- Home

- »

- HVAC & Construction

- »

-

Digital Shipyard Market Size & Share, Industry Report, 2030GVR Report cover

![Digital Shipyard Market Size, Share & Trends Report]()

Digital Shipyard Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Shipyard Type (Commercial, Military), By Capacity (Small, Medium, Large), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-126-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Shipyard Market Summary

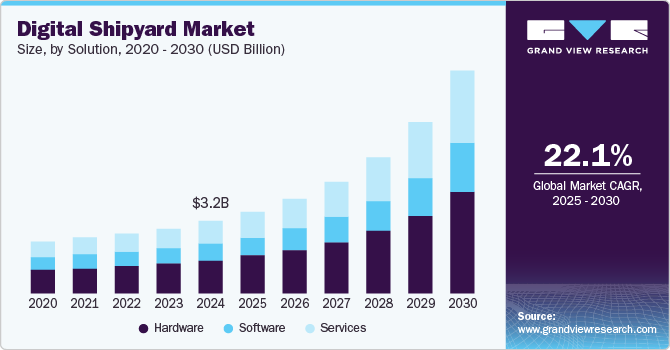

The global digital shipyard market size was valued at USD 3.23 billion in 2024 and is projected to reach USD 9.88 billion by 2030, growing at a CAGR of 22.1% from 2025 to 2030. The market is anticipated to be driven by the proliferation of the Industrial Internet of Things (IIoT) in the shipyard industry.

Key Market Trends & Insights

- North America led the global digital shipyard industry in 2024 with a market share of 28.2%.

- Europe held a significant market share of the overall digital shipyard industry in 2024, with a market share of 27.5%.

- Asia Pacific is anticipated to grow at the fastest CAGR from 2025 to 2030.

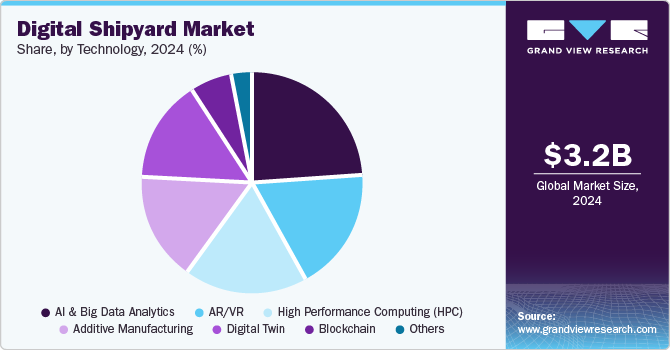

- Based on technology, the AI/Big Data segment dominated the market in 2024 and accounted for a market share of 24.2%.

- In terms of capacity, the large capacity segment dominated the market in 2024 and accounted for a market share of 44.3%.

Market Size & Forecast

- 2024 Market Size: USD 3.23 Billion

- 2030 Projected Market Size: USD 9.88 Billion

- CAGR (2025-2030): 22.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The IIoT enables the integration of physical machinery and assets with digital systems, allowing shipyards to collect and analyze real-time data. This data-driven approach enhances operational efficiency, improves decision-making, and enables predictive maintenance, ultimately leading to cost savings and improved productivity.Furthermore, factors such as the rising interest in connected and autonomous ships fuel the industry's demand for digital shipyard solutions. These solutions enable shipyards to integrate advanced technologies such as sensors, connectivity, automation, and artificial intelligence (AI) into vessels. Connected and autonomous ships offer improved safety, reduced fuel consumption, optimized navigation, and enhanced operational efficiency. Autonomous ships, also called crewless ships, are outfitted with software and hardware that allows them to operate without the intervention of humans. Sensors, automated navigation systems, propulsion and auxiliary systems, GPS trackers, and other components are used in these ships. These components allow the ship to make decisions based on its surroundings.

Moreover, the significance of utilizing a digital twin in the shipyard industry is its potential to transform shipbuilding and maintenance procedures. A digital twin is a virtual replica of a ship or shipyard continuously updated with real-time data. Shipyards can develop advanced 3D models and simulations by employing digital twins, enabling more precise planning and design. This aids in identifying potential issues and streamlining ship construction processes, resulting in cost and time savings. In addition, digital twins comprehensively understand ship and equipment performance in real-time. This facilitates continuous monitoring and optimization of operations, ensuring optimal efficiency and performance throughout the ship's lifespan.

Software companies continuously enhance their products to fortify them against potential hacking attempts. Within the maritime sector, shipyards and ship operators store vast repositories of sensitive data on their IT platforms, including information about ships and components. Consequently, these entities face elevated vulnerability to cyberattacks, which could result in substantial financial losses. The growing adoption of digitalization also raises the specter of cyber threats and cybercrimes aimed at stealing critical operational data from ships, posing a threat to national security. Addressing these cyber risks necessitates deploying sophisticated cybersecurity solutions, which demands increased investments from software companies. As a result, the maritime industry has recognized the imperative of safeguarding against cyber threats and risks. For instance, in January 2021, the International Maritime Organization (IMO) issued Resolution MSC. 428(98) containing the concise guidelines for managing cyber risks, which are applicable to a variety of maritime organizations.

The focus on sustainable shipbuilding is a significant driver of growth in the digital shipyard market, primarily due to increasing regulatory pressures, rising costs of resources, and growing environmental concerns. Digital shipyards leverage advanced technologies such as digital twins, IoT, and AI-driven analytics to reduce emissions, conserve materials, and promote energy efficiency, which aligns with the sustainability goals of the modern maritime industry.

The need for efficiency and cost reduction is a critical factor driving the growth of the global digital shipyard market. Digital technologies enhance operational efficiency and reduce overall costs, making shipyards more competitive and adaptable in a challenging economic landscape. Automation technologies, such as robotic process automation (RPA) and AI, streamline shipyard processes by taking over repetitive tasks and improving workflow organization. This automation reduces labor costs and shortens production times, enhancing overall productivity. Digital shipyards can also allocate resources more effectively, ensuring that every phase of the shipbuilding process operates at peak efficiency, which in turn lowers operational costs.

Solution Insights

In terms of solutions, the market is classified into hardware, software, and services. The hardware segment dominated the overall market, gaining a market share of over 46.0% in 2024. The ongoing advancements in hardware technologies, such as encompassing sensors, the Industrial Internet of Things (IIoT), and edge computing devices, propel the integration of hardware components in the digital shipyard sector. These progressions empower real-time data collection and enable seamless network connectivity and integration with digital twin systems. Notably, these hardware components are pivotal in establishing connections between digital twin models and the tangible assets present within the digital shipyard industry.

The services segment is expected to emerge with a significant CAGR from 2025 to 2030. As the global fleet of ships continues to grow, there is a constant need for ship maintenance and repair services. The services segment within the market caters to this demand by providing specialized services such as ship repair, retrofitting, and maintenance. The need to keep ships in optimal condition and comply with regulations drives the demand for these services. As shipyards increasingly adopt advanced technologies, they require specialized consulting services to tailor these solutions to their unique operational needs. Service providers offer expertise in assessing shipyard processes, integrating digital tools such as IoT, AI, and digital twin technologies, and ensuring that these solutions align with the client’s goals for efficiency and sustainability.

Shipyard Type Insights

In terms of shipyard type, the market is classified into commercial and military. The commercial segment dominated the overall market with a market share of 51.6% in 2024. The growth influences the commercial shipyard segment in maritime trade. As global trade continues to expand, there is a higher demand for new commercial ships and the maintenance and repair of existing ones. For instance, in April 2022, Wartsila introduced virtual and augmented simulation solutions that leverage the latest AR and VR technology. These solutions create immersive environments that simulate real-life shipboard operations, improving learning retention, job performance, and team collaboration. Such innovation drives the need for such services that can optimize shipbuilding and maintenance processes.

The military segment is expected to grow at a faster growth from 2025 to 2030. The allocation of defense budgets plays a crucial role in driving the military shipyard segment. Governments invest in digital shipyard services to optimize defense spending, improve shipbuilding capabilities, and extend the lifespan of existing naval assets. The demand for digital shipyard services within the military segment is influenced by the availability of defense funding and the strategic priorities of nations. For instance, in December 2022, the government of India intends to provide cash subsidies, tax reductions, and other incentives to support its shipbuilding sector. This move aims to alleviate the impact of elevated freight rates on the country's manufacturers. The proposed measures involve offering subsidies to facilitate the construction of a minimum of 50 new vessels and granting the shipbuilding industry "infrastructure status," which would assist in securing financing from banks.

Capacity Insights

In terms of capacity, the market is classified into small, medium, and small and large. Among these, the large capacity segment dominated the market in 2024 and accounted for a market share of 44.3% and is anticipated to retain its dominance over the projected period. The need for larger vessels in various industries, such as shipping, oil and gas, and offshore exploration, drives the demand for digital shipyard services in the large-capacity segment. These services enable shipyards to efficiently design, construct, and maintain large-scale vessels, meeting the increasing demand for transportation and other maritime activities.

The medium capacity segment held a considerable market share in 2024. The medium capacity segment caters to the demand for customized vessels in industries such as offshore support, fishing, and coastal transportation. Digital shipyard solutions enable shipyards to efficiently design and construct vessels that meet the specific requirements of their clients. The ability to offer customized solutions drives the growth of the medium capacity segment within the digital shipyard industry.

Technology Insights

In terms of technology, the market is classified into AR/VR, Digital Twin, Additive Manufacturing, AI and Big Data Analytics, High-Performance Computing (HPC), Blockchain, and others. Among these, the AI/Big Data segment dominated the market in 2024 and accounted for a market share of 24.2%. Adopting AI and Big Data analytics in the digital shipyard market allows shipyards to collect, analyze, and interpret vast amounts of data generated throughout the shipbuilding process. Furthermore, AI and Big Data technologies enable shipyards to implement predictive maintenance and condition monitoring systems. By analyzing data from various sensors and equipment onboard vessels, shipyards can detect potential issues in real time, predict maintenance needs, and proactively address them. This helps reduce downtime, increase vessel availability, and optimize maintenance schedules, leading to cost savings and improved operational performance.

The digital twin segment is expected to emerge as the fastest-growing segment from 2025 to 2030. Digital Twins enable shipyards to create virtual replicas of vessels, allowing for enhanced ship design and planning. Shipyards can optimize vessel performance, identify potential issues, and make informed decisions before physical construction begins by simulating and analyzing different design scenarios. This leads to improved efficiency, reduced costs, and faster time-to-market. Key players such as Dassault Systèmes are undergoing partnerships to enhance the creation of digital shipyards. For instance, in November 2022, Dassault Systèmes and Samsung Heavy Industries (SHI) signed a memorandum of understanding (MoU) to collaborate on the development of a smart shipyard. This partnership aims to utilize digital twin technologies to facilitate the transformation of SHI's shipyard operations and support its business initiatives.

Regional Insights

North America led the global digital shipyard industry in 2024 with a market share of 28.2% and industry in North America is expanding due to substantial defense spending and government support for shipyard modernization, which drive the adoption of advanced technologies such as digital twins, IoT, and AI. These technologies improve operational efficiency, enable predictive maintenance, and align with environmental goals by reducing waste and emissions. In addition, the presence of leading shipbuilding and tech companies in the region further accelerates digital transformation in shipyard operations.

U.S. Digital Shipyard Market Trends

The growth of the digital shipyard industry in the U.S. is primarily driven by robust defense spending, as the U.S. Navy seeks to modernize and expand its fleet with advanced, technology-enhanced capabilities. Government initiatives, such as the National Shipbuilding Research Program (NSRP), further support this growth by encouraging innovation and providing resources for shipyards to adopt digital solutions that enhance productivity and operational efficiency.

Europe Digital Shipyard Market Trends

Europe held a significant market share of the overall digital shipyard industry in 2024, with a market share of 27.5%. The European region has stringent environmental regulations and strongly focuses on sustainable shipping practices. This drives the demand for digital solutions in shipbuilding that can help optimize vessel design, reduce emissions, and improve fuel efficiency. For instance, the International Maritime Organization (IMO) is leading a collective industry endeavor to expedite a significant shift in fuel and technology in response to the climate crisis. The objective is to achieve a minimum 50% reduction in annual CO2 emissions by the year 2050. Digital Shipyard technologies enable shipyards to implement eco-friendly practices and comply with these regulations, leading to increased adoption in the European market.

Asia Pacific Digital Shipyard Market Trends

Asia Pacific is anticipated to grow at the fastest CAGR from 2025 to 2030. The demand for shipbuilding automation has surged in response to the labor shortage that arose during the pandemic. Digital shipyard solutions offer automation capabilities that help address this labor shortage and improve overall productivity in the Asia Pacific shipbuilding industry. Moreover, the Asia Pacific region is a major hub for shipbuilding, with countries such as China, South Korea, and Japan leading the market. The growth of the shipbuilding industry in the region drives the demand for digital shipyard solutions to streamline operations, optimize resources, and meet the increasing demand for ships.

Key Digital Shipyard Company Insights

Some of the key players operating in the market include SAP, Wärtsilä, and Siemens, among others.

- Siemens is a global technology conglomerate headquartered in Munich, Germany, known for its extensive range of products, services, and solutions across industries such as energy, infrastructure, healthcare, automation, and digitalization. Founded in 1847, Siemens has grown to become one of the world’s largest industrial manufacturing companies, with a strong focus on innovative solutions that integrate hardware, software, and digital services to support business and societal transformation.

Kongsberg Digital and Sea Machines Robotics, Inc. are some of the emerging market participants in the target market.

- Kongsberg Digital, a subsidiary of KONGSBERG, focuses on providing advanced digital solutions for industries such as maritime, oil and gas, and renewable energy. The company was founded in 2016 and is headquartered in Norway, with a presence across Asia Pacific, North America, and Europe. Kongsberg Digital’s maritime solutions are engineered to enhance collaboration, centralize data, streamline decision-making, and support cost reduction while prioritizing sustainability. By leveraging a powerful platform of interconnected applications, businesses can achieve optimized, fleet-wide operational improvements.

Key Digital Shipyard Companies:

The following are the leading companies in the digital shipyard market. These companies collectively hold the largest market share and dictate industry trends.

- SAP

- Wärtsilä

- BAE Systems

- Dassault Systèmes

- AVEVA Group Limited

- Siemens

- Accenture

- Hexagon AB

- Inmarsat Global Limited

- Damen Shipyards Group

Recent Development

-

In September 2024, BAE Systems secured a USD 19 million contract from the U.S. Navy for integrating the UPX-24 target data processor into a single digital interrogator Identification Friend or Foe (IFF) solution aimed at enhancing situational awareness, streamlining data collection, and improving decision-making for maritime operations. This consolidated system will replace two separate hardware components with a unified solution, reducing obsolescence, meeting weight, size, power, and cost goals, and enabling quick adaptation to future technological advancements.

-

In May 2024, Inmarsat Maritime, now part of Viasat, Inc., has introduced NexusWave, a fully managed maritime connectivity service that integrates multiple high-speed networks into a single solution, offering unlimited data, global coverage, and secure, resilient communications. NexusWave combines Global Xpress Ka-band, Low-Earth Orbit (LEO) services, coastal LTE, and L-band for high availability and will include the future ViaSat-3 Ka-band service, ensuring high performance, predictable costs, and seamless connectivity to meet the demands of modern maritime operations, crew welfare, and digitalization needs worldwide.

Digital Shipyard Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.64 billion

Revenue forecast in 2030

USD 9.88 billion

Growth rate

CAGR of 22.1% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, shipyard type, capacity, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa;

Key companies profiled

SAP; Wärtsilä; BAE Systems; Dassault Systèmes; AVEVA Group Limited; Siemens; Accenture; Hexagon AB; Inmarsat Global Limited; Damen Shipyards Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Shipyard Market Report Segmentation

This report forecasts market revenue growths at global, regional, as well as at country levels and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global digital shipyard market based on solution, shipyard type, capacity, technology, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Shipyard Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Military

-

-

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

-

Small

-

Medium

-

Large

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

AR/VR

-

Digital Twin

-

Additive Manufacturing

-

AI & Big Data Analytics

-

High performance Computing (HPC)

-

Blockchain

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Digital Shipyard market size was estimated at USD 3.22 billion in 2024 and is expected to reach USD 3.64 billion in 2025.

b. The global Digital Shipyard market is expected to grow at a compound annual growth rate of 22.1% from 2025 to 2030 to reach USD 9.88 billion by 2030.

b. The hardware segment dominated the overall market, gaining a market share of over 46.0% in 2024. The ongoing advancements in hardware technologies, such as encompassing sensors, the Industrial Internet of Things (IIoT), and edge computing devices, propel the integration of hardware components in the digital shipyard sector. These progressions empower real-time data collection and enable seamless network connectivity and integration with digital twin systems.

b. Some of the key player include SAP, Wartsila, BAE Systems, Dassault Systemes, AVEVA, Siemens Digital Industries Software, Accenture, Hexagon, Inmarsat Plc., and Damen Shipyards Group.

b. Digital twin adoption has been fueled by the industry's rapid growth and the demand for cutting-edge technology. Furthermore, factors such as the rising interest in connected and autonomous ships fuel the industry's demand for digital shipyard solutions. These solutions enable shipyards to integrate advanced technologies such as sensors, connectivity, automation, and artificial intelligence (AI) into vessels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.