- Home

- »

- Plastics, Polymers & Resins

- »

-

Crosslinking Agent Market Size, Share & Growth Report 2030GVR Report cover

![Crosslinking Agent Market Size, Share & Trends Report]()

Crosslinking Agent Market (2025 - 2030) Size, Share & Trends Analysis Report By Chemistry (Amino, Amine, Amide), By Application (Decorative Coatings, Automotive Coatings, Industrial Coating), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-330-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crosslinking Agent Market Size & Trends

The global crosslinking agent market size was estimated at USD 7,183.3 million in 2024 and is projected to grow at a CAGR of 11.3% from 2025 to 2030. The growth is attributed to increasing demand for high-performance materials in automotive, electronics, and aerospace industries. Crosslinking agents are essential in various industries as they enhance the properties of polymers by creating strong, covalent bonds between polymer chains. This leads to improved chemical resistance, heat resistance, and mechanical properties of the final products. As such, their critical role in manufacturing high-performance materials drives the demand for crosslinking agents.

The growing demand for water-based crosslinking agents, driven by environmental regulations and a push for more sustainable manufacturing practices, further fuels the market. The construction industry also significantly contributes to the demand, where crosslinking agents are used in coatings, adhesives, and sealants to enhance durability and resistance to environmental damage.

Drivers, Opportunities & Restraints

Crosslinking agents enhance the material's mechanical strength, thermal stability, and chemical resistance, making them ideal for high-performance chemicals. The automotive, construction, and electronics industries demand materials with superior durability and performance, leading to a growing market for crosslinking agents. Recent technological advancements have expanded the product's applications to include 3D printing and biomedical devices.

The high cost of crosslinking agents can pose a significant barrier, especially for small and medium-sized enterprises. Processing and handling these agents can be complicated, requiring specialized equipment and expertise. Some crosslinking agents can be hazardous to human health and the environment, leading to strict regulations and restrictions on their use.

The increasing focus on sustainable and biodegradable polymers creates new opportunities for crosslinking agents designed for eco-friendly applications. Advances in manufacturing processes, such as additive and nanotechnology, also open up new possibilities for crosslinking applications. Developing countries with expanding industrial sectors represent untapped markets for crosslinking agents.

Chemistry Insights

“Isocyanate emerged as the fastest growing application with a CAGR of 13.1%”

The amino segment dominated the market with a revenue share of 45.0% in 2023. Crosslinking agents are crucial in creating strong, durable bonds between polymer chains, enhancing the properties of materials like plastics, resins, and rubbers. Amino is used in the formulation of crosslinking agents. Amino-based crosslinkers are particularly effective in improving the adhesion, thermal stability, and chemical resistance of the materials used. This makes them valuable in various applications, from automotive and construction materials to coating and adhesives industries. Their versatility and efficiency in enhancing material performance underscore their importance in the crosslinking agent market.

Isocyanates play a pivotal role in the crosslinking agent’s market, primarily due to their ability to react with various compounds to form exceptionally durable and resilient polymers. These characteristics make isocyanate-based crosslinkers essential for producing coatings, adhesives, foam, and elastomers. The demand in the market is driven by the need for products that can withstand harsh environmental conditions, chemical exposure, and mechanical stress, particularly in the automotive, construction, and footwear industries. Furthermore, ongoing research and development efforts are focused on overcoming the challenges associated with isocyanate use, such as health risks and environmental concerns, by developing more sustainable and safer alternatives. This continuous innovation ensures the growth and evolution of the isocyanate segment.

Application Insights

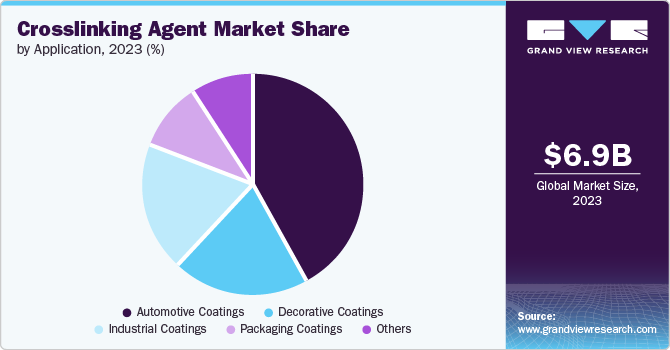

“Automotive emerged as the largest market share of 42.0%”

The automotive application segment dominated the market and accounted for a revenue share of 42.0% in 2023. In the automotive industry, crosslinking agents play an important role in enhancing the properties of polymers used in car parts and coatings. These agents facilitate the formation of chemical bonds between polymer chains, resulting in materials with improved heat resistance, mechanical strength, and chemical resistance. Crosslinking is vital for producing durable rubber components, such as tires and gaskets, and high-performance coatings that protect vehicles against environmental damage and wear. Through crosslinking agents, automotive manufacturers ensure that cars are safer, more reliable, and have a longer service life.

Crosslinking agents are essential in formulating decorative coatings and enhancing various performance characteristics. These agents link polymer chains in the coating's matrix, forming a more tightly knit network. This process, known as crosslinking, significantly improves decorative coatings' durability, chemical resistance, and aesthetic longevity. By facilitating a stronger bond among the coating's molecular components, crosslinking agents ensure that the final product can withstand environmental stresses and wear over time, maintaining its decorative appeal and protective functionality.

Regional Insights

“China emerged as the fastest growing market in Asia-Pacific with a CAGR of 11.8% from 2024 - 2030”

Asia Pacific dominated the market and accounted for a 36.7% share in 2023. The region's leading position is attributed to the rising automotive sector in Asia Pacific and due to the rising construction projects in the region which are expected to drive the market. Additionally, the availability of land, low raw material, and labor costs, along with a favorable government outlook, are key factors associated with high production volumes of crosslinking agents in countries such as China.

China Crosslinking Agent Market Trends

China is a key player in the global crosslinking agent market, with a significant influence on market dynamics. The country's dominance is attributed to its high production capacity, low labor costs, and availability of raw materials, driving the market's competitive pricing and high production volumes. The demand in China is mainly driven by the rising automotive, construction, and electronics industries in the country.

North America Crosslinking Agent Market Trends

The market in North America is expected to be driven by high-performance coatings in automotive and construction fuels the market. The rise in usage of the product market in adhesives and sealants due to their superior properties, such as improved durability and chemical resistance, is one of the drivers as well.

Europe Crosslinking Agent Market Trends

Europe plays a significant role in the crosslinking agent market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the demand from the automotive industry. Additionally, Europe is also seeing a rise in construction projects leading to a rise in demand for crosslinking agents.

Key Crosslinking Agent Company Insights

Some of the key players operating in the global crosslinking agent market include

-

BASF SE, a Germany-based chemicals manufacturing company, holds a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments namely: Chemicals, Surface Technologies, Materials, Nutrition & care, Industrial Solutions, and Agricultural Solutions. Among these, Surface Technologies account for the highest contribution to the company’s consolidated revenue, followed by Materials, and Chemicals. The company has 11 operating divisions which are categorized under the company’s 6 business segments. These divisions are Petrochemicals, Intermediates, Performance Materials, Monomers, Dispersion & Resins, Performance Chemicals, Catalysts, Coatings, Care Chemicals, Nutrition & Health, and Agricultural Solutions. The divisions bear strategic and operational responsibility and are organized according to sectors or products. They manage the 52 global and regional business units and develop strategies for 72 strategic business units.

-

Evonik Industries AG is one of the leading chemicals manufacturing companies operational globally. The company operates through its 5 business segments: Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, and Technology & Infrastructure. The company offers its crosslinking agents to various end use industries like automotive, aerospace, construction, and electronics among others. The company has around 104 production facilities in over 27 countries globally. The largest production facilities are in Germany, Belgium, Singapore, China, and in the U.S.

Huntsman Corporation and Dow are some of the emerging market participants in the global crosslinking agent market.

-

Covestro AG is a manufacturer and supplier of chemicals. Covestro’s crosslinking agents are used across industries such as automotive, construction, electrical and electronics, wood, and furniture, among others. The company has a presence across regions such as North America, Europe, Asia Pacific, Central & Latin America, and the Middle East & Africa.

-

Dow is a manufacturing company operational in more than 31 countries through its 104 manufacturing sites. The company has a wide product portfolio comprising industrial solutions, plastics, coatings & silicones businesses delivering to vast end-user industries like infrastructure, packaging, consumer goods, and automotive, among others.

Key Crosslinking Agent Companies:

The following are the leading companies in the crosslinking agent market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Covestro AG

- Allnex Group

- Evonik Industries

- Huntsman Corporation

- Aditya Birla Corporation

- Wanhua Chemicals Group Co. Ltd.

- Dow

- DSM Coatings Resin

- Ineos

Recent Developments

-

In January 2023, BASF SE announced its plan to expand its existing capacity of isocyanate. The project has a total investment of USD 780 million for the final phase of expansion. The company will increase production capacity to approximately 60,000 metric tons per year.

-

In February 2022, Westlake announced the acquisition of Hexion’s global epoxy business for USD 1.2 billion. This business line includes epoxy specialty resins and base epoxy resins and intermediates product lines.

Crosslinking Agent Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,973.5 million

Revenue forecast in 2030

USD 13,618.30 million

Growth rate

CAGR of 11.2% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million. and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Chemistry, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Covestro AG; Allnex Group; Evonik Industries; Huntsman Corporation; Adity Birla Corporation; Wanhua Chemicals Group Co. Ltd.; Dow; DSM Coatings Resin; Ineos

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crosslinking Agent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global crosslinking agent market report based on chemistry, application, and region:

-

Chemistry Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Amino

-

Amine

-

Amide

-

Carbodiimide

-

Isocyanate

-

Aziridine

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Decorative Coatings

-

Automotive Coatings

-

Industrial Coatings

-

Packaging Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global crosslinking agent market size was estimated at USD 6,907.05 million in 2023 and is expected to reach USD 7,183.33 million in 2024.

b. The global crosslinking agent market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 13,618.30 million by 2030.

b. Asia Pacific dominated the crosslinking agent market with a share of 36.7% in 2023. This is attributable to increasing demand for high performance materials in automotive, electronics, and aerospace industries.

b. Some key player operating in crosslinking agent market include, BASF SE; Covestro AG; Allnex Group; Evonik Industries; Huntsman Corporation; Aditya Birla Corporation; Wanhua Chemicals Group Co. Ltd.; Dow; DSM Coatings Resin; and Ineos.

b. Key factors that are driving the market growth include the automotive, construction, and electronics industries demand materials with superior durability and performance, leading to a growing market for crosslinking agents. Recent technological advancements have expanded the product's applications to include 3D printing and biomedical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.