- Home

- »

- Conventional Energy

- »

-

Digital Oilfield Market Size & Share, Industry Report, 2030GVR Report cover

![Digital Oilfield Market Size, Share & Trends Report]()

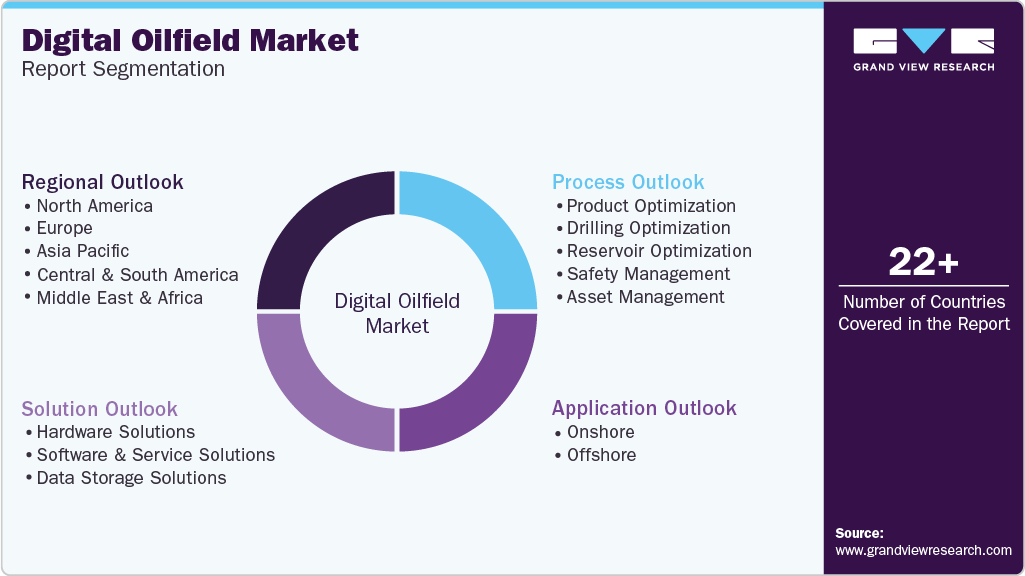

Digital Oilfield Market (2025 - 2030) Size, Share & Trends Analysis Report By Process (Product Optimization, Drilling Optimization), By Solution (Software & Service Solutions, Data Storage Solutions), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-968-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Oilfield Market Summary

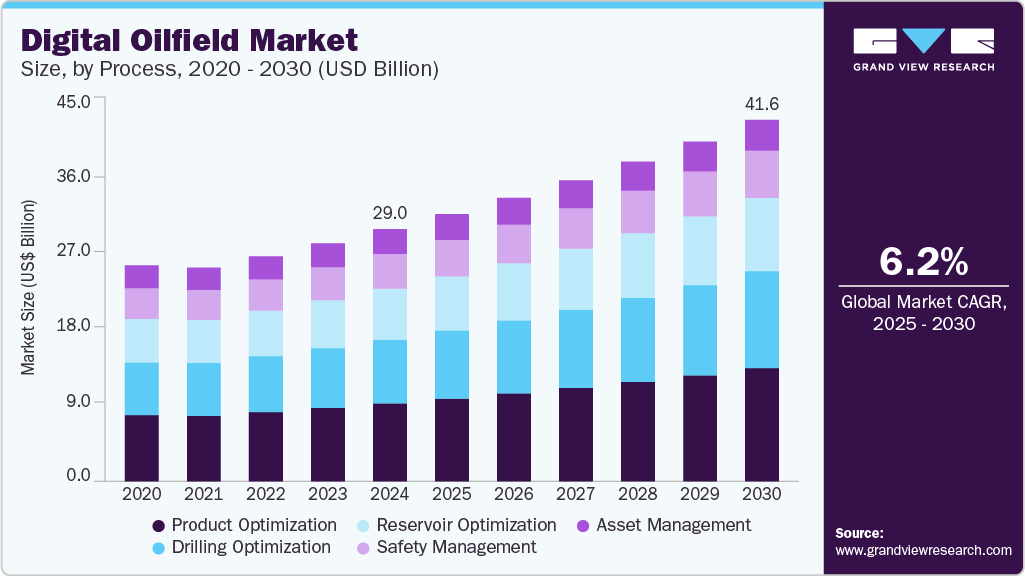

The global digital oilfield market size was estimated at USD 29.03 billion in 2024 and is projected to reach USD 41.6 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The demand for digital oilfield solutions is rising, driven by technological advancements that enhance efficiency, safety, and regulatory compliance.

Key Market Trends & Insights

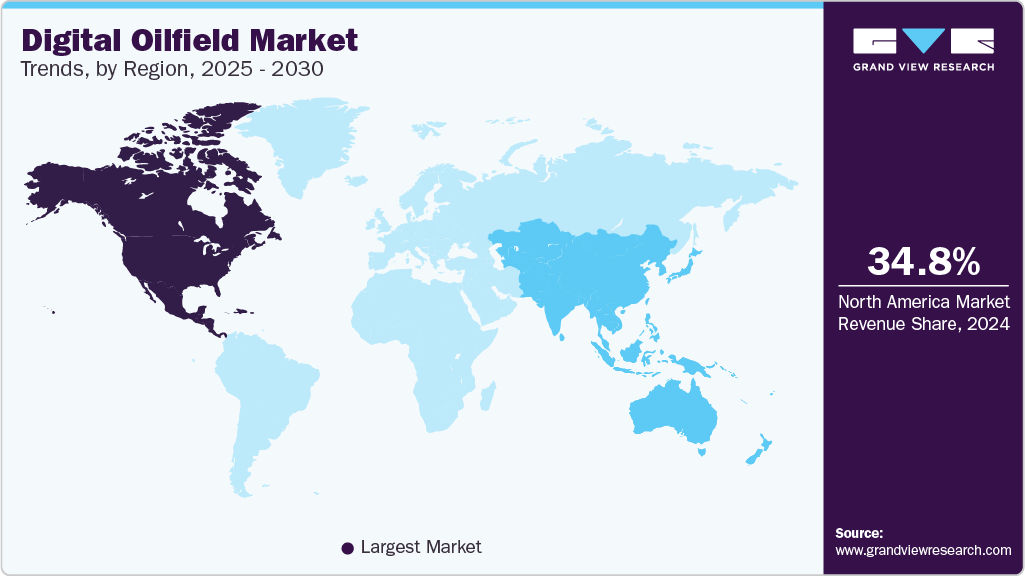

- North America digital oilfield market dominated the global market with a revenue share of 34.85% in 2024.

- The Asia Pacific digital oilfield industry is expected to register the fastest CAGR of 7.2% during the forecast period.

- Based on process, the product optimization segment led the market in 2024 with a revenue share of 30.87%.

- Based on solution, the hardware solutions segment held the largest market share of 49.8% in 2024.

- Based on application, the onshore segment dominated the market with a revenue share of 65.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 29.03 Billion

- 2030 Projected Market Size: USD 41.6 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing need for sustainability, partnerships between energy and tech companies, and increased exploration and production activities will continue to fuel market growth, leading to reduced OPEX costs. The rapid development of technologies such as IoT, AI, robotics, and data analytics is transforming oilfield operations by enabling real-time monitoring, predictive maintenance, and efficient resource management. This enables companies to optimize production processes, reduce operational downtime, and maximize production from mature oilfields. Moreover, the increasing demand for cost-effective solutions in response to fluctuating oil prices and economic conditions is fueling the adoption of digital technologies that can minimize operational costs through improved efficiency and better resource allocation.

Stringent safety and environmental regulations require companies to adopt digital solutions that improve safety management systems and reduce environmental impacts. The integration of advanced data analytics also enables companies to derive actionable insights from vast amounts of data generated during operations, enhancing decision-making processes and leading to improved operational performance and productivity. Furthermore, the emergence of IoT devices and sensors has significantly contributed to the digitalization of oilfields, enabling remote monitoring and automation of critical processes.

The integration of advanced data analytics allows companies to derive actionable insights from vast amounts of data generated during operations, enhancing decision-making processes and leading to improved operational performance and productivity. Furthermore, the aging workforce in the oil and gas sector requires digital solutions that facilitate knowledge transfer and workforce development. Moreover, increasing geopolitical tensions have led to higher investments in cybersecurity within the oil and gas sector, requiring companies to secure their digital infrastructures as they adopt more connected technologies.

Process Insights

Product optimization led the digital oilfield industry in 2024, generating a revenue share of 30.87%, driven by the adoption of product optimization, which enhances efficiency, reduces costs, and increases production rates through the application of modern technology and responsive market trends. As the industry evolves under economic changes and compliance requirements, effectiveness and performance remain top priorities.

Safety management processes are expected to register the fastest CAGR of over 7.1% during the forecast period. The oil and gas industry inherently involves significant risks, including blowouts, spills, and equipment failures. Implementing a robust Safety Management System (SMS) is crucial to proactively identify and mitigate potential hazards. Compliance with complex safety regulations and standards is essential to avoid legal repercussions, fines, and reputational damage.

Solution Insights

Hardware solutions held the largest market share of 49.8% in 2024. Real-time analytics enable companies to optimize drilling and operations, monitor equipment performance, and predict maintenance needs or failures. Automated software solutions and big data predictions help reduce operational expenses and enhance overall performance.

The data storage solutions segment is expected to register the fastest CAGR of 7.3% during the forecast period. The industry generates vast amounts of data through IoT sensors, enhanced drilling processes, and seismic imaging. Effective data management is crucial, requiring robust storage solutions that enable rapid access and processing, enabling timely decision-making and optimizing operational efficiency.

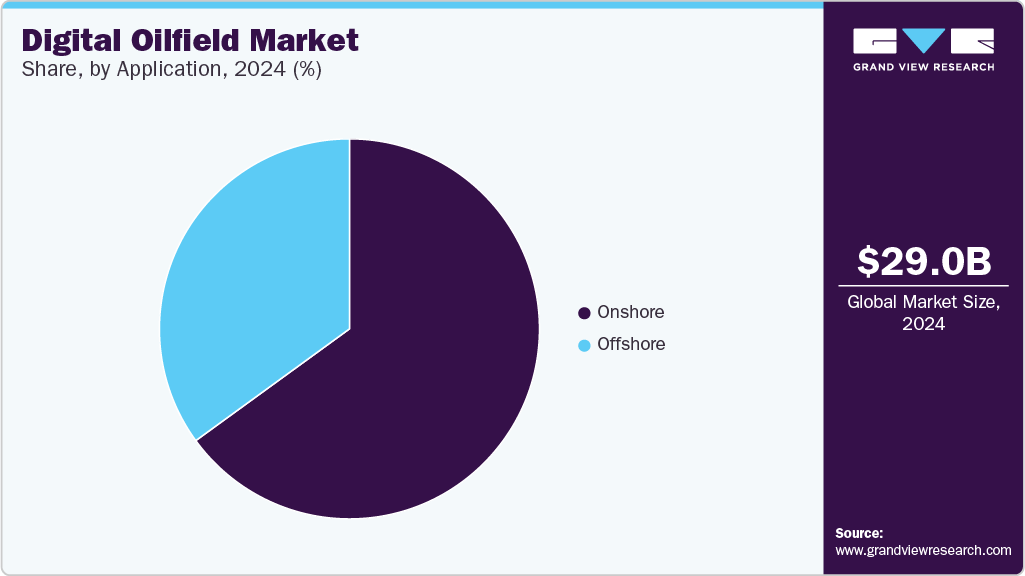

Application Insights

Onshore application dominated the digital oilfield market with a revenue share of 65.34% in 2024. Onshore drilling operations typically require lower upfront capital investments compared to offshore drilling. Reduced infrastructure, transportation, and management expenses lead to lower operational costs, allowing companies to allocate more resources to digital technology for improved operational efficiency. Moreover, onshore fields benefit from technological advancements such as hydraulic fracturing and horizontal drilling.

The offshore application is expected to register the fastest CAGR of 6.6% during the forecast period. Offshore oil fields typically require substantial capital investments due to their complexity and the need for advanced technology. The potential for higher revenue streams has encouraged more companies to engage in offshore drilling. However, prioritizing safety is crucial in offshore operations, given the inherent risks associated with drilling in harsh marine environments.

Regional Insights

North America digital oilfield market dominated the global market with a revenue share of 34.85% in 2024. The North American region has been a pioneer in technology adoption within the oil and gas industry, witnessing significant investments in R&D for digital technologies. Favorable regulatory policies and a focus on safety measures have fostered an environment conducive to innovation, driving growth and efficiency in the oil and gas sector.

U.S. Digital Oilfield Market Trends

The digital oilfield industry in the U.S. dominated North America with a revenue share of over 85.1% in 2024. The United States has witnessed significant investments in federal and private R&D for energy technologies, with a notable increase in funding according to the U.S. Energy Information Administration (EIA). This surge in investment has created a fertile ground for innovation in the oilfield services industry, leveraging the country's developed infrastructure.

Asia Pacific Digital Oilfield Market Trends

The Asia Pacific digital oilfield industry is expected to register the fastest CAGR of 7.2% during the forecast period. Asia Pacific is poised to become a significant growth hub for the digital oilfield, driven by industrialization and rising energy demands. Countries such as China and India are increasingly prioritizing oil and gas exploration and production to meet their growing energy needs, presenting a substantial opportunity for industry growth.

The digital oilfield market in China is expected to grow during the forecast period. China is a global leader in adopting technology and infrastructure for digital oilfield construction, with the government recognizing technology as a key driver of economic growth. The country has allocated significant budgetary resources for energy technology research. State-owned enterprises such as CNPC and Sinopec have also successfully implemented digital technologies.

Europe Digital Oilfield Market Trends

The Europe digital oilfield industry held a significant revenue share in 2024. Environmental policies and the need to reduce greenhouse gas emissions are driving the adoption of digital solutions for cleaner and more efficient oil and gas production. European companies are leveraging technologies such as data analytics, automation, and remote monitoring to enhance competitiveness in the energy market and achieve sustainability goals.

The digital oilfield market in Germany held a significant market share in 2024, driven by the country's reputation for engineering excellence and advanced technology solutions. Germany has prioritized research and development in the energy sector, with leading companies showcasing innovative techniques for near-real-time evaluation and decision-making in oil fields, enhancing operational efficiency and competitiveness.

Key Digital Oilfield Company Insights

Some key companies in the market for digital oilfield market include SLB; Weatherford; Halliburton; and Baker Hughes Company. Market participants are employing strategies such as new product launches, expanded distribution, and geographic expansion to gain a competitive edge.

-

SLB provides digital production optimization services, integrating processes to streamline operations, improve efficiency, and inform decision-making, enabling the oil and gas industry to optimize performance and reduce costs.

-

Halliburton is recognized for its innovative digital solutions, enhancing operational efficiency and manufacturing capabilities. Leveraging advanced data analytics, automation, and real-time monitoring, the company optimizes oil and gas extraction strategies, driving performance and productivity.

Key Digital Oilfield Companies:

The following are the leading companies in the digital oilfield market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Weatherford

- Halliburton

- Baker Hughes Company

- NOV

- Pason Systems Corp.

- Kongsberg Digital

- Viridien (CGG)

- Honeywell International Inc.

- Nabors Industries Ltd.

Recent Developments

-

In July 2024, SLB and Aker BP announced that they are co-developing an AI-driven virtual platform, aiming to enhance innovation and efficiency throughout Aker BP's E&P operations, resulting in significant improvements.

-

In July 2024, Honeywell International Inc. acquired Air Products' liquefied natural gas process technology and equipment business for USD 1.81 billion in an all-cash transaction, expanding its energy transition capabilities and creating a comprehensive solution for customers.

-

In July 2024, SLB and TotalEnergies partnered for 10 years, jointly developing scalable virtual solutions. The partnership aimed to improve access to energy resources, enhancing performance and efficiency, and achieved significant results during its duration.

-

In July 2024, Halliburton partnered with AIQ, an Abu Dhabi-based AI leader, to develop AI-enabled AWC tools. The agreement aimed to optimize production and growth in the global upstream sector.

-

In May 2024, CGG (now, Viridien) and Baker Hughes signed a Memorandum of Understanding to jointly explore offering carbon capture & storage solutions, combining their expertise and technologies to provide efficient and cost-effective solutions to customers worldwide.

-

In February 2024, Nabors Industries Ltd. announced an integration with KCF Technologies, enabling customers to carry information from their wireless machine sensors into the open cloud device.

Digital Oilfield Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.78 billion

Revenue forecast in 2030

USD 41.6 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

SLB; Weatherford; Halliburton; Baker Hughes Company; NOV; Pason Systems Corp.; Kongsberg Digital; Viridien (CGG); Honeywell International Inc.; Nabors Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Oilfield Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital oilfield market report based on process, solution, application, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Optimization

-

Drilling Optimization

-

Reservoir Optimization

-

Safety Management

-

Asset Management

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Solutions

-

Software & Service Solutions

-

Data Storage Solutions

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

CSA

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global digital oilfield market was valued at USD 29.03 billion in the year 2024 and is expected to reach USD 30.78 billion in 2025.

b. The global digital oilfield market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 41.62 billion by 2030.

b. Onshore application emerged as a dominating segment in the market with over a share of 65.0% in 2024 due to the need for cost efficiency, real-time operational visibility, and enhanced recovery from mature fields

b. The key market player in the digital oilfield market includes SLB; Weatherford; Halliburton; Baker Hughes Company; NOV; Pason Systems Corp., among others

b. The digital oilfield market is driven by the industry's growing need to enhance operational efficiency, reduce costs, and maximize hydrocarbon recovery through advanced data integration and automation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.