performance skincare products. Advances in biotechnology and dermatological research have led to the discovery and development of new active ingredients with enhanced benefits, such as anti-aging, anti-acne, and skin-brightening properties.

Moreover, the rising focus on personalized skincare solutions, where products are tailored to individual skin types and concerns, has fueled the demand for a diverse range of active ingredients. Consumers have increasingly sought products with natural and sustainable ingredients, prompting manufacturers to develop biotech-derived actives that meet these preferences. For instance, plant-based formulations and microbial technologies have gained traction due to their eco-friendly profiles and efficacy.

Fragrances are expected to emerge as the fastest-growing segment over the forecast period. The anticipated growth can be attributed to the increasing consumer preference for natural and sustainable products. Consumers have become increasingly aware of synthetic chemicals' environmental and health impacts, leading to a growing demand for natural and biotech-derived fragrances.

These fragrances, produced through biotechnological processes such as microbial fermentation and enzymatic synthesis, offer a sustainable alternative to traditional synthetic fragrances. Furthermore, biotechnology and synthetic biology advancements have enabled efficient production of complex fragrance compounds. Companies such as Debut, Firmenich, and Robertet use genetically engineered microorganisms to produce high-quality fragrances with greater consistency and at a lower cost.

Flavor Ingredients Insights

The flavor segment accounted for 42.0% in 2023. It can be further sub-segmented regarding source, product, and application. Yeast held the largest share per source due to the increasing consumer demand for natural and sustainable products. Being a natural microorganism, Yeast aligns perfectly with the growing preference for clean-label and eco-friendly products. This trend is particularly strong in the food and beverage industry, where consumers have sought flavors derived from natural sources rather than synthetic chemicals.

In addition, modern biotechnological methods have enhanced the efficiency and yield of yeast fermentation processes, making it more cost-effective and scalable. This has expanded the application of yeast-derived flavors beyond traditional uses in baking and brewing to include a wide range of food products. For instance, yeast extracts have been widely used as flavor enhancers due to their rich umami taste, which can improve the flavor profile of various processed foods.

As per flavor products, carbonyl compounds held the dominant market share with the increasing demand for natural and sustainable flavor ingredients. These compounds, including aldehydes and ketones, are essential in creating complex and appealing flavors. Carbonyl compounds have been increasingly utilized for their health benefits and functional properties.

By flavor ingredient application, beverages registered the dominant share owing to the rise of functional beverages. The market witnessed a growing demand for beverages that offer additional health benefits beyond basic nutrition, such as enhanced energy, improved digestion, and immune support. Biotech-derived flavors play a crucial role in masking the often unpleasant taste of functional ingredients, making these beverages more palatable and appealing to consumers.

Fragrance Ingredients Insights

Fine fragrances accounted for the dominant market share in 2023. These fragrances are often associated with luxury and exclusivity. The market witnessed a growing demand for high-end, bespoke fragrances that offer unique scent profiles. Biotech-derived ingredients allow for the creation of complex and sophisticated fragrances that meet the high standards of the luxury market.

Toiletries are expected to emerge at an exponential CAGR of 23.5% over the forecast period. The personal care industry’s focus on hygiene and wellness has been a crucial market driver of the biotech fragrance ingredients market. In turn, the market witnessed a growing surge for toiletries that cleanse and offer additional benefits such as moisturizing, soothing, and anti-bacterial properties. Biotech-derived fragrances enhance these functional benefits, making toiletries more attractive to conscious consumers.

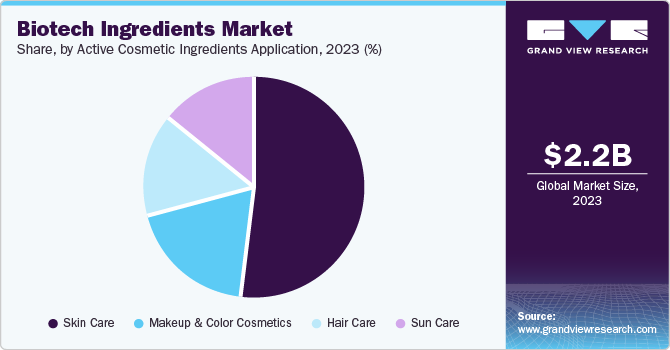

Active Cosmetic Ingredients Application Insights

Skin care led the market with a dominant market share of 52.1% in 2023 attributed to the advancements in biotechnology. Innovations in genetic engineering and fermentation processes have enabled the production of high-quality, bioactive ingredients that offer enhanced efficacy and safety. These advancements have resulted in the development of more effective skincare solutions that address a wide range of concerns, including anti-aging, hydration, acne, and hyperpigmentation. Biotech-derived active ingredients, such as peptides, hyaluronic acid, and antioxidants, enhance the functional benefits of skin care products.

Hair care is expected to emerge as the fastest-growing segment over the forecast period owing to the increasing consumer preference for natural and sustainable products. Consumers have increasingly sought hair care products that contain natural, organic, and biotech-derived ingredients. This shift has led manufacturers to innovate and develop new formulations that meet these demands, incorporating ingredients including plant-based extracts, proteins, and peptides. Moreover, consumers have progressively recognized the importance of a healthy scalp for overall hair health, leading to a rise in demand for products that address scalp issues such as dryness, irritation, and inflammation. This has led to the development of biotech ingredients that can soothe and protect the scalp, thereby improving hair quality.

Regional Insights

The biotech ingredients market in North America held a significant market share in the global market in 2023 due to technological advancements that have revolutionized the production of biotech ingredients. Techniques such as genetic engineering and recombinant DNA technology have improved the efficiency and precision of ingredient production, making it possible to create highly specific treatments tailored to individual patient needs. This is particularly important in the field of personalized medicine, which has gained traction as a major trend in healthcare.

U.S. Biotech Ingredients Market Trends

The U.S. biotech ingredients market is expected to be driven by the rapid growth of the pharmaceutical industry over the forecast period. The U.S. National Institutes of Health (NIH) and FDA have documented the rise of biotech-based drugs such as monoclonal antibodies and gene therapies. For instance, the development of mRNA vaccines, by Pfizer-BioNTech and Moderna heavily rely on biotech ingredients such as lipid nanoparticles and synthetic RNA sequences.

Europe Biotech Ingredients Market Trends

The Europe biotech ingredients market registered the dominant market share of 37.4% in 2023 owing to the increasing adoption of biologics in disease management. Biologics, which are derived from living organisms, have become essential in treating various chronic diseases such as cancer, diabetes, and autoimmune disorders. This shift towards biologics has driven the demand for biotech ingredients, which are crucial for the development and production of these advanced therapies.

Asia Pacific Biotech Ingredients Market Trends

The Asia Pacific biotech ingredients market accounted for a significant market share in 2023 due to the increasing prevalence of chronic diseases such as cardiovascular diseases, cancer, and diabetes. These conditions necessitate advanced therapeutic solutions, which rely heavily on biotech ingredients for their efficacy. The growing burden of these diseases has significantly propelled the demand for innovative and effective biotech ingredients, particularly in the pharmaceutical sector.

The pharmaceutical industry’s shift towards biologics and biosimilars has been a major market driver. Biologics, which are derived from living organisms, and biosimilars, which are nearly identical copies of biologics, require sophisticated biotech processes for their production. For instance, Biocon is a leader in producing recombinant insulin using biotech fermentation processes.

The biotech ingredients market in India dominated the APAC market in 2023. The market growth was driven by government initiatives and supportive policies that encouraged the rising adoption. The Indian government has been actively promoting biotechnology through various initiatives and policies, such as the Biotechnology Industry Research Assistance Council (BIRAC), which supports startups and SMEs in biotechnology.

Key Biotech Ingredients Company Insights

Key players in the global biotech ingredients market such as Titan Biotech, Fermenta Biotech Limited, Conagen Inc., and others have developed flavors using microbial processes, such as biosynthesis or biotransformation, using bacteria, yeast, or fungi. Companies have increasingly focused on R&D based on biotechnology to invent novel microbial fermentation processes for manufacturing natural vanillin.

-

Titan Biotech Limited is a manufacturer and exporter of biological products that serves various industries including pharmaceuticals, nutraceuticals, food and beverages, cosmetics, veterinary, and agriculture. The company is known for its extensive product range, which includes food ingredients, collagen and proteins, probiotics, fermentation ingredients, and culture media.

-

Fermenta Biotech Limited is one of the largest manufacturers of Vitamin D3 globally. It produces niche active pharmaceutical ingredients (APIs), enzymes for antibiotic synthesis, and environmental solutions for wastewater management.

Key Biotech Ingredients Companies:

The following are the leading companies in the biotech ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Fermenta Biotech Limited

- Titan Biotech

- Conagen, Inc.

- Advanced Biotech

- Bell Flavors & Fragrances, Inc.

- Merck KGaA

- International Flavors & Fragrances, Inc.

- Amyris

- dsm-firmenich

- Symrise

- Evonik Industries

Recent Developments

-

In March 2024, Roquette acquired IFF Pharma Solutions, a producer of excipients for oral dosage solution. This acquisition was likely to strengthen Roquette’s position in the market.

-

In February 2024, Evonik introduced Vecollage Fortify L, a new vegan collagen designed for the beauty and personal care market. This product capitalizes on Evonik’s strengths in biotechnology, collagen, and skincare to address the growing demand for vegan collagen in products including anti-aging and hydrating creams.

-

In March 2023, Symrise expanded the Diana food bioactives range with innovative and distinctive nutricosmetic ingredients aimed at enhancing anti-aging, skin conditioning, skin brightening, hair care, and nail care. The range features organically sourced bioactives including vitamin C, vitamin A, collagen type I, and polyphenols.

Biotech Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.34 billion

Revenue forecast in 2030

USD 3.68 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor ingredients source, flavor ingredients product, flavor ingredients application, fragrance ingredients product, active cosmetic ingredients application, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Mexico, Canada, UK, France, Germany, Italy, Spain, China, India, Japan, South Korea, Australia, Singapore, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Fermenta Biotech Limited; Titan Biotech; Conagen, Inc.; Advanced Biotech; Bell Flavors & Fragrances, Inc.; Merck KGaA; International Flavors & Fragrances, Inc.; Amyris; dsm-firmenich; Symrise; Evonik Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biotech Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biotech ingredients market report based on product, flavor ingredients source, flavor ingredients product, flavor ingredients application, fragrance ingredients product, active cosmetic ingredients application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavors

-

Fragrances

-

Active Cosmetic Ingredients

-

-

Flavor Ingredients Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacteria

-

Yeast

-

Filamentous Fungi

-

-

Flavor Ingredients Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbonyls

-

Ketones

-

Aldehydes

-

Lactones

-

Alcohols

-

Acids

-

-

Flavor Ingredients Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Products

-

Beverages

-

Confectionery

-

Others

-

-

Fragrance Ingredients Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fine Fragrances

-

Toiletries

-

-

Active Cosmetic Ingredients Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hair Care

-

Skin Care

-

Sun Care

-

Makeup & Color Cosmetics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.