- Home

- »

- Electronic Devices

- »

-

Brushless DC Motor Market Size, Industry Report, 2030GVR Report cover

![Brushless DC Motor Market Size, Share & Trends Report]()

Brushless DC Motor Market (2025 - 2030) Size, Share & Trends Analysis Report By Rotor, Power Output (Less Than 750 Watt, 750 Watt - 2.99kW, 3kW - 75 kW, Above 75kW), By Speed, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-820-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brushless DC Motor Market Summary

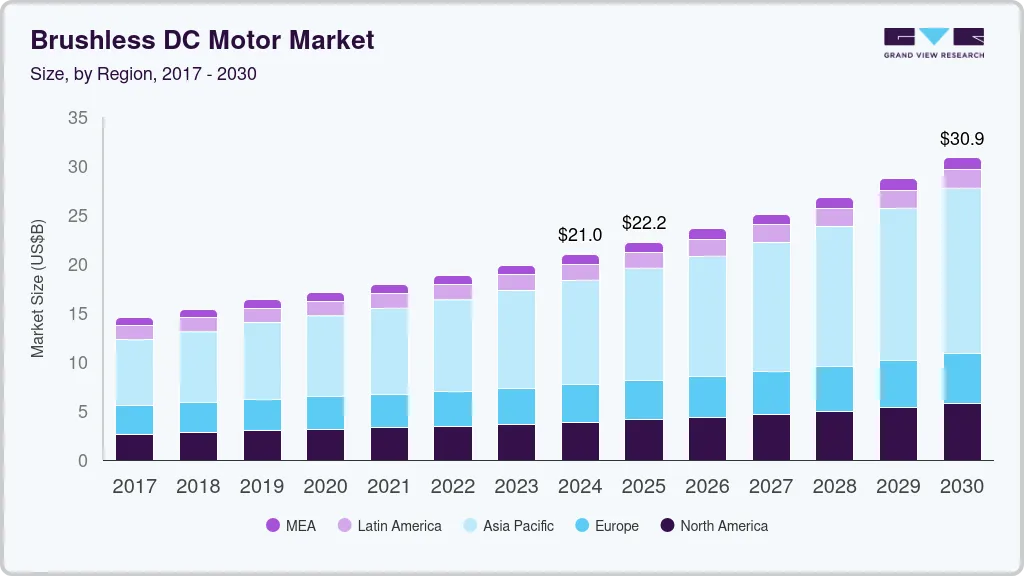

The global brushless dc motor market size was estimated at USD 20,990.5 million in 2024 and is projected to reach USD 30,862.4 million by 2030, growing at a CAGR of 6.8% from 2025 to 2030. The ability of Brushless DC (BLDC) motors to save energy and increase the operational efficiency of equipment in which they are used is expected to drive the growth of the market over the forecast period.

Key Market Trends & Insights

- The Asia Pacific brushless DC motor market dominated with a share of 50.4% in 2024.

- The brushless DC motor market in China accounted for a revenue share of around 39.8%.

- Based on rotor, the inner rotor segment dominated the market with a share of 60.9% in 2024.

- Based on power output, the less than 750 watt segment dominated the market with a share of 50.1% in 2024.

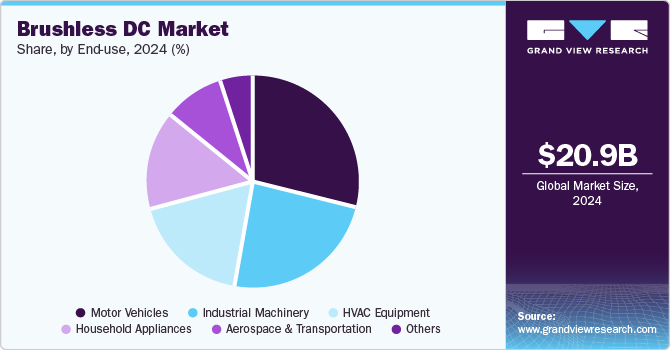

- Based on end use, the motor vehicle segment dominated the market with a share of 28.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20,990.5 Million

- 2030 Projected Market Size: USD 30,862.4 Million

- CAGR (2025-2030): 6.8%

- Asia Pacific: Largest market in 2024

These motors offer optimum efficiency and reliability at the same time, which proves to be economical in the majority of applications, such as window lifters, air conditioners, and sun-roof actuators. These motors are thermally resistant, require low maintenance, and operate at low temperatures, eliminating any threat of sparks. The emergence of sensor-less controls for BLDC type is likely to boost the durability and reliability of the product, thereby reducing the number of mechanical misalignments, electrical connections, as well as the weight and size of the end product. These aforementioned factors are estimated to drive market growth. Furthermore, the market is driven by the rising activity in the electric vehicle (EV) industry, globally. The growing popularity of vehicle features, such as motorized seats, adjustable mirrors, and sunroof systems, is driving the demand for BLDC motors.

The market is witnessing tremendous growth. This can be attributed to the increase in automobile production and the number of BLDC motors used in a car. Automotive motors are used in vehicle powertrain systems, chassis, and safety fittings. The increasing popularity of features, such as motorized seats, wipers, doors, adjustable mirrors, and massage seats, is helping drive their demand, especially BLDC motors.

The increasing adoption of EVs is contributing to the alleviation of problems, such as oil dependency, global warming, and environmental pollution. Several governments have initiated and implemented different policies to encourage and stimulate EV adoption and production. The advantages offered by them, such as less rotor heat and higher peak point efficiency, prove to be critical in a variety of applications, particularly in electrical and hybrid vehicles, which are estimated to result in their increased adoption in hybrid vehicles over the coming years. Moreover, electric car manufacturers prefer using BLDC motors in vehicles owing to low maintenance, higher efficiency, high operating speed, and quick response.

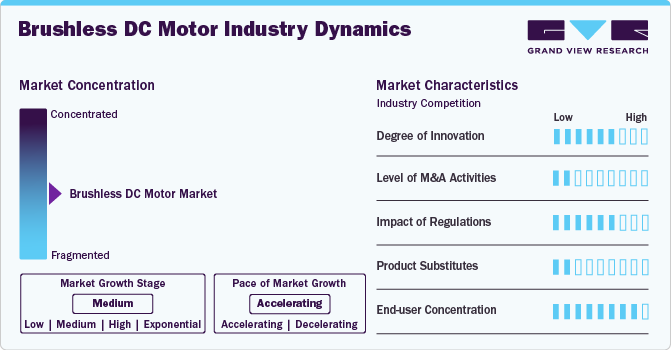

Market Concentration & Characteristics

The brushless DC (BLDC) Motor growth stage is moderate. BLDC motors have emerged as a transformative technology in the field of electric motors, offering distinct advantages over traditional brushed DC motors. This market is characterized by a strong emphasis on efficiency, durability, and precise control, positioning BLDC motors as a preferred choice in various industries. One of the primary market drivers for BLDC motors is their exceptional efficiency. Unlike brushed motors, BLDC motors eliminate the need for brushes, thereby reducing friction and energy losses. This heightened efficiency is particularly significant in applications where energy conservation is paramount, such as electric vehicles, industrial automation, and consumer electronics. The emphasis on sustainability and energy efficiency has propelled the demand for BLDC motors in these sectors.

Furthermore, the compact design of Brushless DC (BLDC) motors significantly influences their market dynamics. The elimination of brushes not only enhances efficiency but also contributes to a reduction in size and weight, making BLDC motors particularly advantageous for applications with stringent space constraints. Industries such as portable electronics, drones, and small appliances capitalize on the compact nature of BLDC motors, allowing manufacturers to create more streamlined and lightweight products. This characteristic not only caters to the demand for miniaturization in consumer electronics but also provides a practical solution for applications where space optimization is critical, further expanding the market reach of BLDC motors.

The widespread adoption of brushless DC (BLDC) motors is hindered by several market restraints. These include the higher initial cost compared to traditional brushed DC motors, the complexity of control systems requiring specialized knowledge, potential compatibility issues in retrofitting existing systems, electromagnetic interference concerns, susceptibility to supply chain disruptions for critical components, limitations in torque at low speeds, challenges in heat dissipation, the need for compliance with regulatory standards, and the limited power density in certain high-power applications. Addressing these constraints is essential for enhancing the broader acceptance of BLDC motors across diverse industries.

End user concentration in the BLDC motor market is diversified across several key industries. The automotive sector plays a significant role, with BLDC motors serving as integral components in electric vehicles and various automotive systems, emphasizing efficiency and precise control. Industrial automation relies on BLDC motors for their precise speed and position control in robotics and manufacturing processes. In addition, BLDC motors find applications in aerospace, medical devices, home appliances, renewable energy systems, healthcare equipment, transportation, and HVAC systems, showcasing their versatility. The broad range of industries leveraging BLDC motors underscores their adaptability and performance across diverse applications, contributing to the overall growth and significance of the BLDC motor market. Top of Form

Rotor Insights

In terms of rotor, the market is further bifurcated into inner rotor and outer rotor. In terms of revenue, the inner rotor segment dominated the market with a share of 60.9% in 2024. This dominance is attributed to the higher power density and compact design of inner rotor BLDC motors, making them suitable for applications requiring efficient torque delivery and space-saving configurations. Industries such as automotive, industrial machinery, and consumer electronics extensively utilize these motors, contributing to their significant market share.

The outer rotor segment also is expected to witness substantial growth from 2025 to 2030. The unique configuration of outer rotor motors, where the rotor encases the stator, offers advantages in torque density and thermal management, making them suitable for these applications. As industries continue to prioritize energy efficiency and performance, the demand for outer rotor BLDC motors is expected to rise, contributing to their significant market expansion during the forecast period.

Power Output Insights

In terms of revenue, less than 750 watt segment dominated the market with a share of 50.1% in 2024. This high share is attributed to the wide usage of these products in numerous applications, such as fans, pumps, compressors, machine tools, domestic appliances, electric cars, HVAC applications, power tools, and automated robots. The high-efficiency BLDC motors are gaining importance due to their long operating life, lower maintenance, low energy consumption, and a higher tolerance for fluctuating voltages. The rising demand for fractional power BLDC motors for various machinery from the agriculture sector in China and India further boosts the product demand.

The above 75 kW segment also is expected to witness substantial growth from 2025 to 2030. This is owing to advantages, such as better performance, in terms of efficiency and reliability over the traditional DC motors with the same power output rating. These BLDC motors are used for a variety of industrial applications, such as milling, drilling, and grinding, deployed in industrial machinery, such as the CNC machines. Moreover, growing consumer awareness and government policies concerning energy conservation are also predicted to drive the market over the forecast period.

Speed Insights

In the BLDC (Brushless DC) motor market, motors are categorized based on their speed ranges. These speed ranges include motors with speeds that are less than 500 RPM, ranging from 501 to 2,000 RPM, ranging from 2,001 to 10,000 RPM, and motors with speeds that exceed 10,000 RPM. The 2,001-10,000 RPM segment dominated the brushless DC motor market in 2024. This RPM range aligns well with requirements for electric vehicles (EVs), hybrid vehicles, and automotive components such as power steering and cooling fans. As the EV market grows, demand for motors in this RPM range is also increasing.

The more than 10,000 RPM segment of the brushless DC (BLDC) motor market is expected to witness substantial growth from 2025 to 2030. High-speed BLDC motors are widely used in medical applications such as dental tools, surgical instruments, and laboratory equipment. With healthcare advancements and increased demand for precision devices, the need for ultra-high-speed motors is growing significantly.

End Use Insights

In terms of revenue, the motor vehicle segment dominated the market with a share of 28.8% in 2024. It is also anticipated to emerge as the fastest-growing segment at a CAGR of 8.1% from 2025 to 2030. The automobile industry uses motors of different types and specifications for numerous applications. Brushless DC motors are preferred over conventional powertrains primarily due to the absence of brushes resulting in less friction. Reduction in friction ensures less wear and tear of the brushless DC motor ultimately resulting in a reduction of maintenance required. These motors are thus ideal for numerous applications in motorized vehicles.

The motor vehicle end use is further sub-segmented into safety, comfort, and performance. The comfort segment acquired the highest market share in 2024 and is expected to be the fastest-growing segment by 2030. Comfort motors are primarily used in automatic window operations, sun-roof actuators, mirror adjusters, and air conditioning, and HVAC systems. Multiple powertrains are required for each of the applications mentioned above which are subsequently expected to drive the demand for brushless DC motors in vehicles by 2030. The industrial machinery segment acquired a substantial market share of more than 23.7% in 2024 and is anticipated to grow steadily from 2025 to 2030. This growth is attributed to the deployment of such equipment in complex industrial applications such as feeder drives, extruders, and robotics. In addition, technological advancements have resulted in increased efficiency of these motors which is further expected to drive the market over the forecast period.

Regional Insights

North America Brushless DC Motor market is expected to register a significant CAGR of over 6.7% from 2025 to 2030. North America has a strong presence in industries that heavily rely on BLDC motors, such as automotive, aerospace, and industrial machinery. The region is known for its technological advancements and innovation, which drives the demand for efficient and high-performance motors such as BLDC motors.

U.S. Burshless DC Motor Market Trends

The Brushless DC Motor Market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The growing use of automation and robots in a variety of sectors, such as manufacturing, aerospace, and automotive, is the main factor propelling the market. Additionally, the market is anticipated to increase as a result of strict government rules on emissions and fuel economy as well as the rising demand for high-performance and energy-efficient motors. The market is also being driven forward by the existence of well-established automotive and aerospace sectors as well as a strong emphasis on technical improvements.

Asia Pacific Brushless DC Motor Market Trends

Asia Pacific brushless DC motor market dominated with a share of 50.4% in 2024. The region has a strong presence in the manufacturing of electronic components and devices across various industries. In addition, Asia Pacific has been witnessing significant investments in the manufacturing of electric vehicle components, particularly battery systems, in India, South Korea, and Japan, which further drives the demand for BLDC motors in the region. The surge in electric vehicle adoption and the flourishing consumer electronics industry also contribute to Asia Pacific's dominance in the BLDC motor market.

The brushless DC motor market in China accounted for a revenue share of around 39.8% in the Asia Pacific market. The availability of cheap labor in China is a significant factor that has a positive impact on the brushless DC motor market. The lower labor costs make it more cost-effective for manufacturers to produce brushless DC motors in China. This cost advantage allows manufacturers to offer competitive prices for their products, making them attractive to both domestic and international customers.

Japan is home to established and reliable manufacturers of brushless DC motors. These companies have marketing networks, strong sales, a diverse product range, and advanced manufacturing technology. Some major players in the market include Nidec Corporation and MinebeaMitsumi Inc.

The brushless DC motor market in India accounted for a revenue share of more than 14% in the Asia Pacific market. The demand for brushless DC motors in India is fueled by factors such as the growing automation in industries, the increasing adoption of electric vehicles, and the rising need for energy-efficient and reliable motor solutions. The Indian government's push for electric mobility and renewable energy also contributes to the demand for brushless DC motors.

Europe Brushless DC Motor Market Trends

The demand for brushless DC motors in the automotive industry in Europe is growing. These motors are used in various automotive applications, including powertrain systems, chassis, safety fittings, and features such as motorized seats, adjustable mirrors, and sunroof systems. The increasing adoption of energy-efficient and environmentally friendly solutions across industries in Europe is driving the demand for BLDC motors.

The brushless DC motor market in the UK accounted for a revenue share of more than 22% in the European market. The rising demand for energy-efficient solutions and advancements in automation and robotics contribute to the increasing demand for BLDC motors in the UK. In the UK, automation and robotics are rapidly advancing in various industries. BLDC motors provide precise control, high performance, and reliability, making them suitable for automation applications.

The brushless DC motor market in Germany accounted for a revenue share of less than 30% in the European market. Germany is renowned for its automotive industry. BLDC motors are increasingly used in electric vehicles (EVs) for various applications, including propulsion systems, power steering, and HVAC systems. The rising adoption of EVs in Germany contributes to the demand for BLDC motors.

The growing popularity of miniature electronic devices, such as drones and mobility scooters, has led to an increased adoption of brushless DC (BLDC) motors in France. BLDC motors are widely used in high-tech electronics due to their high torque-to-weight ratio, efficiency, and precise control capabilities. They are commonly used in drones for propulsion and maneuverability, as well as in mobility scooters for efficient and reliable motor control.

Middle East & Africa Brushless DC Motor Market Trends

The brushless DC motor market in the Middle East & Africa accounted for a revenue share of 4.8%. The market growth is driven by factors such as the increasing adoption of brushless DC motors in various industries, including industrial machinery, automotive, healthcare, HVAC equipment, and others. In June 2023, General Motors surveyed, in collaboration with Morning Consult, to investigate consumer sentiments towards electric vehicles (EVs) in KSA and the UAE. The results revealed that a significant majority of respondents in both countries, with 63% in KSA and 70% in the UAE, are strongly contemplating the purchase of an EV in the future.

The increasing production and adoption of electric vehicles (EVs) in the Kingdom of Saudi Arabia (KSA) is one of the major factors driving the demand for BLDC motors. EVs rely on BLDC motors for their propulsion systems, contributing to the growth of the market. In addition, the demand for HVAC (Heating, Ventilation, and Air Conditioning) systems is also contributing to the rising demand for BLDC motors in KSA.

Key Brushless DC Motor Company Insights

Some of the key players operating in the market include ABB Ltd, and NIDEC CORPORATION, among others.

-

ABB is a multinational corporation formed in 1988 following the merger of ASEA and Brown and Boveri & Cie. ASEA operates as a holding company of ABB. The company holds expertise in automation, power technologies, robotics, electrification products, and motion sectors. It provides diverse products, services, solutions, and systems. It offers products and services for diverse industries, such as manufacturing, utilities, transportation, infrastructure, oil & gas, mining, and power generation. ABB’s automation business develops control, measurement, protection, and process optimization applications. The robotics and motion business segment offers motors, generators, mechanical transmission products, and drives. Its power technologies business segment focuses on power plant automation, power transmission, and distribution. ABB serves customers in over 100 countries. The company is listed on the New York Stock Exchange as NYSE: ABB, SIX Swiss Exchange as SIX: ABB, and Nasdaq Stockholm as Nasdaq Stockholm: ABB.

-

NIDEC CORPORATION is a part of the Nidec Group. Established in 1973, Nidec Group is a multinational conglomerate that offers a wide range of industrial, commercial, and appliance motors & machinery and electronic components & controls. The company operates through over 300 subsidiary companies and has more than 117,206 employees worldwide. As of September 2010, it operates as a subsidiary of Nidec Corporation. Its product offerings include motors for dryers and washing machines, pump motors for pools and spas, dishwashers, refrigerating, and air conditioning equipment, motors for general industrial machines, vehicle drives, and pumps. It has sales, production, and development bases in the U.S., Mexico, UK, and China. It primarily manufactures industrial & home appliances and commercial products. Nidec Group comprises Nidec ASI S.p.A., Nidec Motor Corporation, Nidec Control Techniques Ltd., and Nidec Leroy-Somer Holding.

Johnson Electric and TECO Corporation are some of the emerging market participants in the target market.

-

Johnson Electric is a Hong Kong-based designer and manufacturer of motion subsystems and motion components for automotive and industrial applications. The company caters to more than 500 customers, including tier 1 and tier 2 suppliers and OEMs in the automotive industry. It operates across two major divisions: Automotive Product Group and Industry Product Group. Johnson Electric offers various products, including AC and DC motors, steppers, gears, and piezo motors. The company’s products cater to various industries, such as automotive, business machines, building automation and security, food and beverage, defense and aerospace, HVAC, home technologies, medical devices, industrial equipment, personal care, and power equipment and power tools. The company has its innovation and product design centers in Hong Kong, China, Germany, Switzerland, Italy, Israel, Japan, the UK, and the U.S.

-

TECO Corporation is a motor manufacturer & solution provider. The company provides home appliances, heavy electric equipment, key electronic components, information technology, financial investment, communications, dining, and infrastructural engineering. It operates through six business segments, namely Electrification Products, System & Automation Products, Power Business, Household and Air Conditioning Appliances, ECO Energy Business, and IoT Applications

Key Brushless DC Companies:

The following are the leading companies in the brushless DC motor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Ametek Inc.

- Johnson Electric Holdings Limited.

- NIDEC CORPORATION

- Allied Motion Technologies, Inc.

- WorldWide Electric

- Schneider Electric

- Regal Rexnord Corporation

- Siemens

- TECO Corporation

- MinebeaMitsumi Inc.

- ORIENTAL MOTOR USA CORP

Recent Developments

-

In January 2024, WorldWide Electric announced that it had acquired North American Electric, Inc., a company that specializes in the distribution of electric motors, motor controls, and shaft mount reducers. The acquisition of North American Electric, Inc. further strengthens WorldWide Electric's position in the market and expands its capabilities to serve customers in the industrial sector.

-

In March 2023, ABB unveiled the new Baldor-Reliance EC Titanium for pump, fan, and compressed air systems. This motor offers enhanced energy efficiency and optimized performance, catering to the demands of applications such as pumping, ventilation, and compressed air in industrial settings. ABB's innovation continues to address sustainability and operational efficiency challenges in diverse industries.

-

In December 2022, Nidec Motor Corporation introduced a new high-performance brushless DC motor under its Nidec Motors brand. This motor features a compact design, low noise, and high efficiency, making it suitable for applications such as robotics, medical devices, and industrial automation. The motor's advanced features and capabilities contribute to Nidec's ongoing commitment to providing innovative solutions for various industries.

-

In November 2022, Nidec Motor Corporation announced the expansion of its Monterrey, Nuevo León facility, the largest of its brushless DC motor manufacturing plants, following an investment of USD 18 million. The company specializes in producing and marketing refrigeration solutions, encompassing dishwasher motors, washing machines, dryers, and components for Heating, Ventilation, and Air Conditioning (HVAC) systems. In Mexico, the company maintains a presence across Nuevo León and Tamaulipas, having four product brands and approximately 5,000 employees.

Brushless DC Motor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22,220.9 million

Revenue forecast in 2030

USD 30,862.4 million

Growth rate

CAGR of 6.8% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Rotor, power output, speed, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB; Ametek Inc.; Johnson Electric Holdings Limited; NIDEC CORPORATION; Allied Motion Technologies, Inc.; WorldWide Electric; Schneider Electric; Regal Rexnord Corporation; Siemens; TECO Corporation; MinebeaMitsumi Inc.; ORIENTAL MOTOR USA CORP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brushless DC Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global brushless DC motor market report based on rotor, power output, speed, end use, and region:

-

Rotor Outlook (Revenue, USD Million, 2017 - 2030)

-

Inner Rotor

-

Outer Rotor

-

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 750 Watts

-

750 Watts to 2.99 kW

-

3 kW - 75 kW

-

Above 75 kW

-

-

Speed Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 500 RPM

-

501-2,000 RPM

-

2,001-10,000 RPM

-

More than 10,000 RPM

-

-

End use Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial Machinery

-

Motor Vehicles

-

Safety

-

Comfort

-

Performance

-

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global brushless DC motor market size was estimated at USD 20,990.5 million in 2024 and is expected to reach USD 22,220.9 million in 2025.

b. The global brushless DC motor market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 30,862.4 million by 2030.

b. The motor vehicle segment dominated the global brushless DC motor market with a share of 23.7% in 2024. With the global shift toward sustainable and green energy, electric vehicles (EVs) and hybrid electric vehicles (HEVs) have seen significant growth, which in turn increases the demand for BLDC motors.

b. The Less than 750 Watts segment dominated the global brushless DC motor market with a share of 50.1% in 2024. BLDC motors under 750 watts are integral to a wide range of devices, including consumer electronics like fans, air conditioners, and washing machines, as well as automotive components such as window lifters and sunroof actuators. Their adaptability to various applications enhances their market presence.

b. Asia Pacific dominated the brushless DC motor market with a share of 50.4% in 2024. This is attributable to an increase in expenditure on the development of infrastructure and manufacturing facilities in countries such as China, Japan, and India.

b. Some key players operating in the brushless DC motor market include ABB Ltd; Ametek Inc.; Johnson Electric; Nidec Motor Corporation; Allied Motion Technologies, Inc.; Baldor Electric Company Inc.; Johnson Electric; North American Electric, Inc.; Schneider Electric; and Regal Beloit Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.