- Home

- »

- Next Generation Technologies

- »

-

Commercial Security System Market Size Report, 2033GVR Report cover

![Commercial Security System Market Size, Share & Trends Report]()

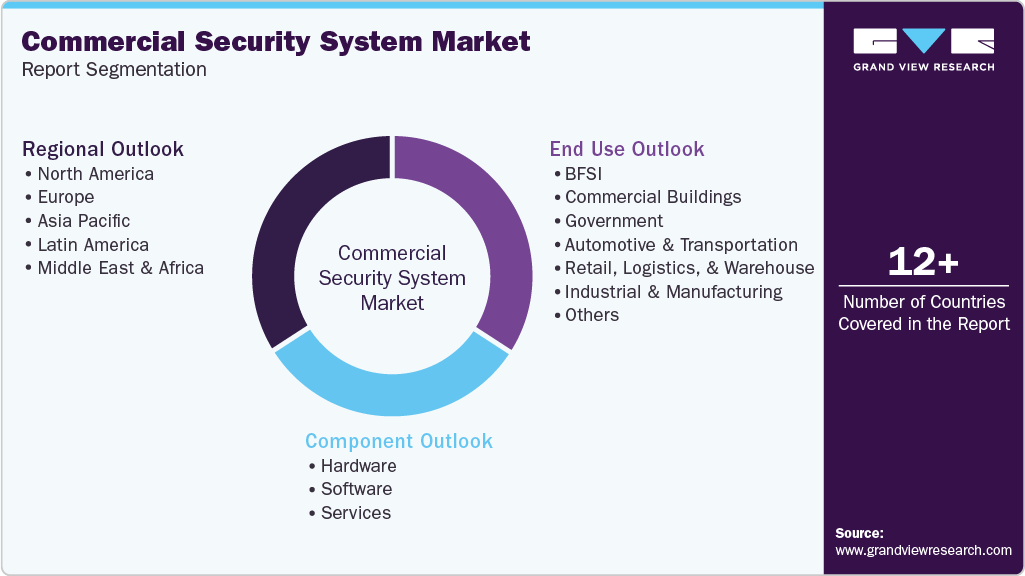

Commercial Security System Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End Use (BFSI, Commercial Buildings, Government, Automotive & Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-628-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Security System Market Summary

The global commercial security system market size was estimated at USD 202.23 billion in 2024 and is projected to reach USD 540.47 billion by 2033, growing at a CAGR of 11.8% from 2025 to 2033. This growth is driven by the rising need for real-time surveillance, access control, and threat detection across commercial facilities to ensure safety and regulatory compliance.

Key Market Trends & Insights

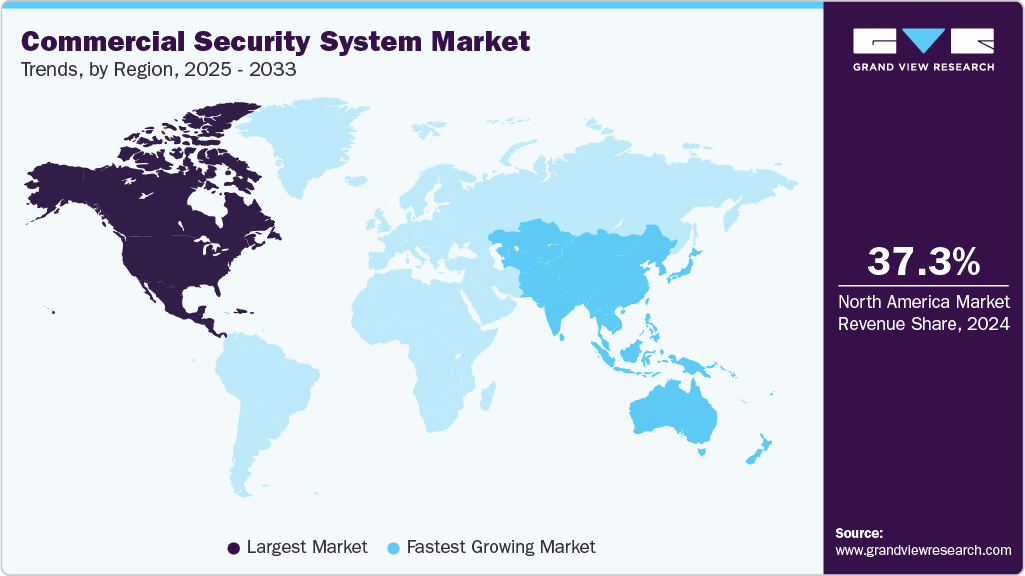

- North America dominated the global commercial security system market with the largest revenue share of 37.3% in 2024.

- The commercial security system market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the hardware segment held the highest market share of 57.2% in 2024.

- By end use, the commercial buildings segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 202.23 Billion

- 2033 Projected Market Size: USD 540.47 Billion

- CAGR (2025-2033): 11.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

The current state of the global commercial security system industry reflects increasing concerns over safety and asset protection across various industries. Growing urbanization and expanding commercial infrastructure increase the demand for integrated security solutions. Technological advancements such as AI-powered surveillance, IoT-enabled devices, and cloud-based management platforms enhance the effectiveness and accessibility of security systems. In addition, rising awareness about workplace safety and the need to mitigate risks related to theft, vandalism, and unauthorized access support the widespread adoption of these systems.

Moreover, the market is influenced by ongoing developments in smart security technologies that improve real-time monitoring and threat detection capabilities. Integrating biometric authentication, video analytics, and automated response mechanisms enhances operational efficiency and reduces human intervention. Increasing emphasis on cybersecurity and physical security drives the adoption of unified platforms that protect digital and physical assets. Furthermore, expanding commercial sectors such as retail, healthcare, and logistics generate demand for customized security solutions tailored to specific operational requirements.

Furthermore, regulatory frameworks encouraging stringent security measures and data privacy standards across regions contribute to market growth. Investments in smart city initiatives and complex infrastructure protection create additional avenues for deploying advanced commercial security systems. The continuous evolution of security technologies and rising security awareness among businesses support sustained market expansion. This dynamic environment encourages innovation and adoption of comprehensive security strategies that address emerging threats and operational challenges.

Component Insights

The hardware segment led the market with the largest revenue share of 57.2% in 2024, due to its foundational role in establishing physical security infrastructure. Components such as surveillance cameras, sensors, fire protection devices, and access control hardware form the backbone of security solutions, enabling real-time detection and response to threats. The widespread deployment of these devices across commercial facilities reflects ongoing investments in upgrading and expanding security coverage. In addition, advancements in hardware technology, including high-resolution imaging and sensor accuracy, enhance the effectiveness of security operations.

The software segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing demand for intelligent security management and analytics capabilities. AI-powered video analytics, facial recognition, and cloud-based video management systems enable enhanced threat detection, behavior analysis, and remote monitoring. The shift toward software-defined security solutions supports scalability and integration across multiple devices and locations, improving operational efficiency. Furthermore, the rising adoption of cybersecurity measures within physical security frameworks increases reliance on software platforms to comprehensively manage access control, incident response, and data security.

End Use Insights

The commercial buildings segment accounted for the largest market revenue share in 2024 as they require comprehensive security systems to protect employees, assets, and sensitive information. Offices, retail spaces, and hospitality establishments implement integrated solutions combining video surveillance, access control, and fire protection to mitigate risks such as theft, unauthorized access, and workplace violence. The complexity and scale of commercial properties necessitate tailored security architectures that support multi-tenant environments and diverse operational needs, driving substantial investment in these systems.

The automotive & transportation segment is anticipated to grow at the fastest CAGR during the forecast period due to increasing security requirements for vehicles, logistics hubs, and transit infrastructure. Rising concerns over cargo theft, vehicle hijacking, and passenger safety prompt the adoption of advanced security technologies, including biometric access, GPS tracking, and AI-enabled surveillance. Integrating security systems with fleet management and traffic control platforms enhances real-time monitoring and incident response. In addition, the growth of connected and autonomous vehicles contributes to this sector's demand for security solutions.

Regional Insights

North America dominated the commercial security system market with the largest revenue share of 37.3% in 2024. This can be attributed to the widespread adoption of advanced security technologies. The region’s infrastructure emphasizes integrating AI, IoT, and cloud-based solutions, enabling real-time monitoring, predictive analytics, and enhanced threat detection capabilities. In addition, heightened concerns over workplace safety and asset protection across diverse sectors drive continuous investments in comprehensive security systems. The focus on innovation to strengthen cybersecurity and physical security sustains the market’s position.

U.S. Commercial Security System Market Trends

The commercial security system market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by increasing demand for integrated, intelligent security solutions that tackle evolving safety challenges. Businesses prioritize systems that combine video surveillance, access control, and emergency notification to protect personnel, assets, and sensitive information. Incorporating health and safety features, such as touchless entry and thermal screening, exemplifies a broader approach to workplace security. Furthermore, cloud-based platforms provide scalability and remote management, accommodating the needs of various commercial environments and enhancing operational efficiency.

Europe Commercial Security System Market Trends

The commercial security system market in Europe is projected to experience at a significant CAGR during the forecast period, fueled by rising concerns about cyber threats, terrorism, and geopolitical tensions, which are prompting substantial investments in physical and digital security infrastructures. The expansion of smart city initiatives and complex infrastructure modernization drives demand for surveillance, access management, and cybersecurity solutions. Regulatory measures emphasizing data protection and compliance further encourage the adoption of integrated security systems. The convergence of AI and IoT technologies improves real-time threat detection and response capabilities, reinforcing the market’s development across the public and private sectors.

Asia Pacific Commercial Security System Market Trends

The commercial security system market in the Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period, due to accelerated urbanization, industrialization, and rising security awareness across commercial sectors. Increasing investments in infrastructure development and initiatives to improve public safety contribute to the widespread deployment of advanced security systems. The region’s growing commercial real estate and retail sectors demand comprehensive surveillance and access control solutions tailored to diverse environments. Technological advancements and rising disposable incomes also support adopting intelligent security platforms that combine physical protection with cybersecurity measures.

Key Commercial Security System Company Insights

Some key companies in the commercial security system industry are ASSA ABLOY, Honeywell International Inc., Johnson Controls, and Robert Bosch GmbH.

-

ASSA ABLOY focuses on providing comprehensive access solutions for commercial environments. Their offerings encompass various products, including mechanical and electromechanical locks, cylinders, security doors, and automated entrances. They integrate advanced technologies such as biometrics, mobile access, and cloud-based platforms to create secure and convenient physical and digital access solutions, serving various sectors such as offices, hotels, and government facilities.

-

Honeywell International Inc. delivers integrated security solutions for commercial buildings as part of its building technologies segment. Their portfolio includes advanced access control systems, video surveillance, intrusion detection, and fire protection systems. They leverage software, AI, and IoT to provide real-time monitoring, predictive analytics, and automation capabilities, helping businesses enhance safety, optimize operations, and manage security risks across diverse commercial, industrial, and institutional settings.

Key Commercial Security System Companies:

The following are the leading companies in the commercial security system market. These companies collectively hold the largest market share and dictate industry trends.

- ASSA ABLOY

- Axis Communications AB.

- dormakaba Group

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls

- Robert Bosch GmbH

- SECOM CO., LTD.

- Securitas AB

Recent Developments

-

In April 2025, Security 101, a commercial security solutions provider, announced the acquisition of Integrated Systems & Services, Inc. (ISSI), a New Jersey-based security integration firm recognized for its extensive experience in the Northeast region and expertise in high-security environments. This acquisition enhances Security 101’s service capabilities and expands its footprint in infrastructure and specialized security markets.

-

In March 2025, Johnson Controls announced significant upgrades to its Access Control and Video Surveillance (ACVS) systems. These enhancements are designed to seamlessly integrate with existing security infrastructures, thereby strengthening the management of security operations for people, buildings, and assets. The upgraded solutions aim to elevate customers’ security capabilities by delivering greater operational agility, improved threat detection, and enhanced cost-efficiency, ultimately advancing the overall security posture of facilities across various sectors.

-

In March 2025, Guardian Protection expanded its commercial and residential security portfolio by acquiring 8,300 commercial accounts and 4,300 residential alarm accounts from Monitronics, known in the residential market as Brinks Home. This acquisition significantly broadens Guardian Protection’s customer base and strengthens its presence in both sectors. The deal enhances the company’s capacity to deliver integrated security solutions, leveraging its advanced monitoring technologies and service capabilities to meet growing demand for comprehensive security systems amid increasing concerns over property safety and asset protection.

Commercial Security System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 221.94 billion

Revenue forecast in 2033

USD 540.47 billion

Growth rate

CAGR of 11.8% from 2025 to 2033

Base year for estimated

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ASSA ABLOY; Axis Communications AB.; dormakaba Group; Genetec Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; Johnson Controls; Robert Bosch GmbH; SECOM CO., LTD.; Securitas AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Security System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global commercial security system market report based on component, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Fire Protection System

-

Fire Detection

-

Fire Suppression

-

Fire Sprinkler Systems

-

Fire Response Systems

-

-

Video Surveillance Systems

-

Camera

-

Monitor

-

Storage Device

-

Digital Video Recorders

-

Network Video Recorders

-

Hybrid Video Recorders

-

Storage Area Networks

-

Direct-Attached Storage Devices

-

Network-Attached Storage Devices

-

-

-

Access Control System

-

Magnetic Stripe Cards and Readers

-

Proximity Cards and Readers

-

Smart Cards and Readers

-

Multi-Technology Readers

-

Electronic Locks

-

Controllers

-

Others

-

-

Biometric System

-

Fingerprint Recognition

-

Palm Recognition

-

Iris Recognition

-

Facial Recognition

-

Voice Recognition

-

-

Building Management System

-

RFID Tags & Readers

-

-

Software

-

Fire Protection System Software

-

Video Surveillance Software

-

Video Analytics

-

Video Management System

-

-

Biometric System Software

-

Access Control Software

-

Building Management Software

-

RFID Software

-

-

Services

-

Fire Protection Services

-

Video Surveillance Services

-

Access Control Services

-

Building Management Services

-

RFID Services

-

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Commercial Buildings

-

Government

-

Automotive & Transportation

-

Retail, Logistics, & Warehouse

-

Industrial & Manufacturing

-

Energy & Utility

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial security system market size was estimated at USD 202.23 billion in 2024 and is expected to reach USD 221.94 billion in 2025.

b. The global commercial security system market is expected to grow at a compound annual growth rate of 11.8% from 2025 to 2033, reaching USD 540.47 billion by 2033.

b. North America dominated the commercial security system market with a share of 37.3% in 2024. This can be attributed to heightened concerns over property crimes, rapid adoption of advanced surveillance technologies, and strong regulatory frameworks promoting security infrastructure investments.

b. Some key players in the commercial security system market include ASSA ABLOY; Axis Communications AB.; dormakaba Group; Genetec Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; Johnson Controls; Robert Bosch GmbH; SECOM CO., LTD.; Securitas AB

b. Key factors that are driving the market growth include increasing concerns over theft and unauthorized access, rising adoption of cloud-based surveillance solutions, and growing integration of AI and IoT in commercial security systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.