- Home

- »

- Advanced Interior Materials

- »

-

Copper Flat Rolled Products Market, Industry Report, 2033GVR Report cover

![Copper Flat Rolled Products Market Size, Share & Trends Report]()

Copper Flat Rolled Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Copper Sheets, Copper Strips, Copper Plates), By End-use (Construction, Electrical & Electronics, Automotive, Industrial Machinery), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-614-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Flat Rolled Products Market Summary

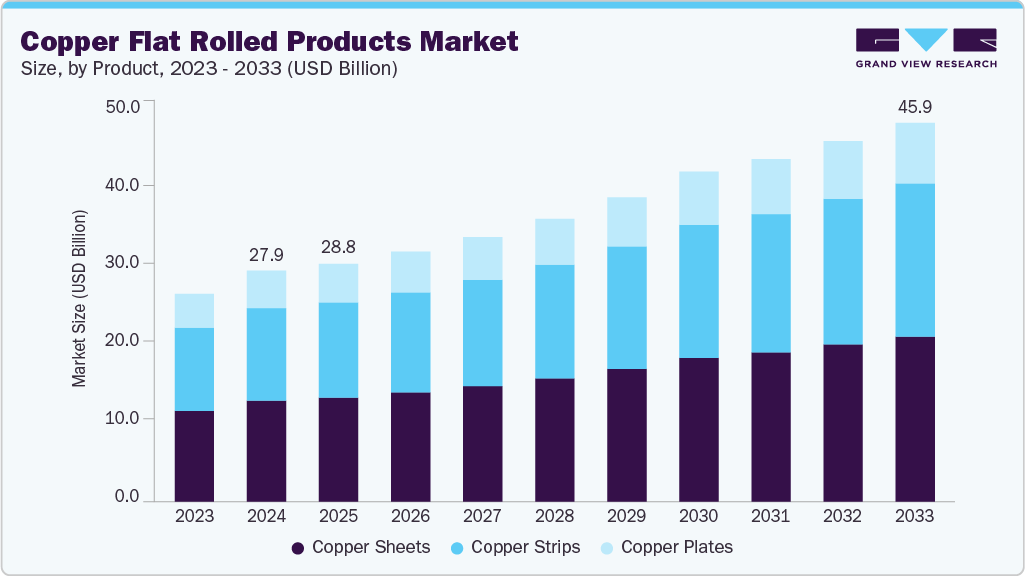

The global copper flat rolled products market size was estimated at USD 27.99 billion in 2024 and is projected to reach USD 45.90 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2033. The market is witnessing robust growth, propelled mainly by rising demand across the electrical and electronics sector, expanding infrastructure development, and the accelerating shift toward electric mobility.

Key Market Trends & Insights

- Asia Pacific dominated the copper flat rolled products market with the largest revenue share of 74.6% in 2024.

- U.S. dominated the revenue share of over 72.0% in 2024, in the North America.

- By product, the copper sheets segment dominated the market with a revenue share of over 43.0% in 2024.

- By end-use, the construction segment held the largest share of over 33.0% of copper flat rolled products revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.99 Billion

- 2033 Projected Market Size: USD 45.90 Billion

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest market in 2024

The products are preferred due to their high-performance, miniaturized, and energy-efficient components. Copper’s excellent electrical conductivity makes it an essential material for printed circuit boards (PCBs), connectors, busbars, and transformer windings. The rapid rollout of 5G infrastructure and the proliferation of smart home and IoT devices have further accelerated the use of copper foils and strips, particularly in compact, high-frequency components where performance and reliability are critical.

Technological innovations in electric vehicles and energy infrastructure design further amplify the demand for flat-rolled copper products. The advancement of high-efficiency electric drivetrains, battery management systems, and next-generation charging infrastructure requires materials with exceptional electrical conductivity, thermal performance, and durability, which are key characteristics of copper. As solid-state batteries and high-voltage EV architectures gain traction, precision-engineered copper foils and sheets become increasingly critical.

Additionally, the global transition toward renewable energy sources such as solar and wind has intensified the need for reliable power transmission and storage solutions. Copper’s role in solar panel connectors, wind turbine generators, and innovative grid components continues to expand, firmly positioning the products at the center of future-ready energy and mobility ecosystems.

Drivers, Opportunities & Restraints

The demand for products in the construction industry is primarily driven by rapid urbanization, smart city development, and the growing emphasis on sustainable and energy-efficient building practices. Its excellent electrical and thermal conductivity make it a key material for modern wiring systems, grounding solutions, and power distribution networks in residential, commercial, and industrial buildings. Its durability, corrosion resistance, and aesthetic appeal also contribute to its widespread use in roofing, cladding, wall panels, and architectural detailing. As infrastructure development accelerates globally, copper enables safe, efficient, long-lasting construction solutions.

Significant opportunities lie in technological advancements in clean energy and electric mobility, where the role of copper is expanding rapidly. The shift toward solid-state batteries, high-performance EVs, and smart grid infrastructure opens new application areas for precision copper foils and high-strength rolled products. Emerging economies with increasing investments in power distribution, telecom infrastructure, and green buildings offer untapped growth potential. Moreover, recycling and sustainable copper processing innovations could enhance profitability and align with environmental mandates, allowing companies to build competitive advantages while meeting ESG goals.

Volatile raw material prices, especially fluctuations in global copper prices, can affect profitability and pricing strategies. The market is also impacted by environmental regulations and high energy consumption associated with copper processing, which could limit production scalability in some regions. Additionally, substitution threats from alternative materials like aluminum, particularly in cost-sensitive automotive or power applications, pose a risk to market growth. Supply chain disruptions and geopolitical tensions further complicate global copper procurement and distribution.

Product Insights

By product, copper sheets dominated the market with a revenue share of over 43.0% in 2024. Copper sheets are valued for their excellent electrical and thermal conductivity, corrosion resistance, malleability, and long-term durability, making them suitable for various industrial and commercial applications. In the construction industry, they are used for roofing, cladding, and architectural detailing due to their weather resistance and aesthetic appeal. Their conductivity makes them essential in electrical systems, including busbars, circuit boards, and grounding equipment. It also plays a vital role in the automotive and renewable energy sectors, where they are used in heat exchangers, battery systems, and solar panel components. Additionally, their antimicrobial properties make them useful for touch surfaces and sanitary fixtures in healthcare environments. These combined attributes contribute to their growing demand across multiple industries.

Copper strips are known for their high electrical and thermal conductivity, excellent flexibility, corrosion resistance, and mechanical strength, making them ideal for precision applications across various industries. In the electrical and electronics sector, they are widely used in switchgear, transformers, and power distribution systems due to their efficiency in conducting electricity. The automotive industry relies on copper strips for EV battery connectors, busbars, and wiring harnesses, where compact design and reliable performance are crucial. In the renewable energy sector, these strips are used in solar panels and wind turbines for efficient power transmission and heat dissipation.

End-use Insights

The construction segment held the largest share of over 33.0% in 2024, due to its unique combination of durability, corrosion resistance, and excellent conductivity. These products are widely used in architectural applications such as roofing, cladding, wall panels, and flashing, where long-term weather resistance and aesthetic appeal are essential. Their formability allows for intricate detailing in facades and decorative elements, while their natural patina adds value to modern and heritage structures. Additionally, its antimicrobial properties make it suitable for high-touch surfaces in public buildings.

They are widely used in the electrical and electronics industry due to their outstanding electrical conductivity, excellent thermal properties, and corrosion resistance. Copper sheets, strips, and foils are essential for producing printed circuit boards (PCBs), connectors, busbars, and transformers. Their high efficiency in conducting electricity with minimal energy loss makes them well-suited for high-frequency and high-current applications. Furthermore, its superior thermal conductivity aids in effectively dissipating heat generated by electronic devices, thereby enhancing their performance and durability. The flexibility and ease with which copper strips and foils can be fabricated allow for precise shaping, which is crucial for compact electronics such as smartphones, computers, and industrial control systems. As technology advances and devices become smaller, this industry's demand for copper flat rolled products remains consistently strong.

Copper’s superior thermal conductivity helps manage heat from batteries and drivetrains, improving safety and performance. Additionally, its corrosion resistance ensures long-lasting use in varied weather conditions. With EV adoption growing worldwide, the demand for copper flat rolled products in the automotive sector is rapidly increasing.

Regional Insights

The North American copper flat rolled products market is poised for growth, driven by technological innovations and increasing demand across various sectors. The growing adoption of electric vehicles (EVs) is a major driver of increased copper flat rolled products demand. EVs typically require three to four times more copper than conventional internal combustion engine vehicles, mainly due to their use in batteries, electric motors, and charging systems. Concurrently, expanding the construction sector, driven by ongoing urbanization and large-scale infrastructure projects, further contributes to its demand. In this segment, copper is extensively used in wiring, plumbing, and roofing due to its excellent conductivity, durability, and corrosion resistance.

U.S. Copper Flat Rolled Products Market Trends

U.S. dominated the revenue share of over 72.0% in 2024, in the North America copper flat rolled product market. The growth is driven by robust demand across key sectors and influenced by evolving trade policies. In February 2025, the U.S. administration initiated an investigation into imposing new tariffs on copper imports, aiming to bolster domestic production and reduce reliance on foreign sources. This move has introduced uncertainties in the market, with potential implications for pricing and supply chains. The U.S. market is poised for continued growth, underpinned by strong demand from construction, automotive, and renewable energy sectors.

Asia Pacific Copper Flat Rolled Products Market Trends

The Asia Pacific market is experiencing significant growth, driven by robust demand across various sectors and supported by governmental initiatives. Governments in the region are implementing policies to support the copper industry. For instance, several countries are investing in infrastructure projects and promoting the adoption of EVs, which increases the demand for copper in power grids and charging stations. Additionally, efforts to enhance recycling capabilities are being emphasized to sustainably meet the growing demand for copper.

Europe Copper Flat Rolled Products Market Trends

The European market navigates a complex landscape marked by supply constraints, shifting trade dynamics, and evolving industrial demands. A significant factor impacting the region is the diversion of copper shipments to the U.S. in anticipation of potential tariffs. This shift has resulted in noticeable shortages and supply tightness across continental Europe. Spot markets, particularly in key hubs like Germany, Livorno, and Rotterdam, have experienced heightened demand for immediate delivery, reflecting growing pressure on local inventories. This situation highlights the vulnerability of European supply chains to global trade policy shifts and geopolitical developments.

Key Copper Flat Rolled Products Company Insights

Some of the key players operating in the market include Aurubis AG, KME Group, and Wieland Group.

-

Aurubis AG, headquartered in Hamburg, Germany, is one of the world's leading providers of non-ferrous metals and a major copper recycler. With a history dating back to 1866, the company specializes in producing copper cathodes, wire rods, continuous cast shapes, profiles, and flat rolled products in copper and copper alloys. Aurubis operates production sites across Europe and the USA, serving a global customer base in various electronics, automotive, and construction industries.

-

KME Group, based in Florence, Italy, is a prominent copper and copper alloy manufacturer. Formed from the merger of several European copper producers, including Kabelmetal AG and Tréfimétaux SA, KME offers a wide range of products such as rolled copper, tubes, bars, and cables. The company serves various industrial sectors worldwide with production facilities in Germany, France, Italy, and the Netherlands.

-

Wieland Group, headquartered in Ulm, Germany, is a leading global manufacturer of semi-finished copper and copper alloy products. Founded in 1820, the company produces sheets, strips, rods, tubes, and foils for the electronics, automotive, and construction industries. Wieland operates at over 80 locations worldwide, including production sites in Asia, Europe, and the USA, employing approximately 9,400 people.

Key Copper Flat Rolled Products Companies:

The following are the leading companies in the copper flat rolled products market. These companies collectively hold the largest market share and dictate industry trends.

- Atlantic Copper

- Aurubis AG

- Boway Alloy

- Heyco Metals

- Hindalco Industries Ltd.

- KEMPER GmbH

- KME Group

- Linlong New Materials

- ThyssenKrupp Materials NA

- Wieland Group

Recent Developments

-

On May 1, 2025, Gopalan Enterprises inaugurated a copper manufacturing plant near Bangalore in the Hoskote industrial area, with an annual production capacity of 6,000 metric tons. For fiscal year 2025, the company aims to produce 3,000 metric tons and generate revenues of INR 270 crores through domestic sales and exports.

-

As of May 2025, KME Group continues strengthening its copper industry position following its acquisition of Aurubis' flat rolled products segment in 2022. This strategic move expanded KME's production capabilities across several countries. In February 2024, KME completed an equity transaction deal to list its Cunova business unit on the New York Stock Exchange (NYSE), reflecting its ongoing efforts to enhance its global presence and investment appeal.

-

In May 2025, Wieland Group made significant progress on its USD 500 million expansion project at the East Alton brass mill in Illinois, USA. The construction includes the development of water retention basins and sewer infrastructure, with a pile driver recently installed to commence vertical construction of a new state-of-the-art hot rolling mill. This expansion aims to enhance the production of critical copper and copper alloy components in advanced energy products like electric vehicles. The project is expected to create 80 new permanent jobs and is supported by tax abatement incentives under the Riverbend Enterprise Zone.

-

On May 10, 2025, Hindalco announced plans to enter copper foil manufacturing, targeting the rapidly growing lithium-ion battery market. The company has finalized the technology selection and is identifying the plant location, with an expected operational timeline of about 2.5 years. Additionally, Hindalco is developing a copper and e-waste recycling facility in Gujarat to support sustainable practices and meet rising demand in the energy storage sector.

Copper Flat Rolled Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.79 billion

Revenue forecast in 2033

USD 45.90 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Turkey; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Atlantic Copper; Aurubis AG; Boway Alloy; Heyco Metals; Hindalco Industries Ltd.; KEMPER GmbH; KME Group; Linlong New Materials; ThyssenKrupp Materials NA; Wieland Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

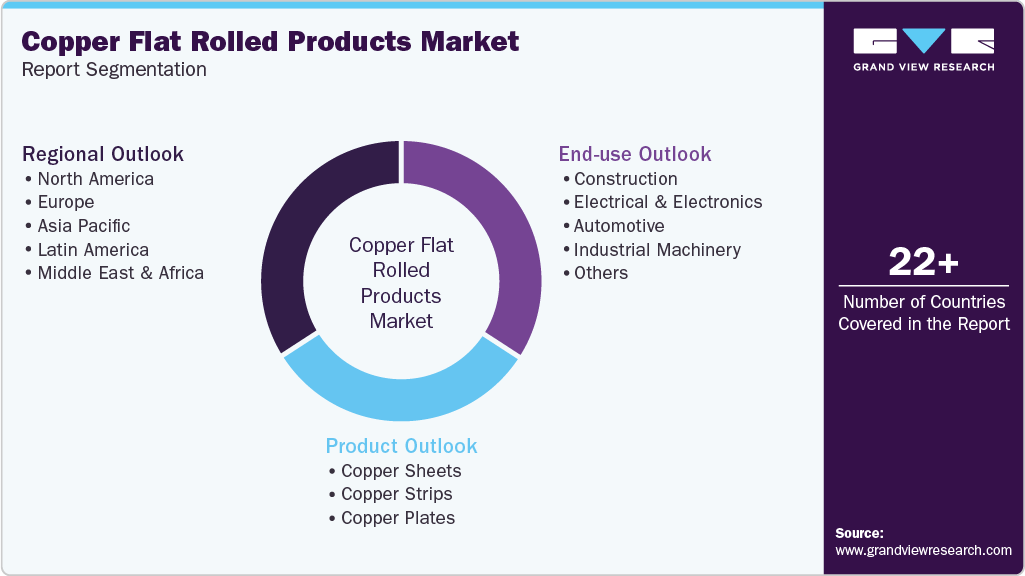

Global Copper Flat Rolled Products Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global copper flat rolled products market report by product, end-use, and region:

-

Product Outlook (Revenue, USD Billion; Volume, Kilotons; 2021 - 2033)

-

Copper Sheets

-

Copper Strips

-

Copper Plates

-

-

End-use Outlook (Revenue, USD Billion; Volume, Kilotons; 2021 - 2033)

-

Construction

-

Electrical & Electronics

-

Automotive

-

Industrial Machinery

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume, Kilotons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global copper flat rolled products market size was estimated at USD 27.99 billion in 2024 and is expected to reach USD 28.79 billion in 2025.

b. The global copper flat rolled products market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033, reaching USD 45.90 billion by 2033.

b. By product, copper sheets dominated the market with a revenue share of over 43.0% in 2024.

b. Some of the key vendors in the global copper flat rolled products market are Atlantic Copper, Aurubis AG, Boway Alloy, Heyco Metals, Hindalco Industries Ltd., KEMPER GmbH, KME Group, Linlong New Materials, ThyssenKrupp Materials NA, and Wieland Group.

b. The demand for copper flat rolled products in the construction industry is primarily driven by rapid urbanization, smart city development, and the growing emphasis on sustainable and energy-efficient building practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.