- Home

- »

- Medical Devices

- »

-

Disposable Prefilled Syringes Market, Industry Report, 2030GVR Report cover

![Disposable Prefilled Syringes Market Size, Share & Trends Report]()

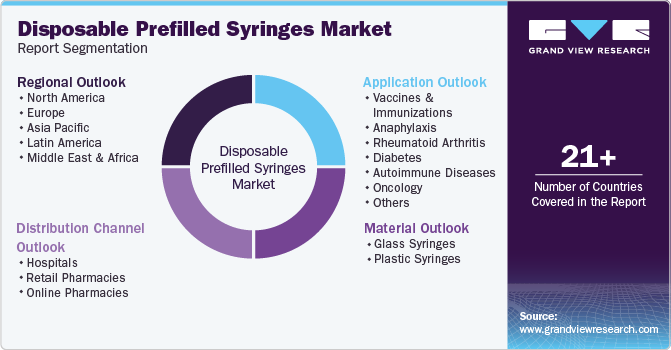

Disposable Prefilled Syringes Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Glass, Plastic), By Application (Vaccines And Immunizations Anaphylaxis), By Distribution Channel (Hospitals, Online Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-526-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Prefilled Syringes Market Summary

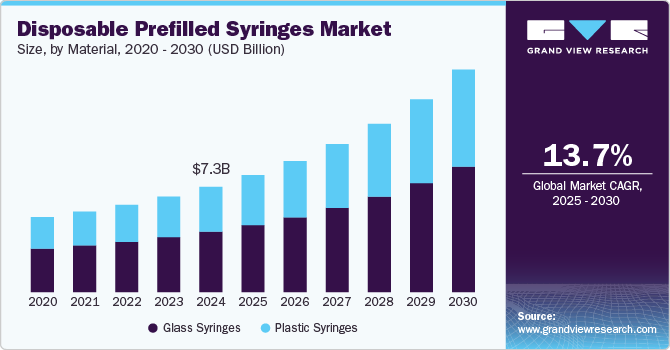

The global disposable prefilled syringes market size was valued at USD 7.3 billion in 2024 and is projected to reach USD 15.5 billion by 2030, growing at a CAGR of 13.7% from 2025 to 2030. This growth is driven by increasing demand for biologics, rising prevalence of chronic diseases, and the growing preference for self-administered injectable drugs.

Key Market Trends & Insights

- The disposable prefilled syringes market in Europe dominated the overall global market with a revenue share of 37.4% in 2024.

- Based on material, the glass syringes segment dominated the market with a market share of 57.4% in 2024.

- Based on application, the vaccines and immunizations segment dominated the market with a share of 26.2% in 2024.

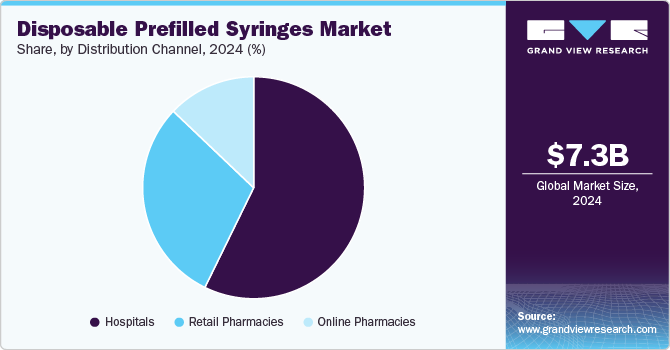

- Based on distribution channel, the hospitals segment led the disposable prefilled syringes industry, accounting for the largest share of 57.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.3 Billion

- 2030 Projected Market Size: USD 15.5 Billion

- CAGR (2025-2030): 13.7%

- Europe: Largest market in 2024

Prefilled syringes enhance patient safety, reduce contamination risks, and improve dosage accuracy, further fueling market expansion. Additionally, advancements in syringe materials, such as glass and polymer-based options, are improving product durability and usability. Expanding healthcare infrastructure and regulatory approvals for biologic therapies will further support market growth.

A significant driver of this market expansion is the escalating demand for biologic drugs, which often require precise and stable delivery systems. Biologics, including monoclonal antibodies used in the treatment of autoimmune diseases and cancers, are frequently administered via injection. For instance, AbbVie's Humira (adalimumab), a leading biologic for conditions such as rheumatoid arthritis and Crohn's disease, is available in prefilled syringe formats to ensure accurate dosing and enhance patient convenience. Similarly, Roche's Actemra (tocilizumab), used for rheumatoid arthritis and certain COVID-19-related complications, is offered in prefilled syringes to facilitate ease of administration.

The rising prevalence of chronic diseases, notably diabetes, further propels the market. According to the International Diabetes Federation, approximately 537 million adults aged 20 to 79 were living with diabetes in 2021, underscoring the need for efficient and reliable insulin delivery methods. Prefilled insulin syringes provide a safer and more convenient alternative to traditional vial-and-syringe approaches, reducing the risk of dosing errors and enhancing patient compliance.

Another contributing factor is the growing trend toward self-administration of injectable medications. Patients managing chronic conditions, such as multiple sclerosis and diabetes, increasingly prefer prefilled syringes for home use, minimizing the necessity for frequent healthcare facility visits. This shift is supported by the development of user-friendly syringe designs equipped with integrated safety features. For example, Sanofi's Dupixent (dupilumab), prescribed for atopic dermatitis and asthma, is available in prefilled syringes, enabling patients to self-administer their treatments effectively.

The COVID-19 pandemic has also influenced the adoption of disposable prefilled syringes, particularly in vaccination efforts. Vaccines developed by companies like Moderna and Pfizer-BioNTech have been distributed using prefilled syringes to ensure precise dosing and reduce contamination risks, highlighting the importance of such delivery systems in large-scale immunization programs.

Technological advancements in syringe materials and manufacturing processes are enhancing product safety and compatibility, especially with complex biologics. Prefilled syringes are now available in both glass and polymer formats, with polymer syringes gaining popularity due to their break resistance and reduced interaction with sensitive drugs. Leading companies like Becton, Dickinson and Company (BD) and Gerresheimer are at the forefront of innovating syringe design and production, focusing on improving drug stability and patient safety.

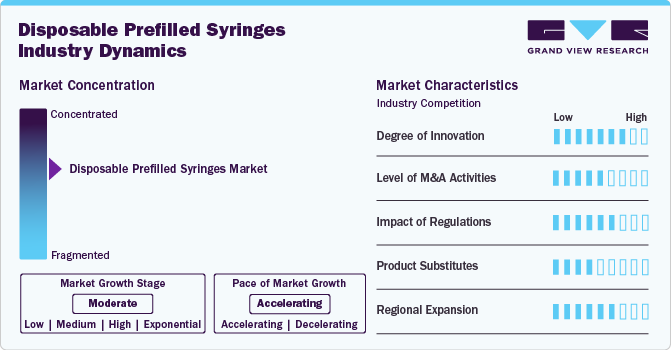

Market Concentration & Characteristics

The disposable prefilled syringes industry is moderately concentrated, with key players like BD (Becton, Dickinson and Company), Gerresheimer, Schott AG, and West Pharmaceutical Services dominating. These companies focus on innovations in syringe materials, safety features, and drug compatibility. The market is characterized by high demand for biologics, increasing self-administration trends, and stringent regulatory requirements. Growth is driven by chronic disease prevalence, technological advancements, and expanding healthcare infrastructure in emerging markets. Companies are investing in polymer-based syringes for enhanced drug stability. The market also faces challenges such as pricing pressure and the need for compliance with evolving global regulations.

Innovations include integrated safety needles, auto-disable features, and dual-chamber syringes for lyophilized drugs. Smart syringes with connectivity features are emerging to enhance patient adherence. Automation in manufacturing ensures precision and sterility, reducing contamination risks. Regulatory compliance drives continuous improvements, with stringent guidelines promoting safer, user-friendly designs. The industry's innovation aims to enhance convenience, minimize dosing errors, and support the growing trend of self-administration.

Regulations in the disposable prefilled syringes industry ensure product safety, efficacy, and compliance with stringent quality standards. Agencies like the FDA, EMA, and ISO set guidelines for materials, sterility, and drug compatibility. Requirements for needle safety, anti-tampering features, and biocompatibility drive continuous innovation. The EU MDR and U.S. FDA’s 21 CFR compliance impact manufacturing and approval processes. Serialization and track-and-trace mandates enhance supply chain transparency. Strict regulatory oversight increases production costs but boosts reliability and market acceptance. Emerging markets are aligning with global standards, fostering growth while posing challenges for smaller manufacturers adapting to evolving compliance requirements.

Mergers and acquisitions in the disposable prefilled syringes industry are accelerating. In May 2024, InjectEZ and Nephron revised their agreements to benefit all parties. Sharps is acquiring a high-tech facility with automated syringe manufacturing for USD 35 million, assuming up to USD 4 million in liabilities. The deal includes a five-year, USD 200 million sales agreement, ensuring Nephron’s supply of next-generation copolymer PFS syringes and 10mL SoloGard polypropylene disposable syringes. This supports Nephron’s 503b expansion while strengthening Sharps’ market position. The acquisition enhances Sharps’ ability to meet Nephron’s needs and grow PFS sales in the broader pharmaceutical industry.

Substitutes for disposable prefilled syringes include traditional vial-and-syringe systems, autoinjectors, and needle-free injection technologies. Vial-and-syringe methods remain common due to lower costs but pose higher contamination and dosing error risks. Autoinjectors, like those for biologics and insulin, offer convenience and safety but are costlier. Needle-free injectors, such as jet injectors, eliminate needle-related risks but face adoption challenges due to complexity and higher prices. While these alternatives provide options, prefilled syringes dominate due to their ease of use, reduced contamination risks, and precise dosing. Continuous innovation in drug delivery may impact their market share over time.

The disposable prefilled syringes industry is expanding globally, driven by increasing demand for biologics, self-administration trends, and improved healthcare infrastructure. North America leads due to high biologic drug adoption and stringent regulations, while Europe follows with strong pharmaceutical manufacturing. Asia-Pacific is witnessing rapid growth, fueled by rising chronic disease prevalence and government initiatives in countries like China and India. The Middle East and Latin America are also emerging markets, supported by expanding healthcare access. Companies like BD and Gerresheimer are investing in regional production facilities to meet demand. Regulatory alignment and technological advancements further accelerate global market penetration.

Material Insights

The glass syringes segment dominated the market with a market share of 57.4% in 2024 driven by its superior chemical resistance, drug stability, and compatibility with biologics. Glass syringes are widely used for vaccines, anticoagulants, and high-viscosity drugs due to their durability and minimal interaction with medications. Major manufacturers like BD and Gerresheimer focus on advanced glass syringe designs to meet regulatory standards. Despite growth in polymer syringes due to break resistance and customization, glass remains preferred for critical injectable drugs. The segment's dominance is expected to continue, supported by increasing biologic drug approvals and stringent safety requirements.

The plastic syringes segment is projected to grow at the highest compound annual growth rate (CAGR) during the forecast period, driven by advancements in polymer materials and increasing demand for cost-effective and lightweight alternatives. Plastic syringes, particularly those made from materials like cyclo-olefin copolymer (COC) and polypropylene, offer enhanced break resistance and flexibility, making them ideal for biologics and vaccines. Their compatibility with high-viscosity drugs and ease of manufacturing further boost their adoption.

Application Insights

The vaccines and immunizations segment dominated the market with a share of 26.2% in 2024, driven by the growing demand for vaccines, particularly in light of global health challenges like the COVID-19 pandemic. Prefilled syringes provide precise dosing, reduced contamination risks, and enhanced convenience for both healthcare providers and patients. Their use in administering vaccines, including COVID-19, influenza, and routine immunizations, has surged due to their ability to maintain drug stability and streamline vaccination processes. As vaccination programs expand globally, particularly in emerging markets, the segment is expected to maintain its dominance in the disposable prefilled syringes industry.

The anaphylaxis segment is expected to grow at the highest compound annual growth rate (CAGR) during the forecast period. In the United States, anaphylaxis rates have doubled over the past two decades, with at least 1,500 fatalities annually, as reported by NCBI data in January 2023. This rise in cases is driving demand for effective and timely treatment solutions, such as epinephrine delivered through disposable prefilled syringes. These syringes offer convenience, fast administration, and precise dosing, crucial in emergency situations like anaphylaxis, contributing to the segment’s anticipated growth.

Distribution Channel Insights

In 2024, the hospitals segment led the disposable prefilled syringes industry, accounting for the largest share of 57.3%. This dominance is attributed to the widespread use of prefilled syringes for administering vaccines, biologics, and other injectable drugs in hospital settings. Prefilled syringes offer enhanced convenience, accuracy, and safety for healthcare providers, reducing the risk of dosing errors and contamination. Additionally, hospitals are adopting prefilled syringes for critical care treatments, including oncology and immunology therapies, further driving market growth.

Online pharmacies are expected to experience the fastest compound annual growth rate (CAGR) during the forecast period, driven by the increasing adoption of e-commerce platforms and growing consumer preference for convenient, at-home healthcare solutions. The rise in online prescription drug sales, particularly during the COVID-19 pandemic, has accelerated this trend. Prefilled syringes are increasingly being offered by online pharmacies due to their ease of use, precise dosing, and the growing demand for self-administered medications, such as insulin and biologics.

Regional Insights

North America disposable prefilled syringes market held a dominant position, capturing 31.7% in terms of revenue in 2024. A key driver for this growth is the focus on preventing needlestick injuries among healthcare professionals in developed regions like the U.S. and Canada. Prefilled syringes equipped with needle guards help minimize the risk of such injuries, contributing to their growing adoption. Additionally, the U.S. Centers for Disease Control recommends prefilled syringes for vaccine administration due to their ability to maintain vaccine potency during long storage periods and their time-saving benefits. These factors are fueling market expansion in the region.

U.S. Disposable Prefilled Syringes Market Trends

The disposable prefilled syringes industry in the U.S. held a significant share of North America in 2024. Various factors spur the U.S. market growth, such as the rising incidences of lifestyle-related illnesses and patients with chronic disorders' increasing need for simple injectables. Moreover, the increased use of auto-injector devices, well-developed pharmaceutical systems, technological advancements, self-administered equipment for patients' routine prescription doses, and recommendations by the Centers for Disease Control and Prevention (CDC) are expected to drive market growth.

Europe Disposable Prefilled Syringes Market Trends

The disposable prefilled syringes market in Europe dominated the overall global market with a revenue share of and is driven by the strong preference of medical professionals for injectable devices that are prefilled to reduce damage caused by needles. Prominent players in the region's market and several government initiatives to enforce the usage of single-use medical goods to prevent infections are anticipated to contribute to the region's growth.

The UK the disposable prefilled syringes market is witnessing significant growth due to the rising incidence of chronic diseases like cancer and the expanding elderly population. For instance, according to the Department of Health & Social Care in the UK the population aged 85 and older is expected to increase by one million between 2021 and 2036.

The disposable prefilled syringes market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data.

The disposable prefilled syringes market in Germany is expected to expand in the foreseeable future. The prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis is increasing in Germany. Disposable Prefilled syringes are a preferred choice for self-administration of these medications, contributing to market growth. For instance, in August 2021, the German specialty glass company SCHOTT AG and its most recent partner, Serum Institute of India, acquired a 50% share in the joint venture SCHOTT Kaisha in India.

Asia Pacific Disposable Prefilled Syringes Market Trends

The disposable prefilled syringes market in Asia Pacific region is projected to experience notable expansion owing to the availability of a significant number of Food and Drug Administration (FDA), Therapeutic Goods Administration (TGA), and European Medicines Agency (EMA)-approved facilities in the region. Additionally, the region's rapidly developing economy and massive unexplored market is anticipated to increase owing to favorable demographic variables such as high population and an increasing frequency of numerous chronic conditions.

The Japan disposable prefilled syringes market is poised for substantial growth, as Japan's aging population has increased the prevalence of chronic diseases, patient’s safety and convenience. In addition, regulatory reforms and incentives, biologics and biosimilars and fast-track approval processes, have attracted pharmaceutical companies to invest in the disposable prefilled syringes in Japan.

The disposable prefilled syringes market in China is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders.

The India disposable prefilled syringes market’s growth is driven by several factors, including a large and genetically diverse population, cost-effective infrastructure, a pool of experienced medical professionals, favorable regulatory reforms, increased industry collaborations. Additionally, rising awareness about chronic diseases, government incentives to promote research, and the potential for accelerated patient recruitment owing to a higher prevalence of certain chronic diseases are projected to foster market growth.

Latin America Disposable Prefilled Syringes Market Trends

The disposable prefilled syringes industry in Latin America is experiencing significant growth. The driving factors for Latin America market include the growing prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis. Moreover, the rise in the aging population & their requirement for regular injections for various medical conditions, technological advancement, government initiatives, and expansion of biopharmaceuticals in Latin America are driving the product demand.

Middle East & Africa Disposable Prefilled Syringes Market Trends

The disposable prefilled syringes market in the Middle East and Africa (MEA) is witnessing steady growth, the region is experiencing rapid expansion, propelled by several key factors. These include rising incidence of chronic diseases, increased awareness about such conditions, favorable governmental policies in selected countries, a diverse and sizable population, and cost advantages in specific economies.

The disposable prefilled syringes market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Disposable Prefilled Syringes Company Insights

The competitive scenario in the disposable prefilled syringes industry is highly competitive, with key players such as West Pharmaceuticals; Medtronic; and SCHOTT Pharma AG holding significant positions. The major companies are undertaking several organic as well as inorganic strategies such as new product development, regional expansion, acquisitions, mergers, and collaborations for serving the unmet needs of their customers.

Key Disposable Prefilled Syringes Companies:

The following are the leading companies in the disposable prefilled syringes market. These companies collectively hold the largest market share and dictate industry trends.

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- SCHOTT AG

- West Pharmaceutical Services, Inc.

- Medtronic

- Roche Holding AG

- Fresenius Kabi AG

- SteriPack

- Ypsomed AG

- Meda Pharmaceuticals

Recent Developments

-

In March 2024 Schott Pharma is expanding in the U.S. with a new manufacturing facility for prefillable syringes. The facility, located in North Carolina, will enhance production capabilities to meet growing demand for biologics and injectable medications. This expansion supports Schott Pharma’s commitment to advancing drug delivery technologies in the U.S. market.

-

In October 2024, BD announced a strategic partnership with Ypsomed, a leading provider of injection systems, to enhance self-injection solutions for high-viscosity biologic drugs. Through a joint initiative, BD and Ypsomed have pre-assessed and optimized the integration of the BD Neopak XtraFlow Glass Prefillable Syringe with Ypsomed’s YpsoMate 2.25 autoinjector platform. This collaboration addresses existing challenges by enabling the delivery of biologic drugs with viscosities exceeding 15cP in an autoinjector format.

Disposable Prefilled Syringes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.1 billion

Revenue forecast in 2030

USD 15.5 billion

Growth rate

CAGR of 13.7% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Becton, Dickinson and Company (BD), Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., Medtronic, Roche Holding AG, Fresenius Kabi AG, SteriPack, Ypsomed AG, Meda Pharmaceuticals

Customization scope

Free report customization (equivalent upto 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Prefilled Syringes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global disposable prefilled syringes market report on the basis of material, application, distribution channel, and region:

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Glass Syringes

-

Plastic Syringes

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Vaccines & immunizations

-

Anaphylaxis

-

Rheumatoid Arthritis

-

Diabetes

-

Autoimmune diseases

-

Oncology

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Retail Pharmacies

-

Online Pharmacies

-

-

Region Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global disposable prefilled syringes market size was estimated at USD 7.3 billion in 2024 and is expected to reach USD 8.1 billion in 2025.

b. The global disposable prefilled syringes market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 15.5 billion by 2030.

b. Europe dominated the disposable prefilled syringes market with a 37.4% share in 2024, driven by the increasing demand for biologics and growing healthcare infrastructure. Regulatory support and advancements in drug delivery technologies further contribute to market growth in the region.

b. Some of the key players operating in the disposable prefilled syringes market include, Becton, Dickinson and Company (BD), Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., Medtronic, Roche Holding AG, Fresenius Kabi AG, SteriPack, Ypsomed AG, Meda Pharmaceuticals

b. Key factors driving the disposable prefilled syringes market growth include the rising demand for biologic drugs and increasing preference for self-administration of injectable medications. Additionally, advancements in syringe design and safety features contribute to the widespread adoption across various therapeutic applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.