- Home

- »

- Healthcare IT

- »

-

Digital Biomarkers Market Size, Share & Growth Report 2030GVR Report cover

![Digital Biomarkers Market Size, Share & Trends Report]()

Digital Biomarkers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Wearable, Mobile Based Applications), By Clinical Practice, By Therapeutic Area, By End-use (Healthcare Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-989-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Biomarkers Market Summary

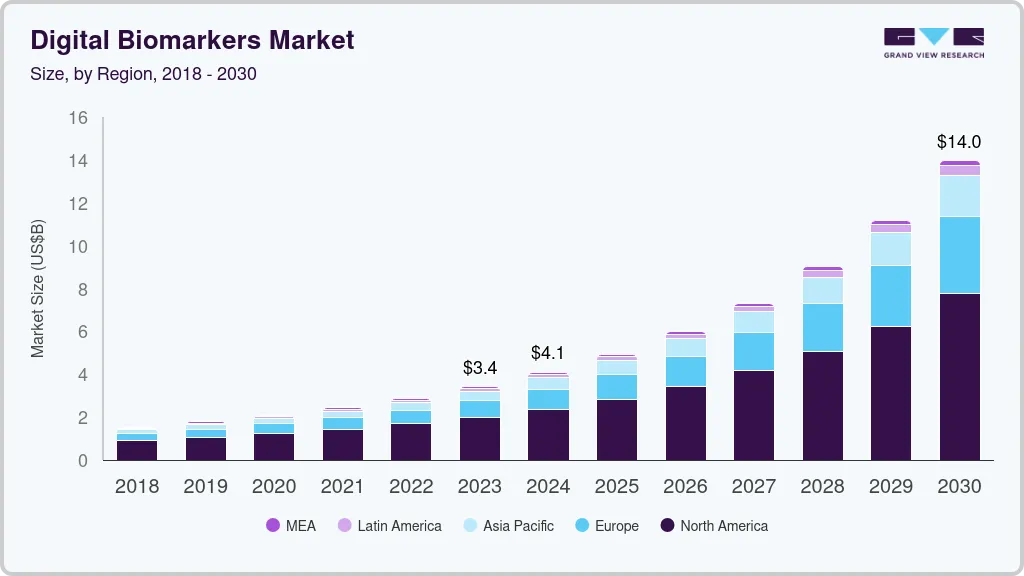

The global digital biomarkers market size was estimated at USD 3,417.3 million in 2023 and is projected to reach USD 13,966.2 million by 2030, growing at a CAGR of 22.7% from 2024 to 2030. The growth is attributed to the increased popularity of recent innovations and remote technologies, the rapid advancement in healthcare technology along with rising healthcare expenditure coupled with growing demand for remote patient monitoring services.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Israel is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, wearable accounted for a revenue of USD 1,352.5 million in 2023.

- Mobile based Applications is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3,417.3 Million

- 2030 Projected Market Size: USD 13,966.2 Million

- CAGR (2024-2030): 22.7%

- North America: Largest market in 2023

In addition, rising usage of smartphones coupled with the emergence of new wearables, expanding therapeutic area applications, and increasing investment in decentralized clinical trials are also driving the market.

As smartphones and wearables become more widely available, new inventive technology enables real-time monitoring of complicated diseases by detecting biomarkers like breathing, speech, heat, and eye movements. Particularly, vocal digital biomarkers (DBMs) have recently emerged and have considerable market growth potential. For instance, in June 2021, the Luxembourg Institute of Health launched CoLive Voice, a digital health company focusing on advancing risk prediction, diagnosis, and remote monitoring of various chronic conditions. These biomarkers are expected to offer a chance to collect information through audio recordings with little to no user load and can be done with tools that patients are already using, like smartphones.

In addition, DBMs developed by wearable sensors and cutting-edge algorithms provide a way to evaluate well investigational medicinal products performed continually and remotely in clinical trials. For instance, in February 2024, Rajant Health Incorporated (RHI) received medical experts endorsements from three industry leaders for its cutting-edge technology wearable Q-Stat, focused at detecting life-threatening medical event. Further providing transparency in measuring activity for remote health management with ECG, SpO2. In addition, cardiovascular diseases are expected to be the largest application segment for DBMs, and this is expected to continue, as cardiovascular disease is the leading cause of mortality worldwide, despite being a largely preventable disease.

The sharp increase in the usage of smartphones, smartwatches and wearable digital technological devices like medical bracelets and fitness trackers. The continuous growth in yearly smartwatch sales is also contributing to the expansion of the digital biomarkers market. In another instance, as per statistics published by GSM association report, the Mobile Economy 2023 the number of people connected to mobile services surpassed 4.4 billion in 2022, and the number of unique mobile subscribers was 5.4 billion in 2022, which is expected to reach 6.3 billion by 2030 (73% of the global population). The penetration of smartphones is also rising significantly. According to the Mobile Economy 2022, smartphone adoption & penetration was 67% in 2021 and is expected to reach 77% by 2025.

Government initiatives and collaborations with global manufacturers are significantly driving the market’s growth.Moreover, rising government support through funding and seeking grant applications for telehealth services is also promoting growth. For instance, in April 2024 NeuReality AI accelerator startup based in Israel, secured funding of USD 20 million from EU Council (EIC) Fund and European Innovation program to further develop its patented algorithms for cancer pathology. Hence, it can be seen as an attractive investment. These funds aimed at deployment of NeuReality’s NR1 AI inference solution to more regions and market segments in Europe.

The rising cost of drug research, combined with its relative low success rate, is fueling the rapid creation of DBMs. DBMs in this field assist in focusing on particular decentralized clinical study areas, including early-onset Alzheimer's or dementia, thereby lowering the time, failure rate of drug development, and cost. For instance, Biogen has invested more than USD 28 billion in neurological research and development since 2003, during which at least 100 medication development programs were abandoned in order to discover a novel therapeutic.

The lack of awareness and scarcity of skilled professionals, especially in developing regions like Latin America and MEA in comparison to Europe and North America, is resisting the market growth. Moreover, issues such as data privacy are anticipated to slow down the growth of the market over the forecast period. However, increasing government support in the form of initiatives and funding for the development of healthcare infrastructure in emerging nations such as India, Japan, and China is expected to drive the demand for market growth in the future.

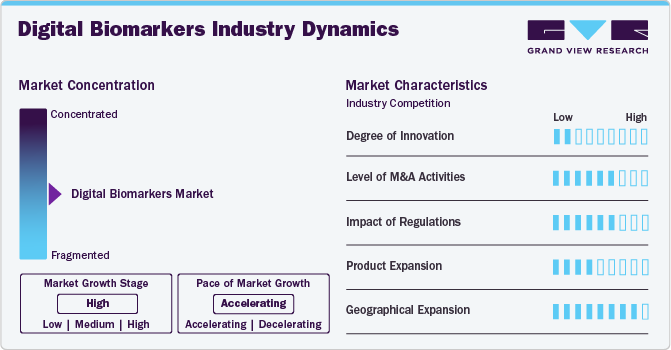

Industry Dynamics

Ongoing advancements in the field of real-time monitoring of complicated diseases by detecting biomarkers like breathing, speech, and heat are driving innovation. New tools and technologies for the surgery of soft tissue injuries and its repair are being developed every year around the world. Vocal digital biomarkers (DBMs) have recently emerged and have considerable market growth potential. For instance, in June 2021, The Luxembourg Institute of Health launched CoLive Voice, a digital health company focusing on advancing risk prediction, diagnosis, and remote monitoring of various chronic conditions. These biomarkers are expected to offer a chance to collect information through audio recordings with little to no user load and can be done with tools that patients are already using, like cell phones.

The digital biomarker market is characterized by a high level of merger and acquisition (M&A) activity by the key players, owing to several factors, including the product launches, competing for product approvals and collaborations with other players to cater to the growing demand for digital biomarker devices and to maintain a competitive edge in the market. For instance, in January 2023, Huma, a digital health company, announced the acquisition of Alcedis to expand its capabilities in the digital clinical trial space. This acquisition further aims at creating an advanced clinical trials division, which utilizes Alcedis platform offering digital health solutions.

Stringent government regulations and regulatory bodies play an important role in defining market development and product movement as in order they ensure unambiguous guidelines about hardware, software, and digital endpoint validation, for instance, manufacturers either regulate their product production and sale themselves or follow FDA guidelines and requirements for medical devices. Although the wearable devices are not governed by any U.S. law, any processing of Protected Health Information (PHI) is governed by the Office of Civil Rights (OCR). Furthermore, government policies can shape the standards for data privacy, security, and interoperability, thereby affecting the overall growth and acceptance of digital biomarkers in the market.

Product expansion can lead to increased adoption in healthcare, fitness, mental health, and other sectors, ultimately enhancing the overall scope and relevance of digital biomarkers in various aspects of daily life. Additionally, product advancements can contribute to refining existing biomarkers, making them more accurate and reliable, which can further expand their scope and utility. For instance, in Jan 2023 FastTrack launched its first affordable smartwatch in Indian market. This product features an array of vital trackers, including a women’s health monitor, heart rate monitor, SpO2 monitor, and sleep tracker.

Number of key industry players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in March 2022, AstraZeneca collaborated with Huma Therapeutics Company to develop Software as a Medical Device (SaMD) companion applications for a range of therapeutic diseases in U.S. These applications combined real-world data with digital biomarkers predictive algorithms

Type Insights

Based on type, the wearable segment dominated the market with the largest revenue share of 39.6% in 2023. The segment growth is attributed to the emergence of new wearables for healthcare purposes. It is anticipated that the market demand for new wearable devices is expected to increase as manufacturers are constantly involved in introduction of new wearables & smart devices. For instance, in November 2022, Zepp Health announced the launch of its Amazfit Band 7 fitness wearable in India. The product has advanced sensors for monitoring stress levels, blood oxygen, and heart rate. Thus, owing to growing product launches and high penetration of wearable products, the segment is likely to grow.

The mobile-based applications segment is anticipated to grow with the fastest CAGR of 24.7% over the forecast period. The segment growth is due to the rising internet usage in various countries such as India, China, and Brazil, simultaneously fueling the global demand for mobile-based applications. With expanding number of mobile-based applications, it is more important than ever to improve client experience. For instance, in January 2022 Voluntis announced a partnership agreement with AliveCor, Inc. Under this partnership AliveCor's KardiaMobile platform is likely to be integrated with Theraxium. Moreover, with this integration, the company aims to manage cardiotoxicity during cancer treatment and promote self-monitoring in fibrillation case. Thus, the growing importance of mobile phones and mHealth for improving health outcomes & patient care is driving the market. As a result, market players are increasing their market presence through strategies such as collaborations, acquisitions, and new product launches, which will enhance overall market growth over the forecast period.

Clinical Practice Insights

Based on clinical practice, diagnostic digital biomarkers dominated the market with the largest revenue share in 2023. This growth is attributable to the increasing use of the linked digital devices and health-related mobile applications for diagnosis & monitoring of the measurements used for a variety of disease categories, including cardiovascular illnesses, mental health, neurological diseases, and diabetes. Owing to this, market players in the industry are investing in biomarker research, which is anticipated to drive growth. For instance, in May 2022, Imagene AI, an Israel-based digital biomarker firm, raised USD 21.5 million in investment, including a USD 3 million seed round headed by Blumberg Capital and a USD 18.5 million Series A round led by technology-driven cancer treatment investors, to focus on precision medicine in cancer care.

The monitoring digital biomarkers segment is anticipated to witness the fastest growth over the forecast period. The growth is attributed to the growing investment in wearable technology & smartwatches, which helps in easier and more accurate access to health-related information. In addition, wearables from biopharmaceutical companies are enhancing assessment of internal systems by understanding patient biometrics and functionality tracking heart rate, sleep, and disease-specific biometrics-such as monitoring, electrostimulation, & sweat analysis.

Therapeutic Area Insights

Based on therapeutic area, the cardiovascular and metabolic disease segment dominated the market with the largest revenue share in 2023. The growth is attributed to the growing number of therapeutic applications and increasing incidences of cardiovascular disorders globally. Moreover, market players are strengthening their market position by adopting strategies such as collaborations with regional companies to expand their client base and offer better solutions at lower costs, For instance, in July 2023, Cardiovascular Network of Canada augmented its digital health platform VIRTUES, improving the delivery of cardiac care to patients across Canada, such instances are anticipated to promote overall growth over the forecast period.

The neurological disorders segment is expected to record the fastest growth over the forecast period. The rising prevalence of neurological disorders is expected to boost the market growth. According to the Pan American Health Organization, regional neurological conditions accounted for approximately 32.9 deaths per 100,000 population in 2019, with 47.4 deaths per 100,000 population in the U.S. Furthermore, the surge in manufacturers involved in product launch with algorithms maximizing insights into brain activity are propelling segment growth. For instance, in June 2023, Koneksa, a digital biomarkers company, announced partnership with Beacon Biosignals to launch a clinical trial in neurological disorder to study combining of Koneksa neuroscience solution toolkit into Beacons electroencephalogram (EEG) in-home biomarkers for detecting early treatment signals. Such development drives the demand for digital neurological biomarkers to detect early signs of neurological disorders and provide real-time data for analysis & diagnosis of the disease.

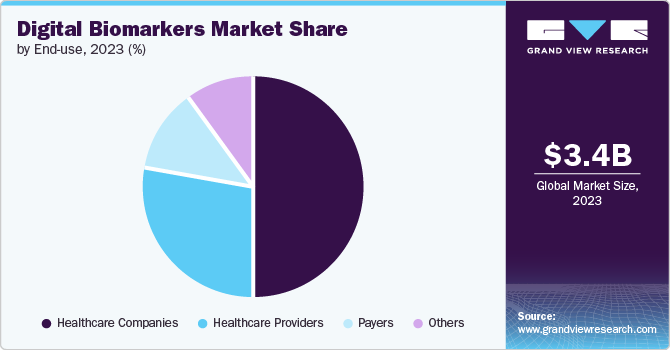

End-use Insights

Based on end use, healthcare companies dominated the market with the largest revenue share in 2023. This can be attributed to the fact that healthcare companies have been working toward integrating digital measurements across the spectrum of clinical care & research to ensure connected devices provide a comprehensive view of patient health.

The payers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the rising adoption of novel digital biomarkers in insurance firms and payers' ability to use these tools to satisfy patient needs further & develop individualized care plans with schedules for prior authorization.

Regional Insights

North America accounted for the largest market share of 58.4% in 2023 owing to the increase in investments in R&D, strong presence of leading market players, growing approval of smart devices, significant product launches, and improved awareness of the effectiveness of digital biomarkers in the region. Besides, the increasing number of initiatives supporting the development of healthcare infrastructure is further driving market growth.

U.S. Digital Biomarkers Market Trends

The digital biomarker market in the U.S. accounted for the largest market share of 67.9% in 2023. Owing to the presence of number of key market players in the country focusing on novel innovations and product launches, coupled with the ongoing partnerships focused at bringing digital biomarkers in clinical trials. For instance, in March 2023, Koneksa extended its partnership with SSI Strategy for adoption of digital biomarkers in clinical trials. The digital biomarkers solutions offered by the company provide clinical sites and sponsors the ability to aggregate data on an individual’s health. Furthermore, funding from public and private organizations is further enhancing the adoption of digital biomarkers in the U.S.

In May 2024, Digital Biomarker Summit USA took place in Tarrytown, NY, the summit highlighted & presented key notes and the discussion which encompassed the subject of digital biomarkers in clinical trials, offering illustrations of how wearable devices contribute to the integration of artificial intelligence (AI). It also explored the concept of digital phenotyping and its influence on observational research. Furthermore, it highlighted recent advancements and developments in regulatory preparedness to embrace these innovative methods for measuring endpoints. Such factors are poised to keep the scope and adoption of digital biomarkers demand high in the region.

Canada digital biomarkers market is anticipated to register the fastest growth rate over the forecast period. This growth is attributable to the rising adoption of digital technology, government partnerships for funding development of new technologies. Furthermore, the launch of digital biomarkers for several conditions to manage the increasing demand is further propelling the market in the country. For instance, in February 2023, researchers at the University of Calgary developed a wearable patch that can help find the correlation between sweat and human stress levels.

Europe Digital Biomarkers Market Trends

The digital biomarkers market in Europe is driven by an increasing number of patients suffering from chronic diseases who require real-time monitoring and diagnosis of various diseases. Furthermore, European markets & governments focus on the digitalization of monitoring services linked with chronic diseases and offer solutions that would ease access to health records, reduce the burden on healthcare facilities & resources, and minimize the repetition of unwanted prescriptions & tests. The European Medicines Agency (EMA) currently manages the approval of medical devices and drugs in Europe. However, new legislation recently developed by the Medical Device Regulation oversees all newer medical devices and implements more stringent rules in comparison to the CDRH approval for medical devices.

UK digital biomarkers market is anticipated to have a considerable market share Europe in 2023. The support from the government and equal adoption of digital biomarkers technology by the National Health Service (NHS) & private physicians to improve affordability & accessibility to healthcare can be attributed to a high market share of the country. Ongoing innovations in the country are further boosting market growth. For instance, In June 2022, the UK’s Defence and Security Accelerator launched a competition for recent innovations in wearable biocompatible technologies under the name Generation-after-next Wearable Technologies with a funding of USD 919,012.50.

The digital biomarkers market in Germany is anticipated to register a considerable growth rate during the forecast period. The market growth is attributable to the presence of key domestic & international service providers in the country, ambiguity of regulations related to digital biomarkers is impeding growth of market in the country. Germany’s digital biomarkers market is expected to witness substantial growth owing to a strong national commitment to health IT, which is utilized by the national eHealth strategy. Government initiatives in Germany are expected to accentuate market growth. Furthermore, government is collaborating with the key players to bring novel technologies related to digital data and digital health, which may lead to the development of novel mobile based applications and wearables in the future, and thus are attributable to market growth in the region.

Asia Pacific Digital Biomarkers Market Trends

The digital biomarkers market in Asia Pacific is anticipated to register the fastest growth during the forecast period, owing to increasing aging population and rising prevalence of chronic diseases. For instance, in 2023, according to the data published by The Lancet Regional Health, in Southeast Asia, cardiovascular diseases (CVDs) accounted for most of the NCD deaths (3.9 million), and NCDs accounted for 55% of all deaths in 2021. Chronic diseases have a negative impact on people's lives by lowering their quality of life, impairing their mobility, and increasing their mortality rate. Furthermore, the region is expected to grow at a rapid pace over the forecast period owing to increasing penetration of smartphones & smart wearable devices and rising adoption of digital health services.

China digital biomarkers market is expected to grow over the forecast period. The enhancement of healthcare infrastructure has led to significant advancements and increase in the integration of digital technologies in healthcare delivery, which influences digital solutions to optimize and complement healthcare services. The increased demand for advanced monitoring systems is pushing manufacturers to introduce novel product portfolios in the market. For instance, in December 2022, Mindray launched mWear system, a wearable patient monitoring solution to monitor various patient conditions and deliver patient-centric care. Such monitoring solutions act as digital biomarkers by collecting crucial health data of patients.

The digital biomarkers market in Japan is expected to grow over significant rate over the forecast period due to the increasing prevalence in the rapid adoption of new technologies and rising popularity of at-home care & regular monitoring services. Moreover, rapid technological advancements, rising usage of smartphones, and emergence of novel wearable solutions are projected to support the country’s market during the forecast period.

Latin America Digital Biomarkers Market Trends

The digital biomarker market in Latin America is anticipated to grow at a significant rate over the forecast period. The high prevalence of chronic diseases, such as cardiovascular disease, arthritis, & cancer, which necessitate ongoing medical supervision, is fueling demand for advanced wearables and digital biomarkers solutions in Latin America. Furthermore, aging population, which is more vulnerable to serious medical conditions, is driving the demand for homecare-based medical treatment, impelling market growth in the region.

Brazil digital biomarkers market is anticipated to grow at a significant rate over the forecast period. Increasing government efforts and collaborations between the government and private investors to promote digitalization of healthcare services are expected to propel market growth in the country. Furthermore, recent product launches in the country are another factor propelling its market. For instance, in June 2022 Amazfit launched the Amazefit Bip 3 in Brazil. The product features advanced sensors that can track stress levels, heartrate, and sleep quality. Furthermore, increasing adoption of digital solutions to manage the rising prevalence of chronic diseases is expected to drive market growth in Brazil.

MEA Digital Biomarkers Market Trends

The digital biomarkers market in MEA is anticipated to grow at a significant rate over the forecast period. Digitalization of healthcare is expected to continue at a steady rate due to factors such as developing infrastructure, large population with unmet medical needs, and lucrative market space for investors further can help the market prosper during the forecast period.

The digital biomarker market in South Africa is anticipated to grow significantly over the forecast period. Government aid, such as the eHealth Strategy South Africa, which provides vision, mission, and strategies for the deployment of eHealth in South Africa can help the market prosper during the forecast period. In addition, in March 2023, BrainTale received CE marking for its brainTale-care digital biomarker platform. Moreover, steps are being taken to boost digital transformation efforts in South Africa. The Digital Health Catalyst (DHC) was created by IDEA-FAST and Mobilise-D in response to the increasing need for application and research in the field of real-world digital measurements. Such initiatives are expected to propel the market in South Africa.

Key Digital Biomarkers Company Insights

Key participants in the digital biomarkers market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Digital Biomarkers Companies:

The following are the leading companies in the digital biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- ActiGraph LLC

- AliveCor Inc.

- Koneksa

- Altoida Inc.

- Amgen Inc.

- Biogen Inc.

- Empatica Inc.

- Vivo Sense

- IXICO plc

- Adherium Limited

- Neurotrack Technologies, Inc.

- Aural Analytic

- Huma

- Sonde Health, Inc.

- Clario

- Imagene AI

- Brainomix

- Kinsa Inc.

- Feel Therapeutics

Recent Developments

-

In February 2024, Biofourmis, a prominent global entity in digital biomarker development and decentralized clinical trial solutions, declares the establishment of four new partnerships with leading pharmaceutical companies. These collaborations is fueled by Biofourmis' demonstrated excellence in digital biomarker innovation, strengthen their clinical trial programs across the U.S, Europe, Asia-Pacific, and the MEA.

-

In March 2024, Indivi and Biogen announced that they have entered into an agreement for integration and advancement of digital health technology and further build digital biomarkers associated with Parkinson’s disease. Collaboration aims at utilizing administration of a digital biomarker platform Konectom, further being managed within the Phase 2b LUMA study, which assesses the effectiveness and safety of BIIB122 for individuals with early-stage Parkinson's disease. This study is also being conducted in partnership with Denali Therapeutics Inc.

-

In March 2023, Koneksa announced that it has extended its partnership with SSI strategy to expand the scale the adoption of in-house digital biomarkers solutions for clinical trials and the SSI likely to be functioning to meet this demand

-

In February 2023, ActiGraph, LLC, and uMotif announced a partnership to provide patient-centered solutions for clinical research, combining ActiGraph's wearable technology with uMotif’s patient engagement platform

-

In November 2022, KT Corporation , a South Korean telecommunication leader made USD 2 million strategic investment in the U.S.-based voice analysis platform Sonde Health. With this investment, the companies may use Sonde’s speech analysis technique to modify KT’s AI-enabled voice business solutions.

-

In November 2022, Empatica, Inc. announced the approval of its health monitoring platform by the U.S. FDA. The health monitoring platform of the company is an advanced data collection solution for healthcare professionals.

Digital Biomarker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.09 billion

Revenue forecast in 2030

USD 13.97 billion

Growth rate

CAGR of 22.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, clinical practice, therapeutic area, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ActiGraph LLC; AliveCor Inc.; Koneksa; Altoida Inc.; Amgen Inc.; Biogen Inc.; Empatica Inc.; Vivo Sense; IXICO plc; Adherium Limited ;Neurotrack Technologies, Inc.; Aural Analytic; Huma; Sonde Health; Inc.; Clario; Imagene AI; Brainomix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Biomarker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital biomarker market report based on type, clinical practice, therapeutic area, end-use, and region:

-

Type Outlook (Revenue, Million, 2018 - 2030)

-

Wearable

-

Mobile Based Applications

-

Sensors

-

Others

-

-

Clinical Practice Outlook (Revenue, Million, 2018 - 2030)

-

Diagnostic Digital Biomarkers

-

Monitoring Digital Biomarkers

-

Predictive And Prognostic Digital Biomarkers

-

Other's (Safety, Pharmaco dynamics/ Response, Susceptibility)

-

-

Therapeutic Area Outlook (Revenue, Million, 2018 - 2030)

-

Cardiovascular And Metabolic Disorders (CVMD)

-

Respiratory Disorders

-

Psychiatric Disorders

-

Sleep & Movement Disease

-

Neurological Disorders

-

Musculoskeletal Disorders

-

Others (Diabetes, Pain Management)

-

-

End-use Outlook (Revenue, Million, 2018 - 2030)

-

Healthcare Companies

-

Healthcare Providers

-

Payers

-

Others (Patient, caregivers)

-

-

Regional Outlook (Revenue, Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global digital biomarkers market size was estimated at USD 3.42 billion in 2023 and is expected to reach USD 4.09 billion in 2024.

b. The global digital biomarkers market is expected to grow at a compound annual growth rate of 22.7% from 2024 to 2030 to reach USD 13.97 billion by 2030.

b. North America dominated the market and accounted for a revenue share of over 58.45% in 2023, owing to the strong presence of leading market players, significant product launches, increase in investments in R&D growing approval of smart devices, and improved awareness of digital biomarker effectiveness in the region. Furthermore, the increasing number of initiatives to promote healthcare IT and the presence of healthcare programs are some of the primary reasons for this region to anticipate market growth.

b. Some key players operating in the digital biomarkers market include ActiGraph LLC; AliveCor Inc.; Koneksa; Altoida Inc.; Amgen Inc.; Biogen Inc.; Empatica Inc.; VivoSense; IXICO plc; Adherium Limited; Neurotrack Technologies, Inc.; Aural Analytic; Huma; Sonde Health, Inc.; Clario; Imagine AI; Brainomix; Kinsa Inc.; Feel Therapeutics; ResApp (Pfizer)

b. Key factors that are driving the market growth include an increase in the usage of health-related mobile applications and connected digital devices, rising usage of smartphones and the emergence of new wearables, and expanding therapeutic area applications across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.