- Home

- »

- Consumer F&B

- »

-

Caramel Ingredients Market Size And Share Report, 2030GVR Report cover

![Caramel Ingredients Market Size, Share & Trends Report]()

Caramel Ingredients Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Liquid, Powdered/Granulated), By Application (Colors, Flavors), By End Use (Bakery, Beverages), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-575-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caramel Ingredients Market Size & Trends

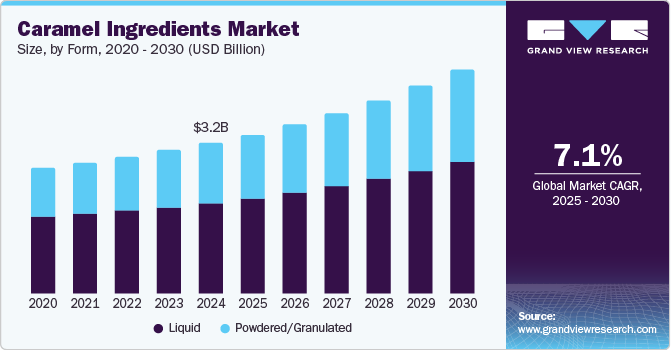

The global caramel ingredients market size was valued at USD 3.19 billion in 2024 and is expected to expand at a CAGR of 7.1% from 2025 to 2030. Caramel is a confectionery product used in foods and beverages for flavoring, filling, coating, coloring, and topping. The market is mainly driven by a booming convenience food industry, a rise in disposable income of consumers, and widespread urbanization, especially in developing economies. Additionally, caramel ingredients are finding applications beyond traditional confectionery, expanding into various food and beverage sectors such as dairy products, bakery items, and beverages are expected to drive market growth.

The versatility of caramel in adding color, flavor, and sweetness to a wide range of products enhances its appeal. Furthermore, the growing indulgence in sweet treats and the expansion of the food service and snack industries contribute to the market's growth. Emerging markets also show a rising interest in caramel as a versatile ingredient, further driving its popularity.

Caramel ingredients have been gaining global acceptance due to rising consumer indulgence in bakery and confectionery products. A prominent application of this ingredient is also noted in the beverages segment, in different forms such as syrups and powders in teas, lemonades, fruit drinks, colas, and beer, to name a few. Recognizing the numerous applications of the ingredient, companies, both large and small, have been looking to make the most of ongoing consumer and food trends to stay ahead of the competition. Product innovation, attractive packaging solutions, investments in marketing and promotions, collaborations with product manufacturers in other application segments, and capacity expansion in newer markets are some of the growth strategies being adopted by players in the market.

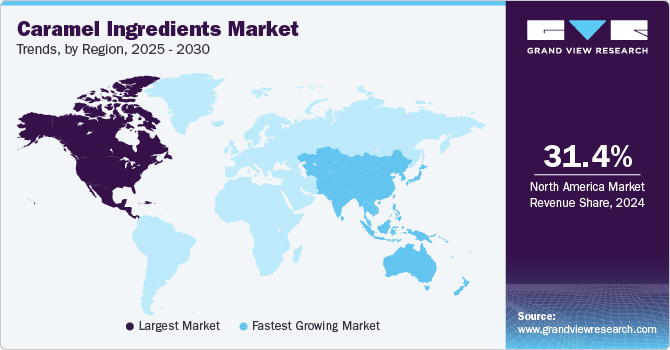

While the market already has an established presence in developed countries across North America and Europe, its scope for growth in developing countries in Asia Pacific and South and Central America is noteworthy. Untapped potential in countries like India, China, and Brazil, particularly in the bakery and confectionery segments, is driven by the strong influence of Western-style dietary habits. This, coupled with rising disposable income and evolving lifestyles, has resulted in a diversified palette, thereby offering players in this market a major opportunity for expansion. Catering to these smaller yet more lucrative markets by considering consumers' preferences, purchasing habits, and tastes can prove immensely profitable for companies.

Form Insights

The liquid segment dominated the market with the largest revenue share of 60.5% in 2024, owing to the widespread application of liquid caramel in various food and beverage products. Liquid caramel is favored for its ease of incorporation into recipes, consistent quality, and ability to provide a rich flavor and appealing color to a wide range of products, including desserts, beverages, dairy items, and bakery goods. The ingredient is widely used in manufacturing various alcoholic beverages such as beer, whiskey, scotch, and dark rum. The salted caramel porter is one of the most popular beers during fall, and year after year, companies introduce innovative and unique twists to the original recipe to give consumers something new. For instance, Arcadia Brewing Company teamed up with Biggby Coffee in December 2018 to introduce the Salted Caramel Coffee Porter. This limited-edition variation of one of the favorite seasonal beers was made available at select retail locations in the U.S.

The powdered/granulated segment is expected to grow at the fastest CAGR of 7.6% over the forecast period. This growth is driven by the increasing demand for easy-to-use and shelf-stable ingredients in various food and beverage applications. Powdered or granulated caramel offers several advantages, including longer shelf life, ease of handling, and precise portion control, making it ideal for industrial and commercial use. Additionally, the versatility of powdered caramel in enhancing flavor and color in products such as bakery items, confectionery, and dairy products contributes to its rising popularity. The expanding food processing industry and the growing trend of home baking further support the strong growth of the powdered/granulated caramel segment.

Application Insights

Colors dominated the market with the largest revenue share in 2024. This is attributed to the wide application of caramel colors in various food and beverage products. Caramel colors are extensively used to enhance the visual appeal of products, including soft drinks, confectionery, bakery items, sauces, and snacks. The versatility of caramel color in providing consistent and appealing hues across different products makes it a preferred choice for manufacturers. Additionally, the increasing demand for natural and clean label ingredients further boosts the market for caramel colors, as they are perceived as a more natural option compared to synthetic colorants.

Inclusions are expected to the grow at the fastest CAGR over the forecast period. Caramel inclusions, such as chips, chunks, and swirls, are being increasingly incorporated into various products, including bakery items, ice creams, confectionery, and dairy products, to enhance their taste and visual appeal. The versatility of caramel inclusions in adding a rich, sweet flavor and a satisfying crunch or chewiness makes them highly desirable among both manufacturers and consumers. Additionally, the growing trend of premiumization in the food industry, where consumers seek high-quality and indulgent experiences, further supports the robust growth of the inclusions segment in the caramel ingredients market.

The topping segment is predicted to exhibit growth over the forecast period. Caramel toppings are immensely popular in several frozen desserts, baked goods, chocolates, shakes, and smoothies and this ingredient is one of the most common additions to fall menu items in North America. For instance, Dairy Queen released two new Blizzards to its 2019 fall menu, one of them being the Heath Caramel Brownie Blizzard. This frozen vanilla treat is available at Dairy Queen outlets across the U.S., including brownie pieces, crunchy Hershey’s Heath Pieces, and a rich caramel topping.

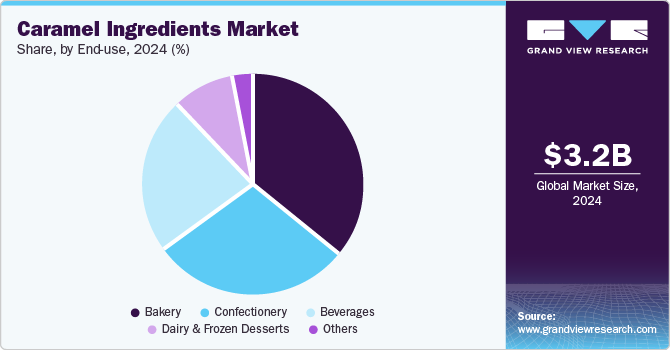

End Use Insights

Bakery dominated the market with the largest revenue share in 2024. This dominance is driven by the widespread use of caramel ingredients in various bakery products such as cakes, pastries, cookies, and bread. Caramel enhances these items' flavor, texture, and color, making them more appealing to consumers. The growing trend of artisanal and gourmet bakery products, which often feature high-quality and unique ingredients like caramel, also contributes to this market share. Additionally, the rise in home baking, spurred by social media and cooking shows, has increased the demand for convenient and flavorful baking ingredients.

Beverages are expected to grow at the fastest CAGR over the forecast period owing to the increasing demand for caramel-flavored beverages and the rising popularity of ready-to-drink products. Caramel is a popular ingredient in various beverage applications, including coffee, tea, alcoholic drinks, and soft drinks, due to its rich flavor and appealing color. The trend towards premium and indulgent beverages, where caramel can add a gourmet touch, further boosts market demand. Additionally, the innovation in beverage formulations and the introduction of new caramel-infused drinks by leading brands support the robust growth of this segment.

Regional Insights

North America caramel ingredients market dominated the global market with the largest revenue share of 31.4% in 2024. The region's robust food and beverage industry, with a significant focus on innovation and premium product offerings, heavily utilizes caramel ingredients to enhance the flavor, color, and texture of a wide range of products. Additionally, the growing consumer demand for natural and clean-label ingredients boosts the adoption of caramel made from real sugar without artificial additives. The presence of major food and beverage manufacturers and the advanced processing technologies in North America further support the market's growth. Companies have made innovation and seasonal favorites a key growth strategy, and this will keep North America and Europe at the top of their game throughout the forecast period. For instance, Mars Wrigley International Travel Retail will be launching its limited-edition M&M’s and Twix selections at the 2019 TFWA World Exhibition & Conference. The Twix Salted Caramel and M&M’s Crunchy Caramel aim to give consumers something new, unexpected, and fun to improve their travel experience.

U.S. Caramel Ingredients Market Trends

The U.S. caramel ingredients market is expected to grow significantly over the forecast period. The increasing demand for natural and clean-label products is a major driver as consumers seek healthier, more transparent ingredient lists. Caramel, made from real sugar and without artificial additives, fits well into this trend. The versatility of caramel ingredients in enhancing the flavor, color, and texture of a wide range of food and beverage products also contributes to its growing popularity. Additionally, expanding the food service and ready-to-eat sectors, where caramel ingredients are widely used, further supports market growth.

Europe Caramel Ingredients Market Trends

Europe caramel ingredients market was identified as a lucrative region in 2024. The region's increasing demand for natural and clean-label ingredients has led to a rise in the use of caramel made from real sugar without artificial additives. This trend aligns with the growing consumer preference for healthier, more transparent food products. Additionally, the expansion of the bakery and confectionery industries, where caramel is widely used as a flavoring, filling, and coloring agent, contributes significantly to market growth. The popularity of caramel inclusions, toppings, and decorations in bakery products and desserts further supports this trend.

Asia Pacific Caramel Ingredients Market Trends

Asia Pacific caramel ingredients market is expected to grow at the fastest CAGR of 8.0% over the forecast period. This rapid growth is fueled by rising disposable incomes and urbanization in countries such as India, China, Indonesia, Malaysia, Korea, and Thailand. The increasing demand for frozen bakery products, confectionery items, and beverages drives the market's expansion. Consumers in the region are showing a growing preference for indulgent and premium food products, which often incorporate caramel ingredients for their rich flavor and appealing color.

Key Caramel Ingredients Company Insights

Some key companies in the caramel ingredients market include Kerry Group plc, Cargill, Incorporated, Sensient Technologies Corporation, Givaudan, Puratos, and others. Companies are introducing innovative caramel ingredients to stay competitive. Additionally, several companies are launching new products and implementing mergers, acquisitions, and marketing strategies. Caramel is an extremely versatile ingredient and is being adopted by an increasing number of confectioners in their products. For instance, Mars Corporation announced a new variety of Milky Way to be introduced in the markets in January 2020. The Milky Way Salted Caramel bar is a twist on the original candy bar. Other products by the company, which has significantly focused on caramel ingredients, include Milky Way Caramel Apple and Milky Way Simply Caramel.

-

Kerry Group plc is a leading player in the global food ingredients market, offering a wide range of caramel ingredients. The company’s product portfolio includes caramel colors, flavors, and syrups used in various applications such as confectionery, bakery, beverages, and dairy products. Kerry is known for its commitment to innovation and quality, providing natural and clean label solutions that meet the evolving demands of consumers.

Key Caramel Ingredients Companies:

The following are the leading companies in the caramel ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Kerry Group plc.

- Cargill, Incorporated

- Sensient Technologies Corporation

- Givaudan

- Puratos

- Sethness Roquette

- D.D. Williamson Caramel

- Nigay

- Metarom USA

- Martin Braun-Gruppe

Recent Developments

-

In September 2024, Zevia, renowned for its zero-sugar beverages, unveiled a new limited-edition Salted Caramel Soda, exclusively available on Zevia.com and Amazon. This seasonal flavor offers a refreshing alternative to traditional fall options like pumpkin and apple.

-

In April 2024, Sweet Freedom expanded its product offerings by introducing a chocolate caramel-flavored spread and a new line of ready-to-drink functional beverages.

-

In March 2024, Nature's Bakery introduced a new flavor in its popular Brownie line, the Salted Caramel Brownie, at the Natural Products Expo West in Anaheim, California. This latest offering, crafted with whole grains, dates, and vegan chocolate, follows the successful launch of the Double Chocolate Brownie in July 2023.

Caramel Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.37 billion

Revenue forecast in 2030

USD 4.75 billion

Growth Rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, Application, End Use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Kerry Group plc.; Cargill, Incorporated; Sensient Technologies Corporation; Givaudan; Puratos; Sethness Roquette; D.D. Williamson Caramel; Nigay; Metarom USA; Martin Braun-Gruppe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caramel Ingredients Market Report Segmentation

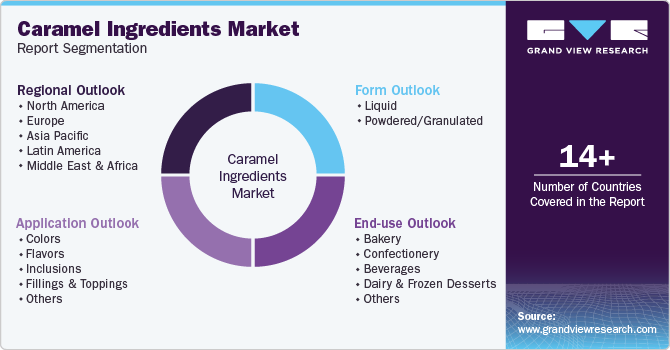

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caramel ingredients market report based on form, application, end use, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powdered/Granulated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Colors

-

Flavors

-

Inclusions

-

Fillings & Toppings

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery

-

Confectionery

-

Beverages

-

Dairy & Frozen Desserts

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.