- Home

- »

- Medical Devices

- »

-

Cell And Gene Therapy Third-Party Logistics Market, 2030GVR Report cover

![Cell And Gene Therapy Third-Party Logistics Market Size, Share & Trends Report]()

Cell And Gene Therapy Third-Party Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Clinical), By Product (Cell Therapies, Gene Therapies), By Temperature Range (Ambient Storage), By Therapeutic Area, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-550-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell And Gene Therapy Third-Party Logistics Market Summary

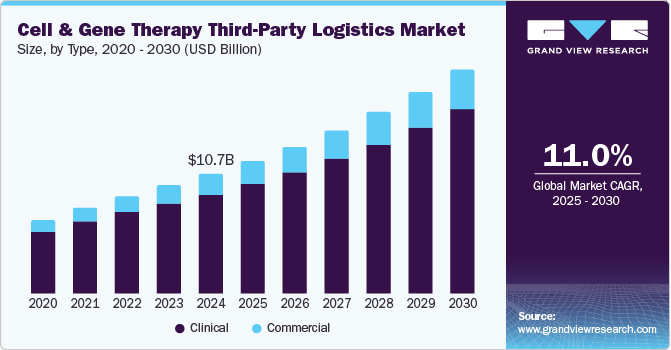

The global cell and gene therapy third-party logistics market size was estimated at USD 10.71 billion in 2024 and is projected to reach USD 20.04 billion by 2030, growing at a CAGR of 11.05% from 2025 to 2030. The growth of the market is due to advancements in personalized medicines, expansion of clinical trials followed by subsequent approvals, and technological advancements mainly in cold chain logistics.

Key Market Trends & Insights

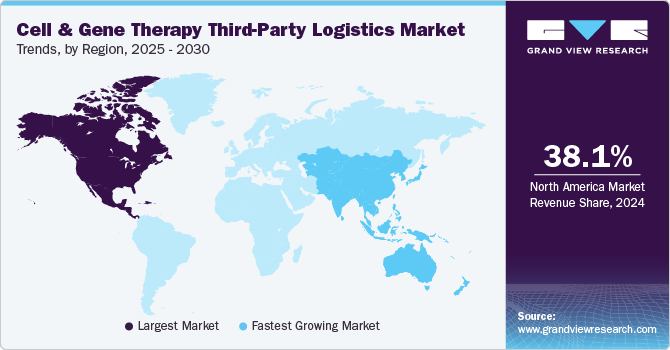

- The North America accounted for the largest market share of 38.13% in 2024.

- Based on type, the clinical segment accounted for the highest market share of 83.33% in the cell & gene therapy third-party logistics industry in 2024.

- Based on product, the cell therapies segment dominated the cell & gene therapy third-party logistics industry in 2024.

- Based on therapeutic area, the oncology segment dominated the cell & gene therapy third-party logistics industry in 2024.

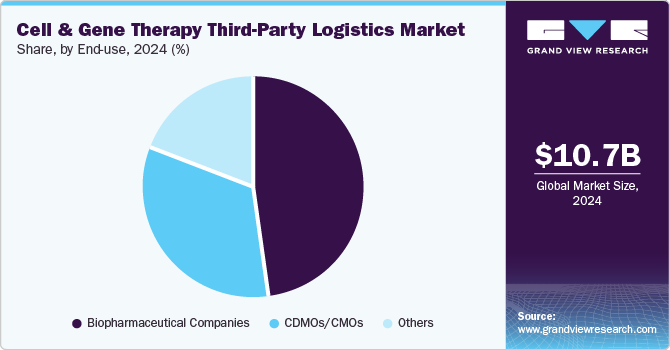

- Based on end-use, the biopharmaceutical companies segment dominated the cell & gene therapy third-party logistics industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.71 Billion

- 2030 Projected Market USD 20.04 Billion

- CAGR (2025-2030): 11.05%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing demand for personalized medicine has transformed healthcare by shifting the focus from generalized treatments to patient-specific therapies. Cell and gene therapies (CGTs) offer customized solutions for previously untreatable conditions. The logistics requirements for CGTs are highly specialized due to their personalized nature, requiring stringent temperature controls, real-time tracking, and rapid delivery.

Furthermore, an increasing number of clinical trials and regulatory approvals for cell and gene therapies is also one of the major factors driving market growth. An increasing number of CGTs are moving from research to clinical development and eventually commercialization, which is driving the need for more secure and efficient transportation. Pharmaceutical and biotech companies are conducting multi-site trials across different regions, requiring advanced logistics solutions to transport temperature-sensitive therapies.

In addition, cell and gene therapies often require patients to visit specialized treatment centers or involve direct-to-patient shipments, making logistics more complex. Among these, several trials focus on rare and orphan diseases, requiring logistics providers to coordinate deliveries to remote or restricted-access locations. The rising number of investigative new drug (IND) applications for CGTs has further increased the demand for logistics companies to offer adaptable and scalable solutions. With the rapid growth of cell and gene therapy clinical trials, third-party logistics (3PL) providers are increasingly required to develop specialized services such as advanced packaging solutions and ultra-cold storage facilities to enhance the safe and efficient transport of these highly sensitive therapies.

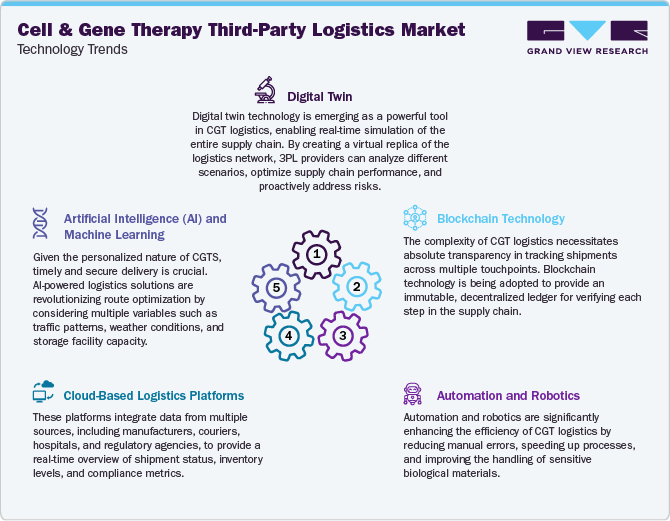

Technology Landscape

Recent technological advancements have significantly enhanced the efficiency and reliability of 3PL services supporting the cell and gene therapy sector. The integration of real-time cold chain monitoring systems using IoT-enabled devices is one of the most innovative developments in recent years. These systems provide continuous tracking of temperature, location, and handling conditions across the supply chain, which is critical for maintaining the integrity of CGT products that are highly sensitive to environmental conditions. Automation in warehousing, such as robotic handling and AI-driven inventory management, improved storage accuracy and responsiveness. Additionally, blockchain technology is being conducted to enhance traceability and reduce data tampering risks, accelerating compliance with regulatory standards. These technologies safeguard the quality of CGT therapies during transportation and allow 3PL providers to deliver a higher level of transparency and accountability to their biopharma clients.

Moreover, advancements in data analytics and machine learning are enabling 3PL providers to optimize route planning and forecast demand with unprecedented precision, which is vital for the time and temperature-sensitive nature of CGT shipments. Predictive analytics platforms can anticipate potential disruptions due to weather, geopolitical events, or logistics bottlenecks, allowing preventive adjustments that minimize transportation delays. Moreover, digital twin technology simulates logistics operations, assisting continuous improvement in packaging methods and delivery protocols. Emerging innovations in packaging, such as phase-change materials and smart insulated containers, also enhance thermal stability during long-distance or last-mile delivery. These technological advancements are critical for managing the logistical complexities of personalized therapies and assisting scalability as more CGT products advance through clinical development and move toward commercialization.

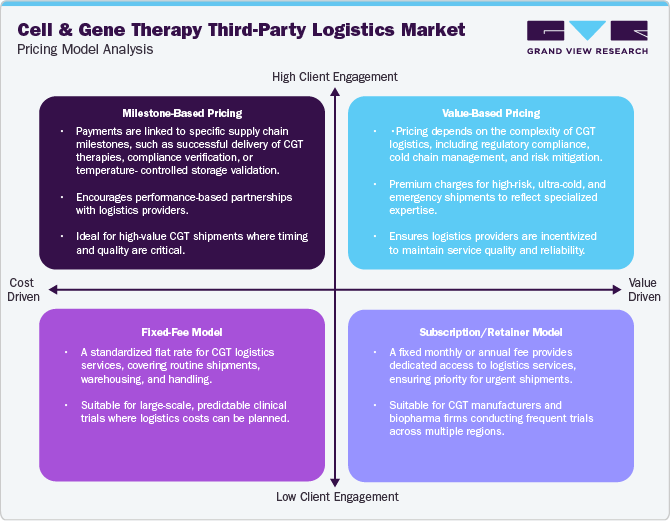

Pricing Model Analysis

Market Concentration & Characteristics

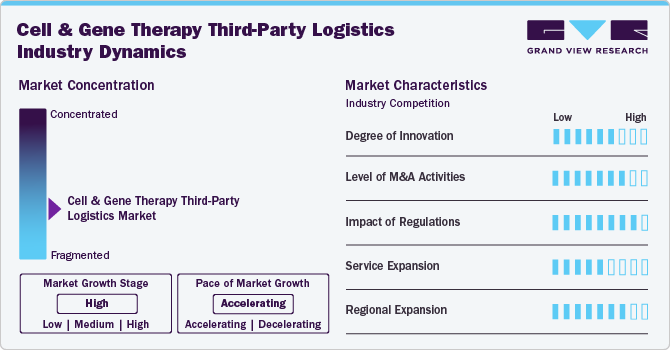

The CGT logistics sector rapidly evolves with AI-driven monitoring solutions that enhance real-time shipment tracking. Blockchain is being integrated to improve supply chain transparency and regulatory compliance.

Large logistics providers are acquiring specialized cold chain firms to expand their CGT capabilities. The industry is witnessing increased consolidation among biopharma-focused logistics companies to strengthen their market presence. Collaborations between tech firms and logistics providers enhance automation and predictive analytics in supply chains. Strategic partnerships are forming to develop end-to-end CGT logistics solutions.

Stringent Good Manufacturing Practice (GMP) and Good Distribution Practice (GDP) guidelines are shaping logistics strategies. Regulatory agencies like the FDA and EMA are increasing scrutiny on CGT transportation and storage protocols. Compliance with region-specific regulations requires logistics firms to implement customized handling solutions. Cross-border transportation remains challenging due to varying national regulations on CGT handling.

The rise of patient-specific therapies is driving demand for just-in-time delivery solutions. Logistics firms are expanding specialized handling and distribution centers for cryogenic storage. Investments in digital tracking platforms ensure the real-time monitoring of CGT shipments. Companies are focusing on developing ultra-cold chain capabilities to meet increasing CGT demand.

North America and Europe continue to lead the CGT logistics market with well-established infrastructure. Asia-Pacific is emerging as a critical region due to increasing CGT clinical trials and investments. Countries such as China, Japan, and South Korea are rapidly expanding their cold chain networks.

Type Insights

The clinical segment accounted for the highest market share of 83.33% in the cell & gene therapy third-party logistics industry in 2024. The growth of the segment is due to the growing number of cell and gene therapy clinical trials worldwide. For instance, over 1,975 ongoing clinical trials for cell and gene therapy as of Q4 2024. The increasing complexity of early-stage research and stringent regulatory requirements have driven demand for specialized logistics solutions to support trial site distribution, sample collection, and real-time temperature monitoring.

The commercial segment is projected to witness the fastest growth over the analysis timeframe due to the increasing number of regulatory approvals and market launches of cell and gene therapies. As more treatments transition from clinical trials to commercialization, the demand for specialized third-party logistics services is rising to ensure seamless global distribution.

Product Insights

The cell therapies segment dominated the cell & gene therapy third-party logistics industry in 2024. The segment’s growth is mainly driven due to the increasing commercialization of autologous and allogeneic cell-based treatments, particularly for oncology and rare diseases. The highly personalized nature of many cell therapies, such as CAR-T treatments, require complex supply chain logistics, including strict cold chain management, real-time tracking, and just-in-time delivery.

The gene therapies segment is expected to experience the fastest growth rate during the forecast period. The growth is due to the increasing number of regulatory approvals, expanding clinical pipeline, and rising investments in genetic medicine. Advances in gene-editing technologies, such as CRISPR and viral vector-based gene delivery, are driving the development of therapies for rare genetic disorders, neurological conditions, and various cancers.

Temperature Range Insights

The ambient storage segment dominated the cell & gene therapy third-party logistics industry in 2024. The segment’s growth is due to the increasing number of gene therapies and certain cell-based treatments that require controlled room temperature storage rather than ultra-cold or cryogenic conditions. As more advanced therapies are developed with improved stability profiles, the demand for ambiance storage solutions has grown, reducing logistical complexities and costs.

The refrigerated storage segment is expected to experience the fastest growth rate during the forecast period. The growth is due to the increasing demand for temperature-controlled logistics in cell and gene therapy distribution. Several advanced therapies, including certain gene-modified cell therapies and viral vector-based treatments, require refrigeration (typically 2-8°C) to maintain stability without the extreme costs and complexities of cryogenic storage.

Therapeutic Area Insights

The oncology segment dominated the cell & gene therapy third-party logistics industry in 2024. The segment’s growth is due to the increasing number of approved and pipeline therapies targeting various cancers. Cell and gene therapies, such as CAR-T treatments, require stringent cold chain logistics, real-time tracking, and precise handling to maintain their efficacy. The growing prevalence of cancer, coupled with increasing regulatory approvals for personalized oncology treatments, has strengthened the demand for specialized logistics solutions.

The neurology segment is expected to showcase a considerable growth rate during the forecast period. The growth is due to the increasing development of cell and gene therapies targeting neurological disorders such as Parkinson’s disease, ALS, and spinal muscular atrophy. Advancements in gene editing, stem cell therapies, and regenerative medicine drive innovation in neurology, leading to a rising number of clinical trials and regulatory approvals.

End-use Insights

The biopharmaceutical companies segment dominated the cell & gene therapy third-party logistics industry in 2024. The growth of the market is due to their significant investment in advanced therapies, the growing number of clinical trials, and the complexity of supply chain requirements for personalized treatments. Stringent regulatory guidelines, including temperature-controlled storage and just-in-time delivery, have driven biopharma firms to rely on specialized third-party logistics providers.

The CDMOs/CMOs segment is expected to witness the fastest growth in the coming years due to the rising demand for outsourced manufacturing of complex cell and gene therapies. Pharmaceutical companies increasingly depend on these specialized organizations to overcome production challenges, scale up manufacturing, and meet stringent regulatory requirements. The surge in clinical trials and the need for cost-effective production and global distribution capabilities drive investment in advanced technologies.

Regional Insights

North America accounted for the largest market share of 38.13% in 2024 due to its advanced healthcare infrastructure and established cold chain networks. The region benefits from a high concentration of CGT developers, leading to increased demand for specialized logistics services. Stringent FDA regulations drive investment in compliant storage, transportation, and monitoring solutions.

U.S. Cell And Gene Therapy Third-Party Logistics Market Trends

The cell & gene therapy third-party logistics market in the U.S. is driven due to the country’s highly developed regulatory landscape such as U.S. FDA, GDP, GMP that mandates strict cold chain compliance. In addition, rising pharmaceutical exports and increased outsourcing of logistics operations to specialized 3PL providers are further accelerating the market growth.

Europe Cell And Gene Therapy Third-Party Logistics Market Trends

The cell And gene therapy third-party logistics market in Europe is experiencing significant market growth over the forecast period. The region has witnessed a surge in investments in GDP-compliant cold storage facilities and last-mile delivery solutions. The European Medicines Agency (EMA) implements rigorous guidelines, requiring logistics providers to adopt real-time temperature monitoring and risk mitigation strategies.

The cell & gene therapy third-party logistics market in the UK held a significant share in 2024. The country’s market growth is due to its robust pharmaceutical supply chain, with high demand for cold chain logistics due to its strong biotech and vaccine production industry. The impact of Brexit led to increased complexities in cross-border pharmaceutical trade, making efficient cold chain management essential.

The cell & gene therapy third-party logistics market in France is driven due to the country’s growing biologics and vaccine production sector. The government’s focus on domestic pharmaceutical manufacturing and R&D investments is increasing the demand for specialized cold chain services.

The cell & gene therapy third-party logistics market in Germany is anticipated to grow due to its strong biopharmaceutical sector and increasing CGT clinical trials. The country’s well-developed cold chain infrastructure supports the transportation of temperature-sensitive therapies. Compliance with strict EU regulations is driving investments in specialized storage and monitoring solutions.

Asia Pacific Cell And Gene Therapy Third-Party Logistics Market Trends

The Asia Pacific cell & gene therapy third-party logistics market is projected to grow at the highest CAGR over the forecast period. The growth of the market is due to rising pharmaceutical manufacturing, vaccine exports, and increasing demand for biologics. The region is witnessing immense investments in temperature-controlled warehouses, IoT-based tracking systems, and express cold-chain transportation.

The cell & gene therapy third-party logistics market in China is expected to grow over the forecast period. The country is rapidly expanding its cold storage and refrigerated transport infrastructure to meet rising demand. Government regulations on pharmaceutical cold chain compliance are becoming stricter, further driving the investments in GDP-certified logistics solutions.

Japan cell & gene therapy third-party logistics market is witnessing significant growth over the forecast period. The country has advanced regulatory compliance, high-tech logistics solutions, and increasing demand for regenerative medicine. The country has one of the most sophisticated cold chain infrastructures, with extensive use of robotic cold storage, AI-driven logistics management, and RFID-based tracking.

India cell & gene therapy third-party logistics market is witnessing a considerable growth due to the increasing government support. The government’s "Make in India" initiative is accelerating the development of domestic cold chain infrastructure.

Latin America Cell And Gene Therapy Third-Party Logistics Market Trends

The Latin America cell & gene therapy third-party logistics market is projected to grow over the forecast period. The growth in the region is due to increasing pharmaceutical imports and expanding healthcare access. Countries like Brazil and Argentina are leading investments in cold storage and refrigerated transportation. Challenges such as infrastructure gaps, regulatory variations, and high logistics costs are advancing providers to adopt cost-effective, region-specific cold chain strategies.

The cell & gene therapy third-party logistics market in Brazil is expected to grow over the forecast period. The country has a rapidly expanding biologics and vaccine distribution network, requiring better cold chain storage and compliance-driven logistics solutions. Regulatory reforms and increased pharmaceutical trade agreements are enhancing international logistics operations.

Key Cell And Gene Therapy Third-Party Logistics Company Insights

Key players in the market are actively enhancing their service offerings to meet the growing demand for temperature-sensitive pharmaceutical products. Companies such as Cencora Corporation, Cardinal Health, McKesson Corporation, EVERSANA, and Knipper Health, among others, are investing in advanced technologies like IoT-enabled tracking systems, real-time temperature monitoring, and automated warehousing solutions. These innovations aim to ensure the integrity and safety of healthcare products during transportation. For instance, in October 2024, McKesson announced the launch of InspiroGene, a dedicated business unit focused on supporting the commercialization of cell and gene therapies.

Key Cell And Gene Therapy Third-Party Logistics Companies:

The following are the leading companies in the cell and gene therapy third-party logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Cencora Corporation

- Cardinal Health

- McKesson Corporation

- EVERSANA

- Knipper Health

- Arvato SE

- DHL

- FedEx

- Kuehne + Nagel

- United Parcel Service of America, Inc.

Recent Developments

-

In March 2025, DHL announced acquisition of U.S.-based pharmaceutical logistics firm CryoPDP to enhance its capabilities in the life sciences and healthcare sector. CryoPDP specializes in temperature-controlled logistics solutions, including shipping, storage, and packaging services for pharmaceutical and biotech companies. This acquisition aims to strengthen DHL's supply chain services in the pharmaceutical industry.

-

In January 2025, Cardinal Health announced the launch of Advanced Therapy Connect,an industry-first integrated ordering platform designed specifically for cell and gene therapies under the Advanced Therapy Solutions division.

-

In August 2024, Alcura, a part of Cencora, received a Manufacturing and Importation Authorization (MIA) license from the Spanish Agency of Medicines and Medical Devices. This license allowed Alcura to offer import, storage, and QP Batch Certification services for investigational and commercial cell and gene therapy products.

Cell And Gene Therapy Third-Party Logistics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 11.86 billion

Revenue Forecast in 2030

USD 20.04 billion

Growth rate

CAGR of 11.05% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, Product, Temperature Range, Therapeutic Area, End-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cencora Corporation; Cardinal Health; McKesson Corporation; EVERSANA; Knipper Health; Arvato SE; DHL; FedEx; Kuehne + Nagel; United Parcel Service of America, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell And Gene Therapy Third-Party Logistics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the cell and gene therapy third-party logistics market on the basis of type, product, temperature range, therapeutic area, end-use, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Clinical

-

Commercial

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Cell Therapies

-

Gene Therapies

-

-

Temperature Range Outlook (Revenue, USD Million; 2018 - 2030)

-

Ambient Storage

-

Refrigerated Storage

-

Ultra-Low Temperature Storage

-

Cryogenic Storage

-

-

Therapeutic Area Outlook (Revenue, USD Million; 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiovascular Diseases

-

Ophthalmology

-

Infectious Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Biopharmaceutical Companies

-

CDMOs/CMOs

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell and gene therapy third-party logistics market size was estimated at USD 10.71 billion in 2024 and is expected to reach USD 11.86 billion in 2025.

b. The global cell & gene therapy third-party logistics market is expected to grow at a compound annual growth rate of 11.05% from 2025 to 2030 to reach USD 20.04 billion by 2030.

b. North America dominated the cell & gene therapy third-party logistics market with a share of 38.13% in 2024. This is attributable to its advanced healthcare infrastructure and established cold chain networks. The region benefits from a high concentration of CGT developers, leading to increased demand for specialized logistics services.

b. Some key players operating in the cell and gene therapy third-party logistics market include TCencora Corporation, Cardinal Health, McKesson Corporation, EVERSANA, Knipper Health, Arvato SE, DHL, FedEx, Kuehne and Nagel, and United Parcel Service of America, Inc.

b. Key factors that are driving the market growth include advancements in personalized medicines, expansion of clinical trials followed by subsequent approvals, and technological advancements mainly in cold chain logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.