- Home

- »

- Next Generation Technologies

- »

-

Computer Vision Market Size, Share & Growth Report, 2030GVR Report cover

![Computer Vision Market Size, Share & Trends Report]()

Computer Vision Market Size, Share & Trends Analysis Report By Component, By Product Type, By Application, By Vertical (Automotive, Healthcare, Retail), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-035-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Computer Vision Market Size & Trends

The global computer vision market size was valued at USD 14.10 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.6% from 2023 to 2030. Artificial intelligence (AI) in computer vision technology is becoming increasingly popular in different use cases, such as computer vision solutions in consumer drones and autonomous & semi-autonomous vehicles. Also, the recent advancements in computer vision comprising image sensors, advanced cameras, and deep learning techniques have widened the scope for computer vision systems in various industries, including education, healthcare, robotics, consumer electronics, retail, manufacturing, and security & surveillance, among others.

For instance, in August 2022, TachyHealth, Inc, a Dubai-based artificial intelligence solution provider for medical centers and hospitals, collaborated with Medical Refill, which provides remote medical consultation for their patients. The collaboration aims to provide technology solutions such as computer vision, artificial intelligence, and big data analytics to the clinical team. Further, it would help them quickly transform the complex laboratory results from PDF or image format to a text format that would improve patient engagement and make it more interactive in their treatment journey.

Computer vision systems improve the security of high-value assets by implementing biometric scanning and facial recognition systems. The most popular use-case of facial recognition is smartphone security, as computer vision systems can recognize different patterns in the retinas and irises of humans. Besides, more advanced use cases of facial recognition are businesses or residential security systems that use individuals' physiological features for identity verification.

Fingerprint analysis also controls access to high-security areas, such as bank vaults and research labs. For instance, in July 2022, IDEMIA, a multinational technology company that offers facial recognition and other computer vision software & products to government and private companies, partnered with the U.S. Department of Homeland Security which takes care of public security in the U.S. The partnership is expected to improve U.S. Department of Homeland Security activities such as identifying suspects during criminal investigations & travelers at the airports and streamlining security at the checkpoints after deploying facial recognition tools.

The automotive industry is witnessing a paradigm shift from human-driven or conventional vehicles to AI-powered or self-driving cars. The application of computer vision systems in self-driving cars is expected to boost the growth of the computer vision market, owing to the need for decision-making ability. Self-driving vehicles are equipped with ultrasonic and LiDAR sensors to identify signposts, other cars, and obstacles. Also, these vehicles are equipped with cameras providing computer vision to read road signs, compute steering angles, and make critical on-road decisions, such as giving way to fire engines or ambulances.

For instance, in May 2021, Aventior, Inc., a technology service provider, stated in its article that computer vision technology is making self-driving cars safe for passengers. The facial recognition tool, which is used with sensor technology, would quickly help identify cars, people, and other objects on the road. Further, computer vision technology would help self-driving vehicles become more intelligent and reliable. It helps to create a 3D map by capturing real-time images, quickly identifying low light conditions with the help of their algorithms and can also easily recognize objects using HDR and LIDAR sensors.

The manufacturing industry is experiencing the most extensive use of automation and robotics. As manufacturing facilities are transitioning towards fully automated manufacturing, the requirement for more intelligent systems to monitor industrial processes and outcomes is increasing. While the IoT (Internet of Things) is revolutionizing the manufacturing sector and making industrial operations more autonomous, computer vision is further assisting in improving them in the form of machine vision.

For instance, in March 2021, Amazon Web Services, Inc., a provider of cloud computing platforms, launched "Amazon Lookout," a vision service for inspecting products in manufacturing. By reducing obstacles in designing, fine-tuning computer vision models, training, monitoring, and deploying, Amazon Lookout aims to make it accessible to many more manufacturing units. Further, it would help its clients to deploy computer vision into its operating systems within their facilities.

COVID-19 Impact Insights

As the novel coronavirus (COVID-19) has spread worldwide, companies of all sizes and across all industry verticals are experiencing difficulties keeping their resources safe and productive during the pandemic. However, this pandemic has brought several opportunities for computer vision systems to combat the epidemic. Several tech startups and giants are working to prevent, mitigate, and contain the virus. For instance, in August 2022, Detect Technologies., an industrial Artificial intelligence-based company that builds cutting-edge technology, partnered with Vedanta Limited, a mining company with primary operations in gold, aluminum, and iron ore. The partnership aims to deploy T-pulse, an AI-based workplace software by Detect Technologies. The T-pulse software's COVID-19 compliance module would help Vedanta Limited's workspaces meet all the necessities required and maintain the highest sanitization standards. Further, the computer vision solutions of T-Pulse would enhance the digital safety monitoring units.

For instance, in February 2021, Devmio, a professional training platform provider, stated that computer vision technology helped Taiwan, which was close to the virus hub during the pandemic. The infrared cameras are controlled by AI-monitored passengers in large airports and transfer the information to a robust industrial GPU device hosting the machine learning algorithms for additional processing.Computer vision also helped in the diagnosis of pneumonia caused due to COVID-19, as well as the detection of the virus.Chinese experts developed an ML-driven system that examines CT scans and clinical information about patients. An unexpected finding emerged when the researchers compared the system's performance to that of a Chinese expert. The combined model successfully identified COVID-19 infection in around 70% of patients whose CT scans were considered normal by medical professionals. Further, the above survey concluded that deep learning and computer vision machines help recognize complicated patterns invisible to human sight.

Component Insights

The hardware segment led the market in 2022, accounting for over 71% share of the global revenue. The hardware segment covers the scope of various hardware components, including processors, cameras, lenses, frame grabbers, and LED lighting. The high share is attributed to the availability of the latest hardware platforms that provide convenient component interconnection and advanced capabilities, such as fast processing, multi-mega-pixel resolution, and fully digital data handling. Also, high-performance hardware components have made the installation of vision systems easier and serve a broad scope of diverse applications by offering different networking architectures. For instance, in August 2022, VisualCortex Pty Ltd, a computer vision technology provider, partnered with i-PRO, a provider of security surveillance for public safety, to facilitate end-to-end implementation of enterprise-wide video analytics systems in the Asia Pacific region. The partnership led VisualCortex Pty Ltd i-PRO's installation of hardware components, including vehicle camera systems, video surveillance cameras, and edge devices, to enhance the standard of video streams recorded for most computer vision applications.

Besides, the software segment is expected to register the highest CAGR over the forecast period. The segment covers the scope of various software that enables the computer vision system to deliver optimal identification and inspection. The primary tasks performed by computer vision software include image classification, object detection, object tracking, and content-based image retrieval. However, many organizations lack the resources and computing power to process a vast amount of visual data, which may hamper the software market for computer vision applications. A few tech giants are working on addressing restraints for computer vision software development. For instance, in June 2022, Visionary.ai, a software provider of image signal processors (ISP), partnered with Innoviz Technologies Ltd, a manufacturer of LiDAR sensors. The partnership aims to provide a combined service of ISP software and LiDAR sensors to improve 3D computer vision's performance for various applications, including drones, robotics, and smart cities. Innovis Technologies Ltd.’s LiDAR sensor and Visionary.ai's advanced software capabilities would enhance and develop a 3D image. They also allow imaging in challenging situations, including shallow light, heavy rain or fog, extensive dynamic range, and flashing headlights.

Product Type Insights

The PC-based computer vision systems segment led the market and accounted for over 49% share of the global revenue in 2022. A PC-based vision system is generally dedicated to image processing, and it needs several peripheral devices for other tasks, such as data transfer, frame grabbing, storage, and lighting. The high share is attributed to its low cost, upgradability, and ability to be swapped to provide relative ease. For instance, in August 2020, Omron Corporation, an industrial automation solution provider, launched a new PC-based camera system. The FJ2 PC-based camera system has advanced features, with a resolution ranging from 0.4MP up to 5MP in color and monochrome visions. With the new FJ2 cameras, manufacturers can easily incorporate computer vision into their existing systems while continuing to use their PC.

Further, the smart camera-based computer vision system segment is expected to demonstrate a notable shift in its demand over the forecast period. Smart camera-based vision systems are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. This high growth is attributed to cost-effectiveness, compact dimensions, and simple integration of a smart camera-based computer vision system. Also, smart cameras are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. Open-embedded processing-based smart cameras are primarily standalone vision systems that can execute tasks with the least reliance on secondary devices. Such a streamlined system reduces the costs of the product while retaining its operational capacity. For instance, in March 2022, Cisco Systems Inc. (Cisco Meraki), an American technology company, partnered with Cogniac, an AI computer vision platform. The collaboration would offer Cisco Systems Inc.'s MV smart cameras and cloud-based platforms to deploy Cogniac's computer vision technology. Both companies would build machine learning models that use image and video data to track the activities without needing new infrastructure or AI expertise.

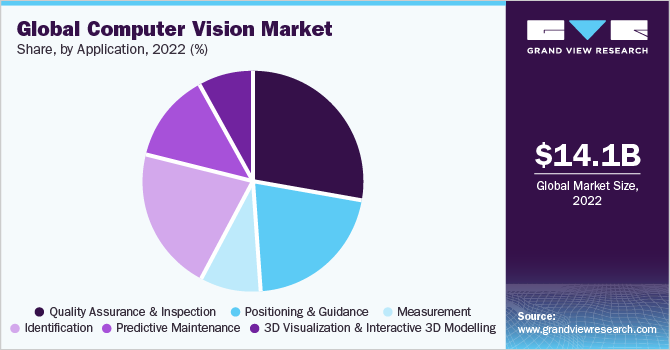

Application Insights

The quality assurance & inspection segment dominated the market and accounted for over 27% share of the global revenue in 2022. Quality assurance is an integral part of the quality management department focused on ensuring quality requirements will be fulfilled. The assurance offered by the quality management department is twofold, first on the inside to management and second to customers, regulators, government agencies, third parties, and certifiers. This high share is attributed to the rapid adoption of process automation in the manufacturing industry to boost productivity.

Computer vision, combined with deep learning algorithms, enables inspection automation for every product in the manufacturing line. For instance, in January 2022, Drishti Technologies, Inc., an AI-driven video traceability and video analytics provider leverages computer vision and deep learning to automate the analysis of manufacturing units' floor videos. Essentially, the firm has set up cameras on production lines to record videos, which are then processed using action recognition, anomaly detection, and object detection. Industrial engineers are then given access to the data to enhance the line.

The 3D visualization & interactive 3D modeling segment is anticipated to witness the fastest-growing CAGR over the forecast period. Further, predictive maintenance is also expected to show significant growth. Predictive maintenance combines machine learning algorithms with the IoT (Internet of Things) devices to monitor the machinery and related components' data. It often uses sensors for data point collection and signal identification to make accurate decisions before the breakdown of assets or components. For instance, in March 2022, Intel Corporation, a U.S.-based company offering cloud computing, data center, and IoT solutions, stated that computer vision, machine learning, and predictive analytics are transforming patient rooms and critical care environments in the healthcare industry. These solutions provide advantages such as better patient outcomes, enhanced operational effectiveness, and decreased harmful exposure for patients and medical staff.

Vertical Insights

The industrial segment dominated the market and accounted for over 49% share of the global revenue in 2022. The industrial segment includes verticals involving computer vision applications in manufacturing processes, such as automotive, pharmaceuticals, electronics & semiconductors, wood & paper, food & packaging, and machinery. This high share is attributed to the rapid adoption of computer vision systems in the automotive and transportation industry. Vision systems were introduced earlier in the automotive sector to automate assembling vehicles. However, the scope of computer vision systems in this industry has widened with the advent of automotive driver assistance and traffic management systems.

For instance, in July 2022, Michelin, a tire manufacturing company, acquired RoadBotics, Inc, a U.S.- based startup that transforms virtual infrastructure data with the help of computer vision technology. The acquisition would let Michelin DDI, a Michelin company, work with the computer vision expertise of RoadBotics, Inc. The combination of both will deliver unique insights into the factors that contribute to driving behavior. Their decisions will be simpler, quicker, and more relevant, and road safety management will be more effective. Further, it would strengthen Michelin's expertise in artificial intelligence and help scale its business in the North American region.

Further, the non-industrial vertical is expected to show significant growth over the forecast period. The non-industrial segment includes security & surveillance, agriculture, healthcare, consumer electronics, intelligent transportation systems, sports & entertainment, retail, and autonomous and semiautonomous vehicles, among different verticals involving machine vision applications. The applications of computer vision systems in non-industrial verticals include packaging inspection, barcode reading, product & component assembly, and defect reduction, among others. For instance, in March 2021, Google LLC launched a new AI-driven tool," Visual Inspection." The AI-driven tool inspects each piece of equipment in a company to ensure that all mechanical parts used by that company are of comparable value. It has also been created to quickly inspect hundreds of products, identify defects, and report them in under a minute. Besides, the healthcare vertical has rapidly adopted computer vision technology for several applications, such as monitoring patients in nursing care, facial recognition for visually impaired users, and medical image analysis, among others.

Regional Insights

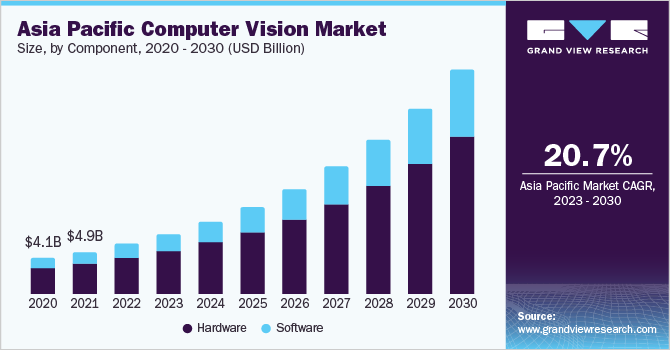

Asia Pacific dominated the market and accounted for over 40% share of global revenue in 2022. The presence of significant players such as OMRON Corporation and Sony Semiconductor Solutions Corporation is expected to boost market growth in the region. Further, the high share is attributable to the significantly increasing investments in Chinese companies and other countries in the APAC region for computer vision technology. For instance, in January 2022, Amazon Web Services, Inc., a provider of cloud computing platforms, launched its AWS Panorama, a software development kit in the Asia Pacific that improves operations with computer vision. Investing in AWS Panorama, to be available in Sydney and Singapore countries, would help businesses automate visual inspection tasks like locating bottlenecks in industrial processes, evaluating manufacturing quality, and determining worker safety within their facilities. Further, the AWS Panorama is interconnected with Amazon SageMaker, which would let the customers train their computer vision model and deploy the model in AWS Panorama.

The Middle East & Africa will likely possess lucrative market opportunities in the coming years due to increasing investment in technology and rising demand for automation and efficiency by AI-based startups. Further, North America is expected to grow significantly over the forecast period. This growth is attributable to favorable government initiatives to encourage the adoption of computer vision in the region. For instance, in May 2021, NEC Corporation of America, which develops IT infrastructure, launched NEC National Security Systems, a new NEC Corporation of America subsidiary. The new subsidiary company would provide computer vision and artificial intelligence applications, the company's biometrics, to the U.S. government.

The primary clients of NEC National Security Systems are the U.S. Department of State, the U.S. Department of Homeland Security, the U.S. Department of Justice, the U.S. Department of Defense, and the U.S. intelligence community. Besides, in March 2022, Fermatagro Technology Limited. an agritech company focusing on computer vision and data science expands its presence in the North American market. Expanding the North American Region would let the company grow in the Canadian market and scale its business. Further, the company would bring new computer vision tools and increase its profitability in the region.

Key Companies & Market Share Insights

The key players are expected to focus on advancing their product line and undertake expansion by acquiring businesses and technologies to mark a footprint in the unreached market. Companies and organizations involved in computer vision research and development, including technology giants, startups, research institutions, and academic organizations, are investing in research and development efforts, collaborating with other organizations, and launching new products or updates to existing products to stay competitive in the market and meet the evolving demands of customers and end-users.

For instance, in March 2023, Red Cat Holdings, a military technology company that integrates robotic software and hardware, partnered with Athena Artificial Intelligence Pty Ltd, a technology company specializing in AI and computer vision. The partnership aims to enhance the capabilities of Red Cat's latest military drone, the Teal 2, by integrating advanced AI and computer vision technologies developed by Athena AI. By leveraging Athena AI's expertise in AI and computer vision, Red Cat aims to augment the Teal 2's capabilities further, making it more efficient, intelligent, and capable of performing complex tasks in challenging environments.

In May 2022, Intel Corporation, a U.S.-based company offering various technology products and services, including cloud computing, data center, and IoT solutions, launched a computer vision software named "Sonoma Creek "to help developers quickly deploy artificial intelligence in their products. Sonoma Creek is designed to work with both Intel corporation and NVIDIA Corporation and also intends to support Intel's forthcoming Arc graphic cards, TensorFlow, the Pytorch, and OpenVino toolkit, the major machine learning developers.

Further, the built-in advanced features in the software make computer vision projects more approachable. Moreover, in May 2022, Encord, a computer vision platform, launched a computer vision image annotation tool, "DICOM," for the healthcare industry. The software tool would allow users to train models to automate medical imaging in 3D, including MRI, CT scan, and X-ray. Further, this tool would eliminate manual data labeling from the healthcare industry and increase accuracy and efficiency for healthcare customers. Some prominent players in the global computer vision market include:

-

Baumer

-

Cognex Corporation

-

Intel Corporation

-

KEYENCE CORPORATION

-

Matterport, Inc.

-

NATIONAL INSTRUMENTS CORP.

-

Omron Corporation

-

Sony Semiconductor Solutions Corporation

-

Teledyne Technologies Incorporated.

-

Texas Instruments Incorporated

Computer Vision Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.68 billion

Revenue forecast in 2030

USD 58.29 billion

Growth rate

CAGR of 19.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product type, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

Baumer, Cognex Corporation; Intel Corporation; KEYENCE CORPORATION; Matterport, Inc.; NATIONAL INSTRUMENTS CORP.; Omron Corporation; Sony Semiconductor Solutions Corporation; Teledyne Technologies Incorporated.; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer Vision Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global computer vision market report based on component, product type, application, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Smart Camera-Based Computer Vision System

-

PC-Based Computer Vision System

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Quality Assurance & Inspection

-

Positioning & Guidance

-

Measurement

-

Identification

-

Predictive Maintenance

-

3D Visualization & Interactive 3D Modelling

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial

-

Automotive

-

Pharmaceuticals

-

Electronics & Semiconductor

-

Food & Packaging

-

Wood and Paper

-

Printing

-

Machinery

-

Others

-

-

Non-Industrial

-

Healthcare

-

Consumer Electronics

-

Security & Surveillance

-

Retail

-

Sports and Entertainment

-

Autonomous and Semiautonomous Vehicles

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global computer vision market size was estimated at USD 14.10 billion in 2022 and is expected to reach USD 16.68 billion in 2023.

b. The global computer vision market is expected to grow at a compound annual growth rate of 19.6% from 2023 to 2030 to reach USD 58.29 billion by 2030.

b. The Asia Pacific dominated the computer vision market with a share of 40.9% in 2022. This is attributable to the significantly increasing investments in Chinese companies for computer vision technology.

b. Some key players operating in the computer vision market include Baumer, Cognex Corporation; Intel Corporation; KEYENCE CORPORATION; Matterport, Inc.; NATIONAL INSTRUMENTS CORP.; Omron Corporation; Sony Semiconductor Solutions Corporation; Teledyne Technologies Incorporated.; Texas Instruments Incorporated

b. Key factors that are driving the computer vision market growth include the rapid adoption of process automation in the manufacturing industry; a surge in demand for vision-guided robotic systems; increasing favorable government initiatives; and increasing demand for hybrid and electric cars.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."