- Home

- »

- Organic Chemicals

- »

-

Chemical Tanker Shipping Market Size & Share Report, 2030GVR Report cover

![Chemical Tanker Shipping Market Size, Share & Trends Report]()

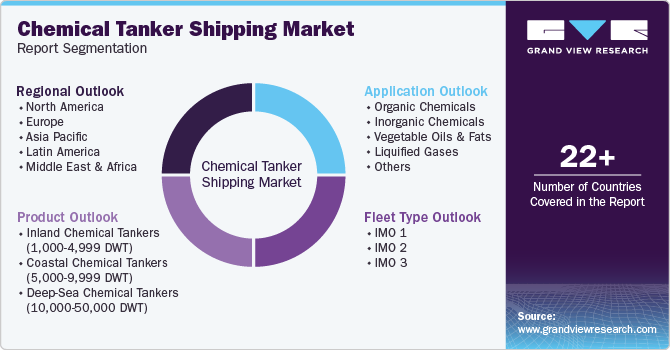

Chemical Tanker Shipping Market Size, Share & Trends Analysis Report By Fleet Type (IMO 1, IMO 2, IMO 3), By Product (Inland, Coastal, Deep-sea), By Application (Organic), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-349-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Chemical Tanker Shipping Market Trends

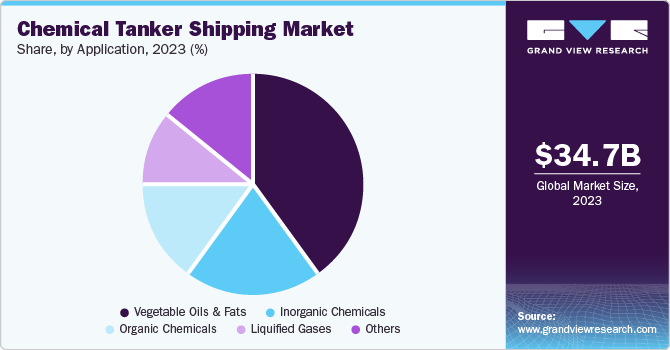

The global chemical tanker shipping market size was valued at USD 34.65 million in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The increasing demand for chemicals worldwide, particularly from industries such as pharmaceuticals, food processing, and personal care, is a significant factor. This demand necessitates efficient and safe transportation, thus boosting the chemical tanker shipping market. In addition, advancements in tank design for better cargo safety and the adoption of marine coatings for corrosion resistance in chemical tankers are also contributing to market growth.

The stringent environmental regulations and an emphasis on reducing greenhouse gas emissions have led to the development of low-emission ships, further driving the market. Lastly, the expansion of chemical manufacturing units, especially in the Asia-Pacific region, is expected to provide lucrative opportunities for the market during the forecast period.

The chemical production industry is witnessing a surge in demand, and the increase in cross-border transportation is further fueling this growth. This has led to significant technological advancements that have become a key driver in the market expansion. Modern chemical tankers are now equipped with numerous features, such as improved vessel design and construction techniques. These enhancements not only reduce maintenance costs but also increase the durability of the tanks.

In addition, safety systems have been upgraded with advanced communication systems and improved navigation features, making them a prominent feature of today's tankers. The integration of automation and digitization, such as the Internet of Things (IoT), has revolutionized the way companies operate. It allows them to monitor cargo conditions in real time, optimize routing, and improve fuel efficiency.

These technological advancements have made transportation safer and more eco-friendly. They have also enhanced logistics management systems, ensuring efficient and effective operations. The industry continues to innovate, focusing on reducing environmental impact and improving operational efficiency. This includes the development of corrosion-resistant coatings, advanced cargo monitoring systems, and eco-friendly propulsion systems.

Fleet Type Insights

IMO 2 fleet type segment dominated the market and accounted for a revenue share of 50.4% in 2023. The IMO 2 fleet type is designed to transport chemicals that present a moderate hazard and require significant preventive measures during transportation. These tankers are equipped with advanced safety features and robust construction techniques, ensuring the safe and efficient transportation of a wide range of chemical products. The dominance of the IMO 2 segment can be attributed to the robust global demand for these chemicals, driven by industrial growth, particularly in emerging markets. The versatility of IMO 2 vessels allows them to serve various sectors, including pharmaceuticals, agrochemicals, and food processing, making them an indispensable part of the chemical shipping industry.

IMO 1 fleet type segment is anticipated to grow at a CAGR of 4.1% from 2024 to 2030. IMO 1 vessels are designed to carry the most hazardous and toxic chemicals, including highly corrosive substances and reactive chemicals. This segment is anticipated to benefit from the increasing global focus on stringent safety standards and the rising demand for the secure transport of hazardous materials. As industries such as pharmaceuticals, petrochemicals, and specialized chemical manufacturing continue to expand, the demand for IMO 1 vessels is expected to grow correspondingly. Additionally, regulatory frameworks mandating the safe handling and transport of hazardous chemicals are likely to bolster the demand for IMO 1 vessels, ensuring steady growth in this market segment over the forecast period.

Product Insights

The deep-sea chemical tankers product segment dominated the market in 2023 attributed to the increasing demand for chemical products in various industries worldwide, such as pharmaceuticals, agriculture, and petrochemicals. The ability of these tankers to transport large volumes of chemicals over long distances has made them a preferred choice for global chemical transportation.

Inland chemical tankers product segment is expected to grow at fastest CAGR from 2024 to 2030. This growth can be attributed to the increasing demand for the localized transportation of chemicals, especially in regions with extensive inland waterways. As the chemical industry continues to expand, the demand for inland chemical tankers is expected to rise, driving the growth of this segment.

Application Insights

The vegetable oils & fats segment dominated the market in 2023, reflecting the robust demand for these products in various industries, including food processing, cosmetics, and biofuels. The dominance of this segment can be attributed to the increasing production and export of vegetable oils, particularly from key producing regions like Southeast Asia, South America, and parts of Africa. The transport of vegetable oils and fats requires specialized tankers equipped with heating systems to maintain the required temperature and prevent solidification during transit, ensuring the integrity of the cargo. The global trade in vegetable oils has been further strengthened by the rising consumer preference for plant-based and organic products. This has led to a steady increase in demand for efficient and safe shipping solutions.

The inorganic chemicals segment is expected to grow significantly over the forecast period. driven by the increasing demand for these chemicals across various industrial applications, including manufacturing, agriculture, water treatment, and construction. Inorganic chemicals, such as sulfuric acid, caustic soda, and phosphoric acid, are essential raw materials in numerous production processes, and their transportation necessitates the use of highly specialized chemical tankers to prevent contamination and ensure safe handling. The anticipated growth in this segment is also attributed to the rising industrial activities in emerging economies, where the demand for inorganic chemicals is surging to support infrastructure development and industrial expansion. Additionally, the growing focus on environmental sustainability is leading to stricter regulations and standards for the transportation of hazardous chemicals, further fueling the need for advanced chemical tanker services.

Regional Insights

The North America chemical tanker shipping market held a largest market share of 36.0% in 2023 attributed to several key factors, including the growth of oil refining industries, the implementation of stringent environmental regulations that promote sustainable practices, and increased investments aimed at fleet modernization. Furthermore, the geopolitical climate in the region is expected to significantly influence the market’s growth in the coming years.

U.S. Chemical Tanker Shipping Market Trends

The chemical tanker shipping market in the U.S. held a significant market share in 2023 due to a growing emphasis on sustainable practices, mergers, and acquisitions between major players to increase the market share. Additionally, the expansion of international trade networks in the country is surging the demand for chemical tankers for large-scale chemical exports and imports thus increasing opportunities for the market in the country.

The chemical tanker shipping market in Mexico is projected to experience significant growth within North America from 2024 to 2030. This growth is driven by a variety of factors. Mexico’s strategic geographic location, serving as a bridge between North and South America, provides increased export opportunities for chemical manufacturers. Additionally, investments in logistics aimed at enhancing loading and unloading processes are reducing overall process times, thereby positively impacting the market. International trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), have also facilitated smoother trade within the chemical sectors, further contributing to the market’s growth.

Europe Chemical Tanker Shipping Market Trends

Europe chemical tanker shipping market has been identified as a lucrative region within this industry. The growth of the market in this region is expected to be driven by geopolitical influences, substantial investments in port infrastructure, and an increasing demand for specialized chemicals in sectors such as agriculture, electronics, and pharmaceuticals. Furthermore, the demand for niche and highly valued products with specialized shipment requirements is also impacting the market in the region.

The chemical tanker shipping market in the UK is projected to experience rapid growth in the coming years. This growth is anticipated to be driven by stringent regulations related to the shipping of hazardous materials and shifting trends toward specialty chemicals, which require unique transportation methods. These factors are expected to further drive the market in the country.

Asia Pacific Chemical Tanker Shipping Market Trends

The Asia Pacific chemical tanker shipping market is expected to grow at the fastest CAGR of 5.0% from 2024 to 2030. This growth is primarily driven by the increasing demand for chemicals across various industries, which directly impacts the demand for the shipping market. Additionally, rapid urbanization and industrialization in many developing and developed countries within the region are also contributing to the market’s expansion.

China Chemical tanker shipping market held the largest market share of 41.57% in 2023. This dominance can be attributed to a combination of factors, including advanced chemical industry, growing export requirements to and from China, superior infrastructure facilities, supportive government policies, advanced technologies, and the burgeoning prospects of specialty chemicals. These factors, along with general economic developments, are the primary drivers for the growth of the chemical tanker shipping business in China.

India chemical tanker shipping market is expected to grow at the fastest rate in the Asia Pacific region over the forecast period. This anticipated growth is attributed to factors such as the expansion of the chemical industry, higher demand for specialty chemicals, the establishment of new infrastructures, government support for chemical industry exports, advancements in technology, and increased safety awareness.

Key Chemical Tanker Shipping Company Insights

Some of the key companies in the chemical tanker shipping market are Stolt-Nielsen, Hafnia, Bahri, and MISC Behrad. Companies in the market are focusing on increasing their revenue and reach to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Hafnia, a foremost shipping company in the chemical tanker shipping market, operates its business in the transportation of a broad spectrum of liquid chemicals and petroleum products. It employs streamlined, efficient, safe, and equipped modern vessels to accommodate global clients’ needs and requests while complying with environmental policies.

-

Stolt-Nielsen Limited is an independent company that offers diversified transportation services, primarily chemical tanker shipping. The firm employs specific chemical carriers that transport large-scale liquid marine chemicals and other products. It also provides additional supply chain solutions to customers.

Key Chemical Tanker Shipping Companies:

The following are the leading companies in the chemical tanker shipping market. These companies collectively hold the largest market share and dictate industry trends.

- Hafnia

- MOL CHEMICAL TANKERS PTE. LTD

- Stolt-Nielsen

- Ardmore Shipping Corporation

- Odfjell

- Team Tankers International Ltd.

- Tokyo Marine Asia Pte Ltd.

- Bahri

- Navig8 Chemical Tankers Inc.

- MISC Berhad

- Ultrabulk

- IINO KAIUN KAISHA, LTD.

- Iino Marine Service Co., Ltd

Recent Developments

-

In March 2024, Mitsui Chemical Tankers, a subsidiary of Mitsui OSK Lines, acquired Fairfield Chemical Carriers at an approximate cost of 400 million USD. This strategic acquisition serves to strengthen MOL’s position in the chemical tanker market and enhances its fleet capacity, thereby providing a competitive advantage.

-

In February 2023, Chemship introduced its inaugural vessel equipped with wind-assisted propulsion technology. The MT Chemical Challenger, now in operation on the company's Trans-Atlantic route between the U.S. East Coast and the Mediterranean, marks a significant industry milestone as the world's first chemical tanker to utilize wind power as a supplementary propulsion source.

Chemical Tanker Shipping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.03 million

Revenue forecast in 2030

USD 46.14 million

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fleet type, product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Stolt-Nielsen; Odfjell; Hafnia; Team Tankers International Ltd.; Ardmore Shipping Corporation; Navig8 Chemical Tankers Inc.; Bahri; MISC Berhad; IINO KAIUN KAISHA, LTD.; Tokyo Marine Asia Pte Ltd.;Ultrabulk; EXMAR; MOL CHEMICAL TANKERS PTE. LTD; Iino Marine Service Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical Tanker Shipping Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemical tanker shipping market report based on fleet type, product, application, and region.

-

Fleet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

IMO 1

-

IMO 2

-

IMO 3

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inland Chemical Tankers (1,000-4,999 DWT)

-

Coastal Chemical Tankers (5,000-9,999 DWT)

-

Deep-Sea Chemical Tankers (10,000-50,000 DWT)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic Chemicals

-

Inorganic Chemicals

-

Vegetable Oils & Fats

-

Liquified Gases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."