- Home

- »

- Homecare & Decor

- »

-

China Kitchenware Market Size, Share, Industry Report 2033GVR Report cover

![China Kitchenware Market Size, Share & Trends Report]()

China Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware, Tableware), By Application (Residential, Commercial) By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), And Segment Forecasts

- Report ID: GVR-4-68040-684-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Kitchenware Market Size & Trends

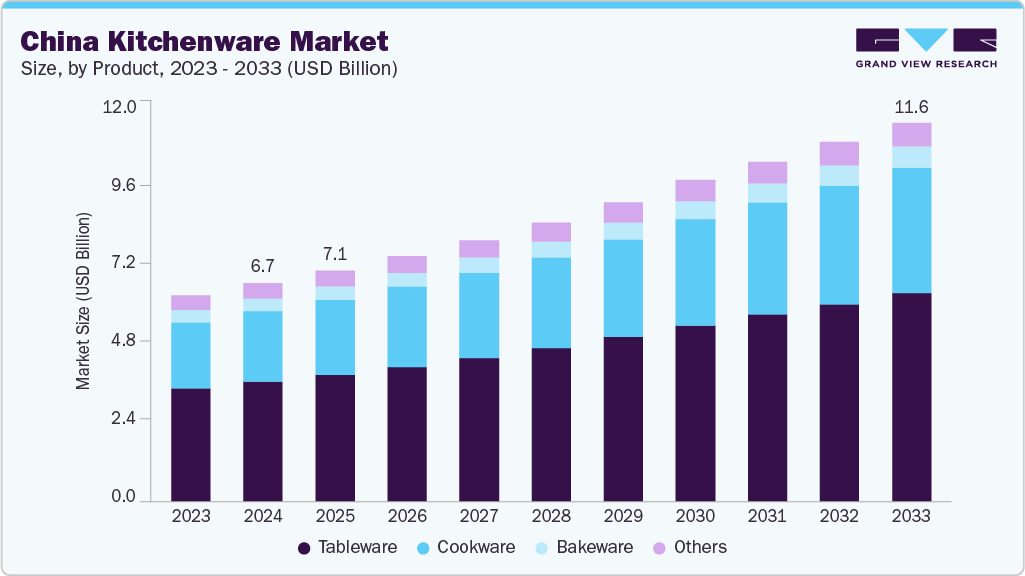

The China kitchenware market size was estimated at USD 6,680.5 million in 2024 and is expected to reach USD 11,599.6 million by 2033 and growing at a CAGR of 6.4% from 2025 to 2033. The kitchenware market in China is being driven by rapid urbanization, rising disposable incomes, culinary heritage and innovation, and a growing preference for modern, functional kitchens. Demand for high-quality, durable, eco-friendly kitchenware is increasing as more consumers, especially in urban and semi-urban areas, embrace healthier lifestyles and home cooking. This trend is further supported by the widespread adoption of e-commerce platforms, which offer greater accessibility, competitive pricing, and a broad product range, making it easier for consumers to upgrade their kitchens with modern tools and appliances.

Consumers in China increasingly prioritize healthy eating and home cooking, which has led to a surge in demand for cookware and kitchen tools that facilitate nutritious meal preparation. Many households now favor appliances and utensils designed for low-oil, low-fat cooking, such as steamers, air fryers, and pressure cookers, to enjoy wholesome meals with minimal effort.

In China, the rising popularity of smart and multifunctional kitchen appliances in the kitchenware industry is transforming household cooking habits, particularly in urban centers. Consumers are embracing devices such as app-controlled rice cookers, AI-powered pressure cookers, and multifunctional blenders that streamline meal prep while offering personalized cooking modes. This trend aligns with the broader adoption of smart home ecosystems, especially among younger, tech-savvy demographics. For example, Midea’s Smart IH Rice Cooker integrates with its home IoT platform, allowing users to remotely control cooking through a smartphone app, monitor energy use, and receive recipe suggestions.

Consumers are increasingly choosing non-toxic, BPA-free, ceramic-coated, and stainless steel cookware that supports healthier cooking techniques such as steaming and low-oil frying. This shift is especially prominent among middle- and upper-income households in urban areas. For example, Supor, a leading Chinese kitchenware brand, has launched a range of PFOA-free non-stick pans and steamers designed specifically for low-oil, low-smoke cooking, catering to consumers prioritizing wellness and environmental sustainability in their kitchens.

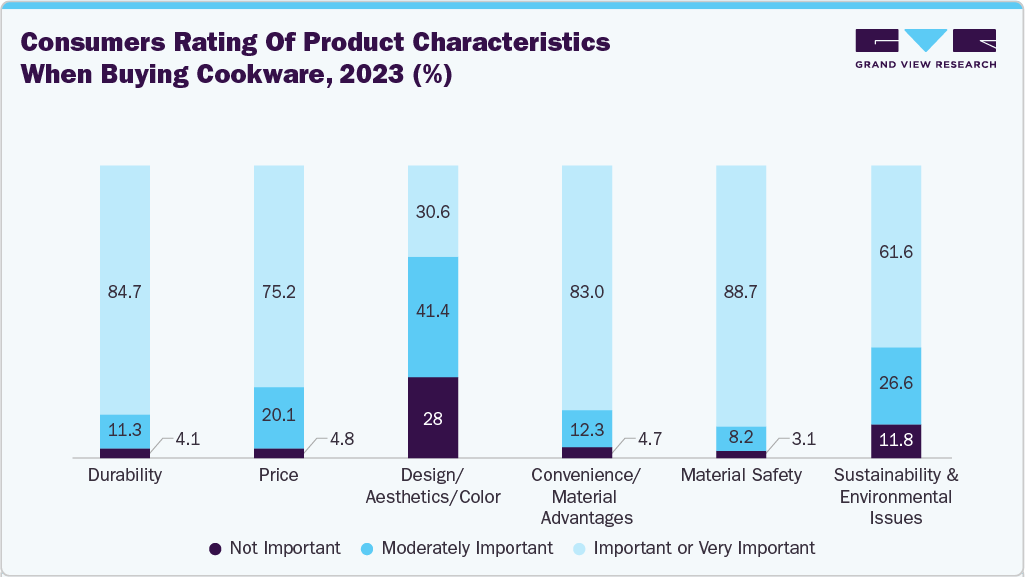

Consumer Insights & Surveys

Consumers increasingly prioritize kitchenware that offers practical benefits and saves time. Multi-functionality appeals to those with busy schedules in cookware, pots, pans, and pressure cookers. Tools like silicone molds or non-stick trays make preparation and cleanup easier in bakeware. The impact is clear: utility-driven products enjoy higher turnover and repeat purchases.

Quality directly affects long-term satisfaction. Stainless steel pots and pans, heavy-duty pressure cookers, and scratch-resistant flatware are perceived as smarter investments. Materials such as carbon steel or silicone add to longevity and user safety in the bakeware segment. Consumers also associate durability with safety, which is important for pressure cookers or sharp cooking tools. The result is growing demand for trusted materials and certifications that ensure robustness.

According to the Food and Chemical Toxicology (FCT) and Chinese Society of Toxicology (CST), durability, material safety, and convenience emerge as the most influential factors in purchase decisions, indicating that functionality and reliability are top priorities for buyers. Price remains important but shows more varied opinions, suggesting that while affordability matters, many are willing to pay more for higher quality. Though less critical, design, aesthetics, and environmental considerations still hold moderate significance, especially among style-conscious and sustainability-aware consumers.

Product Insights

Tableware accounted for the revenue share of about 55.03% of the China kitchenware market in 2024. In China, the popularity of tableware is strongly influenced by cultural traditions that emphasize communal dining and the aesthetic presentation of food. Meals are often social occasions, and beautifully designed plates, bowls, and utensils enhance family dinners and gatherings. At the same time, rising urbanization and a growing middle class have led more consumers to invest in upgrading them at-home dining experiences, with stylish and coordinated tableware becoming a key element of modern lifestyle aspirations.

The demand for cookware is projected to grow at a CAGR of 6.7% from 2025 to 2033, driven by a rise in home cooking and increasing consumer health awareness. As more people prioritize nutritious, homemade meals, they seek cookware that supports healthier cooking methods, such as low-oil, low-smoke, and steaming techniques. This shift is accompanied by a preference for safe, eco-friendly materials such as ceramic, stainless steel, and toxin-free non-stick coatings, reflecting a broader concern for personal well-being and environmental impact. For instance, SUPOR, one of the country's leading cookware brands, has introduced a line of PFOA-free non-stick woks and steamers designed for healthier, low-oil cooking.

Application Insights

The demand for kitchenware used for residential application accounted for about 69.79% of the China kitchenware industry. China’s growing urban population, exceeding 900 million, has significantly boosted demand for household kitchenware. Rapid urbanization has led to a rise in smaller, nuclear families who establish independent homes, each needing their own set of cookware, tableware, and kitchen appliances. This shift has created a steady and scalable market for residential kitchenware, particularly in newly built urban housing developments and apartment renovations. In addition, home cooking remains a fundamental aspect of Chinese culture, particularly valued for fostering family connections and honoring traditional practices during daily meals and festive occasions. This enduring cultural preference drives consistent demand for durable, functional, high-quality cookware and tableware in residential settings.

The demand for kitchenware used for commercial application is estimated to grow at a CAGR of 6.9% over the forecast period. The rapid expansion of China’s hospitality and foodservice industry, including restaurants, catering services, hotels, and cafés, significantly drives demand for large-scale, durable, high-performance kitchenware. The growth of specialized formats such as hotpot chains, themed restaurants, and upscale dining establishments has intensified the need for professional-grade cookware and tailored tableware solutions that meet specific operational and aesthetic requirements.

In 2024, China’s restaurant industry saw significant expansion, with approximately 3.14 million new foodservice enterprises registered by November, bringing the total number of active establishments to around 16.7 million. Major brands also contributed to this growth, with Yum China opening 1,751 new restaurants, including 1,352 KFCs, and McDonald’s China launching 917 new outlets. This rapid development reflects strong consumer demand and reinforces the growing need for commercial kitchenware to support the expanding foodservice sector.

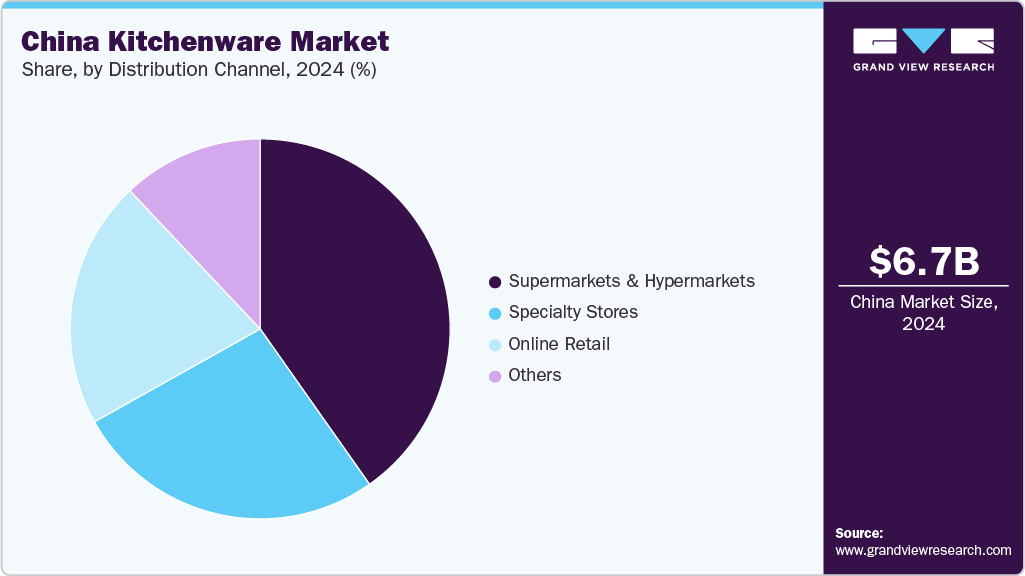

Distribution Channel Insights

The sale of kitchenware through supermarkets and hypermarkets accounted for a revenue share of about 40.24% in 2024due to their convenience and comprehensive shopping experience. These large-format stores allow consumers to browse a wide assortment of kitchen products while completing their routine grocery shopping, making them a practical one-stop destination. Shoppers benefit from physically inspecting and comparing items, with the added advantage of in-store assistance. These retail outlets cater to a broad range of budgets, offering everything from affordable essentials to high-end cookware. These offerings are often enhanced by promotional discounts, bundle deals, and loyalty programs that further incentivize purchases.

The sale of kitchenware through online retail channels is expected to grow at a CAGR of 7.1% from 2025 to 2033. Online retail offers unmatched convenience by enabling consumers to shop anytime, from anywhere. This is particularly advantageous for busy urban dwellers and those living in less accessible areas. E-commerce platforms provide a vast selection of brands and products across different price ranges, along with attractive perks such as flash sales, festival promotions, and exclusive online discounts that appeal to value-driven buyers. Features such as hassle-free returns, home delivery, and secure payment methods have further strengthened trust in online purchases.

Key China Kitchenware Company Insights

The market features a combination of well-established brands and rising newcomers. Leading companies actively respond to evolving consumer preferences by innovating their product lines and broadening their offerings to sustain and enhance their competitive edge.

-

Groupe SEB is a global leader in cookware and small household appliances, recognized for its diverse portfolio of over 45 brands, including Tefal, Moulinex, Krups, Rowenta, WMF, All-Clad, and Supor. With operations spanning more than 150 countries, the company sells over 344 million products annually, serving a broad and varied consumer base. Its offerings range from kitchen appliances such as coffee makers and blenders to cookware and home care products like vacuum cleaners, irons, and hair dryers.

-

Haier Inc. is a leading Chinese multinational home appliance and consumer electronics company headquartered in Qingdao, Shandong. Established in 1984, Haier has grown into one of the world's top appliance brands, offering a wide range of products including refrigerators, washing machines, air conditioners, and kitchen appliances. In the kitchenware segment, Haier is known for its smart, built-in kitchen solutions and energy-efficient appliances that cater to modern households.

Key China Kitchenware Companies:

- Groupe SEB

- Hangzhou Jiuchuang Household Appliances Co.

- Midea

- Haier Inc.

- Gree Electric Appliances, Inc.

- Zwilling J.A. Henckels

- WMF

- Le Creuset

- LocknLock Co.

- Guangdong Galanz Enterprises Co., Ltd.

Recent Developments

-

In July 2025, YD Hardware launched a new line of durable and innovative kitchen products designed to enhance functionality and user experience in both residential and commercial settings. The collection emphasizes robust construction, modern design, and practicality, addressing the growing consumer demand for long-lasting, user-friendly kitchen tools.

-

In April 2025, Jiangmen Lingsheng Kitchenware showcased its latest range of stainless steel kitchen products at the 135th Canton Fair, emphasizing durability, innovation, and user-friendly design. The company introduced upgraded sink systems and advanced cookware, aiming to strengthen its domestic and international market presence.

-

In December 2024, Qianzan Kitchenware unveiled a new line featuring advanced cookware, eco-friendly bakeware, innovative utensils, premium pepper grinders, and state-of-the-art coffee machines. The offering underscores a commitment to quality and sustainability through fresh materials and ergonomic design.

China Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,080.7 million

Revenue forecast in 2033

USD 11,599.6 million

Growth rate

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

China

Key companies profiled

Groupe SEB; Hangzhou Jiuchuang Household Appliances Co.; Midea; Haier Inc.; Gree Electric Appliances, Inc.; Zwilling J.A. Henckels; WMF; Le Creuset; LocknLock Co.; Guangdong Galanz Enterprises Co., Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Kitchenware Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the China kitchenware market report by product, application, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microware Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The China kitchenware market was estimated at USD 6,680.5 million in 2024 and is expected to reach USD 7,080.7 million in 2025.

b. The China kitchenware market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach USD 11,599.6 million by 2033.

b. Tableware accounted for the revenue share of about 55.03% of the China kitchenware market in 2024. In China, the popularity of tableware is strongly influenced by cultural traditions that emphasize communal dining and the aesthetic presentation of food.

b. Some of the key players in the China kitchenware market is Groupe SEB; Hangzhou Jiuchuang Household Appliances Co.; Midea; Haier Inc.; Gree Electric Appliances, Inc.; Zwilling J.A. Henckels; WMF; Le Creuset; LocknLock India; Guangdong Galanz Enterprises Co., Ltd.

b. The kitchenware market in China is being driven by rapid urbanization, rising disposable incomes, culinary heritage and innovation, and a growing preference for modern, functional kitchens.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.