- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Diamond Coatings Market Size, Share, Industry Report, 2033GVR Report cover

![Diamond Coatings Market Size, Share & Trends Report]()

Diamond Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Chemical Vapor Deposition, Physical Vapor Deposition), By Substrates (Metals, Ceramics, Composites), By End Use (Electrical & Electronics, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-652-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Diamond Coatings Market Summary

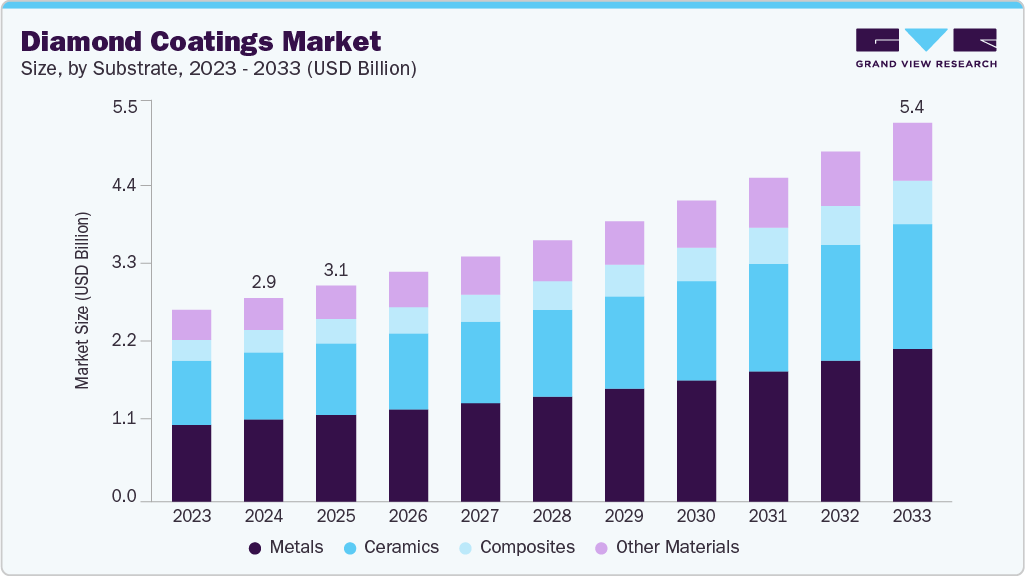

The global diamond coatings market size was estimated at USD 2,884.29 million in 2024 and is projected to reach USD 5,368.78 million by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The market's growth is mainly fueled by increasing demand in manufacturing, electronics, and healthcare.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 39.5% in 2024.

- The diamond coatings market in the U.S. is expected to grow at a substantial CAGR of 7.6% from 2025 to 2033.

- By technology, the chemical vapor deposition (CVD) segment held the highest market share of 65.6% in 2024 in terms of revenue.

- By substrates, the composites segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By end use, the medical segment is expected to grow at a significant CAGR of 7.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2,884.29 Million

- 2033 Projected Market Size: USD 5,368.78 Million

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Diamond-coated tools provide exceptional hardness, wear resistance, and longevity, significantly enhancing performance in aerospace, automotive, and machining applications. These advantages foster widespread adoption of diamond coatings, making them essential for boosting durability, efficiency, and reliability in high-performance and precision-driven industries.Increasing industrial needs for high-performance tooling and components primarily drive the global diamond coatings industry. Sectors such as aerospace, automotive, machining, and electronics increasingly adopt diamond-coated cutting tools due to their unparalleled hardness, wear resistance, and thermal conductivity; this reduces tooling downtime and maintenance costs and enhances machining precision. Rapid advancement in electronics, particularly in heat-intensive applications such as semiconductors, power electronics, and 5G systems, amplifies the demand for diamond coatings to manage thermal loads and friction effectively. Moreover, ongoing innovation in chemical vapor deposition (CVD) and physical vapor deposition (PVD) techniques enables more uniform, adherent, and scalable diamond films, further enabling widespread industrial adoption.

Despite strong demand, the market faces notable challenges. The high production cost associated with advanced CVD and PVD processes remains a significant barrier, particularly for smaller manufacturers and price-sensitive end markets. Uniform deposition on diverse substrates such as metals, ceramics, and composites presents technical obstacles, as inconsistent thickness and adhesion can undermine performance and customer confidence. In addition, limited awareness among potential end-users about the full value proposition of diamond coatings dampens adoption in emerging applications and geographies. These factors restrict market penetration and slow the uptake outside traditional high-performance sectors.

Strategic opportunities abound in expanding diamond coatings beyond conventional sectors. The healthcare industry shows strong potential, with diamond-coated surgical tools and implants gaining traction for their biocompatibility, corrosion resistance, and extended service life. Renewable energy also presents promising use cases: diamond coatings can improve durability and thermal management in components for solar panels, wind turbines, and clean‑energy systems. Nano-engineering trends and growing demand for diamond-like carbon (DLC) coatings also open avenues in wear-critical and optical applications. Finally, accelerating R&D in substrate compatibility and deposition technologies paves the way for entry into new industrial niches, including quantum devices and high-precision optical tooling.

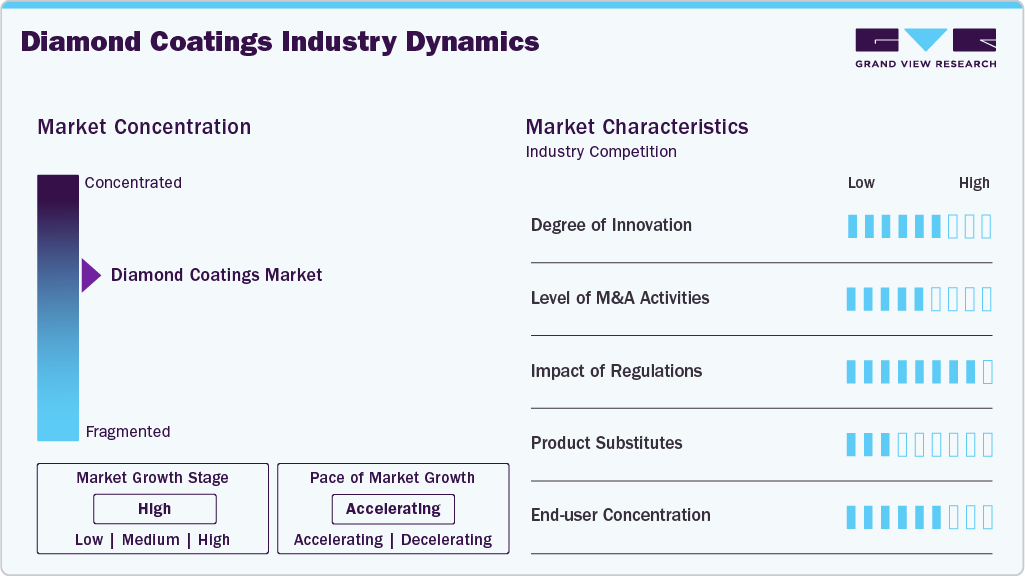

Market Concentration & Characteristics

The global diamond coatings industry exhibits a moderately concentrated structure, led by several prominent firms that shape standards and pricing. Major players such as OC Oerlikon Corporation AG (including its Balzers division), NeoCoat SA, Element Six (UK) Ltd., SP3 Diamond Tech, Crystallume, and Blue Wave Semiconductor, Inc. and others hold a significant share, combining strong R&D capabilities and extensive production infrastructures. These key providers leverage chemical vapor deposition (CVD) and physical vapor deposition (PVD) technologies, enabling economies of scale and technological leadership. Despite this dominance, numerous smaller niche specialists support specialized applications, creating a competitive environment. The top firms compete through advanced process innovation, strategic collaborations, and global service networks, while market entry barriers like capital-intensive equipment and rigorous quality standards limit new competitors.

The diamond coatings industry is characterized by strong technological sophistication and high entry hurdles. Providers employ advanced CVD and PVD methods to deposit ultra-thin diamond films on diverse substrates such as metals, ceramics, composites, and glass, meeting stringent performance standards for adhesion, thickness uniformity, hardness, and thermal conductivity. End-user demand spans aerospace, automotive, electronics, medical, and industrial sectors, with Asia‑Pacific leading due to rapid industrial growth.

Suppliers differentiate through deep customization, tailored coatings for cutting-edge semiconductors, surgical tools, and wear-critical components. Value chains are vertically integrated with advanced material development, precision coating services, and aftermarket support. Regulatory and environmental compliance adds another layer of complexity, reinforcing the advantage of established, experienced providers.

Substrates Insights

The metals segment led the market with the largest revenue share of 40.3% in 2024. This growth is driven by the wide adoption of metals such as steel, carbide, and aluminum alloys as primary substrates in machining tools, automotive components, and aerospace components. Diamond films enhance these metal substrates by providing exceptional surface hardness, wear protection, and thermal conductivity. These improvements increase cutting performance and component life in heavy-duty industrial environments. Metal substrates remain the cornerstone for diamond coatings thanks to their compatibility with established chemical vapor deposition processes and demand in conventional high-wear applications.

Composites segment is anticipated to grow fastest with a CAGR of 7.5% from 2025 to 2033 during the forecast period. This segment is propelled by the expanding use of lightweight composite materials in aerospace, automotive, and renewable energy applications. Diamond coatings on composites improve surface wear resistance, reduce thermal stress, and extend service life without undermining structural lightness. Advances in deposition techniques allowing better adhesion on polymers and fiber‑reinforced composites are unlocking new opportunities where weight savings and durability are critical.

Technology Insights

The chemical vapor deposition (CVD) segment dominated the market with the largest revenue share of 65.6% in 2024. This growth is driven by CVD’s ability to produce uniform, adherent, and high-quality diamond films on various substrates under controlled vacuum conditions. Its scalability, maturity, and compatibility with metals, ceramics, and composites make CVD the go‑to method for industrial coating applications. Ongoing improvements in gas chemistry, plasma control, and substrate preparation reinforce CVD’s technological dominance.

The physical vapor deposition (PVD) segment is anticipated to be the fastest-growing segment over the forecast period. This segment is propelled by PVD’s advantages in depositing diamond-like carbon and nanocrystalline diamonds at lower cost, improved environmental profile, and better compatibility with heat-sensitive materials. PVD technologies also offer benefits in impact strength, abrasion resistance, and conformal coverage, making them suitable for compact electronic and medical applications where precise, thin coatings are required.

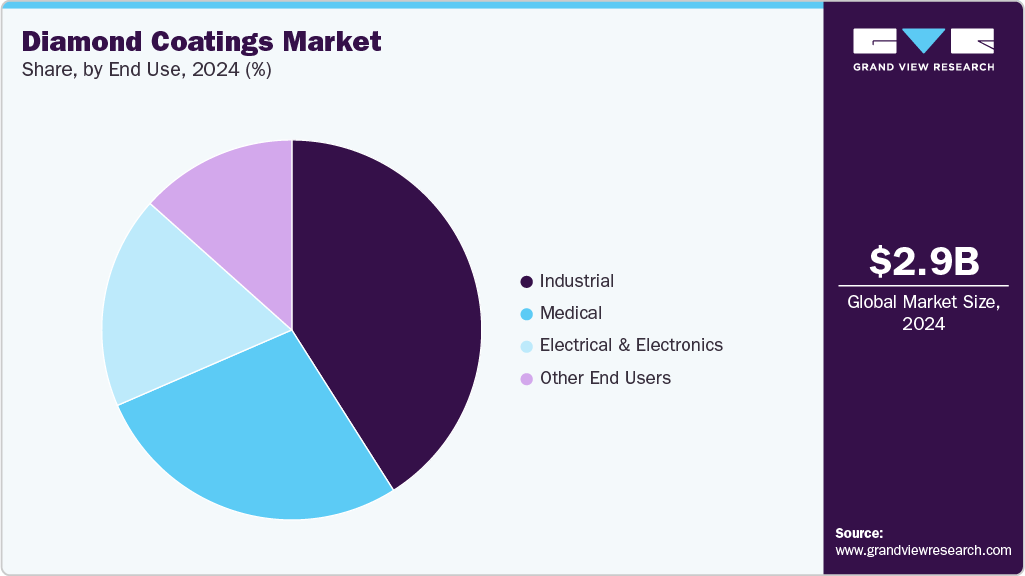

End Use Insights

The industrial segment held the largest revenue share of 41.0% in 2024. This growth is driven by the dominant role of diamond-coated tools, dies, and fixtures in high-performance industrial processes including machining, mining, and precision manufacturing. In such environments, diamond significantly increases productivity through reduced tool changeover, improved tolerances, and much longer lifecycles. The industrial segment remains the foundation of diamond coating applications owing to its high-volume demand, process intensity, and performance-driven return on investment (ROI).

The medical segment is expected to grow fastest with a CAGR of 7.5% from 2025 to 2033 during the forecast period. The accelerating adoption of diamond-coated surgical instruments, implants, and diagnostic tools propels this growth. Benefits include biocompatibility, high wear resistance, corrosion resistance, and reduced friction all contributing to sterilization safety, reduced infection risk, and extended implant lifespan. Recent coating geometry and deposition control innovations align well with stringent medical regulations.

Regional Insights

North America diamond coatings industry is expected to grow fastest, with a CAGR of 7.8% from 2025 to 2033. It holds a strong share owing to advanced industrial infrastructure, robust R&D investment, and stringently regulated manufacturing standards. Key industries such as aerospace, automotive, electronics, and sustainable technology drive the adoption of integrating diamond coatings with additive manufacturing and emphasize eco-efficient processes to further support market expansion. The region also benefits from strong innovation ecosystems and established surface engineering expertise.

U.S. Diamond Coatings Market Trends

The U.S. diamond coatings industry growth is driven by high demand for advanced medical devices, semiconductor components, and aerospace-grade cutting tools. Domestic regulatory compliance requirements incentivize the use of durable, corrosion-resistant coatings. Continuous investment in manufacturing automation, clean energy, and smart tooling reinforces adoption. U.S. providers also benefit from a well-established supply chain for surface technologies and partnerships between academia, national laboratories, and industry leaders.

Asia Pacific Diamond Coatings Market Trends

Asia Pacific diamond coatings industry held the largest revenue share of 39.5% in 2024. It is primarily attributed to rapid industrialization and expansion in key economies such as China, India, and Japan, which drive demand from the electronics, automotive, and aerospace sectors. Competitive labor costs and availability of raw materials have attracted significant investment in coating facilities. Rising middle-class consumption and domestic manufacturing policies are further accelerating the adoption of diamond coatings in tooling and component applications.

China’s diamond coatings industry is distinguished by the country’s dominance in global electronics manufacturing and infrastructure development. The need for high-precision cutting tools and thermal management coatings in semiconductor and automotive production propels demand. Local manufacturers benefit from supportive government policies for the advanced materials and coatings industries. Ongoing expansion of domestic R&D in surface-engineering technologies strengthens competitiveness and feedstock availability, consolidating China’s role as a regional diamond-coating powerhouse.

Europe Diamond Coatings Market Trends

Europe's diamond coatings industry is also anticipated to grow rapidly at a CAGR of 7.7% during the forecast period. The market is increasing due to strong automotive and aerospace sectors in regional powerhouses, supported by advanced manufacturing initiatives and emphasis on component longevity. Demand is also influenced by the electronics segment, including industrial machinery and high-precision tools. European providers leverage technological expertise in CVD/PVD processes, enhanced by cross-border collaborations and stringent environmental regulations.

Germany’s diamond coatings industry is experiencing consistent growth, driven by its world-class automotive and machine-tool industries. Local manufacturers prioritize high-wear tools with superior precision and thermal performance. Emphasis on Industry 4.0, smart tooling, and sustainable production amplifies market demand. German coating suppliers benefit from close collaboration between industrial original equipment manufacturers (OEMs) and research institutions, ensuring rapid deployment of advanced surface-engineering solutions.

Latin America Diamond Coatings Market Trends

The Latin America diamond coatings industry is emerging as a key market, driven by rising industrialization, particularly in Brazil and Mexico. Expansion in automotive manufacturing, mining, and energy sectors fosters demand for durable, wear-resistant coatings. Increased foreign capital inflows and government support for modernization in manufacturing infrastructure are accelerating uptake. The region’s growing focus on tool performance and component reliability motivates broader adoption of diamond coatings.

Middle East and Africa Diamond Coatings Market Trends

The Middle East & Africa diamond coatings industry growth is driven by infrastructure development, oil and gas equipment refurbishment, and emerging aerospace and medical industries. Investments in petrochemical plants and mining machinery have generated demand for wear-resistant components. Meanwhile, regional governments are expanding healthcare and defense infrastructure, boosting demand for high-performance coating technologies. Resource-rich economies in the Gulf Cooperation Council (GCC) and South Africa are gradually modernizing manufacturing, underpinning the adoption of diamond coatings.

Key Diamond Coatings Company Insights

Some of the key players operating in the market include OC Oerlikon Corporation AG, Blue Wave Semiconductors, Inc., Element Six (UK) Ltd., and others.

-

OC Oerlikon Corporation AG is a Swiss technology group headquartered in Pfäffikon, specializing in surface technologies and polymer processing. It operates global brands such as Oerlikon Balzers, Metco, AM and Barmag, developing advanced materials, coating systems, and complete plant engineering solutions. Its Surface Solutions division supplies coating equipment and services for high-tech industries including aerospace, automotive, energy, medical, and luxury, enabling enhanced performance, sustainability and design. Oerlikon’s diamond coatings segment offers diamond‑like carbon and diamond composite layers crafted to improve wear resistance, reduce friction, and extend service life in cutting‑edge industrial components.

-

Element Six (UK) Ltd. is a globally recognized developer of synthetic diamond, tungsten carbide and supermaterials, part of the De Beers Group. Headquartered in the UK with manufacturing across Europe, the US, and South Africa, it focuses on material innovation and scalable manufacturing platforms. Its expertise supports high‑precision applications in abrasive machining, semiconductor fabrication, quantum optics, thermal management and water treatment. Element Six’s diamond coatings segment delivers bespoke chemical vapour deposition diamond layers engineered to guide heat, and enhance hardness and wear resistance, solving complex thermal, optical, and mechanical challenges in advanced technology industries.

NeoCoat SA, SP3, Diamond Product Solutions, and Crystallume are some of the emerging market participants in the diamond coatings industry.

-

NeoCoat SA is a Swiss high‑tech specialist based in La Chaux‑de‑Fonds that focuses on CVD diamond film growth through proprietary reactor systems. It provides custom thin and thick polycrystalline and doped‑diamond coatings under brands like neoDiam and neoCoat electrodes. Serving precision industries such as watchmaking, microsystems, tooling, chemical synthesis and water treatment, NeoCoat emphasises innovation through internal research and customised process engineering. NeoCoat’s diamond coatings segment offers tailored CVD diamond films optimised for wear resistance, chemical stability and performance in demanding mechanical and electrocatalytic applications.

-

SP3 is a specialist CVD diamond technology provider headquartered in California, with origins dating back to early CVD innovation. It pioneered proprietary hot‑filament reactor processes and continues refining those systems for coating services, reactor equipment supply, and application support. SP3 works closely with clients to deploy diamond solutions for cutting tools, semiconductor components, electrodes, CMP pad conditioners and mechanical seals. Its diamond coatings segment focuses on delivering tailored polycrystalline diamond layers engineered for enhanced thermal performance, wear resistance and machining durability in mission‑critical industrial environments.

Key Diamond Coatings Companies:

The following are the leading companies in the diamond coatings market. These companies collectively hold the largest market share and dictate industry trends.

- OC Oerlikon Corporation AG

- Blue Wave Semiconductors, Inc.

- NeoCoat SA

- ENDURA COATINGS

- SP3

- JCS Technologies Pte Ltd

- Surface Technology, Inc.

- Element Six (UK) Ltd.

- Crystallume

- Diamond Hard Surfaces Ltd

- Diamond Product Solutions

- Sandvik AB

- Hyperion Materials & Technologies

- Diamond Innovations Inc.

- Sumitomo Electric Industries, Ltd.

Recent Development

-

In June 2025, Oerlikon Balzers introduced BALDIA VARIA, a CVD diamond coating tailored for cutting tools used in machining fiber-reinforced plastics, ceramics, and composites. Designed for micro and large-scale applications, it improves wear monitoring, tool life, and part quality. Its plasma-driven nanocrystalline structure ensures coating consistency and optimized tool usage. With this launch, Oerlikon expands its coating solutions for high-performance manufacturing, particularly in aerospace and medical sectors, reinforcing its commitment to sustainable, cost-effective machining technologies.

-

In April 2025, Element Six and Bosch formed a joint venture Bosch Quantum Sensing to accelerate the commercialization of diamond-enabled quantum sensors. Leveraging Element Six’s synthetic diamond technologies and Bosch’s sensor engineering, the partnership targets applications in healthcare, mobility, and geophysics. The goal is to scale compact, high-sensitivity quantum devices for industrial use. This strategic move positions Element Six at the core of next-gen sensing solutions, advancing the role of synthetic diamond coatings in precision technologies and real-world innovation.

Diamond Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,061.21 million

Revenue forecast in 2033

USD 5,368.78 million

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, substrates, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

OC Oerlikon Corporation AG; Blue Wave Semiconductors, Inc.; NeoCoat SA; ENDURA COATINGS, SP3; JCS Technologies Pte Ltd; Surface Technology, Inc.; Element Six (UK) Ltd.; Crystallume; Diamond Hard Surfaces Ltd; Diamond Product Solutions; Sandvik AB; Hyperion Materials & Technologies; Diamond Innovations Inc.; Sumitomo Electric Industries, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diamond Coatings Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global diamond coatings market report based on technology, substrates, end use, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Chemical Vapor Deposition

-

Physical Vapor Deposition

-

-

Substrates Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Metals

-

Ceramics

-

Composites

-

Other Materials

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Electrical & Electronics

-

Medical

-

Industrial

-

Other End Users

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global diamond coatings market size was estimated at USD 2,884.29 million in 2024 and is expected to reach USD 3,061.21 million in 2025.

b. The global diamond coatings market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 5,368.78 million in 2033.

b. Asia Pacific market accounted for the largest revenue share of 39.5% in 2024. This is primarily due to rapid industrialization in China, India, and Japan, boosting demand from electronics, automotive, and aerospace sectors. Competitive labor, raw material availability, and supportive manufacturing policies are driving investments in coating facilities, accelerating the adoption of diamond coatings.

b. Some key players operating in the diamond coatings market include OC Oerlikon Corporation AG, Blue Wave Semiconductors, Inc., NeoCoat SA, ENDURA COATINGS, SP3, JCS Technologies Pte Ltd, Surface Technology, Inc., Element Six (UK) Ltd., Crystallume, Diamond Hard Surfaces Ltd, Diamond Product Solutions, Sandvik AB, Hyperion Materials & Technologies, Diamond Innovations Inc., Sumitomo Electric Industries, Ltd.

b. The global diamond coatings market is growing steadily due to rising demand across industries such as electronics, aerospace, automotive, and medical. Diamond coatings offer superior hardness, wear resistance, and thermal conductivity, enhancing component performance and lifespan. Technological advancements in deposition methods and increasing applications in high-precision and high-temperature environments further support market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.