- Home

- »

- Next Generation Technologies

- »

-

Computer Vision Hardware Market Size, Share, Report, 2033GVR Report cover

![Computer Vision Hardware Market Size, Share & Trends Report]()

Computer Vision Hardware Market (2025 - 2033) Size, Share & Trends Analysis Report By Processor (Graphics Processing Units, Central Processing Units), By Imaging Device, By Sensor, By Memory & Storage Units, By Networking Module, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-743-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Computer Vision Hardware Market Summary

The global computer vision hardware market size was valued at USD 14.21 billion in 2024 and is projected to reach USD 71.11 billion by 2033, growing at a CAGR of 19.7% from 2025 to 2033. This growth is driven by the proliferation of AI & deep learning, the expansion of Industry 4.0 & Automation, and the surge in autonomous vehicles & ADAS.

Key Market Trends & Insights

- Asia Pacific dominated the global computer vision hardware market with the largest revenue share of 37.1% in 2024.

- The computer vision hardware market in the U.S. led the North America market and held the largest revenue share in 2024.

- By processor, Graphics Processing Units (GPUs) led the market, holding the largest revenue share of 30.2% in 2024.

- By imaging device, 3D cameras & stereo vision cameras held the dominant position in the market.

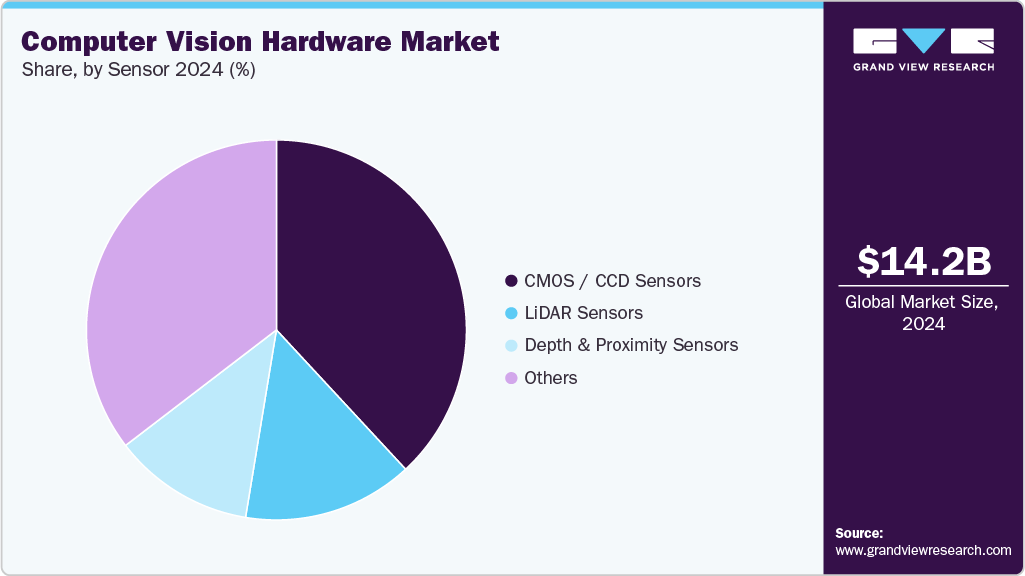

- By sensor, CMOS / CCD Sensors held the dominant position in the market.

- By memory & storage units, the high-speed DRAM segment held the dominant position in the market.

- By networking module, the wired segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 14.21 Billion

- 2033 Projected Market Size: USD 71.11 Billion

- CAGR (2025-2033): 19.7%

- Asia Pacific: Largest market in 2024

The industry is primarily driven by the accelerating adoption of artificial intelligence and deep learning technologies. Increasing demand for real-time image recognition, object detection, and advanced analytics has created strong requirements for specialized processors such as GPUs, VPUs, FPGAs, and ASICs. These hardware accelerators provide low-latency, high-speed performance essential for numerous applications across manufacturing, automotive, healthcare, and retail sectors. Industry 4.0 initiatives are further fueling investments in smart automation, robotics, and predictive maintenance systems. Enterprises are increasingly deploying hardware driven vision solutions to enhance productivity, reduce operational errors, and improve overall efficiency within industrial workflows.The surge in adoption of autonomous vehicles, Advanced Driver-Assistance Systems (ADAS), and intelligent transportation infrastructure is also driving the growth of the computer vision hardware market. Automotive manufacturers are increasingly investing in vision-enabled hardware for enhanced safety, navigation, and traffic monitoring solutions. Moreover, the healthcare industry is expanding the use of vision-powered medical imaging, diagnostic systems, and robotic surgeries, pushing demand for high-accuracy, low-power hardware devices. Retail and security markets are also leveraging smart cameras and edge vision solutions for surveillance, inventory tracking, and customer behavior analytics. Governments worldwide are implementing smart city projects, and computer vision hardware forms a crucial backbone for security, monitoring, and regulatory compliance.

Additionally, the proliferation of edge computing, Internet of Things (IoT), and mobile vision applications is shaping market momentum. Companies are deploying compact, power-efficient processors at the edge to enable real-time decision-making without reliance on cloud networks. This trend is supported by substantial investments from semiconductor companies, startups, and research institutions, resulting in accelerated innovation pipelines. Strategic collaborations between technology providers and industry verticals are fostering adoption at scale. Furthermore, government initiatives promoting digital infrastructure, industrial automation, and AI-powered safety standards are reinforcing growth. Collectively, these factors are driving the growth of the computer vision hardware market.

Processor Insights

The Graphics Processing Units (GPUs) segment led the market in 2024, accounting for over 30% of global revenue, primarily due to the increasing demand for high-performance computing and real-time data processing capabilities. GPUs enable parallel processing, which is critical for computer vision tasks such as image recognition, object detection, and 3D modeling. Growing adoption of artificial intelligence (AI) and deep learning algorithms in various industries such as automotive, healthcare, robotics, and surveillance further fuels GPU demand. Additionally, advancements in GPU architecture, energy efficiency, and integration with edge computing devices enhance processing speed and accuracy. The surge in demand for autonomous systems, smart devices, and AI-enabled analytics continues to act as a significant growth catalyst for this segment.

The Application-Specific Integrated Circuits (ASICs) / Vision Processing Units (VPUs) segment is predicted to experience the fastest growth in the forecast years, driven by the increasing demand for high-performance, energy-efficient processing in AI and edge devices. ASICs and VPUs offer customized, low-power solutions optimized for computer vision workloads, enabling real-time image and video analysis in various sectors such as autonomous vehicles, robotics, and smart surveillance. Growing adoption of AI-driven applications, including facial recognition, object detection, and augmented reality, further fuels market growth. Additionally, rising investments in edge computing and demand for miniaturized, low-latency devices encourage manufacturers to deploy ASICs and VPUs. The combination of enhanced processing speed, reduced power consumption, and scalability positions this segment as a key enabler of next-generation computer vision solutions.

Imaging Device Insights

The 3D cameras & stereo vision cameras segment accounted for the largest market revenue share in 2024, fueled by several factors such as industrial automation and robotics increasingly relying on 3D cameras for precise quality control, assembly, and robotic guidance across industries such as automotive, electronics, and packaging. Advances in AI and deep learning enhance stereo vision systems, enabling real-time object recognition and inspection in complex environments. Consumer electronics and AR/VR applications benefit from stereo cameras for accurate depth perception, improving gaming, simulation, and medical imaging experiences. Additionally, autonomous vehicles and robotics leverage stereo vision for navigation and obstacle detection, collectively boosting demand and innovation in the computer vision hardware sector.

The 2D segment is expected to grow significantly during the forecast period. The 2D cameras segment is a fundamental driver in the computer vision hardware market due to its wide applicability, cost efficiency, and maturity compared to advanced imaging technologies. These cameras are extensively used in quality inspection, barcode reading, object detection, and assembly verification across industries such as manufacturing, logistics, retail, and healthcare. Their affordability and compatibility with existing vision systems make them a preferred choice for high-volume production environments. Growing adoption in e-commerce warehouses for automated scanning and tracking, as well as in smart retail for inventory management, further supports demand. Additionally, continuous improvements in resolution, processing speed, and integration with AI enhance their role in enabling efficient, real-time visual analysis.

Memory & Storage Units Insights

The high-speed DRAM segment accounted for the largest market revenue share in 2024. The high-speed DRAM segment plays an essential role in the computer vision hardware market by enabling fast data processing and memory access essential for real-time image and video analysis. As computer vision applications in autonomous vehicles, robotics, industrial automation, and healthcare demand higher frame rates and lower latency, the need for high-speed DRAM intensifies. The growing deployment of AI-powered vision systems requires large memory bandwidth to efficiently handle massive datasets and deep learning workloads. Additionally, the surge in edge computing accelerates adoption, as devices must locally process visual data with high efficiency. Advancements in DRAM technology, including GDDR6 and HBM, further fuel adoption by supporting energy-efficient, high-performance vision hardware.

The graphics memory segment is expected to grow at the highest CAGR during the forecast period, primarily driven by the rising demand for high-performance computing and real-time image processing across industries such as automotive, healthcare, consumer electronics, and industrial automation. Graphics memory, particularly GDDR and HBM, plays a critical role in enabling fast data transfer, high bandwidth, and low latency, which are essential for advanced vision tasks like object recognition, 3D reconstruction, and AI-driven analytics. The proliferation of autonomous vehicles, augmented/virtual reality applications, and edge AI devices further fuels demand, as these technologies require robust memory solutions for handling large datasets and complex algorithms. Additionally, advancements in GPU architectures and increasing adoption of cloud-based vision solutions are accelerating growth in this segment.

Networking Module Insights

The wired segment accounted for the largest market revenue share in 2024, primarily due to the increasing need for high-speed, reliable, and low-latency data transmission in applications such as industrial automation, smart manufacturing, and intelligent transportation systems. Ethernet-based connectivity is widely adopted in machine vision systems for real-time data transfer between cameras, processors, and storage devices, ensuring seamless integration in Industry 4.0 environments. Additionally, the rising demand for high-resolution imaging and multi-camera setups fuels the need for robust wired networking solutions that can handle large data volumes. Growing adoption in healthcare imaging, surveillance, and automotive ADAS systems further accelerates the market growth for wired connectivity modules.

The wireless segment is anticipated to grow at the highest CAGR during the forecasted period. The Wireless Networking & Connectivity Module segment plays a crucial role in the computer vision hardware market by enabling seamless data transfer, real-time image processing, and device interoperability across diverse applications. Growing demand for connected devices in industries such as automotive, healthcare, manufacturing, and smart cities is driving adoption of advanced wireless technologies such as, Wi-Fi 6, 5G, and Bluetooth Low Energy (BLE). These modules support low-latency, high-bandwidth communication essential for autonomous vehicles, robotics, and IoT-enabled surveillance systems. Additionally, the rising integration of AI-powered vision solutions in edge devices accelerates the need for efficient connectivity, enhancing scalability, remote monitoring, and operational efficiency, thereby boosting market growth for wireless networking and connectivity modules.

Sensor Insights

The CMOS / CCD sensors segment accounted for the largest market revenue share in 2024, supported by their pivotal role in delivering high-quality image capture across diverse applications. CMOS sensors are increasingly preferred for their low power consumption, faster processing speeds, and cost-effectiveness, making them suitable for smartphones, consumer electronics, and automotive vision systems. Meanwhile, CCD sensors remain vital in areas demanding superior image clarity and low-light performance, such as medical imaging, industrial inspection, and scientific research. Growing adoption of automation, machine vision, and AI-driven imaging solutions further accelerates demand for these sensors, as industries require precise, reliable, and scalable imaging technologies to enhance efficiency and decision-making.

The LiDAR sensors segment is expected to grow at the highest CAGR during the forecast period, driven by rising demand for high-precision 3D mapping, depth sensing, and object detection. In the automotive sector, increasing adoption of LiDAR in advanced driver-assistance systems (ADAS) and autonomous vehicles is a key driver, as it enables accurate perception in complex environments. Additionally, industries such as robotics, industrial automation, construction, and agriculture are leveraging LiDAR for navigation, obstacle detection, and real-time spatial analysis. The expanding use in smart cities, drones, and augmented reality applications further accelerates adoption. Continuous advancements in miniaturization, cost reduction, and sensor integration strengthen the segment’s role in enhancing computer vision capabilities across diverse applications.

Regional Insights

North America computer vision hardware industry held a revenue share of over 30% in 2024 primarily driven by rapid advancements in artificial intelligence (AI), machine learning (ML), and edge computing technologies, which enhance the accuracy and speed of vision-based systems. Strong adoption in industries such as automotive (for ADAS and autonomous vehicles), healthcare (for diagnostics and medical imaging), manufacturing (for automation and quality inspection), and retail (for customer analytics and surveillance) further fuels growth. Additionally, rising demand for smart city infrastructure, robotics, and security systems, supported by favorable government initiatives and digital transformation strategies, strongly contributes to market expansion.

U.S. Computer Vision Hardware Market Trends

The computer vision hardware industry in the U.S. is expected to grow significantly. Key growth drivers include robust investment in R&D and domestic semiconductor manufacturing, bolstered by the CHIPS Act’s multi-billion-dollar support for advanced hardware innovation. Industrial automation in manufacturing, automotive, and quality inspection fuels demand for PC-based systems, smart cameras, and advanced image sensors. The rise of edge computing and AI integration promotes localized, real-time visual processing, enhancing performance and privacy.

Asia Pacific Computer Vision Hardware Market Trends

The computer vision hardware industry in the Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. The Asia-Pacific market is propelled by the region’s robust manufacturing ecosystem and rapid industrial automation, which demand high-speed smart cameras, sensors, and 3D vision systems. Cost-effective components, skilled labor, and government initiatives such as China’s “Made in China 2025”, India’s Digital India and Make in India, and Japan’s Society 5.0 boost local hardware production and adoption. Expanding applications across cashier-less stores in retail, drone-based crop monitoring in agriculture, smart cities, surveillance, and ADAS further stimulate demand. Additionally, China’s increased investments in vision technologies for smart infrastructure and EVs reinforce market growth.

Europe Computer Vision Hardware Market Trends

The computer vision hardware market in Europe is expected to grow significantly over the forecast period. Strong industrial and automotive automation in Germany and the U.K. propels demand for hardware such as smart cameras, imaging sensors, and AI chips for quality inspection, predictive maintenance, and autonomous driving. Public and private investment in high-performance computing (HPC) and AI infrastructure from EU initiatives such as EuroHPC and InvestAI are boosting compute capacity for vision workloads. Rising edge computing adoption and improved hardware affordability enable real-time analytics at the device level, essential for surveillance, healthcare, and smart manufacturing. Strong regulatory and funding ecosystem, favoring AI and digital innovation, including GDPR compliance and EU research programs, also supports hardware deployment.

Key Computer Vision Hardware Company Insights

Key players operating in the computer vision hardware market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Computer Vision Hardware Companies:

The following are the leading companies in the computer vision hardware market. These companies collectively hold the largest market share and dictate industry trends.

- Cognex Corporation

- KEYENCE CORPORATION

- Intel Corporation

- NVIDIA Corporation

- Ambarella International LP

- Basler AG

- Sony Semiconductor Solutions Corporation

- Teledyne Vision Solutions

- ViTrox Corporation

- Zivid

Recent Developments

-

In August 2025, EssilorLuxottica, an eyewear and optical products provider, acquired Automation & Robotics, a designer and manufacturer of automated systems used for optical lens quality control, serving both large-scale production facilities and prescription laboratories. The company applies proprietary technologies in optical metrology to support lens manufacturers in implementing digital processes in the production workflows.

-

In June 2025, Snap Inc., a technology and social media company, announced to launch of a standalone, AI-powered ‘Specs’, smart glasses that operate without a smartphone tether. Packing proprietary visual AI plus integrations with OpenAI, Google Gemini, and DeepSeek, this new product is a major push into computer-vision-enabled wearables.

-

In September 2024, EssilorLuxottica, eyewear and optical products provider, extended its partnership with Meta through a new long-term agreement to continue collaboration into the next decade on the development of multi-generational smart eyewear. The two companies collaborated earlier and introduced two generations of Ray-Ban-branded smart glasses, which introduced wearable devices into the consumer market.

Computer Vision Hardware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.88 billion

Revenue forecast in 2033

USD 71.11 billion

Growth rate

CAGR of 19.7% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Processor, imaging device, sensor, memory & storage units, networking module, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Cognex Corporation; KEYENCE CORPORATION; Intel Corporation; NVIDIA Corporation; Ambarella International LP; Basler AG; Sony Semiconductor Solutions Corporation; Teledyne Vision Solutions; ViTrox Corporation; Zivid

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer Vision Hardware Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global computer vision hardware market report based on processor, imaging device, sensor, memory & storage units, networking module, and region:

-

Processor Outlook (Revenue, USD Million, 2021 - 2033)

-

Graphics Processing Units (GPUs)

-

Central Processing Units (CPUs)

-

Field-Programmable Gate Arrays (FPGAs)

-

Application-Specific Integrated Circuits (ASICs)/ VPUs (Vision Processing Units)

-

Others

-

-

Imaging Device Outlook (Revenue, USD Million, 2021 - 2033)

-

2D Cameras

-

3D Cameras & Stereo Vision

-

Infrared / Thermal Cameras

-

Others

-

-

Sensor Outlook (Revenue, USD Million, 2021 - 2033)

-

CMOS / CCD Sensors

-

LiDAR Sensors

-

Depth & Proximity Sensors

-

Others

-

-

Memory & Storage Units Outlook (Revenue, USD Million, 2021 - 2033)

-

High-speed DRAM

-

Flash and SSD storage

-

Graphics Memory

-

Others

-

-

Networking Module Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global computer vision hardware market size was estimated at USD 14.21 billion in 2024 and is expected to reach USD 16.88 billion in 2025.

b. The global computer vision hardware market is expected to grow at a compound annual growth rate of 19.7% from 2025 to 2033 to reach USD 71.11 billion by 2033.

b. North America dominated the computer vision hardware market with a share of 30.1% in 2024. This is attributable to the rising demand for smart city infrastructure, robotics, and security systems, supported by favorable government initiatives and digital transformation strategies.

b. Some key players operating in the computer vision hardware market include Cognex Corporation; KEYENCE CORPORATION; Intel Corporation; NVIDIA Corporation; Ambarella International LP; Basler AG ; Sony Semiconductor Solutions Corporation; Teledyne Vision Solutions; ViTrox Corporation ; and Zivid.

b. Key factors that are driving the computer vision hardware market growth include the proliferation of AI & deep learning, expansion of industry 4.0 & Automation, surge in autonomous vehicles & ADAS.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.