- Home

- »

- IT Services & Applications

- »

-

Captive Portal Market Size & Share, Industry Report, 2033GVR Report cover

![Captive Portal Market Size, Share & Trends Report]()

Captive Portal Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud, On-premises), By Application (Wi-Fi Management, Content Filtering), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-633-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Captive Portal Market Summary

The global captive portal market size was estimated at USD 1.95 billion in 2024 and is projected to reach USD 6.20 billion by 2033, growing at a CAGR of 13.9% from 2025 to 2033. The market is driven by increasing demand for secure and user-authenticated public Wi-Fi access across various industries.

Key Market Trends & Insights

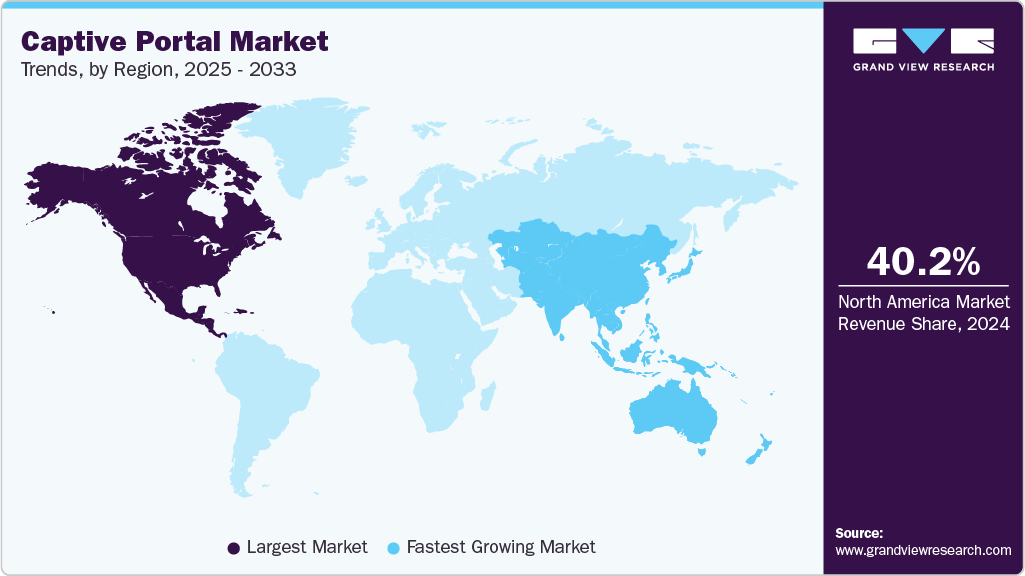

- North America held a 40.2% revenue share of the global captive portal market in 2024.

- In the U.S., the market is driven by the increasing demand for secure and personalized Wi-Fi access in public spaces, such as airports, hotels, and retail establishments.

- By component, solution segment held the largest revenue share of 66.9% in 2024.

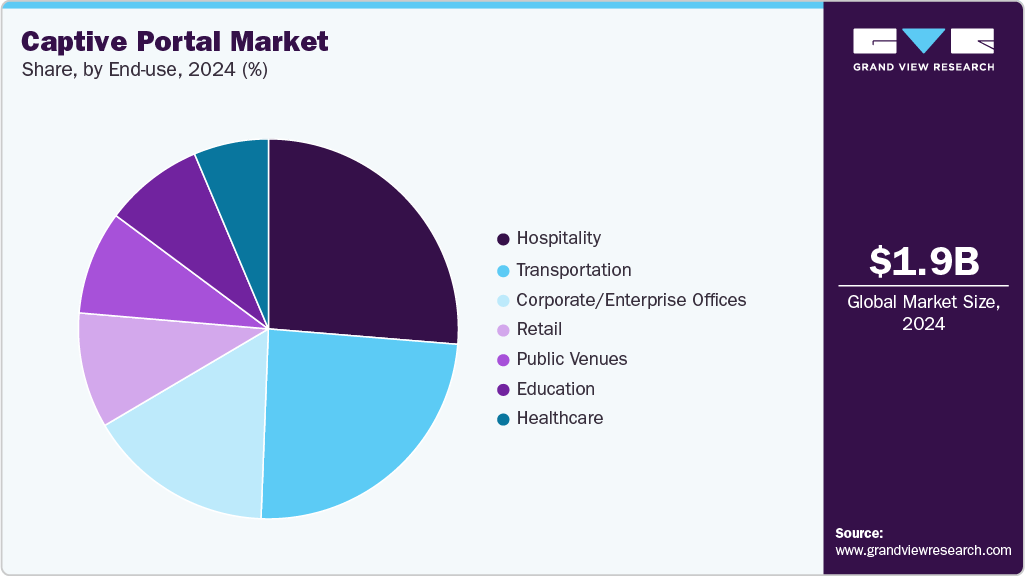

- By end use, the hospitality segment dominated the market and accounted for the revenue share of over 26.0% in 2024.

- By application, Wi-Fi management segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.95 Billion

- 2033 Projected Market Size: USD 6.20 Billion

- CAGR (2025-2033): 13.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, organizations are leveraging captive portals not only to manage guest connectivity but also to enhance user engagement, collect customer data, and enforce content filtering. The growing demand for secure and controlled access to public and semi-public Wi-Fi networks drives the global captive portal market. As digital connectivity is becoming essential in hospitality, retail, healthcare, education, and transportation sectors, businesses are adopting captive portals to regulate access, ensure compliance with privacy laws, and deliver customized user experiences.

Key trend fueling market growth is the integration of captive portals with advanced analytics and marketing automation tools. By capturing user information during login, businesses can build first-party data sets that are valuable in a privacy-first digital environment. This enables personalized marketing, customer segmentation, loyalty program integration, and real-time promotions, which improve customer retention and increase revenue per user. For instance, in April 2025, SplashAccess updated its compatibility with Cisco Meraki, offering businesses branded, secure Wi-Fi login portals that capture user data while meeting privacy regulations. This setup enables personalized experiences, automated marketing, and real-time insights, turning guest Wi-Fi into a powerful tool for customer engagement and business growth.

Component Insights

Solution segment dominated the market and accounted for the revenue share of 66.9% in 2024 due to the rising demand for integrated platforms that combine secure user authentication, branded splash pages, data analytics, and seamless marketing automation within a single package. Businesses adopt these comprehensive solutions over standalone services, as they simplify deployment, ensure regulatory compliance, and enable advanced customer engagement strategies. For instance, in July 2021, Cisco Meraki partnered with Kloudspot to introduce real-time location-awareness features powered by Wi‑Fi and cloud analytics. This collaboration enabled public venues such as the City of Erie and Nuevo León to transform standard Wi‑Fi logins into interactive, branded user experiences that double as marketing touchpoints and safety alert systems. Therefore, the above-mentioned factors are contributing significantly to driving the adoption of solution segment.

The service segment is expected to register the fastest growth during the forecast period due to the increasing need for specialized expertise in deploying and maintaining advanced captive portal solutions. Additionally, the growing demand of portals in organizations for CRM integration, personalized marketing, and compliance with evolving privacy regulations is driving the need for professional services such as consulting, system integration, and customization. Moreover, managed services reduce the operational burden of network performance monitoring, content filtering, security updates, and real-time analytics, particularly in retail chains, hotels, and public venues, where centralized support ensures uniformity and efficiency. For instance, in May 2025, ivision was recognized as a Cisco Premier Provider for its managed “Meraki Access” service, highlighting the growing trend toward outsourcing captive portal operations. This service supports hundreds of retail locations by delivering scalable, secure, and branded Wi-Fi login experiences. Such advancements emphasize that managed and professional services have evolved from being supplementary offerings to becoming integral elements of contemporary captive portal strategies.

Deployment Mode Insights

Cloud segment dominated the market in 2024, as it offers improved scalability and centralized control that are essential for organizations managing guest Wi‑Fi across multiple locations. Cloud-based captive portals enable real-time analytics, enhanced security, and rapid deployment without requiring on-site infrastructure. This allows businesses to deliver consistent, branded login experiences while integrating portal data with CRM, marketing, and compliance platforms. For instance, in February 2025, Cisco Meraki achieved FedRAMP authorization for its cloud networking platform including captive portal functionality endorsed by the U.S. Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency. This achievement highlights the cloud model’s robust security and compliance standards and paves the way for federal agencies and other regulated industries to implement cloud-managed captive portals. Therefore, as organizations prioritize security and centralized management, the cloud deployment segment is projected to witness growth throughout the forecast period.

On-premises segment is expected to grow at the fastest growth rate over the forecast period as many organizations, especially government, healthcare, and finance, prefer to maintain full control over their network infrastructure and user data. On-premises deployment offers enhanced security by keeping data within the organization's own environment, reducing reliance on external cloud providers and mitigating risks associated with data breaches and compliance violations. Additionally, some enterprises with existing robust IT infrastructure favor on-premises solutions for customization, low latency, and integration with legacy systems. Consequently, the above-mentioned factors are contributing notably to driving the growth of cloud-based captive portal market.

Application Insights

Wi-Fi Management segment dominated the market in 2024 due to its essential role in enabling secure, scalable, and user-friendly guest access across various industries. Captive portals function as the primary interface for user authentication, onboarding, and compliance in public and enterprise Wi-Fi networks, facilitating seamless connectivity and delivering valuable analytics for network administrators. For instance, in November 2022, GoZone WiFi’s launched the first enterprise-grade application suite for the Telecom Infra Project (TIP) emphasizing the increasing demand for advanced captive portal solutions that provide operators with greater control over user authentication, network monitoring, and customer experience. These advancements support the importance of Wi-Fi management in the captive portal market, as businesses rely on these portals to ensure secure access and gather data for optimization and engagement.

Content filtering segment is expected to grow at the highest CAGR during the forecast period due to increasing concerns around cybersecurity and regulatory compliance. Organizations across education, healthcare, and enterprise sectors are deploying captive portals with integrated content filtering to enforce browsing policies, block malicious websites, and reduce the risk of data breaches. Additionally, a rise in remote work is also driving the growth of the content filtering segment as organizations seek to maintain secure and compliant internet usage across distributed networks and personal devices. As employees access corporate resources from diverse locations using unsecured networks, content filtering via captive portals allows IT teams to apply consistent web usage policies and safeguard sensitive data against cyber threats. For instance, according to the U.S. Department of Commerce, the shift toward remote work has been significant, with 13.8% of U.S. workers working from home in 2023 more than double the 5.7% in 2019. The number of remote workers rose from around 9 million in 2019 to over 22 million by 2023, highlighting a growing need for content filtering solutions via captive portals to secure and regulate internet use across decentralized, home-based work environments.

End Use Insights

The hospitality segment dominated the market and accounted for the revenue share of over 26.0% in 2024 driven by its pivotal role in delivering secure, seamless, and brand-consistent guest access across industries. Captive portals serve as the essential gateway for user authentication, onboarding, and compliance enforcement functions that are foundational to both public and private Wi‑Fi networks. They not only streamline connectivity but also empower network operators with rich analytics on usage patterns, device types, and traffic flows, enabling smarter infrastructure decisions and improved service quality. For instance, in June 2023, IHG Hotels & Resorts rolled out its Wi‑Fi Auto Connect feature, implemented across more than 5,000 properties worldwide. Loyalty members who opt in within the IHG One Rewards app are now automatically connected to the hotel Wi‑Fi upon arrivaleliminating the need for manual login, passwords, or splash pages. This initiative has logged over 5.3 million monthly connections, saving guests time and simultaneously providing IHG with valuable insights into guest behavior and preferences

Retail segment is expected to register a fastest growth during the forecast period driven by the rising adoption of captive portals as strategic tools for customer engagement and data monetization. As retailers seek to enhance in-store experiences and compete with e-commerce platforms, captive portals offer a unique way to transform free Wi‑Fi access into a marketing and analytics engine. By prompting users to sign in through branded splash pages, retailers collect valuable first-party data such as email addresses, demographic details, and behavioral insights linked to loyalty programs. This enables them to deliver hyper-personalized promotions, trigger real-time offers based on user profiles or store location, and re-engage customers across digital channels. For instance, in May 2025, European retailer Système U partnered with Cloudi‑Fi to deploy a fully branded, cloud-based captive portal across its 1,568 stores, providing secure guest Wi‑Fi while gathering consent-based customer data to tailor marketing campaigns. This rollout empowers Système U to deliver targeted content, streamline user onboarding, and enhance shopping satisfaction across its network, thereby driving the adoption of captive portals in retail for engagement, data-driven marketing.

Regional Insights

North America captive portal market held a significant share of 40.2% in 2024, driven by increasing investments in advanced network security and seamless user authentication systems, particularly in sectors like hospitality, retail, and healthcare. Businesses are leveraging captive portals not only to provide controlled Wi-Fi access but also to gather actionable customer data that supports targeted marketing and personalized engagement strategies. The rise of remote work and mobile device usage has intensified demand for reliable, secure network access, pushing organizations to adopt cloud-based captive portal solutions for scalability and compliance with evolving privacy regulations. Additionally, collaborations between captive portal providers and major cloud and networking companies are accelerating innovation, driving adoption of sophisticated features such as AI-powered analytics and real-time user behavior monitoring across the region.

U.S. Captive Portal Market Trends

The captive portal market in the U.S. is expected to grow significantly driven by the increasing demand for secure and personalized Wi-Fi access in public spaces, such as airports, hotels, and retail establishments, which has led businesses to adopt captive portals to authenticate users and collect valuable data. Additionally, advancements in technology, including the integration of artificial intelligence and machine learning, have enhanced the capabilities of captive portals, enabling businesses to offer tailored experience and targeted marketing. Moreover, the proliferation of mobile devices and the growing emphasis on data privacy and compliance with regulations like GDPR and CCPA have further fueled the adoption of captive portal solutions across various industries.

Europe Captive Portal Market Trends

Captive portal market in Europe is anticipated to register considerable growth from 2025 to 2033, owing to the increasing adoption of cloud-based solutions, enhancing scalability and flexibility, enabling businesses to manage multiple locations efficiently. Additionally, integration with Internet of Things (IoT) provide enhanced user experience and operational efficiencies. Advanced analytics tools offer actionable insights into user behavior, allowing businesses to personalize services and improve customer engagement. Moreover, innovations in user authentication methods, such as biometric authentication and QR code scanning, are enhancing security and user experience. Furthermore, collaborations between captive portal providers and industries are fostering innovation and expanding the functionalities of captive portals. These developments are contributing to the growth of the captive portal market in Europe, as businesses seek to enhance user experience and operational efficiencies.

The UK captive portal market is experiencing notable growth driven by increasing demand for secure Wi-Fi access in public spaces like airports, hotels, and retail establishments. Additionally, the proliferation of mobile devices alongside stringent data privacy regulations such as GDPR has further accelerated adoption across industries. For instance, in May 2023, GlobalReach Technology’s Trusted Wi-Fi platform, a cloud-based solution designed for managed service providers and broadband carriers, was launched that enables rapid deployment of customized, large-scale Wi-Fi portal services. This platform offers features like customizable captive portals with branding options, diverse authentication methods, anonymized data capture, and robust analytics, while seamlessly integrating with various Wi-Fi hardware and providing unified management through a single dashboard.

The captive portal market in Germany is growing driven by stringent data privacy regulations such as GDPR and a strong emphasis on secure and controlled Wi-Fi access in public and enterprise environments. The market growth is supported by increasing internet penetration, the proliferation of smart devices, and the rising adoption of cloud-based captive portal solutions that offer scalability, centralized management, and compliance capabilities. Key industry verticals fueling demand include hospitality, retail, transportation, and coworking spaces, where secure guest access and user authentication are critical. Germany’s market dominance in Europe is also attributed to substantial investments in digital infrastructure and the presence of major technology providers innovating in captive portal platforms.

Asia Pacific Captive Portal Market Trends

Asia Pacific is expected to register the fastest CAGR of 14.7% from 2025 to 2033, due to the increasing government investments in digital education across Asia Pacific countries. As governments prioritize the development of digital infrastructure to enhance educational access and quality, the demand for secure and scalable Wi-Fi solutions in educational institutions is rising. Captive portals play a crucial role in this ecosystem by providing secure internet access, user authentication, and data collection capabilities, thereby supporting the delivery of digital education services. For instance, in December 2023, the Government of India launched the Digital India initiative, aiming to enhance online infrastructure and increase internet connectivity. This initiative includes plans to connect rural areas with high-speed internet networks, thereby facilitating the delivery of digital education services and driving the demand for captive portals in educational institutions.

Japan captive portal market is experiencing substantial growth, driven by increasing internet penetration and the government's push for enhanced digital infrastructure. Key trends include a rising demand for secure and seamless Wi-Fi access in public spaces such as airports, train stations, and commercial establishments and this demand is fueled by a growing number of tourists. Additionally, there's a heightened focus on leveraging captive portals for data collection and personalized marketing, aligning with the country’s advanced technology adoption. The integration of advanced authentication methods, such as biometric verification and mobile-based logins, is also gaining traction to enhance security and user experience.

The captive portal market in China held a substantial market share in 2024, owing to the substantial investment in smart infrastructure. As part of the government’s broader “new infrastructure” initiative, China has been rapidly deploying technologies like 5G, AI, and IoT to transform industries ranging from manufacturing to education and urban development. Smart city projects such as Hangzhou’s “City Brain” and the creation of over 30,000 smart factories illustrate how real-time data and connectivity are central to China’s modernization agenda, requiring robust network access management. Captive portals serve as a critical function by providing secure authentication, usage analytics, and compliance with data policies, making them indispensable in these high-tech environments. In education, programs like “Three Links and Two Platforms” have expanded digital learning nationwide, further increasing the need for controlled and trackable Wi-Fi access in schools.

Key Captive Portal Company Insights

Key players operating in the captive portal industry are Cisco Systems, Hewlett Packard Enterprise Development, Extreme Networks and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Astound Business Solutions launched Wi-Fi Pro for Small Businesses, a new Wi-Fi networking solution powered by eero, designed to deliver fast, secure, and scalable internet connectivity for businesses with up to 50 employees. The product features eero’s mesh Wi-Fi technology and includes a captive portal that enables businesses to offer branded guest Wi-Fi experience with customizable splash pages, guest access controls, and bandwidth management. This captive portal functionality enhances security and user engagement, making it easier for small businesses to manage and personalize their guest network while maintaining reliable performance.

-

In September 2023, Authentic raised USD 5.5 million in a seed funding round led by Slow Ventures to launch its "Captive in a Box" platform. This turnkey insurance solution enables vertical SaaS companies, franchises, and associations to quickly and easily establish captive insurance programs, handling all logistics such as legal, underwriting, reinsurance, and claims management.

-

In May 2023, Juniper Networks introduced the Mist Access Assurance service, which integrates cloud-native network access control (NAC) with AI-powered automation to enhance security, streamline operations, and enable scalable network management. By leveraging Mist AI, the service optimizes user connectivity and enforces network policies more effectively.

Key Captive Portal Companies:

The following are the leading companies in the captive portal market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems

- Hewlett Packard Enterprise Development

- Extreme Networks

- Arista Networks

- Juniper Networks

- Purple

- Cloud4Wi

- IronWifi

- Netgear

- GlobalReach

- GoZone WiFi

- Adentro

- Spotipo

- Boingo

- Datavalet

- ray.life

Captive Portal Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.19 billion

Revenue forecast in 2033

USD 6.20 billion

Growth rate

CAGR of 13.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

Cisco Systems; Hewlett Packard Enterprise Development; Extreme Networks; Arista Networks; Juniper Networks; Purple; Cloud4Wi; IronWifi; Netgear; GlobalReach; GoZone WiFi; Adentro; Spotipo; Boingo; Datavalet; ray.life

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Captive Portal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global captive portal market report based on component, deployment mode, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Wi-Fi Management

-

Content Filtering

-

Device Management

-

Bandwidth Management

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitality

-

Retail

-

Healthcare

-

Education

-

Transportation

-

Public Venues

-

Corporate/Enterprise Offices

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global captive portal market size was estimated at USD 1.94 billion in 2024 and is expected to reach USD 2.19 billion in 2025.

b. The global captive portal market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2033 to reach USD 6.20 billion by 2033.

b. Solution segment dominated the market and accounted for the revenue share of 66.9% in 2024 due to the rising demand for integrated platforms that combine secure user authentication, branded splash pages, data analytics, and seamless marketing automation within a single package.

b. Some of the key companies operating in the captive portal market include Cisco Systems, Hewlett Packard Enterprise Development, Extreme Networks, Arista Networks, Juniper Networks, Purple, Cloud4Wi, IronWifi, Netgear, GlobalReach, GoZone WiFi, Adentro, Spotipo, Boingo, Datavalet, ray.life and Others.

b. The global captive portal market is driven by the growing demand for secure and controlled access to public and semi-public Wi-Fi networks. As digital connectivity is becoming essential in hospitality, retail, healthcare, education, and transportation sectors, businesses are adopting captive portals to regulate access, ensure compliance with privacy laws, and deliver customized user experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.