- Home

- »

- Medical Devices

- »

-

Biotechnology And Pharmaceutical Services Outsourcing Market Report, 2030GVR Report cover

![Biotechnology And Pharmaceutical Services Outsourcing Market Size, Share & Trends Report]()

Biotechnology And Pharmaceutical Services Outsourcing Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Consulting, Auditing & Assessment), By End-use (Pharmaceutical Companies, Biotech Companies), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-326-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biotechnology And Pharmaceutical Services Outsourcing Market Summary

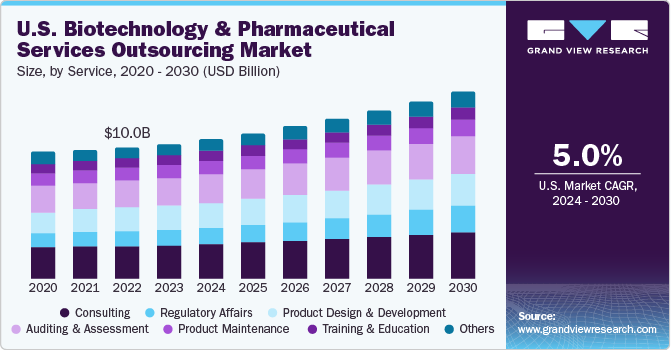

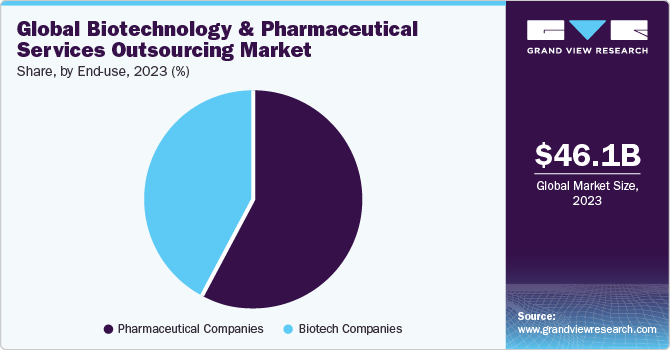

The global biotechnology and pharmaceutical services outsourcing market size was estimated at USD 46.15 billion in 2023 and is projected to grow at a CAGR of 5.67% from 2024 to 2030.Rising drug development costs, diminishing internal capabilities, increasing regulatory frameworks, and low-cost service deployment to contract research organizations (CROs), and contract manufacturing organizations (CMOs) are some of the major factors driving market growth.

Key Market Trends & Insights

- North America dominated the global biotechnology and pharmaceutical services outsourcing market in 2023.

- By service, the consulting services segment dominated the market with the largest revenue share of over 24% in 2023

- By end use, the pharmaceutical companies segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 46.15 Billion

- 2030 Projected Market Size: USD 66.95 Billion

- CAGR (2024-2030): 5.67%

- North America: Largest market in 2023

Post-pandemic, demand for innovative and effective therapies is increasing and driving growth. The rising drug development costs coupled with higher failure rates and growing regulatory pressure also have a significant impact on market dynamics, accelerating market growth rate. Furthermore, well-established CROs, regulatory outsourcing firms, management consulting firms, and contract manufacturers are catering to the complex demands of pharmaceutical and biotechnological sectors. Contract research and manufacturing companies are investing in personnel, infrastructure, and technology to acquire a significant share of the healthcare outsourcing market.

Increasing demand due to the ongoing patent cliff of biotechnology drugs is anticipated to fuel demand. An increasing number of end-to-end service providers, to meet the rising demand for low-cost drug development and manufacturing, is further anticipated to propel market growth. Moreover, novel drug delivery mechanisms and new product launches are anticipated to drive outsourcing demand. Many companies are opting for outsourcing owing to increasing competition in the healthcare industry. For instance, in February 2023, Lonza completed expansion of its conjugation facility in Visp, Switzerland.

The expansion included the addition of manufacturing suites & supporting infrastructure, increasing development & manufacturing capacity for bioconjugates & antibody-drug conjugates for preclinical, clinical, & commercial supply. An increasing number of R&D activities for new drug development, combination products, and other advanced medicines have increased demand for contract biotechnology and pharmaceutical services. Currently, the global pharmaceutical industry has the second-highest R&D intensity measures of any sector, which indicates that spending on R&D is increasing, and overall spending is likely to grow during the forecast period. For instance, in 2023, the 10 major pharmaceutical companies invested over USD 126.9 billion in research and development (R&D), constituting 41% of the overall research expenditure in the global biopharmaceutical sector for the previous year.

Market Concentration & Characteristics

The biotechnology and pharmaceutical services outsourcing industry is characterized by a high degree of innovation. The pharmaceutical and biotechnology industry is driven by continuous advancements in technology. Novel manufacturing processes, analytical techniques, and research methodologies are developed to improve efficiency, reduce costs, and enhance the quality of biopharmaceutical products.

The market is also characterized by a high level of merger and acquisition (M&A) activity by leading players. Companies merge or acquire others in biotechnology and pharmaceutical services outsourcing sector to expand their service offerings, geographic reach, or client base. For instance, in March 2024, Lonza announced the acquisition of a large scale biologics manufacturing site from Genentech, part of Roche in the U.S. for USD 1.2 million. Through this acquisition, Lonza will broaden its manufacturing capacity of biologics to cater to increasing customer demand and gain a competitive edge in the market.

The market is characterized by a high impact of regulations. The pharmaceutical and biotechnology sectors are subject to strict quality and safety standards to ensure efficacy and safety of drugs and biologics. Regulatory agencies establish and enforce these standards, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

The market is characterized by a high impact on service expansion. Biotechnology and pharmaceutical companies prefer outsourcing partners that offer integrated solutions, covering a wide spectrum of services. Service expansion allows outsourcing providers to offer end-to-end solutions, encompassing discovery, clinical trials, preclinical development, regulatory affairs, manufacturing, and post-market support.

The market is characterized by a high impact of regional expansion. Companies in the biotechnology and pharmaceutical sectors look for opportunities to access emerging markets with growing healthcare needs. Regional expansion allows them to establish a presence in these markets, collaborate with local partners, and tap into new patient populations. For instance, in January 2024, Parexel and the Japanese Foundation for Cancer Research (JFCR) formed a strategic alliance to enhance access to oncology clinical trials in Japan. Similarly, in September 2023, CTI Clinical Trial & Consulting Services opened state-of-the-art European Laboratory in Bilbao, Spain.

Service Insights

The consulting services segment dominated the market with the largest revenue share of over 24% in 2023. The segment is expected to maintain its position over the forecast period. This can be attributed to increasing M&A activities and constantly changing regulatory protocols. However, the pharma and biotech market has witnessed a continuous entry of new players, such as bioSyntagma, Signa Medical Writing, and Fieve Clinical Research, Inc. These players need to be compliant with set standards and norms, for which consulting is essential as these new entrants lack such capabilities.

The regulatory affairs segment is expected to witness the highest CAGR of 8.37% over the forecast period. Outsourcing trends for regulatory affairs has become an increasingly important practice in the healthcare industry. An increase in geographical expansion activities by companies that aim for speedy approvals in local markets is expected to contribute to the adoption of outsourcing models for regulatory services. Outsourcing market for regulatory affairs is expanding rapidly due to increased R&D activities, rising preference for personalized medicine and biologics augmenting overall volume of clinical trial applications and product registrations.

End-use Insights

The pharmaceutical companies segment dominated the market with the largest revenue share in 2023. An increase in R&D spending by pharmaceutical companies for development of potential novel products and a rise in investments by CROs for development of core capabilities are expected to drive market demand in the region in the forthcoming years. Contract service providers are recognized as an effective strategic decision to curb the issues of drug shortfall and high production costs, as well as to meet the growing industry demand.

The biotechnology companies segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to rapidly expanding biotech product pipelines, along with a trend toward biotechnology entities retaining their assets longer. Moreover, CROs concentrate on adapting their services to smaller biotechnology firms, which have emerged as prominent players in the clinical development of novel medicines and are responsible for driving innovation and expansion.

Regional Insights

The biotechnology and pharmaceutical services outsourcing market of North America held a significant market share in 2023. This growth is attributed to the strong presence of several established CROs and CMOs, such as Thermo Fisher Scientific, Catalent, IQVIA, and Samsung Biologics, and growing R&D investments by life sciences and pharmaceutical companies in the region. The strong presence of stringent regulatory policies and a rise in R&D expenditure are among key factors that are likely to boost demand for outsourcing of services by pharmaceutical and biotechnology companies in the region. In addition, the expansion of several CMOs and CROs into the country is projected to propel market growth. For instance, in May 2022, Lonza expanded its inhalation facility at its Tampa (the U.S.) site to improve its capabilities in the development and manufacture of inhaled formulations

U.S. Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The biotechnology and pharmaceutical services outsourcing market in the U.S. held dominant share in North America in 2023. Pharmaceutical and biotechnology companies outsource part of their regulatory functions, such as report writing & publishing, clinical trial application services, and product design & maintenance, to regulatory service providers, thereby contributing to market growth. Moreover, outsourcing helps a company focus more on its core capabilities and improve its service delivery, thereby providing competitive advantage.

Asia Pacific Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The biotechnology and pharmaceutical services outsourcing market in Asia Pacific region dominated the global market in 2023 and accounted for the largest share of over 40.00% of the overall revenue. The regional growth is owing to a rise in investments by developed countries and various regulatory reforms in clinical trial evaluation to align with the standards of various countries investing in the region. Low cost of drug development & manufacturing and availability of a skilled workforce is likely to foster contract development and manufacturing in this region. Moreover, economic policy reforms in countries, such as China, are anticipated to create an open and balanced economy, which presents ample growth opportunities for market players to invest in this region. For instance, in August 2022, Porton Advanced Solutions, a Chinese CDMO entity, raised USD 80 million to advance the cell and gene therapy platform.

The China biotechnology and pharmaceutical services outsourcing market held the largest share in 2023 in Asia Pacific. The country’s market growth is owing to entry of new players and service providers in the country, which can be attributed to stringent standards around patient safety in conducting clinical trials, easy access to a large patient pool, and cheap labor. In addition, low operating cost, increasing investments to improve technology, high R&D capacity, and rising adoption of global R&D standards to meet international requirements are some of the key factors responsible for the growing demand for regulatory & consulting services in China.

The biotechnology and pharmaceutical services outsourcing market in Japan is expected to grow substantially over the forecast period. Rising R&D costs prompt companies to outsource various stages of drug development to reduce expenses and focus on core competencies. Demand for specialized expertise in navigating complex regulatory requirements and advancing technologies drives outsourcing to contract research and manufacturing organizations in the country.

The India biotechnology and pharmaceutical services outsourcing market is anticipated to grow at the fastest CAGR over the forecast period. Cost benefits, improvements in infrastructure, and availability of expertise are some of the major factors driving growth of biotechnology/pharmaceutical services outsourcing market in the country. Western companies outsource their business processes to Asian countries such as India to gain competitive edge.

Europe Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The biotechnology and pharmaceutical services outsourcing market in Europe is growing due to the demand for advanced medicines, which can be attributed to rising incidence of chronic & communicable diseases and rapidly aging population. Increase in consumption of advanced medicines is boosting the need for support from CROs.

The Germany biotechnology and pharmaceutical services outsourcing market is one of the largest pharmaceutical markets in the world after the U.S., China, Japan, and India and this is one of the major factors responsible for high demand for pharmaceutical and biotechnology contract services in the country. Moreover, Germany is known for its engineering and designing capabilities worldwide, hence services such as product design, consulting, product maintenance, and others are expected to contribute majorly in terms of revenue over the forecast period.

The biotechnology and pharmaceutical services outsourcing market in the UK is growing as the companies are outsourcing business activities to increase cost-efficiency, productivity, and focus on innovation. The companies are using hybrid-sourcing models across the value chain to strengthen their capabilities in areas of data management, logistics management, R&D, and analytics.

Latin America Biotechnology And Pharmaceutical Services Outsourcing Market Trends

Latin America is one of the fastest-growing markets for outsourcing in pharmaceutical and biotechnology industries. The growth of this market can be attributed to various factors such as increase in the number of clinical trials and rise in the number of new players venturing into the medical devices market. Countries such as Brazil, Mexico, Venezuela, and Argentina are contributing to the growth of biotechnology/pharmaceutical services outsourcing market in Latin America.

The Brazil biotechnology and pharmaceutical services outsourcing market is one of the largest pharmaceutical markets in the world owing to the growing demand for pharmaceutical products. Moreover, the number of international pharmaceutical companies in the country has increased owing to easier access to private healthcare, enhanced national healthcare services coupled with improved business regulations, and generic drug market expansion through government policies. Hence, Brazil is expected to contribute considerably to the Latin America market during the forecast period.

MEA Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The increase in the number of R&D projects and pharmaceutical companies in the region is expected to boost market growth during the forecast period. The country is adopting global standards and collaborating with other global CROs to mark its market presence. Moreover, MEA CRO industry offers advantages such as world-class medical facilities, well-developed infrastructure, and low operational cost, thereby boosting market growth.

The Saudi Arabia biotechnology and pharmaceutical services outsourcing market is growing as the establishment of universities focused on biotechnology and increase in the number of clinical research organizations with proven track records of conducting clinical trials are some of the factors driving the industry. Moreover, increase in the number of western-trained experts and rapid rise in healthcare investments are some of the factors expected to propel market growth during the forecast period.

Key Biotechnology And Pharmaceutical Services Outsourcing Company Insights

The key companies are implementing several market strategies, such as merger & acquisition, collaboration, regional expansion, service portfolio expansion, and competitive pricing, to sustain in the competitive environment and acquire a higher market share. For instance, in May 2023, Vetter announced plans for the expansion of its production capacities and services at its Austrian site. This strategic move comes in response to rising demand from pharmaceutical clients, aiming to meet their evolving needs and address increased requirements for services, such as drug development, aseptic filling, and packaging.

Key Biotechnology And Pharmaceutical Services Outsourcing Companies:

The following are the leading companies in the biotechnology and pharmaceutical services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Parexel International Corporation

- The Quantic Group

- IQVIA

- Lachman Consultant Services, Inc.

- GMP Pharmaceuticals Pty Ltd.

- Concept Heidelberg GmbH

- LabCorp

- Charles River Laboratories

- ICON plc.

- Syneos Health

- Lonza

- Catalent Inc.

- Samsung Biologics

Recent Developments

-

In September 2023, ICON plc partnered with U.S. Biomedical Advanced Research and Development Authority (BARDA) for initiation of a clinical trial designed for evaluation of effectiveness of next-gen COVID-19 vaccine candidates.

-

In September 2023, Charles River Laboratories International, Inc. declared a collaboration agreement encompassing multiple programs to deploy Logica across various targets within the RS portfolio previously unexplored for drug development. Logica is an Artificial Intelligence (AI)-driven drug solution that converts biological insights into refined assets.

-

In September 2023, Syneos Health and Oracle extended their partnership. The companies hope to shorten the time it takes to find patients for clinical studies and broaden the patient populations taking part in medical research by utilizing the Oracle Cerner Learning Health Network (LHN) and some of Oracle's study startup solutions.

-

In May 2023, LabCorp declared its commitment to enhancing the enduring strategic collaboration with Providence through a newly established agreement. As part of this arrangement, LabCorp will acquire the outreach laboratory business of Providence Oregon and specific assets situated in Oregon.

-

In March 2023,Charles River launched Apollo, a cloud-based platform that assists drug developers in accessing study data, study milestones, documents, cost estimates, and program planning tools.

Biotechnology And Pharmaceutical Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.08 billion

Revenue forecast in 2030

USD 66.95 billion

Growth rate

CAGR of 5.67% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa, Kuwait

Key companies profiled

The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; Concept Heidelberg GmbH; LabCorp; Charles River Laboratories; ICON plc; Syneos Health; Lonza; Catalent Inc.; Samsung Biologics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Biotechnology And Pharmaceutical Services Outsourcing Market Report Segmentation

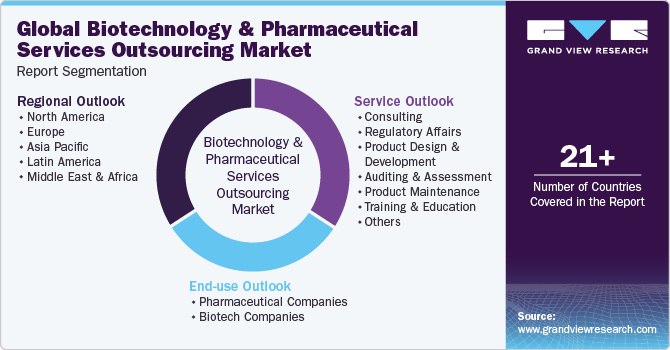

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biotechnology and pharmaceutical services outsourcing market report based on service, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Consulting

-

Regulatory Consulting

-

Clinical Development Consulting

-

Strategic Planning & Business Development Consulting

-

Quality Management Systems consulting

-

Others

-

-

Regulatory Affairs

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Others

-

-

Product Design & Development

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Auditing and Assessment

-

Product Maintenance

-

Training & Education

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biotechnology and pharmaceutical services outsourcing market size was estimated at USD 46.15 billion in 2023 and is expected to reach USD 48.08 billion in 2024.

b. The global biotechnology and pharmaceutical services outsourcing market is expected to grow at a compound annual growth rate of 5.67% from 2024 to 2030 to reach USD 66.95 billion by 2030.

b. Key factors that are driving the biotechnology and pharmaceutical services outsourcing market growth include growing drug development costs coupled with high clinical development failure rates and increasing competition within the healthcare drug manufacturers.

b. Asia Pacific dominated the biotechnology and pharmaceutical services outsourcing market with a share of 40.0% in 2023. This is attributable to low cost of drug development & manufacturing and the availability of a skilled workforce is likely to foster contract development and manufacturing in this region.

b. Some key players operating in the biotechnology and pharmaceutical services outsourcing market include The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; Concept Heidelberg GmbH; LabCorp; Charles River Laboratories; ICON plc; Syneos Health; Lonza; Catalent Inc.; Samsung Biologics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.