- Home

- »

- Clinical Diagnostics

- »

-

CRISPR-Based Diagnostics Market, Industry Report, 2030GVR Report cover

![CRISPR-Based Diagnostics Market Size, Share & Trends Report]()

CRISPR-Based Diagnostics Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Enzymes, Kits & Reagents, Software & Libraries), By Technology (Cas9, Cas12), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-572-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

CRISPR-Based Diagnostics Market Summary

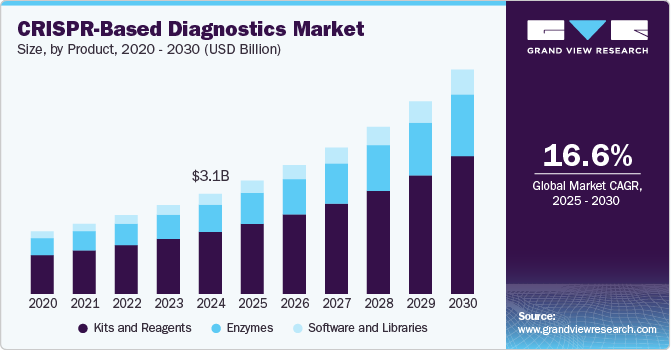

The global CRISPR-based diagnostics market size was estimated at USD 3,084.3 million in 2024 and is projected to reach USD 7,554.2 million by 2030, growing at a CAGR of 16.57% from 2025 to 2030. The increasing global burden of infectious diseases is a key driver for the growth of CRISPR-based diagnostics.

Key Market Trends & Insights

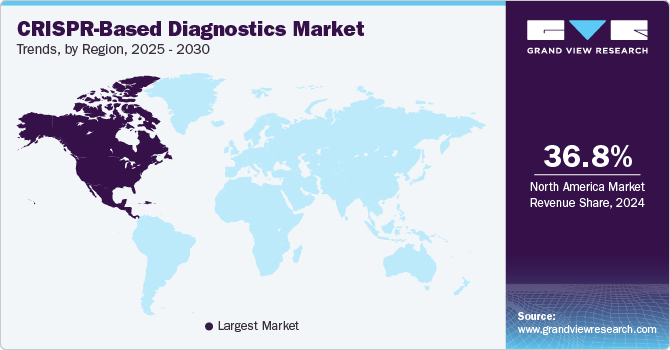

- In terms of region, North America was the largest revenue generating market in 2024.

- In terms of segment, enzymes accounted for a revenue of USD 3,510.1 million in 2024.

- Enzymes is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,084.3 Million

- 2030 Projected Market Size: USD 7,554.2 Million

- CAGR (2025-2030): 16.57%

- North America: Largest market in 2024

According to the World Health Organization’s 2024 Report, tuberculosis (TB) remains the second most prevalent infectious disease worldwide, with 10.8 million cases reported in 2023. African countries recorded the highest incidence rates, while Europe and the Americas reported the lowest. This high disease burden has created an urgent demand for accurate, rapid diagnostics.

CRISPR-based technologies, known for their precise detection of specific genetic sequences, offer superior accuracy, minimizing false positives and negatives. Their ability to detect pathogens quickly and reliably positions them as essential tools in disease surveillance and control. As infectious diseases continue to affect millions globally, the need for innovative diagnostics like CRISPR is expected to grow significantly during the forecast period, ensuring timely intervention and better healthcare outcomes.

The rising incidence of genetic disorders globally is further accelerating the demand for advanced diagnostic solutions such as CRISPR-based tests. According to the International Agency for Research on Cancer’s April 2024 estimates, new cancer cases are expected to increase dramatically, from 21.3 million in 2025 to 35.3 million by 2050. Moreover, research from the Lancet Regional Health published in August 2024 revealed unexpected high prevalence rates of cystic fibrosis in non-European populations, especially across the Indian subcontinent. Other genetic conditions, including arthritis, heart disease, and diabetes, are also on the rise. CRISPR-based diagnostics offer unparalleled precision in detecting genetic mutations early, facilitating prompt treatment and disease management. As the global healthcare community prioritizes early detection and prevention strategies, the expanding prevalence of genetic diseases will continue to drive robust demand for cutting-edge CRISPR-based diagnostic technologies.

Continuous innovations in CRISPR technology are transforming the diagnostics landscape by improving test speed, accuracy, and cost-effectiveness. In August 2023, CrisprBits, a biotechnology start-up focused on CRISPR gene-editing applications, partnered with Molbio Diagnostics to integrate CRISPR into Point-of-Care (POC) testing platforms. CrisprBits developed the PathCrisp platform, which delivers rapid, precise, and affordable POC testing for various diseases, while Molbio leveraged its manufacturing and distribution capabilities. Such technological advancements are enhancing the appeal of CRISPR diagnostics among healthcare providers worldwide. The ability to conduct fast and highly accurate tests without needing complex laboratory setups makes CRISPR diagnostics highly desirable in both developed and emerging markets. As technological refinement continues, CRISPR-based tests are expected to become even more accessible, further driving their adoption in mainstream healthcare services and boosting overall market growth during the forecast period.

The widespread use of CRISPR-based diagnostics is driving demand for specialized enzymes that facilitate gene editing and molecular analysis. CRISPR-Cas systems, including Cas9, Cas12, and Cas13, are critical for ensuring diagnostic accuracy and efficiency. A January 2024 study published in Nucleic Acids Research emphasized the extensive utilization of Class 2 CRISPR-associated enzymes across clinical, research, and agricultural sectors. These enzymes enable the precise targeting and modification of genetic material, essential for reliable diagnostic outcomes. As CRISPR applications broaden beyond research into clinical diagnostics, the need for tailored, high-performance enzymes will continue to rise. Innovations aimed at improving enzyme stability, specificity, and activity will further enhance CRISPR diagnostics' effectiveness. Consequently, enzyme manufacturing will play a pivotal role in scaling up the deployment of CRISPR diagnostics across various healthcare environments globally.

Collaborations between biotechnology firms, research institutions, and healthcare organizations are catalyzing innovation in CRISPR-based diagnostics. For example, in April 2024, Regeneron Pharmaceuticals invested USD 100 million in Mammoth Biosciences to leverage their compact Cas enzymes for in vivo gene-editing therapies across multiple tissue types. These partnerships accelerate the development of new CRISPR tools by combining technical expertise, financial resources, and manufacturing capabilities. Such strategic collaborations not only enhance enzyme and diagnostic tool development but also expand the applications of CRISPR technologies into new therapeutic and diagnostic areas. By fostering interdisciplinary research and commercialization, these partnerships are expected to drive market expansion significantly. With a growing pipeline of collaborative projects, the CRISPR-based diagnostics sector is well-positioned for rapid growth over the next several years.

The increasing adoption of CRISPR diagnostics across various sectors, including genetic testing, infectious disease management, and personalized medicine, is opening up new market opportunities. Investments in expanding CRISPR’s applications-from rapid pathogen detection to cancer biomarker identification-are fueling its acceptance in clinical settings. The combination of government initiatives promoting genetic screening, the rising interest in personalized healthcare, and advancements in diagnostic enzyme technology are creating a favorable environment for market growth. Furthermore, the portability and affordability of CRISPR-based tests make them particularly suited for deployment in low- and middle-income countries, where access to centralized laboratories remains limited. As CRISPR diagnostics continue to prove their versatility and reliability, their integration into routine healthcare services is likely to increase dramatically, driving robust market growth during the forecast period.

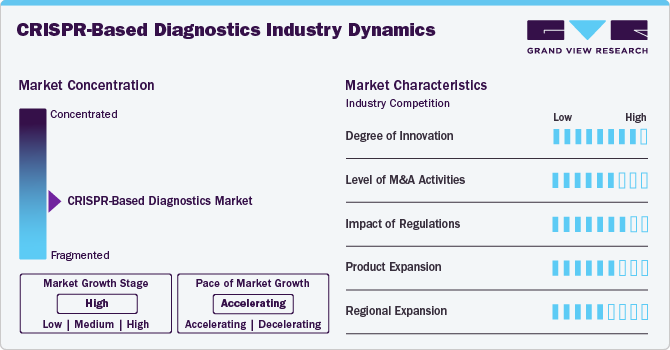

Market Concentration & Characteristics

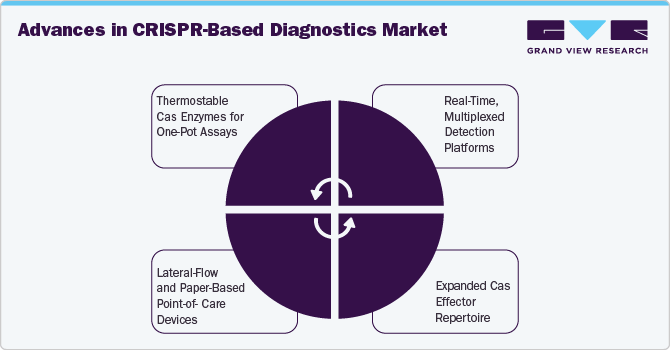

CRISPR continually evolves from Cas9 to Cas12, Cas13, and novel variants, enabling multiplex, one-pot, thermostable assays, improved sensitivity and specificity, integration with isothermal amplification, paper-based lateral flow, miniaturization, AI-driven analysis, lab-on-chip, and digital CRISPR. These breakthroughs push diagnostic boundaries, reducing time to result, simplifying workflows, and expanding diagnostic targets. Rapid prototyping via synthetic biology accelerates iteration, fostering next-gen platforms that seamlessly enable wider healthcare access globally.

Strategic mergers and acquisitions are shaping the CRISPR diagnostics landscape. Leading biotech firms and diagnostic companies are acquiring start-ups with proprietary CRISPR platforms or enzyme technologies to bolster their pipelines. Recent deals include pharmaceutical players investing in Cas enzyme producers and point-of-care platform developers. This consolidation accelerates commercialization and leverages manufacturing capabilities. Heightened M&A activity signals strong investor confidence and will likely continue as companies seek to capture market share.

Regulatory frameworks are crucial for CRISPR diagnostics adoption and market growth. Agencies such as the FDA, EMA, and China’s NMPA are evolving guidelines for gene-editing diagnostics, balancing innovation with safety. Innovation-focused pathways and defined performance criteria for CRISPR assays have emerged, though stringent validation requirements and ethical oversight can prolong approvals. Harmonized global regulations with clear performance metrics will be essential to streamline processes, fostering broader clinical implementation and commercial scale-up.

Manufacturers are rapidly expanding CRISPR diagnostic offerings beyond single-target assays to include multiplex panels, at-home kits, and integrated services. New products leverage Cas12 and Cas13 enzymes to simultaneously detect multiple pathogens or genetic markers in a single run. Companies are also bundling CRISPR reagents with sample prep and software, creating end-to-end solutions. This diversification meets varied customer needs-from hospital labs to community clinics-enhancing market penetration across healthcare settings worldwide.

Established markets in North America and Europe provide strong R&D and regulatory support. Emerging markets in Asia Pacific, Latin America, and the Middle East and Africa are gaining traction as local partnerships, government initiatives, and increased healthcare spending drive uptake. Localization of manufacturing and tailored distribution networks enhances affordability and access. Joint ventures and licensing partnerships enable CRISPR companies to reach diverse patient populations worldwide.

Product Insights

In 2024, kits and reagents led the market with a 61.73% driven by the widespread deployment of CRISPR-based detection systems in both clinical and research settings. The increasing global demand for point-of-care diagnostics, particularly for infectious and genetic diseases, has amplified the need for ready-to-use diagnostic kits and high-quality reagents. These kits simplify complex CRISPR workflows, making them accessible to non-specialist users and broadening their application across hospitals, laboratories, and pharmaceutical companies. Furthermore, ongoing innovations in CRISPR enzymes and detection chemistry are continuously enhancing the performance of these products, boosting adoption rates. As governments and health organizations push for faster disease detection methods, the kits and reagents segment is expected to continue its strong upward trajectory, reflecting its central role in CRISPR diagnostic

The software and libraries segment is projected to expand at a CAGR of 17.11% over the forecast period, driven by the increasing complexity and scale of genetic data analysis. As CRISPR technologies advance, the need for robust bioinformatics tools to interpret diagnostic results has become essential. Software solutions support the design of guide RNAs, analyze sequencing data, and validate target specificity, which enhances the accuracy and efficiency of CRISPR-based tests. Moreover, libraries-containing curated collections of guide RNAs and target sequences-are critical for high-throughput screening and multiplexed diagnostics, especially in infectious disease and oncology applications. The integration of artificial intelligence and machine learning into CRISPR diagnostic platforms is also propelling this segment forward by enabling predictive analytics and real-time data interpretation. Although this segment currently holds a smaller market share compared to kits and reagents, its strategic importance is rising, particularly in research and pharmaceutical settings where precision and scalability are vital.

Technology Insights

The Cas9 segment secured the dominant market share in 2024 due to its foundational role in the development of CRISPR technologies. As the first and most widely studied CRISPR-associated protein, Cas9 has been instrumental in enabling precise DNA targeting and cleavage, making it a preferred tool for genetic diagnostics. The market supported by its established performance in detecting genetic mutations and infectious pathogens with high specificity. While newer enzymes such as Cas12 and Cas13 are gaining traction for their advantages in collateral cleavage and RNA targeting, Cas9 remains the backbone for many diagnostic workflows, particularly in laboratory-based assays. Its compatibility with various detection platforms and existing infrastructure contributes to sustained adoption. Moreover, ongoing research to improve Cas9 variants-such as high-fidelity or enhanced-specificity forms-is expected to expand its application scope. Overall, the Cas9 segment is growing steadily, though at a slower pace compared to emerging enzymes.

The Cas12 segment is projected to expand at significant growth over the forecast period, due to its unique biochemical properties. Unlike Cas9, Cas12 exhibits collateral cleavage activity, enabling it to indiscriminately cut single-stranded DNA once activated by a target sequence. This characteristic has been harnessed in highly sensitive diagnostic platforms, such as SHERLOCK and DETECTR, which are capable of detecting pathogens such as SARS-CoV-2, HPV, and other infectious agents with high accuracy and speed. The demand for point-of-care diagnostics and rapid, low-cost testing solutions has propelled Cas12 adoption, particularly in low-resource and decentralized settings. Its versatility also supports multiplexing, enabling the detection of multiple targets in a single test-an advantage for both clinical and field applications. As CRISPR diagnostics shift from research labs to real-world settings, Cas12's adaptability and efficiency continue to attract significant commercial and academic interest, positioning it as a major driver of future market expansion.

Application Insights

The infectious disease diagnostics held the largest market share of 52.89% in 2024, driven by the urgent global need for rapid, accurate, and scalable testing solutions. CRISPR technologies, particularly those leveraging Cas12 and Cas13, enable highly sensitive detection of viral and bacterial pathogens by identifying nucleic acid sequences with precision. This capability became especially valuable during the COVID-19 pandemic, where CRISPR-based tests offered faster turnaround times and point-of-care deployment compared to traditional PCR methods.

Meanwhile, cancer diagnostics are expected to be the fastest-growing segment over the forecast period. CRISPR technology enables the identification of specific genetic mutations and biomarkers associated with various cancers, offering unprecedented accuracy in diagnosis and patient stratification. In particular, CRISPR-Cas systems can detect low-abundance cancer-related DNA or RNA in blood, urine, or tissue samples, making them suitable for non-invasive liquid biopsy applications. As cancer incidence rises globally, there is increasing demand for diagnostics that can identify malignancies at early stages and monitor treatment response. CRISPR-based tools are being integrated into next-generation diagnostic platforms that provide rapid, real-time results with high sensitivity and specificity. Furthermore, advancements in guide RNA libraries and CRISPR screening techniques are accelerating the discovery of novel cancer biomarkers. While still emerging compared to infectious disease diagnostics, the cancer segment holds strong growth potential through 2030, driven by research investment and clinical innovation.

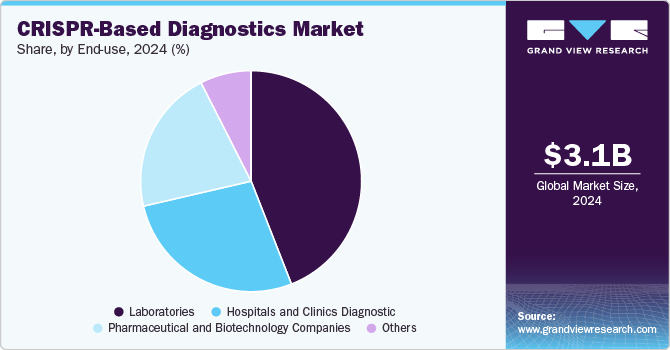

End-use Insights

Laboratories are expected to dominate the market in 2024 with share of 44.05% and is expected to be the fastest-growing segment over the forecast period. Driven by the rising prevalence of infectious diseases such as HIV, hepatitis, tuberculosis, and respiratory infections, which require accurate and timely diagnosis. These laboratories are well-equipped with advanced infrastructure and expertise, enabling them to handle high test volumes efficiently. In addition, the growing shift toward personalized medicine has significantly increased the demand for molecular diagnostic services. By identifying specific genetic markers and pathogens, molecular diagnostics facilitate tailored treatment plans, enhancing treatment efficacy while minimizing adverse effects.

The hospitals and clinics segment is experiencing steady growth in the CRISPR-based diagnostics market as healthcare providers increasingly adopt advanced molecular testing for faster and more accurate disease detection. CRISPR-based diagnostic tools offer rapid turnaround times, high specificity, and the potential for point-of-care implementation-making them particularly valuable in clinical settings. These tools are being used to detect infectious diseases, genetic disorders, and, increasingly, cancer-related mutations directly in hospital laboratories.

Regional Insights

North America’s CRISPR-based diagnostics market is poised for robust expansion, underpinned by a high burden of chronic and infectious diseases, a growing focus on personalized medicine, substantial R&D spending, and advances in point-of-care testing. For example, a Pathogens study from October 2024 reports that in 2022 Mexico alone saw 117,412 hepatitis B and 678,258 hepatitis C cases-conditions for which CRISPR diagnostics can deliver rapid, highly specific pathogen detection. Beyond screening, CRISPR’s precision gene-editing capability also holds promise for developing targeted therapies, offering new avenues for both diagnosis and disease management. Strategic collaborations between academia, biotech innovators, and healthcare providers are further accelerating the evolution of CRISPR diagnostic tools in the region. In October 2024, ERS Genomics Limited granted Université de Montréal a non-exclusive license to its CRISPR/Cas9 patent portfolio, enabling UdeM to build two state-of-the-art CRISPR/Cas9 screening platforms at its Institute for Research in Immunology and Cancer. Such partnerships not only democratize access to cutting-edge IP but also foster the creation of next-generation diagnostic assays, reinforcing North America’s leadership in the global CRISPR-based diagnostics market.

U.S. CRISPR-based Diagnostics Market Trends

The CRISPR-based diagnostics market in U.S. is rapidly expanding, fueled by a supportive regulatory environment and milestone approvals. Clear guidance from the FDA has streamlined product pathways-most notably the April 2023 emergency use authorization for the Sherlock™ CRISPR SARS-CoV-2 kit, which marked the agency’s first-ever green light for a CRISPR-based infectious disease assay. This precedent not only validates CRISPR’s diagnostic potential but also accelerates the development of intuitive, point-of-care platforms. By reducing time to result and enhancing usability for clinicians and patients alike, these regulatory and technological advances are driving robust market uptake across the U.S.

Europe CRISPR-based Diagnostics Market Trends

Europe CRISPR-based diagnostics market is witnessing steady growth, powered by robust EU funding programs (Horizon Europe), collaborative translational research networks, and strong regulatory guidance from the European Medicines Agency. Higher healthcare spending on precision medicine, coupled with increasing incidence of genetic and infectious diseases, drives demand for rapid, accurate assays. Innovations from leading biotech hubs in Germany, France, and Switzerland, alongside scalable manufacturing capabilities, further accelerate adoption across clinical laboratories and point-of-care settings.

The UK CRISPR-based diagnostics market is expanding rapidly, driven by strong federal funding (BMBF), world-class research institutes (Max Planck, Fraunhofer), and leading pharmaceutical companies. High healthcare expenditure and early adoption of precision-medicine initiatives create fertile ground for rapid assay uptake. German labs are pioneering multiplexed Cas12- and Cas13-based platforms for oncology and pathogen detection. Strategic partnerships between SMEs and large OEMs are facilitating scalable production, ensuring German innovations reach domestic and export markets swiftly.

The CRISPR-based diagnostics market in Germany is experiencing significant growth, driven by strong federal funding (BMBF), world-class research institutes (Max Planck, Fraunhofer), and leading pharmaceutical companies. High healthcare expenditure and early adoption of precision-medicine initiatives create fertile ground for rapid assay uptake. German labs are pioneering multiplexed Cas12- and Cas13-based platforms for oncology and pathogen detection. Strategic partnerships between SMEs and large OEMs are facilitating scalable production, ensuring German innovations reach domestic and export markets swiftly.

Asia Pacific CRISPR-based Diagnostics Market Trends

The Asia Pacific region is emerging as a high-growth market for CRISPR diagnostics, underpinned by expanding healthcare infrastructure in India, Southeast Asia, and Australia. Governments are investing heavily in biotech parks and approval fast-track schemes, while a large infectious-disease burden-from TB to viral outbreaks-creates urgent demand for rapid, low-cost tests. Local manufacturing partnerships and telemedicine integration are enhancing test accessibility in rural areas. Rising disposable incomes and digital health initiatives further propel market expansion.

The China CRISPR-based diagnostics market is poised for rapid expansion, backed by national strategies like “Made in China 2025” and substantial R&D grants from the Ministry of Science and Technology. Regulatory reforms by the NMPA are streamlining approval pathways for in-vitro diagnostics. Domestic biotech champions are developing Cas-based POC devices for large-scale screening of infectious diseases and cancer biomarkers. Integration with AI and cloud-based data analytics accelerates test interpretation, driving widespread clinical adoption.

The CRISPR-based diagnostics market in Japan is poised for rapid expansion. Japan aging population and strong emphasis on preventive healthcare are catalyzing growth in CRISPR diagnostics. AMED’s funding programs support academic-industry collaborations focusing on precision oncology panels and rare-disease screening. The PMDA’s clear guidance on gene-editing assays helps expedite product approvals. Japanese diagnostics companies are rolling out compact, user-friendly devices suitable for hospital and home use. Integration with Japan’s national health insurance system encourages adoption by clinicians and patients seeking rapid, accurate results.

Latin America CRISPR-based Diagnostics Market Trends

Latin America CRISPR-based diagnostics market is expanding, driven by government initiatives to modernize public health labs and rising prevalence of infectious diseases such as Zika, dengue, and HIV. Partnerships between global biotech firms and local distributors are lowering costs and enabling regional manufacturing. Fast-track approvals by national regulatory agencies (ANVISA, COFEPRIS) are improving market access. Growing awareness of genetic testing for cancers and inherited disorders further stimulates demand for advanced CRISPR-based assays across Brazil, Mexico, and Argentina.

Middle East & Africa CRISPR-based Diagnostics Market Trends

The CRISPR-based diagnostics market in Middle East and Africa is experiencing nascent yet accelerating growth due to increased healthcare investment from governments and private entities. Initiatives such as the UAE’s Genomics and Precision Medicine strategy and South Africa’s National Health Insurance plans emphasize modern molecular diagnostics. Collaborations with international biotech firms bring POC CRISPR platforms to urban and rural clinics. High burden of infectious diseases, coupled with improved regulatory frameworks, is driving uptake of rapid, accurate CRISPR-based tests.

Key CRISPR-based Diagnostics Company Insights

The global CRISPR-based diagnostics market is highly competitive, with key players such as Thermo Fisher Scientific Inc.; Integrated DNA Technologies, Inc.; Molbio Diagnostics; Horizon Discovery; Synthego Corporation; focusing on enhancing speed, accuracy, specialty, and precision in their products. These companies prioritize new product development, research & development (R&D) investments, and strategic mergers and acquisitions to strengthen their market position. For instance, In February 2024, CrisprBits Private Limited unveiled OmiCrisp, a rapid CRISPR-based assay that not only detects SARS-CoV-2 but also distinguishes Omicron lineage variants from other variants of concern. Molecular Solutions Care Health LLP now employs this weekly test to track the Omicron-derived JN.1 variant in wastewater samples collected from 14 different neighborhoods in Bengaluru, India.

Key CRISPR-based Diagnostics Companies:

The following are the leading companies in the CRISPR-based diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Integrated DNA Technologies, Inc.

- Molbio Diagnostics

- Horizon Discovery

- Synthego Corporation

- Mammoth Biosciences

- Sherlock Biosciences

- Caribou Biosciences

- CrisprBits

- ToolGen Inc.

Recent Developments

-

In January 2025, CrisprBits launched its Research and Innovation Centre focused on CRISPR gene editing and diagnostics in Bengaluru, India. The facility is equipped with advanced laboratory infrastructure, offering dedicated areas for lyophilization (a technique to stabilize reagents at room temperature), as well as spaces for cell and tissue culture, bacterial culture, molecular biology research, and cleanroom activities.

-

In June 2024, Jumpcode Genomics, a company specializing in genome technology to advance human biology research, and Takara Bio USA, Inc., a subsidiary of Takara Bio Inc., settled their patent dispute and entered into a partnership. Together, they aim to combine their intellectual property to enable the targeted removal of unwanted transcripts, such as ribosomal RNAs, from NGS libraries using CRISPR-based technology.

-

In March 2024, Scope Biosciences, a Netherlands-based biotech company, secured USD 2.68 million through the EIC Transition program, underscoring its leadership in molecular diagnostics innovation. The grant, stemming from a successful two-year collaboration with Wageningen University under the ERC-Proof of Concept initiative, will accelerate the development of the scopeDx platform, designed to enhance point-of-care diagnostics by delivering high-accuracy results in on-site environments.

CRISPR-based Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.51 billion

Revenue forecast in 2030

USD 7.55 billion

Growth rate

CAGR of 16.57% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Integrated DNA Technologies, Inc.; Molbio Diagnostics; Horizon Discovery; Synthego Corporation; Mammoth Biosciences; Sherlock Biosciences; Caribou Biosciences; CrisprBits; ToolGen Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CRISPR-Based Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CRISPR-based diagnostics market report based on product, technology, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzymes

-

Kits and Reagents

-

Software and Libraries

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cas9

-

Cas12

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease Diagnostics

-

Genetic Disorder Diagnostics

-

Cancer Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics Diagnostic

-

Laboratories

-

Pharmaceutical and Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CRISPR-based diagnostics market size was estimated at USD 3.08 billion in 2024 and is expected to reach USD 3.51 billion in 2025.

b. The global CRISPR-based diagnostics market is expected to grow at a compound annual growth rate of 16.57% from 2025 to 2030 to reach USD 7.55 billion by 2030.

b. North America dominated the CRISPR-based diagnostics market with a share of 47.43% in 2024. This is attributable to high burden of chronic and infectious diseases, a growing focus on personalized medicine, substantial R&D spending, and advances in point-of-care testing

b. Some key players operating in theCRISPR-based diagnostics market include Thermo Fisher Scientific Inc.; Integrated DNA Technologies, Inc.; Molbio Diagnostics; Horizon Discovery; Synthego Corporation; Mammoth Biosciences; Sherlock Biosciences; Caribou Biosciences; CrisprBits; ToolGen Inc.

b. Key factors that are driving the market growth include the increasing global burden of infectious diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.