- Home

- »

- Next Generation Technologies

- »

-

Data Center UPS Market Size, Share, Industry Report, 2030GVR Report cover

![Data Center UPS Market Size, Share & Trends Report]()

Data Center UPS Market (2025 - 2030) Size, Share & Trends Analysis Report By Setup (Centralized, Distributed), By UPS Architecture, By Data Center Size, By Product, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-276-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center UPS Market Summary

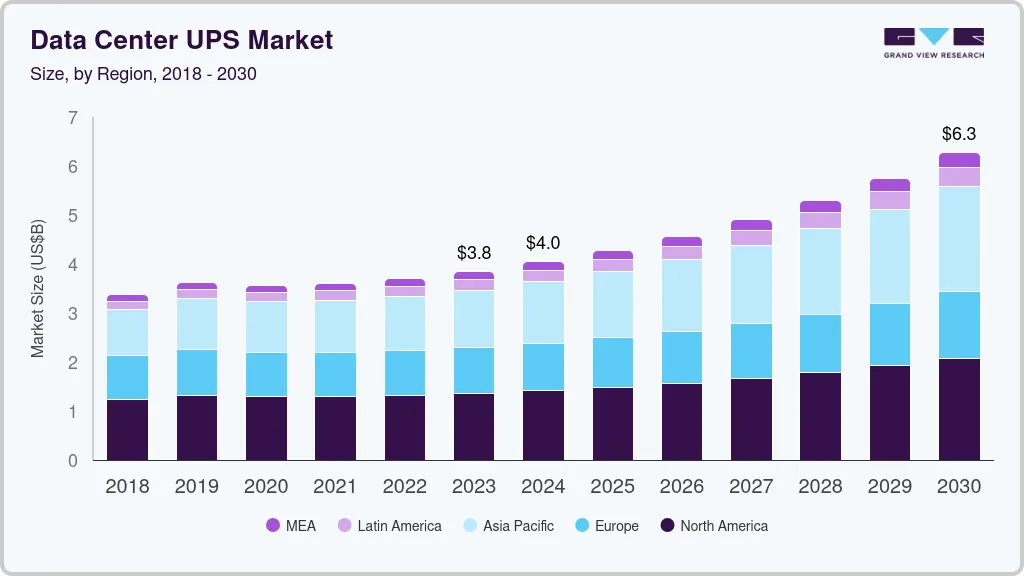

The global data center UPS market size was estimated at USD 4.04 billion in 2024 and is projected to reach USD 6.27 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. One of the primary drivers is the rapid expansion of data centers due to increasing digitalization and the growing reliance on cloud computing services.

Key Market Trends & Insights

- North America dominated the data center UPS market with the largest revenue share of 35.0% in 2024.

- The U.S. data center UPS market led North America with the largest revenue share in 2024.

- By setup, the centralized segment led the market, holding the largest revenue share of 65.8% in 2024.

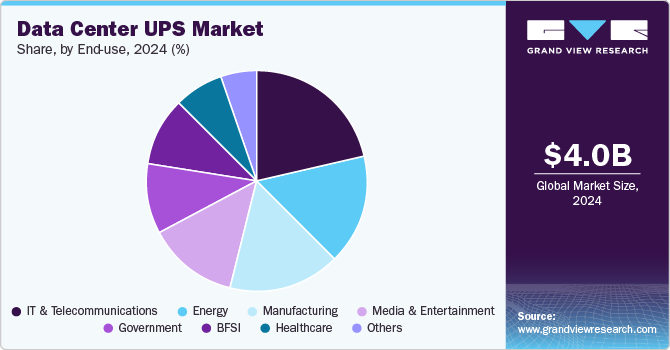

- By end use, the BFSI segment is expected to grow at the fastest CAGR of 9.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.04 Billion

- 2030 Projected Market Size: USD 6.27 Billion

- CAGR (2025-2030): 8.0%

- North America: Largest market in 2024

As businesses and consumers demand more digital services, the need for reliable, Uninterruptible Power Supply (UPS) systems has intensified to ensure operational continuity. In addition, the rising awareness of the potential risks associated with power outages, such as data loss and operational downtime, has led organizations to prioritize robust power management solutions within their data centers.

Technological advancements are expected to propel the data center UPS industry further. The shift toward more sophisticated UPS systems that can handle higher capacities and enhance efficiency is becoming increasingly important. Innovations such as modular UPS systems and lithium-ion battery technology are gaining traction, offering improved performance and reduced maintenance costs. These technological advancements enhance reliability and align with the growing emphasis on energy efficiency and sustainability in data center operations.

Moreover, regulatory pressures and corporate sustainability goals are likely to drive demand for eco-friendly UPS solutions. As governments implement stricter regulations regarding energy consumption and carbon emissions, data centers are increasingly required to adopt greener technologies to comply with these mandates. This shift toward sustainable practices encourages investment in advanced UPS systems that utilize renewable energy sources and promote energy efficiency. These factors are set to create a robust growth trajectory for the global data center UPS market in the coming years.

Setup Insights

The centralized segment dominated the market with a share of 65.8% in 2024 due to its capacity to deliver reliable and efficient power management for large-scale data centers. Centralized UPS systems are designed to support extensive IT infrastructure, ensuring uninterrupted power supply during outages. This configuration allows for easier maintenance and management, making it a favored choice among operators seeking to optimize performance and minimize downtime. In addition, centralized systems often integrate advanced monitoring and management features, enabling operators to address potential issues before they escalate proactively.

The distributed segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing need for flexibility and scalability in data center operations. As organizations expand their digital infrastructures, distributed UPS systems offer modularity that aligns with evolving business requirements. These systems allow for decentralized power management, which is particularly beneficial in multi-site operations where power demands vary significantly. Furthermore, the ability to easily scale up or down based on real-time needs makes distributed systems appealing to businesses aiming to enhance their operational resilience.

UPS Architecture Insights

The monolithic segment dominated the market with the largest revenue share in 2024. Monolithic systems are ideal for facilities with consistent power demands, providing robust support without the complexities associated with modular setups. Their reliability in critical applications has solidified their position within the data center UPS industry. Moreover, monolithic UPS systems often feature high-efficiency rates and lower total cost of ownership, making them an economical choice for organizations focused on long-term operational stability. Monolithic systems play a significant role in shaping market dynamics as more companies seek dependable solutions for their power needs.

The modular segment is expected to grow at the highest CAGR over the forecast period. Modular UPS systems allow incremental capacity upgrades, accommodating fluctuating power needs without significant upfront investments. This feature is particularly appealing in an era where rapid technological advancements necessitate agile infrastructure solutions. In addition, modular designs facilitate easier maintenance and replacement of components, reducing downtime during service operations. For instance, many power modules are designed in two rows to maximize space efficiency, resulting in a footprint that can occupy up to 50% less floor space compared to traditional standalone units. As organizations strive to optimize their energy consumption while maintaining high availability, modular UPS systems are becoming integral to future-proofing data center operations within the data center UPS industry.

Data Center Size Insights

The small data centers (20 kVA to 200 kVA) segment dominated the market with the largest revenue share in 2024 due to the proliferation of edge computing and localized data processing needs. These smaller facilities often require cost-effective yet reliable power solutions, making them ideal candidates for efficient UPS systems that can ensure operational continuity without excessive expenditure. The growth of IoT devices and applications has further increased demand for small data centers that can process data closer to its source. As businesses seek to enhance responsiveness and reduce latency, investments in small-scale UPS solutions are expected to continue rising within the data center UPS industry.

The large data centers (More than 500 kVA) segment is expected to grow at the highest CAGR over the forecast period. The growing volume of data generated by enterprises necessitates robust backup power solutions that can support extensive operations during outages. These large facilities often host critical applications that require uninterrupted service delivery; thus, they demand advanced UPS systems capable of handling significant power loads efficiently. As large organizations invest heavily in their IT infrastructure and digital transformation initiatives, demand for high-capacity UPS solutions tailored for these environments is set to increase.

Product Insights

The double conversion segment dominated the market with the largest revenue share in 2024, owing to its superior protection against power disturbances. This technology provides a clean and stable output voltage by converting incoming AC power into DC and back into AC, making sensitive equipment housed within data centers essential. The reliability offered by double conversion systems has made them a standard choice among operators looking to safeguard critical operations against voltage fluctuations and outages. Furthermore, as businesses increasingly rely on high-performance computing applications, the demand for double-conversion UPS systems remains strong within the data center UPS industry.

The line-interactive segment is expected to grow at the highest CAGR over the forecast period as businesses seek cost-effective solutions that still provide essential backup capabilities. Line-interactive UPS systems offer a balance between performance and price, making them attractive for small to medium-sized enterprises that require dependable power without extensive investment. These systems utilize Automatic Voltage Regulation (AVR) technology to correct minor fluctuations in voltage without switching to battery mode, thereby extending battery life and reducing operational costs.

End Use Insights

The IT & telecommunications segment dominated the market with the largest revenue share in 2024 due to its heavy reliance on data centers for storing and processing vast amounts of information. The critical nature of data integrity and availability within this sector drives significant investments in UPS systems designed specifically for high-demand environments. Companies operating within this space require reliable power solutions that can support continuous operations while minimizing risks associated with downtime or system failures.

The BFSI segment is expected to grow at a significant CAGR over the forecast period as financial institutions increasingly prioritize data security and operational continuity. The reliance on real-time transactions necessitates robust UPS solutions that can mitigate risks associated with power failures while ensuring compliance with regulatory requirements regarding data protection. As financial services continue their digital transformation journeys, investments in advanced uninterruptible power supply systems are essential for maintaining service reliability and safeguarding sensitive information.

Regional Insights

North America data center UPS market dominated the global market with a revenue share of 35.0% in 2024 due to a mature digital infrastructure and high demand for cloud services. The region's numerous data centers leverage advanced UPS technologies to maintain operational efficiency amidst growing digital transformation initiatives across various industries. In addition, North America's strong focus on innovation drives continuous improvements in power management solutions tailored for diverse applications within data centers.

U.S. Data Center UPS Market Trends

The U.S. data center UPS market dominated the regional market in 2024 due to its concentration of major technology firms and extensive data center networks. This dominance reflects substantial infrastructure investments to meet increasing consumer demands for digital services while ensuring a reliable power supply during outages or fluctuations. The presence of leading cloud service providers further amplifies the demand for sophisticated UPS solutions capable of effectively supporting large-scale operations.

Middle East & Africa Data Center UPS Market Trends

Middle East & Africa data center UPS market is anticipated to grow at the highest CAGR. The increasing establishment of new data centers driven by economic diversification efforts highlights a critical need for reliable power solutions supporting expanding operations across various finance, healthcare, and telecommunications sectors. As governments prioritize digital infrastructure development initiatives to foster economic growth through technology adoption, demand for advanced uninterruptible power supply systems is expected to rise within this region's evolving landscape.

Saudi Arabia data center UPS market dominated the regional market in 2024. The country's focus on diversifying its economy beyond oil has increased demand for efficient UPS solutions capable of supporting expanding data center operations across multiple industries, including finance and telecommunications sectors. As Saudi Arabia continues to invest heavily in building state-of-the-art facilities equipped with cutting-edge technologies such as AI-driven analytics tools and IoT-enabled devices, advancements within its local data center UPS market are expected to support this growth.

Asia Pacific Data Center UPS Market Trends

Asia Pacific data center UPS market is expected to grow at a significant CAGR from 2025 to 2030 as countries within this region ramp up their digital initiatives amid rising internet penetration rates and increasing smartphone adoption trends among consumers worldwide. The rising number of new entrants into this space and existing players expanding their footprints reinforces opportunities available across various segments, including small-to-medium-sized enterprises seeking reliable backup options tailored to unique operational requirements.

Key Data Center UPS Company Insights

The data center UPS market features several key players who shape its landscape. ABB is known for its MegaFlex DPA UPS solutions, emphasizing high efficiency and compact design and catering to the demand for sustainable power technologies. Vertiv Group Corp. provides robust UPS systems such as the Liebert ITA2, designed to ensure operational continuity for critical applications. AMETEK, Inc. focuses on advanced power management solutions that enhance reliability and efficiency in data center operations. These companies play a significant role in shaping the data center UPS industry.

-

ABB specializes in providing innovative solutions for the data center UPS market, focusing on energy efficiency and reliability. The company offers a range of uninterruptible power supply systems, including the MegaFlex DPA, which is designed for high-density computing environments. Their products address critical power challenges by ensuring seamless power availability, maximizing uptime, and enhancing overall energy management.

-

Vertiv Group Corp. delivers comprehensive power management solutions tailored for the data center UPS market. The company’s offerings include a variety of uninterruptible power supply systems designed to ensure operational continuity and protect sensitive IT equipment from power disturbances. Vertiv’s Liebert UPS systems are engineered for high performance and reliability, catering to a wide range of applications within data centers. The company emphasizes efficiency and scalability in its products, enabling data center operators to adapt to changing demands while maintaining optimal performance.

Key Data Center UPS Companies:

The following are the leading companies in the data center UPS market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Vertiv Group Corp.

- AMETEK, Inc.

- Belkin

- BENNING Elektrotechnik und Elektronik GmbH & Co. KG

- Clary Corporation

- Eaton

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

Recent Development

-

In December 2024, Vertiv launched the Vertiv PowerUPS 9000, a compact and energy-efficient uninterruptible power supply (UPS) system featuring high power density. Designed to support various IT applications, from traditional computing to high-density environments, this UPS is available globally in CE and UL models, with power capacities ranging from 250 to 1250 kW per unit.

-

In May 2024, ABB unveiled the integration of nickel-zinc (NiZn) batteries into its MegaFlex line of high-power uninterruptible power supply (UPS) solutions designed for data centers and critical power applications. These batteries, sourced from ZincFive, provide a safe, resilient, and sustainable energy storage option compared to conventional battery technologies.

Data Center UPS Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.27 billion

Revenue forecast in 2030

USD 6.27 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Setup, UPS architecture, data center size, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia, South Africa

Key companies profiled

ABB; Vertiv Group Corp.; AMETEK, Inc.; Belkin; BENNING Elektrotechnik und Elektronik GmbH & Co. KG; Clary Corporation; Eaton; Emerson Electric Co.; Fuji Electric Co., Ltd.; General Electric Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center UPS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global data center UPS market report based on setup, UPS architecture, data center size, product, end use, and region:

-

Setup Outlook (Revenue, USD Million, 2018 - 2030)

-

Centralized

-

Distributed

-

-

UPS Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Monolithic

-

Modular

-

-

Data Center Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Data Centers (20 kVA to 200 kVA)

-

Medium Data Centers (200.1 kVA to 500 kVA)

-

Large Data Centers (More than 500 kVA)

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Line Interactive

-

Standby

-

Double Conversion

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunications

-

BFSI

-

Healthcare

-

Government

-

Manufacturing

-

Media & Entertainment

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.